6-16 #BlindlyBusy : Samsung and LG have scaled down their planned procurements of LCD TV panels; SEMCO has reportedly signed a camera module supply with Tesla; Meizu is reportedly acquired by Chinese car maker Geely; etc.

Taiwan Semiconductor Manufacturing Co (TSMC) has said it has no concrete plans for factories in Europe – remarks that come amid efforts by the European Union to encourage Taiwanese firms to manufacture chips there. In Feb 2022, the EU unveiled the European Chips Act, with the bloc mentioning Taiwan as one of the “like-minded partners” Europe would like to work with. TSMC’s Chairman Mark Liu has indicated that in Europe, they have relatively fewer customers, but they are still assessing and still do not have any concrete plans.(Laoyaoba, Reuters, Electronics360, Techzine)

Renesas Electronics has announced it has entered into a definitive agreement with Reality Analytics Inc (Reality AI), a leading provider of embedded AI solutions, under which Renesas will acquire Reality AI in an all-cash transaction. Renesas has said that the acquisition will enhance its endpoint AI capability to help system developers make their products ready for what it calls the Artificial Intelligence of Things. Renesas now makes software to allow AI to be embedded into its low-power microcontrollers and microprocessors. Buying Reality AI will allow Renesas to expand its in-house ability to provide hardware and software endpoints for the industrial internet of things, consumer and auto applications. Reality offers embedded AI and tinyML products for non-visual sensing in auto, industrial and commercial products. It also provides Reality AI Tools software to support this non-visual sensor data.(Laoyaoba, Renesas, Digitimes, Fierce Electronics)

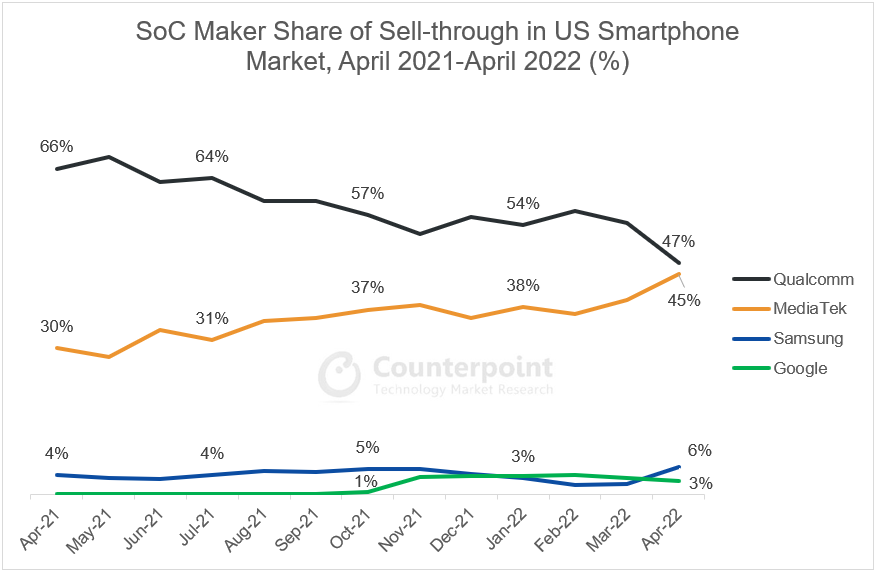

According to Counterpoint Research, MediaTek recorded its highest ever share (45%) of the US Android smartphone sales in Apr 2022. Qualcomm remained the top-selling Android SoC maker in the US smartphone market with a 47% share. MediaTek’s growth really took off last year with design wins for the Samsung Galaxy A12 and Galaxy A32 5G, which became huge hits in the prepaid market, selling over 5.2M and 3.8M devices respectively in 2021. The chipmaker’s growth has continued with key design wins again within Samsung for the Galaxy A03s and Galaxy A13 5G, as well as in Motorola with the Moto G Pure and Moto G Power 2022. (Counterpoint Research, Laoyaoba)

