8-10 #EveryDayPoked : US President Biden has signed CHIPS; The Indian government is seeking to restrict Chinese vendors from selling sub-INR12,000 smartphones; OPPO and OnePlus have stopped selling products through their German online stores; etc.

United States President Joe Biden has signed into law a bipartisan bill that aims to boost U.S. competitiveness with China. The bill includes more than USD52B for U.S. companies producing semiconductors, as well as billions more in tax credits to encourage investment in chip manufacturing. The White House has said that multiple companies, “spurred” by the chips bill, have announced more than USD44B in new semiconductor manufacturing investments. (CN Beta, The Verge, CNBC)

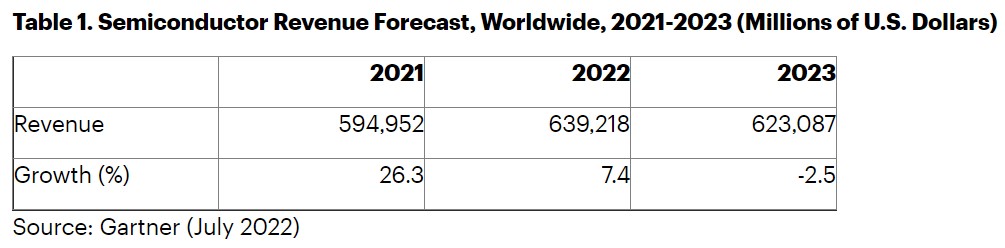

Global semiconductor revenue is projected to grow 7.4% in 2022, down from 2021 growth of 26.3%, according to the latest forecast from Gartner. This is down from 1Q22’s forecast of 13.6% growth in 2022. Although chip shortages are abating, the global semiconductor market is entering a period of weakness, which will persist through 2023 when semiconductor revenue is projected to decline 2.5%. Richard Gordon, Practice VP at Gartner has indicated that we are already seeing weakness in semiconductor end markets, especially those exposed to consumer spending. Rising inflation, taxes and interest rates, together with higher energy and fuel costs, are putting pressure on consumer disposable income. This is affecting spending on electronic products such as PCs and smartphones. (CN Beta, Gartner)

Samsung will begin making semiconductor parts in Vietnam in Jul 2023 as Samsung further diversifies its manufacturing and as the U.S., China and other powers race to master their technology supply chains. Samsung is now testing ball grid array products and intends to mass produce them at the Samsung Electro-Mechanics Vietnam factory in northern Thai Nguyen Province. Semiconductors would mark a third business for Samsung in Vietnam, where the company makes home appliances and half of its smartphones.(GizChina, IT Home, Asia Nikkei, VN Express)

Samsung is allegedly planning to bring a foldable Android tablet to the market within 1H23. The tablet would arrive alongside the Galaxy Tab S9 series, which seems most likely to make its debut with the Galaxy S23 series. This new foldable Android tablet would be Samsung’s third form factor for foldables, following the Galaxy Fold-type that was first introduced in 2019 and the Galaxy Z Flip-type which was first launched in 2020. (Android Central, 9to5Google, Naver)

Samsung Display (SDC) and LG Display (LGD) were both developing OLED on silicon (OLEDoS) and LED on silicon (LEDoS) technologies. These microdisplay technologies are aimed to be applied to virtual / augmented reality (VR / AR) devices. Japan’s Sony is currently the leader in OLEDoS and it uses white OLEDs and red, green and blue color filters. SDC is aiming to supply its OLEDoS to parent company Samsung in 2024 with a resolution of 3,000 pixels per inch (ppi) and 10,000nit brightness. For LEDoS, the South Korean display panel maker is aiming for a resolution of 6,000 to 7,000ppi. OLEDoS is aimed at virtual reality devices and LEDoS is aimed at augmented reality devices. LGD has started developing OLEDoS earlier for Apple but has now recently begun developing LEDoS technology as well.(The Elec, Apple Insider)

Omdia forecasts that Samsung will ship 11M units of its upcoming Galaxy Z Fold 4 and Galaxy Z Flip 4 foldable smartphones by 2022. Samsung has reportedly ordered enough components to manufacture 15M units of its new foldable phones to its supplier. (CN Beta, The Elec)

SK IE Technology (SKIET), a company under SK group and in the business of electronics materials that it has signed a deal with Vingroup to supply battery materials. Vin Energy Solution (VinES) has entered into an agreement with SKIET. Under this agreement, SKIET will supply battery separators to Vingroup’s subsidiary without disclosing further details.(CN Beta, Korea Biz Wire, Korea IT Times, Digitimes)

Tesla has reportedly agreed to a deal with the Indonesian government that will secure the automaker about USD5B worth of nickel. The new deal between Tesla and Indonesia has to do with nickel supply for Tesla’s batteries. The battery materials will be purchased from a nickel processing company in Indonesia within 5 years. The report further points out that Indonesia has been trying to get Tesla to build production facilities in the country. (GizChina, Electrek, Reuters, Teslarati, IT Home)

