9-18 #NotAlone : Intel introduces “Intel Processor”; Google is allegedly working on a compact Pixel smartphone codenamed “Neila”; Samsung may be planning to introduce the satellite connectivity feature; etc.

Intel introduces a new processor for the essential product space: Intel Processor. The new offering will replace the Intel Pentium and Intel Celeron branding in the 2023 notebook product stack. Intel Processor will serve as the brand name for multiple processor families, helping to simplify the product purchase experience for consumers. Intel will continue to deliver the same products and benefits within segments. The brand leaves unchanged Intel’s current product offerings and Intel’s product roadmap. (Neowin, Intel, My Drivers, CN Beta)

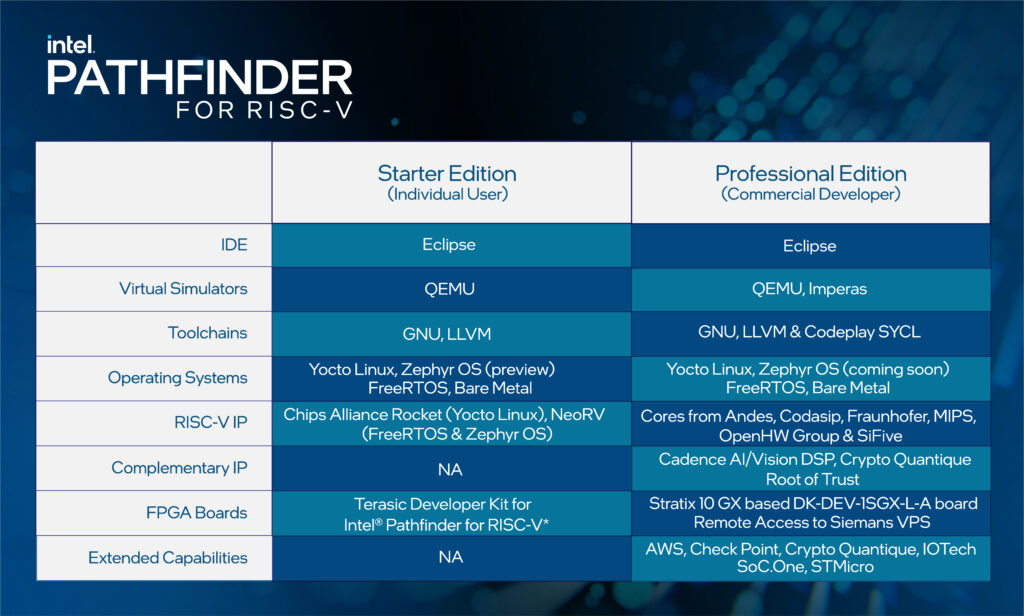

Intel has taken a significant new step in supporting wider adoption of RISC-V cores by launching a unified integrated development environment (IDE) called Intel Pathfinder, along with partner ecosystem of intellectual property (IP) providers, operating systems, tool chains and software to support new product development. The premise behind the new Intel Pathfinder platform is that system-on-chip (SoC) architects and system software developers can create their own products using a variety of RISC-V cores and intellectual property (IP) from the partner ecosystem, instantiate on FPGA and simulator platforms, and then run industry leading operating systems and tool chains within a unified IDE.(Laoyaoba, Design Reuse, Embedded)

Gudeng Precision Industrial, a key supplier of extreme ultraviolet (EUV) pods to Taiwan Semiconductor Manufacturing Co (TSMC) has said it is positive about growth for the next 18 months, as demand is expected to spike after its major customer’s 3nm chip begins mass production later 2022. The company chairman Bill Chiu has indicated that their revenue in 2H22 will be better than in 1H22. Its revenue growth would not be affected by a key customer’s EUV tool adjustments, providing some relief to its production lines since the company’s capacity has been full for the past 2 years. Gudeng, which commands a 40% share of China’s front-opening unified pod (FOUP) market, expects FOUP revenue to grow up to 40% YoY, a similar growth is expected in 2023. (Laoyaoba, TechNews, CNYES, CTEE, Taipei Times)

Automotive OEMs should work closely with IDM and pure-play foundries and consider building “buffer stocks” to ensure their stable supply, according to Ming-Cheng Lin, director of automotive and MCU business development for TSMC. The production cycle from receiving automotive IC orders to starting shipments takes about 5 months, said Lin. Building new manufacturing lines or fabs for automotive chip production would take much longer, Lin continued. All these matters explain why the supply of automotive ICs has been constrained since 2021. TSMC with its comprehensive technology portfolio consisting of N5A and N6RF, and sufficient fab capacity is capable of supporting the car industry. TSMC is also engaged in the development of manufacturing processes for automotive discrete components and GaN devices, according to Lin.(Laoyaoba, 163.com, CNYES, LTN, TechNews, Digitimes)

