12-9 #Defend : Apple will buy U.S.-made microchips; Foxconn is investing another USD500M in India; Apple has reportedly scaled back ambitious self-driving plans; etc.

Apple CEO Tim Cook has confirmed that Apple will buy U.S.-made microchips. The chip factories will be owned and operated by Taiwan Semiconductor Manufacturing Company (TSMC). The plants will be capable of manufacturing the 4nm and 3nm chips that are used for advanced processors such as Apple’s A-series and M-series and Nvidia’s graphics processors. The factories in Arizona will be partially subsidized by the U.S. government. Earlier 2022, President Joe Biden signed the CHIPS and Science Act into law, which includes billions of dollars in incentives for companies that build chip manufacturing capabilities on U.S. soil. TSMC would spend USD40B on the two Arizona plants. The first plant in Phoenix is expected to produce chips by 2024. The second plant will open in 2026. The TSMC plants will produce 600,000 wafers per year when fully operational, which is enough to meet U.S. annual demand, according to the National Economic Council. The U.S. plants will be a small fraction of TSMC’s total capacity, which produced 12M wafers in 2020.(Apple Insider, CNBC, CNBC, GizChina, Engadget)

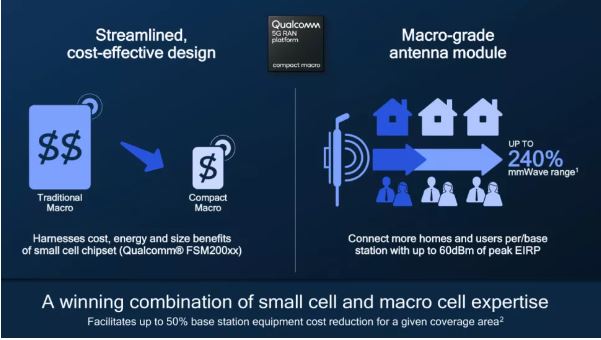

Hoping to address the range and cost deployment issues that surround outdoor mmWave deployments, Qualcomm has announced its Compact Macro 5G RAN Platform. The new tech can boost the range of mmWave deployments by up to 240% while reducing equipment costs by up to 50%, the company claimed. Qualcomm explained that the more than doubling of range is compared to small cells designed using its FSM 5G RAN Platform for Small Cells. By doubling the range, operators can reduce the number of cell sites needed to deploy to provide wide area coverage, it said, thus reducing equipment costs. (Android Central, RCR Wireless, Qualcomm, Business Standard)

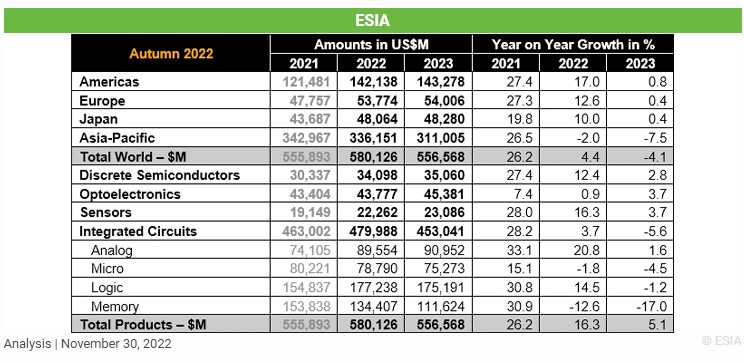

Following a strong growth of 26.2% in the year 2021, World Semiconductor Trade Statistics (WSTS) has revised its forecast down to a single digit growth for the worldwide semiconductor market in 2022 with a total size of USD580B, up 4.4%. WSTS forecast lowered growth estimation as inflation rises and end markets seeing weaker demand, especially those exposed to consumer spending. While some major categories are still expected to see double-digit year-over-year growth in 2022, led by Analog with 20.8%, Sensors with 16.3%, and Logic with 14.5% growth. Memory is expected to turn negative in the forecast and decline with 12.6% YoY. In 2022, all geographical regions are seen to show double-digit growth except Asia Pacific. The largest region, Asia Pacific, is expected to decline 2.0%. The Americas region is expected to show growth of 17.0%, Europe 12.6%, and Japan 10.0%. (Evertiq, WSTS)

