8-5 #Space : Intel and Italy are reportedly close to a USD5B deal to build a chip plant in Italy; The etching machine manufactured by AMEC will be shipped to TSMC’s US factory; CATL has decided to push back announcing a multibillion-dollar North American plant; etc.

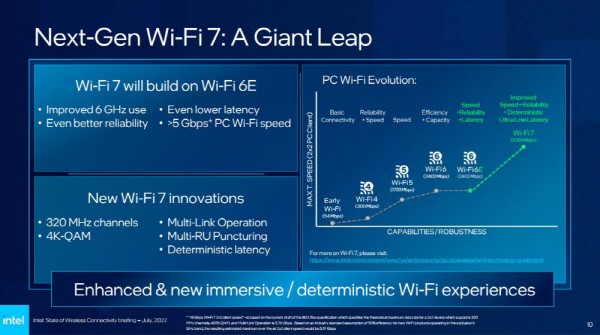

Intel will unveil their next-generation Wi-Fi 7 (802.11be) in 2024. Intel is currently developing Intel’s Wi-Fi ‘802.11be’ in order to obtain the ‘Wi-Fi Alliance’ certification, and it will be installed in PC products such as laptops by 2024. Wi-Fi 7 is the successor to the Wi-Fi 6E ‘802.11ax’ that was previously unveiled by Intel. It maximizes the use of existing 802.11ax technology, increases frequency (6 GHz) bandwidth stability and data processing speed, making it a more advanced form of Wi-Fi than Wi-Fi 6E. Wi-Fi 7 almost doubles the frequency bandwidth of 802.11ax (170MHz) to 320MHz and doubles the speed of Wi-Fi. Wi-Fi 7 will add the full 6GHz band that Wi-Fi 6E dabbled in, bringing the total number of Wi-Fi bands to three. It also doubles channel size from 160MHz to 320MHz and adds 4K Quadrature Amplitude Modulation (QAM), which lets it better organize data streams to improve density (Wi-Fi 6 only had 1K QAM). (Laoyaoba, The Register, TechRadar, ET News)

Intel and Italy are reportedly close to a USD5B deal that would see the tech giant build a chip plant in Italy. Intel plans to invest upwards of USD88B toward building chips in Europe in an effort to diversify its supply chain. The chip factory will potentially be in the northern regions of Piedmont or Veneto, though the Lombardy, Apulia and Sicily regions were reportedly looked into initially. Earlier 2022, news broke that Intel would heavily invest in the European Union when it comes to semiconductor manufacturing. Italy is just one of the planned countries that Intel will expand in, alongside Germany, Poland, and Spain.(CN Beta, Reuters, Windows Central, Tom’s Hardware)

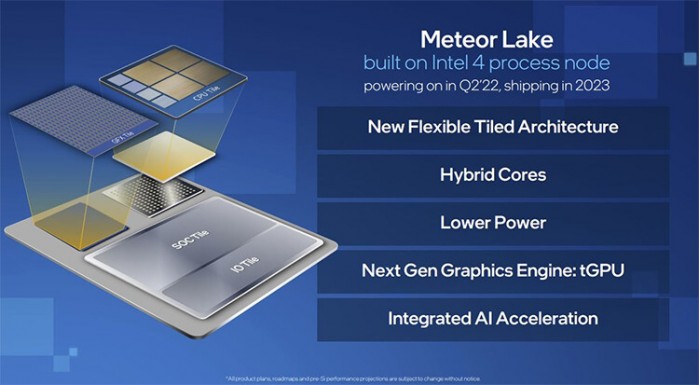

According to TrendForce, Intel plans to outsource the tGPU chipset in Meteor Lake to TSMC for manufacture. Mass production of this product was initially planned for 2H22 but was later postponed to 1H23 due to product design and process verification issues. Recently, the product’s mass production schedule has been postponed again to the end of 2023 for some reason, nigh completely cancelling 3nm production capacity originally booked in 2023 with only a marginal amount of wafer input remaining for engineering verification. TrendForce indicates that this incident has greatly affected TSMC’s production expansion plan, resulting in Apple being the one company among the first wave of 3nm process clients from 2H22 to the start 2023 with products including M series chips and A17 Bionic. (MacRumors, My Drivers, Neowin, TrendForce)

