12-24 #MerryXmas : TSMC’s new US fab in Arizona has obtained 4nm chip orders from Tesla; Micro has announced a host of cost-cutting measures; Xiaomi has begun laying off workers across several of its smartphone and internet services units; etc.

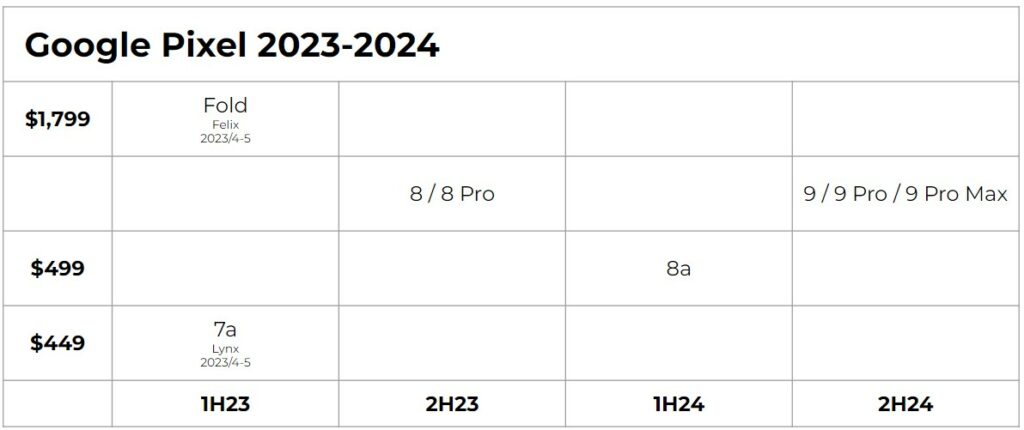

Google Pixel roadmap leaks, revealing every smartphone the company has planned from 2023 to 2025. For 2025, the company could go in different directions depending on how successful (or not) its strategy for 2023 and 2024 turns out to be.(Android Authority, GSM Arena)

Samsung has drastically reduced its shipment target for its mid-tier smartphone Galaxy A23 5G in 2023. The company originally planned to ship 12.6M units but this has been dropped to below 4M units, a 70% drop. Earlier 2022, Samsung had set a goal to ship 17.1M units of Galaxy A23 4G and 12.6M units of Galaxy A23 5G. (GSM Arena, The Elec)

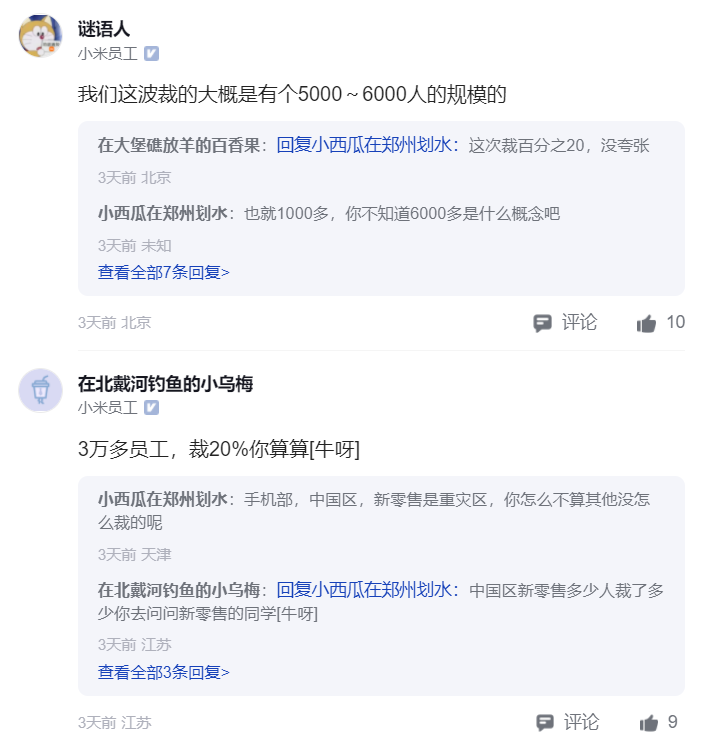

Xiaomi has begun laying off workers across several of its smartphone and internet services units. The job cuts are reportedly affecting around 15% of the company’s workforce. The company has claimed that Xiaomi recently implemented routine personnel optimization and organizational streamlining, with affected parties totalling less than 10% of total workforce. Those affected have been compensated in compliance with local regulations. (Laoyaoba, CNN, Business Today)