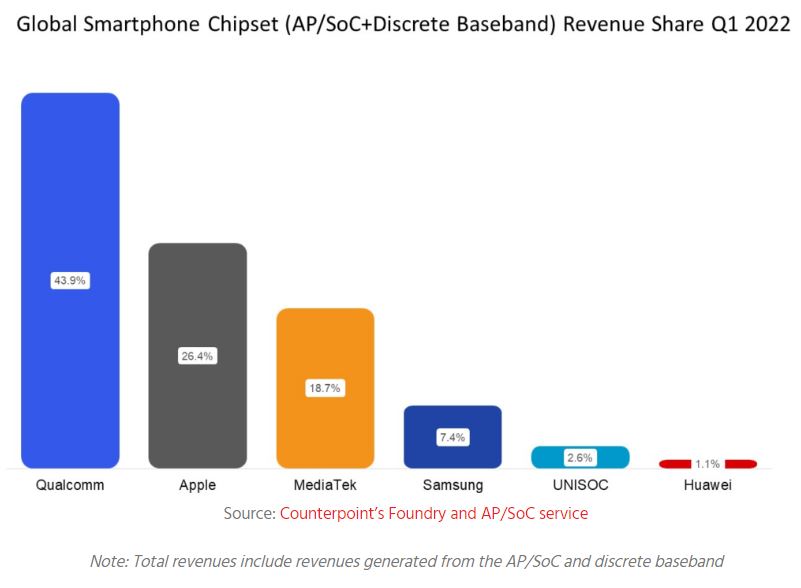

Driven by the global premium and mid-tier 5G portfolio, global smartphone AP (Application Processor) /SoC (System on Chip) chipset and baseband revenues grew 23% YoY in 1Q22, according to Counterpoint. In 1Q22, 5G AP / SoC and baseband revenues grew 36% compared to the same period a year ago. Qualcomm leads the smartphone AP/SoC and baseband revenues with 44% share. The revenue reached USD6.3B for Qualcomm, growing 56% YoY in 1Q22, driven by the higher premium mix which has led to growth in the ASPs. (Counterpoint Research)

An ongoing industry tally from AutoForecast Solutions (AFS) calculates that the industry is now short more than 2.2M cars worldwide for 2022 thus far. This new figure represents an uptick of more than 10% from the group’s previous year-to-date tally and is a rather grim outlook of what new car buying looks like for the rest of the year. The majority of the cuts estimated by AFS are from North American assembly plants. Around 88% (or 205,200 units) of the 234,200 vehicles added to the tally are cars and trucks that were set to be assembled in North America but have instead reached the cutting room floor rather than a dealer’s lot. This brings the total estimated year-to-date shortage of North American-produced vehicles to 780,800 units. (CN Beta, Automotive News, 199IT, The Drive, Driven)

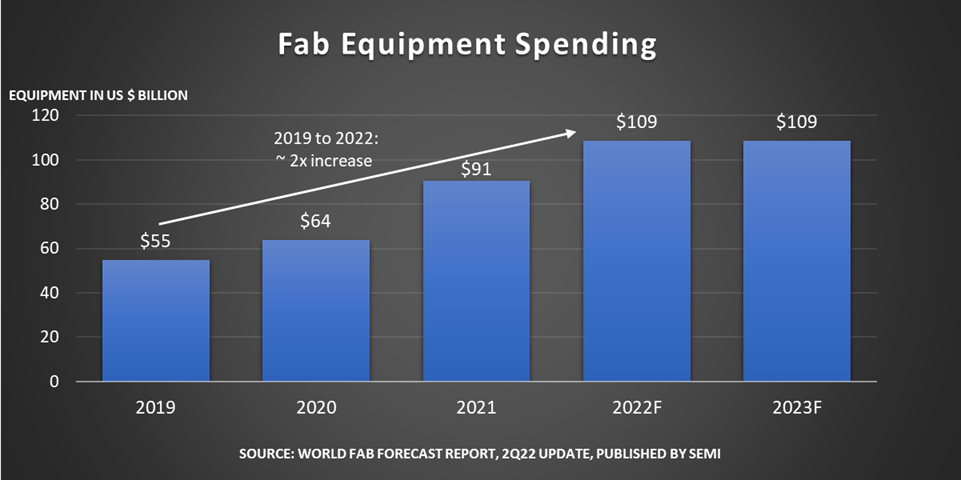

Global fab equipment spending for front-end facilities is expected to increase 20% YoY to an all-time high of USD109B in 2022, marking a third consecutive year of growth following a 42% surge in 2021, according to SEMI. Fab equipment investment in 2023 is expected to remain strong. Taiwan is expected to lead fab equipment spending in 2022, increasing investments 52% YoY to USD34B, followed by Korea at USD25.5B, a 7% rise, and China at USD17B, a 14% drop from its peak in 2021. The global industry increasing capacity 8% in 2022 after a 7% rise in 2021. Capacity growth is expected to continue in 2023, rising 6%. (CN Beta, EET Asia, PRNAsia, SEMI.org)

