9-8 #3Years : Qualcomm SD6Gen1 and SD4Gen1 are announced; Apple is expected to use ‘hybrid’ OLED panels; SK Hynix will build the M15X new fab; etc.

According to Qualcomm, the Snapdragon 8 Gen 2 chip is expected to be released in Nov 2022, and uses TSMC’s 4nm process. The first batch of mobile phones equipped with Snapdragon 8 Gen2 is currently tentatively scheduled for the second half of Nov 2022, and the progress of the first manufacturers is OK. Xiaomi Mi 13 series, Redmi K60 series, vivo X90 series will be equipped with Snapdragon 8 Gen2 processor. (GizChina, IT Home)

Automotive IC IDMs including Rohm Semiconductor will reportedly raise their prices to reflect rising raw material costs, according to Digitimes. On 1 Sept 2022, IT companies were reportedly notified via a letter signed by Raita Fujimura, chairman of Rohm’s Shanghai subsidiary, that prices for new and old products would increase to reflect increasing raw material costs. there are still concerns about uneven materials supply for automotive chips. Inventory pressure on components from long supply chains is building up, but there is still tight supply of power semiconductors and microcontroller units (MCU) continues, the sources said. Systems manufacturers are also looking for alternatives since the price of automotive chips, including power components, is expected to continue rising in 2023. According to the sources, Taiwan-based power component makers including Taiwan Semiconductor (TSC), Pan Jit International, Eris Technology, Advanced Power Electronics (APEC), Sinopower Semiconductor, Excelliance MOS (EMC), Niko Semiconductor, Force Mos, and uPI Semiconductor have seen demand in the consumer electronics and IT sectors fall. (Laoyaoba,Digitimes, Digitimes, press)