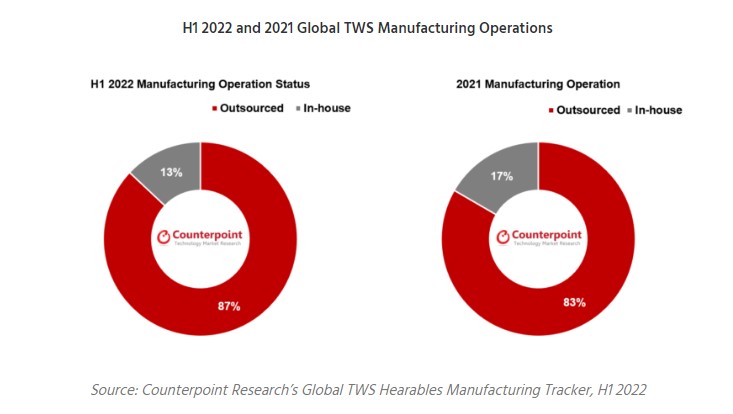

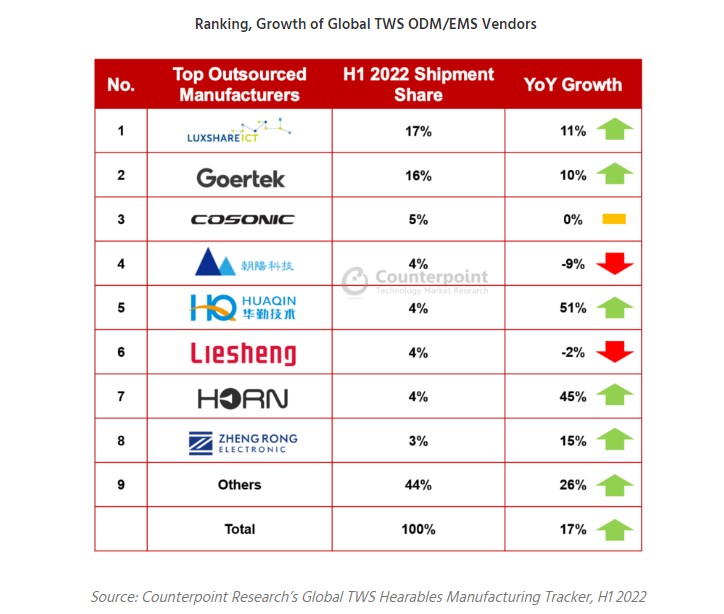

TWS shipments from outsourced manufacturing companies increased 16% YoY in 1H22, according to Counterpoint Research. Meanwhile, total global TWS shipments grew 9.4% YoY in 1H22. The share of TWS shipments from outsourced production (ODM / EMS) increased to 87% of total global TWS shipments in 1H22 from 83% in 2021. Despite economic headwinds in 1H22, the global TWS market continued to grow, especially in emerging markets. ODMs / EMSs stand to benefit from this growth trend because several key TWS brands rely on outsourced manufacturing. Luxshare and Goertek remained the top-ranking ODMs / EMSs in the competitive global TWS landscape in 1H22. The two companies jointly accounted for 33% of the global outsourced TWS manufacturing in 1H22, down from 35% in 1H21. (Counterpoint Research)

Huawei has licensed technology to top automakers including Mercedes Benz, Audi, BMW and Porsche as Huawei seeks to turn its trove of patents into a new revenue source amid a U.S. clampdown on its core businesses. The patent licensing agreements, reached during the second half of 2022, mean Huawei technologies will be used in 15M of the 70M cars produced globally each year, Alan Fan, global head of Huawei’s Intellectual Property Department. Aside from the German carmakers, Huawei has also signed deals with Japan’s Subaru, France’s Renault, Lamborghini, and Bentley.(My Drivers, Laoyaoba, Reuters, Asia Nikkei, Huawei Central)

Walmart-owned e-commerce platform Flipkart and digital payments platform PhonePe, have announced the full ownership separation of PhonePe as the company gears up for initial public offering (IPO). The separation from Flipkart makes PhonePe a fully India-domiciled company, a process that started earlier 2022. Founded in 2015, PhonePe forayed into financial services in 2017 and has since introduced several mutual funds and insurance products on the platform. The company was acquired by the Flipkart Group in 2016. It claims to have more than 400M registered users as well as 35M offline merchants spread across Tier 2, 3, 4 cities and beyond, covering 99% of pin codes in the country. (TechCrunch, India Times, Live Mint)