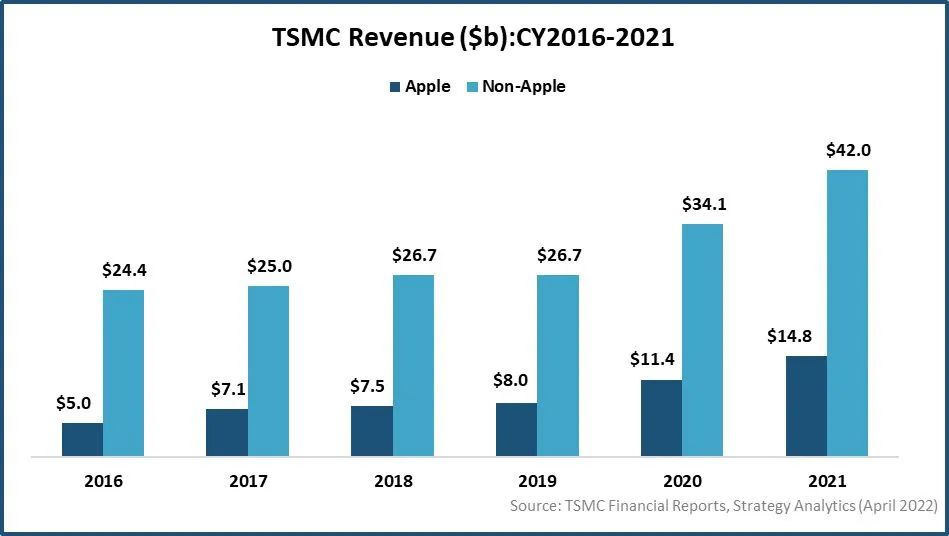

According to Strategy Analytics data, the proportion of TSMC’s revenue from Apple has gradually increased in recent years. Between 2016 and 2021, TSMC’s revenue from Apple rose 24%, while non-Apple revenue grew only 11% over the same period. In 2021, TSM’’s average revenue from its top 10 customers is USD4B. Among them, among TSMC’s top 10 customers, Apple’s share of revenue has also increased from 25% in 2016 to 37% in 2021. (Laoyaoba, CSIA, UDN)

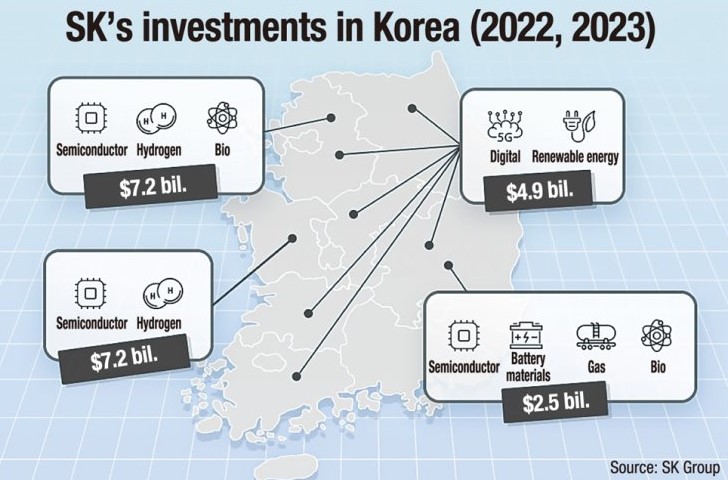

SK companies will invest KRW67T (USD49.8B) in the non-capital area over five years to build manufacturing facilities for chips, electric vehicle batteries, biopharmaceuticals and hydrogen. The funding is committed to all regions within the country excluding Seoul, Gyeonggi and Incheon, where its major industrial complexes and offices are already located. The plan is a part of SK’s 5-year investment plan worth KRW179T in Korea. Of the planned investment, KRW73 T will be spent in 2022 through 2023 “to pre-emptively respond to economic uncertainties and geopolitical risks,” with a separate KRW25T to be reserved for research and development. SK siltron, a wafer supplier to SK hynix and Samsung Electronics, will inject KRW1T to build a wafer manufacturing plant at Gumi, North Gyeongsang, by 2025. (Laoyaoba, Korea Herald, Pulse News, KED Global, Business Korea)