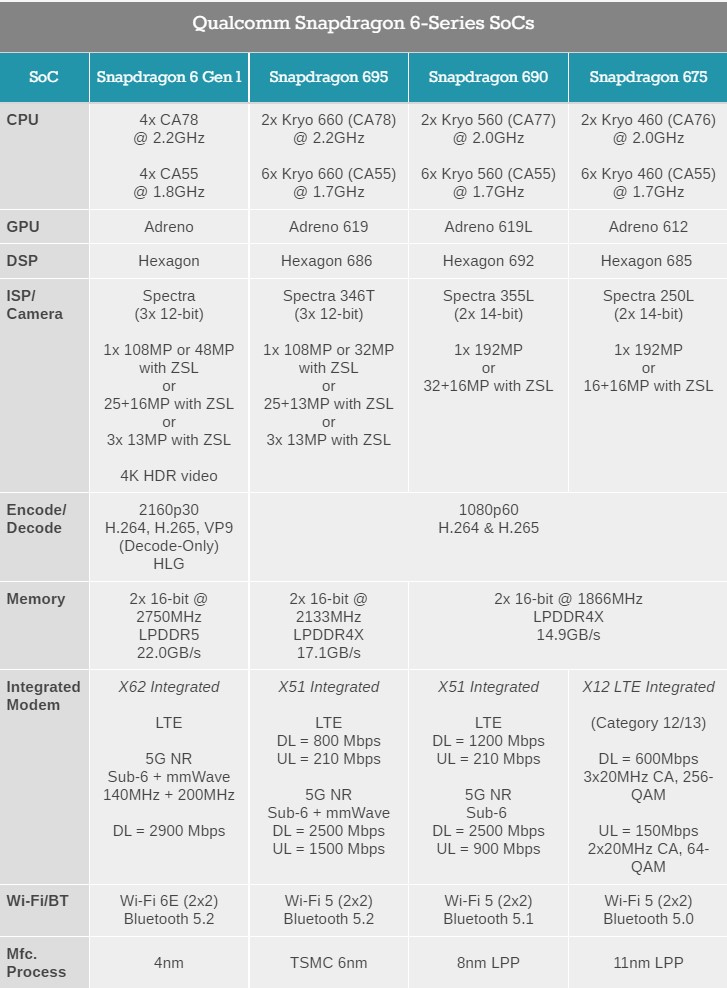

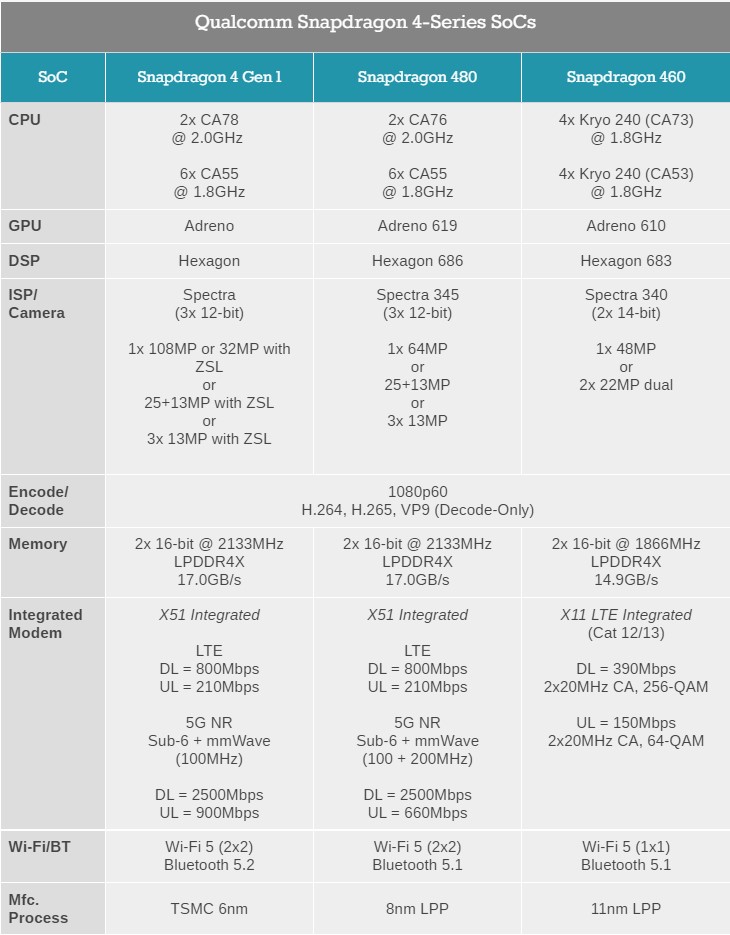

Qualcomm is announcing the Snapdragon 6 Gen 1 and Snapdragon 4 Gen 1. Both SoCs are receiving similar spec bumps, incorporating newer and faster IP blocks from Qualcomm – such as Arm Cortex-A78 derived CPU cores – as well as moving to newer, more contemporary manufacturing processes. The 6 Gen 1 is built on a 4nm manufacturing process, while the more affordable 4 Gen 1 stays on the 6nm node.(Android Headlines, CN Beta, GSM Arena, Digital Trends, Liliputing, AnandTech, Qualcomm, Qualcomm)

Randy Abrams, head of research at Credit Suisse Asia Semiconductor Securities and Taiwan Securities Research, has indicated that demand in the technology industry has moderated moderately because of the supply side. Currently, fab capacity is expected to increase by about 10% in the next few years, compared with 8-9% in previous years. Consistently, the capacity utilization rate will be maintained at 90-95%, and the supply side is not excessive, so there is no need to worry too much. He believes that the shortage of semiconductor chips has been very serious in the past two years. Now we can see that the inventory is very high, which is about the highest level of inventory days since 2000. Many companies have taken actions to reduce inventory. It is estimated that the inventory peaked in 3Q22 and can be seen in 4Q22. However, under the influence of geopolitics, the overall inventory days of the industry in the future will still be higher than in the past. (Laoyaoba, UDN, HKET)

IDMs are still striving for more available foundry capacity while IC design houses continue to cut back wafer starts at foundries, according to Digitimes. Recently, some IC design companies have reduced their wafer foundry orders or lowered their capacity forecasts. However, European and American IDM factories such as Texas Instruments, NXP, Infineon and STMicroelectronics seem to be less affected by the market environment, emphasizing that the demand side of automobiles and industrial control is still strong. While other IC design companies are lowering wafer prices, IDM is expanding its foundry orders to compete for more mature processes. Sources say that material supply shortages have not been fully resolved, and prices of some power components may rise. (Digitimes, Laoyaoba)