SK hynix has completed its acquisition of Key Foundry to enhance its foundry business 9 months after signing a deal to take over a full stake in the domestic foundry firm from Magnachip Semiconductor for KRW575.8B (USD439.6M). Key Foundry operates an 8” wafer fab and provides foundry service for 90-nanometer or higher growth products to global fables companies. It delivered KRW616B in revenue in 2021. With the acquisition of Key Foundry, 8” wafer production output can be doubled from current level. SK hynix system ic is capable of producing 80,000-100,000 units of 8” wafers per month, and Key Foundry about 85,000 units.(Laoyaoba, Korea Herald, Pulse News)

The etching machine manufactured by AMEC will be shipped to TSMC’s US factory in 2H22 for 5nm process chip production. During the closed-loop production of Zhongwei Semiconductor in 2022, the import of raw materials is very high. (CN Beta, UDN, EET China)

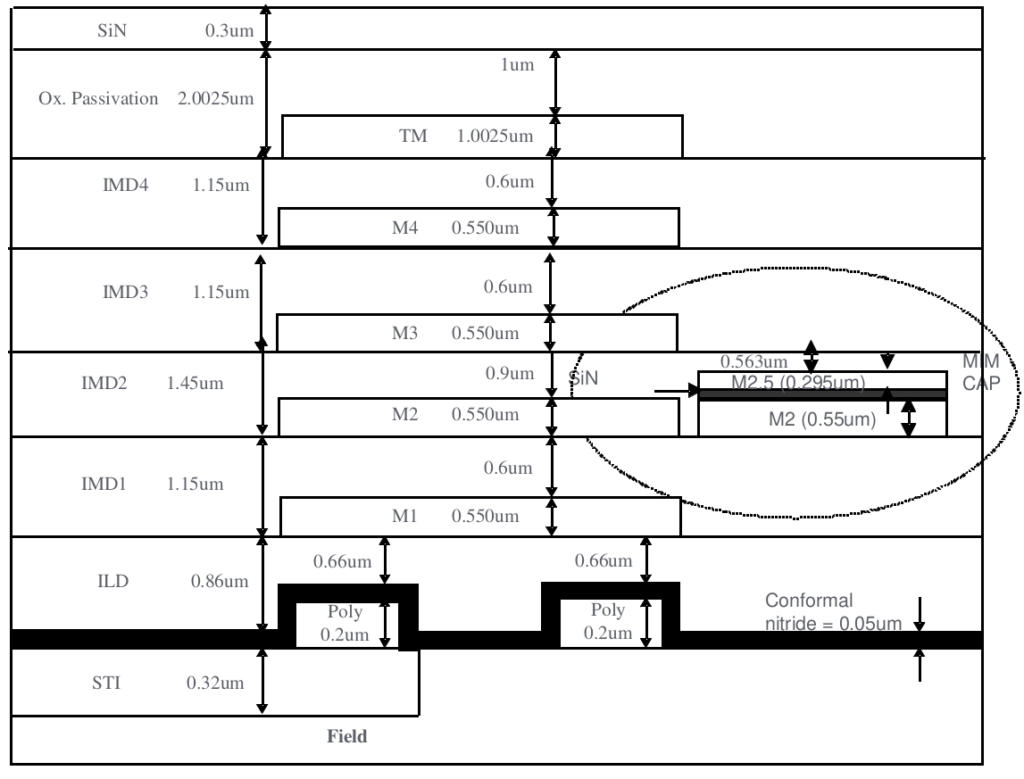

Google has announced that GlobalFoundries (GF) is participating in its open-source silicon initiative as a new partner, calling the new partnership a milestone in the foundry ecosystem market. It is releasing the process design kit (PDK) for the GlobalFoundries 180MCU technology platform under the Apache2.0 license along with a no-cost silicon realization program to manufacture open-source designs on the Efabless platform, which provides low-cost end-to-end chip creation solutions for universities, research labs, and startups. GF has said applications using 180nm are at a global capacity of 16+M wafers a year and bound to grow to 22+M wafers in 2026. The 180nm application space continues to see strong market demand in motor controllers, RFID, general purpose MCUs and PMIC, along with emerging applications such as IoT Sensors, dual frequency RFID and motor drive. (CN Beta, Google, Digitimes)

