11-1 #Quarantine : TI is rumored to have adopted a more flexible pricing strategy for PMICs; Samsung has reportedly set a target to ship 270M smartphones in 2023; Autonomous vehicle company Argo AI is shutting down; etc.

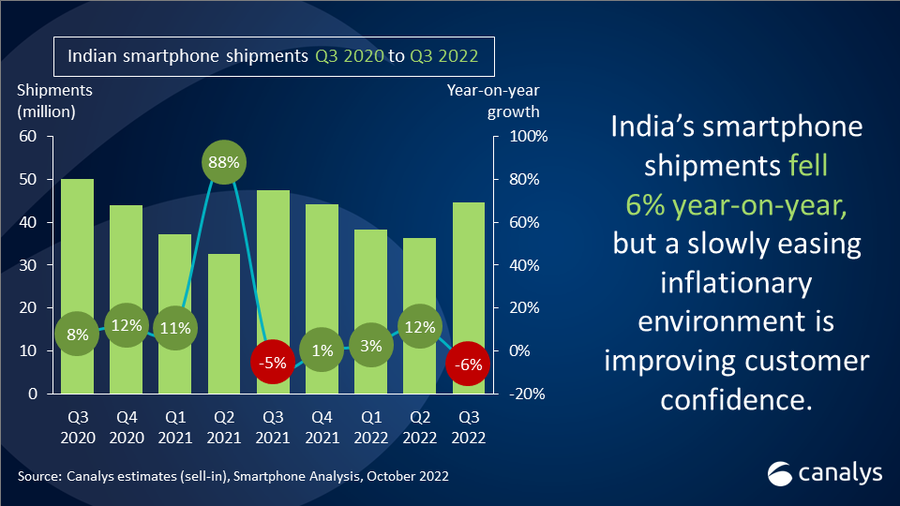

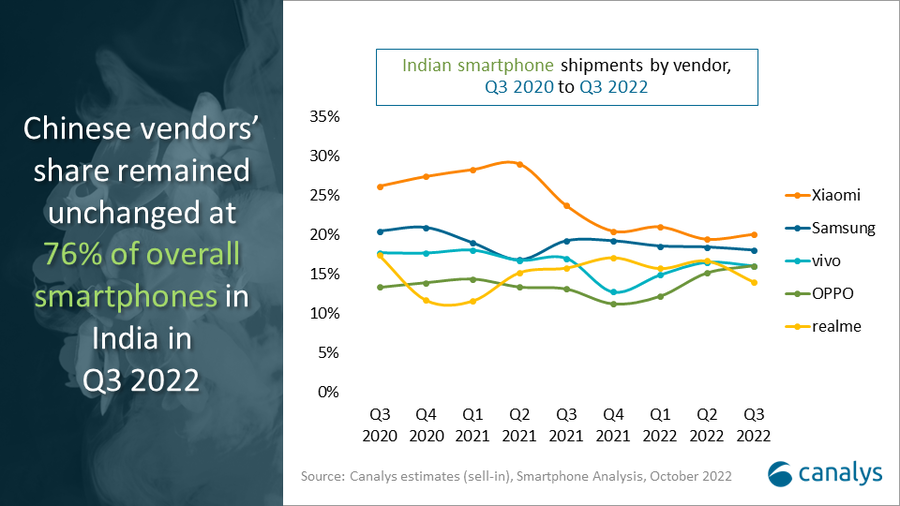

India’s smartphone shipments in 3Q22 were 44.6M units, a 6% decline from the previous year dragged by a lackluster low-end segment. Xiaomi held onto first place with 9.2M units as the brand gained traction from July’s online sales ahead of the festival season. Samsung came second with 8.1M shipments and saw strong momentum in the mid-high-end category owing to aggressive offers and promotions. vivo and OPPO jumped to third and fourth place, shipping 7.3M and 7.1M units respectively, while realme dropped to fifth, shipping 6.2M. (GSM Arena, Canalys)

Samsung and TikTok have teamed up to announce StemDrop – a new format for recording and mixing music on TikTok. Simon Cowell is the creative director behind the venture and Syco Entertainment and Universal Music Group are also on board too. Stems are the building blocks of a music track broken down into elements such as vocals, drums and bass and TikTok is adding a StemDrop Mixer to help anyone mix and master songs to their liking.(GSM Arena, Samsung)

