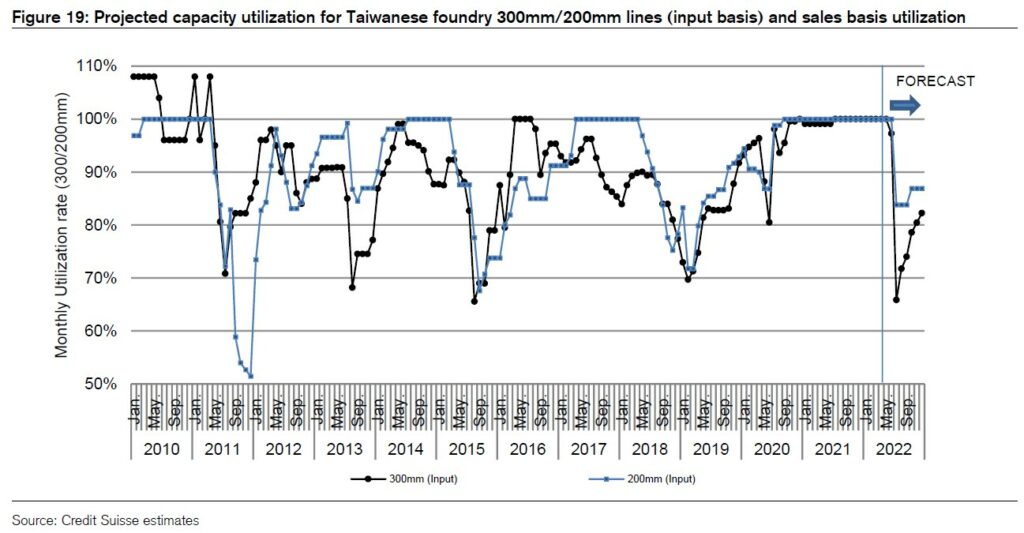

7-4 #VIP : Capacity utilization has fallen to 20–30% at Samsung’s CIS production line; Taiwanese foundries are still operating at full capacity for both 200mm and 300mm wafer production; CATL has indicated that the total amount of lithium in the world is sufficient; etc.

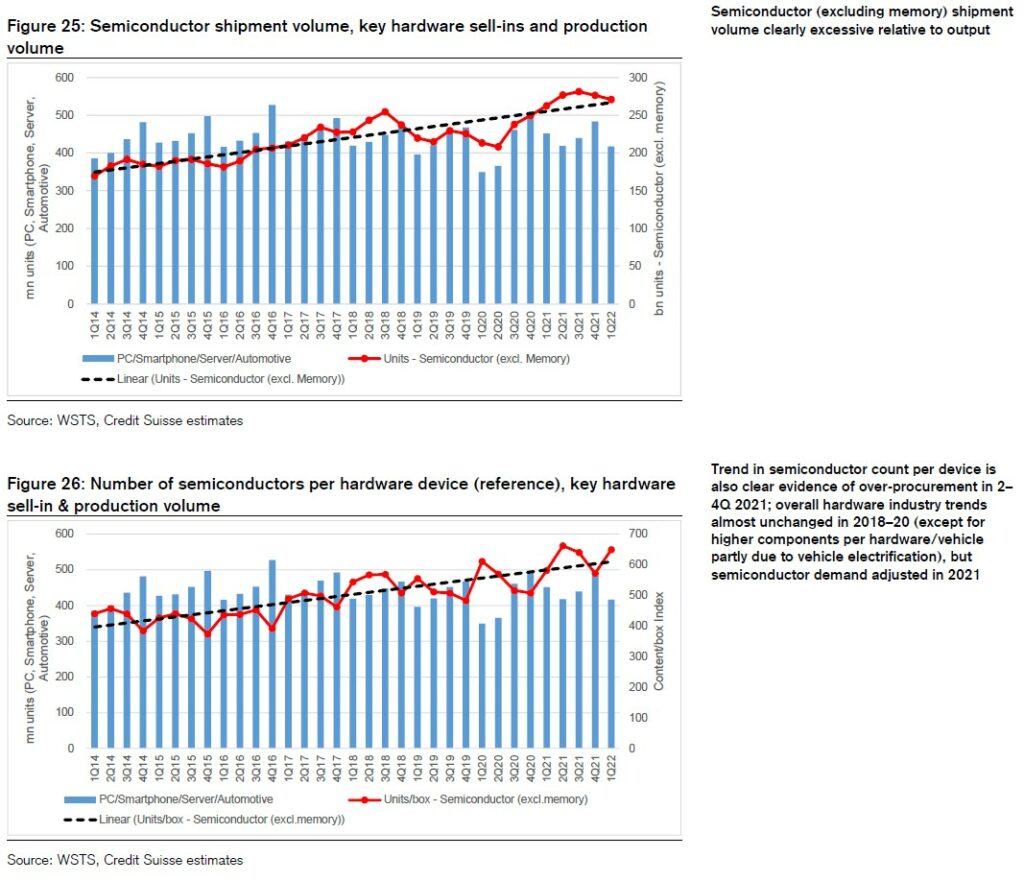

Taiwanese foundries are still operating at full capacity for both 200mm and 300mm wafer production. The 28nm process is running at full capacity, but demand looks to be slowing somewhat. Foundries have maintained full capacity utilization by increasing production of driver ICs to offset the decline in demand for LSIs for CIS devices (ISPs, or “image signal processors”). Utilization rates for Samsung’s foundry processes appear to have started to decline. Capacity utilization is also falling for 10nm/14nm processes and cutting-edge 4nm / 5nm processes. Samsung has also canceled LSI orders for CISs (ISPs) to GlobalFoundries and UMC due to a sharp decline in CIS operating rates. The book-to-bill ratio is around 1.2x. For power devices, the ratio for MOSFETs is 1.3x. However, demand has weakened in the short term, and it is unclear at this point whether this is due to lockdowns or a change in actual demand trends. (Credit Suisse report)

