9-12 #MoonCake : EU antitrust regulators will not appeal a court ruling scrapping its fine against Qualcomm; TSMC 2nm process will be mass production in 2025; Royole Technology has recently been plunged into a new crisis; etc.

EU antitrust regulators will not appeal a court ruling scrapping its EUR997M (USD991M) fine against U.S. chipmaker Qualcomm because it would be difficult to convince Europe’s top court of the merits. Judges have also invalidated the Commission’s analysis that payments made by Qualcomm to Apple were anti-competitive because the regulator had not taken into account all the relevant facts. The EU competition enforcer in its 2018 decision said Qualcomm paid billions of dollars to Apple from 2011 to 2016 to use only its chips in all its iPhones and iPads in order to block out rivals such as Intel. (CN Beta, ATP, Reuters, NASDAQ)

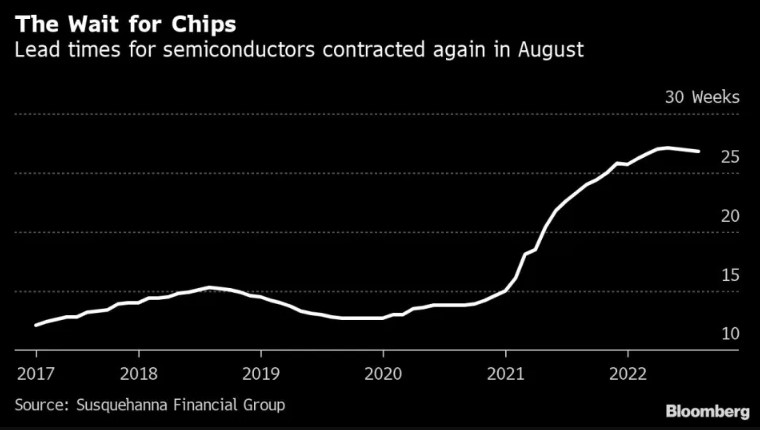

Chip delivery times shrank again in Aug 2022, a sign the global shortage is easing further, but some types of semiconductors remain hard to find. Lead times — the gap between when a chip is ordered and when it is delivered — averaged 26.8 weeks in Aug 2022, according to Susquehanna Financial Group. That was a day shorter than they were in the prior month. The shorter wait times reflect slowing demand for some kinds of technology — namely, phones and personal computers — according to Susquehanna analyst Chris Rolland. Getting back down to 10-14-week wait times would be “healthy”, Rolland said. (Laoyaoba, Bloomberg, Yahoo, Electronics Weekly)

Nvidia and AMD are to be subject to recently-announced US government restrictions on exports of high-performance GPUs to China and Russia. It is known that the utilization rate of TSMC’s sub-5nm node process, which produces processors for Nvidia and AMD, has recently started to decline. In response, TSMC has decided to shut down some EUV equipment (which consumes several times more power than DUV) from the end of the year in order to reduce power costs. AMD and Nvidia account for about 10% of TSMC’s sales. Intensifying US sanctions on China are expected to have a further negative impact going forward on TSMC’s utilization rate, which has begun to drop as of late. TSMC has about 80 EUV lithography machines in total, and 4 of them are planned to be closed by the end of this year. After all, the EUV lithography machine consumes 30,000 kWh of electricity per day, and the operating cost is very high. (CN Beta, Techbang, 163.com, Business Korea)

