7-2 #VIP : GlobalWafers has announced plans to build a plant in Texas; TSMC will increase prices for most of its manufacturing processes of about 6% starting Jan 2023; TSMC has seen its major clients adjust downward their chip orders for the rest of 2022; etc.

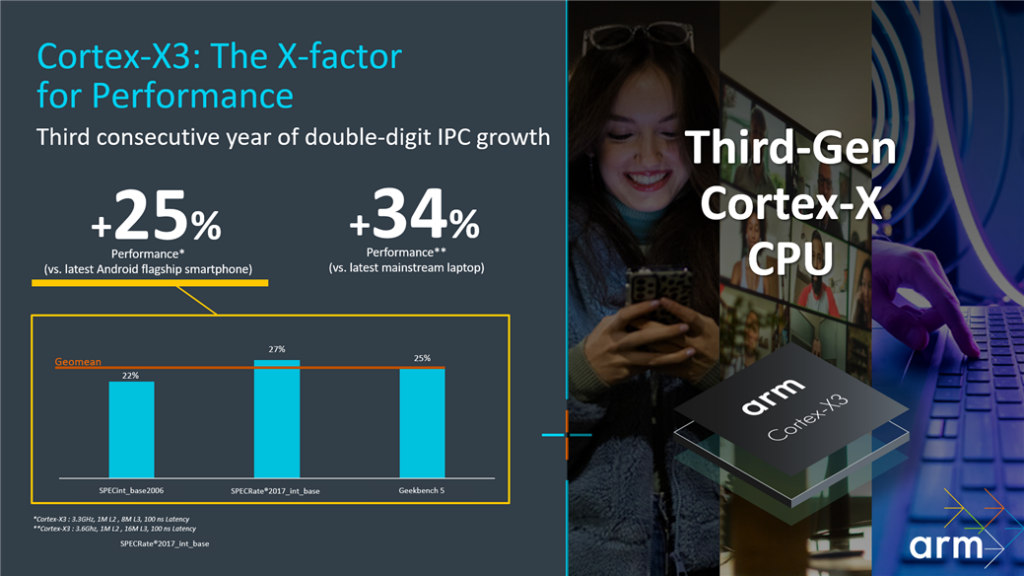

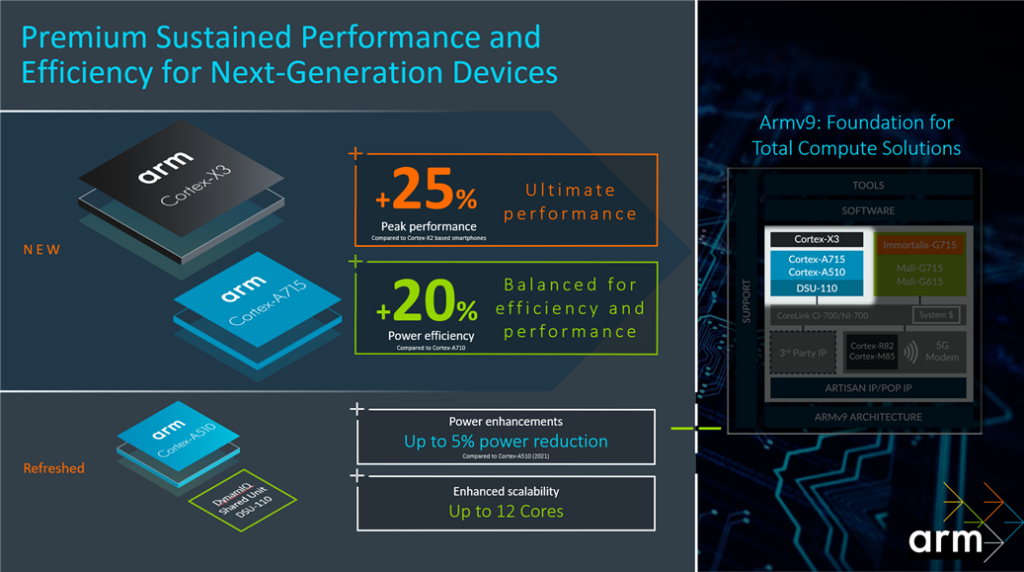

Arm has announced second generation of Armv9 based CPUs. These include the Arm Cortex-X3 and Arm Cortex-A715, as well as important updates to Arm Cortex-A510 and the DSU-110 (DynamIQ Shared Unit). The new Armv9 CPUs and updates form the foundation of Arm’s new Total Compute Solutions (TCS22). The new Cortex-X3 and Cortex-A715 and the upgrades to Cortex-A510 and DSU-110 are all designed to push the limits of peak performance and deliver exceptional sustained performance and efficiency.(GSM Arena, ARM, Wikichip)

