11-6 #Suggest : Xiaomi invests in Aoxin Technology; AUO and Innolux pay attention on Mini-LED and Micro-LED; Tianma introduces the latest LCD CUP full-screen solution; etc.

China’s high-reliability automotive chip design company Aoxin Technology has announced to add Xiaomi as a new investor with revised registered capital, according to Tianyancha, China’s corporate information platform. Founded in 2021, Aoxin Technology focuses on high-reliability automotive chips, covering digital-analog hybrid chips (vehicle transceiver CAN/SBC/Ethernet PHY chips, etc.)(Laoyaoba, Laoyaoba, Sina)

Both AUO and Innolux are optimistic about the prospects of new-generation display technologies such as Mini LED and Micro LED, and they both announced their participation in the private placement of Taiwan LED leader Ennostar. The board of directors of Ennostar has resolved to issue a private equity common stock through a cash capital increase, totaling 70M shares. The proceeds will be used for capital expenditures such as the construction of a dedicated 6” wafer fab for Micro LED, the purchase of epitaxy processes, and equipment related to the die process, and the application will be disclosed. According to the latest market research report, Micro LED large-scale displays will enter the home theater level and high-end commercial display market. It is estimated that the output value of Micro LED large-scale display chips will reach USD54M in 2022; CAGR of 204%. (UDN, UDN, CNYES, Digitimes)

Tianma introduces the latest LCD CUP (Camera Under Panel) full-screen solution. Tianma’s full-screen solution is to adopt an innovative RGBW pixel design, drive circuit and over 300 PPI pixel density in the CUP area in the LTPS LCD screen structure, and match the unique backlight architecture. As a key technology to enhance screen performance and aesthetics, the CUP full-screen solution with Tianma’s extremely narrow bezel technology will deliver a nearly 100% screen-to-body visual effect. By adopting a new pixel electrode structure design in the CUP aperture area and selecting a highly transparent electrode material to achieve high transmission performance, the light transmission rate in the aperture area is significantly increased to over 15%.(Laoyaoba, IT Home, My Drivers, Tianma, Techgoing)

Foshan-based NationStar Optoelectronics has revealed that it has developed Micro-LED mass transfer technology, which is now in the stage of small batch verification. At present, the transfer rate and yield rate are steadily increasing. In terms of Mini-LED, Nationstar has the capacity for mass production. Among them, IMD-M07 has achieved mass production. The standard version of IMD-M09 is widely praised by customers for its high cost performance. On the basis of the standard version, it continues to attack the high-end market and completes the IMD-M09 Large-scale trial production of the flagship version; for Micro LED, MIP devices with a new packaging structure were developed for the first time, and MIP display modules were prepared, which verified the industrialization possibility of Micro LED in the field of >100-inch ultra-high-definition display, and the latest launch of the second generation The new Micro LED – nStar II, with a pixel pitch of 300 microns (P0.3), achieves a display effect of 8bit (256 grayscale) color depth, and achieves breakthroughs in mass transfer and mass bonding, and its comprehensive yield rate up to 99.99%.(Laoyaoba, LEDInside, NBD)

A global leader in high-precision motion capture technology for the gaming and animation sectors, StretchSense has completed a NZD13.3M Series A led by existing investor GD1 and Scottish Enterprise, a NZD13.3M Series A led by Par Equity backed by Scotland’s National Economic Development Agency. It plans to grow its world-class engineering team to meet strong customer interest in the compatibility of its technology with market-leading motion capture and VR tools. It will also focus on developing new sensor technology to enable high-precision tracking in emerging applications such as the rapidly evolving corporate virtual training industry. (TechCrunch, CNYES, Marsbit, Latest Finance)

