7-21 #GreenThing : GlobalFoundries’ planned factory in upstate New York will likely be delayed; Samsung may offer tri-cam for its future Galaxy A series; General Electric has revealed the names of the 3 distinct companies; etc.

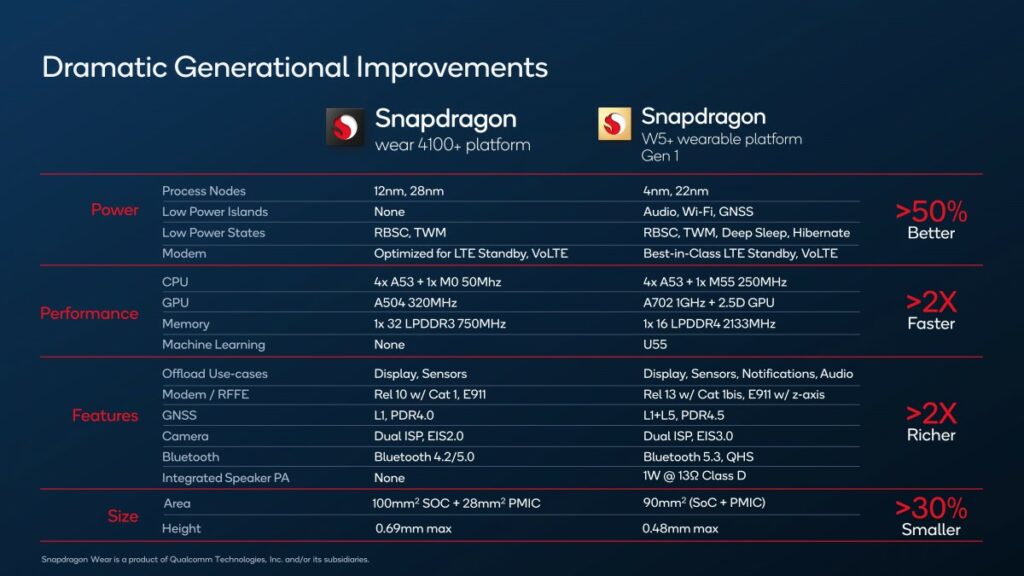

To succeed the Snapdragon Wear 4100+ platform, Qualcomm announces the Snapdragon W5 Gen 1 and the W5+ Gen 1. Qualcomm touts that its new wearable chipsets will offer up to 2X the performance using half as much power compared to the Snapdragon Wear 4100+ Platform. Headlining upgrades include ultra-low power Bluetooth and low power islands for Wi-Fi, GNSS, and audio. The hybrid architecture also facilitates low-power states such as Deep Sleep and Hibernate. The SoC is brand new, leaping from 12nm to 4nm, as is the new 22nm co-processor. The modem, RFFE, and Bluetooth are also newly imagined. (GSM Arena, The Verge, Engadget, Android Authority)

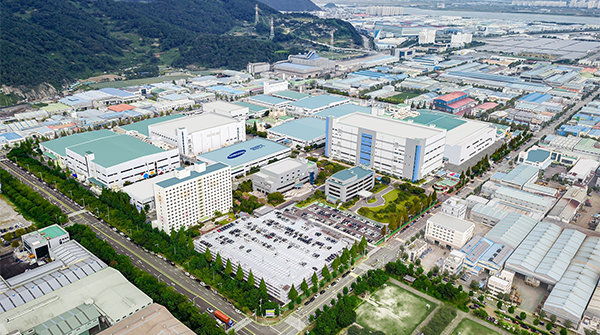

Samsung Electro-Mechanics Co (SEMCO), the electronic parts making unit of Samsung Group, has started the mass production of flip chip ball grid array (FCBGA) for servers for the first time in Korea with a goal of becoming one of the world’s top three suppliers of high-end FCBGA. The company so far in 2022 has injected KRW300B (USD227.4M) in domestic manufacturing lines including SEMCO’s Busan plant for next-gen package substrates. It spent around KRW2T over the last 2 years in the facility expansion on FCBGA. SEMCO in 2021 produced total 703,000 square meters of package substrates, equivalent to 100 soccer fields. It estimates the FCBGA market would grow by 14% per year for the next 5 years to reach USD17B by 2026. (Laoyaoba, TechNews, Korea JoongAng Daily, Pulse News)