Arm introduces Immortalis-G715, which is ARM’s first GPU to have hardware acceleration for ray tracing. There is also a new Mali-G715 GPU as well as a Mali-G615. The major difference between the two are the core counts – 6 or less for G615, 7-9 for G715 (and 10 or more for Immortalis). All three GPUs support Variable Rate Shading (VRS). This is a system that allows game developers to tell the GPU where to focus its efforts, rendering things at full resolution (e.g. the player character) and where it can take shortcuts (e.g. background). All three GPUs also come with an improved execution engine, which will deliver a 15% performance improvement, making these the fastest ARM GPUs to date.(GSM Arena, Arm, XDA-Developers)

GlobalWafers has announced plans to build a USD5B plant in the U.S. state of Texas, a boost for Washington’s ambition to bring more of the semiconductor supply chain onshore. The Texas plant will be the country’s largest site for 300mm wafer material when it begins production as soon as 2025. The plant will sit in the city of Sherman, near the Texas-Oklahoma border, where it is slated to bring in 1,500 jobs as production climbs towards 1.2M wafers per month. GlobalWafers Chair and CEO Doris Hsu has indicated that instead of importing wafers from Asia, GlobalWafers USA (GWA) will produce and supply wafers locally, thereby reducing significant carbon footprint. (CN Beta, Yahoo, Asia Nikkei, Reuters, UDN)

Samsung will start trial production of its 3nm foundry process for customers end Jun 2022 at the earliest. The first customer for the process will be the Chinese application-specific IC firm PanSemi, which makes chips used in Bitcoin mining. Qualcomm, Samsung’s largest customer, had also made reservations for the process, with the pair agreeing that the US company can ask for the process anytime. Samsung’s gate-all-around (GAA) 3nm processes, as its name implies, have the current gates on all four surfaces. The most advanced process that has been commercialized to date is FinFET, which uses three surfaces, and is sometimes called 3D for this reason. GAA is more advanced and allows for more precise control of currents while the gate width is even narrower. TSMC’s 3nm process is called N3 by the firm and uses FinFlex technology, a modification of FinFET.(My Drivers, CN Beta, The Elec)

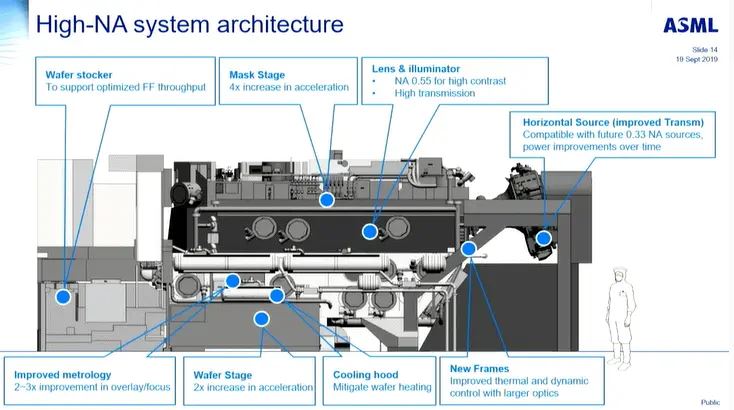

Samsung Electronics Vice Chairman Lee Jae-yong has met with ASML CEO Peter Wennink and CTO Martin van den Brink and sealed a deal to introduce EUV lithography equipment to be produced in 2022 and high-numerical aperture (NA) EUV lithography equipment scheduled to come out in 2023. High-NA EUV lithography equipment is next-generation equipment that can engrave finer circuits compared with existing EUV lithography equipment. It is considered a game changer that will determine the winner of a technological race in the sub-3nm foundry market. The unit price of high-NA EUV lithography equipment is estimated at KRW500B, twice as high as existing EUV lithography equipment.(CN Beta, Business Korea, Asia Nikkei)

TSMC has determined that prices for most of its manufacturing processes will rise about 6% starting Jan 2023, despite concerns raised recently about a potentially disappointing 2H22 for a number of end markets, according to Digitimes. Many IC design companies are pessimistic about their sales prospects by the end of this year due to reduced orders from brand-name equipment suppliers amid growing macroeconomic uncertainty. TSMC and other Taiwan-based foundries have not yet seen significant cuts in orders from their major customers, which are on track to still account for more than 95% of production capacity by the end of 2022. Taiwan-based foundries are also mainly seeking capacity expansion as they enter into long-term order commitments with their customers. In addition, rising raw material and labor costs, coupled with rising electricity costs, are putting pressure on foundries to further increase their offers. The longer lead times for semiconductor equipment are also dragging down the capacity expansion of global foundries. Delays in the delivery of fab equipment have risen to as long as 30 months, with no sign of decline. (Digitimes, Seeking Alpha, IT Home, Asian Tech Press)

