12-6 #Freedom : TSMC’s new Arizona plant will allegedly offer advanced 4nm chips; TSMC will build 1nm fab in Longtan; Apple has reportedly accelerated plans to shift some of its production outside China; etc.

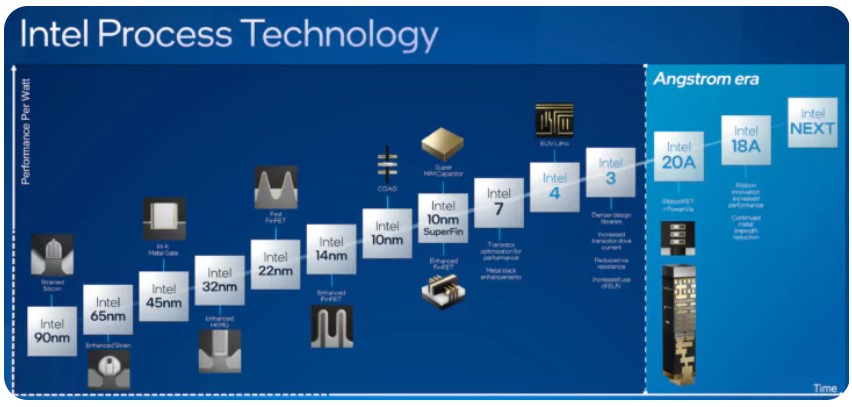

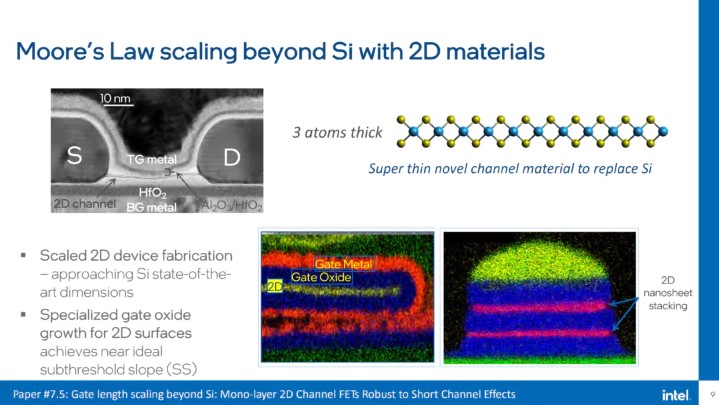

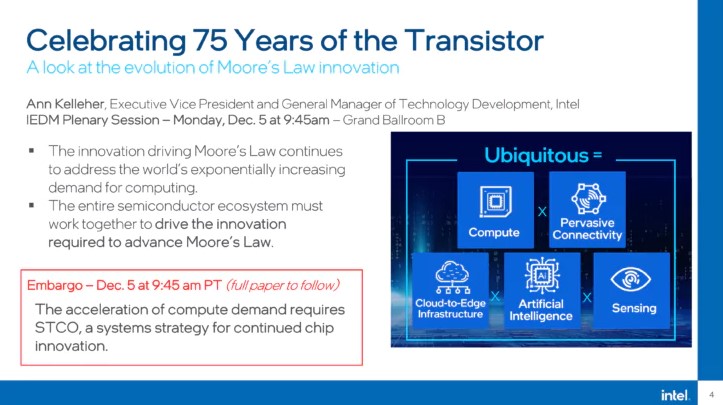

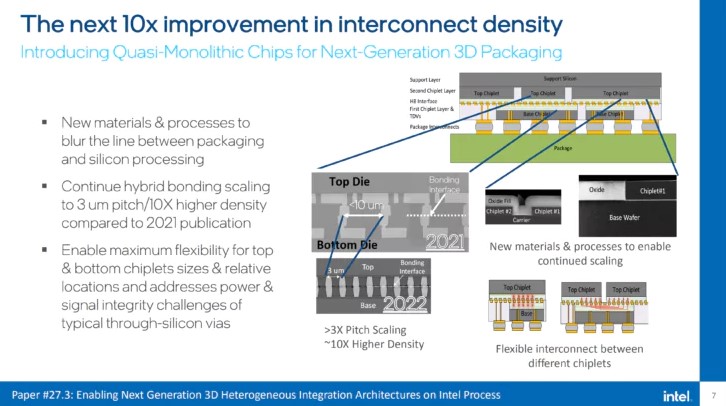

Intel Research has showcased how Moore’s Law is alive and how Intel plans to offer next-gen chips with a Trillion transistors by 2030. Intel targets new 10x density improvement in packaging technology and uses novel material just 3 atoms thick to advance transistor scaling. Intel researchers have showcased advancements in 3D packaging technology with a new 10x improvement in density; novel materials for 2D transistor scaling beyond RibbonFET, including super-thin material just 3 atoms thick; new possibilities in energy efficiency and memory for higher-performing computing; and advancements for quantum computing.(VentureBeat, WCCFTech, Intel)