The European Union Chamber of Commerce in Korea has announced that 23% of European enterprises canceled or postponed their investment in China in 2Q22. This is because China’s economic growth is slowing down and the United States and the European Union are reshaping global supply chains against China. Likewise, in a recent survey conducted by the Federation of Korean Industries, 86% of South Korean companies in China have answered that their investment environment is deteriorating compared to a decade ago. More than 38%, 20% and 18% of the respondents have mentioned government risks, discrimination and U.S.-China trade disputes as reasons, respectively. (Laoyaoba, Business Korea)

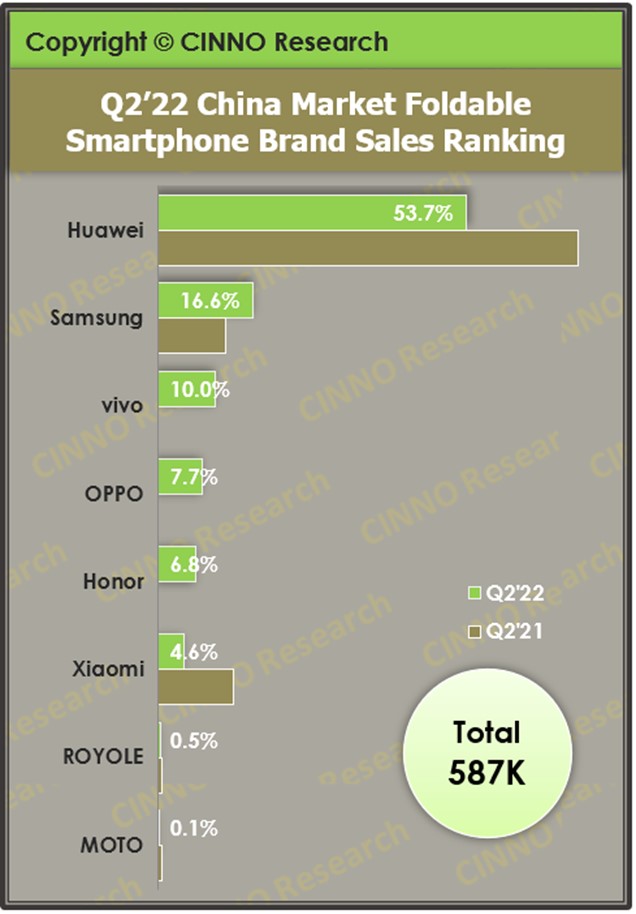

According to statistics from CINNO Research, the sales volume of foldable phones in the Chinese market reached 587,000 units in 2Q22, a significant increase of 132.4% YoY. The cumulative sales volume in 1H22 reached 1.3M units, surpassing the 1.16M units in 2021. Foldable displays are showing rapid growth. growth trend. Huawei’s foldable mobile phone sales in 2Q22 were about 315,000 units, a YoY increase of 70%, ranking No. 1 in the domestic foldable phone market, mainly due to the good sales of its new P50 Pocket / Mate X2 Collector’s Edition launched in 4Q21. (CINNO Research)

According to CINNO Research, the shipment of AMOLED smartphone panels in the global market in 1H22 is about 278M pieces, down 10.5% from the same period in 2021. In terms of regions, the Korean market share of the global AMOLED smartphone panel market in 1H22 accounted for 76.5%, and domestic manufacturers accounted for 23.5% of the market share. rising. From the perspective of the market structure, in 1H22, the global AMOLED smartphone panel market Samsung Display (SDC) shipments fell by 14.2% YoY, with a market share of 70.1%. It is still the main force in AMOLED panel shipments, ranking first in the world. (CINNO Research)