The semiconductor shortage is mainly a bottleneck in mature processes, but the book-to-bill (BB) ratio for discrete/analog ICs remains high at 1.2x. However, Credit Suisse thinks this has eased somewhat from the 1.5x ratio from three months ago, as customers are starting to feel they have sufficient inventories. Nevertheless, Chinese smartphone makers are starting to cancel PMIC and RFIC orders. Chinese distributors also have excess PMIC inventories, raising the risk of a correction. Demand appears to be slowing in the short term, but it is still difficult to determine whether this is a change in market conditions or the impact of the Shanghai lockdowns. On the downstream side of the supply chain, however, inventories have built up due to the Shanghai lockdowns and the war involving Ukraine and Russia, which is being used as justification for force majeure order cancellations and inventory adjustments. Meanwhile, US and European semiconductor makers continue to rescind on contractual commitments for EVs, home appliance, and other applications in China and Japan. (Credit Suisse report)

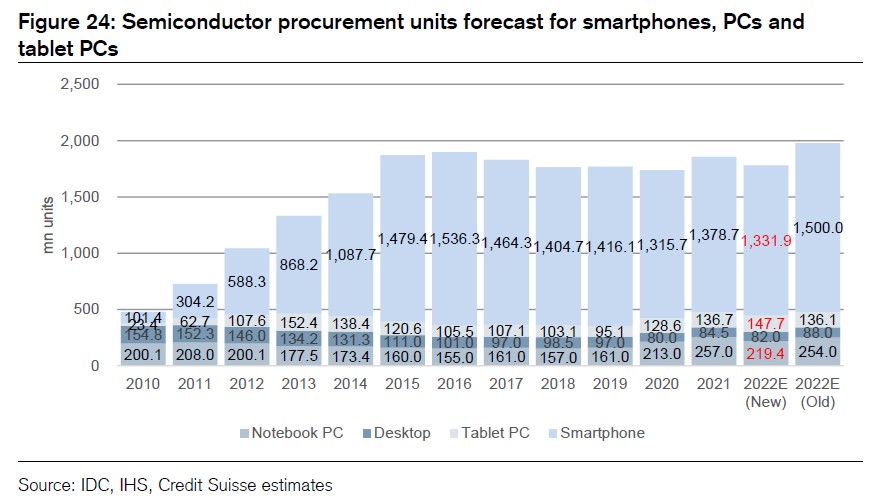

According to Credit Suisse, smartphone makers are no longer seeing a shortage of 5G chipsets. Chinese smartphone makers have revised 5G smartphone production plans to −21% YoY in 2022, and demand for 5nm / 7nm processes is expected to peak out. Smartphone makers have cancelled AP orders, while Qualcomm and MediaTek have also cancelled orders meant for foundries. MediaTek’s AP production plan for 2022 was lowered by an amount corresponding to 200K wafers (around 100mn processors). Qualcomm revised down plans by around 40K wafers. In 5G, chipset inventories are also building, with inventory adjustments in PMICs and RFICs as well as for APs. MediaTek has cancelled 30% of its PMIC orders to SMIC and UMC. AP makers are also holding off on sales of low-end APs to try and maintain ASPs and are increasing supply of mid-range APs. However, the product mix is deteriorating due to slowing demand for high-end application processors. (Credit Suisse report)

The APs used in Apple’s iPhones are expected to be both the A16 (4nm process) and the A15 (5nm), with the A16 featured in the Pro model only. Apple plans to start mass production of 3nm processes in 2023, but the 3nm process roadmap for Qualcomm and MediaTek is still unclear. Apple’s in-house modem (for the 2023 iPhone) is not a single chip, but has a two-chip structure. The company expects to design its own modems manufactured using TSMC’s 5nm processes, but it does not appear to be compatible with millimeter wave technology. Foundries’ wafer prices for 5nm processes are USD15,000–17,000, and USD19,000–30,000 for 3nm processes. According to Credit Suisse, Qualcomm will find it difficult to use 3nm processes unless foundry wafer costs do not fall to closer to USD20,000. There are no news of improvements in Samsung’s 4nm process yields. Samsung’s foundries are expected to win orders for products using AMD’s 4nm process.(Credit Suisse report)

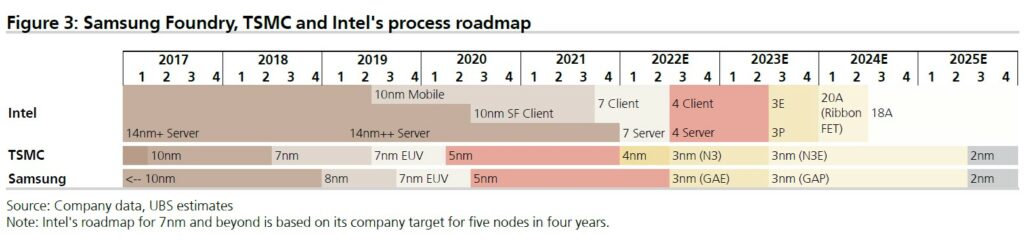

UBS believes TSMC has the most advanced transistor density since 2019, and expect it to lead in 3nm over 2023-24. The competitive pressure from Samsung Foundry and Intel has only become more significant in recent years because of geopolitical tensions and the strategic importance of semiconductor and leading-edge technology. But, based on UBS’ comprehensive industry analysis, TSMC continues to execute and carefully manage risks in 3/2nm, with the highest visibility and probability, to move forward in its advanced node roadmap for the next couple of years. UBS thinks TSMC is on track to mass produce next gen 3nm (N3) with FinFET in 2H22, but with sales contribution in 1Q23 due to the long cycle time. TSMC has planned a more conservative route for GAA, for which it believes N3 adoption might be immature and so could extend FinFET for another generation. As Samsung Foundry is struggling with 3nm GAA migration, UBS’ industry analysis suggests TSMC could take significant 3nm share in 2023-2024. (UBS report)