Intel is offering thousands of workers in Ireland 3 months unpaid leave as the US chipmaker looks to cut costs by USD3B in 2023 to counter a dramatic downturn in the global industry. The company, which earlier in 2022 announced it was boosting investment at a new facility in Ireland, said employees at its manufacturing plant in Leixlip were being asked, not told, to consider the leave offer. Intel said the scheme is a “voluntary time-off programme”. Asked what would happen if too few, or too many, staff signed up, Intel added: “Staff can apply and the business will decide what it can manage”. The move comes as tech companies have announced a wave of job cuts in recent months as businesses tighten their belts to cope with an economic slowdown.(My Drivers, Yahoo, FT, Reuters)

Prodded by U.S. customers such as Apple, TSMC’s new Arizona plant will offer advanced 4nm chips when it opens in 2024. Wang Meihua, head of Taiwan’s regional economic department, denied the claim when she attended the event. Wang Meihua said that for TSMC’s new plant in the United States, Liu Deyin, chairman of TSMC, has made it clear that there will be 500 employees to support it, and all of them have fixed-term contracts. Regarding whether TSMC’s Arizona factory plans to produce 4nm chips, Wang Meihua emphasized, “This is what the media is talking about”. (Laoyaoba, LTN, UDN, Yahoo, TechNews)

Taiwan Semiconductor Manufacturing Co (TSMC) will build a wafer fab using the super sophisticated 1nm process in the Longtan section of Hsinchu Science Park, according to the head of the Hsinchu Science Park Bureau. The bureau completed a pilot project in mid-November for the third expansion phase of the Longtan section, which is located in Taoyuan, to accommodate the new TSMC plant, according to Wayne Wang, director general of the bureau. The company is spending USD12B to build a fab in the U.S. state of Arizona, with mass production to start in 2024, using the 5nm process, and is planning to introduce the 3nm process during phase II of the Arizona investment. The chipmaker is also developing the 2nm process and plans to build a fab using the technology in Hsinchu with commercial production scheduled for 2025. (My Drivers, CNYES, China Times, Focus Taiwan)

Developed by Lenovo for the Flatiron Institute in New York, the two petaflop Henri system is the first and only system using Nvidia’s Hopper GPU architecture to make it onto this fall’s Supercomputing leaderboards. The system itself is really more of an HPC cluster than a supercomputer, similar to Frontier or LUMI. Based around Lenovo’s ThinkSystem SR670 V2 server platform, each node pairs two 32-core Ice Lake Xeon Scalable processors with four of Nvidia’s 80GB H100 GPUs. With a total of 5920 cores between the CPU and GPUs, Henri is the second-smallest system on the list. At just over 65 gigaflops per watt, Henri managed to squeak past Oak Ridge National Laboratory’s TDS testbed, the prior efficiency champion. And that’s despite the fact Henri is only achieving 37.6 percent of its 5.4 petaflop maximum theoretical performance. (My Drivers, Lenovo, HPC Wire, The Register)

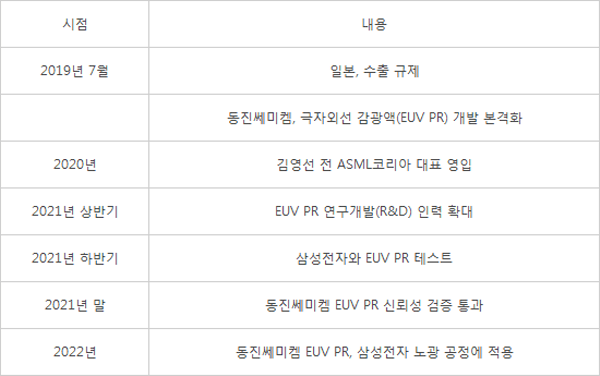

Samsung Electronics has introduced extreme ultraviolet (EUV) photoresist(PR) for high-tech processes developed by the Korean company Dongjin Semichem to their mass production line. This is the result after three years of flat-out efforts for localization due to Japan’s export regulations in 2019. Dongjin Semichem jumped into product development when Samsung Electronics attempted to reorganize their EUV PR supply chain after Japan’s export restrictions. In 2020, Young-sun Kim, former CEO of ASML Korea, was recruited as vice chairman to lay the groundwork for advancing into the EUV PR business. Early last year, they accelerated product development by securing additional EUV PR research and development (R&D) personnel.(My Drivers, Laoyaoba, ET News)