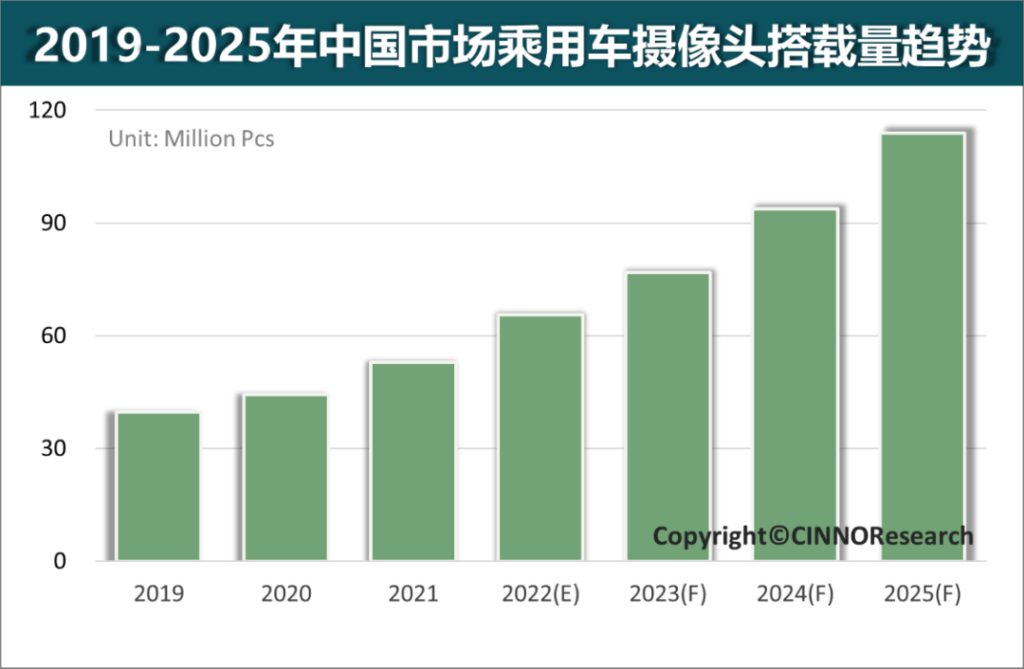

Compared with millimeter-wave radar and lidar, the vehicle camera has low cost and relatively mature hardware technology, so it has become the first core sensor for intelligent automotive applications. According to CINNO Research, in the past 3 years, the average number of cameras mounted on a passenger vehicle in the Chinese market has shown a step-by-step growth trend. In 1Q22, the average number of cameras installed in China’s passenger cars was about 2.7, an increase of about 0.3 YoY and an increase of about 0.1 MoM. At present, there are many types of in-vehicle cameras. According to different automatic driving functions and installation positions, they can be divided into five types of cameras: front view, rear view, side view, surround view and interior view. (Laoyaoba, CINNO Research)

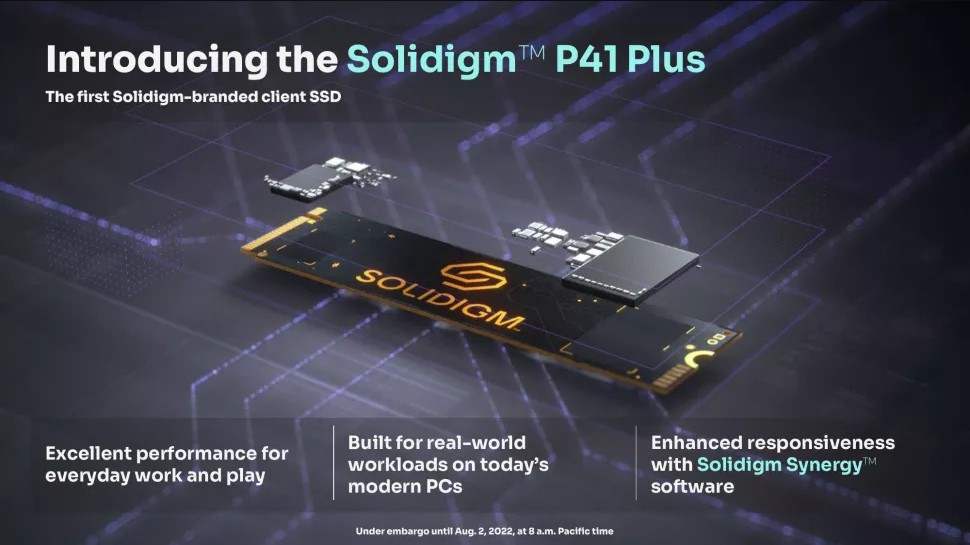

Solidigm, Intel’s former SSD division acquired by SK Hynix in Apr 2022, has introduced its first new family of solid-state drives for client PCs. The P41 Plus SSDs are essentially younger brethren of the company’s Platinum P41 high-performance drives aimed at demanding users and gamers. Solidigm’s P41 Plus SSDs are based on the company’s proprietary controller with a PCIe 4.0 x4 interface as well as the company’s 3D NAND memory. The drives will be available in 512GB, 1TB, and 2GB configurations as well as in M.2-2280, M.2-2242, and M.2-2230 form-factors. As far as performance is concerned, Solidigm rates its P41 Plus for a sequential read speed of up to 4125 MB/s and sequential write speed of up to 3325 MB/s. Meanwhile, random read speed is claimed to be up to 390K IOPS, whereas random read speed is said to be up to 540K IOPS. (CN Beta, Tom’s Hardware, AnandTech, Business Wire)