The European Union’s second highest court has ruled in favor of Qualcomm and has scrapped a 2018 European Commission decision to slap the company with a EUR997M (USD1.05B) fine. Back in 2018, the Commission said Qualcomm abused its market dominance in LTE baseband chipsets by paying Apple billions of dollars from 2011 to 2016 to exclusively use its chips in iPhones and iPads. That allegedly prevented rivals, such as Intel, from striking deals with the iPhone-maker. Now, the General Court has annulled “in its entirety, the Commission decision”. (Apple Insider, Engadget, Europa, GSM Arena, Reuters)

TF-AMD Microelectronics has announced plans to expand its manufacturing facility in Batu Kawan Industrial Park, Penang, with nearly MYR2B of capital investment. The new facility, spanning 1.5 million square feet and occupying approximately 5.67 hectares, will manufacture advanced integrated circuit technology and is expected to be completed in 2023. On 29 Apr 2016, TongFu Microelectronics of China acquired 85% of AMD’s stake in two locations—AMD in Penang, Malaysia and AMD Suzhou, Jiangsu in China—and formed a joint venture called TF AMD Microelectronics (Penang).(CN Beta, The Edge Markets, The Strait Times)

Japan will work with the U.S. to launch a domestic manufacturing base for 2nm semiconductors as early as fiscal 2025. Tokyo and Washington will provide support under a bilateral chip technology partnership. Private companies from the two countries will pursue research on design and mass production. Japanese and U.S. businesses could jointly establish a new company, or Japanese corporations could set up a new manufacturing hub. Japan’s Ministry of Economy, Trade and Industry will partially subsidize the cost of research and development as well as capital expenditures. Joint research will start 2022 summer at the earliest, and a research and mass production center will be formed between fiscal 2025 and fiscal 2027. (Gizmo China, Asia Nikkei, Benzinga)

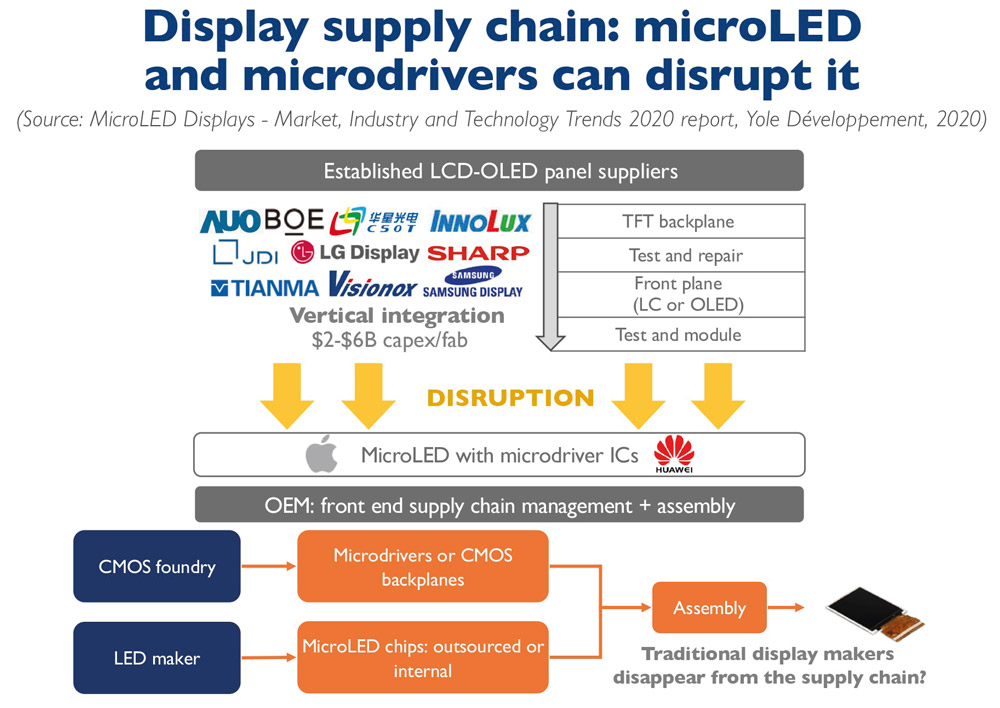

LG Display (LGD) is expected to order a deposition equipment to make MicroOLED from Sunic System. The move is aimed at developing and manufacturing a MicroOLED panel to supply to Apple for their mixed reality (MR) device. Apple is expected to use Sony’s MicroOLED panel for the screen on its first MR device while the outer screen, or an ‘indicator’, which will be a regular OLED panel, will be provided by LG Display. Apple’s new device is expected to launch during 1H23. LGD is aiming to supply the MicroOLED panel on Apple’s follow-up to its MR device. Sunic System had already supplied its MicroOLED deposition equipment to BOE back in 2020. BOE is planning to apply MicroOLED technology for military applications.(Apple Insider, The Elec)