A rapid fall in China’s weekly iPhone sales may signal bigger challenges ahead for Apple, whose smartphone had mostly been resilient to the global economic downturn, according to Jefferies. Apple’s sales of iPhones in China slumped by 27% in the week of 24 Oct 2022, a third successive week of increasingly steep drops. Even adjusting for the device’s earlier release this year, the negative trend holds and has been worse than the recent drops for Android rivals, according to the Jefferies analysts including Edison Lee. In the 3 months to Sept 3033, China sales of iPhone were up 5.7% compared to a 15.2% fall for Android alternatives (Bloomberg, Laoyaoba, UDN)

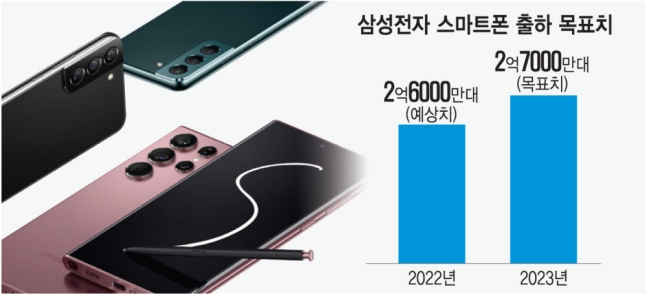

Samsung has reportedly set a target to ship 270M smartphones in 2023. That is lower than the company’s usual target of around 300M shipments (about 25% of global smartphone shipments). The company’s shipment figures peaked in 2017 at 320M.The company could ship around 260M smartphones in 2022. Samsung has decided to increase the share of foldable phones in its annual shipment targets. The company is aiming to sell over 60M Galaxy S and Galaxy Z series devices. (GSM Arena, Naver, SamMobile)

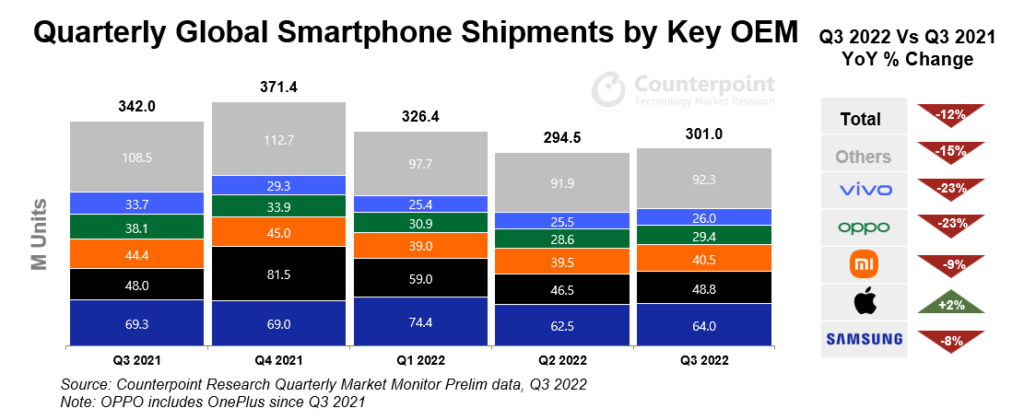

According to Counterpoint Research, the global smartphone market declined by 12% YoY even as it grew by 2% QoQ to reach 301M units in 3Q22. While quarterly growth in Apple and Samsung pushed the global smartphone market above 300M units, a level it failed to reach last quarter, political and economic instability drove negative consumer sentiment. Apple was the only top-five smartphone brand to grow YoY, with shipments increasing 2% YoY, growing market share by two percentage points to 16%. Samsung’s shipments declined by 8% YoY but grew 5% QoQ to 64M. Xiaomi, OPPO (including OnePlus) and vivo, recovered slightly after receiving heavy beatings due to lockdowns in China in 2Q22, and as they captured more of the market ceded by Apple and Samsung’s exit from Russia. (Counterpoint Research)