Morse Micro, a fabless semiconductor company reinventing Wi-Fi for the Internet of Things (IoT), has announced USD140M in Series B funding. The round was led by MegaChips, a leading ASIC and SoC services company based in Japan. Morse Micro intends to use the capital raised to revolutionize our digital future by achieving unprecedented scale and demand for its Wi-Fi HaLow technology. It will focus on deepening its offerings, including the design of new solutions, while accelerating the go-to-market strategy for its existing Wi-Fi HaLow chips and modules. (CN Beta, TechNode, IT News, CNYES, Yahoo, Business Wire, Financial Review)

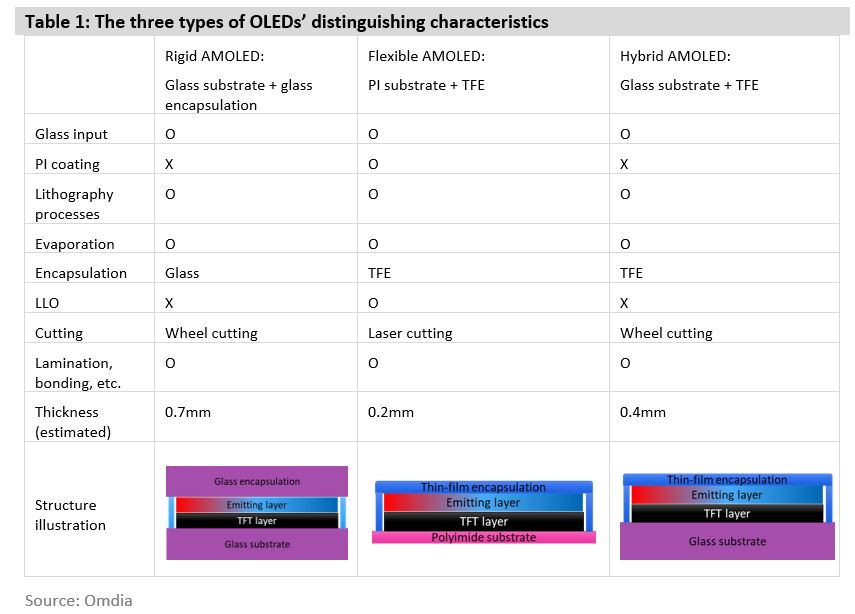

Apple is expected to use ‘hybrid’ OLED panels in its first OLED iPad that it will launch a few years from now. Hybrid OLED panels refer to OLED panels that use both rigid OLED panel and flexible OLED panel technologies. Rigid OLED panels use glass as substrates while flexible OLED panels use plastics, mostly polyimide, that are encapsulated for protection. A hybrid OLED panel uses a glass substrate like rigid OLED panels do but also uses the thin-film encapsulation of flexible OLED panels. Apple is not too keen on using flexible OLED panels, which are mostly used in premium smartphones, some parts of the screen may look crumpled. Samsung Display and LG Display are currently developing an ultra-thin glass substrate for use in hybrid OLED panels. They are attempting to make glass substrates that are 2mm thin, instead of the 5mm ones currently mostly used. (Apple Insider, The Elec, MacRumors, Omdia)

Tianma has announced that it has reached a cooperation with Lenovo’s LCFC, and the two parties will start from the joint laboratory. It is reported that Lianbao Technology, which cooperated with Tianma this time, is Lenovo’s largest PC R&D and production base in the world. For every 8 laptops sold in the world, 1 is from LCFC.(My Drivers, 163.com, World Tech)

Samsung Display is planning to manufacture single stack OLED first at its first Gen 8 OLED production line. The company is planning to build a Gen 8 (2200x2500mm) substrate OLED production line. Samsung Display’s co-project to develop a full-cut, vertical deposition machine optimized for a Gen 8 line with Japan’s Ulvac had been aimed at single stack OLED from the start at the design concept stages. Single stack OLED means there is one red, green and blue emission layer while two stack tandem OLED means there is one more additional layer. Having two RGB emission layers stacked in tandem increases the brightness of the screen while also extending its life, making the technology more optimal for tablets and PCs that are used longer than smartphones. Apple is expected to launch its first OLED iPad in 2024 with a two-stack tandem OLED panel.(Laoyaoba, The Elec)

AUO Display Plus (ADP), a wholly-owned industrial and commercial display subsidiary of AUO Corporation, has acquired the long-running cloud-based digital signage software company Rise Vision, strengthening ADP’s growing portfolio of partners and enabling them to help organizations communicate better using digital signage solutions. The acquisition of Rise Vision provides ADP with deeper expertise in the education market and subscription-based SaaS services, tapping into Rise Vision’s expertise to enable a new service for ADP’s worldwide customer base.(CN Beta, PR Newswire, Rise Vision)