TSMC has seen its major clients adjust downward their chip orders for the rest of 2022, which may prompt the pure-play foundry to cut its revenue outlook for 2022, according to Digitimes. In addition to the 10% drop in the target shipment of Apple’s new iPhone, the first wave of 90M target shipments has dropped by 10%, TSMC’s big client AMD has also reduced orders for the 7 / 6nm process by about 20,000 pieces. NVIDIA, which has fully returned from Samsung Electronics, has subsided due to the mining boom, and it is also reported that NVIDIA hopes to delay the purchase of goods for one season. It is also worth noting that due to the declining demand at the consumers segment, prolonged equipment delivery and labor shortages, it has also been reported that TSMC’s new Kaohsiung 7 / 28nm plant, which was expected to be mass-produced in 2024, will be postponed to the end of 2024 and mass production in 2025. (Digitimes, Digitimes, press, CTEE)

TF Securities analyst Ming-Chi Kuo has responded on the rumors that TSMC’s Apple iPhone14 orders will decrease by 10% are inconsistent with his investigation, maintaining that Apple’s iPhone14 1H22 shipments may reach about 90M-100M units. It is common for Apple to make small adjustments to its iPhone shipment forecasts, including before new models go into production. Apple typically does not significantly change its shipment forecast for new iPhones until it releases new models and confirms actual market demand/feedback. If supply chain issues cause major changes in the shipping schedule for the new iPhones ahead of mass production, Apple typically delays orders rather than cuts them. The above logic also applies to other Apple products. (CN Beta, Twitter)

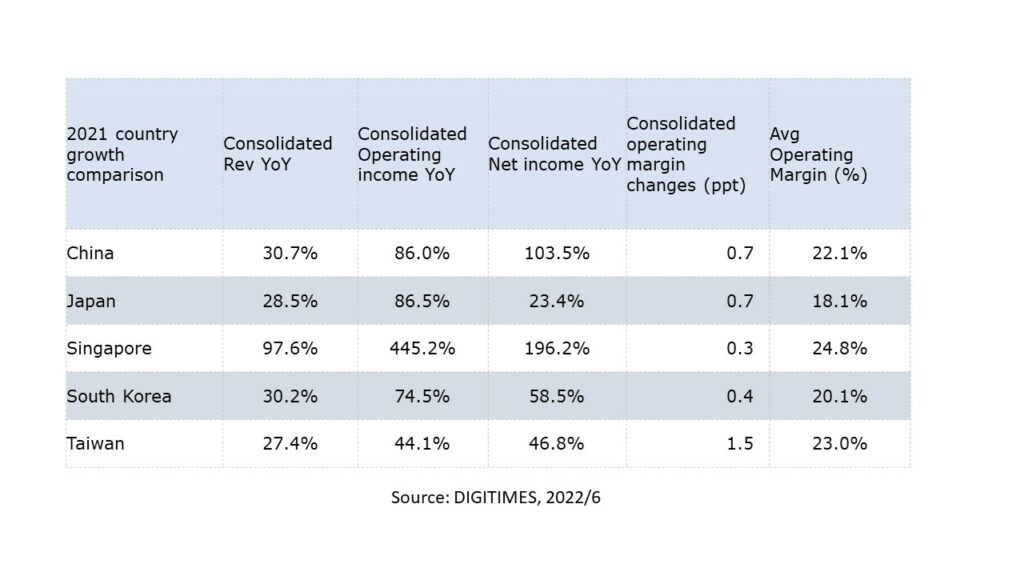

According to Digitimes, the 2021 revenue of the top 50 semiconductor companies in Asia (i.e. IC 50) totaled USD348.99B, up 29.3% on year. If compared to the semiconductor industry output value of the world and Asia respectively, the aggregated sales of these top 50 Asia semiconductor companies take up 39.1% of the global share, and 78.8% in Asia, respectively. In the IC 50 ranking, Samsung’s device solutions division, which includes memory, system LSI and foundry businesses, took No. 1 place in terms of revenue and operating profit, while TSMC, SK Hynix, MediaTek, and Tokyo Electron took the second to fifth place. Samsung is the world’s No.1 memory maker, while TSMC is the largest pure foundry manufacturer. MediaTek is Asia’s largest fabless company, and Tokyo Electron is the No.1 semiconductor production equipment manufacturer in Asia, while ASE is the largest OSAT in the world. (Digitimes, press)

Foxconn’s annual semiconductor procurement has exceeded USD60B, accounting for more than 10% of the global semiconductor procurement market. Foxconn Group, as the world’s largest buyer of electronic components, has great purchasing power and can maximize bargaining space and reduce procurement costs. Young Liu, chairman of Foxconn, said that in terms of semiconductors, the group will actively build its own semiconductor production capacity in the future, and its own and outsourced production capacity will be used flexibly. The goal is to provide a never-shortage semiconductor supply solution for EV and telecom customers, and to be the first EMS factory with never-shortage capability.(SemiMedia, Laoyaoba)

The shipment share of AMD-powered servers is estimated to rise in 2023 and 2024, while that of Arm-powered serves will triple the 2020 percentage in 2024, according to the latest figures from DIGITIMES Research. According to DIGITIMES, AMD-powered servers will account for nearly 18% of overall server shipments in 2024, up from 10.1% in 2020 and 16.3% in 2023, due to the successful penetration of AMD platforms into the cloud data center industry and the HPC server market. Cloud data center operators’ computing services rely heavily on the system’s virtual CPUs (vCPUs). AMD’s processors, on the other hand, have a large number of cores and can provide more vCPU-oriented services than competing processors of the same level. This makes AMD’s platform more attractive to operators. (Digitimes, CN Beta)

