11-25 #Thanksgiving : OPPO to continue to invest in the underlying technology of chipsets; OPPO claims they do not have inventory problem in 2022; Xiaomi has revealed that the current inventory in China has returned to the health level; etc.

SuperGaming, a Pune-based game development firm, has announced that it is collaborating with Google’s cloud unit Google Cloud to bring its game engine SuperPlatform to developers worldwide, allowing them to create better games. The platform will be available to game developers as a software-as-a-service (SaaS) model and will act as an independent software vendor on Google Cloud. It will enable game developers to manage live operations, matchmaking, player progression, player data, analytics, monetization systems, server scaling, sales, and merchandising, in addition to integrating with popular game development platforms like Unity, Unreal Engine, PlayCanvas, and Cocos Creator. (TechCrunch, Money Control)

Liu Bo, vice president of OPPO and president of China, said that the Reno series has accumulated 70M users worldwide, and the brand repurchase rate exceeds 56%. OPPO will continue to build the Reno series in terms of appearance, video, and smoothness, and bring high-end experience to the mid-range product line. He has revealed that OPPO has always maintained a sound financial strategy, with sufficient cash flow, and there is no need to sell goods to get cash to promote business. He said that there is no obvious pressure to clear inventory in 2022. OPPO must accurately predict demand and market conditions. In 2021 and 2022, there is not no inventory at all, but it has maintained relative restraint and rationality.(My Drivers, Sina, C114)

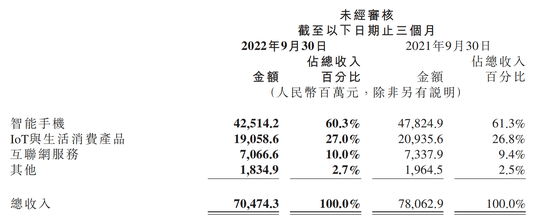

Wang Xiang, a partner and president of Xiaomi Group, has revealed that the current inventory in China has returned to the health level. Now it will use several important (promotion) festivals to deal with overseas inventory problems, but some inventory is for 4Q22. As the sales will see the inventory decline, the inventory will not cause great problems in general, and the current YoY and MoM are reduced by 9%.(Sina, CNMO, My Drivers)

Finnfund invests USD3.4M in KaiOS Technologies, maker of KaiOS, the leading mobile operating system for smart feature phones. It has been estimated that 3.4B people in emerging markets do no use internet despite living in areas with mobile broadband coverage. One of the greatest barriers to mobile internet adoption is the cost of a smartphone, often being more than 20% of monthly income. KaiOS brings mobile connectivity to millions of people in emerging markets by providing an operating system that allows manufacturers and operators to make KaiOS powered phones affordable.(TechCrunch, FinnFund)

