7-9 #Multiscreens : vivo has allegedly sent about 50% of its turnover in India to China to avoid paying taxes; SEMCO plans to spend more on its FCBGA packaging substrate production; Tesla CEO terminates deal to buy Twitter; etc.

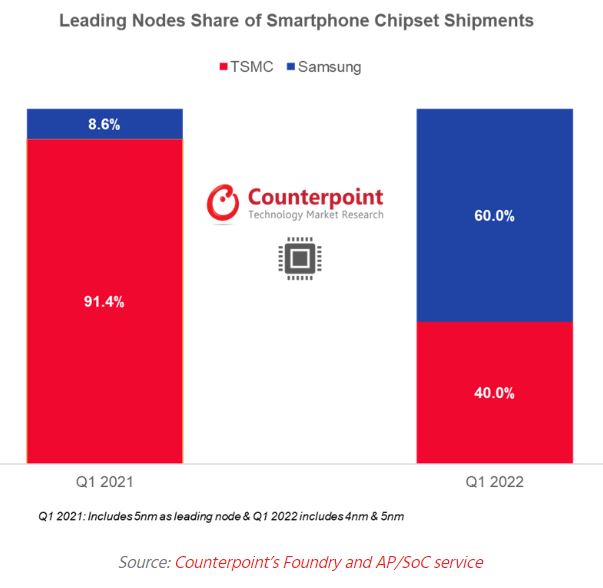

Global smartphone chipset (SoC/AP+Baseband) shipment declined 5% YoY in 1Q22 due to seasonality, weaker demand in China amid lockdowns and over shipping from some chipset vendors in 4Q21, according to Counterpoint Research. However, this decline was offset by strong growth in the chipset revenues which grew a healthy 23% YoY in 1Q22, as the chipset mix shifted towards costlier 5G smartphones. TSMC captured nearly 70% share of manufacturing the key chipsets going into the smartphones from the complete System-on-Chip (SoC) to discrete Application Processors (AP) and cellular modems. Samsung Foundry was the second largest foundry behind TSMC capturing a 30% share of the global smartphone chipsets. (Counterpoint Research, CN Beta)

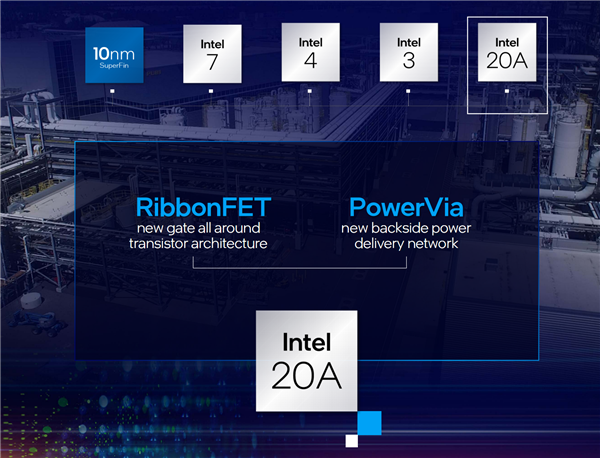

In Intel’s IDM 2.0 strategy launched in 2021, investing USD20B in the construction of 2 advanced process fabs in the United States is a very critical part. The bill has not yet passed, but now it is reported that Intel has been subsidized and the new factory has started. According to reports from Digitimes, Intel has officially acquired the land required for a new wafer fab in Ohio, the United States. The investment amount is as high as USD20B. According to Intel’s previous information, the two new fabs will be named Fab 52 and Fab 62 respectively, and it is revealed for the first time that these factories will mass-produce 20A process in 2024, which is Intel’s future-oriented CPU process. In the nano era, the first Angstrom-level technology was launched, in which A stands for Angstrom. (Digitimes, CN Beta, My Drivers, CRN, Fierce Electronics)