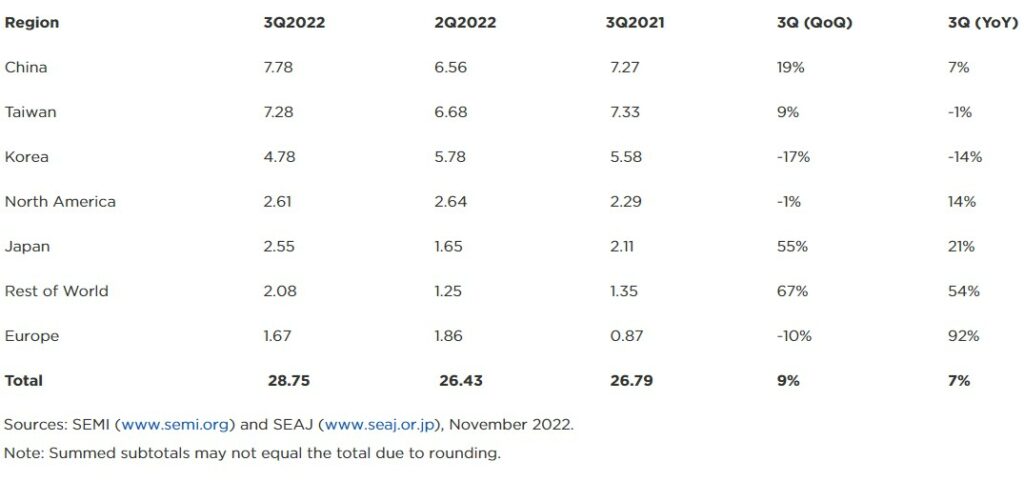

Global semiconductor equipment billings rose 9% from the 2Q22 to 3Q22 and 7% year-over-year to USD28.75B, according to SEMI. According to Ajit Manocha, SEMI president and CEO, semiconductor equipment revenue growth in 3Q22 remained in line with positive forecasts for 2022. The 9% QoQ increase in equipment spending for 3Q22 reflects the semiconductor industry’s determination to bolster fab capacity to support long-term growth and technology innovation. (Laoyaoba, SEMI)

onsemi, a leader in intelligent power and sensing technologies, has announced the completion of the sale of its Niigata, Japan facility to JS Foundry K.K. The divestiture aligns with onsemi’s fab-liter strategy to expand gross margin and improve predictably of its financial results by reducing fixed cost footprint. JS Foundry K.K. was founded through a partnership between Mercuria Investment Co (Mercuria) and Sangyo Sosei Advisory Corporation (SSA). Mercuria, a subsidiary of Mercuria Holdings (a listed company on the Prime Market of the Tokyo Stock Exchange) is one of the leaders in the Japanese alternative investment space and its investments cover different industries including manufacturing and service industries.(Laoyaoba, Business Wire, onsemi, Semi Media)

It is rumored that KINIK and Phoenix Silicon, two major secondary wafer manufacturers in Taiwan, have signed long-term agreements (LTAs) with major wafer foundries, and the content of the contracts covers both quantity and price guarantees. It is reported that recycled wafer manufacturers mostly carry out recycling and processing based on the customer’s production capacity in the current month, and seldom supply goods in the long-term contract mode. Secondary wafer demand is quite positive. Previously, KINIK has predicted that the total production capacity of 12” wafers of 300,000 wafers and 8” wafers of 150,000 wafers would continue to be fully loaded in 2H22, and the demand in 4Q22 would be flat, and the proportion of high-end products would continue to increase. Phoenix Silicon’s current monthly production capacity of 12” regenerated wafers has reached 380,000 pieces. It is currently the largest manufacturer in Taiwan. In 2021, Phoenix Silicon spent NTD7.2B setting up a factory in the Science and Technology Industrial Park, becoming the world’s first automatic and intelligent remanufactured wafer factory. It is expected that the new production capacity will be opened in two stages. Among them, in 2022, the goal is to expand 80,000 to 100,000 pieces. (Laoyaoba, CNYES, MoneyDJ, UDN)