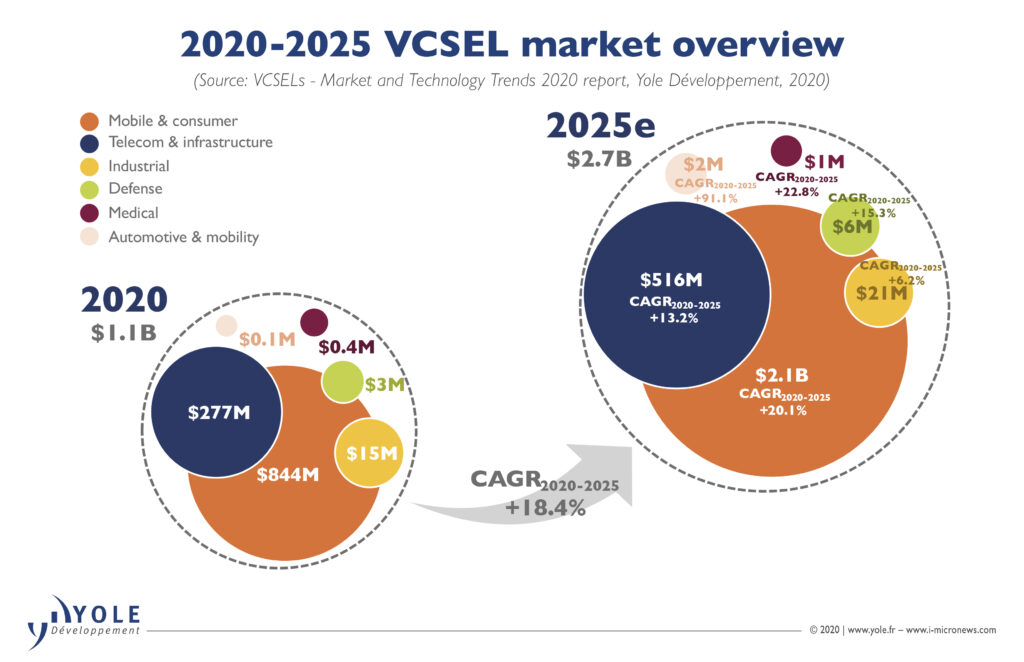

According to Digitimes, both II-VI and Sony are eyeing business opportunities related to Apple’s vertical-cavity surface-emitting laser (VCSEL) chips for 3D sensing modules. Lumentum and its partners, including epitaxial wafer supplier IQE and Taiwan foundry Win Semiconductors, were once Apple’s only VCSEL chip supplier, but II-VI has already got a small piece of the share after cutting into the iPhone supply chain. US-based II-VI sources some of its epitaxial wafers from Taiwan-based LandMark Optoelectronics for Apple’s orders. II-VI is seeking more VCSEL chip orders for Apple’s iPhone front-facing 3D sensor. (Digitimes, Laoyaoba)

