6-23 #Airplane : Samsung is expected to announce mass production of 3nm next week; Apple will start evaluating BOE’s samples of OLED panels; Samsung Display may supply 80M OLED panels to Apple; Sony is reportedly developing 100MP sensor aiming; etc.

Apple’s AirTag could see a second-generation release, TF Securities analyst Ming-Chi Kuo suspects, but only if shipments of the tracking accessory continue to grow. The AirTag has gradually grown in shipments since its release. The shipment estimates for the tracker are thought to have reached roughly 20M in 2021, while in 2022, it is reckoned will reach 35M. (Apple Insider, CN Beta, Twitter)

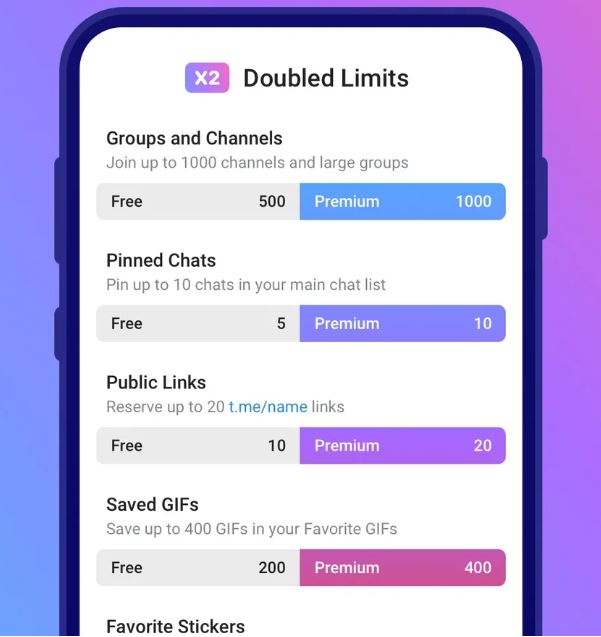

Telegram has amassed over 700M monthly active users. Telegram is rolling out the paid tier, which gives users access to extra features for USD4.99 / month. Premium subscribers will also get double the limits imposed on standard users. Instead of joining up to 500 channels, subscribers are capped at 1,000 channels. The same goes for other features on Telegram — subscribers can create 20 chat folders with 200 chats each, save up to 10 stickers, pin up to 10 chats, and add a total of four accounts to Telegram instead of three. Premium users also get to have longer bios with a link.(TechCrunch, The Verge, Telegram)

Samsung reportedly has nearly 50M units of smartphones in distributor stocks. Its mid-tier Galaxy A series took up a huge portion of smartphones in inventory being read to be sold. Samsung is aiming to ship around 270M units of smartphones in 2022 and 50M units is 18% of that. Healthier numbers will be somewhere around 10% to early-10% so the number shows Samsung is suffering from low demand for smartphones. Samsung has manufactured around 20M units of smartphones per month in Jan-Feb 2022. This has dipped to 10M units in May 2022, a likely reaction to too many units in the inventory and low demand. (Android Authority, CN Beta, SamMobile, The Elec)

Metaverse Standards Forum is formed aiming to drive open interoperability, which could make it easier for developers to build across platforms. The forum will focus on collaborative hackathons, open-source tooling, and consistent standards across different metaverse projects. There are 37 companies and nonprofits have joined thus far, including Adobe, Epic Games, Huawei, Meta, Microsoft, Nvidia, Qualcomm, and Sony. (Android Authority, Apple Insider, Metaverse Standards, TechCrunch)

Tencent has reportedly announced to its staff the official formation of an “extended reality” (XR) unit, formally placing its bets on the metaverse concept of virtual worlds. The unit is tasked with building up the extended reality business for Tencent including both software and hardware, the sources said, adding that it will be led by Tencent Games Global’s Chief Technology Officer Li Shen and will be part of the company’s Interactive Entertainment business group. The XR unit will mark a rare foray into hardware for Tencent, which is mostly known for its software such as its suite of games as well as social media applications. (CN Beta, Reuters, Asia Financial)

Malaysia has moved EV adoption to the top of its priority list, while aiming to achieve carbon neutrality by 2050, according to ASEAN Briefing. Malaysia’s semiconductor industry and copper wire industry are the two pillars of its EV future, and investment has been growing. Car component supplier GCG Asia, for one, has unveiled its plan to build a battery factory in Malaysia. According to Malaysian Investment Development Authority (MIDA), Malaysia is the third-largest automobile market in ASEAN with a total of 28 car parts suppliers and assemblers. The car industry accounts for 4% of the country’s GDP. EVs are still a luxury for most Malaysians. The cheapest model available still costs around two times the annual income of a middle-income family in Malaysia. By far, there are about 600 charging stations across the country, but the government has promised to build 10,000 more by 2025. (Digitimes, press, ASEAN Briefing, Digitimes)

Honda Motors will introduce a three-wheeled electric scooter into the market by 4Q22. This is following the formation of Striemo, an arm of Honda’s Ignition Initiative. The Honda Striemo electric scooter is a micro-mobility EV with some unique features. Stability is enhanced with a sturdy frame and technology that supports such balance even at top speeds. The self-balancing mechanism, according to Honda, is a vital element of the scooter’s structure. The Striemo has a top speed of 25km/h and a range of 30km on a single charge.(Gizmo China, Inside EVs, Green Car Congress, Honda)