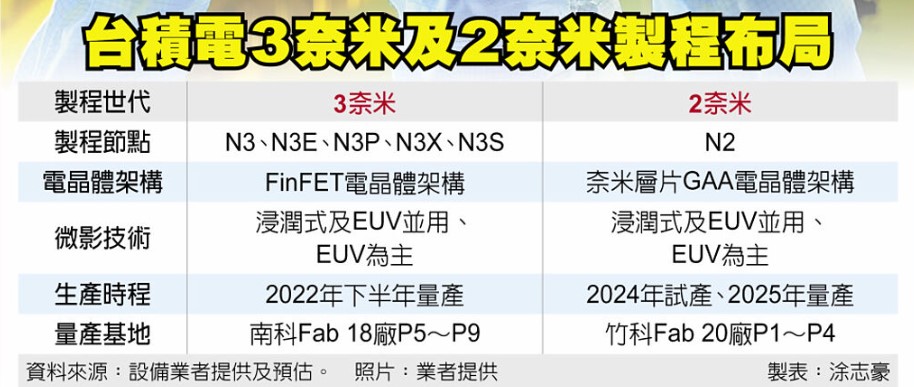

TSMC 2nm process will be mass production in 2025, the market is optimistic that the progress can be expected to be ahead of rivals Samsung and Intel. TSMC advanced process is progressing well, 3nm will be mass produced in the second half of this year, the upgraded version of 3nm (N3E) process will be mass production a year after the 3nm mass production, that is, mass production in 2023, 2nm is expected to mass production in 2025. TSMC’s 2nm plant will be located in the second phase of the expansion plan of Zhuche Baoshan, “Zhuche Administration” has started the construction of public facilities, TSMC 2nm plant also began to carry out the whole land operations.(CN Beta, UDN, CTEE, TechNews, TechNode, Techgoing)

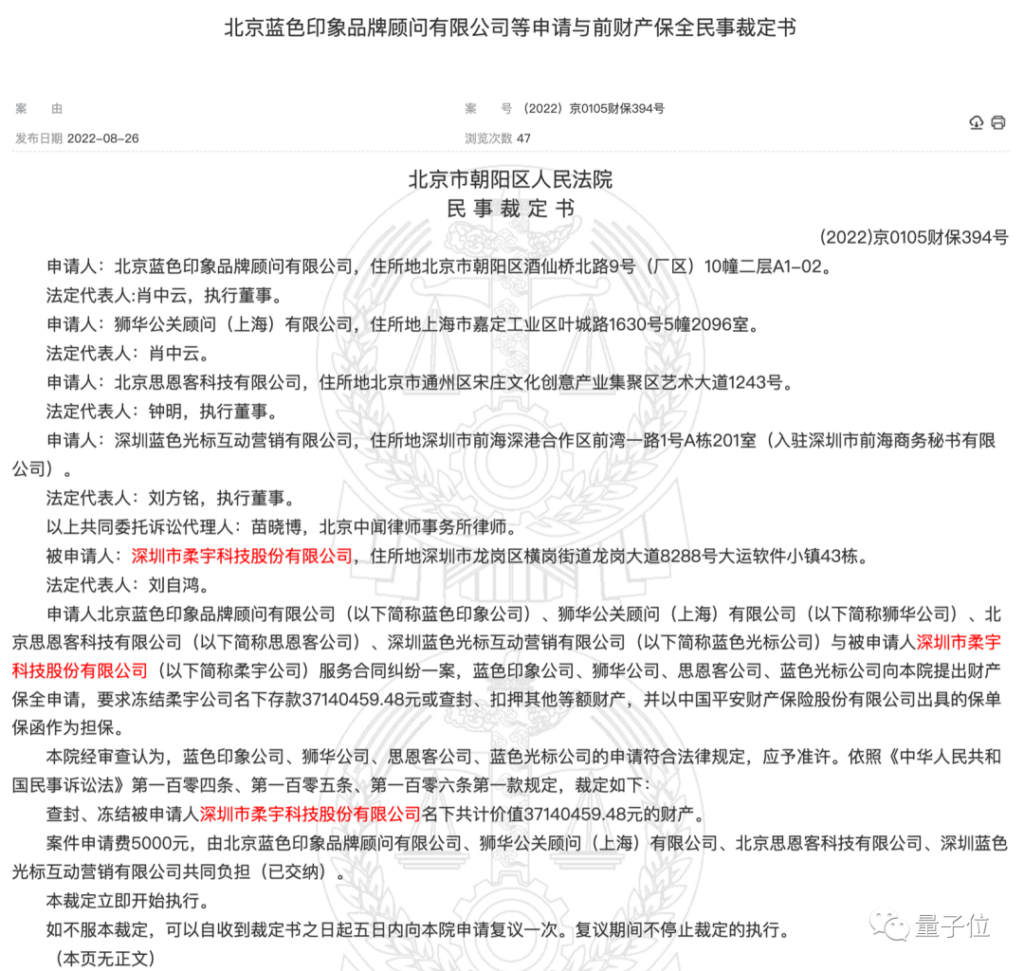

Royole Technology has recently been plunged into a new crisis, after CNY37M (USD5.3M) in assets were frozen by a local court. The four plaintiffs are all related to communications services group BlueFocus. The media firm Blue Impression, advertising firm SNK and Shenzhen BlueFocus are all subsidiaries of Beijing BlueFocus. PR company Merlion Communications is also listed as a sub-brand on the official website of BlueFocus.(CN Beta, Sina, EET-China, Caixin Global, Pandaily)