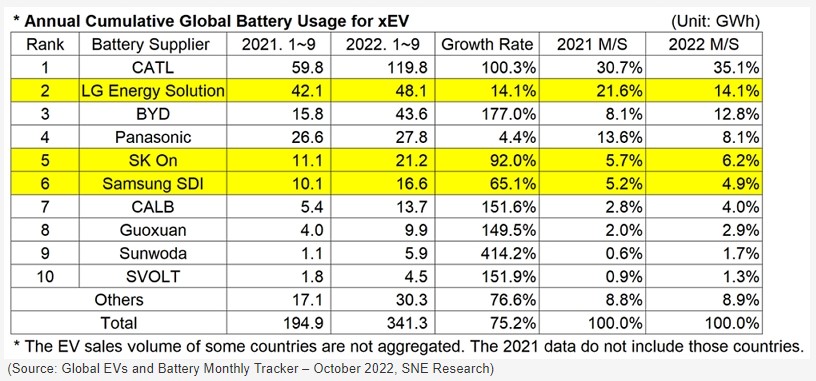

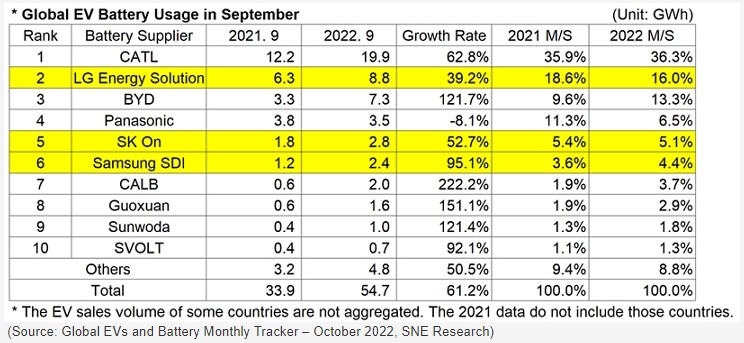

According to SNE Research, In Jan-Sept 2022, the amount of energy held by batteries for electric vehicles registered worldwide was 341.3GWh, a 75.2% YoY increase. Since 3Q20, the electric vehicle market has been in an upward trend. Several Chinese battery manufacturers, with CATL and BYD at the forefront, led the market growth, and those Chinese makers in the global top 10 including CALB have all boasted a triple-digit, high growth. On the other hand, the Japanese makers including Panasonic remained in the downward trend, with most of them showing below-average growth rates. The market shares of 3 K-battery makers have declined by 7.3%p from 32.5% to 25.2% compared to the same period of 2021, but they are still in the trend of steady growth. LG Energy Solution remained 2nd on the rank with 48.1GWh, a 14.1% increase from the same period of last year. SK-On recorded 21.2GWh, a 92.0% increase, and Samsung SDI exhibited 16.6GWh, a 65.1% increase. (SNE Research, Laoyaoba)

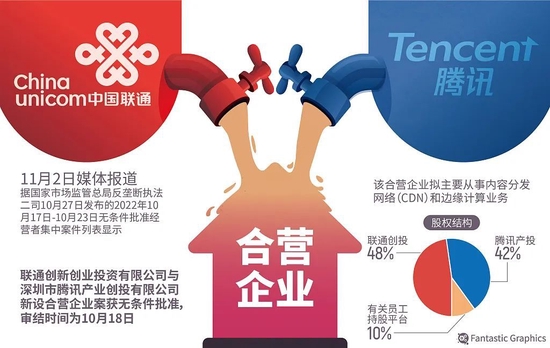

Tencent and state-owned telecommunication titan China Unicom have received regulatory approval to set up a joint-venture company. The joint venture will mainly engage in content distribution network (CDN) and edge computing business. After the transaction is completed, Unicom Innovation Venture Capital, a subsidiary of China Unicom, will control 48% of the new company, while Shenzhen Tencent Industry Venture Capital, a subsidiary of Tencent, will hold 42%.(Laoyaoba, Sina, Forbes China, Wallstreet CN)

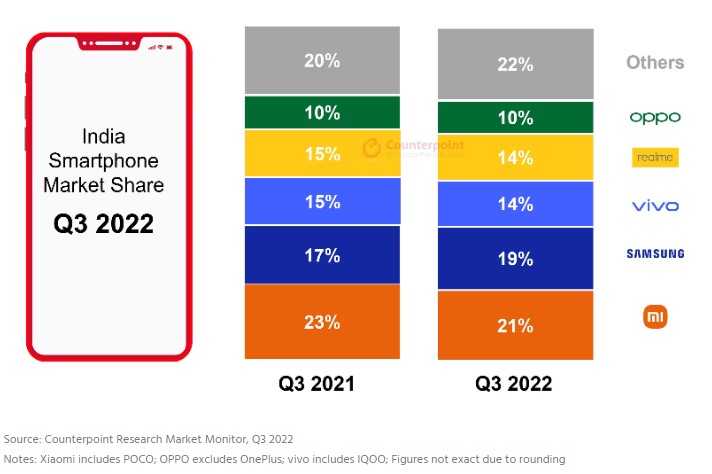

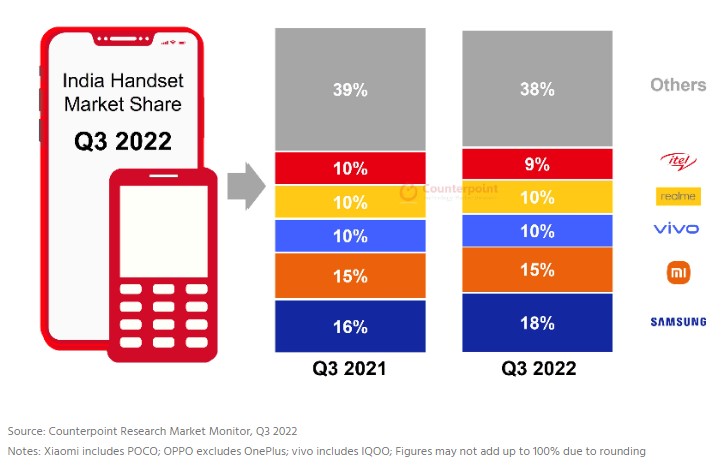

India’s smartphone shipments declined 11% YoY to reach over 45M units in 3Q22, according to Counterpoint Research. Xiaomi led the market with a 21% shipment share, closely followed by Samsung. One in three smartphones shipped during the quarter was a 5G smartphone. Samsung led the 5G smartphone segment with a 20% share, closely followed by OnePlus and vivo. Apple led the premium smartphone segment, followed by Samsung. For the first time ever, an iPhone (iPhone 13) topped the overall India smartphone quarterly shipment rankings. (GSM Arena, Counterpoint Research)