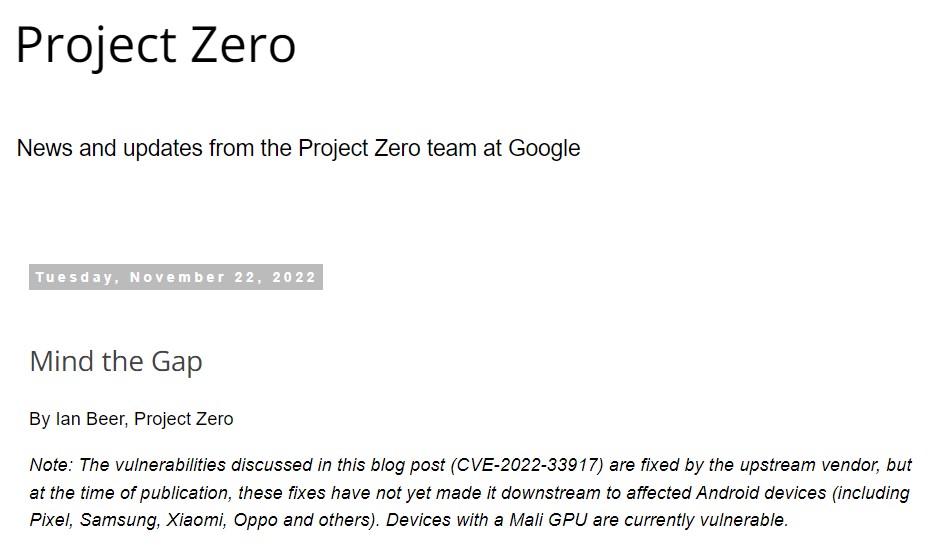

Google has disclosed several security flaws for phones that have Mali GPUs. Google’s Project Zero team says it flagged the problems to ARM (which designs the GPUs) back in the summer 2022. ARM resolved the issues on its end in Jul / Aug 2022. However, smartphone manufacturers including Samsung, Xiaomi, OPPO and Google itself have not deployed patches to fix the vulnerabilities. Researchers identified five new issues in June and July and promptly flagged them to ARM. “One of these issues led to kernel memory corruption, one led to physical memory addresses being disclosed to userspace and the remaining three led to a physical page use-after-free condition”, according to Project Zero’s Ian Beer. (Engadget, Google)

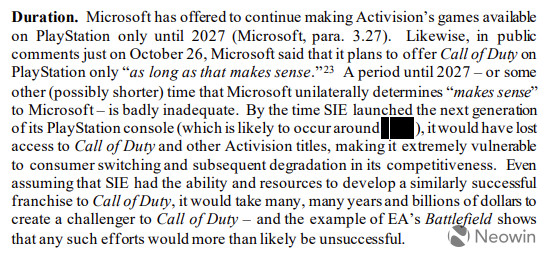

Sony appears to already be planning the release of its next console generation, Playstation 6 (PS6). As a document from the company says that it will happen around 2027. The document has been made public as part of the investigation by the UK’s Competition and Markets Authority into Microsoft’s USD68B acquisition of Activision Blizzard, a deal that Sony has opposed.(Neowin, Sony, GizChina, Playstation Lifestyle)

The global TV sales in the first 3 quarters of 2022 were 143M units, with sale revenue hitting USD72.39B, a YoY decrease of 4.4% and 12.7%, respectively, according to Omdia. In terms of sale revenues, Samsung, LG Display, and China’s TCL ranked the top 3 with a market share of 30.2%, 17%, and 9.3%, respectively. For the shipment volume, Samsung claimed the largest share of 20.2%, followed by LG Display’s 12%. Chinese TV manufacturers TCL, Hisense, and Xiaomi entered the top 5, with 11.7%, 10.1%, and 6.5% market shares. According to Omdia’s data, Samsung Electronics and LG Display account for 37.5% and 16.2% of the premium ultra-large screen TVs of 75” or larger. Sony has a market share of 13.2%, followed by Chinese brands TCL and Hisense, with sales percentages of 10% and 9%. (Laoyaoba, KED Daily, Hankyung)

Tesla’s “Full Self-Driving” Beta, which has been gradually rolling out over the past couple of years, is now available to anyone who’s paid for the feature in North America, as the CEO Elon Musk announced, “Tesla Full Self-Driving Beta is now available to anyone in North America who requests it from the car screen”. Getting access to the beta has typically required that drivers hit a minimum safety threshold with Tesla’s built-in Safety Score feature as well as logging 100 miles using the company’s advanced driver-assist feature Autopilot.(Pocket-Lint, The Verge, Twitter)

General Motors (GM) is aiming to have more than 15 new electric vehicle models, based on General Motors’ dedicated EV platform Ultium, on offer to Chinese customers by 2025, in a bid to catch up with leaders in the world’s biggest EV market. In Sept 2022, the American legacy carmaker began delivery of the Cadillac Lyriq crossover, its first Ultium-based vehicle introduced to China and locally made with partner SAIC. The company plans to sell imported premium EVs via a new direct sales business platform in 2024, including a fully electric Hummer and Cadillac Celestiq. GM’s China sales increased by 1% YoY to around 629,900 vehicles in 3Q22.(Laoyaoba, Seeking Alpha, Technode, GM)