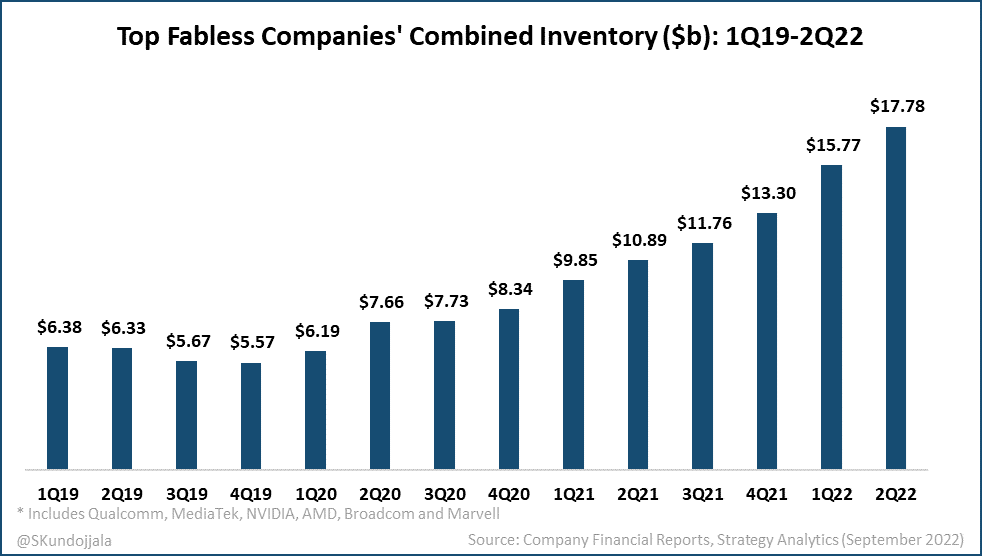

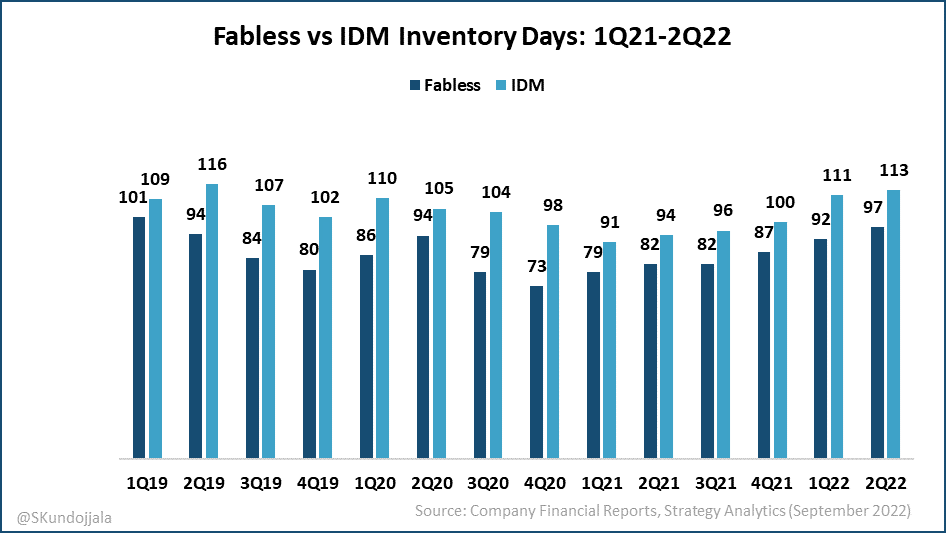

Strategy Analytics research director Sravan Kundojjala has said that in 2Q22, the inventories of the world’s major IC design companies increased by 13% QoQ, reaching a new high since 2019, but the cumulative revenue fell by 1%, marking the fourth consecutive quarter that the growth rate of inventory outpaced that of revenue. Income growth phenomenon. Kundojjala pointed out that in terms of inventory turnover days of major manufacturers, AMD and Broadcom are at relatively ideal levels, while Qualcomm’s inventory levels continue to rise, while Nvidia and MediaTek show signs of inventory adjustment in 2Q22, and are expected to be further revised in 2H22. In addition, Kundojjala also reminded that the inventory of IDM enterprises is also rising, reaching a new high in 3 years at the same time as fabless vendors, and they are also facing the pressure of destocking. (Laoyaoba, Sina)

Google is allegedly working on a compact Pixel smartphone codenamed “Neila”. The device which could end up being the Pixel 7a is said to feature a flat-screen with punch-hole selfie camera cutout and a rear visor just like on the Pixel 6 series phones. (GSM Arena, Weibo, IT Home)

LG Display (LGD) is reportedly in the final stages of review by Apple for its low-temperature polycrystalline oxide (LTPO) OLED for use in iPhone 14 Pro Max. This is the first time that LG Display is attempting to commercialize its LTPO thin-film transistor (TFT) OLED. Rival Samsung Display is already manufacturing the panels for both iPhone 14 Pro Max and Pro. It has commercialized the technology back in 2020. If approved by early Oct 2022, LGD can start mass production right away, which will win it more orders. It will be able to supply over 10M units from newly produced batches from its E6 production line at Paju of up to 8M units. (CN Beta, IT Home, The Elec)