Qualcomm has named Samsung the official smartphone partner of its Snapdragon Pro Series. The partnership will see competitors exclusively use Snapdragon-powered Galaxy smartphones at certain levels of the multi-title mobile esports league. Qualcomm will also feature the Samsung branding during the league across multiple regions. This partnership will be effective starting the Mobile Challenge Finals at DreamHack Valencia later in Dec 2022. All competitive games in the Finals will be played on Galaxy devices.(Android Headlines, Qualcomm, Gizmo China)

MediaTek has announced the Dimensity 8200 with a more affordable, but still strong, offering for Android phones. It is built with a single Cortex-A78 core at 3.1GHz and three other A78 cores at 3.0GHz. There are four Cortex-A55 cores supporting that at 2.0GHz. It uses the same Mali-G610 MC6 GPU as the prior generation, though with some minor upgrades. “HyperEngine 6.0” unlocks ray-tracing support as well as display support up to FHD+ at 180Hz and WQHD+ at 120Hz. Cameras can be up to 320MP with 4K60 HDR10+ video recording on the Imagiq 785 ISP. You’ll also find Wi-Fi 6E and Bluetooth 5.3.(Digital Trends, GSM Arena, MediaTek, XDA-Developers, 9to5Google)

Canon has announced the launch in Japan of the FPA-5520iV LF2 Option for back-end process semiconductor lithography i-line stepper1 systems that contributes to 3D advanced packaging technologies with a 0.8 µm (micrometer2) resolution and a wide exposure field of 100 mm x 100 mm. The new FPA-5520iV LF2 Option reduces distortion aberration of less than 1/4 that of its predecessor model, the FPA-5520iV LF Option (released in Apr 2021), and features a new projection optical system with greater light level uniformity. These advancements allow LF2 Option steppers to provide 0.8 µm resolution across a large 52 mm × 68 mm single-exposure field at while also making possible an ultra-wide 100 mm x 100 mm exposure field. (Canon, Re-How, My Drivers)

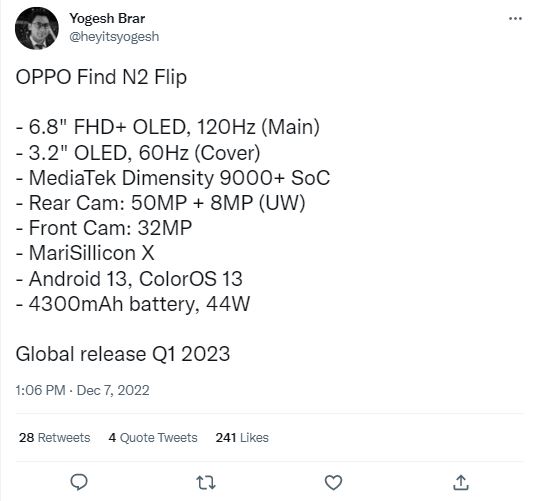

OPPO’s alleged Find N2 Flip foldable phone features Mediatek Dimensity 9000 Plus processor, MariSilicon X imaging chip, and a 4,300mAh battery with 44W wired charging. The outer display is 3.2” 60Hz OLED and internal foldable display to be 6.8” FHD+ OLED 120Hz. (GSM Arena, Android Authority, Twitter)

Apple is reportedly developing a 20.25” foldable MacBook laptop, which will launch in 2025. When folded, the device will offer a 15.3” screen. Apple also plans to release the first iPad with an OLED screen in 2024. In 2025 a foldable device may launch as an alternative to the compact tablet iPad mini. (GizChina, Android Authority, The Elec, MacRumors)

Samsung Electronics and NAVER Corporation, a global internet company with top-notch AI technology, have announced a wide-reaching collaboration to develop semiconductor solutions tailored for hyperscale artificial intelligence (AI) models. Leveraging Samsung’s next-generation memory technologies like computational storage, processing-in-memory (PIM) and processing-near-memory (PNM), as well as Compute Express Link (CXL), the companies intend to pool their hardware and software resources to dramatically accelerate the handling of massive AI workloads.(Neowin, Samsung)