Worldwide tablet shipments were down 8.8% YoY in 3Q22, totaling 38.6M units, according to IDC. This was the fifth straight quarter of decline for the tablet market. Chromebook shipments also struggled in 3Q22, falling to 4.3M units and a YoY decline of 34.4%. Both markets have now shifted from supply constrained industries to ones that are demand challenged as consumer and education spending has slowed in the face of economic uncertainties. Chinese vendors continue to do well in emerging markets where there is low-end demand. Sanctions from many vendors also enabled Chinese vendors like Huawei to perform well in the Russian market. Meanwhile, the emergence of low-priced Chinese OEMs like realme, Xiaomi, OPPO and others, has fueled strong competition in the lower range devices. However, these gains still couldn’t offset the decline experienced by the main tablet vendors. (Neowin, IDC)

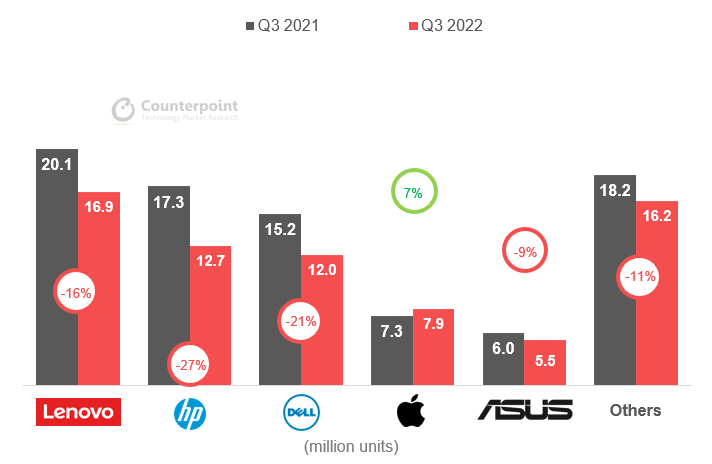

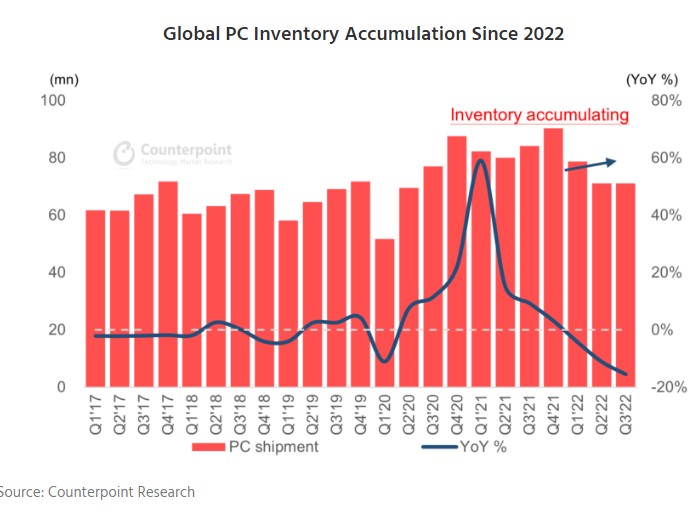

Global PC shipments in 3Q22 fell 15.5% YoY basis as per Counterpoint Research data. PC OEMs have shipped 71.1M units in 3Q22. Counterpoint states that this is another wave of huge YoY decline after the severe annual and sequential falls of 11.1% in 2Q22. The decline in 3Q22 is attributed largely due to demand weakness across both consumer and commercial markets, mainly driven by global inflation. OEMs and ODMs have a negative outlook on 4Q22 and 1H23 despite the issue of a component shortage being resolved. (Counterpoing Research, Gizmo China)

Autonomous trucking company TuSimple is under investigation for its ties to a Chinese company. The FBI and SEC are said to be looking into whether the San Diego-based company defrauded investors by financing and transferring technology to Hydron, a company led by one of TuSimple’s founders. It was the latest sign of the hard road ahead for many AV companies, as the industry shrinks, capital dries up, timelines are pushed out, and regulators spot cracks in the system. TuSimple, a leading supplier of autonomous truck technology, is already under scrutiny from the Federal Motor Carrier Safety Administration for a crash involving one of its trucks earlier 2022. (The Verge, WSJ, Reuters)

Autonomous vehicle company Argo AI is shutting down. Ford (a major investor in Argo AI) has noted that the company is being wound down and that it will hire engineers from the startup to expand and speed up development of Level 2+ and Level 3 autonomous driving systems. Ford says that it made a decision to refocus its self-driving capital spending from the Level 4 systems Argo was working on (where the vehicles handles most driving operations) to Level 2+ (advanced driver assistance) and Level 3 (conditional automation) tech it’s developing in-house. It noted that Argo AI wasn’t able to attract new investors and that it was taking a “USD2.7B non-cash, pretax impairment on its investment” in the company, which led to it posting an USD827M net loss for 3Q22. (TechCrunch, Yahoo, Reuters)