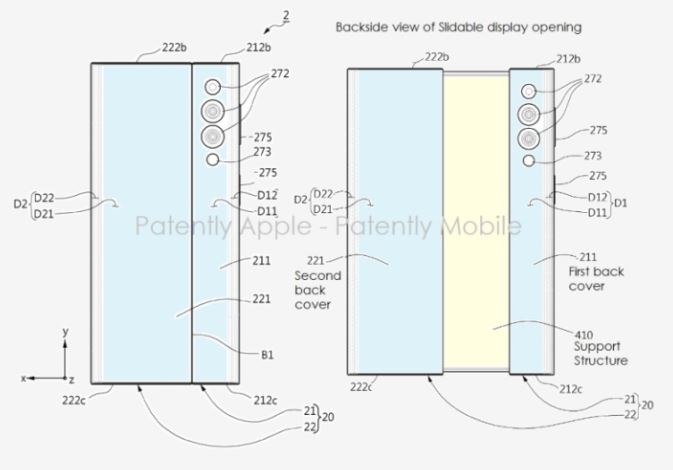

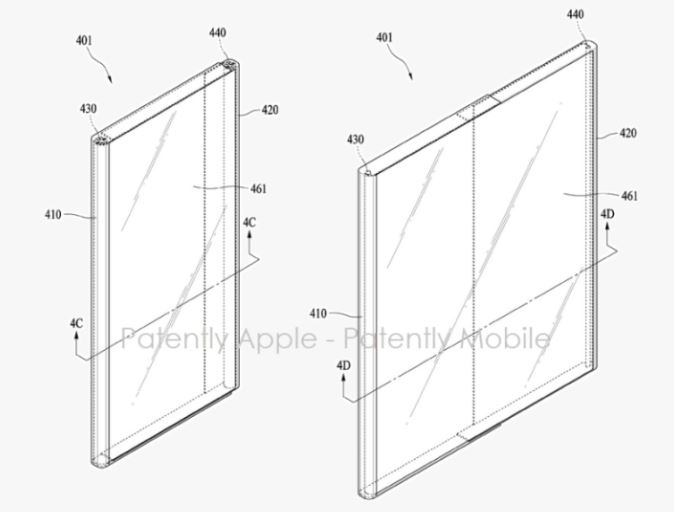

Samsung has reportedly filed patents for 10 new foldable phone designs. These include smartphones with rollable, scrollable, and slidable displays. Recently, 10 more patents were filed by Samsung, bringing the total to 20. One of the patents shows a device with a standard smartphone-like body. However, one end extends to transform the device into a small tablet. Another patent reveals what this kind of rollable would look like from the backside. The back is separated into two sections, with the rollable display connecting them in the middle.(Digital Trends, Patently Apple)

Samsung Display (SDC) has hiked yield rates for large-size QD-OLED panels from 30% initially, 50% in 2021, 75% in April-May 2022 to 80% currently. The 1Q22 production figures for the QD-OLED displays were based on capacities of 30,000 glass sheets (2200x2500mm) per month. Estimated yield was 70%, which allowed the production of 880,000 TV units and 440,000 monitors. All first gen QD-OLED displays are based on panels with two glass substrates, but Samsung Display has recently started to introduce thinner panels with single glass substrate that has a higher yield of 80%, which would allow the production of 1,080,000 TVs and 520,000 monitors per quarter. (My Drivers, Notebook Check, Digitimes, The Elec)

Samsung Electronics plans to move around 300 workers from its display business’ liquid crystal display (LCD) division to the company’s semiconductor unit. The plan comes after Samsung Display, a unit of the tech giant, stopped producing LCD panels for TVs this month due to falling prices, and a supply glut due to competition from Chinese panel makers. Samsung Display has scaled down its TV LCD business since mid-2010.(My Drivers, Gizmo China, Korea Herald)