SK Hynix will build the M15X(eXtension), a new fabrication plant, in Cheongju, Chungcheongbuk-do, in preparation for future growth. The company will start construction of the M15 extension on the site it secured previously earlier than initially planned, considering various market situations. The new plant will be built from October on the 60,000 square meter land located in the Cheongju Technopolis industrial complex and completed early 2025. A total of KRW15T will be injected over the next 5 years to build the fab and set up production facilities. The fab will be a two-story building equivalent to a combination of M11 and M12 in size. As for the next M17 fab, the company will decide construction plan after reviewing overall business environment including changes in the semiconductor business cycle.(CN Beta, SK Hynix)

Brazil’s Ministry of Justice has fined Apple BRL12.275M (USD2.3M) and halted iPhone 13 sales until the company once again includes a charger in the box. The São Paulo consumer protection agency has said it was a violation of Consumer Law Code. Apple also lost a 2022 lawsuit in the country after a customer who did not receive a charger sued. Apple plans to appeal a move by Brazil to ban the sale of iPhones without battery chargers, arguing that the company has helped reduce environmental waste by not including the accessory with new devices. (Android Authority, G1, Apple Insider, MacRumors, Reuters, Bloomberg)

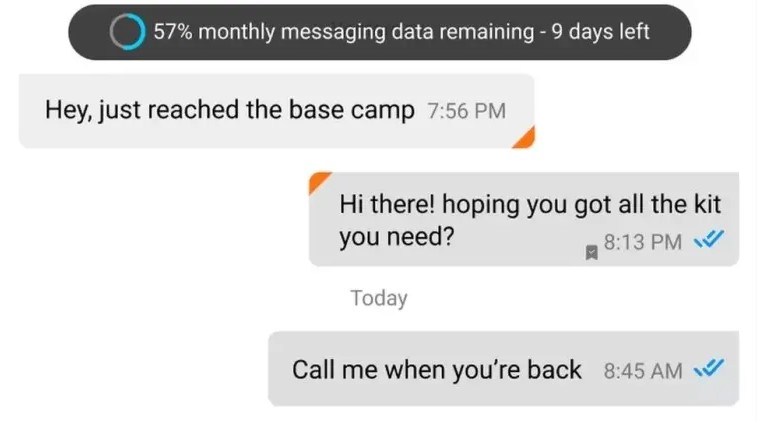

British smartphone maker Bullitt is working on a new mobile phone that will feature satellite connectivity. The Bullitt phone will connect to the global satellite networks if there is no Wi-Fi or mobile network signal. The phone will initially allow users to send and receive only text messages using satellite connectivity. In order to use the satellite service, Bullitt phone users will have to pay a monthly subscription. The recipients will get the message in the form of SMS and can reply back to the senders after downloading Bullitt’s app. Bullitt worked with a chip manufacturer in Asia to develop the chip that could make satellite connectivity possible.The service is due to launch in Feb 2023. (Neowin, BBC)

ZTE together with China Mobile Research Institute, China Transport Telecommunications & Information Group, the Beijing Branch of China Mobile and other partners, has showcased world’s first 5G NTN (Non-Terrestrial Network) field trial at the 5G-Advanced Industry Development Summit in Beijing. This brings achievement breakthroughs in two aspects, ultra-long distance as far as 36,000 km and direct connection between mobile phones, enabled by two innovations including dynamic compensation of big latency and RF data conversion between the satellite and terrestrial. The trial was end-to-end and demonstrated services such as short messages and voice services, with satisfactory performances. During this trial, communication cases such as synchronization, broadcasting, accessing and data transmission, and services such as short text messages and voice messages were successfully tested. The latency of 64-byte ping is about 4s. (My Drivers, ZTE, ZTE)

The European Commission is looking to force smartphone manufacturers to offer longer software support and enable self-repairs. A draft regulation published by the Commission states that smartphones sold in the region should get at least three years of software updates and five years of security updates. Additionally, the European Union (EU) lawmakers want manufacturers to make repair parts available for at least 5 years. The Commission says the motive behind this initiative is to make smartphones and tablets more sustainable. (Android Headlines, Europa)