The power management chip (PMIC) market price war is imminent, and Texas Instruments (TI) is rumored to have adopted a more flexible pricing strategy for PMICs due to the release of new capacity and dim demand expectations. According to different products and quantities, TI provides about 8%-15% discount. At present, the inventory level of downstream products such as mobile phones, PCs, TVs, and consumer electronics is still high, and the actual destocking speed is lower than expected. The inventory days of major system manufacturers are about 130-150 days, which is significantly higher than the average level of 80-100 days in previous years. It is expected that there will be a chance to see a turnaround in 2Q23. The arrival of TI’s flexible pricing strategy is earlier than expected, and the price cut is also larger than expected, and it is worried that the price war may be more severe in 1H23. Investment institutions predict that after the production capacity of TI’s new 12-inch fab is released, product production costs may be reduced by 35%-40%, providing it with more room for price strategies. In contrast, due to product and brand disadvantages, Taiwanese companies may need to cut prices more than TI to maintain market share, and the impact of price cuts may lead to a double-digit decline in related business revenue in 4Q22. (CTEE, China Times, Laoyaoba)

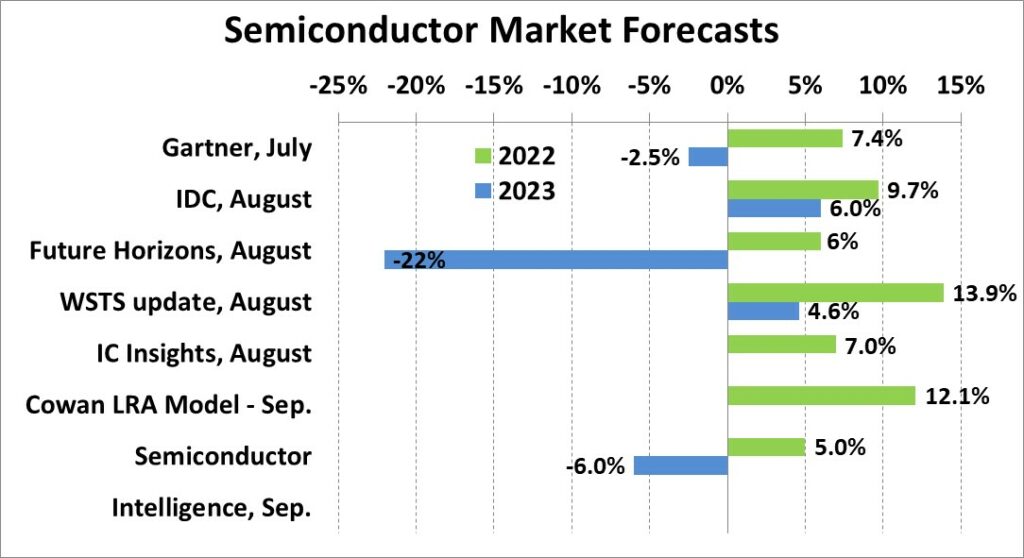

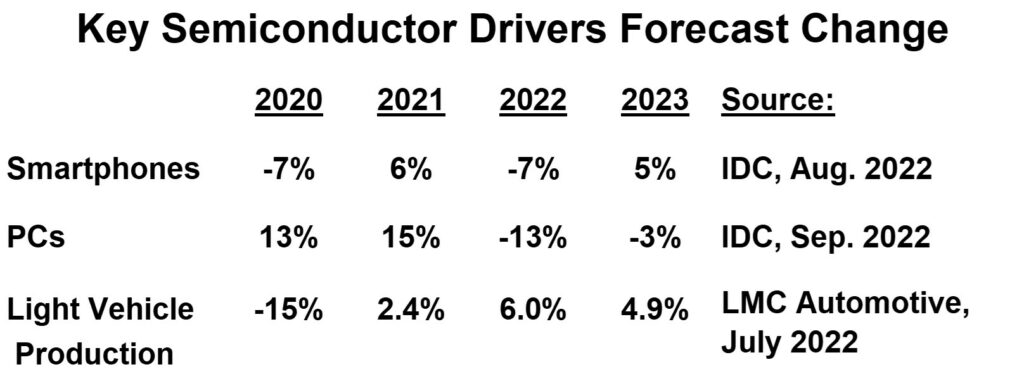

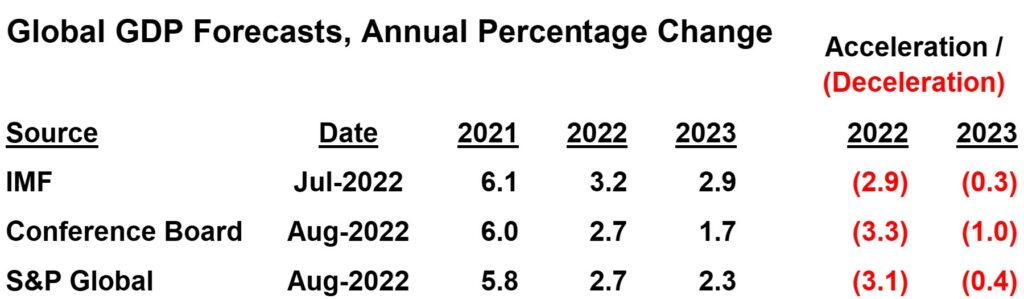