Visiting Vietnamese President Nguyen Xuan Phuc will hold a summit meeting with Korean President Yoon Suk-yeol in Seoul on 5 Dec 2022. The meeting will be reportedly attended by the heads of major Korean conglomerates such as Samsung, Hyundai Motor, LG and Lotte. A large-scale economic delegation was included in the Vietnamese delegation to Korea this time, so a deep discussion on business and investment cooperation is expected to take place through this meeting. The visiting Vietnamese president is highly likely to ask Samsung Electronics chairman Lee Jae-yong to set up a semiconductor plant in Vietnam. Meanwhile, Samsung Electronics will complete its Vietnamese R&D center, the largest in Southeast Asia, in Hanoi, Vietnam, at the end of December. The USD220M center will have 2,200 employees and will focus on the development of mobile terminals, networks, and software.(Business Korea, Laoyaoba)

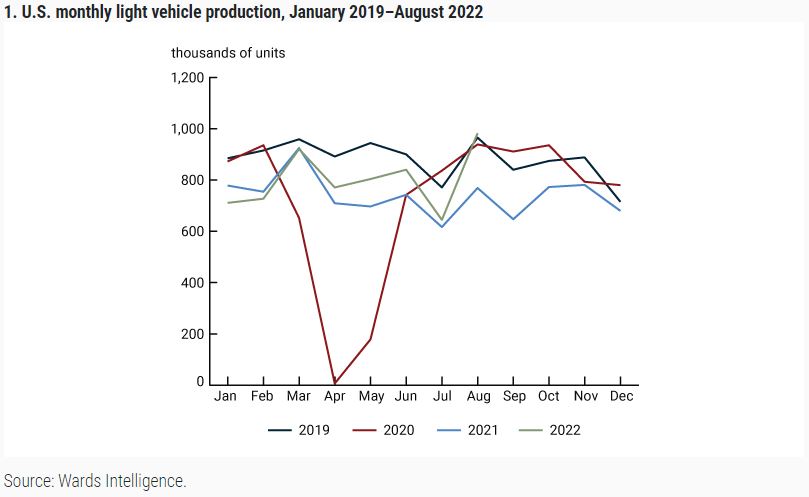

Kristin Dziczek, policy advisor or Federal Reserve Bank of Chicago, claims the shortage of microprocessors in the auto industry will last into 2024, mirroring other predictions made by industry insiders, most notably Intel CEO Pat Gelsinger. She attributes the continuing problem to several factors, including the cold snap in Texas early last year which left parts of the state without power, the Japanese earthquake which triggered a fire at a car chip supplier, China’s Zero Covid policy, and Russia’s invasion of Ukraine since both countries supply critical elements for chip production. All these problems have led S&P Global to estimate chip lead times are four times longer than before covid spread worldwide – that is a big problem. Dziczek points out the auto industry has dug itself into a hole, too. Automakers are absolutely in love with technology at the moment, we think because it justifies pushing car prices ever higher. But shoving all kinds of advanced systems into cars, especially with the push toward electrification and autonomous drive systems, means today’s vehicles require far more microprocessors than ever. (Wards Auto, Yahoo, Laoyaoba, Motorious, UDN, Chicago Fed)

Karnataka may become India’s first state to have a semiconductor fab. The International Semiconductor Consortium’s (ISMC) proposed USD3B fab may start construction as early as Feb 2023. The ISMC will make 40-65nm analog chips which will cater to “defence and auto sectors” and to some other sectors. The Centre had announced subsidies of up to 50 per cent of the project costs for semiconductor manufacturers under its INR76,000 crore Production-linked Incentive (PLI) scheme in 2021. Moreover, the latest set of restrictions imposed by the US on sales of semiconductor-making equipment to China has encouraged companies to shift to India. ISMC, which is a joint venture between UAE’s Next Orbit Ventures and Israel’s Tower Semiconductor, will be among the three consortia shortlisted by the Centre for incentives. Tower Semiconductor was acquired by Intel in Feb 2022. (Live Mint, TechNews, Laoyaoba, Trak.in)