Qualcomm now supply Apple with 100% of the 5G modems for the 2023 iPhone 15 line. Apple has paid USD1B to buy Intel’s smartphone modem business before. There was speculation that after Apple reached a settlement with Qualcomm allowing all legal action between the pair to be dropped, Apple would use Qualcomm’s Snapdragon 5G modem chips for a few years while developing its in-house component. Apple’s failure to design its own 5G modem chip was not the result of Apple being unable to develop such a component. Instead, a new report indicates that the issue is related to a pair of Qualcomm patents that is blocking Apple from finishing the development of its own 5G modem.(Phone Arena, 9to5Mac)

Xiaomi has recently has deepened its in-house chip development by investing in a new semiconductor company, sparking market speculation that Xiaomi may renew development of its own mobile SoCs. The newly-added enterprise is Zhuhai Xinshijie Semiconductor Technology, with an investment ratio of 15%. The semiconductor firm was established on June 23, 2022, with a registered capital of CNY200M (USD29.9M). Its business scope includes the design, manufacturing and sales of integrated circuits, as well as special equipment for semiconductor devices.(Digitimes, Digitimes, EET-China, Sohu, Digitimes, Pandaily)

MediaTek plans to set up a new design center in Indiana in partnership with Purdue University. The company will seek to recruit engineers from top schools in Indiana and other nearby states, who will typically be recruited to its design center in California.(CN Beta, Purdue University, Reuters, MediaTek)

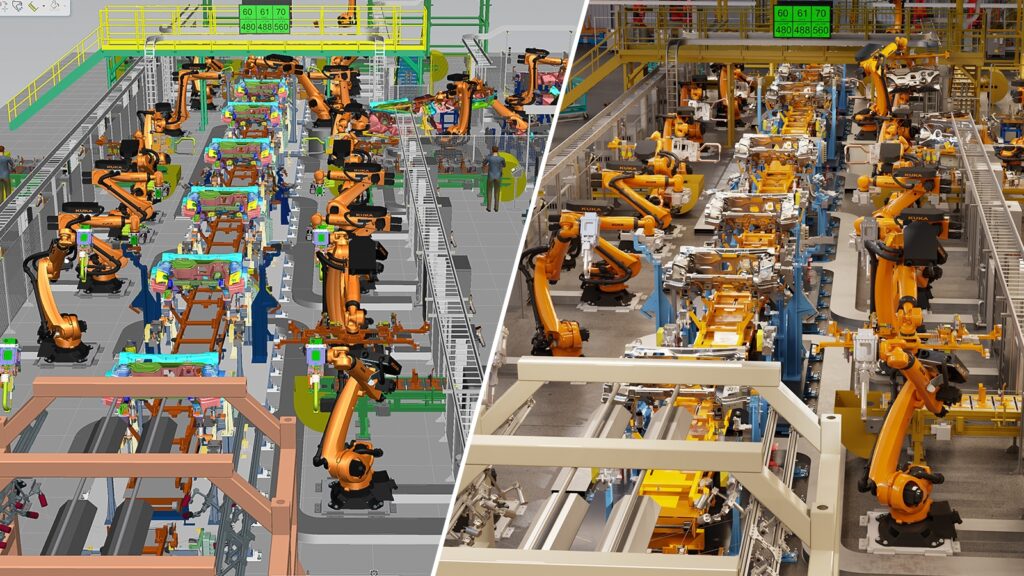

Siemens and NVIDIA have announced an expansion of their partnership to enable the industrial metaverse and increase use of AI-driven digital twin technology that will help bring industrial automation to a new level. As a first step in this collaboration, the companies plan to connect Siemens Xcelerator, the open digital business platform, and NVIDIA Omniverse, a platform for 3D design and collaboration. This will enable an industrial metaverse with physics-based digital models from Siemens and real-time AI from NVIDIA in which companies make decisions faster and with increased confidence. According to a forecast from Fortune Business Insights, the market for digital twin technology and services will generate an estimated USD8.9B in revenue in 2022, growing to USD96B by 2029.(Laoyaoba, The Register, Nvidia, Fortune Business Insights)

Samsung is reportedly working on more affordable Galaxy Z Flip and Galaxy Z Fold devices. Samsung is aiming to deliver a foldable with a price tag under KRW1M (~USD770), although it is unclear if this is the target price for both models or the Flip device. For what it is worth, the Galaxy Z Flip 3 launched at KRW1.25M (~USD963) in Korea. (Android Headlines, ET News, Android Authority)