The global chip market will contract by 6% in 2023, according to market analysis firm Semiconductor Intelligence but with downside risk. This is a lot more bullish than the 22% contraction predicted by Malcolm Penn and Future Horizons. Weakness in the PC and smartphone markets ar being referenced by semiconductor companies as major factors in expected 3Q22 revenue drops. Smartphone unit shipments are expected to decline 7% in 2022 after 6% growth in 2021. The smartphone market will grow 5% in 2023, referring to IDC’s data. Semiconductor Intelligence also takes into consideration global GDP growth and predicts a 3-percentage point deceleration in GDP growth will result in a 16-point deceleration in semiconductor market growth. Semiconductor Intelligence forecasts 5% growth in 2022, just below Future Horizons’ forecast of 6% growth. (Semiconductor Intelligence, EE News Analog, EE News Analog, Laoyaoba)

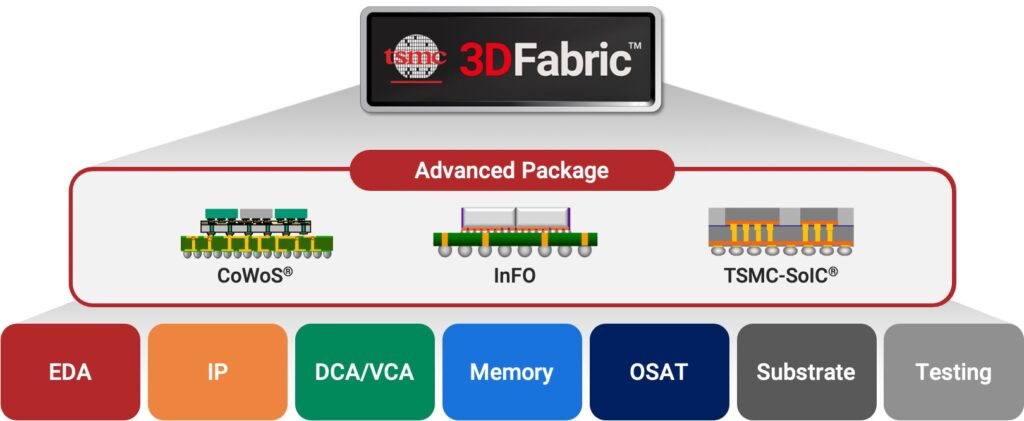

TSMC introduces the new 3DFabric Alliance, a significant addition to TSMC’s Open Innovation Platform (OIP), to help customers overcome the rising challenges of semiconductor and system-level design complexity and achieve speedy implementation of innovations for next-generation HPC and mobile applications using TSMC’s 3DFabric technologies. The new TSMC 3DFabric Alliance is TSMC’s sixth OIP Alliance and the first of its kind in the semiconductor industry that joins forces with partners to accelerate 3D IC ecosystem innovation and readiness, with a full spectrum of best-in-class solutions and services for semiconductor design, memory modules, substrate technology, testing, manufacturing, and packaging. This alliance will help customers achieve speedy implementation of silicon and system-level innovations and enable next-generation HPC and mobile applications using TSMC’s 3DFabric technologies, a comprehensive family of 3D silicon stacking and advanced packaging technologies.(Laoyaoba, TSMC, HPC Wire, AnandTech)