Samsung Display is expected to gain more orders for the low-temperature polycrystalline oxide (LTPO) OLED panels used in Apple’s top-tier iPhone 14 models. Samsung Display ordered more equipment from AP Systems, HB Solution and Philoptics late Aug 2022. They will deliver the equipment to Samsung Display’s factory in Vietnam, where display panels are made into modules before delivery. Samsung Display has increased its iPhone OLED shipment goal from the previous 130M units to 149M units from the increased demand from Apple.(The Elec)

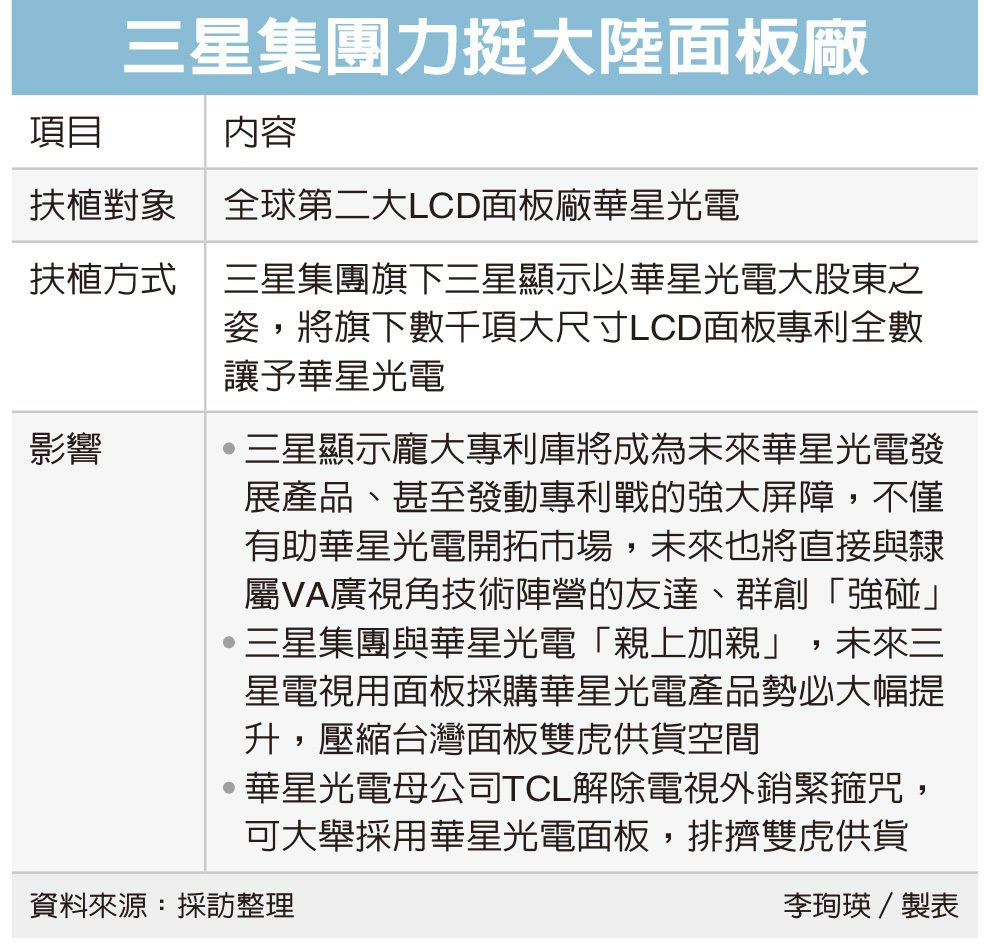

After Samsung Display, a subsidiary of Samsung Group, withdrew from LCD panel manufacturing in mid-2022, it has declared that it will transfer all of its thousands of large-size LCD panel patents to the world’s second largest LCD panel manufacturer, China Star Optoelectronics (CSOT). At a time when the panel market is sluggish, Samsung is supporting the red chain, Innolux and AUO are facing multiple pressures such as Samsung’s outsourcing orders may be compressed, and CSOT is rushing to the market with its abundant patent advantages. (UDN)

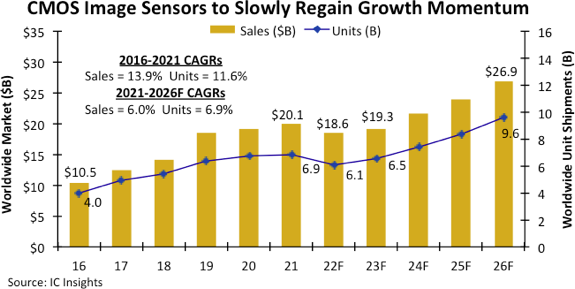

For most of the last two decades strong growth in CMOS image sensors pushed this product category to the top of the optoelectronics market, in terms of sales volume, generating over 40% of total opto-semiconductor annual revenues. In 2022, however, the CMOS image sensor market category is on track to suffer its first decline in 13 years with sales expected to fall 7% to USD18.6B and unit shipments projected to drop 11% to 6.1B worldwide, according to IC Insights. The projected 2022 decline in CMOS image sensors comes after two years of meager sales growth in 2020 (+4%) and 2021 (+5%). Year 2022 sales drop reflects overall weakness in consumer smartphones and portable computers with digital cameras for video conferencing following an upsurge in demand for Internet connections and online conferencing capabilities during the Covid-19 virus pandemic. The 3Q22 Update forecast shows a modest recovery in CMOS image sensors next year with market revenues growing 4% to USD19.3B and then rising 13% in 2024 to reach a new record high of USD21.7B. (IC Insights, Laoyaoba)