With Chinese smartphone vendors making several downward revisions to their shipment goals in 2022, inventory adjustments at suppliers of related chips including application processors and RF power amplifiers will last at least one quarter, according Digitimes. Mobile phone application processor prices have begun to trend downward, with prices for some high-end processors remaining flat. Prices of RF power amplifiers for mobile phones are also under downward pressure. It was previously reported that Xiaomi, OPPO, vivo and other leading smartphone makers in mainland China have told suppliers that orders in the next few quarters will be reduced by about 20% compared with previous plans. Xiaomi is rumored to have told suppliers that it will lower its full-year forecast to around 160-180M units from its previous target of 200M units. vivo and OPPO also reduced orders by about 20% in 2Q22 and 3Q22 in an attempt to digest the excess inventory currently flooding retail channels. (Digitimes, Laoyaoba, UDN)

According to Digitimes, Qualcomm and Marvell have notified customers that price increases could begin as early as Aug 2022. Several chip suppliers, including Intel and TSMC, are also looking to raise their offers despite growing concerns about demand volatility. Intel has informed its customers that it will raize the price of chip products by 10%-20% in 2H22. In Mar 2022, Samsung announced a 20% increase in the price of its microchips. In addition, TSMC has previously announced that it will raise prices by single digits. (Digitimes, Digitimes, press)

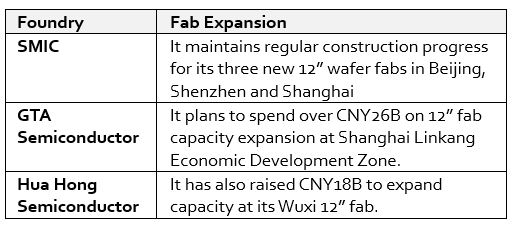

China’s semiconductor equipment vendors managed to score impressive revenue gains for 1H222, and remain confident about their shipment prospects for the rest of 2022 thanks to abundant orders in hands, according to Digitimes. Advanced Micro-fabrication Equipment (AMEC), Piotech, ACM Research (Shanghai), Kingsemi, Naura Technology and Hwatsing have also registered notable revenue increases for 1H22, with clear order visibility through the next 6-12 months. In 2Q22 alone, these foundries and other local peers including Yan Dong Microelectronics Technology and Triton Semiconductor together registered to purchase a total of 1,930 units of semiconductor processing machines and equipment through open tenders, the sources said, stressing that equipment demand will sustain momentum amid stable capacity expansion paces at China foundries. (Digitimes, press)

GlobalFoundries CEO Tom Caulfield has indicated that a planned semiconductor factory in upstate New York will likely be delayed if a bill to bolster the U.S. computer chip industry fails to pass in the coming weeks. The U.S. Senate is due to vote on a slimmed-down version of legislation to provide USD52B in subsidies and tax credits for the industry more than a year after passing its first version of a bill. The bill, which aims to counter rising competition from China, would provide payments to companies like Intel, Samsung Electronics, Taiwan Semiconductor Manufacturing Co and GlobalFoundries to construct chip factories in the United States.(CN Beta, Reuters, US News)

NXP Semiconductors has announced that it has signed a memorandum of understanding with Hon Hai Technology Group (Foxconn) to jointly develop platforms for a new generation of smart connected vehicles. The collaboration builds on the company’s initial digital cockpit partnership, based on the NXP i.MX applications processors and NXP Software Defined Radio platform. The primary focus of the expanded collaboration is aimed at Foxconn’s efforts in electrical vehicle (EV) platforms, leveraging NXP’s system expertise and comprehensive electrification portfolio, from NXP S32 processors to analog-front-end, drivers, networking and power products.(Reuters, Globe Newswire, Neowin)