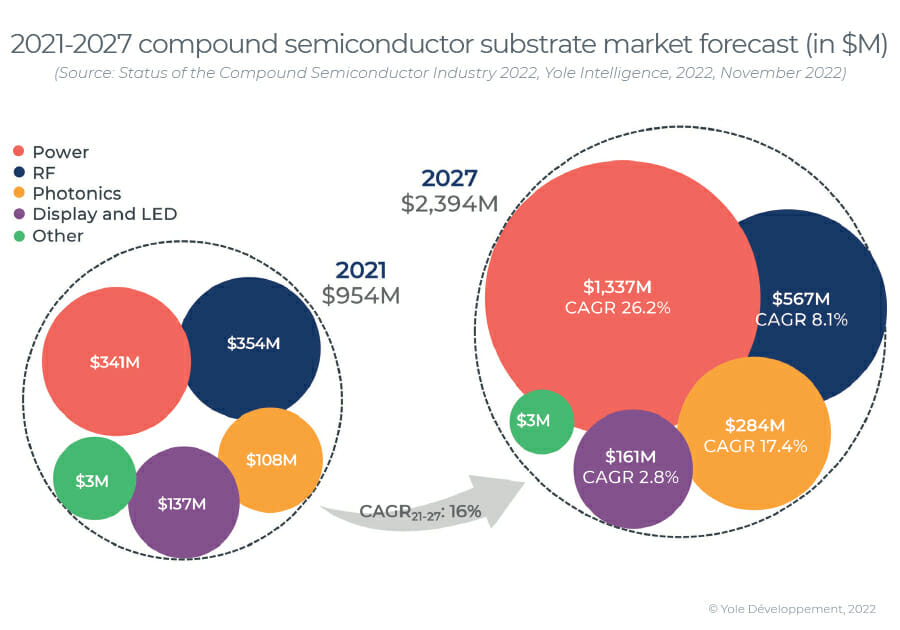

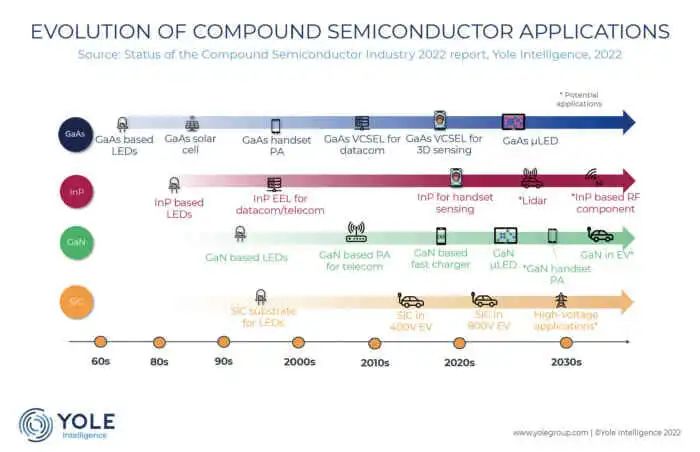

The global compound semiconductor (CS) substrate market is strongly driven by power and photonics applications and will be worth close to USD2.4B by 2027 with a 16% CAGR, according to Yole Intelligence. Chinese company SICC in eastern China’s Shangdong Province is among the leading suppliers in the world. CS has been adopted in various applications over the past decades; recently, however, SiC and GaN in power, GaN and GaAs in RF, GaAs and InP in Photonics, and LED and µLED in display, have all gained momentum. As a result, the substrate and epiwafer markets are also expected to grow, said the Yole Intelligence report. (Laoyaoba, Yole Development, Semiconductor Today, EET China)

Samsung Electronics will make semiconductors with the 3nm process node for its clients, including Nvidia, Qualcomm Technologies, IBM and China’s Baidu. Samsung is jointly developing advanced chips with 5-6 fabless clients for supply in large quantities from as early as 2024. According to Samsung, its 3 nm technology improves power efficiency and chip performance by 45% and 23%, respectively, compared with its earlier 5 nm technology. Further, Samsung said it plans to commercialize more advanced 2 nm GAA technology by 2025 to become the top player in the foundry market by 2030. (Laoyaoba, Appuals, KED Global)