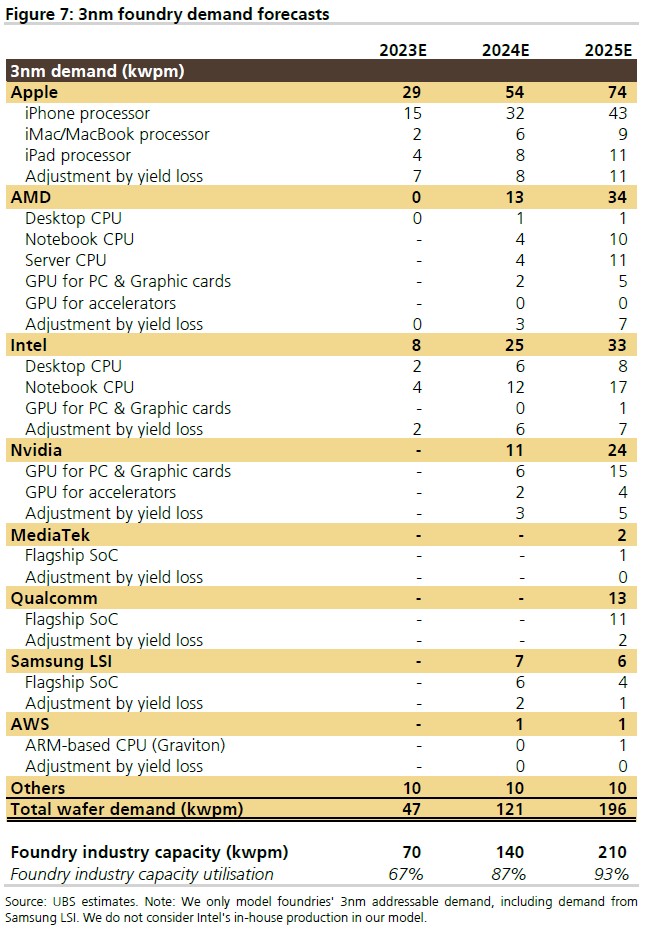

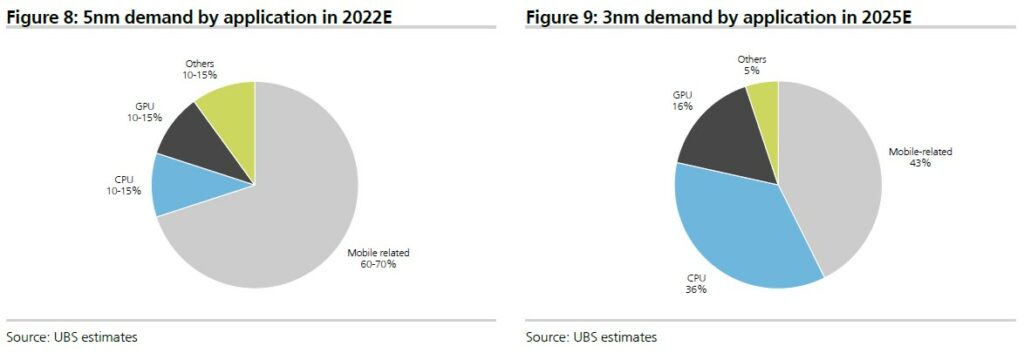

Looking at the addressable 3nm market size for ‘foundry’, UBS believes the ultimate volume could be as large as 5nm and 7nm, with upside potential, given the expanding applications of HPC, AMD’s share gain and Intel’s CPU outsourcing. UBS estimates the foundry size could be roughly 200kwpm for 5 / 7nm. 3nm could be of similar scale or slightly larger by 2025. For 2024, it is still not clear in terms of how quickly the foundry capacity build can be, given the stretched equipment lead time, and the migration path of key customers. But for now, UBS assumes faster process upgrade by AMD and Nvidia, and smartphone customers MediaTek and Qualcomm also use 3nm for flagship SoCs in 2025. By application, HPC, including CPU, GPU and application-specific integrated circuits (ASICs), should be a more critical driver of 3nm and could account for 50-60% of demand compared with 20-30% for 5nm in the third year of mass production. Smartphones contribution could diminish for 3nm at 40-45%, below 60-70% for 5nm. (UBS report)

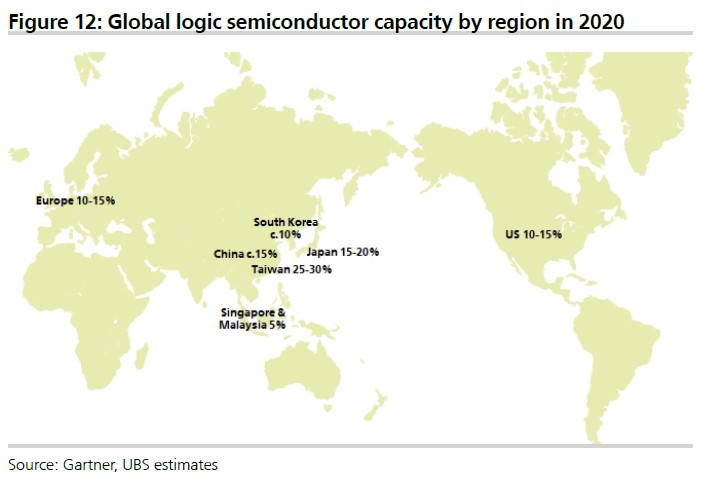

In recent years, governments of several countries and regions are resuming efforts to revamp the domestic semiconductor supply chain, especially for logic semiconductor foundries. This is likely a result of rising consciousness about the importance of foundries due to the Huawei issues, geopolitical tensions, the severe supply chain constraints with COVID-related disruptions in 2020-2022 that have led to component shortage for the automotive / industrial segments, among others. As of 2020, roughly 70-80% of global logic semiconductor capacity (including both foundries and IDMs) is in Asia overall, 10-15% in the US and 10-15% in Europe. Taiwan accounts for the highest portion with 25-30% total capacity. The supply concentration could be even higher for leading-edge logic (i.e., 7 / 5 / 3nm) with over 70% in Taiwan and Korea as of 2022. (UBS report)