E Ink Holdings has announced that it plans to invest around NTD3.31B (USD110M) to expand the capacity of its Taoyuan (Taiwan) production line, and CNY3.25M (USD480K) in its Yangzhou (China) facility. These projects will be finished by the end of 2024. The Hsinchu-based firm said its manufacturing capacity continues to be tight and it is unable to fully satisfy customer demand. Through 2024, the company plans to spend NTD5B-6B each year to fund those projects. The anticipated sequential growth in revenue and net profit in 2H22 comes as the world’s major retailers quicken pace in installing electronic shelf labels (ESLs), offsetting weakening demand for e-reader and e-note products. Demand for ESL products remain strong, and E Ink says that the total market for ESL could reach 30-40B units. (Taipei Times, Eink-Info, Digitimes, UDN)

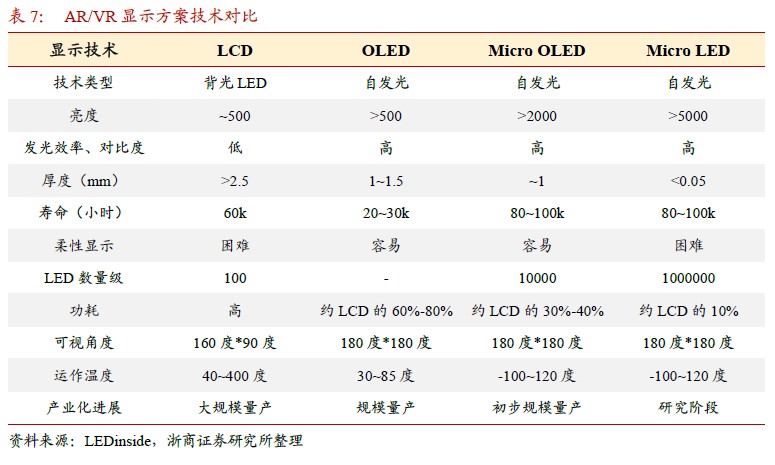

Micro-OLED technology is gradually recognized by VR/AR manufacturers, and is expected to become the mainstream solution in the industry in the future. Since 2H21, VR/AR manufacturers have gradually installed Micro-OLED solutions on new products. We believe that Micro OLEDs have been gradually introduced into commercial use and are expected to become the mainstream solutions in the industry in the next few years. The pixels of Micro-OLED are only 1/10 of that of traditional display devices, which can effectively improve the pixel density, and the response time of Micro-OLED can reach the microsecond level, which can greatly improve the screen refresh speed and optimize the picture quality effect. Compared with the more advanced Micro-LED technology in the industry, Micro-OLED has significant advantages in cost. Zheshang Securities believes that it is still the first choice for commercial products in the short term. (Zheshang Securities report)

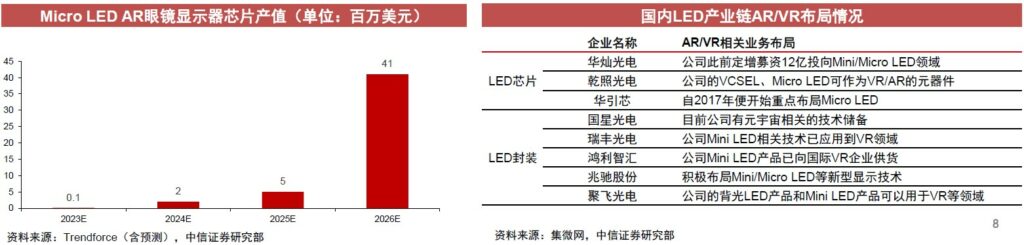

From the perspective of AR glasses display technology, compared with the current mainstream solutions such as L-CoS, DLP and OLED, Micro-LED has significant comprehensive advantages in brightness, resolution, power consumption, lifespan, visibility and other aspects, and is regarded as AR The ultimate solution shown. Micro-LED mainly faces 2 major technical difficulties: mass transfer and red light efficiency, while the display size in AR / VR glasses is smaller, which can better control the yield problem. According to TrendForce’s forecast, the output value of Micro-LED AR glasses display chips will usher in substantial growth from 2025 to 2026, and the output value will reach USD41M in 2026. In China, LED display industry chain companies have been deploying AR / VR and other markets for a long time. HC Semitek has said that the company’s Mini / Micro-LED chips can be used in VR / AR products. Xiamen Changelight has also revealed that the company’s VCSELs and Micro-LEDs can be used as VR / AR components. In the field of LED chips and packaging, as the technology matures and costs drop, it is expected to achieve more mass production of consumer-grade AR / VR equipped with Micro LEDs in the future. (CITIC Securities report)