Samsung Electro-Mechanics (SEMCO) has announced plans to spend more on its FCBGA packaging substrate production in South Korea and Vietnam. SEMCO will invest KRW300B (USD231M) to expand production of semiconductor package substrates and widen its product range to produce substrates for servers. The investment will be used to produce flip-chip ball grid array (FCBGA) packages at its existing plants in Busan, Sejong and Vietnam. FCBGA refers to a sophisticated type of chip substrate designed to bind together high-performing processors and protect them from the surrounding environment.(CN Beta, The Elec, Korea JoongAng Daily)

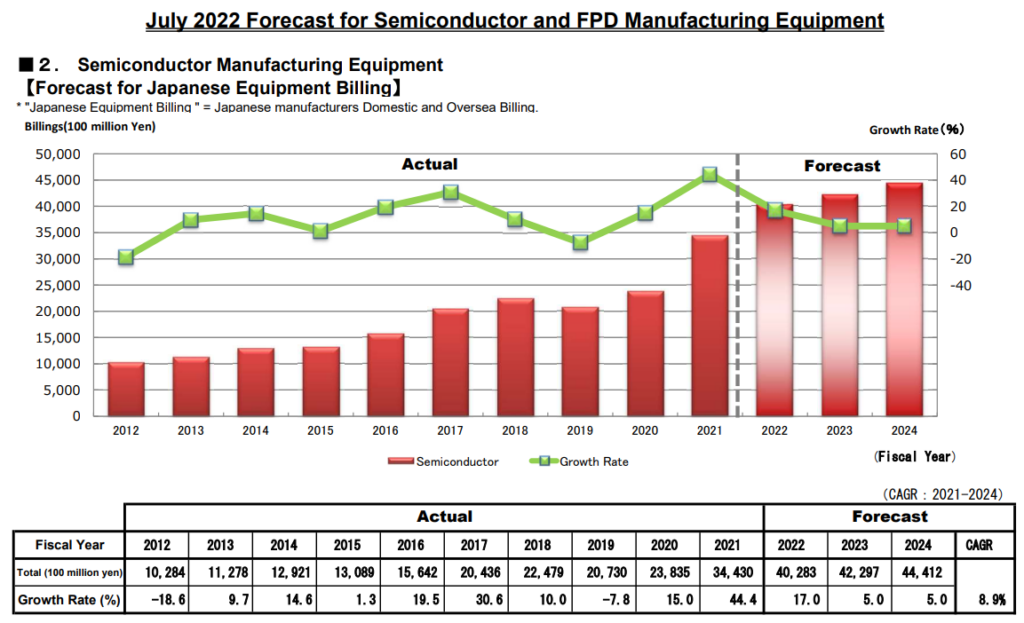

Although the prolonged conflict in Ukraine, the impact on consumer spending amid rapid inflation, supply chain turmoil and parts shortages continue, active investments in logic/foundries and in memory have maintained, as Semiconductor Equipment Association of Japan (SEAJ) forecast sales of semiconductor manufacturing equipment made in Japan for fiscal 2022 to be JPY4.03T (USD29.4B), an increase of 17.0% from the previous year. For fiscal 2023, for which SEAJ expects stable growth as well, SEAJ forecast sales of JPY4.23T, an increase of 5.0%. For fiscal 2024 as well, they forecast sales of JPY4.41T, an increase of 5.0%. (SEAJ, Laoyaoba)

Samsung Foundry will engage Ansys’ industry-leading electromagnetic (EM) simulation tools to develop ultramodern designs, including 5G / 6G, on the most advanced chips, nodes, and process technologies. Ansys’ simulation solutions will deliver a comprehensive EM-aware design flow with greater capacity, speed, and integration capabilities for Samsung’s most advanced semiconductor technology, accelerating on-chip design cycle times to boost high-speed connectivity while helping to reduce design error and risk. (CN Beta, Ansys, Techpowerup)