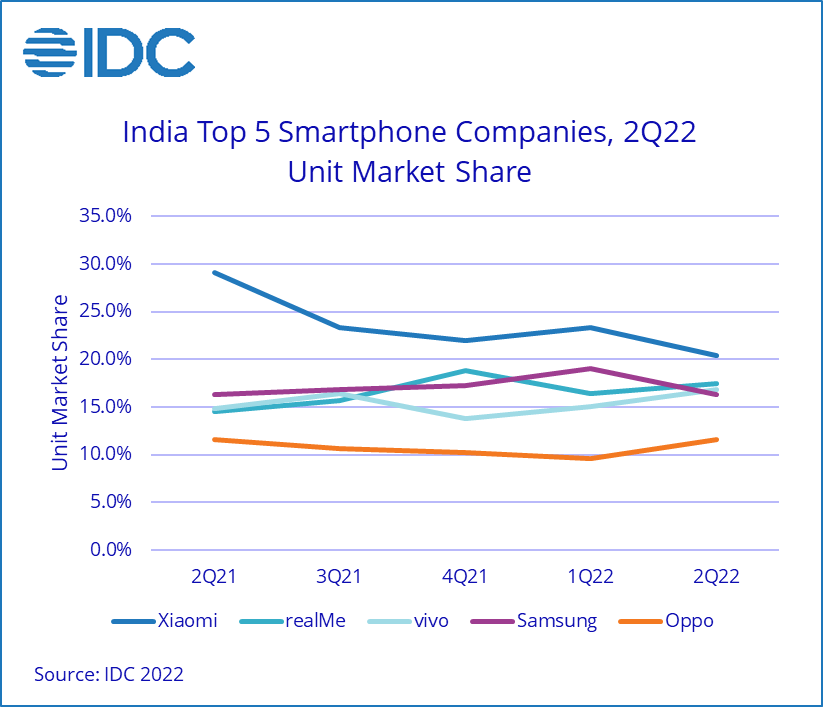

The Indian government is seeking to restrict Chinese vendors from selling sub-INR12,000 (USD150 / EUR147) smartphones in the country in a bid to push the Chinese brands out of the lower segment. This move would affect Xiaomi, realme, and Transsion the most since they sell a lot of smartphones in the sub-INR150 segment in India. The idea behind banning Chinese brands from selling smartphones in the sub-INR150 segment in India is to allow local players such as Lava and Micromax to boost their sales in this category and regain the market share. (Gizmo China, GSM Arena, Bloomberg)

OPPO and its subsidiary OnePlus have stopped selling smartphones and smartwatches through their German online stores. The product withdrawal follows a court decision in favor of Nokia, which has sued over two Standard-Essential Patents (SEP). Both OnePlus and OPPO blame Nokia’s demands for an “unreasonably high fee” for the two patents. Back in 2018 Nokia and OPPO signed a multi-year patent agreement, however the relationship started to fall apart in 2021.(GSM Arena, Gizmo China, Juve Patent, The Verge)

According to IDC, 35M smartphones were shipped to India in 2Q22, a 3% YoY growth, while 1H22 declined by 1% YoY to 71M units. The second quarter of the year normally has seasonally strong demand compared to the first quarter, but dwindling consumer demand led to a decline of 5% QoQ. Xiaomi continued to lead but was the only vendor amongst the top ten with declining shipments (-28%) YoY in 2Q22. realme climbed to the second slot for a second time, with a strong YoY growth of 24% (highest among top five vendors) in 2Q22. (GSM Arena, IDC, Gizmo China)

TF Securities analyst Ming-chi Kuo has indicated that Apple may announce the AR/ MR headset as soon as Jan 2023. It is expected that user scenarios, software/service/development ecosystem, and hardware specification details will be the three key points of the announcement. The market expects Apple AR/MR headsets to be priced at USD2,000-2,500 or higher. He believes it will affect shipments. (Twitter, Apple Insider)

Google is suing speaker-maker Sonos over alleged patent infringement. In two lawsuits filed in US District Court in California, Google alleges that Sonos’ latest voice-assistant technology violates 7 patents related to Google Assistant. Sonos launched its own voice assistant in Jun 2022, allowing customers to control their speakers using voice commands starting with the phrase “Hey Sonos”. Google said in the lawsuits that it has made its technologies available to users across the globe, “even providing its Google Assistant software to Sonos for many years”. The suits also said Google has for years worked with Sonos engineers on the “implementation of voice recognition and voice-activated device controls in Sonos’ products”.(Engadget, CNET, Thomson Reuters)

Foxconn has signed its first contract manufacturing agreement since acquiring a Ohio facility from Lordstown Motors. In addition to building EVs for Lordstown and Fisker Inc, Foxconn will now also be manufacturing advanced, driver optional electric tractors and battery packs for Monarch Tractors. According to Foxconn, MX-V electric tractor production will begin in Lordstown in 1Q23, somewhere within its 6.2M square foot campus of scalable production space.(CN Beta, Reuters, Electrek)