UVeye, a provider of advanced vehicle diagnostic systems, has announced that it has received an investment from the capital venture arm of General Motors, GM Ventures, to help fund the development and commercialization of the company’s vehicle inspection technology. UVeye also has entered into a commercial agreement with General Motors to explore the expansion of UVeye’s automated high-speed systems to GM dealerships throughout various markets. UVeye systems use artificial intelligence, machine-learning and high-definition camera technologies to quickly and accurately check tires, underbody components and vehicle exteriors for defects, missing parts and other safety-related issues.(CN Beta, Times of Israel, PR Newswire)

UPS has unveiled a battery-powered, four-wheeled cycle to more efficiently haul cargo in some of the world’s most congested streets and to reduce its carbon footprint. The company is trying to reach carbon neutrality by 2050. The slimmed-down vehicles don the company’s gold-colored logo and accompanying stripe on a dark brown background. But the “eQuad” — as the company calls it — garnered amusement from passersby.(GizChina, Electrek, NY Post)

Cashify, a marketplace for gadgets trade-ins and buybacks in India, has raised USD90M in a new financing round as it looks to expand its business in the world’s second-largest smartphone market. The new round, which multiples the startup’s valuation by 2.5 times since Series C funding, takes Cashify’s to-date funding to over USD130M. Cashify operates an eponymous platform — both online and physical stores and kiosks — for users to sell and buy used smartphones, tablets, laptops and other gadgets. Users sell to and buy devices from the startup by visiting the startup’s website or app.(TechCrunch, Business Standard)

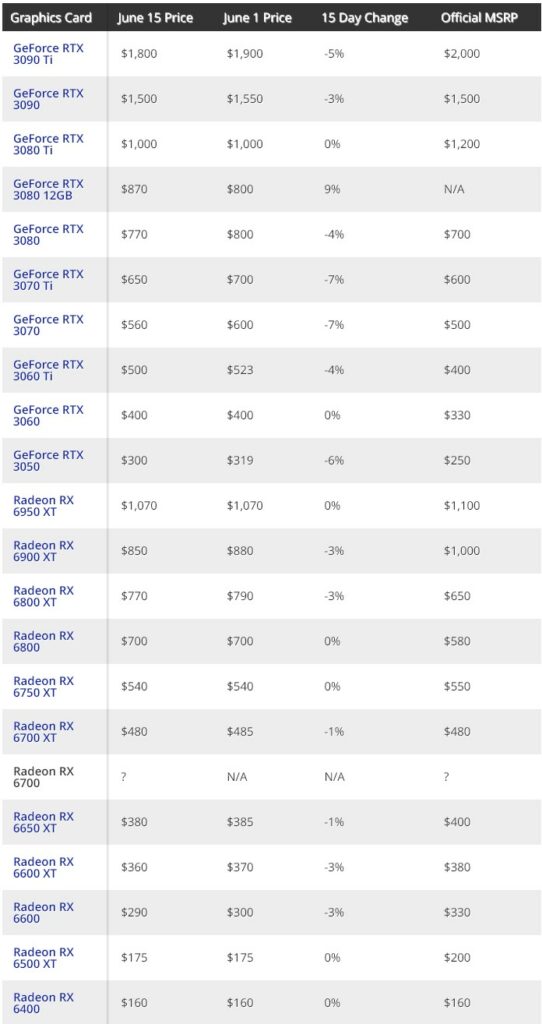

GPU prices dropped 15% in May 2022, and there is similar 10–15% drops each month for the past several months. The best graphics cards come back into stock (at retail) as GPU mining profitability has plummeted — and that was before Bitcoin and Ethereum crashed again, dropping Bitcoin from around USD30,000 to the low USD20,000s and Ethereum from around USD1,900 to about USD1,100. In mid Jun 2022, Bitcoin’s value dropped over 30%, while Ethereum plunged by more than 40%. (CN Beta, Tom’s Hardware)

IC design houses are negotiating with upstream foundries about their wafer starts between the end of 2022 and early 2023, but are finding it difficult to plan, according to Digitimes. IC design-related industry players have pointed out that downstream customers are putting more and more pressure on prices. At the same time, the supply of upstream wafers is still relatively tight. In addition to continuing to increase prices in 2023, wafer foundries will also It is the beginning of asking IC designers to shorten the payment period, which brings less pressure than downstream customers. In fact, during the period of severe shortage in the past year, the difficulty for IC designers to strive for production capacity is that they do not know who else to ask for more, the difficulty at this stage is that we do not know whether to turn conservative or continue to maintain the strategy of taking as much as we can. At this stage, relatively long materials for TV, mobile phones, notebooks and other applications can be determined, and orders placed in 2023 should be significantly reduced. For example, the demand for large-size DDI has begun to weaken from the end of 2021, and it can be expected that the 8” related process will be freed up in 2023. (Digitimes, Digitimes, press, China Times)