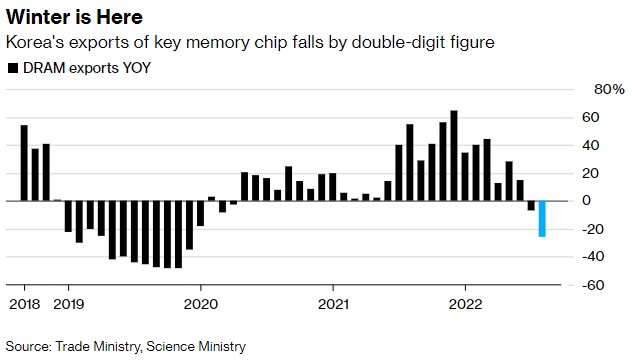

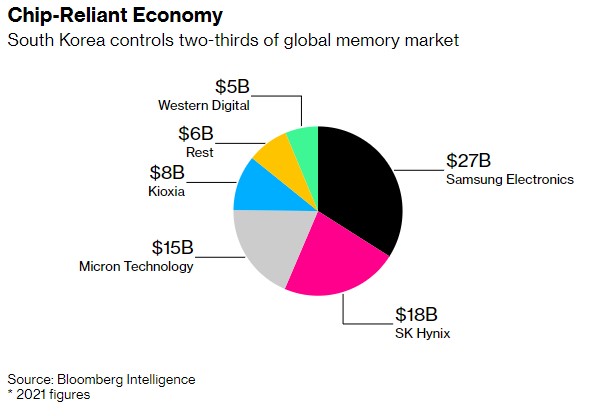

South Korea’s exports of its most lucrative memory chip fell by the most since 2019, indicating a deepening slump in technology demand central to global economic growth. Shipments of dynamic random access memory fell 24.7% from Aug 2021, compared with a 7% decline in Aug 2022, according to the trade ministry. DRAM accounts for almost half of Korean exports of memory chips, and works with processors and other types of semiconductors to store and process information in a wide range of electronics. Korea’s tech exports, which account for a third of the country’s total shipments abroad, fell 4.6% in Aug 2022, separate data from the ministry showed. Smartphones, displays and computers all declined in shipment value as consumer demand slackened. (CN Beta, Yahoo, EET-China, Bloomberg)

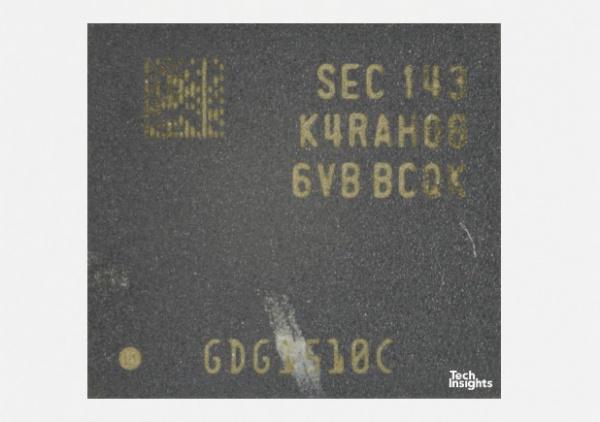

Samsung Electronics has begun commercializing DDR5 DRAM in 2021, the industry’s first DRAM technology developed using the High-K Metal Gate (HKMG) process. According to analyst firm Tech Insights, Samsung Electronics has provided DDR5 DRAM memory particles based on high-K metal gate (HKMG) technology to memory stick maker G.Skill. The agency has said it has confirmed that Samsung Electronics’ HKMG DDR5 DRAM is loaded into G.SKILL’s Trident Z5 series. It also expects HKMG to become the new standard in the next-generation DRAM industry.(Laoyaoba, iFeng, TechInsights)

Samsung may be planning to introduce the satellite connectivity feature to its upcoming Galaxy devices. It is unclear if this emergency feature will be available on the Galaxy S23 smartphones. (Gizmo China, Twitter, Phone Arena)