According to DSCC analyst Ross Young, the upcoming Samsung Galaxy Z Flip lineup will come with a larger 3” cover display compared to the 1.9” screen on the current-gen Galaxy Z Flip 4. Apart from the cover display, the company is also expected to upgrade the hinge mechanism to make it less noticeable. (Gizmo China, Tom’s Guide, Twitter)

Xu Fengying, executive vice president and chief operating officer of Visionox, has revealed that the first domestic Micro LED production line built by the company will achieve mass production in Chengdu. The Micro LED production line is built by Chengdu Chenxian, a joint-stock company of Visionox. It is the first Micro LED pilot test line in China from driver backplane, mass transfer to full coverage of modules. It continues to iterate innovative technologies and improve the yield of mass transfer. and technological level to promote mass production. And made a breakthrough in the key technology of Micro LED – independently developed a large-size glass-based TFT hybrid drive mass production solution, the mass transfer yield reached 99.95%, and continued to promote mass production.(DoNews, Laoyaoba, Sohu)

BOE has showcased what is the world’s first 600Hz laptop display. The current lineup of gaming laptops does not offer such a high refresh rate and the display will come with added technology. The current Nvidia RTX 4000 series are unlikely to support a 600Hz display. BOE is showcasing several display technologies. The lineup of innovative BOE offerings includes the 34” ultra-wide Mini-LED gaming screen with 165Hz refresh rate, Z-shape folding smartphone displays, and a 16” 600Hz laptop screen. The 600Hz display also comes with 1.66ms fps. The laptop could use TN or IPS panels and either FHD or FHD+ display resolution. The aspect ratio of the 600Hz laptop is 16:10.(Gizmo China, IT Home)

GalaxyCore has released the world’s first single-chip 32Mp CMOS image sensor, GC32E1. This product adopts the GalaxyCell 0.7μm process of the latest FPPI patented technology of Gekewei, and cooperates with the 4Cell Bayer architecture to achieve equivalent 1.4μm pixel performance. At the same time, it supports sHDR video recording, providing a mature high-pixel solution for high-end smartphones’ proactive needs. GC32E1 is GalaxyCore’s first image sensor based on the latest FPPI patented technology with 0.7μm pixels, supporting 32M full-pixel output. With the Remosaic decoding function of the mobile phone platform, it can achieve high-resolution, detailed and colorful image effects. In nighttime, dark conditions and other environments, it supports 4Cell synthesis equivalent to 1.4μm 8M pixel output, which can take bright and clear photos.(Laoyaoba, iFeng, GalaxyCore)

Samsung is collaborating with Zigbang to bring the first UWB-equipped smart door lock. Those with a UWB-equipped Galaxy smartphone and the Samsung Wallet app can enter and exit a home with Zigbang’s new door lock. Unlike smart door locks that require NFC, this door lock does not need to be tapped with the smartphone. Moreover, with the Zigbang app, registered family members can know who is entering and exiting the home. The new smart door lock is also compatible with Samsung’s Find My Device network, so when a smartphone is lost, the user can simply log into the Find My Device website and delete the digital key for Zigbang’s door lock. Samsung said it would collaborate with more brands to bring UWB-based smart home devices. (Gizmo China, IT Home, SamMobile)

The European Union is now deciding whether to allow flights to provide 5G services in the air. If the bill is approved, the EU will require carriers to offer 5G networks to users instead of paying for Wi-Fi. It also means that the mandatory shutdown of cell phones or putting phones in flight mode will end. If the EU approves the bill, airlines will have 6 months (until 30 Jun 2023) to prepare these 5G networks. The aircraft will use special network equipment called “pico cells” to connect the aircraft to the ground. With this technology, passangers will transmit calls, texts, and internet data over the terrestrial satellite network. (GizChina, IT Home, Travel Radar, Silicon, Yahoo, Europa)

Short Messaging Service (SMS) has turned 30, and to celebrate its birthday, Google has announced that its Messages app will support end-to-end encryption for group chats, a feature that’s been available for one-on-one conversations for a couple of years. In addition to announcing end-to-end encryption for group chats, Google has also announced that the Messages app will soon let users react to RCS (Rich Communication Services) messages with any emoji, similar to WhatsApp. (GSM Arena, Google)