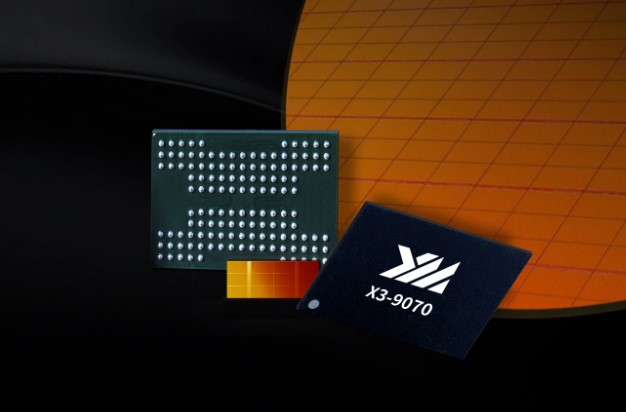

Yangtze Memory Technologies Corp (YMTC) has unveiled its X3-9070 TLC 3D NAND flash powered by Xtacking 3.0 architecture. According to YMTC, compared with the previous generation product, the X3-9070 can achieve an I/O transmission rate of 2400MT/s, conforms to the ONFI5.0 specification, and achieves a 50% performance improvement. At the same time, the X3-9070 is also the flash memory particle with the highest density in the history of Yangtze Memory, which can achieve 1Tb capacity (128GB) in a smaller single chip. Finally, the X3-9070 adopts an innovative 6-plane design. Compared with the traditional 4-plane, the performance is improved by more than 50%, and the power consumption is reduced by 25%. The energy efficiency ratio is significantly improved, which can reduce the total cost of ownership for users.(CN Beta, PR Newswire)

Supporting the Linux Foundation’s Software-Enabled FlashTM open-source project, KIOXIA America has announced innovative new software-defined technology and sample hardware based on PCIe and NVMe technology. This technology fully uncouples flash storage from legacy HDD protocols, allowing flash to realize its full capability and potential as a storage media. (CN Beta, Business Wire, Yahoo, Kioxia)

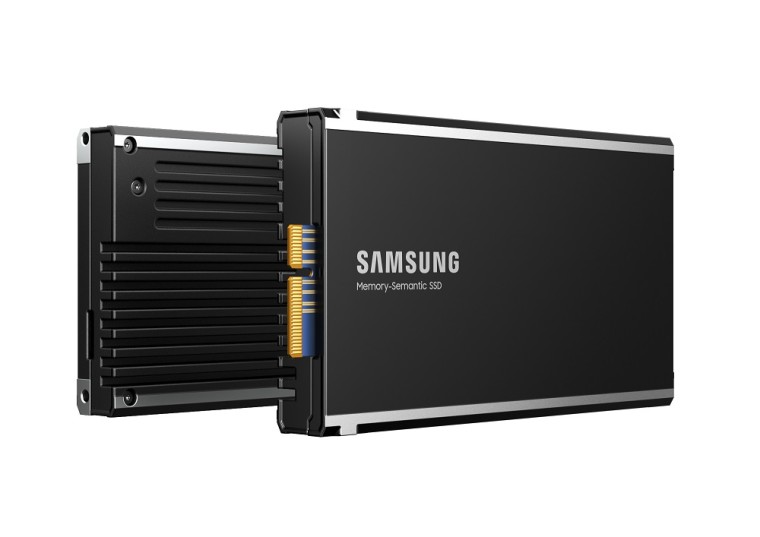

Samsung has unveiled its new CXL-based “Memory-semantic” SSDs. While SSDs utilizing DRAM cache are not new, the new Memory-semantic SSDs, will utilize the super-fast CXL (Compute Express Link) interface. Samsung has announced its ‘Memory-semantic SSD’ that combines the benefits of storage and DRAM memory. Leveraging Compute Express Link (CXL) interconnect technology and a built-in DRAM cache, Memory-semantic SSDs can achieve up to a 20x improvement in both random read speed and latency when used in AI and ML applications. Optimized to read and write small-sized data chunks at dramatically faster speeds, Samsung’s Memory-semantic SSDs will be ideal for the growing number of AI and ML workloads that require very fast processing of smaller data sets.(Neowin, Samsung)