According to Tony Ran, president of Honor Europe, states that the brand “will always be about creating value for customers and partners through innovation”. Ran says this will change in the coming months, and that Honor will follow a dual-flagship release cycle in global markets as well. Ran says that Honor is working with more telecom partners and retailers to make its devices widely available in Western Europe. To date, the company is working with more than 35 telecom operators and over 65 distributors in the region to bring our products to more consumers. Honor is focusing on the U.K., France, Germany, Italy, and Spain as it aims to rebuild its global market share, and Ran notes the brand is not ready just yet to reenter North America. The brand is betting on its Honor Connect platform as a key software differentiator, noting that it wants to “break the boundaries across devices” even if they are running a different OS.(Android Central)

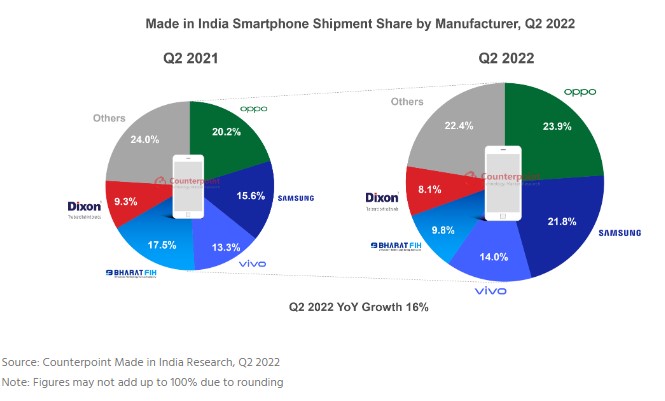

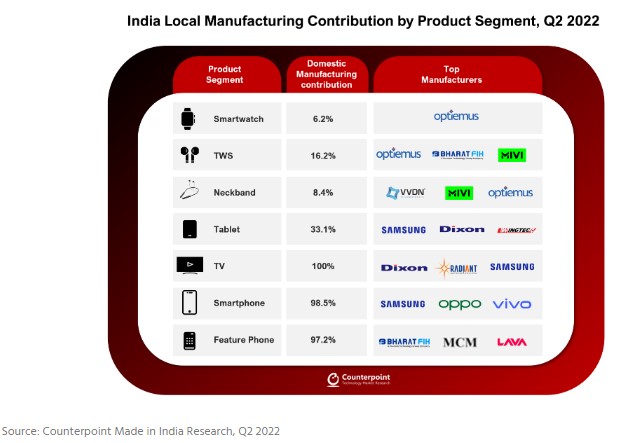

“Made in India” smartphone shipments grew 16% YoY in 2Q22 to reach over 44M units, according to Counterpoint Research. This was the first quarter of the new financial year and the companies pushed for higher output to meet the criteria for PLI incentives. In the smartphone segment, in-house manufacturing contributed to almost 66% of the total Made in India shipments in 2Q22, while the rest of the 34% shipments came from third-party EMS players. OPPO led the Made in India shipments with a 24% share, followed by Samsung and vivo. Among the third-party EMS players, Bharat FIH, Dixon and DBG were the leading players during the quarter. Padget Electronics (396% YoY), Wistron (137% YoY) and Lava (110% YoY) were the fastest growing smartphone manufacturers during the quarter in terms of shipments. (Gizmo China, Counterpoint Research)

Adobe has announced it has entered into a definitive merger agreement to acquire Figma, a leading web-first collaborative design platform, for approximately USD20B in cash and stock. The acquisition will allow Adobe to incorporate Figma’s popular design tools into its widely-used portfolio of creative apps. Design and prototyping, for individuals and teams, executed in a very streamlined and modern, cloud-based environment, are Figma’s product strengths, and it has amassed some 4M users to date.(CN Beta, Adobe, Figma, TechCrunch, The Verge)

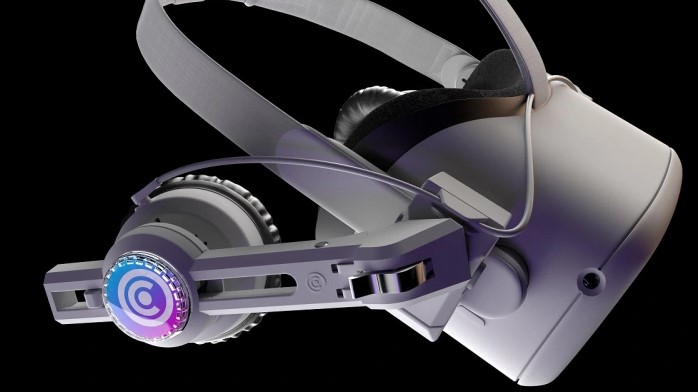

Conquest VR has announced that its audio headsets are available now for the virtual (VR) and augmented reality (AR) market. The company has designed its Conquest Pro headphones to deliver hyper-immersive VR sound and capture all the nuances of spatialized audio. The headphones are Hi-Res Audio Certified, an accreditation awarded to high fidelity audio products with a frequency range of up to 40,000Hz.(VentureBeat, Globe Newswire, Mixed News, Sina)