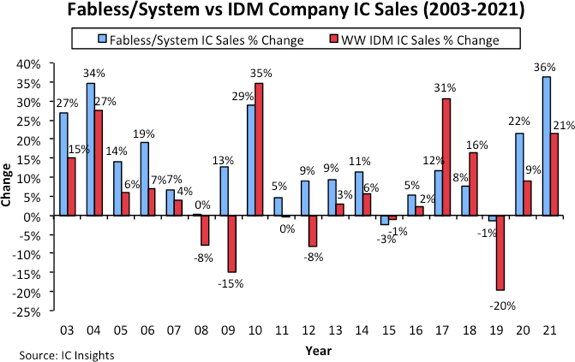

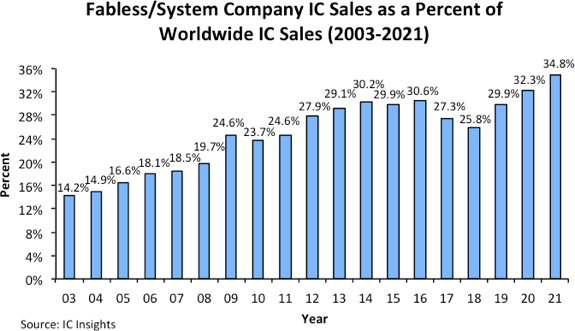

While there is a relatively close relationship between the annual market growth of the fabless IC suppliers and foundries, the sales growth rates of fabless IC companies versus IDM (integrated device manufacturers) IC suppliers have usually been very different. Typically, the sales growth rate registered by the fabless IC suppliers is better than that displayed by the IDMs. In fact, according to IC Insights, the first time on record that IDM IC sales growth outpaced fabless IC company sales growth was in 2010 when IDM IC sales grew 35% and fabless IC company sales grew 29%. The disparity between fabless IC supplier growth and IDM IC supplier growth has been especially pronounced over the past 3 years. In 2019, driven by a collapse in the memory market, IDM IC sales plunged by 20%. In contrast, fabless IC supplier sales declined only 1%. In 2020, fabless IC company sales jumped by 22% while IDM sales increased by only 9%. In 2021, fabless IC company sales surged 36% while IDM sales were up by 21%. (Laoyaoba, IC Insights)

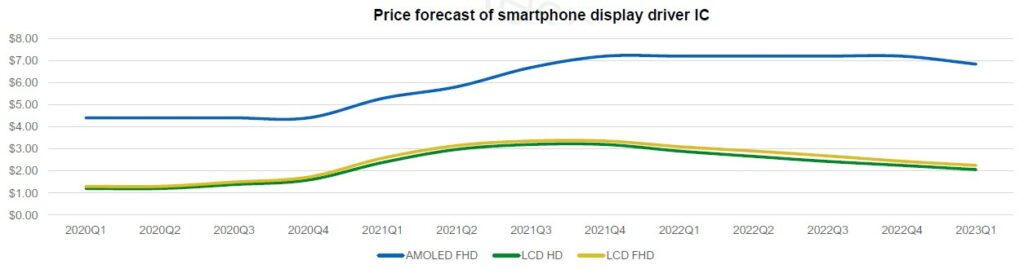

The price trend of IC has been fine tuned in 1Q22. TDDI IC price has fallen from the highest level has been close to 20%. Of course, the differentiation between different spec is more obvious. HD resolution TDDI has fallen significantly, and the lowest price can even break USD2.6 in the South China market, because HD TDDI has the lowest threshold. In order to get rid of the goods in hand as soon as possible, s ome operators and agents even offer to sell at a lower price. But the TDDI of FHD resolution because the threshold is higher than HD, the decline is not so aggressive. For OLED DDI, it is still flat for the whole year, mainly due to the increasing proportion of AMOLED penetration. But now the uncertainty is increasing because of the poor market conditions. (Nafers report, Nafers report)