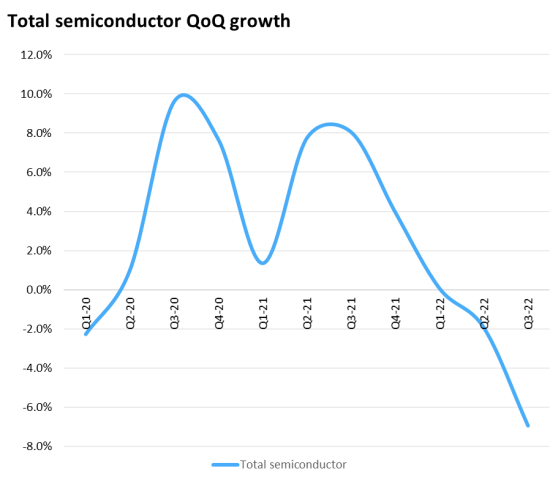

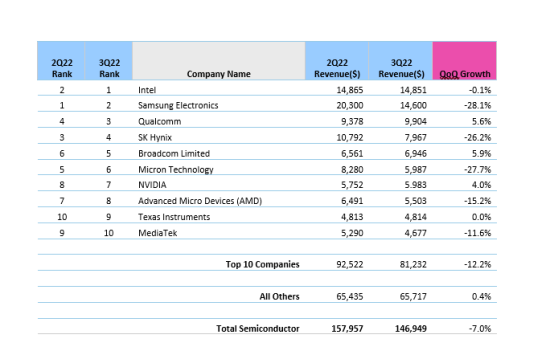

The semiconductor market has had an exceptional run of sequential revenue growth during the COVID-pandemic period that began in early 2020 according to Omdia. A record eight-straight quarters of revenue growth occurred during this time. Now the market has begun to shrink for the last 2 quarters. 3Q22 semiconductor revenue was USD147B, down 7% from the previous quarter of USD158B. The three memory-focused companies (Samsung Electronics, SK Hynix, and Micron Technology) all dropped one position. While the major memory suppliers accounted for a drop of over USD10B in semiconductor revenue for 3Q22, they were not the only companies to struggle. AMD revenues declined as they experienced a slow-down in demand for PCs and inventory reductions, the same market conditions that Intel felt the previous quarter. (My Drivers, Business Korea, Omdia, SamMobile)

Semiconductor Manufacturing International Corp (SMIC) would provide 340,000 units of 12” wafers in the next 5-7 years in new production line projects at its fabs in Shenzhen, Beijing, Shanghai, and Tianjin. SMIC has revealed that at least a third of the new capacity would meet the dynamic demands, and the rest two thirds will be for market segments and technology iteration. Currently, about 70% of the company’s production capacity is from the Chinese market, and 30% comes from overseas.(Laoyaoba, EET-China)

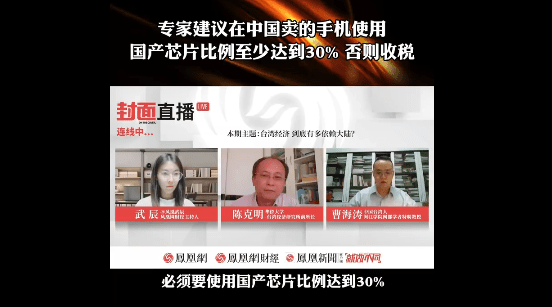

Cao Haitao, a Distinguished Professor of Mindu Scholars at Minjiang University, has said that 30% of smartphones sold in China must use Chinese chips. He also suggests that any brand that chooses to do otherwise should pay up to 400% more tax. Cao Haitao also said that the purpose of this is to cultivate the Chinese market. This is because when there is a market, there is income, and when there is income, there is R&D investment. Otherwise, it will always be controlled by others. Chen Keming, former director of the Taiwan Economic Research Institute of Huaqiao University and director of the National Taiwan Research Association, said that TSMC is the leader in the semiconductor industry in Taiwan, but its high valuation is a problem. 80% of TSMC’s shareholders are overseas, and only 20% are in the hands of Taiwan compatriots. In other words, 80% of the money the industry makes is taken by foreigners. (GizChina, My Drivers, Sina, Sohu)