Signify introduces a new app, features and products for its WiZ smart lighting system to enhance users’ daily convenience. The WiZ app is at the core of the WiZ ecosystem, functioning as the enabler of all features in products. SpaceSense is a software feature coming to Signify’s Wi-Fi smart lighting line WiZ. It uses Wi-Fi sensing technology that detects changes in Wi-Fi signal strength caused by movement to turn lights on when someone walks into a room and off when motion stops. Wiz has a wide range of Wi-Fi-powered smart light bulbs starting at USD11. All WiZ products work with Amazon Alexa, Google Home, Apple Siri Shortcuts, IFTTT, and SmartThings.(CN Beta, Signify, The Ambient, The Verge)

Samsung Electronics would likely make a further downward revision to its TV shipment goal for 2022, according to Digitimes, citing slow order pull-ins from suppliers and continuous flat sales at the end market. Samsung will aim to ship at least 38M TVs in 2022, down from 42M a year ago. But sources say Samsung may lower the target again, to 36M or 33M units in the worst case. Although Samsung and LG Electronics are shifting their focus to QD-LCD and OLED models, the LCD panel supply-demand imbalance is unlikely to improve until the end of 1Q23. (Laoyaoba, Digitimes, Digitimes)

HP has announced HP SitePrint, an autonomous robot that precisely prints construction site layouts onto the floor. SitePrint will be available to customers in North America starting Sept 2022 through an early access program. The company is planning for a wider commercial release of the robot in 2023. SitePrint was designed to automate the site layout process. It includes a light, compact, autonomous robot, cloud tools to submit and prepare jobs to be printed and manage the fleet, a touch screen tablet for remote control and configuration, and a portfolio of inks for different surfaces, environment conditions and durability requirements. (CN Beta, Interesting Engineering, TechTimes, The Robot Report)

Autonomous and electric truck maker Einride is rolling into Germany, representing its first new market in Europe outside its native Sweden. Founded out of Stockholm in 2016, Einride has raised some USD150M in funding to commercialize a cab-less autonomous cargo truck, one that can be controlled remotely, if required, by human operators. It is also worth noting that Einride is gearing up to deploy its fully autonomous pods on U.S. public roads in partnership with GE Appliances, with imminent plans to start operating on a mile-long stretch of road between GE Appliance’s factory and a warehouse in Selmer, Tennessee. (TechCrunch, Electrek, Business Wire)

Miami-based Doroni Aerospace has announced it is accepting orders for its soon-to-available H1 personal flying car. The H1 has a two-seat bubble of a cockpit, sandwiched between large front and rear wings. These wings are dominated by enormous ducts sunk into them, each housing a pair of large, contra-rotating vertical lift props, for a total of eight. At the back of the aircraft, there is a further two props for horizontal thrust. Doroni says the H1 will fly at a top speed of 140mph (225km/h). Safety-wise, the landing gear is a bit springy and the body is apparently designed to dissipate energy.(CN Beta, New Atlas, MotorBiscuit, Auto Evolution, Robb Report)