For capacity, UBS estimates TSMC’s overseas fabs could contribute around 14% of total capacity by 2025, assuming additional capacity increase in Nanjing and Arizona than announced. TSMC’s overseas capacity was about 8% of the total in 2020. In this case, if assume all overseas fabs have roughly 3-5% lower GM, the incremental GM impact could be 0.2-0.3%. If we take a more conservative view and assume overseas fabs with 10-20% lower GM given worse-than-expected operational efficiency and limited subsidies, this could lead to 0.6-1.2% incremental GM headwind. (UBS report)

In the past 18 months, UBS thinks Intel has demonstrated firm commitment and aggressive planning to expand capacity scale to support its own production and foundry business, with nine new leading-edge mega fabs in Arizona (US), Israel, Ireland, Ohio (US) and Magdeburg (Germany) over the next decade. Intel’s series of announcements have spurred investor queries regarding the impact on the foundry space. (UBS report)

Capacity utilization has fallen to 20–30% at Samsung’s CIS production line. Related capex has reportedly dropped to near zero, except for some 100MP / 200MP production and the basic line maintenance. There are reportedly no prospects of production recovering in 2022. The CIS production slump at Samsung is attributable to (1) quality issues in the Chinese market, and (2) loss of market share due to Chinese customers switching to Sony. With the inventory correction also affecting image signal processors (ISPs) and other LSI chips that form CIS attachments, chip foundries are maintaining production at full capacity by investing more in display driver ICs (DDIs).(Credit Suisse report)

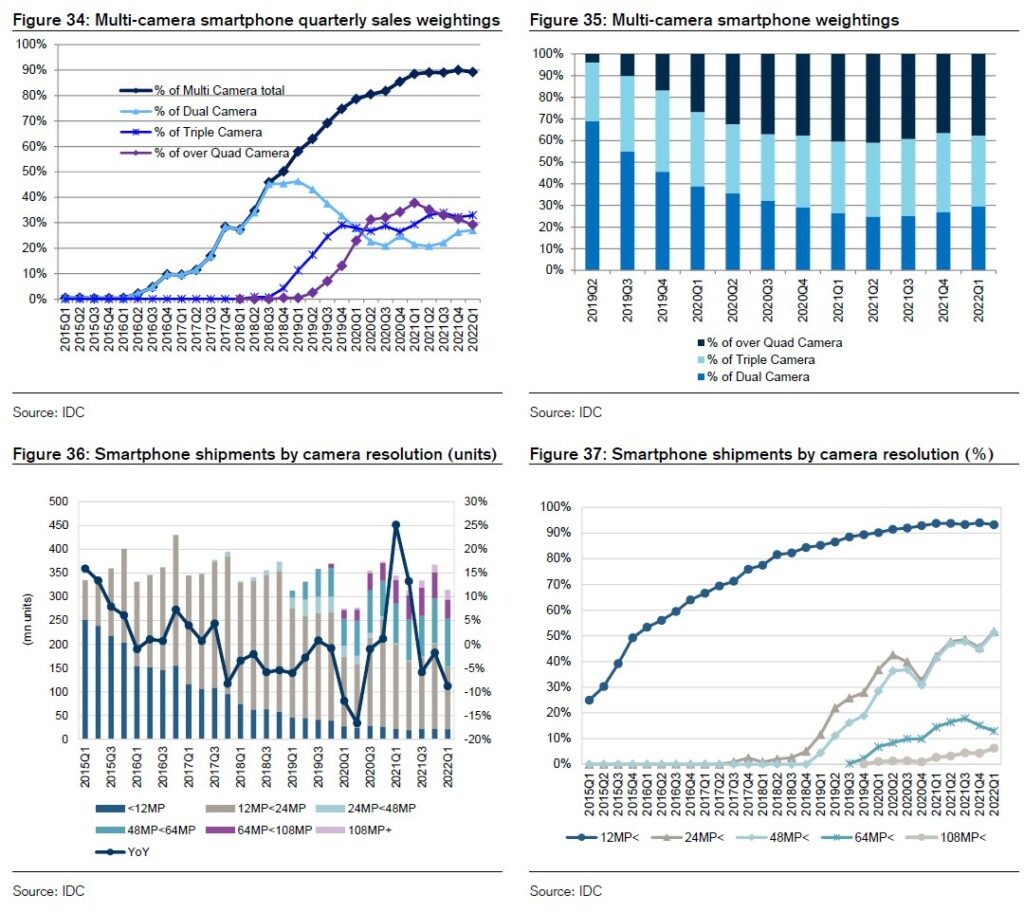

The ratio of multicamera smartphones fell 1ppt QoQ in Jan–Mar 2022 to 89%. This included modest QoQ declines for triple- and quad-camera models. While the increasing quad-camera ratio is rising for premium models priced at USD1,000 or higher, low-end and mid-range phones are shifting from triple to dual cameras. In pixel density, the proportion of phones with 48MP and larger cameras rose both YoY and QoQ. In particular, the low-end to USD1,000 range saw an increased weighting of 48–64MP cameras. High-end models in the USD600–1,000 range conversely saw a decreased weighting of 64MP and over. Premium models priced at over $1,000 had increases for both 48–64MP and 108MP. (Credit Suisse report)