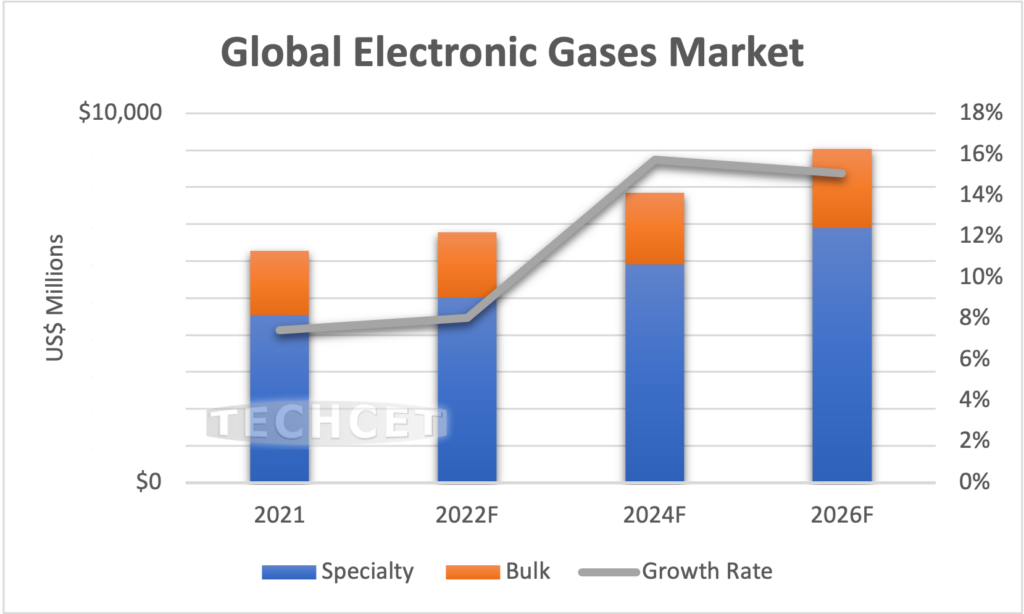

TECHCET Electronic Gases market revenues hit USD6.3B in 2021 and is forecasted to grow to 8% in 2022. TECHCET forecasts the 2022 Electronic Gases market will reach almost USD6.8B—growth primarily attributed to Specialty Gases. As leading-logic and new generations of memory continue to ramp, Specialty Gases consumed in etching, deposition, chamber cleaning, and other applications remain in strong demand. This segment is forecasted to increase by 10% in 2022 with ~9% CAGR through to 2026. As new semiconductor device fabs come online globally over the next several years, supply constraints may appear for other gases (B2H6, WF6, NF3, CF-gases) since demand increases are expected to outpace supply. With semiconductor manufacturers increasing fab production capacity, the demand for diborane (B2H6) material is rapidly increasing as it is critical in many device applications such as in doped carbon hard masks. (Laoyaoba, TECHCET)

Samsung has unveiled an aggressive plan of investing around USD355B that could help it to gain the #1 spot, overthrowing Taiwan Semiconductor Manufacturing Company (TSMC) as the world’s premier fabrication firm. In response, TSMC has announced an investment of around USD120B to keep it ahead of the competition. Through this, the Taiwanese firm intends to build four new chip fabrication lines in Tainan, Taiwan worth USD10B each. These factories shall manufacture lightning-fast 3nm chips. Both manufacturers claim to make these chips available by the end of the year 2022. Looking ahead, plans are underway by both competing firms to mass-produce 2nm chips intended to hit the market by 2025.(Neowin, Asia Nikkei)

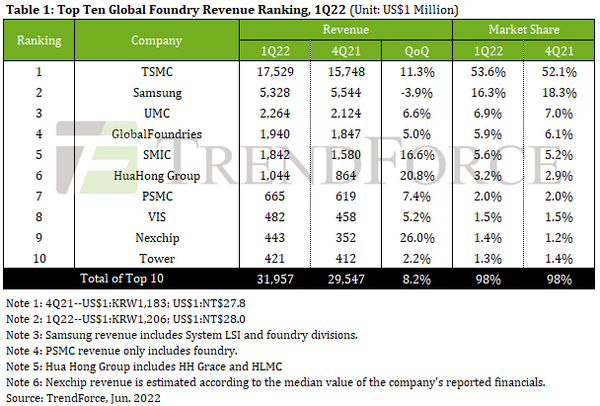

According to TrendForce, although demand for consumer electronics remains weak, structural growth demand in the semiconductor industry including for servers, high-performance computing, automotive, and industrial equipment has not flagged, becoming a key driver for medium and long term foundry growth. At the same time, due to robust wafer production at higher pricing in 1Q22, quarterly output value hit a new high for the 11th consecutive quarter, reaching USD31.96B, 8.2% QoQ, marginally less than the previous quarter. In terms of ranking, the biggest change is Nexchip surpassed Tower at the ninth position. (CN Beta, TrendForce, TrendForce)