According to IDC research director Vinay Gupta, the semiconductor supply is not going to increase immediately. There are a lot of raw materials, gases, which were required for production of those semiconductors. Citing supply chain challenges due to Russia’s war in Ukraine, Gupta has said the two countries capture a large part of the market share, with Russia and Ukraine being the largest exporters of krypton — a gas used in the chip production. Neon is also critical for the chipmaking process and is used for lasers, known as lithography, where machines carve patterns onto tiny pieces of silicon made by the likes of Samsung, Intel and TSMC. More than half of the world’s neon is produced by a handful of companies in Ukraine, according to Peter Hanbury, a semiconductor analyst at research firm Bain & Co. Furthermore, Gupta has said that rising inflation and expectations of more monetary tightening are already causing a “consumer-led slowdown”. Thus, IT spending, especially consumer IT spending, is showing signs of recession. (HS Tong, Silicon Angle, CNBC)

CARIAD, the software unit of Volkswagen Group, and STMicroelectronics (STM) have announced they will shortly launch the joint development of an automotive system-on-chip or SoC for software-defined vehicles. This cooperation targets the new generation of Volkswagen Group vehicles. Also, CARIAD, TSMC, and ST plan that TSMC will manufacture the system-on-chip wafers for STMicroelectronics. CARIAD will enter into direct relationships with semiconductor suppliers at the Tier 2 and Tier 3-level for the Volkswagen Group. CARIAD plans to direct Tier 1 suppliers of the Group to use only the SoC co-developed with ST and ST’s standard Stellar microcontroller for CARIAD’s zone architecture. (CN Beta, Globe Newswire, Business Insider)

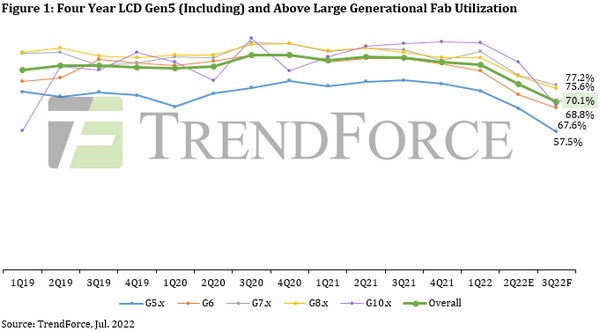

Moving into 2H22, terminal brands continue to adjust their inventory, not only weakening panel demand, but also inducing a sustained drop in panel quotations. The sharp increase in operating pressure affecting panel manufacturers has forced the display industry to restrain production. According to TrendForce, utilization rate (calculated by the volume of glass input) in 3Q22 is expected to fall to 70%, a substantial decrease of nearly 7.3 percentage points from 2Q22. TrendForce indicates that the utilization rate of Gen-5 to Gen-7.5 is expected to decrease by 7.7% percentage points to 63.7% and the utilization rate of Gen-8 to Gen-10.5 will decrease by 7 percentage points to 75% in 3Q22. More than 90% of the Gen-10.5 utilization rate used to produce TVs is expected to drop by 17.8 percentage points QoQ, which also highlights the continuing pessimistic demand for TV panels in 3Q22. TrendForce indicates, if panel makers do not wish to face the risk of high inventories at the beginning of 2023, they should maintain reduced operations in 4Q22 in order to eliminate existing panel inventory. (TrendForce, TrendForce)

While demand and prices for LCD display driver ICs (DDI) are declining across all sizes segments, demand and prices for OLED DDI are relatively stable, and attracting more efforts from design houses, according to Digitimes. Since there are fewer OLED DDI suppliers than LCD suppliers, the supply of OLED DDI is quite tight at present, the available capacity of 40nm process has not been expanded, and the cost of 28nm process is higher. Novatek, a Taiwan-based driver IC design company, said that the capacity it has acquired may not be enough to meet OLED DDI shipments in 4Q22. It is understood that the penetration rate of OLED DDI in mobile phones is currently only 50%, and there is still a lot of room for growth. Demand for these chips is also increasing in tablets and wearables, while laptop suppliers continue to incorporate OLED technology into new models. (Digitimes, Digitimes, Laoyaoba)