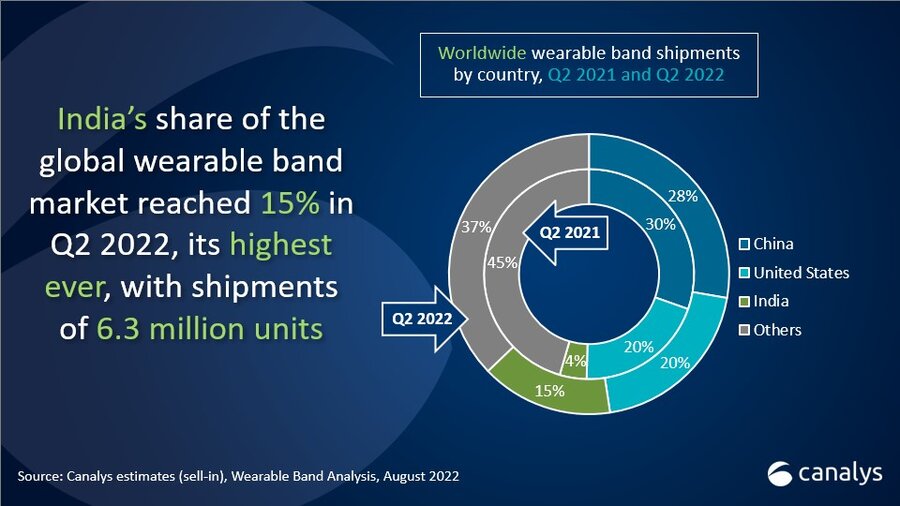

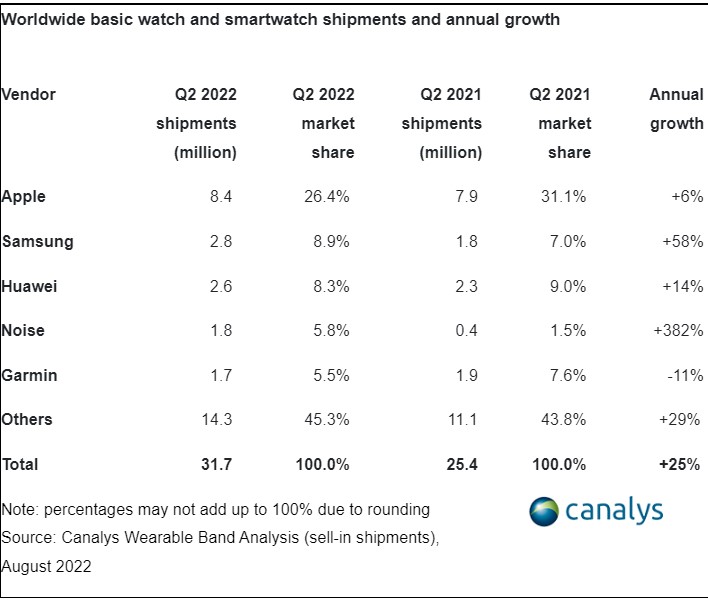

According to the latest Canalys estimates, global wearable band shipments were up 2.0% in 2Q22 at 41.7M units, a return to growth after a decline of 3.7% in 1Q22. Basic watches and smartwatches, categorized under wristwatches, grew 46.6% and 9.3%, respectively. The wristwatch category continues to drive development of the wearable band market, while basic bands suffered a big 35.5% decline in 2Q22. Like the smart personal audio market, India’s wearable band market performance was the highlight in 2Q22, with impressive shipment growth of 275%, driven by basic watches. While India stayed in third place behind China and the US in terms of overall wearable band shipments, its share hit 15% for the first time. (CN Beta, GSM Arena, Canalys)

Lightyear, a Dutch startup developing a long-range hybrid solar-powered car, has announced that it has raised EUR81M as it prepares to begin production of its first vehicle in the coming months. A number of companies are pushing to make solar-powered cars a mass-market reality, however, such as Germany’s Sono Motors, which recently revealed the final production design of its inaugural solar-electric vehicle, scheduled to launch some time in 2023, and Lightyear, a 6-year-old startup that debuted its prototype back in 2019, which had previously raised more than USD100M in funding. Lightyear is scheduled to begin production of its Lightyear 0 (formerly called Lightyear One) car fall 2022, costing prospective buyers a cool EUR250,000. So far, the company has pre-sold 150 of these vehicles, and it has capacity to build nearly 1,000 — an indication that the initial product is more a show of technology than anything else.(TechCrunch, Electrek, Lightyear)