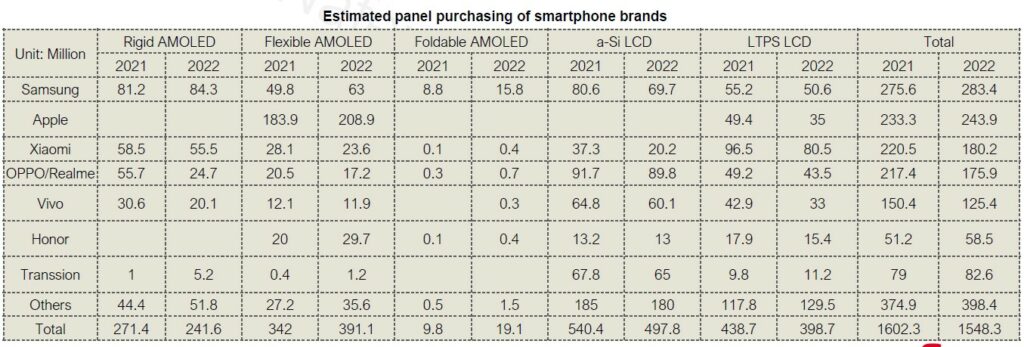

Samsung, Apple, Honor, Transsion and other brands are expected to maintain a positive growth in purchasing volume for smartphone panels. However, Xiaomi, OPPO and vivo will reportedly reduce their purchases in 2022. Their panel purchasing volume in 2021 was far greater than terminal sales volume. In order to absorb excess inventory, the 3 brands are constantly releasing new models with older screens, limiting display procurement in 2022. (Nafers report, Nafers report)

Micron has announced commercial and industrial channel partner availability of Micron DDR5 server DRAM in support of industry qualification of next-generation Intel and AMD DDR5 server and workstation platforms. The move to DDR5 memory enables up to an 85% increase in system performance over DDR4 DRAM5. Micron’s new server DDR5 memory maximizes performance for AI, HPC and data-intensive applications that require more CPU compute capacity and higher memory bandwidth than DDR4 technology can support. DDR5-enabled servers are being evaluated and tested in data center environments and are expected to be adopted at an increasing rate throughout the remainder of 2022. (CN Beta, Micron)

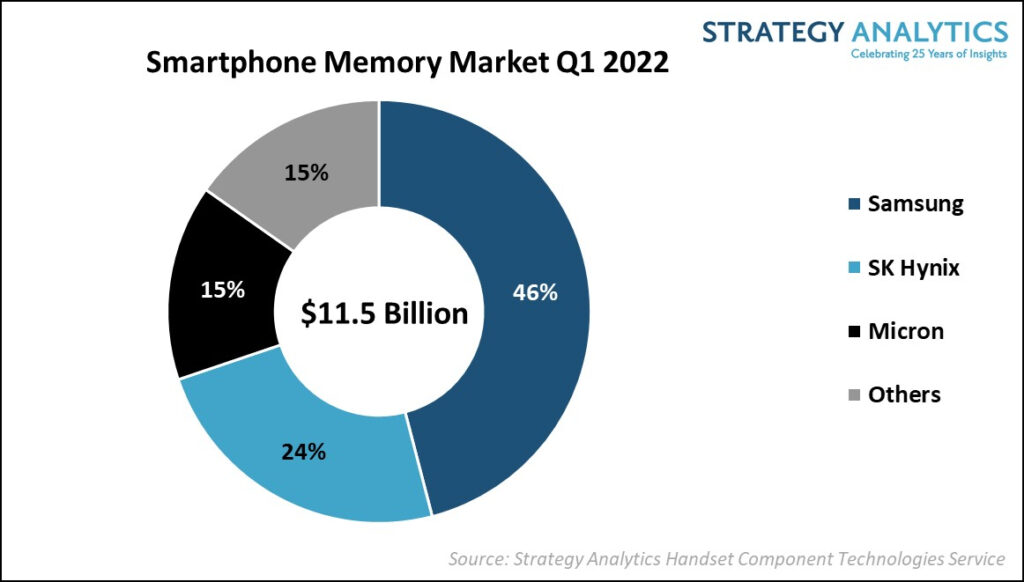

The global smartphone memory market clocked a total revenue of USD11.5B in 1Q22, according to the Strategy Analytics. Samsung managed the top spot in the smartphone memory market (DRAM & NAND) followed by SK Hynix and Micron in 1Q22. The combined revenue share of the top 3 vendors reached 85% in the global smartphone memory market in the quarter. The overall NAND flash market revenue for smartphones witnessed a revenue growth of 7% YoY driven by the shipment of high-capacity UFS NAND flash chips. The smartphone DRAM memory chip segment revenues suffered a decline of 7% as OEM demand weakened due to seasonality and disruption in the customer supply chain. (Strategy Analytics, Laoyaoba)