According to Counterpoint Research, Huawei has run out of in-house-designed semiconductors for its smartphones. The company is battling stiff US trade sanctions aimed at cutting Huawei’s access to advanced new chips. The sanctions, imposed since 2019, are part of US pressure to remove Huawei, one of the world’s largest suppliers of networking and 5G technology, from the markets and systems of allies. The US banned Huawei equipment in government use and discouraged its use in the commercial market. In May 2022, Canada banned Huawei equipment from its 5G network. Huawei has struggled to get access to new in-house-designed integrated circuits (ICs) manufactured by some of the leading chip companies due to tightening of US sanctions. HiSilicon’s market share was 3% in 2021, but dropped to zero in 3Q22. (Phone Arena, SCMP, NDTV)

TSMC is expected to see its capacity utilization for 7 / 6nm process nodes rebound in 2H23, thanks to substantial orders for Qualcomm’s RF chips used in Apple’s next-generation iPhones, according to Digitimes. Apple has reportedly ordered a significant amount of 5G and RF chips from Qualcomm, possibly the Snapdragon X70. The Snapdragon X70 is manufactured by TSMC, which expects a nearly full utilization of its 7 / 6nm process nodes in 2H23, when iPhone 15 manufacturing would be in full swing. (Digitimes, Phone Arena)