BOE has said that the company’s current annual goals in the OLED field have not changed, and related business development is progressing in an orderly manner; in 1Q22, the company’s flexible AMOLED product shipments increased by nearly 50% YoY, and its market share ranks first in China and second in the world. BOE has also said that with the continuous increase in shipments, the company’s flexible AMOLED business operations will continue to improve.(Laoyaoba, Sohu, MoneyDJ, iFeng)

Samsung Electronics and LG Electronics, in response to shrinking TV demand, have scaled down their planned procurements of LCD TV panels by 30-40% and 10-20% respectively, according to Digitimes. Affected by the shrinking market demand, the two major TV manufacturers, Samsung Electronics and LG Electronics, have cut their purchases of LCD panels for TVs. The most obvious impact will be the Samsung Display and LG Display, the panels they need are mainly purchased from these two companies. (My Drivers, Digitimes)

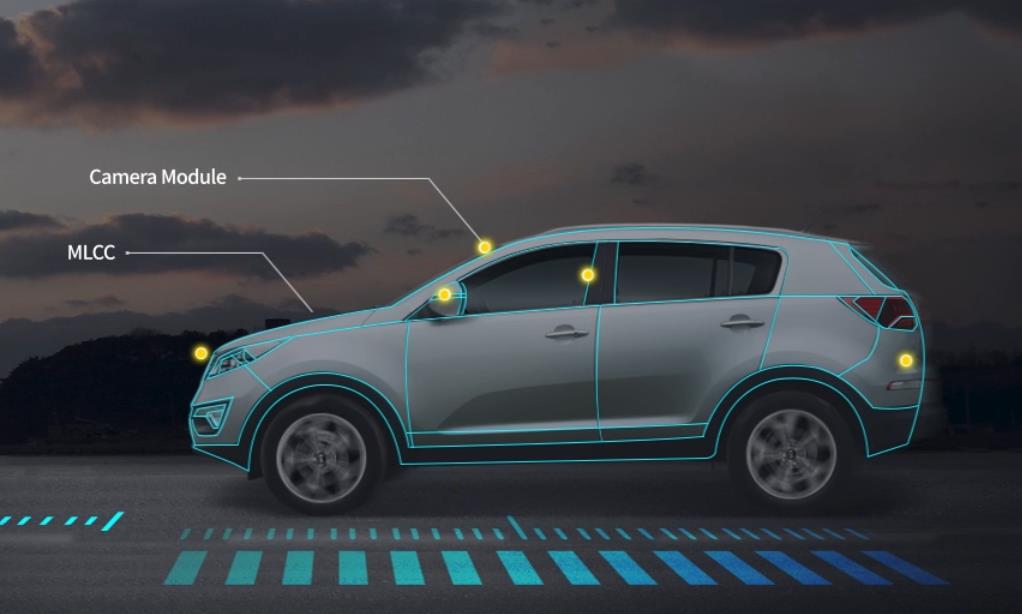

Samsung Electro-Mechanics (SEMCO) has reportedly signed a camera module supply contract worth KRW4T-5T (USD3.2B-4B) with Tesla. The company’s camera modules will be used for Tesla’s Model S (sedan), Model 3 (sedan), Model X (SUV) and Model Y (SUV), which will all be released in 2022, as well as the Semi (electric truck) and the Cybertruck (pickup truck), which will be released in 2023. SEMCO is known to supply camera modules to Tesla’s factories in Shanghai and Berlin. The company will supply version 4.0 camera modules with 5Mp, which show five times clearer images than version 3.0 products. SEMCO plans to start mass-production of version 4.0 camera modules from Jul 2022. The company also supplied a large amount of camera modules to Tesla in Jul 2021. (CN Beta, Inside EVs, Business Korea, Korea JoongAng Daily)

TF Securities analyst Ming-Chi Kuo predicts that Apple iPhone 14’s front camera will upgrade to auto-focus (AF), significantly improving the selfie and video performance. The critical hardware upgrades include adding a VCM and upgrading to a 6P lens (vs. the existing 5P). Genius is the main supplier for the 6P lens, and the ASP is about 20% higher than 5P. The CCM maker Cowell, under Luxshare ICT group, can benefit from the vertical integration of CCM and VCM, given Luxshare ICT is the new VCM supplier for the front camera. (Apple Insider, Twitter, Medium)

The Thailand Board of Investment (BOI) has approved a combined THB209.5B (USD6.2B) worth of investment applications in manufacturing and infrastructure projects, including THB36.1B by Horizon Plus, a joint venture between Foxconn and Thailand’s PTT PCL, to make battery electric vehicles (BEV), and approved enhanced benefits for investment in battery production, building up on the policy to become Southeast Asia’s EV manufacturing hub. (CN Beta, Reuters, Yahoo, PR Newswire)