Samsung Display and Japan’s Ulvac will start price negotiation for the Gen 8.5 OLED deposition equipment that the latter will be supplying. The pair have been working to develop a deposition machine for Gen 8.5 (2200x2500mm) substrate that uses full-cut substrates and deposits organic materials vertically. Ulvac is demanding around KRW700B-800B per unit for the new deposition machines. Samsung Display is countering by demanding a price of around KRW400B, citing that the deposition machine was not completed. It will likely also highlight that it was the only vendor that can buy the machines. Samsung Display is expected to start with a capacity of 15,000 Gen 8.5 substrates per month, potentially adding another 15,000 depending on market demand. Samsung Display will likely be able to mass-produce Gen 8.5 OLED panels in late 2024 to aim for Apple’s second-generation OLED iPads. The company, along with LG Display, is planning to use existing Gen 6 OLED lines to make the first batch of 11-inch and 12.9-inch OLED panels for Apple’s first-generation iPads launching in 2024.(Apple Insider, The Elec)

Sony will be the first to launch a 1” smartphone camera sensor, the IMX989. It is a 50MP camera sensor, and its native pixel size will be around 1.5µm, which should theoretically offer excellent performance in low-light conditions. While some Sony phones already use 1-inch sensors, they are all cropped versions of sensors used in Sony’s digital cameras. The IMX989 is the first 1” sensor explicitly made for smartphones. Sony is also rumored to be working on a 100MP mid-range camera sensor.(Android Headlines, SamMobile)

Xiaomi has officially released a new self-developed technology – FBO Renewal Storage Technology, which supports automatic detection and automatic sorting of mobile phone storage fragments. The technology is included in the official specification of the next generation flash memory standard UFS 4.0 and has received recognition from JEDEC (International Semiconductor Industry Standardization Association). UFS 4.0 will be accessible to the entire industry once it is put into mass production.FBO the new storage technology will be supported by mainstream flash memory brands such as Western Digital, Micron, Samsung, SK Hynix, Kioxia, and Yangtze Memory.(My Drivers, XiaomiUI)

Samsung SDI is reportedly preparing a pilot line at its Cheonan plant in South Korea to test batteries it will be supplying to Tesla. The batteries are 4680 cylinder batteries (46mm diameter, 80mm length) and Samsung SDI will verify the technology within 2022. Samsung SDI is preparing at least two versions of the battery with the alternative version to the original being shorter than 80mm in length. The pilot line being prepared at Cheonan has an annual capacity slightly below 1GWh with 20ppm production speed. The aim is to increase production speed to between 200 to 300ppm, which will equal between 8GWh to 12GWh to annual production capacity.The actual mass production line will likely be built at Samsung SDI’s battery plant in Seremban, Malaysia. Samsung SDI added 2170 cylinder battery production there last year. The plant began making cylinder batteries back in 2012.(CN Beta, Teslarati, The Elec)

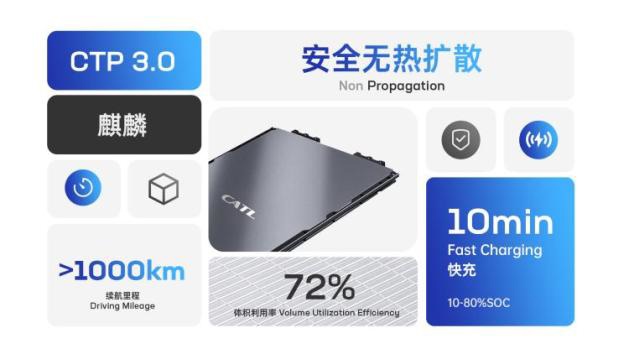

Contemporary Amperex Technology Co Ltd (CATL) has revealed that the company has super-fast charging technology that can charge up to 80% in as little as 5 minutes. That is apparently faster than the CTP (cell to pack) 3.0 Qilin Battery it just announced, which CATL has said could charge to 80% in as little as 10 minutes.(My Drivers, Auto Home, IT Home, CN EVpost, CN Beta)

Anatel, the Brazilian regulatory agency, has proposed new requirements for smartphone manufacturers when it comes to the charging port. Anatel believes that USB-C allows “greater convenience for consumers” and that it will also help reduce waste as users can actually reuse their power adapters regardless of what device they have. The project is focused on smartphones (at least for now). Anatel’s proposal would require companies to switch to USB-C by 1 July 2024. (9to5Mac, Apple Insider, Tecnoblog)

The European Union will continue to prevent carriers from appling roaming charges for travelers from and to any of the 27 member states of the union or the European Economic Area for 10 more years. The “roam like at home” initiative abolished roaming charges 5 years ago and put an end to carriers putting surcharges on travelers using their network. Now the initiative will stay on until 2032. A new part of “roam like at home” is the focus on the quality of service. It means that customers should be offered the same services when abroad that they have at home, provided the network supports them. (Pocket-Lint, GizChina, IT Home, TechCrunch, GSM Arena)