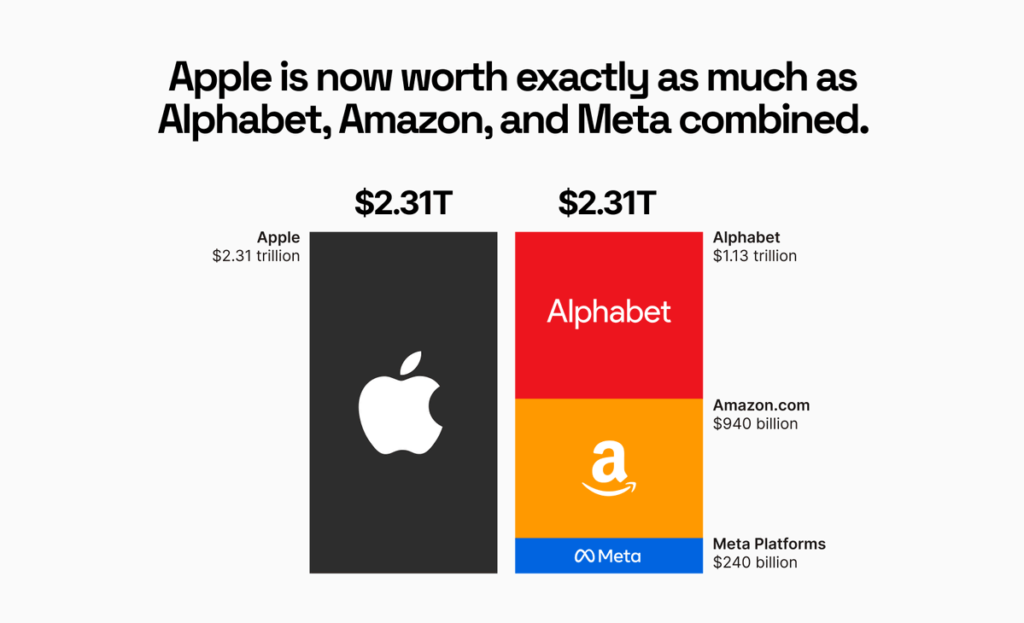

Apple’s market value briefly eclipsed the value of Alphabet, Amazon, and Meta combined, according to market data by Yahoo Finance. When markets closed in first week of Nov 2022, Apple had a market value of USD2.307T, while the market value of Amazon, Alphabet, and Meta combined was USD2.306T. Alphabet leads the group with a market value of USD1.126T alone. (MacRumors, Yahoo, Mashable, Business Insider)

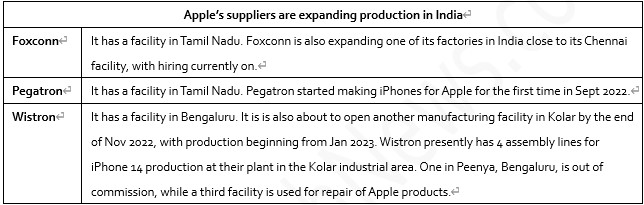

Apple’s Taiwanese contract manufacturer Pegatron has started assembling the latest iPhone 14 model in India. This makes Pegatron the second Apple supplier to produce the iPhone 14 in the country. Foxconn’s plant in Zhengzhou- the largest manufacturing facility for iPhones in the world – was recently put under lockdown as China sticks to its strict zero covid policy. Apple’s contract manufacturers in India – Foxconn, Wistron and Pegatron – are on an expansion phase, adding more assembly lines to their facilities to offset a slowdown in iPhone manufacturing in China ahead of the upcoming Chinese New Year amidst robust local demand. (Laoyaoba, UDN, CNYES, Economic Times, Bloomberg, Yahoo)