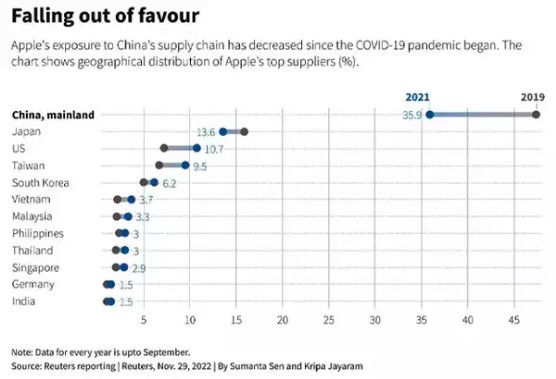

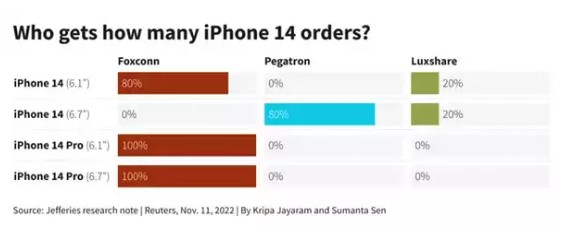

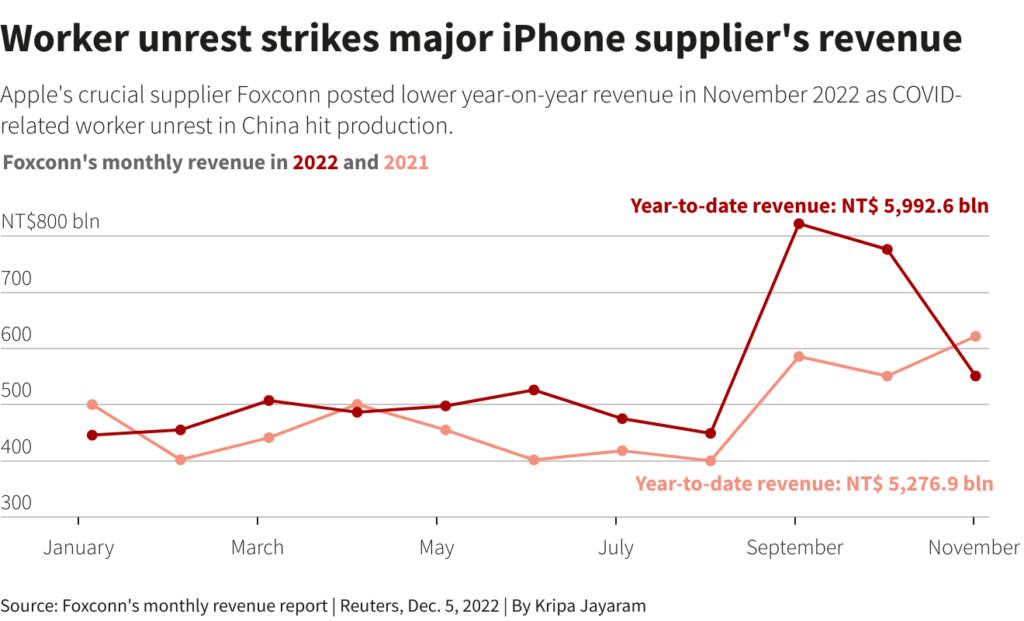

Apple has reportedly accelerated plans to shift some of its production outside China, long the dominant country in the supply chain that built the world’s most valuable company. It is telling suppliers to plan more actively for assembling Apple products elsewhere in Asia, particularly India and Vietnam, and looking to reduce dependence on Taiwanese assemblers led by Foxconn Technology Group. Apple’s longer-term goal is to ship 40-45% of iPhones from India, compared with a single-digit percentage currently, according to Ming-chi Kuo, an analyst at TF International Securities who follows the supply chain. Suppliers say Vietnam is expected to shoulder more of the manufacturing for other Apple products such as AirPods, smartwatches and laptops. (Apple Insider, WSJ, Live Mint, Business Insider, India Times)