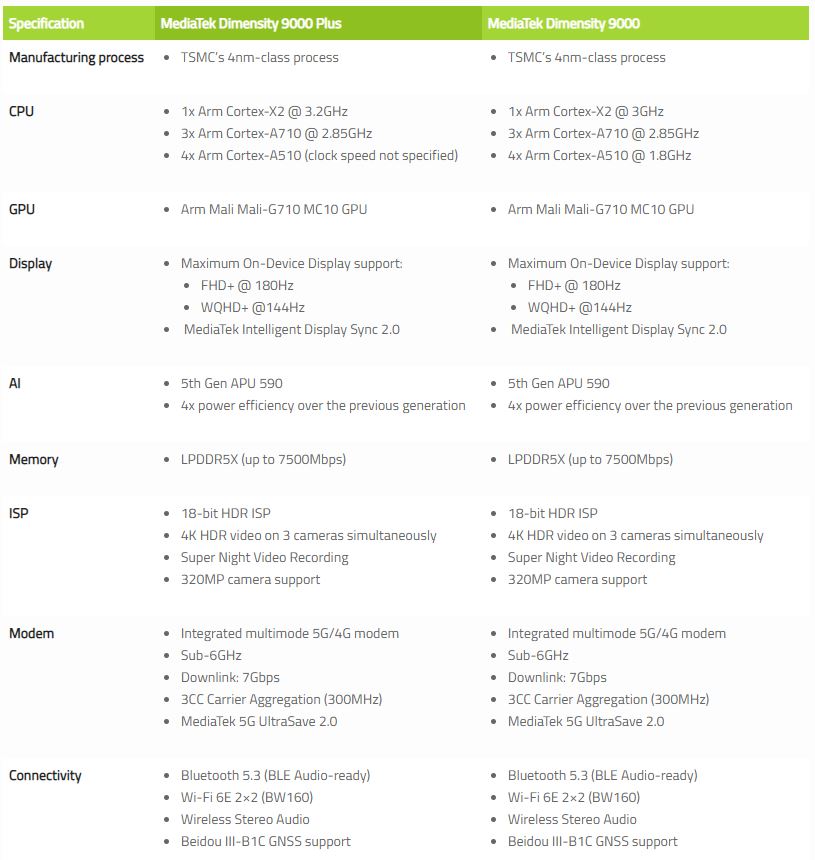

MediaTek has announced the new Dimensity 9000+ flagship chipset. The upgraded processor differs from the Dimensity 9000 by offering a 5% clock speed increase for the Cortex-X2 heavyweight core, going from 3.05GHz to 3.2GHz. Mediatek adds that the GPU has also received a 5% clock speed boost (and a graphical performance improvement of over 10%). It is built with 4nm by TSMC. It has an octa core CPU consisting of one Cortex-X2 core, three Cortex-A710 cores, and four Cortex-A510 cores.(Android Authority, Android Central, XDA-Developers, 9to5Google)

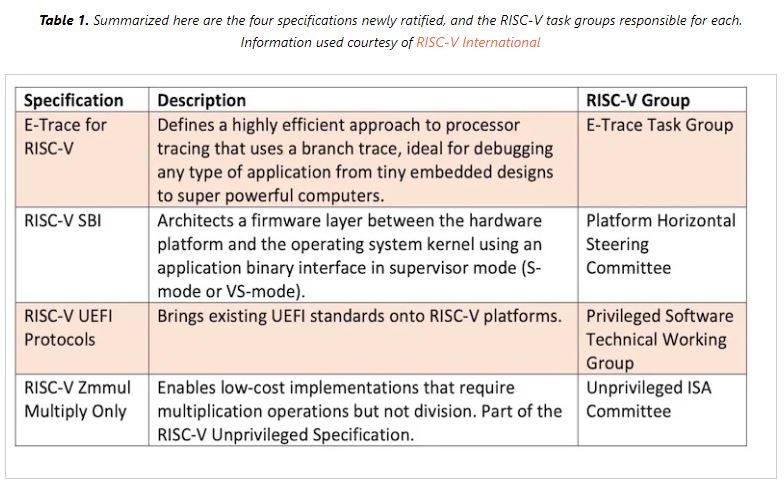

RISC-V International, the global open-design standards pioneer, announced its first four specification and extension approvals of 2022 – Efficient Trace for RISC-V (E-Trace), RISC-V Supervisor Binary Interface (SBI), RISC-V Unified Extensible Firmware Interface (UEFI) specifications, and the RISC-V Zmmul multiply-only extension. The news builds on momentum from 2021, in which 16 specifications representing more than 40 extensions were ratified. E-Trace for RISC-V defines a highly efficient approach to processor tracing that uses a branch trace, ideal for debugging any type of application from tiny embedded designs to super powerful computers. RISC-V specification for SBI architects a firmware layer between the hardware platform and the operating system kernel using an application binary interface in supervisor mode (S-mode or VS-mode). RISC-V UEFI Protocols bring existing UEFI standards onto RISC-V platforms.(CN Beta, The Register, RISC-V)

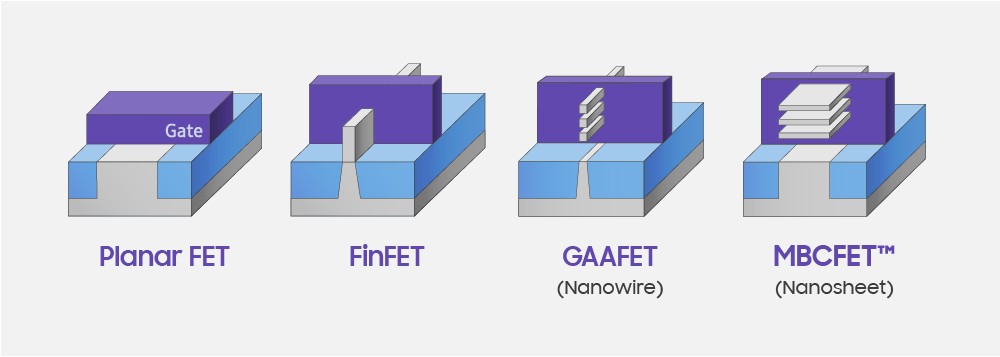

Samsung Electronics is expected to announce mass production of 3nm semiconductors in end Jun 2022, beating its foundry rival TSMC in advanced chipmaking process. The next-generation 3nm chips will be built on the Gate-All-Around (GAA) technology, which Samsung said will allow up to 45% area reduction while providing 30% higher performance and 50 percent lower power consumption, compared with the existing FinFET process.(GSM Arena, YNA)