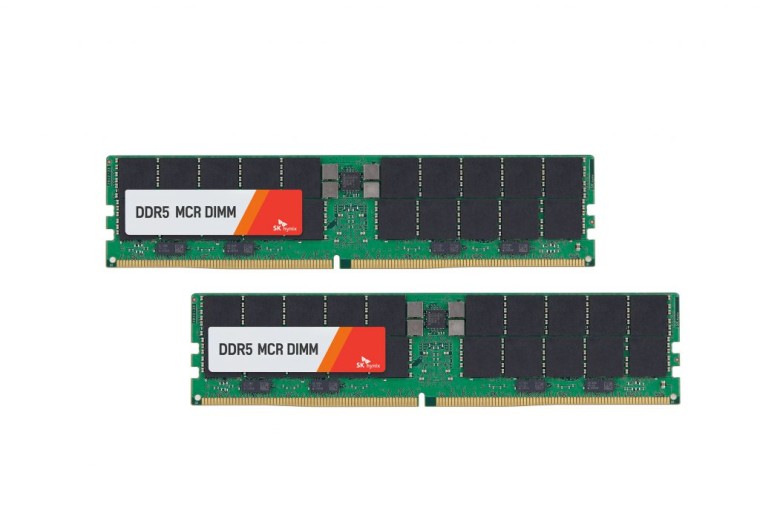

SK hynix has announced that it is building the world’s fastest server memory modules which will be capable of 8Gbps or roughly 8000MT/s. The company says it is able to achieve this using the new Multiplexer Combined Ranks (MCR) technology from Intel, which allows for running two ranks simultaneously utilizing the server buffer area. Hence, instead of running the chips themselves at faster speeds, MCR helps the entire module run twice as fast, moving 128B of data instead of 64. (Neowin, Digitimes, SK hynix)

General Motors (GM) has installed its first Level 2 charging stations in Wisconsin and Detroit as part of a community charging initiative unveiled in 2021. A dealership in Marshfield, Wisconsin put up stations at locations including parks, a library and a sports complex, while another installed them at a healthcare/wellness center in Owosso, Michigan. The aim is to help dealers install up to 40,000 chargers in community locations (including underserved rural and urban areas) across the US and Canada. (Engadget, Road and Track)

SK On, a subsidiary of SK Innovation in South Korea, will raise KRW695.3B-1.32T (USD500M-1B) from a number of investment companies (including Korea Investment PE). SK On will sell convertible preferred shares to investors at a price of KRW55,000 per share. At present, it has been confirmed that KRW695.3B can be raised for investment, with a maximum of KRW1.32T. SK On will be listed before the end of 2026, or within 4 years after the transaction is completed. On 25 Nov 2022, SK On signed a memorandum of understanding with South Korea’s ECOPRO and GEM to build an HPAL factory in Morowali, Sulawesi Island, Indonesia, to produce MHP, with an annual output of 30000 gold tons of nickel, and ensure the supply to the precursor joint venture above at a transparent and competitive price. (Laoyaoba, Just Auto, Takoma Battery)

Apple has issued the developer Release Candidate for iOS 16.2 and, with it, support for 5G networks on iPhone in India. Carriers in India had been rolling out 5G since the start of October in 8 major cities. In mid-Oct 2022, Apple confirmed that iPhone users in India would see 5G support before the end of 2022.(Apple Insider, Twitter)

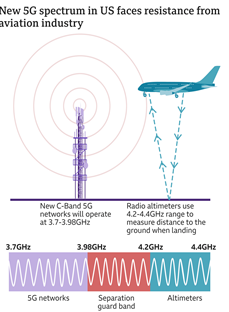

The Department of Telecommunications (DoT), the government body that handles telecom operations in India, in its recent order to telecom operators Reliance Jio, Bharti Airtel and Vodafone Idea, directed them to restrict their infrastructure enabling C-Band 5G networks (between 3.3-3.67GHz) from over 1.3 miles (2.1km) away from runway endpoints at all airports in the country. It has also ordered all three operators to limit the power emission of their equipment installed after the given range. The restrictions are enforced in response to concerns raised by the Indian Directorate General of Civil Aviation (DGCA). In Sept 2022, the aviation department suspected that 5G networks operating on the C-Band spectrum would interfere with flight altimeters — the instrument that helps pilots maintain the required altitude during flight. (TechCrunch, India Times, Business Today)