Hon Hai Precision Industry has announced that the company increased its Czech subsidiary, Foxteq CZ s.r.o, by about USD58.98M through reinvestment through subsidiaries; at the same time, it also increased its capital in Taiyuan Fuchi Technology by CNY1B to expand its production capacity in Europe and China. Foxconn (Far East) Limited, a subsidiary of Hon Hai, increased the capital of FoxteqCZ s.r.o through Foxteq Holdings Inc., Foxteq Integration Inc., PCE Paragon Solutions Kft and other reinvestment structures in sequence. It is understood that Foxteq CZ s.r.o is a subsidiary of Hon Hai in the Czech Republic. The local bases of the group are located in Kutna Hora and Pardubice. In addition to manufacturing displays, mobile phones, wireless communications, confidential machinery, cloud servers and other products, Foxteq CZ s.r.o also has R&D facilities. and Design Center.(Market Screener, Laoyaoba)

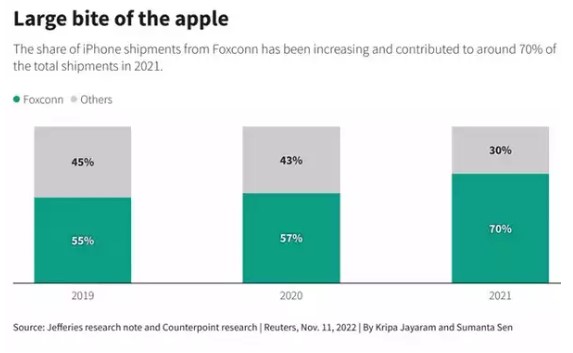

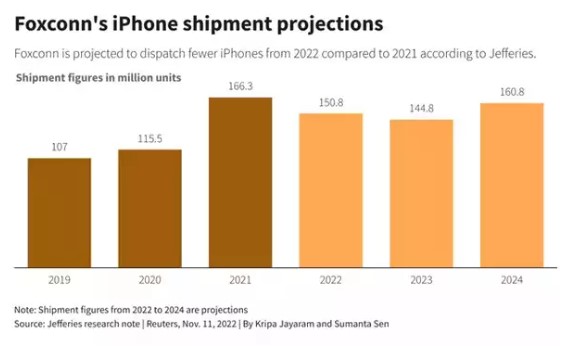

Apple supplier Foxconn expects its COVID-hit Zhengzhou plant in China to resume full production around late Dec 2022 to early Jan 2023, after worker unrest in Nov 2022 disrupted the world’s biggest iPhone factory. Foxconn assembles around 70% of iPhones, and the Zhengzhou plant produces the majority of its premium models including iPhone 14 Pro. (Apple Insider, MacRumors, Reuters)

HMD Global, the exclusive licensee of Nokia-branded smartphones, has filed a complaint to EU antitrust regulators against VoiceAge EVS’s patent practices and royalty rates. Disputes over royalties have dogged the telecoms industry since the last decade. The most high profile were between Apple and Samsung Electronics, and Apple versus Qualcomm (QCOM.O) which the companies eventually settled among themselves. HMD and VoiceAge EVS, which was set up in 2018 to license Canadian tech company VoiceAge Corp’s enhanced voice services patent portfolio, are fighting in courts in Germany, the United States and Brazil over various patents for technology related to voice calls.(Laoyaoba, Reuters)

Google’s Android Partner Vulnerability Initiative (APVI) has publicly disclosed a new vulnerability that affected devices from Samsung, LG, and others. The core of the issue is that multiple Android OEMs have had their platform signing keys leaked outside of their respective companies. This key is used to ensure that the version of Android that iss running on device is legitimate, created by the manufacturer. That same key can also be used to sign individual apps. By design, Android trusts any app signed with the same key used to sign the operating system itself. A malicious attacker with those app signing keys would be able to use Android’s “shared user ID” system to give malware full, system-level permissions on an affected device. In essence, all data on an affected device could be available to an attacker. (Phone Arena, Twitter, Twitter, 9to5Google)

Xiaomi celebrates 8 years of Redmi Note sales in India, and it announced that it shipped over 72M units of the series since the first smartphone was announced back in 2014. The main reason for the huge success is the rapid expansion of the retail network, with 3,000 stores and service centers across India alone.(Gizmo China, GSM Arena, Twitter)

Nothing founder Carl Pei has revealed that after sticking to markets in Europe, the Middle East and Asia, smartphone company Nothing may launch a future model in the US. The company is in discussions with some carriers in the US to potentially launch a future product there. He has indicated that the different US carrier bands and other issues make launching a new device complicated for a startup. The company said it has sold 500,000 units since it launched in Jul 2022, along with 600,000 of its wireless earbuds. It expects to see USD250M in revenue in 2022.(Engadget, CNBC, Neowin)