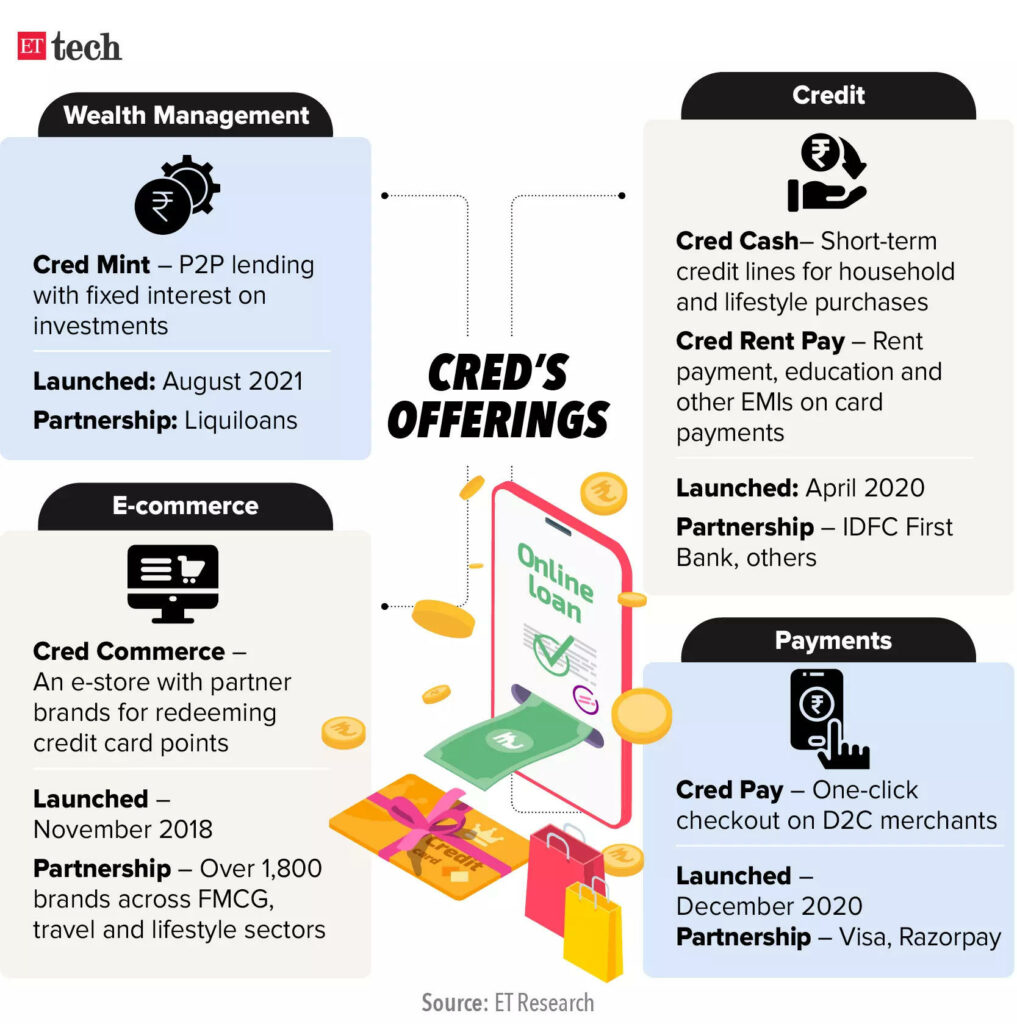

CRED plans to invest about USD10M in its lending partner LiquiLoans as the Indian fintech startup broadens its ownership in financial services. The Bengaluru-headquartered startup’s investment in Mumbai-headquartered LiquiLoans increases the lender’s valuation to close to USD200M. CRED partnered with LiquiLoans in 2021 to launch CRED Mint, a service that allows CRED customers to lend to one another at an interest rate of up to 9% annually. (TechCrunch, PYMNTS, India Times, CRED)

Square Enix, one of the biggest Japan-based gaming companies, has inked a partnership with Oasys, a Web3-oriented blockchain project. As part of this partnership, Square Enix will be part of the first 21 validators of the Oasys network, and will explore new possibilities regarding developing blockchain games using this decentralized tech, including user-generated contributions. Square Enix will be using the Oasys blockchain as a tool for the development of new blockchain games and the inclusion of user-generated content in virtual worlds.(VentureBeat, Eurogamer, Coin Telegraph, Bitcoin.com, Bloomberg)

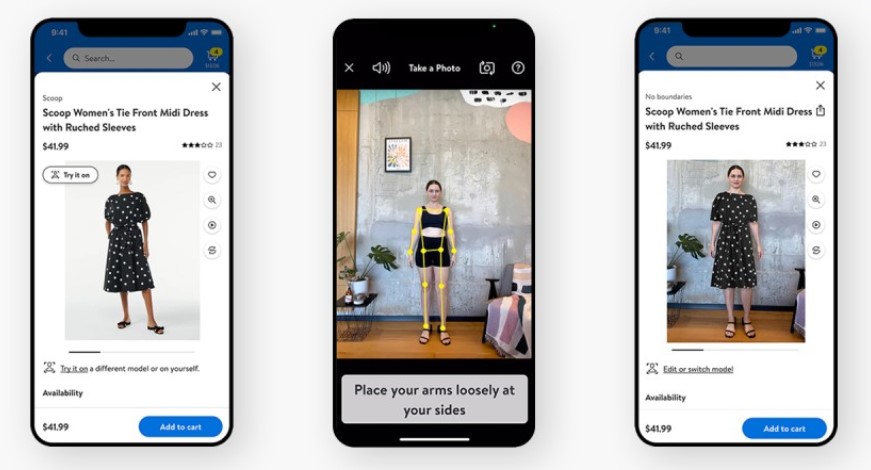

Walmart is expanding its support for AI-powered virtual try-on technology that allows online shoppers to better visualize clothing on models that look like themselves in both appearance and body type. The retailer is launching new technology called “Be Your Own Model”, which lets shoppers use their own photos to see how clothing looks on them, instead of choosing one of the existing fashion models. The virtual try-on technology hails from Walmart’s 2021 acquisition of the startup Zeekit. The computer vision and neural network-powered feature is capable of analyzing catalog images of garments to create a dressed image. The use of neural networks helps to determine the different variations of a product, including size, color and other factors — like fabric draping or sleeve length, for example.(TechCrunch, Walmart, Fast Company)