Samsung president TM Roh has announced that Samsung shipped 10M foldable phones in 2021. This represents a 300% increase in foldable sales compared to 2020. Samsung says 70% of the foldables shipped in 2021 were in the style of the Galaxy Z Flip 3, leaving just 30% in the style of the Galaxy Z Fold 3. (Android Authority, Samsung, My Drivers)

Samsung Display (SDC) has rsuccessively received requests from its parent company and customers to develop Micro OLED. However, because the AR/VR market is still very small, the panel is smaller than that of smartphones, and there are other competing technologies for Micro OLED, development Micro OLEDs are extremely low-margin, and SDC is still shunning demands. In addition, it is also reported that SDC’s competitor, LG Display (LGD), will order from Sunic System for evaporation equipment for Micro OLED. The recent trial production will naturally lead to expectations for SDC’s development of Micro OLED. Taking Micro OLED as an example, the current main consumer market is not AR / VR devices, but digital camera Electronic Viewing Window (EVF). (CN Beta, Money DJ)

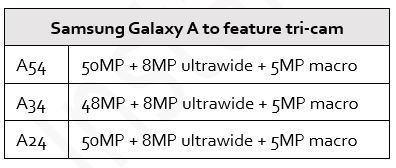

Samsung has offered quad-camera setups on its Galaxy A series phones for a while now, usually consisting of a primary camera, ultrawide shooter, macro camera, and depth sensor. Samsung reportedly plans to remove the depth camera from the Galaxy A24, Galaxy A34, and Galaxy A54 smartphones. These phones are tipped to keep their primary, ultrawide, and macro lenses.(Android Authority, The Elec, Android Headlines)

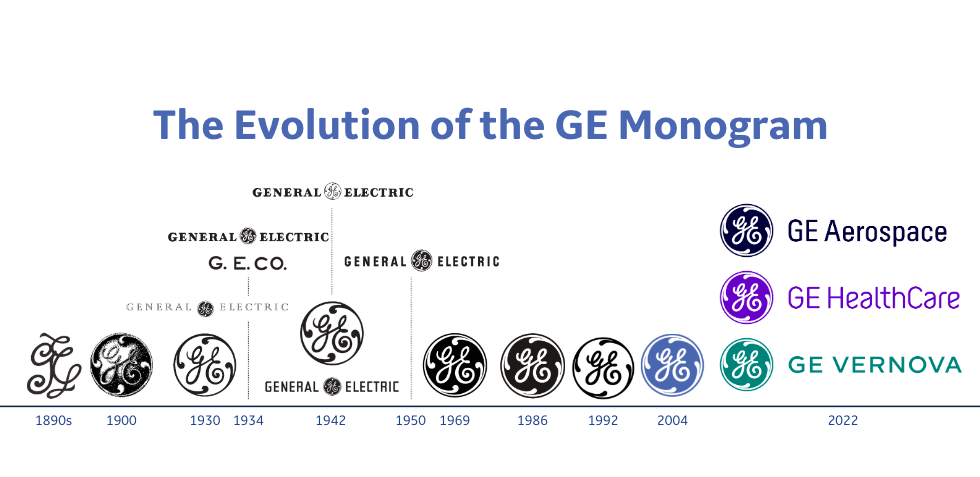

General Electric (GE) has revealed the names of the 3 distinct companies that will result from the conglomerate’s historic split: GE HealthCare, GE Aerospace and GE Vernova. GE HealthCare will encompass the company’s health-services branch. GE Aerospace will encompass the company’s aviation branch, which includes a fleet of 39,400 commercial and 26,200 military aircraft. The company’s renewable energy businesses will fall under the name GE Vernova. GE maintains an installed base of 7,000 gas turbines and 400 gigawatts of renewable energy equipment. The spinoff of that business is expected to be completed in early 2024. Collectively, the separations will cost around USD2.5B, GE has said, when taxes and operational expenses are ultimately tallied. (Laoyaoba, CNBC, The Street, Seeking Alpha, NY Post)