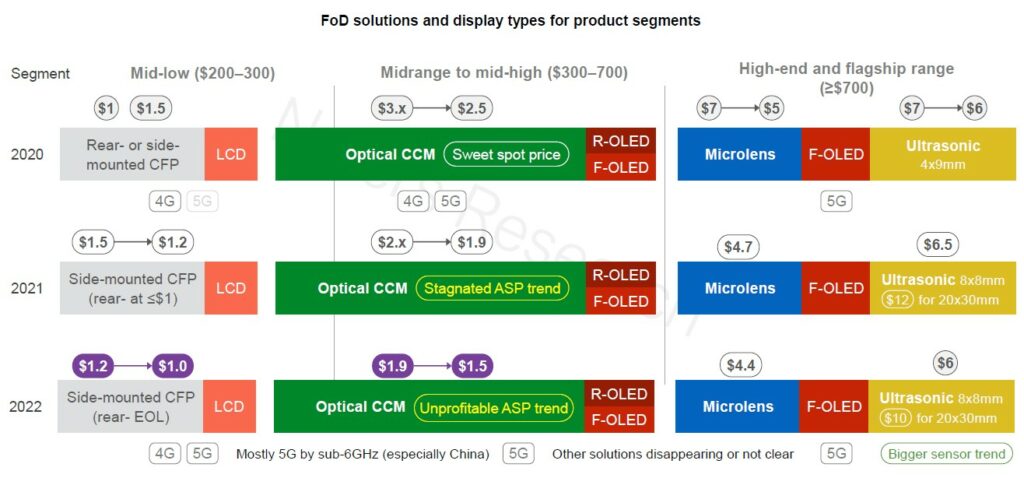

For fingerprint on display (FoD ), Nafers has significantly revised down the shipment of optical fingerprints. The optical (CCM) market is mainly impacted by the side capacitance fingerprint, while the optical (microlens) market is gradually shrinking due to the difficulty of price reduction of Goodix as the exclusive supplier. Ultrasonic fingerprint shipment forecast is slightly revised, mainly because now more and more brands began to accept ultrasonic fingerprint, and some fingerprint manufacturers including Goodix began to develop and plan mass production of ultrasonic fingerprint, is expected to break Qualcomm monopoly, reduce the price, and further expand the market capacity. (Nafers report, Nafers report)