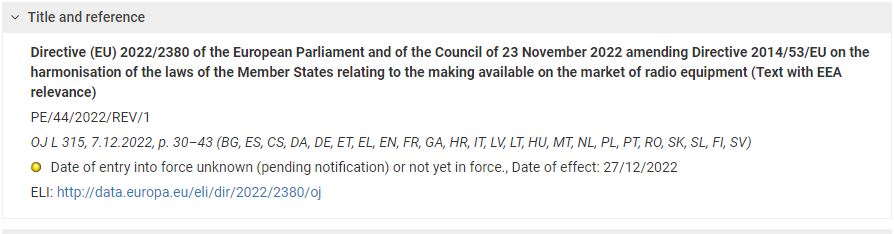

The EU officially approved the common charger law in Oct 2022, but a specific date for when the law would come into force was unknown. Now, in a newly published directive, the EU says all smartphones must have USB-C by 28 Dec 2024. Other consumer products, such as tablets and gadgets, will also be required to switch to USB-C under the new law. Products that rely solely on wireless charging with no port will not have to include USB-C. (EUR-LEX, MacRumors)

The U.S. is looking to spend USD1.5B to develop its own “standards-based” alternative to the telecom equipment offered by companies like Huawei and ZTE on the low end, and Ericsson, Nokia, and Samsung at the high end. The goal is to develop American telecom gear that would allow U.S.-based wireless firms to buy domestic equipment to build out their networks. Alan Davidson, Assistant Secretary of Commerce for communications and information and NTIA administrator said, “The highly consolidated global market for wireless equipment creates serious risks for both consumers and U.S. companies”. (Phone Arena, Axios)

Xiaomi says that it has sold over 300M units of Redmi Note smartphones globally. In Oct 2021, the global sales figure of the Redmi Note series stood at 240M units. A little over a year later, this figure has now risen by 60M units.(Gizmo China, GSM Arena, Twitter)

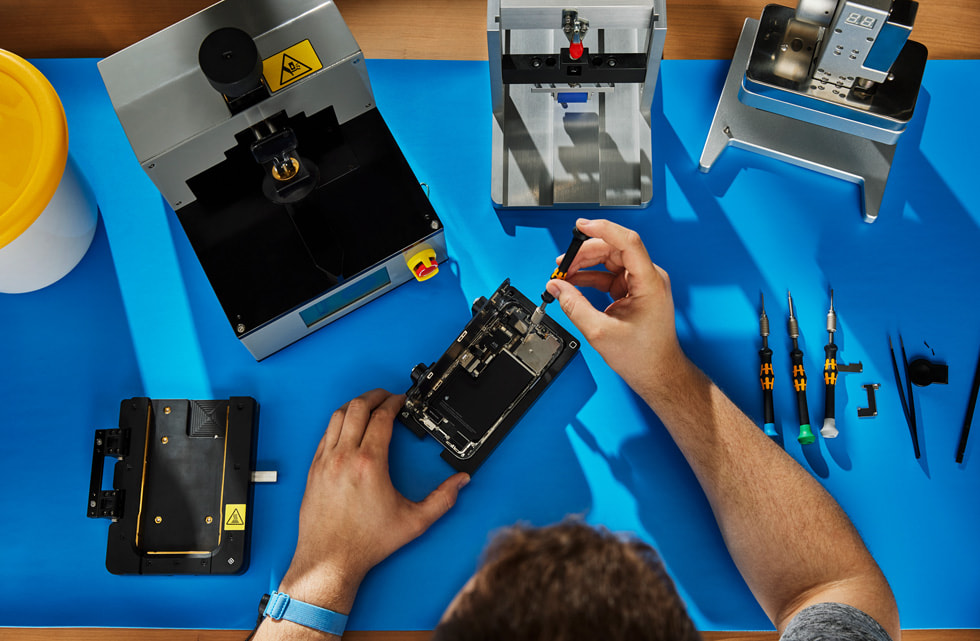

Apple has announced Self Service Repair is now available in eight European countries, providing repair manuals and genuine Apple parts and tools through the Apple Self Service Repair Store. Customers who wish to complete their own repairs will be able to perform many of the most common repairs for the iPhone 12 and iPhone 13 lineups, and Mac notebooks with Apple silicon. The Self Service Repair Store provides access to more than 200 individual parts and tools, as well as repair manuals.(MacRumors, GSM Arena, Apple)