Liu Bo, vice president of OPPO and president of China, revealed that OPPO will continue to invest in the underlying technology. Currently, the number of chip teams is still increasing, and new products will be launched soon. In addition, OPPO has been operating in accordance with the norms and standards of listed companies, but there is no clear time to go public. The OPPO Reno9 series is equipped with the self-developed Mariana MariSilicon X chip. It is reported that OPPO has placed an order for more than 10M chips with TSMC. Liu Bo said that the current chip consumption has exceeded 10M, “there will be some more orders later”.(Laoyaoba, NBD, Sina)

Xiaomi President Wang Xiang has said that the U.S. chip ban has no effect on Xiaomi, and the supply of chips is stable. In addition, Wang Xiang said that the company is progressing very smoothly for Xiaomi’s goal of formal mass production in 2024. At present, the efficiency and scale of Xiaomi’s investment in car manufacturing will not have a major impact on the group. At present, the Xiaomi car research and development team has more than 1,800 people.(Laoyaoba, Sohu, Sina)

When the U.S. government imposed sweeping sanctions against Chinese semiconductor and supercomputer sectors in Oct 2022, the global semiconductor industry immediately lost some USD240B in stock valuation. According to Applied Materials, a major maker of fab tools, Chinese companies can tune their process technologies to circumvent the new rules slyly. Brice Hill, the chief financial officer of Applied Materials, has indicated that they expect some customers may decide to change their plan or change their technology, so it does not go above the threshold that is affected by the rules at this point. The latest U.S. export regulations restrict the import of American tools and technologies that can produce logic chips with non-planar transistors on 14nm / 16nm nodes and below, 3D NAND with 128 or more layers and DRAM memory chips of 18nm half-pitch or less. SMIC could possibly come up with a 17nm fabrication process, whereas YMTC could reduce the number of active 3D NAND layers in its chips. (TechNews, Tom’s Hardware, Yahoo, Seeking Alpha, BIS)

SFC, the joint venture between Samsung Display and Japanese chemical firm Hodogaya, has succeeded in nullifying a patent related to deuterium used in OLED in South Korea. The patent in question is co-owned by LG Display and Material Science, and was canceled in a ruling by the Intellectual Property Trial and Appeal Board in Jun 2022. SFC had filed a request to the board to have the patent, called 2277303 and concerning organic field-effect emitting device, canceled in January. The patent deals with deuterium, one of two stable isotopes of hydrogen and a material used to increase the life of OLED devices. LG Display had said late 2021 that it plans to apply deuterium technology to all its large OLED panels starting this year. The company even has a brand called OLED.EX, an OLED panel with 30% increased brightness thanks to the use of deuterium. However, a family patent of 2277303 called 2136806, which also relates to deuterium, is still registered. The patent’s owners are also LG Display and Material Science and registered back in Jul 2020.(My Drivers, Sina, EET-China, The Elec)

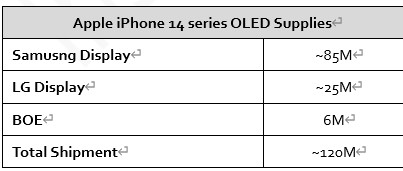

Samsung Display is supply over 70% of the OLED panels that Apple use for its iPhone 14 series. Samsung Display supplies OLED panels for all four models; LG Display supplies LTPS for the regular 6.1” model and LTPO for the 6.7” Pro Max model. BOE only supplies LTPS for the 6.1” regular iPhone. Samsung Display supplies OLED panels for all four models; LG Display supplies LTPS for the regular 6.1” model and LTPO for the 6.7” Pro Max model. BOE only supplies LTPS for the 6.1” regular iPhone.(Gizmo China, The Elec)