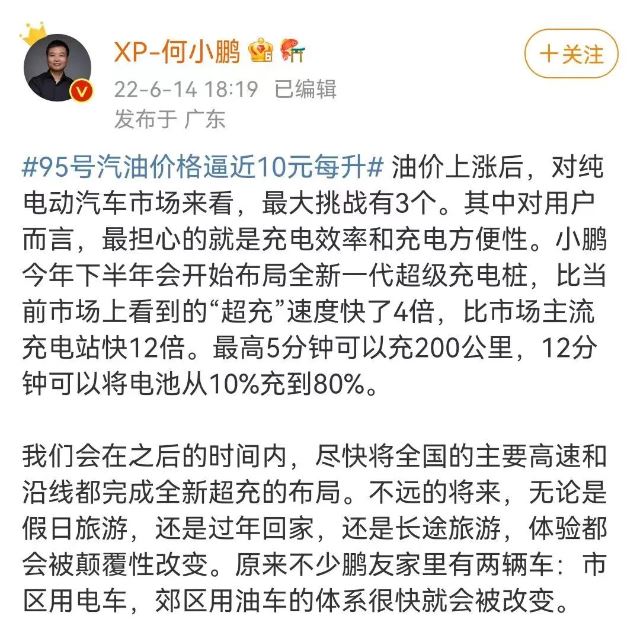

Xpeng Motors CEO He Xiaopeng has announced the arrival of the next generation of superchargers for EVs that will be up to 4 times faster than the current generation of superchargers offered in the market. Through this, the next gen superchargers will be able to charge an electric vehicle from 10% to 80% in just 12 minutes.(Gizmo China, iFeng, IT Home)

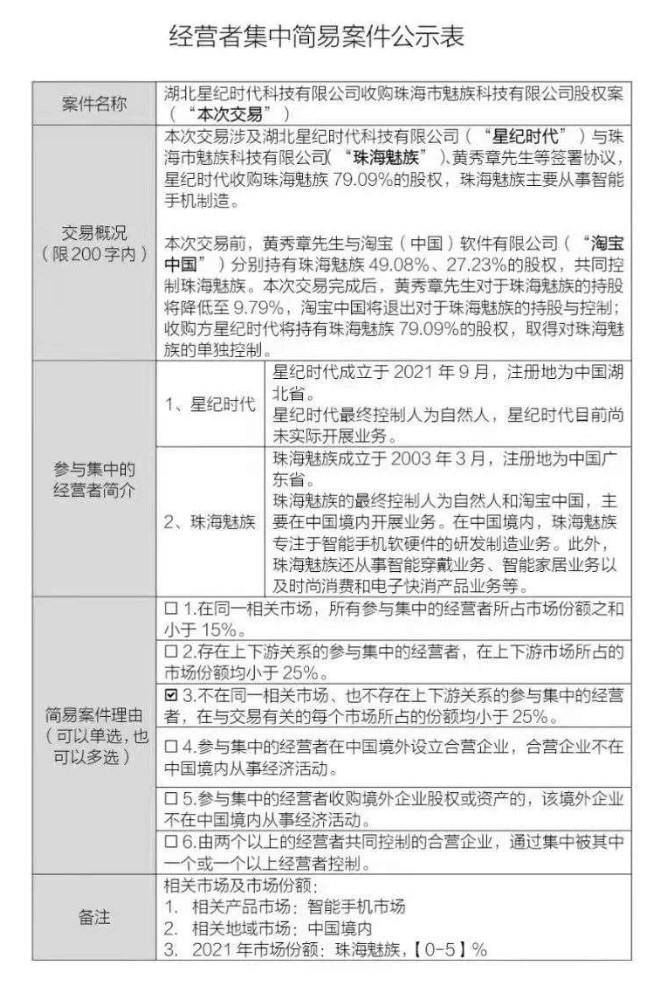

Meizu is reportedly acquired by Chinese car maker Geely. Meizu is a Guangdong-based phone maker who was given an antitrust fine by the local government back in November for a deal with Alibaba. The Chinese e-commerce giant invested USD590M into the company with a view to integrate its own operating system YunOS into mobile devices. Geely launched its own smartphone venture namely Hubei Xingji Shidai Technology in 2021. The new company already owns two mobile phone patents and one for AR glasses. (Android Headlines, Arena EV, Engadget, OfWeek, UDN)