TF Securities analyst Ming-Chi Kuo has indicated that the demand for Apple‘s upcoming iPhone 14 may be stronger than the already popular iPhone 13 lineup. He says his latest survey of Chinese distributors and retailers indicate that they have had to pay the highest prepaid deposit ever for the iPhone 14 to ensure a consistent supply. He points out that the prepaid deposits, which are fees to secure upcoming smartphone supply prior to launch, is “significantly higher” than the iPhone 13. In some areas, it is as much as twice as high as the prior lineup. The iPhone 14 shipment forecast of component suppliers and EMS is about 100M and 90M units in 2H22, respectively. The solid demand for iPhone 14 in the Chinese market may reduce market concerns about the risk of the iPhone 14 order cut after the launch. (Twitter, Apple Insider, CN Beta)

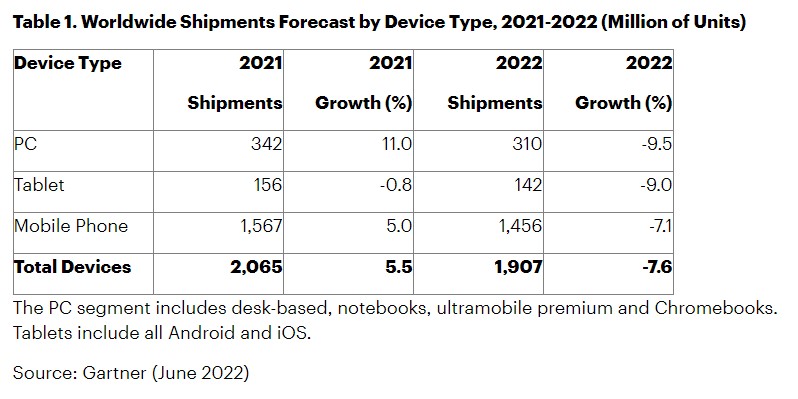

According to Gartner, overall, global shipments of total devices (PCs, tablets and mobile phones) are on pace to decline 7.6% in 2022, with Greater China and Eastern Europe including Eurasia recording double-digit declines. While global mobile phone shipments are expected to decline 7.1% in 2022, smartphone shipments are estimated to decrease 5.8% YoY. Regionally, Greater China will be hit the hardest with smartphone shipments on pace to decline 18.3% in 2022. Regionally, Greater China has been leading the adoption of 5G phones over the last two years. However, the collapse of the smartphone market in the region will mean a 2% decline in 5G phone shipments in 2022, after growing 65% in 2021. In 2022, Gartner expects worldwide 5G phone shipments will total 710M units. While this is an increase of 29% from 2021, it is down from previous expectations. (CN Beta, Gartner, Neowin)

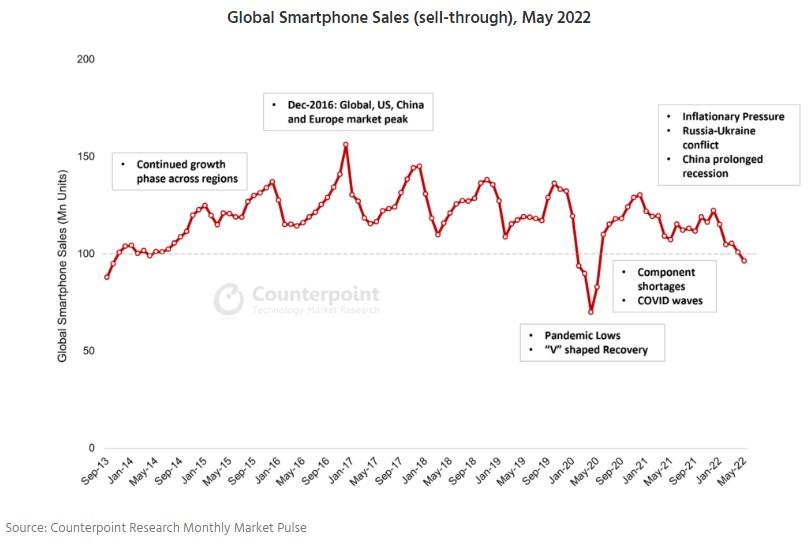

The global smartphone market sales declined 4% Month on Month (MoM) and 10% Year on Year (YoY) in May 2022 to 96M units, according to Counterpoint Research. This was the second consecutive month of MoM decline and the 11th consecutive month of YoY sales decline. Even after a “V” shaped recovery following the first COVID-19 wave in 2020, the smartphone market has still not reached the pre-pandemic levels. In 2021, the smartphone market was impacted by supply constraints and persistent COVID waves. In 2022, the component shortages, although not fully resolved, have been stabilizing. However, the smartphone market is now hit by a demand slump due to multiple factors including inflation, China’s slowdown, and the Ukraine crisis. (Counterpoint Research, Gizmo China)