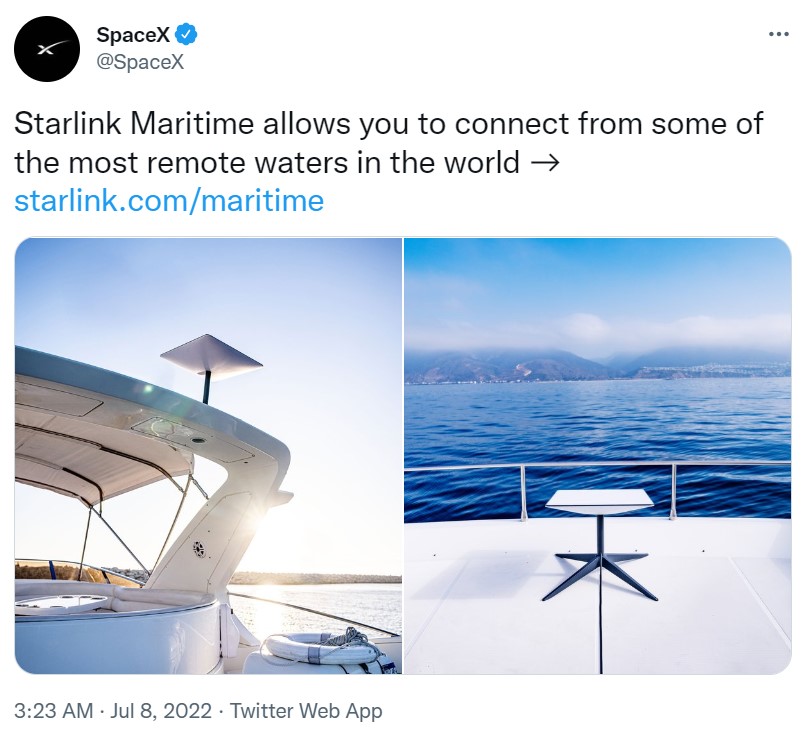

Starlink has launched a ruggedized version of its dish for boats, ships and yachts called Starlink Maritime. Starlink Maritime can deliver up to 350Mbps download speeds while at sea. The hardware itself costs about USD10,000 and the service itself costs USD5,000 a month. It will only work in the coastal waters of the USA (not including Alaska), Europe (except most of Norway, Sweden and Finland), Australia, Brazil, Chile, most of the southern part of Australia and New Zealand.(Engadget, Starlink, Twitter)

According to the Enforcement Directorate (ED) of India, vivo has sent INR62,476 crore (about 50% of its turnover) mainly to China to avoid paying taxes. The agency has blocked 119 bank accounts linked to vivo’s India business which were holding INR465 crore, INR73 lakh cash and 2kg gold bars, as part of a probe into alleged money laundering by the company. According to the ED, they have evidence that the vivo officials used forged documents while incorporating the companies. (Gizmo China, NDTV, CN Beta)

Elon Musk, the CEO of Tesla, has said he was terminating his USD44B deal to buy Twitter because the social media company had breached multiple provisions of the merger agreement. Musk’s lawyers claim that Twitter did not respond to requests for details about fake and bot accounts on the platform, which became a major blocker.(CN Beta, Neowin, Reuters)

The geopolitical conflict between Russia and Ukraine since March combined with the impact of the epidemic in China market, Chinese OEMs such as Xiaomi, OPPO, vivo and Honor all revised down orders and shipment expectation in 2Q22. The restricted sales market led to an increase in channel inventory levels. Based on supply chain inventory survey, it is estimated that Xiaomi, OPPO , vivo and Honor smartphone inventory exceeds 60M units, of which Xiaomi accounts for over 50%, and Xiaomi’s overall order is expec ted to be revised down by more than 20%. (Nafers report, Nafers report)

Mexican Foreign Minister Marcelo Ebrand has announced that Samsung will invest USD500M in Mexico to promote the production of household appliances. The company will also invest these funds in two Mexican cities, Querétaro in central Mexico and Tijuana. Ebrand adds that he had a meeting with Samsung Electronics CEO Han Jong-Hee to discuss the details of the investment. However, Samsung already operates a TV assembly plant in Tijuana, Mexico, with an annual output of about 19M units. (GizChina, SamMobile, Reuters, US News, Twitter)

Xperi has acquired Vewd Software for USD109M through a mixture of cash and debt. Vewd, which was created out of Opera TV in 2002 and rebranded in 2017, has offices in Norway, Sweden, Taiwan and Poland. In all over 450M connected TV devices have shipped with Vewd smart TV solutions from customers that include Amazon, Commscope, Hisense, Nintendo, Sagemcom, Skyworth, Sony, Swisscom, TCL, TPV Phillips and Vestel. It also has interests in in-car entertainment and broadband devices. The acquisition establishes Xperi as a leading independent streaming media platform through its TiVo brand and the largest independent provider of smart TV middleware globally.(Laoyaoba, Business Wire, Broadband TV News, Xperi)