Nippon Denkai will build a USD150M plant in the U.S. that will make copper foil for electric vehicle batteries. The plant’s construction will start in Sept 2022 in Augusta, Georgia. Samples will start shipping in summer 2024, and production capacity is set at 9,500 tonnes a year. Nippon Denkai originally planned to spend JPY19B (USD137.7M) to expand an existing plant in Camden, South Carolina. Annual capacity from that project would have been 9,000 tonnes. After considering cost competitiveness and future expansion potential, the company chose the Georgia site. Annual capacity could be tripled to 28,500 tonnes to meet future demand. (CN Beta, Asia Nikkei)

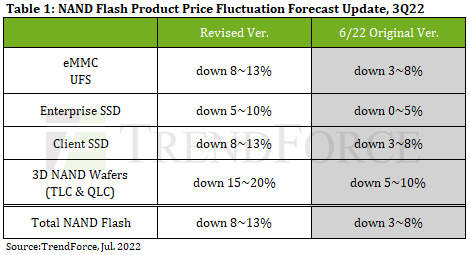

According to TrendForce, market oversupply intensified in 2Q22 due to lagging demand and continued NAND Flash output and process advancement. The market consensus is a disappointing 2H22 peak season for consumer electronics including notebooks, TVs, and smartphones. Material inventory levels continue to rise and has become a risk to the supply chain. Due to slow destocking among distributors and a conservative stocking approach among clients, inventory problems have bubbled over upstream onto the supply side and sellers are under increased pressure to sell. TrendForce estimates, due to the rapid deterioration of the balance between supply and demand, the drop in NAND Flash pricing will expand to 8~13% in 3Q22, and this decline may continue into 4Q22. (TrendForce, TrendForce)

Braving the headwinds facing the NAND flash market, China’s Yangtze Memory Technologies (YMTC) is set to commercialize new capacity at its second NAND plant in the country by the end of 2022 looking to narrow its capacity gap with Samsung Electronics and Micron. Its original plant has been running near capacity and churned out 100,000 wafers a month at the end of 2021. About 40% of its output at present is 128-layer 3D NAND flash memory, the most advanced produced so far by a Chinese chipmaker. But that is one or two generations behind global leaders Samsung, SK Hynix and Micron. The rest of YMTC’s output is of older 64-layer 3D NAND flash memory. The new plant would first build mainly 128-layer flash memory and could later shift to even more cutting-edge chips, such as 196-layer or 232-layer 3D NAND flash memory, assuming development goes smoothly in 2023 and 2024.(Digitimes, Sina, EET-China, Nikkei Asia)

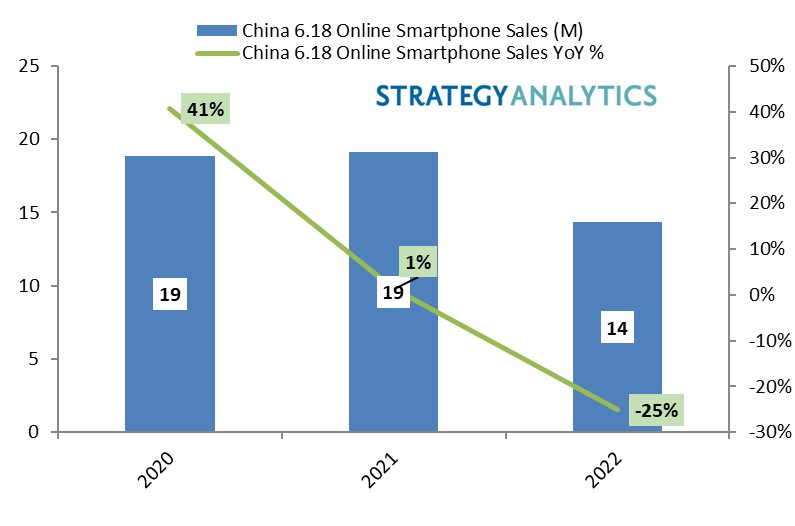

According to new research from Strategy Analytics, 14M units of smartphones were sold during 6.18 online shopping festival in China in 2022, down -25% YoY. Apple solidified the leadership at the expense of Chinese brands. Xiaomi and Honor follow and rank in the top 3 list. Apple has outperformed its rivals, selling nearly 7M iPhones during the festival, and the company was ranked top by revenue share across all major merchant platforms. (MacRumors, Strategy Analytics)