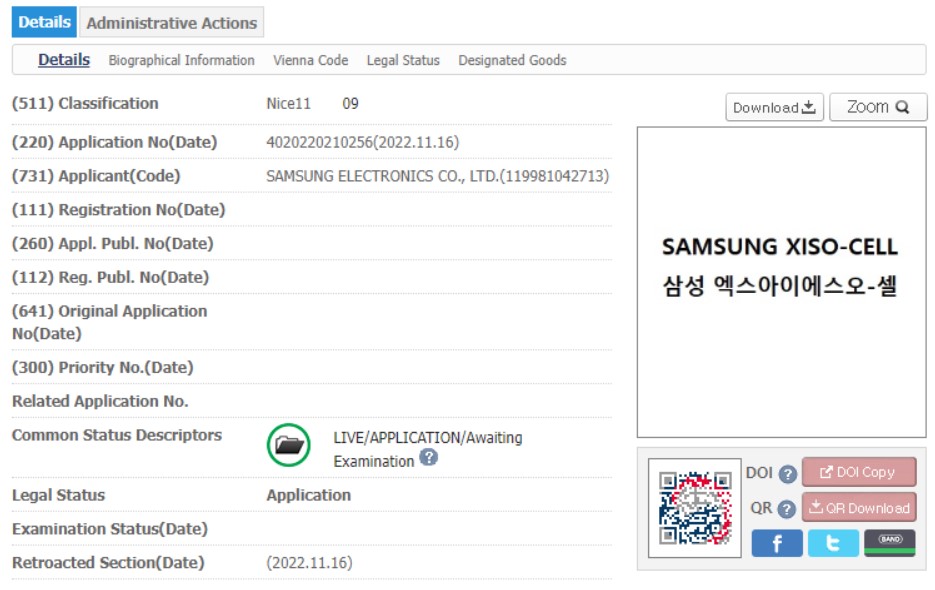

Samsung has recently applied for trademark rights for the XISO-CELL branding with KIPRIS (Korea Intellectual Property Rights Information Service) in South Korea. The ISOCELL branding originated from the words “isolated cells”, which was Samsung’s way to reduce interference and noise from two adjoining pixels in a camera. (GizChina, IT Home, SamMobile, GalaxyClub)

Zeiss Korea is building a R&D center for semiconductors and electron microscopes in Korea. They will pour in funds reaching KRW50B over 4 years. They will cooperate with semiconductor manufacturers and clients to develop new equipment. With plans to open as early as 2023, they began recruiting a workforce. Zeiss Korea is planning to develop equipment tailored for Korea to respond to the demands of electron microscopes and semiconductor equipment, which are their main solutions.(Laoyaoba, ET News)

According to IC Insights, the DRAM market often enjoys robust sales in 2H22 when system makers place orders for memory to use in their new generation of products that they plan to release for the year-end holiday season. That scenario has not panned out in 2022. Weakening economic conditions and high inflation rates have slowed global demand for personal computers, mainstream smartphones, and other consumer electronics. As a result, DRAM demand has spiraled downward and sales are now forecast to fall -40% to USD29.3B in 2H22 compared to USD49.0B in 1H22. For all of 2022, the DRAM market is forecast to fall -18%. The big three memory makers noted in their earnings conference calls that inflation had put a dent in consumer discretionary spending, at a time of year when sales normally heat up. Add ongoing supply chain disruptions and bloated inventory levels and a DRAM market correction was almost unavoidable. (IC Insights, Laoyaoba)