LG Display (LGD) was expected to mass produce micro-OLED panels for the second-generation AR headset. Now, LGD reportedly would be using the ultra-high-resolution fine metal mask (FMM) from AP Systems. Back in 2021, Apple reportedly requested FMM samples from AP Systems for use in its mixed reality headset. The resolution of the headset’s display was 3000PPI, with the end goal for Apple was wanting to bring it to mass production. It should be noted that the same AP Systems was appointed by the Ministry of Trade, Industry, and Energy to develop micro-OLED technology for high-resolution AR displays. These panels would also exude high brightness levels and would be used in a variety of applications. AP Systems was appointed to develop panels for the national project with a 4000PPI resolution by 2024. That is the same year Apple is rumored to launch its pair of AR glasses and second-generation AR headset.(CN Beta, WCCFTech, Patently Apple)

Apple will start evaluating BOE’s samples of OLED panels aimed for the upcoming iPhone 14. BOE is hoping to receive approval from the iPhone maker within Jun 2022. Earlier 2022, BOE was caught by Apple having changed the circuit width of the thin film transistors on the OLED panels it was manufacturing for iPhone 13. This caused its supply of OLED panels for iPhone 13 to dip beginning in Feb 2022. BOE has reportedly received re-approval to supply panels for iPhone 13 by Apple. BOE will likely end up supplying around 5M units at most, given its recent debacle with the panels for iPhone 13.(Apple Insider, The Elec)

Samsung Display is planning to apply new materials in its production of foldable OLED panels to reduce cost. It is planning to use optically clear resin (OCR), which is a liquid, over optically clear adhesive (OCA), which is a film form, to attach the cover window on the OLED panel. Samsung Display previously used OCA for its foldable OLED panels, which takes longer than OCR as the transparent film must be put in place. Instead, it will now use inkjet machines to disperse the liquid OCR on the panels which reduces production downtime and is less expensive to procure. The inkjet machines will be supplied by STI and Samsung Display has already placed the order. STI had already supplied inkjet machines which are being used at the display panel makers plant in Cheonan in South Korea.(CN Beta, The Elec)

Japan Display Inc (JDI) has further developed its breakthrough transparent Rælclear display technology and expects to begin mass production of a new 20.8” Rælclear display with 2X brightness in the fall of 2023. Rælclear is a revolutionary display technology with glass-like transparency and sharp and vivid images fully visible from both the display’s front and back. In addition to the larger 20.8” screen, JDI has deployed its proprietary backplane technology to 2X the refresh rate, reducing flicker and improving image quality. JDI has also upgraded the 20.8” display with higher performance LEDs to 2X brightness. The 12.3” Rælclear display was primarily intended for use in facilitating face-to-face communication by converting voice into text.(CN Beta, JDI, Money Controller, My Drivers)

Samsung Display will supply Apple with organic light emitting diode (OLED) displays for their new iPhone 14. It is estimated that 80M OLEDs will be used for iPhone 14. Samsung Display collaborates with Duksan Neolux, Solus Advanced Materials, and Samsung SDI to mass-produce and supply OLED displays. Samsung Display will supply low-temperature polycrystalline oxide (LTPO)-thin film transistor (TFT) based OLEDs with excellent power efficiency and low-temperature polysilicon (LTPS)-thin film transistor (TFT) based OLEDs with high charge transfer and stability to the iPhone 14 series. (GizChina, GSM Arena, ET News)

Chinese startup CISTA has secured nearly CNY300M (USD44.8M) in a Series C2 round of financing to step up its development of electronic image sensors for applications in smartphones, public security, and wearable devices. CISTA, founded in 2013, specialises in the R&D of complementary metal-oxide-semiconductor (CMOS) image sensors, which are basically semiconductor devices built into today’s digital cameras and mobile phones to serve as “electronic eyes”. As the global demand for image sensors rises driven by the popularity of smartphones, laptops, and other electronic products, the new funding will help CISTA expand the R&D team, increase investment in new product development, scale-up production, and attract new clients. (Laoyaoba, Sina, 163, Deal Street Asia)

Teroshi Shimizu, president of Sony Semiconductor Solutions, a subsidiary of Sony Semiconductor, said that TSMC’s establishment of a factory in Kumamoto “increased confidence” in the expansion of its procurement channels amid the prolonged shortage of semiconductors. He has said that the company hopes to increase sales, but semiconductor procurement is a topic worthy of study under the current situation of shortage of production capacity, and the company considers improving benefits by stabilizing procurement. (CN Beta, Focus Taiwan)