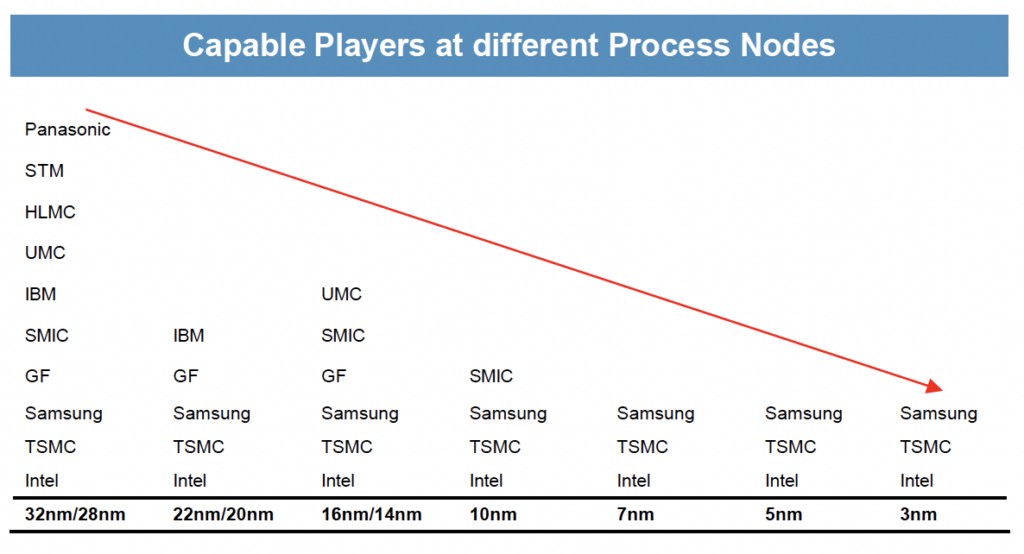

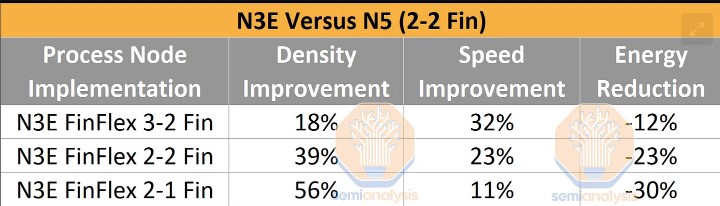

In early 2018, TSMC announced an investment in a new fab site. This new site would hold its most advanced technology, N5. With Apple and Huawei committing to N5 wafers for 2020, it was the perfect opportunity for a colossal buildout. TSMC stated that their investment in Fab 18 phases 1 through 3 would be over NTD500B (~USD17B). This site was slated to produce over 80 thousand wafers each month. TSMC has confirmed that N5 was in high-volume production, likely at phase 1. Although Fab 18 in the Tainan Science Park will remain the primary location for N5 production, TSMC also announced its expansion into the US in Phoenix, Arizona. In mid-2018, TSMC announced that this site would involve a total investment of USD12B and a production of 20,000 wafers per month. This fab, when completed, will be the most advanced technology node manufactured by TSMC outside of Taiwan. With TSMC’s N5 capacity being well over 120,000 wafers per month in 2022, this would account for only about 15% of TSMC’s N5 capacity. Recently, TSMC announced another investment in Fab 21 Phase 2. This expands its existing fab in Arizona to produce N3 wafers. The new plans for Arizona would increase TSMC’s total spending to USD40B and increase capacity to 50,000 wafers per month. 20,000 of these will still be N5, and 30,000 will be N3. When completed, N3 capacity would account for ~25% of TSMC’s global capacity for N3. (My Drivers, Semi Analysis)

TSMC’s new US fab in Arizona has obtained 4nm chip orders from Tesla, with volume production slated to kick off in 2024, according to Digitimes. The foundry will reportedly produce Tesla’s advanced self-driving chips on one of its N4 (4nm-class) fabrication processes starting in 2024. Previously Tesla used Samsung Foundry to make the chips for autonomous driving. Tesla will reportedly be one of the first and one of the largest customers for TSMC’s Fab 21 in Arizona. Tesla would be one of the Top 3 customers for TSMC’s Fab 21, it means that the automaker plans to produce a significant number of chips there, perhaps not only the FSD SoC. (Andriod Headlines, Digitimes, Laoyaoba, SamMobile, Tom’s Hardware)

TSMC has responded to the rumor that “the expansion of the Nanjing plant is suspended”, saying that the expansion of the 28nm process at the Nanjing plant will remain unchanged and proceed as planned. According to TSMC’s plan, the newly added 28nm production capacity of the Nanjing plant will be gradually released in 2H22, and will reach a monthly production scale of 40,000 pieces in mid-2023 to meet the increase in structural demand. (Laoyaoba, My Drivers, UDN, CNYES, Techgoing)

Intel has announced that it would split its Accelerated Computing Systems and Graphics (AXG) business unit to separately address the gaming and data center markets by placing it under two other business units. The new alignment places the consumer-focused portion of the Accelerated Computing Systems and Graphics (AXG) business unit under Intel’s Client Compute Group (CCG). Intel’s CCG is responsible for developing consumer computing platforms around the company’s CPU products.(My Drivers, Tom’s Hardware, Bloomberg)

Pete Lau, chief product officer of OPPO and founder of OnePlus, has revealed that OPPO will invest CNY10B (USD1.43B) into OnePlus in the next 3 years, and provide support in technology, channels and services. In terms of specific investment directions, Li Jie, president of OnePlus China, said that OnePlus will start from 3 perspectives: CPU, memory and storage, and will plan to develop its own memory chips in the future.(Laoyaoba, EET-China, Sigmaintell, China Daily, Technode)

Tsinghua Unigroup has established Ziyue Semi, a new chip company with 80% equity ownership, according to the information revealed in China’s enterprise data service platform Tianyancha. The new company has a registered capital of CNY100M (USD14.32M) and the other 20% owner is GBA SIG. Ziyue Semi’s business scope covers software services, IC chip design, manufacturing, sales and other related services.(Laoyaoba, Laoyaoba, Sina)

IBM and Rapidus, a newly formed chipmaker backed by the Japanese government, have announced a partnership that aims to manufacture the world’s most advanced chips in Japan by the second half of the decade. Japan’s industry and trade ministry said it would invest an initial JPY70B (USD500M) in Rapidus, a venture led by tech companies including Sony Group and NEC. Although that is small in the world of chip manufacturing, where plants can cost tens of billions of dollars. IBM’s director of research, Dario Gil, said the two companies would work together to manufacture IBM’s 2nm-node chips, unveiled in 2021. As part of their agreement, Rapidus scientists and engineers will work alongside IBM Japan and IBM researchers at the Albany NanoTech Complex in New York state.(My Drivers, IBM, Asia Nikkei)

Micron Technology has said the worst industry glut in more than a decade would make it difficult to return to profitability in 2023. The company has announced a host of cost-cutting measures, including a 10% workforce reduction, aimed at helping it weather a rapid drop in revenue. The company CEO Sanjay Mehrotra has revealed that the industry is experiencing its worst imbalance between supply and demand in 13 years. Inventory should peak in the current period, then decline. Customers would move to more healthy inventory levels by about the middle of 2023, and the chipmaker’s revenue would improve in 2H23.(Laoyaoba, AP News, Taipei Times)