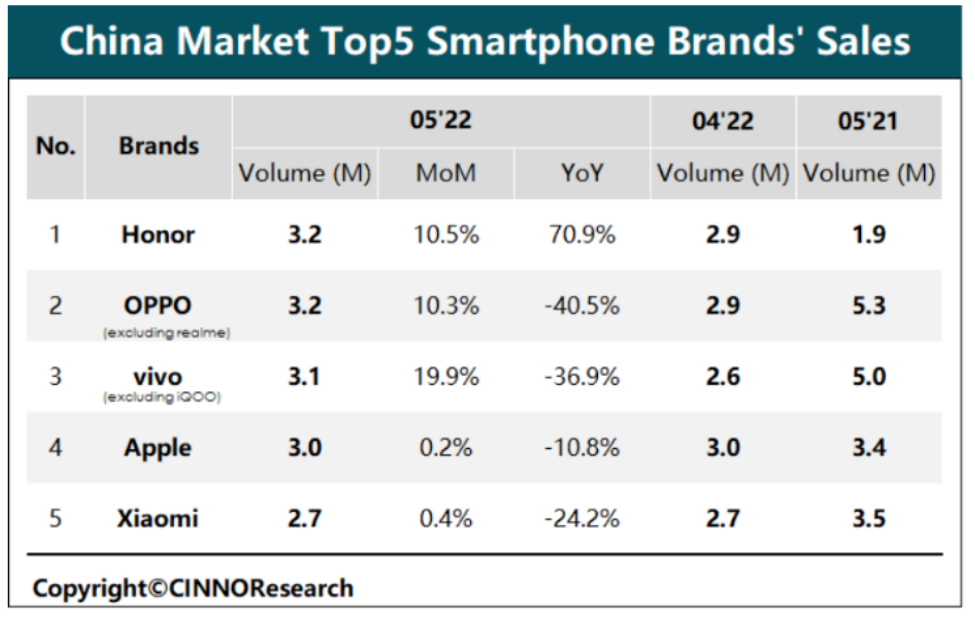

According to data from CINNO Research, in May 2022, smartphone sales in the Chinese mainland market will be approximately 19.12M units, an increase of 8.6% from the previous month. , the worst May single-month sales since 2015. Honor and OPPO ranked 1st and 2nd, with a month-on-month increase of 10.5% and 10.3% respectively. Honor increased by 70.9% YoY, while OPPO decreased by 40.5% YoY. (CINNO Research, Laoyaoba)