Contemporary Amperex Technology (CATL) has decided to push back announcing a multibillion-dollar North American plant to supply Tesla and Ford Motor. CATL has been considering at least two locations in Mexico near the Texas border, as well as sites in the US, for the plant. China’s CATL has been in an advanced stage of site selection and negotiating incentives, in anticipation of announcing its selection in the coming weeks. CATL is reportedly considering Ciudad Juarez, in the state of Chihuahua, and Saltillo, in Coahuila, and that the company is contemplating an investment of as much USD5B in the project. Sites in the US and Mexico are still under active consideration, and there’s no intention to walk away from the plan.(CN Beta, Reuters, Inside EVs, Auto Blog)

EV company Komaki has launched fireproof batteries in India that will be available in all company vehicles from Sept 2022. It has introduced lithium-ion ferro phosphate (LiFePO4) batteries in the market, which are more fire-resistant. The company claims that they have developed an easy-to-use mobile application which will notify the end users and dealers about the battery health. The cells in the LiFePO4 batteries contain iron, making the batteries more safe and secured from fire even in extreme cases. LiFePO4 has a life cycle of 2500-3000, which is far more as compared to 800 life cycle in NMC (nickel, manganese and cobalt) batteries. (Gizmo China, Business Insider, India Times)

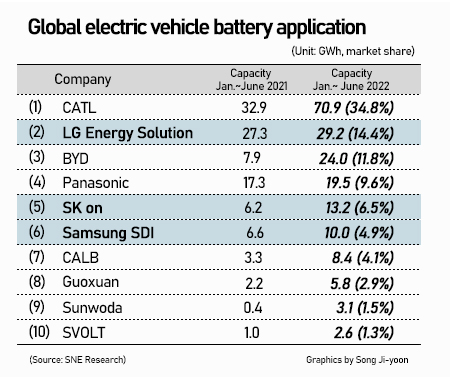

South Korean battery majors LG Energy Solution, SK on, and Samsung SDI have continued to lose their share in the global electric vehicle battery market during 1H22 due to the rapid rise of Chinese battery makers. According to energy market watcher SNE Research, South Korean battery makers were behind 52.4 GWh of 203.4 GWh power capacity in electric vehicles on the roads worldwide in 1H22 to make up 25.8%, off from 34.9% a year ago. Chinese battery firms such as CATL, on the other hand, recorded 3-digit growths in share amid fast expansion in the Chinese EV market. The No.1 battery maker CATL’s market share gained 6.2 percentage points to 34.8%, and BYD, ranked third, rose 5 percentage points to 11.8%. (Pulse News, YNA, Arirang)