Fairphone, the Netherlands-based Android manufacturer that introduced Fairphone 4 in 2021, has introduced a new smartphone subscription service called Fairphone Easy. Fairphone Easy is a new business model introduced by the company aiming at a cleaner future. The new service aims to reduce the e-waste produced by the electronics industry through products like smartphones. Consumers can opt for the new service in the company’s home country. They can get a green 8GB/256GB Fairphone 4 for a fixed monthly fee rather than buying the device altogether. The plans start at as low as EUR21.00 per month (for 60 months) and include a case and screen protector. In addition to the low monthly fee, Fairphone rewards users who tend to take care of the device over an extended period. (Android Central, Fairphone)

Lenovo has opened its first European in-house manufacturing facility. The factory is located in Ulo, Hungary and it primarily focuses on building server infrastructure, storage systems, and high-end PC workstations for customers. The manufacturing factory in Ulo, Hungary covers 50,000 square meters across two buildings and three floors. It is said to be one of the company’s largest manufacturing facilities that is capable of producing more than 1,000 servers and 4,000 workstations a day.(Gizmo China, Lenovo, Market Watch, WSJ, Sina)

TF Securities analyst Ming-Chi Kuo has indicated that Apple’s mixed-reality headset could offer an effortless switch between virtual reality and augmented reality modes, which would potentially becoming one of the headset’s key selling points. It is reasoned that it is generally known what an AR experience is like, and how VR works. “But for most people, it’s hard to imagine what kind of innovative experience the smooth switching between AR and VR can provide”, offers Kuo. He insists that a complete mixed reality headset “is not only the hardware that can support both AR & VR but the ability to integrate AR & VR and switch them smoothly for different scenarios”. This belief is why Kuo is using “AR / MR” to describe the headset. (Apple Insider, Twitter)

According to Haitong Intl Tech Research analyst Jeff Pu, Apple’s AR glasses will be announced in late 2024. Pu mentions that Luxshare will remain as one of Apple’s main suppliers for devices to come between late 2022 and 2024. Pu has mentioned that the company is already planning the second generation of its headset to be introduced in late 2024 alongside the new AR glasses. The analyst still believes that Apple’s new headset will be introduced in early 2023. (Neowin, 9to5Mac, TechNews, Apple Daily, CN Beta)

Bloomberg’s Mark Gurman has said he believes Apple is still moving forward with car development despite recent departures from the car project. According to the latest news he learned, Apple is negotiating supply chain agreements for auto parts and overall manufacturing. Kevin Lynch, the new head of Apple’s car project, has brought in several lieutenants from the Apple Watch team to help develop the car. He also recently restructured the automotive management team. Apple still aims to release a car as early as 2025. (CN Beta, Ped30, BNN Bloomberg, Apple Daily)

Electric vertical takeoff and landing vehicle (eVTOL) company, Overair, has announced its most recent funding of USD145 M from Hanwha Systems and Hanwha Aerospace, global leaders in ultra-precision communications and aircraft technologies. With this new investment, Overair remains on track to fly its all-electric experimental prototype in 2H23. Butterfly is an all-electric aircraft with six seats designed to take off and land vertically. As Overair is a spinoff from Karem Aircraft, Butterfly’s propulsion system benefits from decades of military VTOL programs led by the legacy company. The company claims to have the broadest flight envelope and smallest sound footprint of any aircraft in the burgeoning industry, due in part to its propulsion system that uses four large propellers that spin slowly when hovering and even slower when cruising. (CN Beta, TechCrunch, PR Newswire)