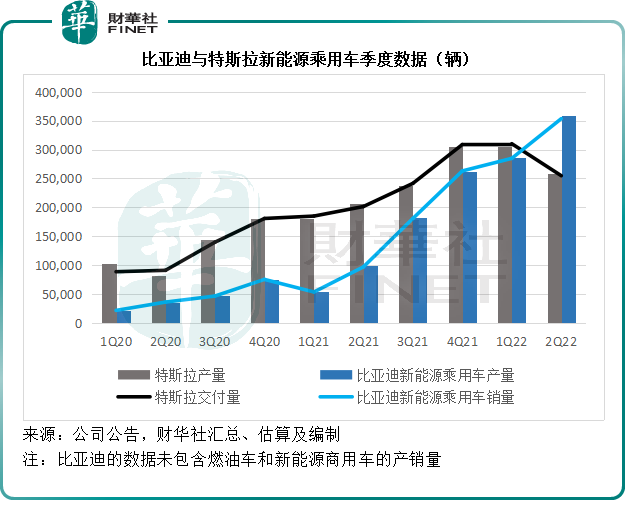

China’s BYD has dethroned Tesla as the world’s biggest electric vehicle (EV) producer by sales in 1H22. Based in Shenzhen City of south China’s Guangdong Province, BYD sold about 641,000 vehicles in 1H22 with a YoY increase of over 300%, while around 564,000 vehicles were sold by Tesla during the same time period, according to company filings. (Gizmo China, CGTN, UDN, FiNet, Sina, CNYES)

Rocket Lab, a leading launch and space systems company, has announced it is introducing a Responsive Space Program designed to on-ramp commercial and government satellite operators to the Company’s 24/7 rapid call-up launch capability and streamlined satellite build and operation options. Rocket Lab founder and CEO Peter Beck has said that they recognize customers need a reliable responsive launch service and dependable satellite solutions that can promptly and accurately restore or establish assets on orbit, so they have made that possible with Electron and Rocket Lab designed and built satellites, including Photon. Responsive launch capability was baked into the design of Electron and our launch sites since day one, and we’ve made strategic investments into vertical spacecraft manufacturing to enable this.(CN Beta, TechCrunch, Business Wire)

Meta has unveiled a new AI model called NLLB-200 that can translate 200 languages and improves quality by an average of 44%. According to Meta, NLLB-200 scored 44% higher in the “quality” of translations compared to previous AI research. For some African and Indian-based languages, NLLB-200’s translations were more than 70 percent more accurate. Meta has created a dataset called FLORES-200 to evaluate and improve NLLB-200. The dataset enables researchers to assess FLORES-200’s performance “in 40,000 different language directions”. Both NLLB-200 and FLORES-200 are being opened to developers to help build on Meta’s work and improve their own translation tools.(CN Beta, Weights and Biases, Meta, AI News)