Sony Group is raising the bar on image sensor technology as it aims to hold off rapid gains by Samsung Electronics and other players to capture over 50% the global market. President Terushi Shimizu of Sony Semiconductor Solutions has indicated that the company is conducting R&D feeling an intense threat posed by international rivals. Sony’s pricier products started to make up less of its sales, a development the Japanese company calls the “Huawei shock”. The group saw its global market share slide from 53% in fiscal 2019 to 43% in fiscal 2021. Rivals are rapidly closing in. Samsung has captured 18.5% of the market, while OmniVision Technologies enjoys strong business with the automotive industry and China’s GalaxyCore is boosting sales for lower-priced phones. Sony will also ramp up production capacity. A majority of the JPY470B (USD3.5B) in capital outlays earmarked group-wide for fiscal 2022 will go toward semiconductors, with the figure representing a 35% increase on the year. At the main image sensor plant in Nagasaki, a new fab that came online in 2021 is already undergoing a second expansion that began in May 2022. (Asia Nikkei)

Sony is reportedly developing 100MP sensor aiming at premium mid-range smartphones. The sensor will allegedly be part of the Sony IMX8 series. The series recently made its debut with the IMX800, a 54MP 1/1.49”. The company is also working on an IMX9 series, which will be more capable and will go up against some impressive sensors coming from competitor Samsung. (GSM Arena, SamMobile, Weibo, Android Headlines)

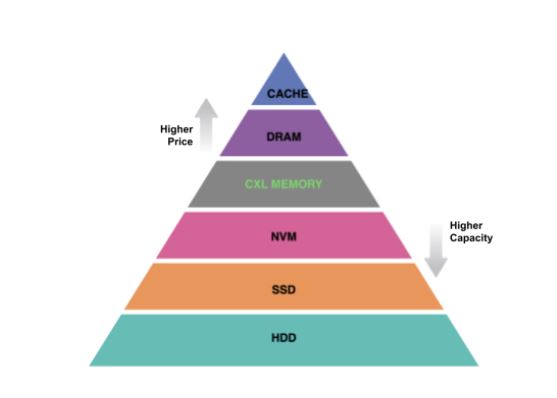

Meta has showcased Transparent Memory Offloading (TMO) as a new Linux kernel feature they developed that is already used in production on Facebook / Meta servers. Within Meta’s data centers this TMO functionality is saving 20~32% memory per server across their millions of servers. TMO has been running in production for more than a year, and has saved 20 percent to 32% of total memory across millions of servers in our expansive data center fleet. We have successfully upstreamed TMO’s OS components into the Linux kernel.(CN Beta, Meta, Phronix)

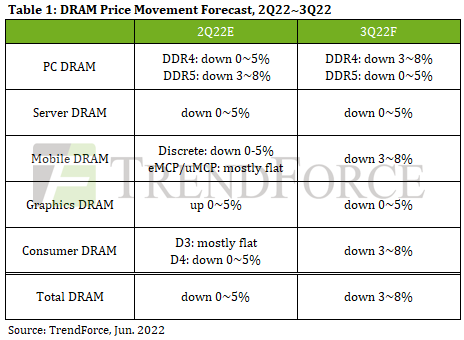

According to TrendForce, despite the significance of peak season and rising DDR5 penetration, the 3Q22 DRAM market still succumbed to the negative impact of weak consumer electronics demand resulting from the Russian-Ukrainian war and high inflation, which in turn led to an increase in overall DRAM inventory. This is the primary reason for a 3-8% drop in DRAM prices in 3Q22 and a more than 8% pricing dip in certain DRAM products for PCs and smart phones cannot be ruled out. In terms of Mobile DRAM, as sales in the consumer market fail to meet expectations, suppliers are forced to incrementally reduce the proportion of mobile DRAM production quarter by quarter and switch to server DRAM, thereby stabilizing market inventory and prices. However, the supply of mobile DRAM bits did not drop significantly due to the increased manufacturing. In addition, average memory installed per machine failed to increase significantly, resulting in continued oversupply and expanding price decline to 3~8% compared to 2Q22. (CN Beta, TrendForce, TrendForce)

Nanya Technology has received government grants to build a new NTD300B (USD10.17B) fab after a 9-month deferral primarily due to red tape, as well as shortages of labor and raw materials. Nanya Technology expects the fab, to be built in New Taipei City’s Taishan District, to start commercial operations in 2025. It had expected the fab to start operations in 2024 with a monthly capacity of 15,000 wafers. The chipmaker expects production this year to be little changed for a second year, after a 35% YoY expansion in 2020. It plans to ramp up production of its first-generation 10nm process technology in the second half of this year, allowing it to offer an 8-gigabyte DDR4 DRAM, among other memory chips. (CN Beta, UDN, Taipei Times, Digitimes)