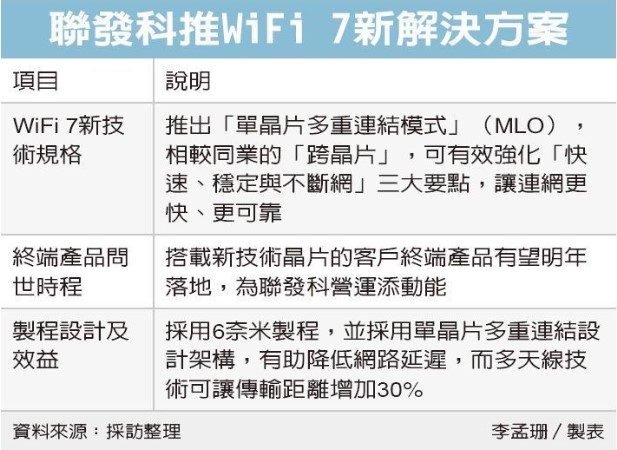

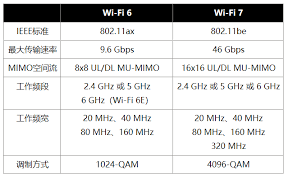

Ye Xinzhong, Assistant General Manager of MediaTek’s Smart Unicom Business Unit, said that he is optimistic about the development prospects of Wi-Fi 7. It is expected that the output value of Wi-Fi 7-related semiconductors, components and terminals in the next 5 years is expected to reach NTD770B. Ye Xinzhong said that the main application products of Wi-Fi 7 from 2024 to 2029 include wireless access points, mobile phones, broadband wireless and consumer electronics. It is reported that MediaTek’s Wi-Fi 7 solution uses a 6-nanometer process and has new features such as higher throughput, lower network latency, and higher network efficiency.(Laoyaoba, C114, UDN)

Qualcomm has announced that its Snapdragon Automotive Platforms will power the Volvo EX90, the Swedish company’s largest EV to date. the electric EV EX90 will possess a vertical large central display and a smaller, horizontal display placed directly in front of the driver. While the smaller screen displays essential driving information, the larger one displays infotainment data, navigational maps, and information related to vehicle status. The Snapdragon Cockpit Platform is a part of Qualcomm’s Snapdragon Digital Chassis that also includes Snapdragon Ride – Qualcomm’s solutions for advanced driver assistance systems (ADAS), Snapdragon Auto Connectivity – covering cellular, Wifi and Bluetooth connections, and Snapdragon’s Car-to-Cloud Services for software updates across a vehicle’s life cycle.(Digitimes, EE News Auto, Pocket-Lint)

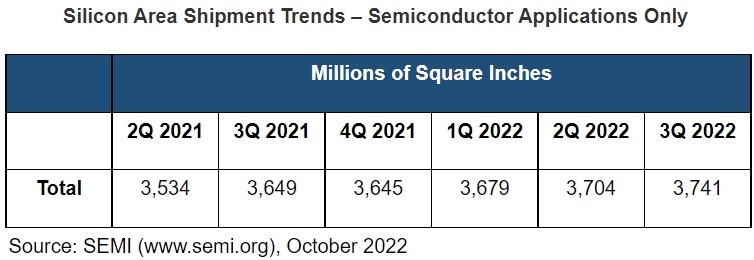

Worldwide silicon wafer shipments reached a new record of 3,741 million square inches (MSI) in 3Q22, increasing by 1% QoQ and growing by 2.5% from the 3,649 MSI recorded during the same quarter in 2021, according to the SEMI Silicon Manufacturers Group’s (SMG) quarterly analysis of the silicon wafer industry. (Laoyaoba, EET-Asia, SEMI)

Huawei has filed a lawsuit against Amazon and its product partners in China over infringing the E Ink patents. The case aims at Amazon’s subsidiary in Beijing and Compal Electronics’ 3 subsidiaries. Amazon’s Kindle e-readers are currently produced in China by Compal Electronics. Huawei has managed to sell over 110,000 units of MatePad Paper in China and surpass Kindle sales after just 2 months after late Feb 2022 launch. (Android Headlines, GSM Arena, Sina, Global Times)