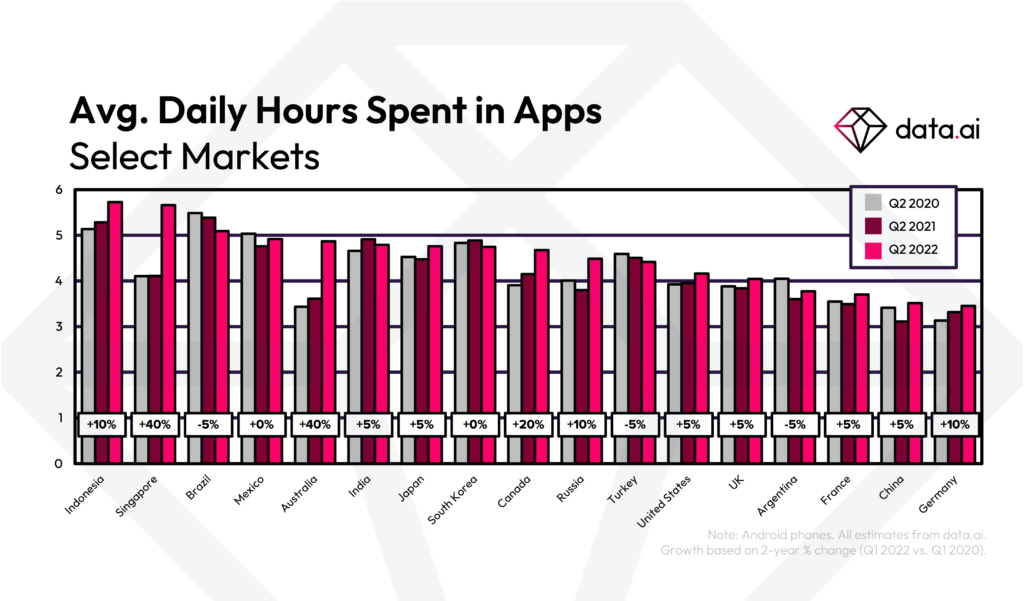

According to data.ai’s 2Q22 Regional Pulse Index, consumer appetite for mobile content is still trending upwards – with users in the top two markets, Indonesia and Singapore – now spending 5.7 hours a day on mobile. The data reveals that consumers in three markets (Indonesia, Singapore, Brazil) now spend more than 5 hours a day in apps. Meanwhile users in 13 regions (Indonesia, Singapore, Brazil, Mexico, Australia, India, Japan, South Korea, Canada, Russia, Turkey, US, UK) now commit to more than 4 hours per day. (TechCrunch, Data.ai)

During an investigation pertaining to vivo, the Directorate of Revenue Intelligence (DRI) has said it has detected customs duty evasion of around INR2,217 crore (USD280M).The finance ministry has said that its Directorate of Revenue Intelligence recovered “incriminating evidence indicating wilful misdeclaration in the description of certain items” imported by vivo’s India unit while conducting searches at its factories. The finance ministry has also stated that Vivo India “voluntarily deposited” USD7.5M as a part of its differential custom duty liability. (TechCrunch, India Times, Live Mint, Ministry of Finance)

NIO Mobile Technologies has been officially formed with a registered capital of USD100M. The legal representative of the company is the co-founder and president of Nio, Qin Lihong and the company is registered at the Nio’s global HQ in Anting, Shanghai. NIO’s first mobile phone will reportedly be a candy bar, positioned as a flagship, which perfectly matches NIO cars and has the same color appearance. It is expected to be listed in about a year, the price is expected to exceed CNY7,000. (CN Beta, ArenaEV, CN EV Post, Electrek, Yicai Global)