Garmin has 2 brand stores across India. They are located in Pune and Delhi NCR. Now, Garmin has announced the launch of its new experience brand store in the country. This takes the total number of Garmin brand stores in India to 3. The company aims to set up 7 more stores in India by the end of 2023.(Gizmo China, Fonearena, Financial Express)

OPPO has announced that its self-developed intelligent cross-end system, Pantanal, will integrate the Matter protocol for the first time to build a broader, more connected and open ecosystem. OPPO has said that the smart cross-end system Pantanal, as part of ColorOS, expands the smart cross-end capability of ColorOS as an operating system, and can break the differences and limitations between devices and systems to connect different devices with the help of Andes Smart Cloud AIoT platform. According to OPPO, Matter protocol is currently one of the important standard protocols in the global smart home field, which can connect devices that support WiFi, Thread and other connections through IP to create a seamless product experience with reliable security. (Techgoing, Laoyaoba, Sina, EET-China, IT Home)

According to Mercedes-Benz CTO Markus Schäfer, the company is happy to build human-driven taxis and a Level 3 automated system where drivers can basically stop paying attention while on the highway. The company is in the midst of a supercharged transformation into an EV platform while working to become the first automaker to have a passenger vehicle for sale in the United States with Level 3 driver-assistance technology. The system allows the driver to not pay attention to the road or control the vehicle under very select circumstances — typically on the highway. (The Verge)

The venture between Stellantis and Guangzhou Automobile Group producing Jeep vehicles in China will file for bankruptcy, after a lengthy decline for the oldest foreign auto brand in the world’s largest market. Stellantis has announced that it had fully impaired the value of an investment in the joint venture in its results for 1H22. It also said it would continue to provide service to Jeep customers in China. GAC, which approved the bankruptcy filing, said the joint venture had liabilities of almost 111% of its assets of CNY7.3B (USD1.00B). The bankruptcy will not have a significant impact on GAC’s operations. Stellantis terminated the venture with GAC in Jul 2022, only months after it said it would raise its stake in the business to 75% from 50%. In the following days, GAC criticized Stellantis and said it was “deeply shocked” by comments from the European automaker about the end of their joint venture in China. Sales at the joint venture, which produced and sold the Jeep Cherokee and Compass crossover, have been in sharp decline the past 4 years. Volume fell by 50% in 2021 from the previous year to 20,396. In 2022, the JV sold fewer than 2,000 vehicles. In May 2022, it reported selling only a single vehicle. (My Drivers, Sohu, Sina, 36Kr, Stellantis, Reuters, Just-Auto, Auto News)

Taiwan-based Hon Hai Precision Industry has partnered with Saudi Arabia’s sovereign wealth fund Saudi Public Investment Fund (PIF) to build electric vehicles. The new brand, Ceer, will license component technology from BMW, and design and manufacture vehicles in Saudi Arabia for consumers in the Middle East and North Africa region. The plan is to roll out the first Ceer vehicles in 2025. The PIF said that Ceer would offer SUVs and saloons in Saudi Arabia, the rest of the Middle East and north Africa. The fund said the business was projected to add USD8B to the kingdom’s GDP by 2034 and create up to 30,000 jobs. (TechCrunch, Financial Times, PIF, Asia Nikkei)

The PayPal and Venmo iOS apps will soon offer Apple’s Tap to Pay on iPhone functionality, allowing merchants that use PayPal or Venmo to accept contactless debit or credit cards and mobile wallet payments, including Apple Pay. Introduced in Feb 2022, Tap to Pay is designed to allow compatible iPhones to accept payments via Apple Pay, contactless credit and debit cards, and other digital wallets with no additional hardware required.(The Verge, MacRumors)

Ant Group has been quietly forming partnerships with local payments providers in Asia. It is built something akin to the Mastercard or Visa network for digital payments, allowing consumers to travel easily with their mobile wallet from home. Ant dubs the payments processing network Alipay+ to distinguish it from Alipay, its consumer-facing wallet that has become ubiquitous in China. Alipay+ has integrated with 15 payment methods, allowing its partnered merchants to reach more than 1B consumers, according to Angel Zhao, president of international business at Ant Group. It is now supporting over 2.5M businesses around the world today.(TechCrunch, Business Wire, Sina, IT Home)