The joint innovation center of Nationstar Optoelectronics and Huawei was established. On 12 May 2022, China-based Nationstar Optoelectronics announced a new “cooperation agreement” with Huawei for the development of mini-LED and micro-LED display technologies. The two companies will conduct “in-depth innovation” in these fields, and will open a joint innovation center. (Laoyaoba, IT Home, LEDinside, EET-China, Micro-LED, GizChina)

China’s BOE Technology, one of the world’s largest display manufacturers, plans to build a massive new factory in Beijing, as it looks to next-generation technology for new revenue streams. BOE will invest CNY29B (USD4B) in the 600,000 sq. meter factory, with an eye toward expanding into markets for new technologies, such as panels for virtual reality (VR) devices, and a new type of high-end panel called mini-LED. The designed production capacity is about 50,000 pieces/month, and the construction period is from 2023 to 2025, with mass production in 2025 and full production in 2026.(EET-China, Yicai, Laoyaoba, Asia Nikkei, BOE)

DSCC had expected that 4Q22 foldable panel shipments of 5.4M based on supplier surveys, but now they are seeing 2.9M, a 46% reduction. The foldable panel shipments in 4Q22 are expected to be down 54% QoQ and 26% YoY. Sell through of Samsung Galaxy Z Flip 4 and Z Fold 4 have been below expectations. Apple’s iPhone 14 Series has sucked up most of the attention and sell-through and the Z Fold 4 price of USD1,799 remains too high in this environment. As a result, both the Z Fold 4 and Z Flip 4 are expected to be down YoY vs. the Z Fold 3 and Z Flip 3 in 4Q22, in fact, they are expected to be down big. However, they were up in 2Q22 and 3Q22 and should be up for 2022, but only in the mid-single digits. Also weighing on 4Q22 foldable panel shipments are a number of Chinese models ramping slower and/or later than expected. (Laoyaoba, TechNews, DSCC, Twitter)

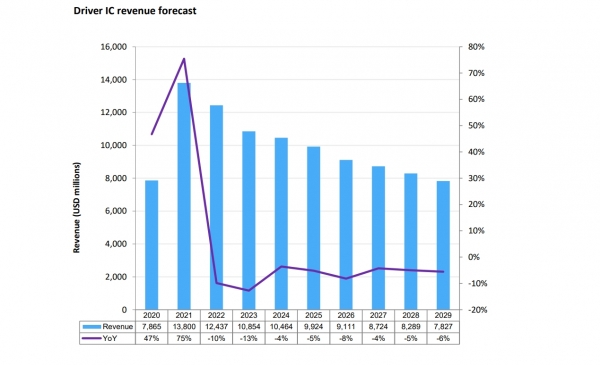

Research firm Omdia has recently updated its market tracker, predicting that the overall size of the display driver chip (DDI) market will shrink from USD13.8B in 2021 to USD7.8B in 2029, the same size as the market in 2020. The firm has also revised down its demand forecast for display driver chips this year. Due to the macroeconomic environment suppressing consumer demand for IT equipment, it is expected that DDI’s annual shipments will be slightly less than 8B units, down 12% from the 2021 level. At the same time as the demand is declining, due to the oversupply, the product price has also turned to a downward trend after 2Q22. The price of TDDI for touch display may drop to USD2 by the end of 2022 or early 2023, and the decline in both volume and price will make the market in 2022. Scale is expected to shrink 10% to USD12.4B. (Sohu, ET News, Laoyaoba)

Supplier and fabless manufacturer of display drivers and other semiconductor products, Himax Technologies has announced that it has divested its wholly owned subsidiary Emza Visual Sense, a company dedicated to the development of proprietary vision machine-learning algorithms. Following the transaction, Himax will continue to partner with Emza. The divestiture will not affect the existing business with the leading laptop customer where Himax continues to be the supplier for the leading-edge ultralow power AI processor and always-on CMOS image sensor. (Laoyaoba, Seeking Alpha, Globe Newswire)