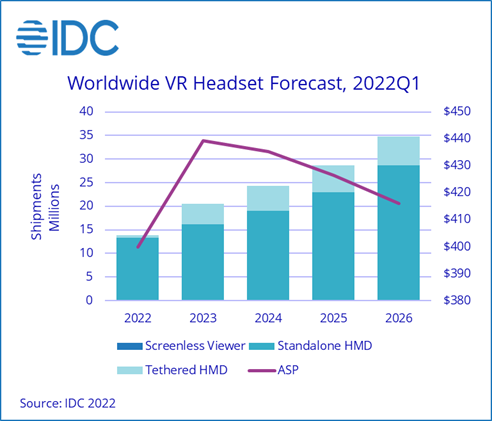

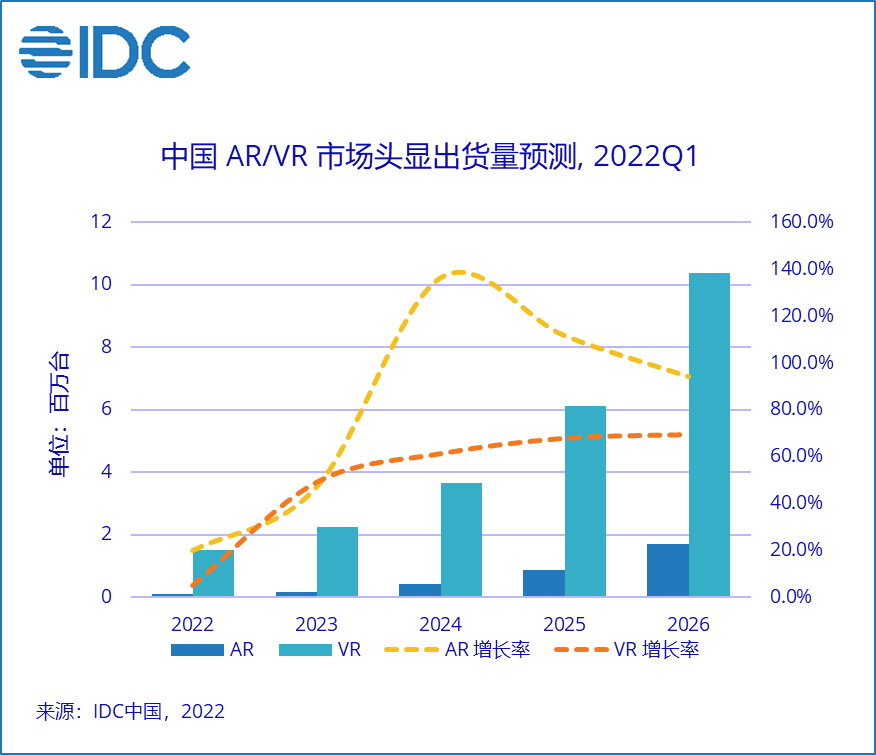

Global shipments for virtual reality (VR) headsets jumped 241.6% during 1Q22 compared to the same period in 2021, according to IDC. Meta furthered its share, capturing 90% of the market as the Quest 2 remains immensely popular and Meta continues to offer more exclusive content while subsidizing hardware. Following Meta was ByteDance’s Pico with 4.5% share. While Pico has largely operated within China’s borders, it has maintained a presence in many global markets though this has primarily occurred in the commercial segment. Recent expansion into many European countries as well as a growing library of consumer-friendly content should help the company attract a larger audience in the coming quarters. DPVR, HTC, and iQIYI rounded out the top 5 companies with less than 4% share combined. (CN Beta, IDC, IDC)

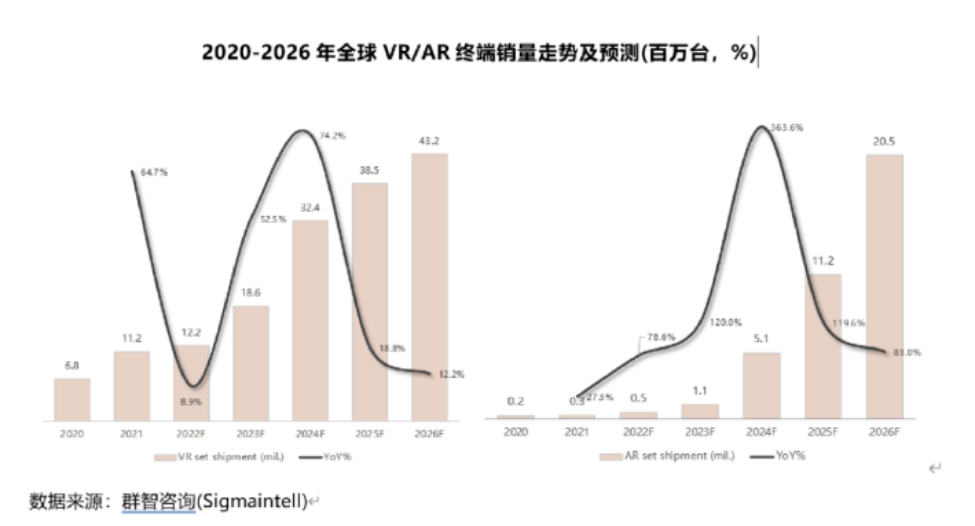

According to Sigmaintell’s data, in 2021, global VR equipment shipments will exceed 10M, and sales will reach 11.2M, a YoY increase of about 65%. In 2022, with the turbulent external environment, the overall consumer electronics market demand will weaken, and the growth of demand will slow down. However, with the launch of Apple’s MR products in early 2023, the overall market revenue and average price will increase significantly. It is estimated that the global VR (MR) industry will be about 43M units in 2026, with a compound growth rate of about 26.4% in the past 5 years. (Laoyaoba, Sigmaintell)

Volvo Cars plans to build a new European plant in eastern Slovakia. Volvo’s third European plant will be located in Kosice, Slovakia’s second-largest city, Economy Minister Richard Sulik said. Volvo will receive about 20% of the EUR1.2B (USD1.25B) needed for the project as support from the Slovak government. The plant is expected to produce some 250,000 electric cars a year and to create some 3.300 jobs. Construction is scheduled to begin in 2023 and production to start in 2026. Volvo has set a goal of only making electric cars by 2030.(CN Beta, Motor1, Reuters, Washington Post, Green Car Congress, Volvo)

General Motors (GM)has called off the sale of a shuttered Indian plant to China’s Great Wall Motor after they failed to obtain regulatory approvals, amid a tougher stance by New Delhi towards investments from Beijing. GM struck a deal in Jan 2020 to sell the plant to Great Wall, with the Chinese SUV-maker expected to pay up to USD300M as part of a broader plan to invest USD1B to establish a presence in India’s growing car market. The agreement, which was extended twice, expired on 30 Jun 2022.(CN Beta, Business Standard, CNBC)

After debuting NFT support on Instagram in May 2022, Meta has launched digital collectibles support on Facebook with select creators. The company has started a slow rollout that allows a select group of creators in the United States to post digital collectibles on Facebook. With this feature, these creators will be able to show off NFTs on their profiles under a new tab, and the art will have a “digital collectibles” label — just like Instagram. Meta CEO Mark Zuckerberg has said the company would be testing NFT support on Facebook soon. At the time, Zuckerberg said the test will allow creators to cross-post on Instagram and Facebook. However, the sharing feature across both platforms has not yet rolled out, but is coming soon. On Instagram, NFTs minted on Ethereum and Polygon were supported at launch, with Solana and Flow support in the works. Meta did not say if the same blockchains are supported on Facebook, but that is likely the case. Zuckerberg has also said Meta is going to work on augmented reality NFTs, or 3D NFTs. (CN Beta, Social Media Today, TechCrunch)