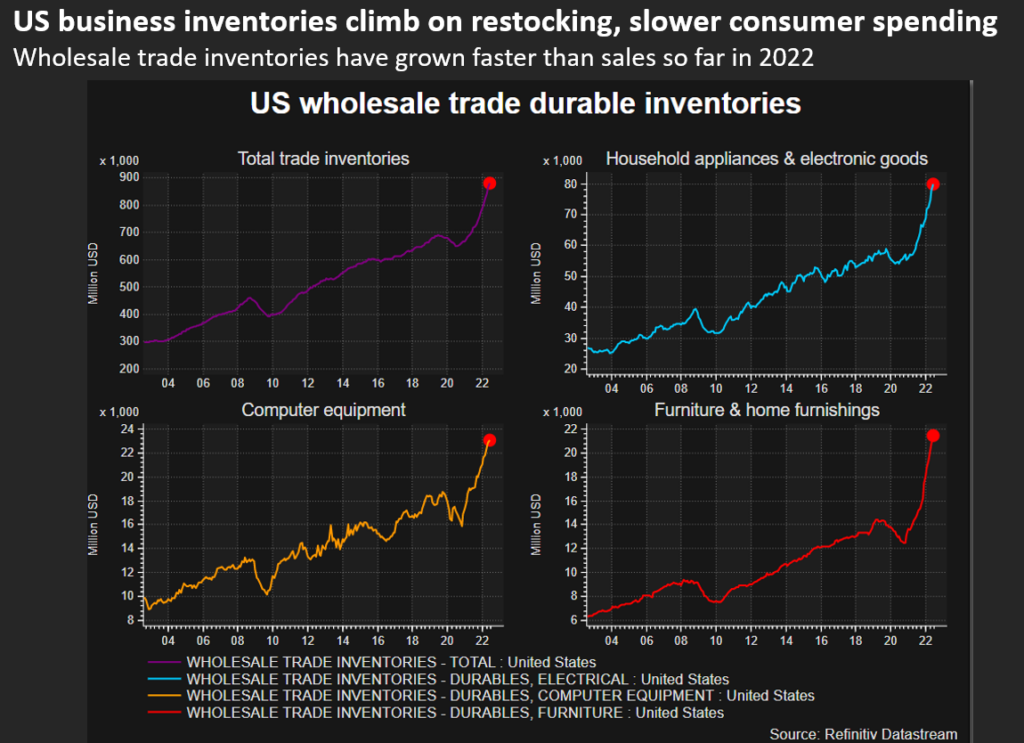

Samsung Electronics has allegedly scaled back production at its massive smartphone plant in Vietnam, as retailers and warehouses grapple with rising inventory amid a global fall in consumer spending. America’s largest warehouse market is full and major U.S. retailers such as Best Buy and Target Corp warn of slowing sales as shoppers tighten their belts after early COVID-era spending binges. The effect is acutely felt in Vietnam’s northern province of Thai Nguyen, one of Samsung’s two mobile manufacturing bases in the country where the world’s largest smartphone vendor churns out half of its phone output. (Reuters, CN Beta)

Foxconn will soon put into commercial production another phone manufacturing unit within its Foxconn Hon Hai Tech India facility close to Chennai. The existing facility in Tamil Nadu is close to the Chennai facility already used for iPhone production. Foxconn is expected to finish the new expansion and begin hiring within the next 2 months. The Foxconn expansion in India is part of its previously announced plans, not a new effort. The new facility would aid in Apple’s efforts to diversify its supply chain locations and have more devices made outside of China.(CN Beta, Apple Insider, Economic Times)

Pixalate has analyzed more than 5M mobile apps across the Google and Apple app stores, and found that nearly 600,000 were delisted in 2Q22— an increase of almost 3x from the 220,000 delisted in 1Q22. Through analysis of delisted Google Play Store and Apple App Store apps in Q2 2022, Pixalate found that 592,000 apps were delisted from the Apple App Store and Google Play Store in 2Q22. There is 8,652% increase in apps delisted from the Apple App Store from 1Q22 to 2Q22. (Phone Arena, PR Newswire)

Commercial EV manufacturer Nikola Corporation has announced it has signed an agreement to acquire EV battery developer Romeo Power. Nikola will absorb Romeo’s battery manufacturing facility in Southern California and begin engineering its own EV packs in-house. The transaction has been approved by the Boards of Directors of both companies and will consist of Nikola acquiring all of the outstanding shares of Romeo common stock, equating to an equity value of around USD144M. In Mar 2021, Nikola began serial production of its all-electric Tre truck in Coolidge, Arizona, followed by first deliveries in Apr 2021. (CN Beta, Nikola, Electrek, Reuters)

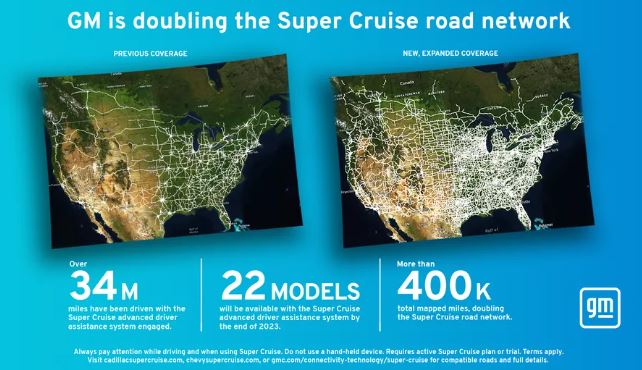

Super Cruise, the “hands-free” advanced driver-assist system (ADAS) from General Motors (GM), will soon be available on a lot more roads in North America. GM has announced that, later in 2022, the ADAS system will be able to operate on 400,000 miles of roads, including non-divided highways — which would essentially double Super Cruise’s current coverage in the US and Canada. (TechCrunch, The Verge, Reuters)

Pony.ai, an autonomous driving company, has announced that it has reached a cooperation agreement with Chinese online ride-hailing platform Caocao Mobility, whereby the two sides will jointly promote the large-scale application of urban robotaxi services. Users in Beijing can enjoy robotaxi services provided by Pony.ai via Caocao Mobility’s mobile application and mini program. Before placing an order, users need to choose the number of passengers, departure place and destination. The ride and payment process is no different from that of ordinary online car-hailing services.(Laoyaoba, TechNode, Pandaily, Pony.ai)