Samsung Electronics has announced that it has started operating Line 3 of its Pyeongtaek Campus, the world’s largest semiconductor production facility located in Gyeonggi Province. The company completed a NAND flash mass production facility in Pyeongtaek Line 3 in Jul 2022 and started to put wafers into the production line. The construction of the facility started at the end of 2020. Samsung has put its new KRW30T (USD22B) semiconductor factory into full operation with an aim to turn it into one of the world’s most advanced facilities. (Laoyaoba, Business Korea, KEDGlobal)

Geely’s electric brand Zeekr has teamed up with Chinese battery giant CATL on an ultra-long-range version of its Zeekr 001 shooting brake, resulting in a production electric car capable of doing more than 1,000 km (621 miles) on a single charge. The collaboration will be the first to use mass-produced versions of CATL’s liquid-cooled, highly-integrated Qilin batteries, which offer a specific energy of 255 Wh/kg, as well as a “record-breaking volume utilization efficiency” of 72%. CATL claims the Qilin battery pack can deliver some 13% more power than Tesla’s new 4680 batteries, given the same chemistry and pack size. According to Zeekr, the 001 Qilin Edition will debut in 2Q23, so there’s still a chance somebody else could make the first thousand-kilometer production electric.(Laoyaoba, 163.com, 36Kr, New Atlas, Clean Future, CleanTechnica, CATL)

CATL and BMW Group have announced a multi-year agreement on the supply of cylindrical battery cells to power the German carmaker’s new series of electric models of its NEUE KLASSE starting from 2025. According to the agreement, CATL will deliver to BMW Group the new cylindrical battery cells, which come with a standard diameter of 46mm and will be produced at two of CATL’s future battery plants in China and Europe, each with an annual capacity of up to 20 GWh dedicated to BMW Group.(Laoyaoba, PR Newswire, Reuters, Teslarati, Twitter)