A French environmental group has filed a complaint against Apple because the company restricts the use of “unauthorized” parts in iPhone repairs. The “Halte L’Obsolescence Programmee” (HOP) group says Apple limits repairs, especially from non-authorized repair providers. In some instances documented in the complaint, malfunctions were found where the device was repaired with a part Apple did not authorize. It is forbidden under French law to deliberately reduce the lifespan of a product to increase its replacement rate. (Apple Insider, Investing, Reuters, Yahoo)

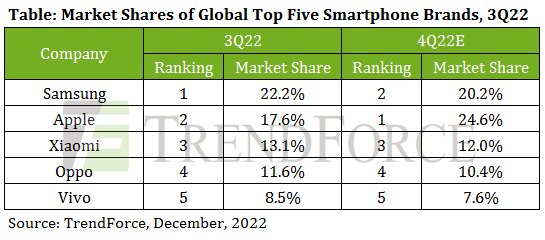

According to TrendForce’s latest research, global smartphone production totaled around 289M units for 3Q22, showing a slight QoQ drop of 0.9% and a YoY drop of 11%. The smartphone market thus exhibited an extremely weak demand situation as the “iron law” of positive growth in the third quarter was broken after being in effect for years. The contraction of smartphone production during this year’s peak season was mainly attributed to smartphone brands giving priority to consumption of channel inventory for whole devices and maintaining a fairly conservative production plan for 3Q22. Moreover, they had kept lowering their production targets due to strong global economic headwinds. (GSM Arena, TrendForce, TrendForce, Android Headlines)

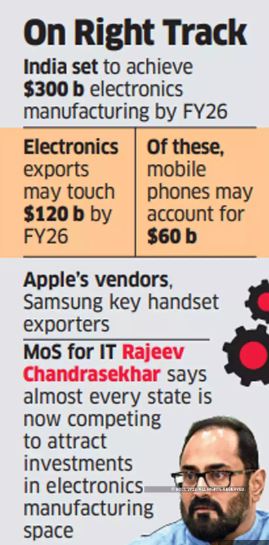

Apple supplier Foxconn is investing another USD500M in India. In a stock exchange filing in Taiwan, Foxconn said its Singapore subsidiary is deploying the capital into the India entity, Hon Hai Technology India Mega Development Private Limited. The move follows Foxconn, also known as Hon Hai, picking up pace to expand its smartphone production capacity in India as key partner Apple begins locally producing the current generation iPhone units in the country. (TechCrunch, India Times, Reuters, Business Standard, UDN, IT Home)

In the current fiscal year 2022–2023, mobile phone exports from India are expected to increase to USD9B from USD5.8B. According to a report in the Economic Times, the increase in exports is expected as firms increase production and shipment levels. In addition, it stated that India was on track to produce USD300B worth of electronics by 2025–2026. According to the article citing data from industry body India Cellular and Electronics Association, electronics worth approximately USD87B were produced locally in FY22, and this amount is anticipated to increase to USD100B in FY23 (ICEA). Over USD5B worth of mobile phone exports have already been recorded, more than doubling the USD2.2B exports that were recorded a year ago. Samsung and Apple have been the main driving factors behind the growth of the phone industry. Half of the phones made in India are produced by these two businesses. (SamMobile, Business Standard, Digitimes, Digitimes, India Times)