According to Credit Suisse, DRAM makers plan to carry 3–4 weeks’ worth of inventories into 2023 due to weak demand. China’s CXMT continues to struggle, has no solid plans for investment. Chengdu Jinsemi has been struggling with prototypes, and first output for another prototype is likely to be in Jun 2022. In Samsung’s DRAM process migration roadmap, Plan A (its original plan for the 1Bnm process) has been canceled, and Plan B has been put into action. Plan B adopts a process node between Plan A’s 1Anm and 1Bnm nodes. As with 1Anm, EUV is expected to have 5 layers. Emerging DRAM makers in China are struggling on the development side, so there is no need to take them into account when thinking about global supply volume. However, Chengdu Jinsemi has plans to expand capacity by 40K / month in 2023 in the best-case scenario, but this will depend on the development situation. The first output is scheduled to be released in Jun 2022. (Credit Suisse report)

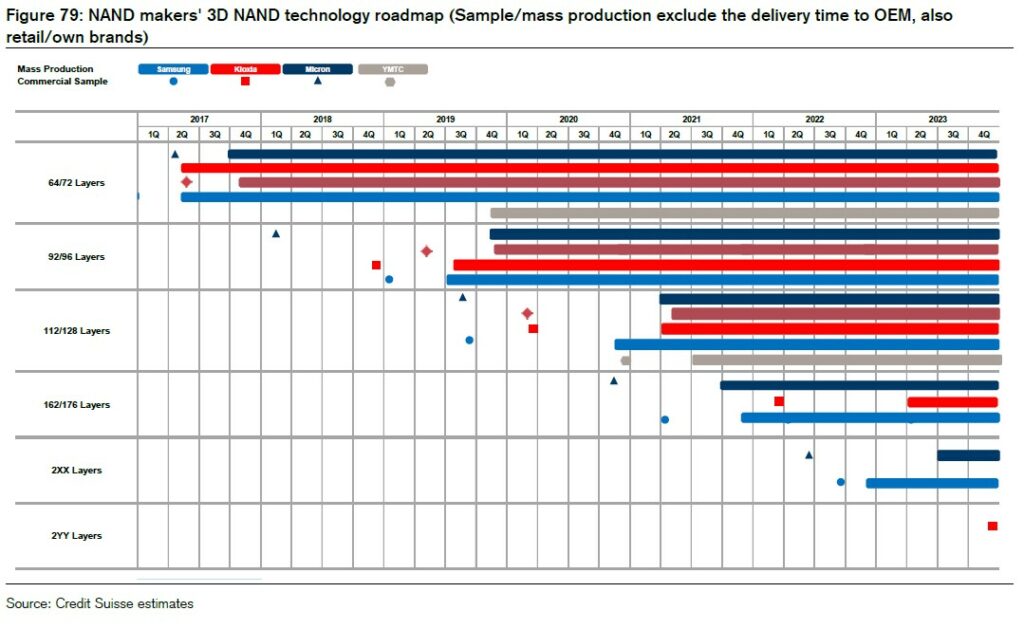

Mass production plans for improvements to Samsung Electronics’ 128-layer (V-NAND 6G: V6) via a 133-layer NAND (V6P: V6 Prime) appear to have been shelved for now. However, it is trying to find business for applications with high-cost applications and it does not seem to have given up. Samsung’s 7th gen V-NAND (176-layer; V7) is unlikely to go into mass production, and although the company is prioritizing mass production for V8, development has been slow. Commercial samples (CS) for the V8 were planned for Sept 2022, but shipments in 2022 now look more challenging. Samsung plans to use a three-stack structure for the V10 (420-layer; CS shipments in 1Q25) and V11 (576-layer; Apr 2026). Micron Technology’s 176-layer sample shipments are ahead of peers, but there are issues with reliability and mass production yields. Development of BiCS 6 (162-layer) by Kioxia / Western Digital (WDC) is slow. BiCS6 samples have been sent to Apple, but it will need to develop controllers to supply other customers, and it has not yet fixed a date for shipping samples in 2022. YMTC has revised its 196-layer plans and is focusing on improving yields for the 128-layer chip for the time being.(Credit Suisse report)

LG Energy Solution has signed an MOU with Compass Minerals of the United States to purchase lithium carbonate and lithium hydroxide. LG Energy Solution will receive 40% of the eco-friendly lithium carbonate and lithium hydroxide to be produced by Compass Minerals for seven years from 2025. Lithium carbonate and lithium hydroxide are used for production of cathode materials, one of the key materials for high-capacity electric vehicle batteries. LG Energy Solutions is preemptively securing key battery materials by solidifying its raw material supply chains in Australia, Europe, and South America. It signed long-term supply contracts with major lithium producers – SQM in Chile and Vulcan Energy in Germany. It also inked long-term supply contracts with Sigma Lithium in Brazil and Lion Town in Australia, which are mining companies that produce lithium concentrates.(Laoyaoba, Reuters, PR Newswire, Business Korea)

According to chief scientist of CATL Wu Kai, the total amount of lithium in the world is sufficient, and the main reason for the price increase is speculation. Since 2021, the prices of various raw materials for power batteries have risen significantly. Lithium, nickel, cobalt, lithium hexafluorophosphate, diaphragms and even graphite have risen to varying degrees. Among them, the most obvious price increases are lithium and nickel. On the one hand, lithium ore can be auctioned for sky-high prices, and on the other hand, lithium ore continues to auction at new highs. This is affecting the price of everything that uses it including lithium batteries. A 54.3% stake in Sichuan Yajiang Snowway Mining Development was won at a price of USD299M. The starting price was only USD500,000. This means that the final price is 596 times the starting price. On the other hand, the Australian lithium mine Pilbara has been selling its own spodumene by auction since 2H21. The company had a new auction record relative to a price of USD5,955 / ton. (GizChina, IT Home)