Xiaomi has announced that it has shipped 200M smartphones to India to date. It took just about 3 years to sell over 100M phones as against 5 years for the first 100M shipments in India. Xiaomi also disclosed that 15 5G smartphones have been released under its name within 2021.(Gizmo China, Twitter, CN Beta)

Google has recently begun ramping up work on an AR headset, internally codenamed Project Iris, that it hopes to ship in 2024. Google’s device uses outward-facing cameras to blend computer graphics with a video feed of the real world, creating a more immersive, mixed reality experience than existing AR glasses from the likes of Snap and Magic Leap. The hardware is powered by a custom Google processor and runs on Android. Given power constraints, Google’s strategy is to use its data centers to remotely render some graphics and beam them into the headset via an internet connection. Google has bought a smart glasses startup called North that was focused on fitting AR tech into a pair of normal-looking eyewear.(Phone Arena, The Verge)

According to TrendForce research, sales of electric vehicles (EVs) that can be externally charged or refueled such as BEVs, PHEVs, and FCVs are estimated to exceed 25% of global new vehicle sales by 2025. The main driving force in the market comes from accelerated worldwide decarbonization. In order to meet the goals of carbon neutrality, nations and corporations will eliminate internal combustion vehicles that are highly dependent on fossil fuels and also major carbon emitters. Many industries have ascended along with EVs and charging facilities are one of the largest non-vehicle business opportunities. The extensiveness of charging facilities is key to the sustainable growth of EVs in any given country. According to TrendForce’s observations, national budgetary allocations will accelerate towards supporting the construction of charging facilities and establishing systems and standards. (Laoyaoba, TrendForce, TrendForce)

Isuzu Motors, Toyota Motor, Hino Motors, and Commercial Japan Partnership Technologies Corporation (CJPT) have announced they would jointly plan and develop light-duty fuel cell (FC) electric trucks for the mass-market. The joint initiative is expected to contribute to the realization of a hydrogen society, as well as carbon neutrality by expanding the options available for customer use and increasing the demand for hydrogen. The companies will also promote the introduction of FC electric trucks to the market along with their widespread use. Light-duty trucks are often used for distribution in supermarkets and convenience stores that support people’s daily lives. In addition to being equipped with refrigeration and freezing functions, they are required to drive long distances over extended hours to perform multiple delivery operations in one day. They must also meet requirements such as fast refueling capability.(CN Beta, Toyota, Automotive World, Financial Express, Bloomberg)

Baidu has unveiled its next-generation fully autonomous vehicle (AV) Apollo RT6, an all-electric, production-ready model with a detachable steering wheel. Designed for complex urban environments, Apollo RT6 will be put into operation in China in 2023 on Apollo Go, Baidu’s autonomous ride-hailing service. With a per unit cost of CNY250,000 (USD37,000), Apollo RT6 is set to accelerate AV deployment at scale, bringing the world closer to a future of driverless shared mobility. Apollo RT6 integrates Baidu’s L4 autonomous driving system, powered by automotive-grade dual computing units with a computing power of up to 1200 TOPS. The vehicle utilizes 38 sensors, including 8 LiDARs and 12 cameras, to obtain highly accurate, long-range detection on all sides.(CN Beta, Bloomberg, Pandaily, TechCrunch)