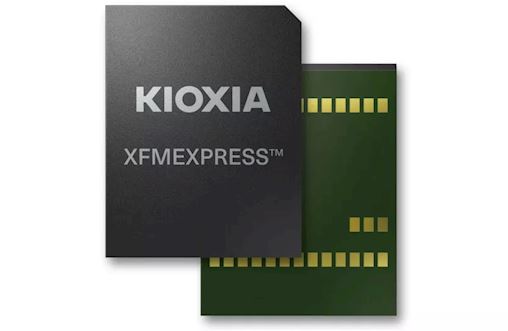

KIOXIA Corporation has started sampling of the XFMEXPRESS XT2 removable PCIe/NVMe storage device compliant with XFM DEVICE Ver.1.0-standard with dimensions of just 18×14 mm. The JEDEC XFM DEVICE Ver.1.0 form factor’s small size and low profile (14mm x 18mm x 1.4mm) offers a 252mm footprint. Designed for speed, the XFMEXPRESS XT2 implements a PCIe 4.0 x 2 lanes, NVMe 1.4b interface.(CN Beta, CNX-Software, Kioxia, TechRadar)

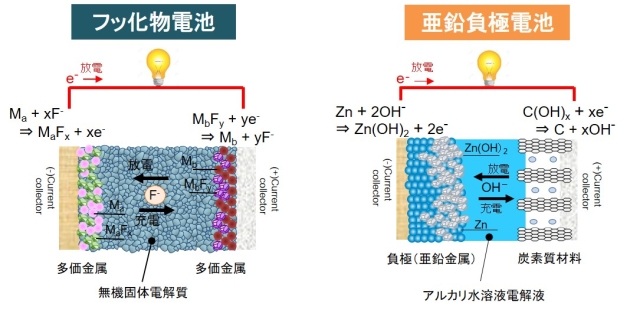

US and European battery makers are placing their focus on developing semi-solid-state and solid-state batteries, while manufacturers based in South Korea and China continue to compete in the US lithium battery market, according to Digitimes. The US lithium battery market was initially dominated by South Korea-based companies, before their Chinese competitors decided to collaborate with US electric vehicle (EV) makers and energy storage solution providers to set up manufacturing plants in the country in 2022. With lithium batteries being treated as national strategic resources, it would take some time for US and European battery makers to surpass their Chinese and South Korean peers in terms of ternary and LFP (lithium iron phosphate) battery mass production. However, the US and European companies may be adopting different strategies to enhance their competitiveness. Instead of commercialized technologies, US and European battery makers are focusing on next-generation manufacturing processes, and they will likely use most of their resources to develop semi-solid-state and solid-state batteries. Since solid-state batteries require less production time than mainstream liquid batteries, they will be more cost-competitive once they enter volume production. (Digitimes, press, Korea Herald)

TCL-owned renewable energy subsidiary company, the “TianJin ZhongHuan Semiconductor Company” (TJSEMI), has gone through a rebranding exercise by its parent company, TCL. And as of today onwards, the company has been renamed the “TCL Zhonghuan Renewable Energy Technology” (TZE), which stands for TCL Zhonghuan Energy. TCL clarifies that the decision to rebrand the company to TZE was in line to further improve clarity, and accurately portray the subsidiary company’s operations and functions to the general public. (Gizmo China, Sohu, 163)

Audi has partnered with German–Indian start-up Nunam to recycle the electric car batteries it used from test vehicles in the Audi e-tron test fleet. A second life for electric car batteries, Audi and Nunam explore modules made with high-voltage batteries that can be reused after their car life cycle and become a viable second-life use case. Nunam has developed the three prototypes in collaboration with the training team at Audi’s Neckarsulm site, which is also considered an engine of intercultural exchange. The non-profit start-up based in Berlin and Bangalore is funded by the Audi Environmental Foundation, and this is the first joint project between both AUDI AG and the Audi Environmental Foundation in addition to Nunam.(Gizmo China, Design Boom, Inside EVs)

The Japanese heavy engineering corporation Kawasaki Heavy Industries has taken up the development of the main components of a hydrogen-fueled passenger aircraft. They are supposed to be provided to foreign aircraft manufacturing companies in order to launch the production of such liners around 2040. The hydrogen-fueled passenger airliner, which does not emit carbon dioxide into the atmosphere during operation, is designed for about 150 seats, it is assumed that its flight range will be 2,000-3,000km. The development of these components will require an expenditure of more than USD133M. These funds will mainly come in the form of assistance from government agencies interested in Japan’s leadership in this technological area. By 2030, it is expected to begin testing the components of the hydrogen-fueled airliner.(CN Beta, NEDO, Digitnews)