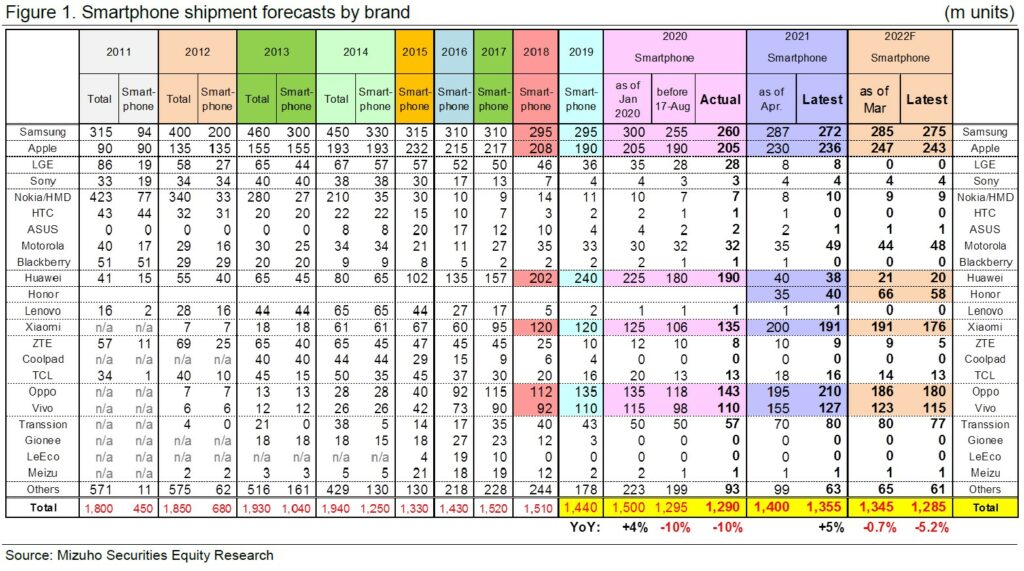

Mizuho Securities maintains their fundamental view that momentum will be stronger for high-end smartphones than for middle- and low-end smartphones and stronger for Apple iOS devices than for Android devices. By brand, they still expect volume to exceed the 2021 levels for Apple (mainly high-end smartphones with emerging markets accounting for a small portion of business) and Samsung Electronics (high-end smartphones; benefits from built-in 4G SoC smartphones). However, they lower estimates slightly for low-end models, namely the iPhone SE and the Galaxy A-series from Samsung Electronics. Among Chinese phone makers, they expect Huawei and Honor to try and expand sales of high-end models in China and middle-range models overseas. They forecast particularly high growth for Honor. They estimate that shipment volume in 2023 will increase by around 6% for Xiaomi, OPPO, and vivo as a result of sales growth in emerging economies and the benefits of a domestic market recovery. (Mizuho Securities report)

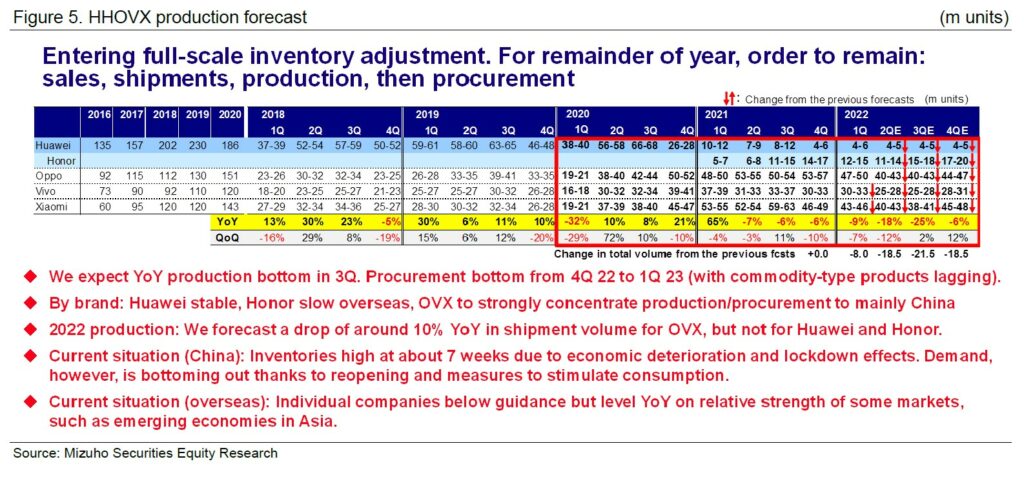

Chinese smartphone makers are drastically toning down their strategies owing to waning demand within China and stalling demand in key export markets (Europe, Asia, South America). Consequently, Mizuho Securities thinks the backward correction will continue in 2022, starting with sell-through, then feeding back to shipments, production, and procurement. Once the inventory adjustment has progressed sufficiently, they expect production to recover from around Oct 2022, with procurement bottoming out around three months later depending on the specific parts and materials (the correction will likely take longer for semiconductors / commoditized components, where the shortage was less pronounced). For Samsung Electronics, Mizuho Securities expects the correction to hit midrange and lower rather than high-end models (such as the Galaxy S), with some constraint on parts procurement. (Mizuho Securities report)