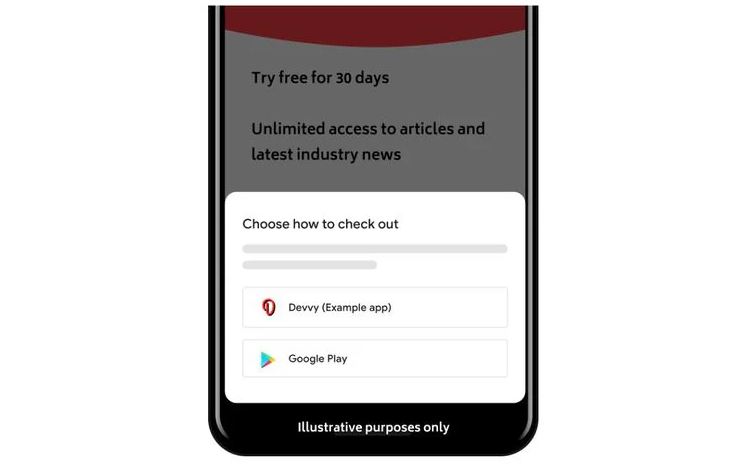

Alphabet unit Google has said it will cut fees to 12%, from 15%, for non-gaming app developers on its Google Play App Store which switch to rival payment systems, as it moves to comply with new EU tech rules. Google has said the fee cut applies only to European consumers while the freedom to use another payment system will eventually be expanded to gaming apps as well. The EU rules known as the Digital Markets Act (DMA), which will come into force in 2023, require tech giants to allow app developers to use rival payment platforms for app sales or risk fines of as much as 10% of their global turnover. Apple and Google are the most affected by this requirement.(Engadget, Google, MacRumors, Reuters)

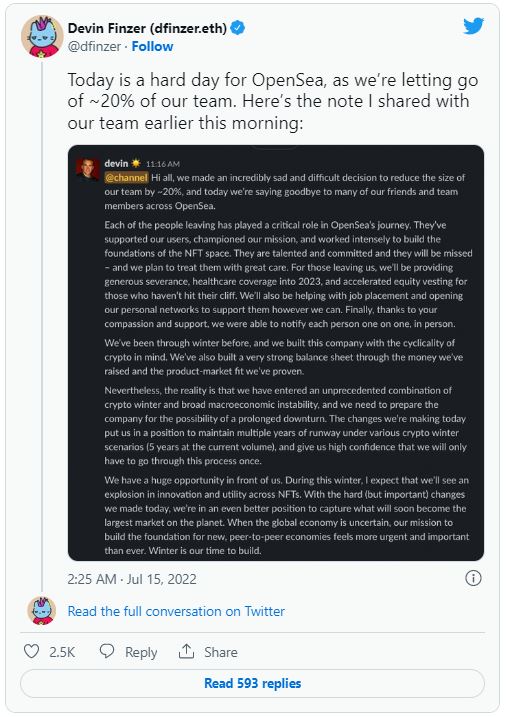

NFT marketplace OpenSea CEO Devin Finzer has announced that the company has laid off about 20% of its staff. He believes that they have entered an unprecedented combination of crypto winter and broad macroeconomic instability, and need to prepare the company for the possibility of a prolonged downturn. Gemini, Coinbase, Crypto.com and Bullish.com have all announced layoffs recently. (TechCrunch, CoinDesk, Twitter)

Hang, a Web3-powered platform that connects brands with members, has announced that it raised USD16M in a Series A funding round led by Paradigm. Hang co-founder and CEO Matt Smolin has indicated that the funding will be used on the product, engineering and go-to-market teams with a focus on “speed and scaling”. The Hang platform lets brand program managers set up membership rules, add benefits and rewards and connect to third-party services. The membership programs use non-fungible tokens (NFTs) to incentivize customers with rewards and perks.(TechCrunch, CoinDesk, NFT Gators)

Square Enix has teamed up with Enjin to create non-fungible tokens (NFTs) for digital collectibles for the 25th anniversary of Final Fantasy VII. Enjin has said it will make branded tokenized collectibles using its Efinity Network, which is a decentralized cross-chain blockchain network designed to make NFTs more accessible. The digital collectibles will be accessible to consumers who purchase items in the physical collection, which is expected to launch in 2023.(VentureBeat, The Verge, The Block)