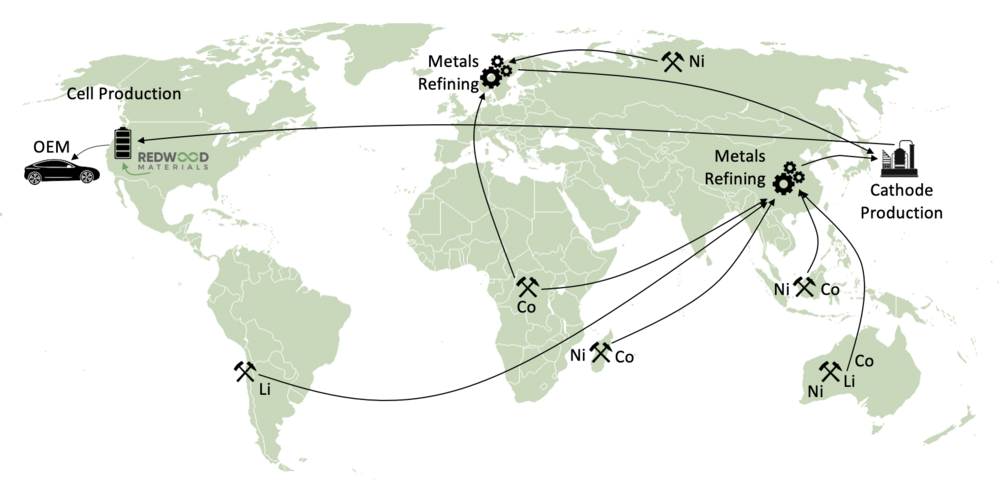

Toyota is partnering with Redwood Materials, a battery recycling company, to collect and recycle vehicle batteries. The plan is to take old, worn-out batteries and either refurbish them or break them down so their materials can be used to create new batteries. Redwood specifically plans on producing materials for anodes and cathodes — two major components of a battery cell. The company’s ultimate goal is to create a “closed-loop supply chain for electric vehicles”, meaning that it takes batteries from old EVs and turns them into batteries for new cars.(The Verge, Redwood Materials)

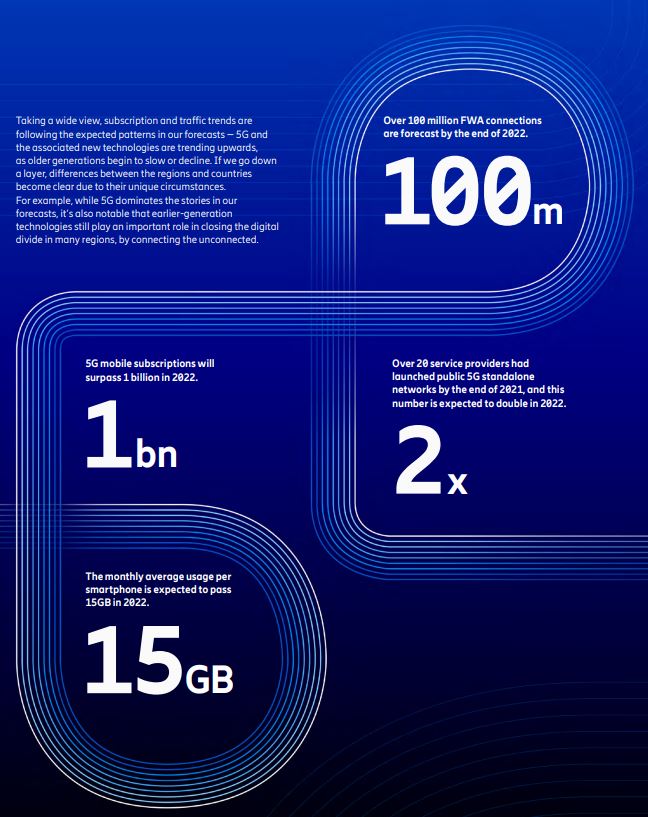

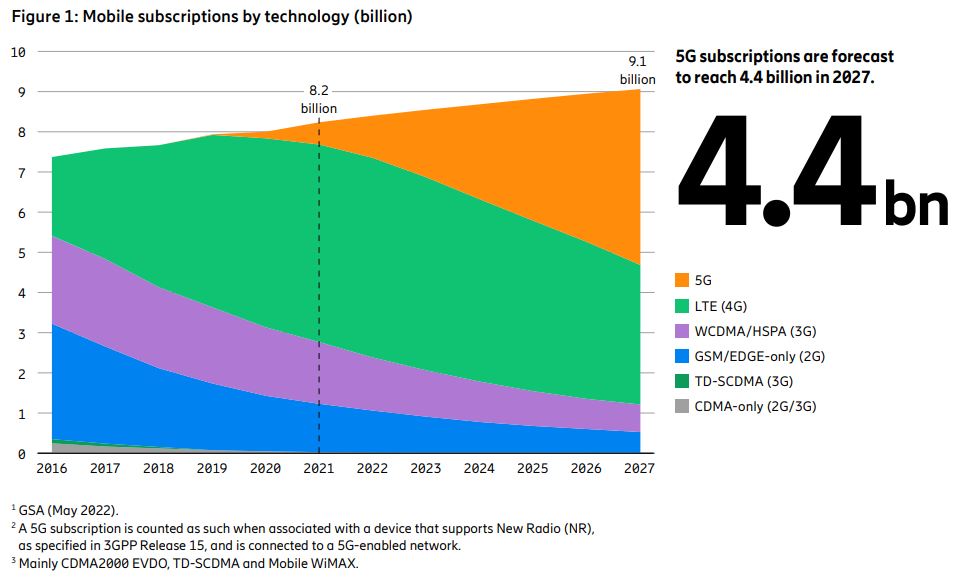

Ericsson expects global 5G mobile subscriptions to surpass 1B in 2022, helped by higher adoption in China and North America. A weaker global economy and the uncertainties caused by Russia’s invasion of Ukraine lowered its estimate for 2022 by around 100M. North America is forecast to lead the world in 5G subscription penetration in the next 5 years with nine-of-every-ten subscriptions in the region expected to be 5G in 2027. In India, where 5G deployments have yet to begin, 5G is expected to account for nearly 40% of all subscriptions by 2027. In global terms, 5G is forecast to account for almost half of all subscriptions by 2027, topping 4.4B subscriptions.(GizChina, Ericsson, report, Light Reading)