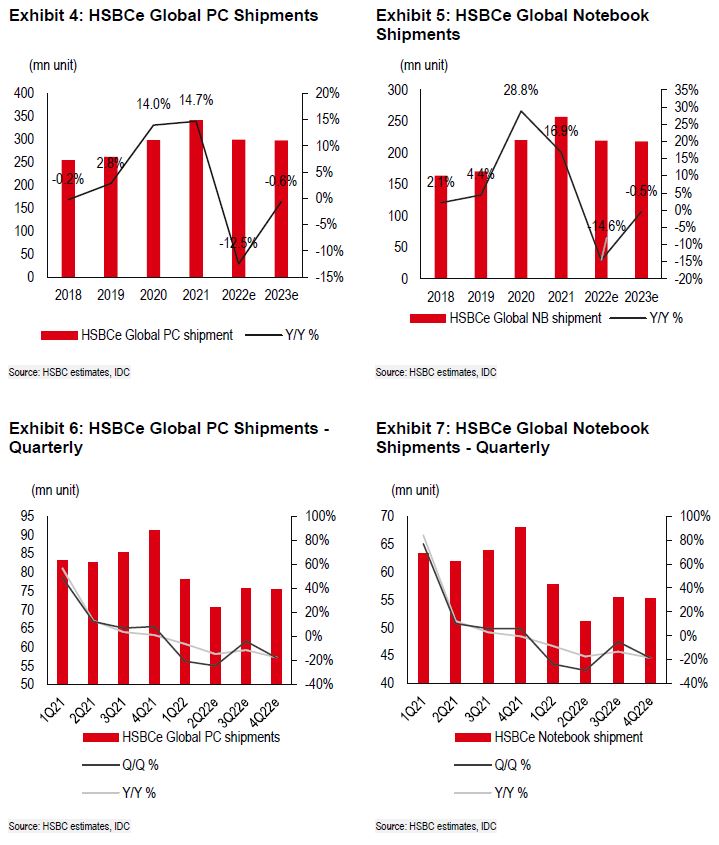

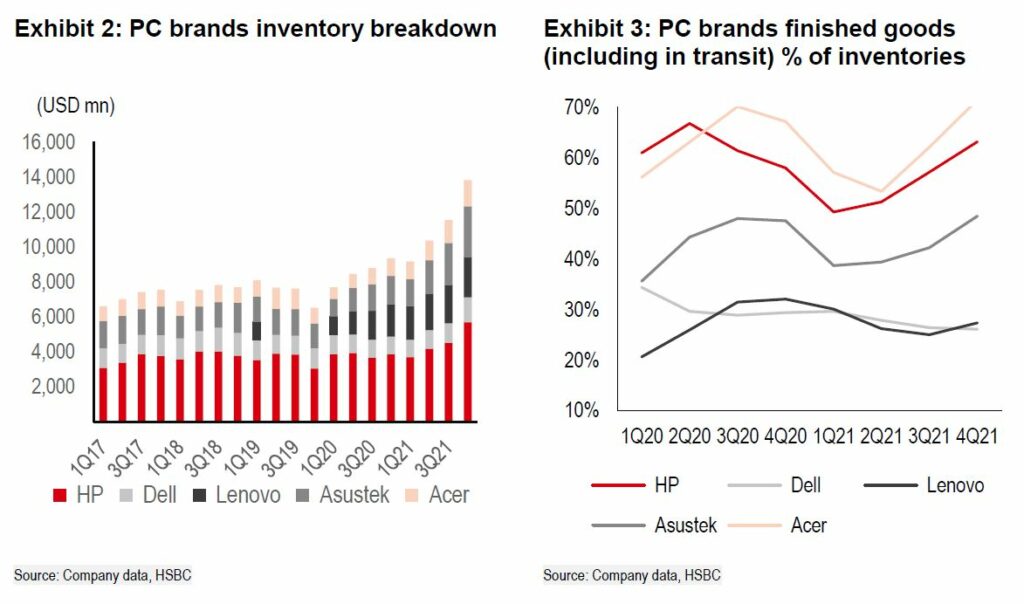

HSBC Global Research now estimate 2Q22 global notebook (NB) shipments will decline 12% QoQ (compared to their previous forecast of up 6% QoQ), which will likely be the trough for global NB shipments in 2022e, owing to the production constraints due to China lock-downs, as well as tepid Chromebook and consumer demand. Looking forward, the production in Shanghai and Kunshan has been recovering since end-May 2022 and was back to a 90%+ utilization rate in June 2022. However, in-transit finished goods have been gradually arriving to the channels in 2Q22, post the logistics constraints, which has led to higher than normal inventory levels in channels (currently above 12 weeks vs. the normal level of 8-12 weeks). This implies downside risk for mainstream consumer notebook shipments due to the unclear demand visibility for 2H22. Thus, HSBC expects a weaker rebound and a more flattish seasonality than normal in 3Q22. Overall, HSBC forecasts a +8.3% QoQ increase in NB shipments in 3Q22, vs. the average QoQ increase of +12.6% during 2017-2019. (HSBC Research report)

HSBC further lower their 2022 global notebook shipment forecast from flat YoY to -15% YoY (vs. the latest IDC forecast of -8.6%) as they expect a tepid rebound in 2H22 due to overall demand uncertainty. Specifically, although HSBC still expects YoY growth for commercial and gaming models, HSBC are seeing slower enterprise spending and gaming demand growth. Thus, they lower their shipment forecasts for commercial/gaming models to +7% / +5% YoY in 2022e, vs. their previous forecasts of +16% / +10%. Furthermore, they cut forecasts for mainstream consumer / Chromebook shipments more significantly, to –23% / -59% YoY, vs. the previous -7% / -30% YoY in 2022, as they see weaker demand due to elevated pricing due to global inflation, and muted demand in Europe capped by the Russia-Ukraine war, coupled with inventory digestion due to the increasing levels of inventory in transit. (HSBC Research report)