The Competition Commission of India has approved PayU’s USD4.7B acquisition of online payments firm Billdesk, which is the second largest M&A deal in the South Asian market’s consumer internet space. PayU and 20-year-old BillDesk process a significant amount of payments transactions in India. Once combined, they will assume a clear lead in the Indian market — music to investors’ ears but worrying signs for any regulator. (TechCrunch, LiveMint, Twitter, India Times)

Financial management startup Mesh Payments has landed USD60M in new funding. Founded in Israel and now with headquarters in New York, Mesh Payments is one of a growing group of startups focused on helping companies manage their spend through automation. It is crowded space that includes the likes of Ramp, Brex and Airbase, and more recently, TripActions and Rho, among others. For its part, Mesh says it saw its revenue run rate triple in 1H22, since its Nov 2021 raise. The company has over 1,000 customers and close to USD1B in annualized payment volume (TPV) flowing through its platform. (TechCrunch, PYMNTS, PR Newswire)

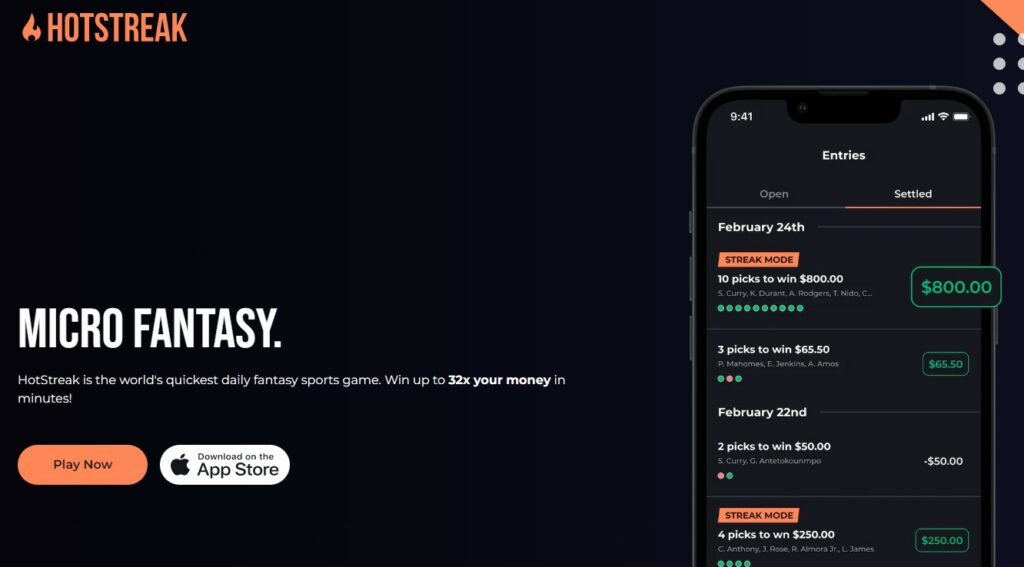

In the world of sports betting, instant payments and reliable custody are key to the user experience. HotStreak, a web3 platform for daily fantasy sports (DFS) contests, is wagering that the decentralized nature of the blockchain makes it an ideal solution for DFS platforms. The sports betting market in the U.S. has grown rapidly as states begin loosening regulations around the industry. It doubled in size in 2021, with over USD52.7B total wagered over the year, according to Morning Consult. HotStreak’s decentralized SHARP protocol aims to tackle both sides of the issue from a payments and custody perspective by facilitating near-instant payments and handling custody of assets based on a set of rules pre-determined within the protocol itself rather than relying on counterparties to initiate payments to other players. (TechCrunch, CYNES)

Misfits Market founder and CEO Abhi Ramesh has announced that the company is acquiring Imperfect Foods in an all-stock deal. Both online grocery platforms, Misfits Market raised nearly USD530M since being founded in 2018, most recently a USD200M Series C round in 2021 that put its valuation at over USD1B. Meanwhile, Imperfect Foods, founded in 2015 to rescue and redistribute goods, brought in a total of USD229M, including a USD110M Series D round in 2021.(TechCrunch, Bloomberg, Business Wire)