Apple has allegedly talked to Indian officials about locating some iPad manufacturing in the country as U.S.-China relations sour and China’s Covid crackdowns snarl supply chains. Apple already manufactures older iPhones and some iPhone 14s in India. The biggest barrier now is a lack of local manufacturing expertise. Gene Munster at Loop Ventures estimates that 10% of iPhones are manufactured in India, but he expects production to increase at a slow pace. He has further added that he thinks in 5 years, 35% will be manufactured in India. In addition to producing current-generation iPhones with Foxconn in India, Apple also diversified its portfolio of contract manufacturers in the country by outsourcing some orders to Pegatron and Wistron in the country. (Apple Insider, Neowin, CNBC)

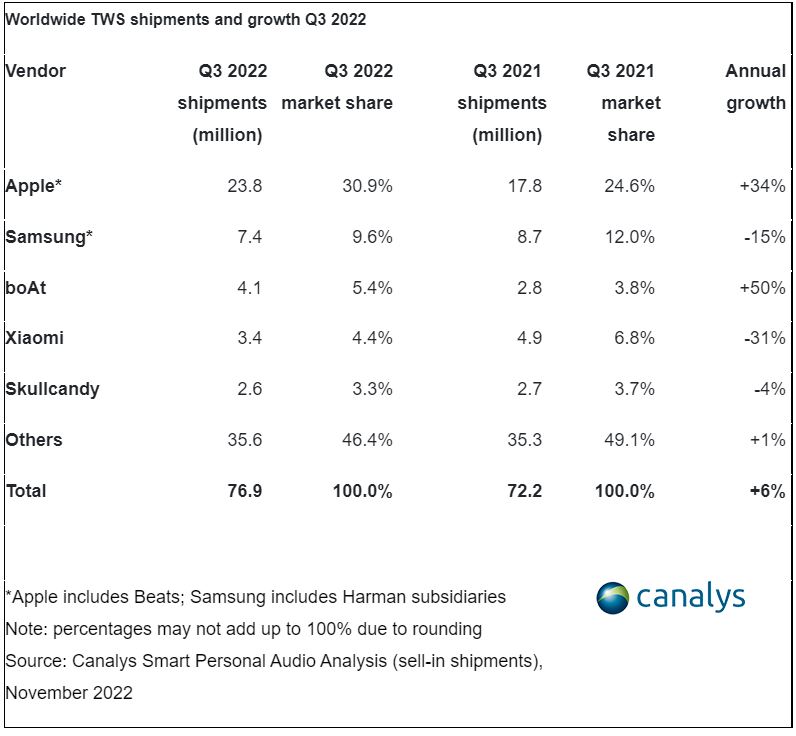

According to the latest Canalys estimates, the global smart personal audio market suffered its second consecutive decline in 3Q22, with shipments down 4% to 113.6M units. TWS remained the only category (including wireless earphones and wireless headphones) to show an increase, with 6% growth to 76.9M units in the quarter. Apple (including Beats) defended its leadership position with the second-generation AirPods Pro launch, which led to a 34% increase in shipments and a 31% market share. Samsung (including Harman subsidiaries) took second place, but its shipments fell 15% despite its new Galaxy Buds2 Pro launch. (Gizmo China, My Drivers, Canalys)

Apple has reportedly scaled back ambitious self-driving plans for its future electric vehicle and postponed the car’s target launch date by about a year to 2026. In a significant shift for the project, the company is now planning a less-ambitious design that will include a steering wheel and pedals and only support full autonomous capabilities on highways. The company’s automotive efforts, known as Project Titan, have proceeded unevenly since 2014, when it first started to design a vehicle from scratch. (MacRumors, Bloomberg, Reuters, TechCrunch, LA Times, Yahoo)

Sony has indicated that it has the technology to make humanoid robots quickly once it has identified how they could be effectively used. According to Sony Chief Technology Officer Hiroaki Kitano, the creation of an application is crucial. More than 20 years ago, Sony introduced a robotic dog by the name of Aibo. From 1999 to 2006, it sold around 150,000 units of Aibo. Humanoid robots have been in development for decades by Honda Motor and Hyundai Motor and in Sept 2022, Tesla Chief Executive Elon Musk showed off a prototype of its humanoid robot Optimus.(GizChina, Reuters, Jerusalem Post, Mashable)