Samsung has increased pricing of its 3D NAND flash memory devices by 10% in the first half of Dec 2022, following blacklisting of China-based YMTC by the U.S. Department of Commerce. Since some PC makers suspended their work with Yangtze Memory (YMTC) for now, demand for 3D NAND from other makers increased, which is why Samsung increased its quotes, according to Digitimes. U.S. politicians publicly called YMTC a threat to national security in the last couple of months after it got into the DoC’s Unverified List (UVL). As a consequence, Apple decided to withhold from buying 3D NAND from Yangtze Memory even for iPhones bound to be distributed in China. As a result, demand for 3D NAND memory produced by other makers — including Micron, Samsung, and SK Hynix — increased and market leader Samsung even decided to increase its 3D NAND prices to take advantage of the situation. It is unclear how Samsung’s increase in contract 3D NAND pricing for 1H Dec 2022 will affect prices of 3D NAND in general and solid-state drives in particular. Quotes for 3D TLC memory have been stagnating for months, so a slight increase will be a positive sign for flash memory manufacturers. (Laoyaoba, UDN, TechNews, Tom’s Hardware, Digitimes)

Sony is considering building a new plant in southwestern Japan to produce semiconductors used in smartphones, with an investment of several hundred billion yen. Sony expects the new factory in Kumamoto Prefecture to start operations in fiscal 2025 or later, and could begin construction as early as 2024. The plant is likely to be located near Sony’s sensor factory where Japan Advanced Semiconductor Manufacturing (JASM) is building a 16 / 12nm fab to ship vital components for image sensors. JASM was set up by TSMC in 2021, with Sony and Toyota Supplier Denso taking a minor stake. Japan’s government has provided subsidies of USD3.5B to JASM as part of its plan to grow the country’s semiconductor sector.(Laoyaoba, Asia Nikkei, Kyodo News)

Facebook parent Meta has agreed to pay USD725M to settle a class action lawsuit that claimed the social media giant gave third parties access to user data without their consent. The class action lawsuit was prompted in 2018 after Facebook disclosed that the information of 87M users was improperly shared with Cambridge Analytica. Cambridge Analytica, which shut down after the allegations, was controversial because the data it harvested from Facebook was used to inform political campaigns. (Android Headlines, Apple Insider, CNBC)

LG Energy Solution has signed an agreement with Chungcheongbuk-do Cheongju-si to invest in building new and expanded battery production facilities worth a total of KRW4T in the Ochang Industrial Complex by 2026. LG Energy Solution built a total of 13 gigawatt-hour (GWh) cylindrical battery production lines at its Ochang plant. It is capable of producing more than 600,000 EV batteries. These are 9GWh production lines for 4680 cylindrical batteries and 4GWh production lines for 2170 cylindrical batteries. LG Energy Solution plans to expand battery supply to global automakers such as Tesla, General Motors, and Hyundai Motor through this domestic investment.(Laoyaoba, Korea JoongAng Daily, ET News)

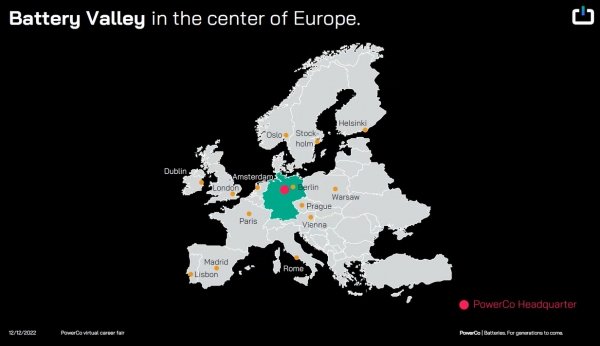

Volkswagen will concentrate on producing battery cells at its factories that will be constructed in Europe while also developing CATL’s cell to pack (CTP) technology. Volkswagen will complete its battery factory in Salzgitter, Germany, then build another in Spain and all across Europe. CTP removes the module that covers the cells before they are put into packs. Soonho Ahn, the CTO at Volkswagen’s battery cell subsidiary PowerCo, has implied PowerCo is planning to develop a similar technology to that of CATL’s, which is used widely in Tesla models. Volkswagen is planning to use high manganese cathode which uses less nickel and lithium which are relatively more expensive than manganese for the batteries that will go into its budget EV models. When a cathode is called high manganese, it usually means manganese accounts for around 10% to 20% of the cathode material.(The Elec, Teslarati, Electrive)