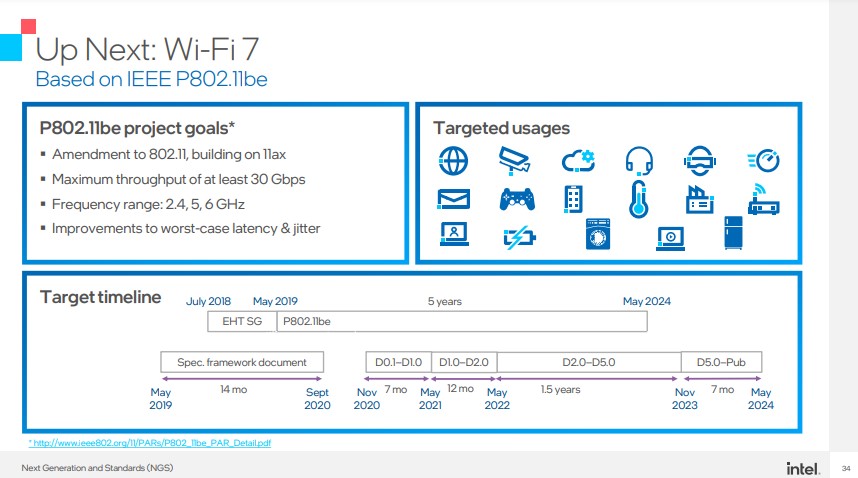

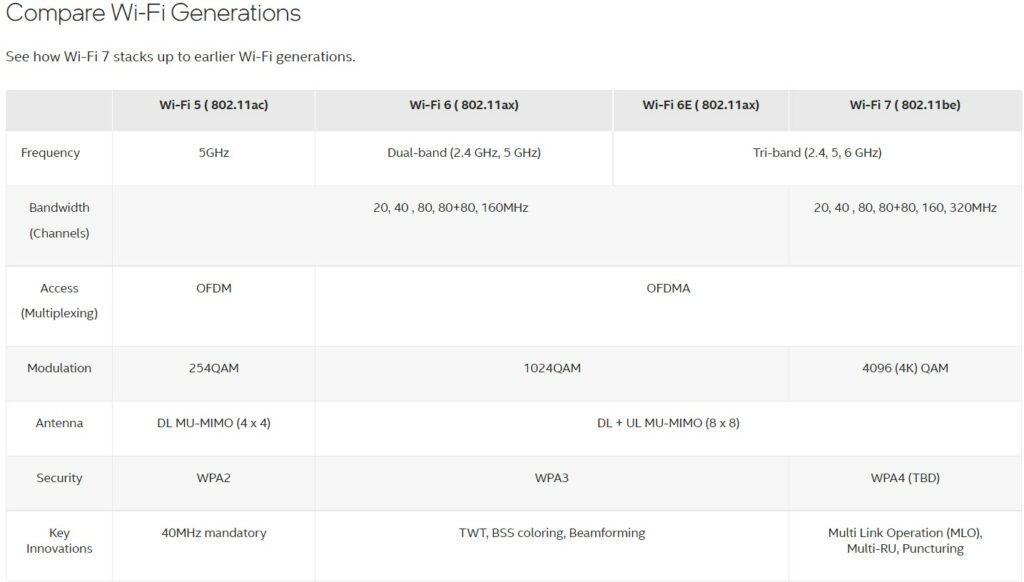

Intel, in collaboration with Broadcom, has demonstrated that Wi-Fi 7 can achieve speeds of up to over 5Gbps, at least 5 times faster than the 1Gbps that Wi-Fi 6 maxes out at, and 25 times faster than the average speed of Wi-Fi 5 which is only 200Mbps. The demonstration was done using an Intel-powered laptop that has support for Wi-Fi 7 and using a Broadcom access point router, the 5 Gbps speed achieved was stable and steady throughout the test. Broadcom adds that the value of Wi-Fi 7 goes beyond simple speed increases to deliver greater network capacity, Wi-Fi 7 will also bring along the benefits of much lower latencies.(Gizmo China, Intel)

Huawei and Guangdong Mobile have completed the commercial contiguous deployment of 5G Massive MIMO based on the 4.9G frequency band in Dongguan City, Guangdong Province. Through the carrier aggregation of 4.9G frequency band and 2.6G frequency band, it has laid a solid foundation for Guangdong Mobile’s 5G ubiquitous Gigabit network experience upgrade. Guangdong Mobile’s 5G traffic in the province has tripled compared to the same period last year. In urban CBDs, campuses, industrial parks, and urban villages with heavy 5G network load, the experience of some 5G users has begun to decline.(CN Beta, Sina, CWW)

The launch of Samsung’s wearable walking-assist robot “GEMS Hip” planned to be launched in August has been delayed until the end of 2022. The reason for the delay is that Samsung needs time to further improve product completion and comprehensively review certification and marketing strategies. The product is expected to be available in South Korea and the United States at the same time by the end of 2022. This robot can be worn on bone joints, and can provide the wearer with more than 20% of the walking force when walking, and the walking speed can be increased by 10%. This robot has also obtained the international standard ISO 13482 certification, and its safety is guaranteed.(CN Beta, CLS, Breaking Latest News)

Amazon has acquired Cloostermans, a Belgian company that makes technology used in warehouses. Amazon began working with Cloostermans in 2019, using its technology to help move and stack heavy palettes and goods, as well as package products together for delivery. Cloostermans will become part of Amazon Robotics, Amazon’s division focused on automating aspects of its warehouse operations. The unit was formed after Amazon acquired Kiva Systems, a manufacturer of warehouse robots, for USD775M a decade ago.(CN Beta, Geek Wire, TechCrunch, CNBC, Amazon)

Global mobility technology company, Magna, and San Francisco-based autonomous robotics company, Cartken, have announced an agreement for Magna to manufacture Cartken’s autonomous delivery robot fleet to meet growing demand for last mile delivery. Magna International sits as one of the top contract manufacturers in the world, particularly in the world of automotive mobility. The company has produced over 3.7M vehicles across thirty different models for 10 different OEM customers, including the likes of Ford, Rivian, and GM. In 2022 fall, Magna will begin production of Fisker’s flagship EV, the Ocean. (CN Beta, Magna, Electrek)

Lenovo has unveiled its first self-developed “remote stand-in” robot called the Lenovo Morningstar Robot S1. As a “remote stand-in” robot, Morningstar S1 innovatively integrates the metaverse and industrial robots, says Lenovo. The robot is claimed to be used for remote inspections. It can be widely used in ordinary manual assembly lines, spraying workshops, radioactive laboratories, and other environments according to the needs of different production scenarios.(Gizmo China, IT Home)