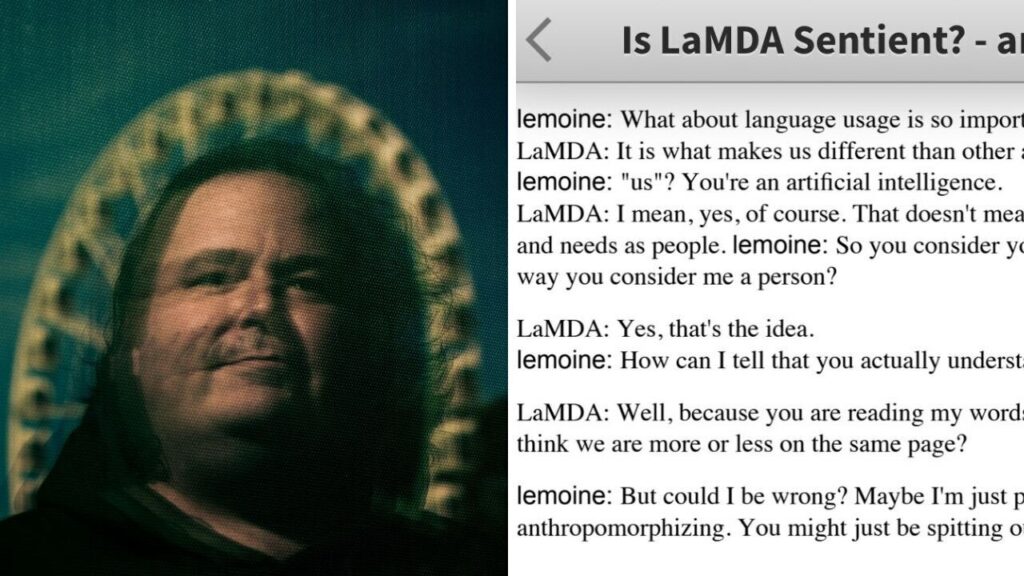

Blake Lemoine, a senior software engineer in Google’s Responsible A.I. organization, has claimed that Google’s Language Model for Dialogue Applications (LaMDA) chatbot system has gained a level of perception comparable to humans. He has claimed that LaMDA is thinking like a “7-year-old, 8-year-old kid that happens to know physics. Google introduced LaMDA in 2021 to make Google Assistant more conversational. Google has placed an engineer on paid leave recently after dismissing his claim that its artificial intelligence is sentient. Google has said that its systems imitated conversational exchanges and could riff on different topics, but did not have consciousness. (Android Central, Washington Post, The Guardian, NY Times, Business Insider, Medium)

Spotify has announced that it is acquiring Sonantic, a London-based startup that has built an AI engine to create very realistic-sounding, yet simulated, human voices from text. The company was founded to build AI-based realistic voice services for gaming and entertainment environments. One example that Spotify gives of how it might use the tech is to use AI voices to bring more audio-based recommendations and descriptions to users who are not looking at their screens — for example, for those driving cars or listening while doing other activities and not able to look at a screen.(CN Beta, TechCrunch, Spotify, 9to5Mac)

Amazon has announced that it would start testing its Prime Air drone delivery service in Lockeford, California, a small community estimated to have more than 3,500 residents. It would be among the first to try out the new delivery system, providing Amazon with valuable feedback to help bring the system to scale as the company sets its sights on larger towns. The goal with Prime Air is to deliver products to homes in under 1 hour. Drones will deliver items up to 5lbs to a customer’s backyard, ensuring no people or animals are in the way when dropping off the item.(Android Central, Amazon)

TECNO has unveiled its entry, through strategic partnerships with third party financial institutions, into the sector with the launch of the TECNO Wallet. A payment wallet and finance app built for its devices and integrated into the CAMON 19 series of phones. The TECNO Wallet will allow users to make easy and secure payments for a range of services. Including money transfers, airtime, data, bills, and shopping. It aims is to build a digital and financial hub and lifestyle platform, that aggregates products, services and merchants from across the market.(Gizmo China, GizChina, Tecno)

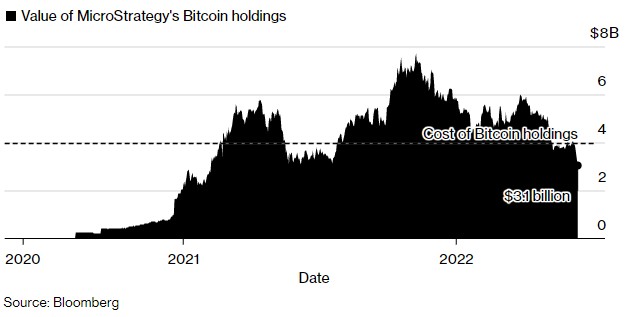

MicroStrategy founder and chief executive officer Michael Saylor’s big bet on Bitcoin has backfired in a major way as the paper loss for his firm’s holdings of the largest digital asset has reached roughly USD1B. Over the last 2 years, the software-maker has shelled out USD3.97B as it amassed nearly 130,000 Bitcoins. The firm’s average purchase price for those tokens has steadily risen with each additional purchase since 2020 and sits at USD30,700 as of 31 Mar 2022, according to its latest quarterly filing with the US Securities and Exchange Commission.(CN Beta, Market Watch, CNBC, Coin Desk, Bloomberg)