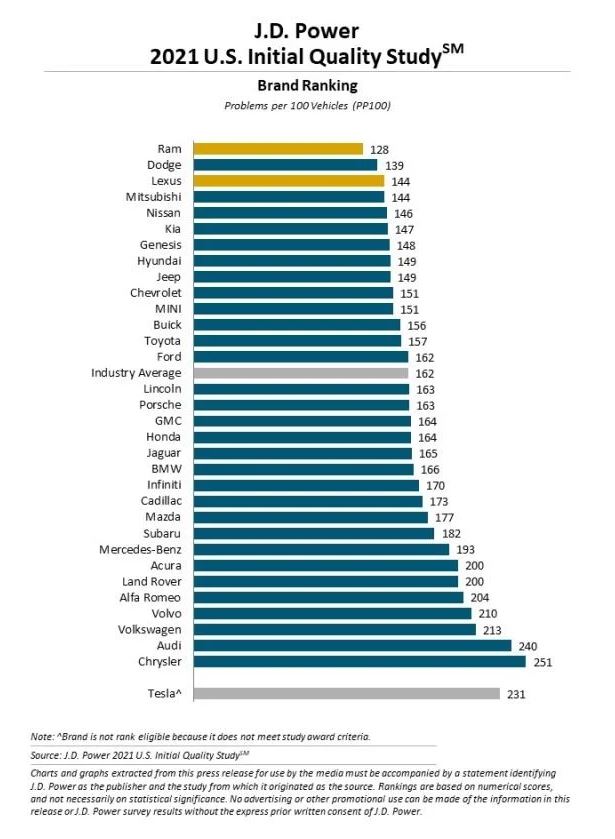

Battery-electric vehicles and plug-in hybrids have more problems than the average car, according to the annual J.D. Power U.S. Initial Quality Study (IQS). The 2022 survey found that EV owners cited 39% more problems with their new vehicles than did owners of new combustion-engine vehicles. Industrywide, problems per 100 vehicles rose 11% this year, for an average of 180 problems per 100 vehicles. But EV and PHEV owners reported about 240 problems per 100 vehicles (PP100), compared with 175 PP 100 for gas-engine models. Tesla, making its J.D. Power survey debut, outpaced the electrified segment with 226 problems per 100 vehicles. The 2022 J.D. Power U.S. Initial Quality Study is based on responses from 84,165 purchasers and lessees of new 2022 model-year vehicles between February and May 2022. They answered 223 questions organized into 9 vehicle categories: infotainment, features, controls and displays; exterior, driving assistance, interior, powertrain, seats, driving experience and climate. (TechCrunch, CN Beta, JD Power)

Akio Toyoda, president of Toyota and chairman of the Japan Automobile Manufacturers Association (JAMA), is reported to have secured an amendment to a key policy document by Japan’s government to include hybrid vehicles in the category of electric vehicles, effectively putting them on an equal footing. The use of synthetic fuel would make hybrid cars “100% clean”, Toyoda argued. He says that JAMA could not support a government that rejected hybrids. The final version of the document refers to Japan’s 2035 target for all new car sales domestically to be “so-called electric-powered vehicles” and specifically mentions in the main text that such vehicles include hybrids. (Reuters, Electrive, Asia Financial, IT Home)

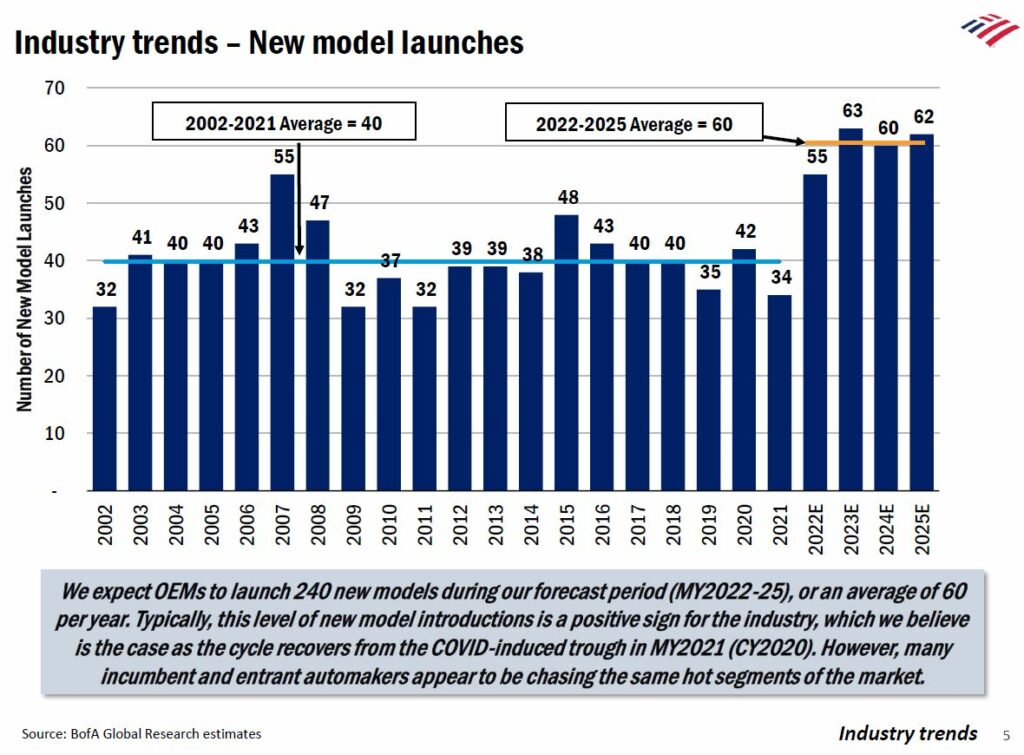

Bank of America has predicted that Ford and General Motors (GM) would surpass Tesla’s electric vehicle sales by 2025. According to the analyst John Murphy, Tesla’s current 70% market share in electric vehicles could drop to closer to 11% in the next 3 years. Meanwhile, he expects Ford and GM to approach 15% thanks to their new electric car offerings. The analyst has noted that the issue with Tesla lies in its lack of product portfolio and the fact that the company CEO Elon Musk is introducing products at a slow rate. Annual US sales of EVs could grow eightfold to more than 3.2M by 2025 from about 400K in 2021. GM plans to launch 17 new EV models in the US market from 2023 to 2026, Ford will have 6. Volkswagen AG will have 11 during that span, and the Korean duo of Hyundai and Kia will have 13. (BofA Securities report, Teslarati, Auto News, CN Beta, Bloomberg)