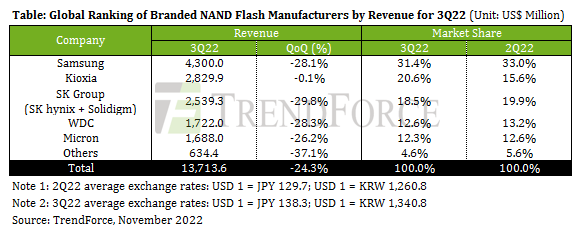

TrendForce reports that the whole NAND Flash market was severely weakened by plummeting demand in 3Q22. Because shipments of end products including consumer electronics and servers had been below expectations, the overall NAND ASP fell by 18.3% QoQ. Furthermore, the general economic outlook remained pessimistic, so enterprises across many sectors started to scale back their capital expenditure plans and halted the momentum of their procurement activities. Due to this development, the problem of excess inventory eventually spread to NAND Flash suppliers. The pressure on suppliers to make sales was ratcheted up dramatically. According to TrendForce’s investigation, NAND Flash bit shipments fell by 6.7% QoQ for 3Q22, and the overall NAND Flash ASP also kept sliding. On account of the unfavorable market situation, the NAND Flash industry recorded a total revenue of around USD13.71B for 3Q22. The QoQ revenue decline reached as much as 24.3%. (Laoyaoba, TrendForce, TrendForce)

BlueOval SK, the battery joint venture between SK On and Ford, is unlikely to Chinese equipment maker for its planned factory in the US due to the ongoing trade war between the US and China. Ultium Cells, the joint venture between LG Energy Solution and General Motors, had also excluded Chinese suppliers for their factories for the same reason. South Korean equipment makers Kapjin and Wonik PNE are taking part in BlueOval SK’s equipment bidding order for its planned factory in Tennessee. Out of the KRW3T that will be spent on the factory, around KRW1T will be for equipment. Kapjin and Wonik PNE are experts in making formation and cycler equipment used in battery production. (Laoyaoba, The Elec)

Electric vehicle startup Nio is accelerating its expansion in Europe. It has just launched its first power-swapping station in Varberg, Sweden. The company has begun by offering lease-only for its models in all European countries except Norway but shortly added the option for customers to purchase the vehicles after initial market feedback. It’s also ramping up its operational footprint in Europe, with an R&D center in Berlin to work on “localized development and deployment of digital cockpits and to continuously improve the intelligent digital experience of local users.”(TechCrunch, Linkedin, IT Home)

Sunwoda Electric Vehicle Battery will supply batteries for German automaker Volkswagen’s HEV project. Sunwoda’s production capacity of its batteries with ultra-fast charging tech is ramping up, which will be one of the company’s important development directions in the future. The company’s current ultra-fast charging batteries use ternary cathode materials and will also develop batteries with lithium iron phosphate cathode materials in the future to enrich the company’s product portfolios. The company has cooperated with many well-known domestic and international auto manufacturers such as Geely, Dongfeng, Liuzhou Motor, Renault, Nissan, eGT New Energy Auto, SAIC-GM-Wuling, GAC, SAIC, and SAIC Maxus. In the future, as the company’s new customers’ orders increase, its power battery business customers will be more diversified, according to Sunwoda. (Sunwoda, Sunwoda, Laoyaoba, Laoyaoba)

CCIG, a subsidiary of China’s leading investment company China International Capital Group, announced to work with local governments to set up a new material industry fund with a total scale of CNY5B (USD698.71M) in Yangzhou, eastern China’s Jiangsu Province. CCIG will cooperate with the local government and Shenda Group, an industrial cornerstone investor, to manage the fund investment in key fields such as new energy and new materials. The initial investment scale is expected to reach CNY2B (USD279.49M). CCIG said it would give full play to its professional advantages and brand influence to help the city build a regional industrial innovation highland. (Laoyaoba, Laoyaoba)

Ericsson is to establish a new research unit in the UK as part of a multi-million-pound investment to boost the country’s future wireless connectivity capabilities. Tens of millions of pounds (GBP) will be invested by Ericsson over the next 10 years in a UK-based program that will focus on 6G research and breakthrough innovations. Research areas will include network resilience and security, artificial intelligence, cognitive networks and energy efficiency – all considered to be key building blocks of the world’s future digital infrastructure for society, industries and consumers. (Phone Arena, Ericsson)

Samsung is reportedly planning to add satellite communication feature to the upcoming Galaxy S23 series. Samsung is said to be partnering with Iridium, a global satellite communications company, to transmit data such as text messages and low-capacity images via satellite. Samsung is preparing to introduce satellite communication feature to upcoming Galaxy S23 smartphones with an aim to transmit data such as text messages and low-capacity images at hundreds of kbps. (Gizmo China, ET News)