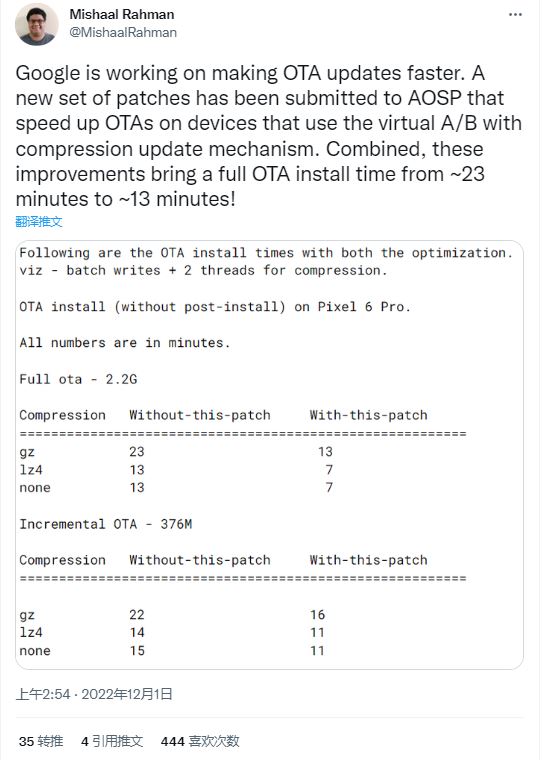

Google is working on speeding up the installation of OTA updates on devices that support virtual A/B partitions with a compression mechanism. Looking to reduce the time it takes a Pixel user to install an OTA (over-the-air) update, Google has submitted new patches to the Android Open Source Project (AOSP) gerrit.The patches took 10 minutes or 43% off the time required to install a 2.2GB OTA update on a Pixel 6 Pro. The patches also reduced the time it took to install an incremental 376MB update to 16 minutes from 22 minutes (a 27% reduction). Google introduced Seamless Updates for Android with Android 7.0 Nougat which was released in the summer of 2016.(Phone Arena, Android Police, Twitter)

Mass shipments of Apple’s long-rumored AR / VR headset may be delayed until 2H23 due to unspecified “software-related issues”, according to TF Securities analyst Ming-Chi Kuo. Kuo has said mass shipments of components for the headset are still likely to begin in 1H23, but he believes that mass shipments of fully assembled headsets may not begin until 2H23. Apple’s headset is expected to be an expensive, niche product, with Kuo forecasting that the company will ship fewer than 500,000 headsets in 2023. (Apple Insider, Twitter, MacRumors)

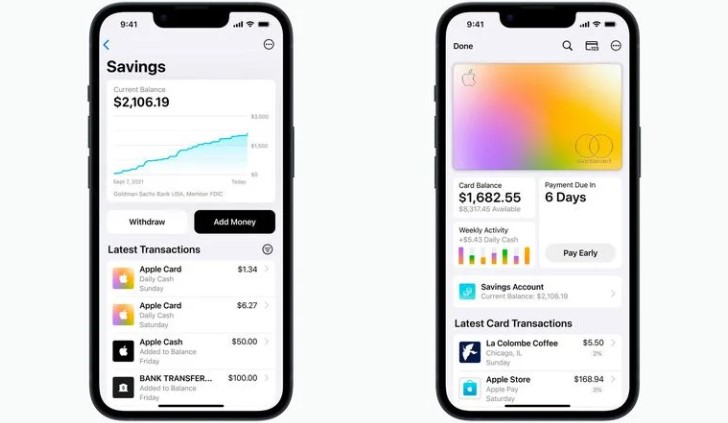

Goldman Sachs has updated its Apple Card customer agreement to reflect the credit card’s upcoming Daily Cash savings account feature, which was expected to launch with iOS 16.1 but appears to have been delayed. In Oct 2022, Apple announced that Apple Card users would soon be able to open a new high-yield savings account from Goldman Sachs and have their Daily Cash cashback rewards automatically deposited into it, with no fees, no minimum deposits, and no minimum balance requirements. The account will be managed through the Wallet app on the iPhone. The savings account was listed in the release notes for the iOS 16.1 Release Candidate, but it did not end up launching with that update. The savings account has not been present in any iOS 16.2 betas, so it is unclear when it will become available, but Goldman Sachs evidently continues to lay the groundwork for the feature’s launch. (Sohu, MacRumors, iMore, Mac Daily News)