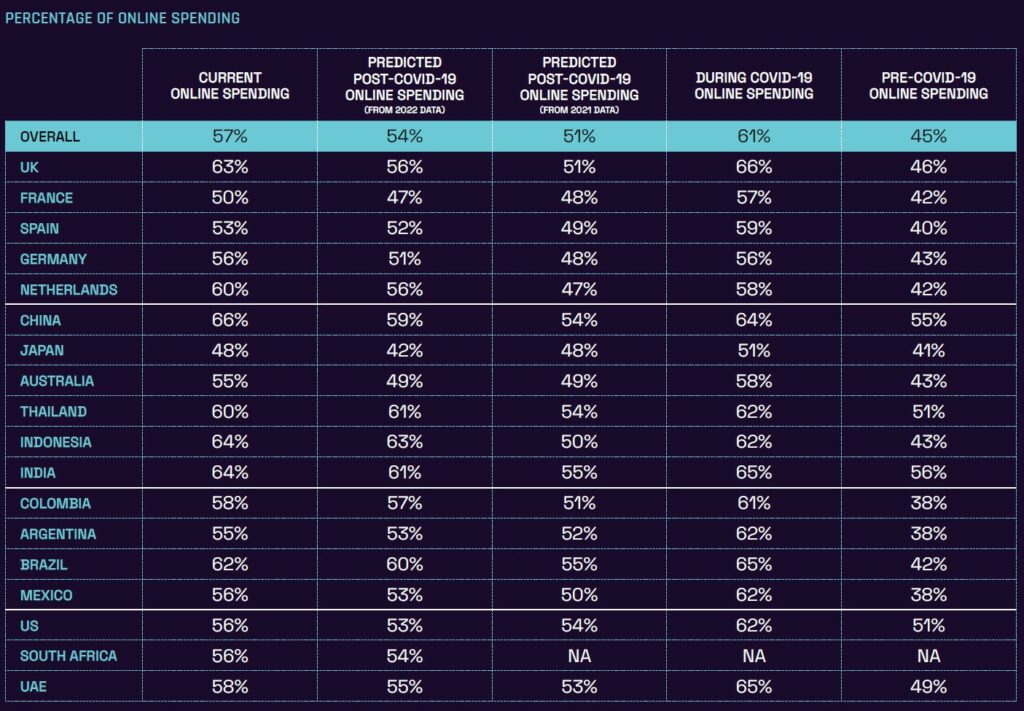

According to Wunderman Thompson, global consumers spend 57% of their total spend on their online shopping. The biggest online consumer base is China (66%), while the lowest is Japan with 48% – meaning that in every country in our survey, online accounts for at least 48% of spend. That is a staggering figure, and one that should spark any business into action, if still behind the digital curve. (Wunderman Thompson report)

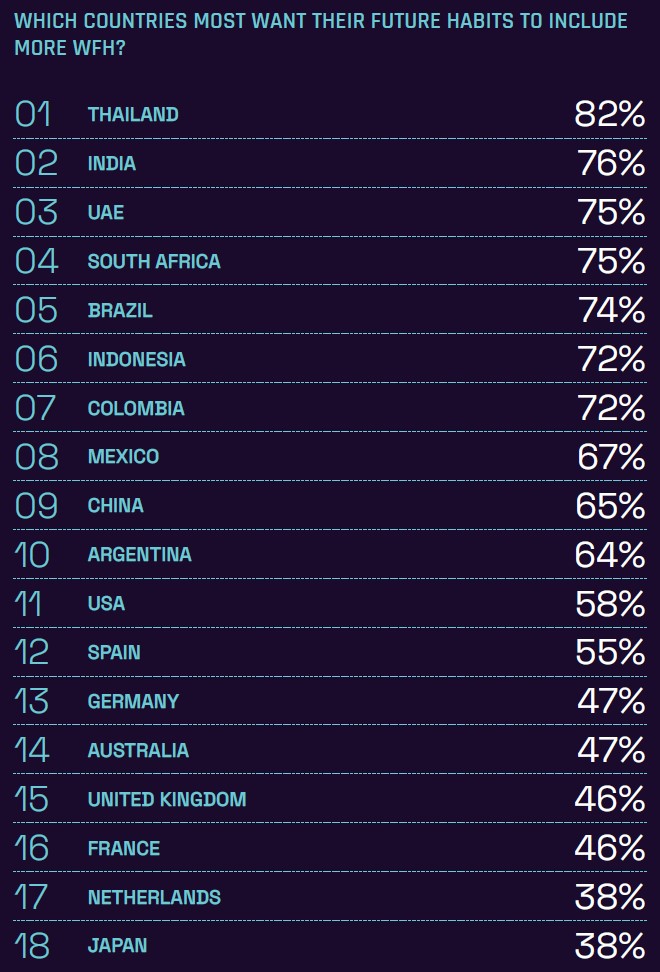

Perhaps one of the major lasting impacts of the pandemic will be a shift to more consumers working from home (WFH). Whether this continues or not is to be debated, but what we do know is that consumers want it, with 60% saying they wish their future working habits include more working from home than prior to the pandemic. Notably, there is variance across countries. This change in mindset has forced consumers to reconsider how and where they live. A huge 41% of consumers are thinking about relocating due to working from home, while 47% are reconsidering their reliance on a car. (Wunderman Thompson report)