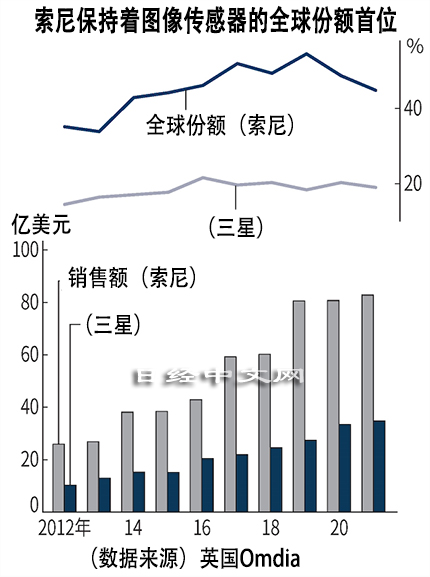

Terushi Shimizu, CEO of Sony Semiconductor, has said that due to the innovation of back-illuminated and stacked CMOS image sensors, Sony Semiconductor has fully grasped the dividends of the smartphone market. revenue, accounting for 13% of Sony Group’s total revenue. Although the current smartphone market is facing headwinds, Shimizu believes that even if the smartphone market has peaked, the annual sales volume is 1.2-1.3B units, plus 3-4 CISs, so there is a market of about 5B units per year. The company’s Nagasaki plant is currently undergoing a second expansion to meet the demand for CIS for high-end smartphones. While consolidating the existing market advantages of smartphone CIS, the company is actively expanding more application markets, among which automotive CIS is the future focus. The company established a joint venture “Sony-Honda Mobility” with Honda in Sept 2022. It is expected to mass-produce electric vehicles in 2025, which will be equipped with Sony automotive CIS products.(Laoyaoba, Nikkei, Nikkei, The World Folio)

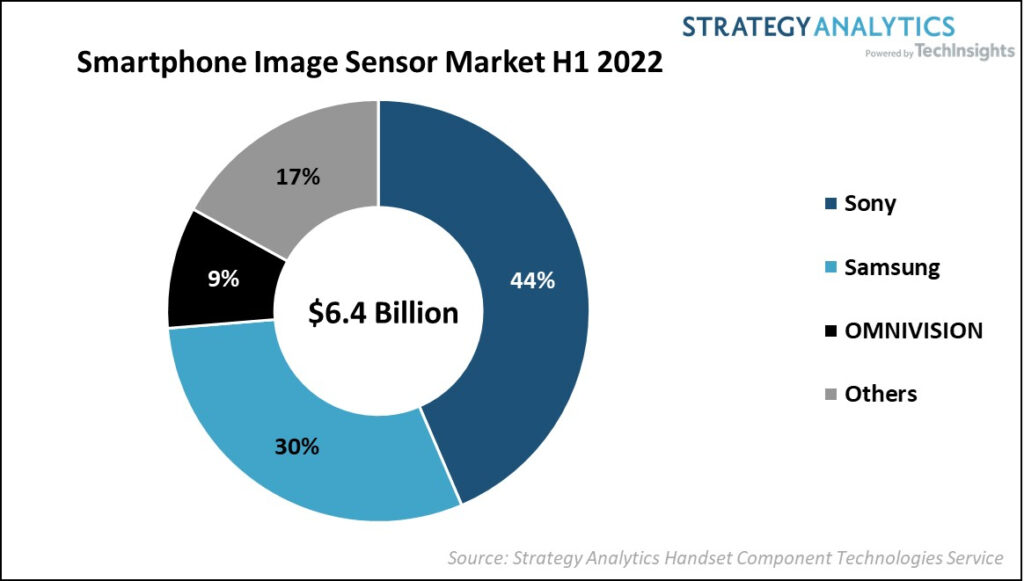

The global smartphone Image sensor market clocked a total revenue of USD6.4B, according to the Strategy Analytics. This Strategy Analytics research finds that the market for smartphone image sensors experienced a decline of more than 5 percent YoY in 1H22. Sony SemiconductorSolutions captured the top spot with 44% revenue share followed by Samsung System LSI and OmniVision in the period. Sony, Samsung and OmniVision captured nearly 83% revenue share in the global smartphone image sensor market. In terms of smartphone multi-camera applications, Image sensors for Depth and Macro applications dropped to 26% share while those for Ultrawide application jumped to 20% share. (Laoyaoba, Strategy Analytics)