1-19 #CNY : Unigroup has discussed initial public offerings (IPOs) for 3 subsidiaries; Samsung and SK Hynix are planning to procure fewer silicon wafers; LGD may continue to scale down its LCD TV panel production; etc.

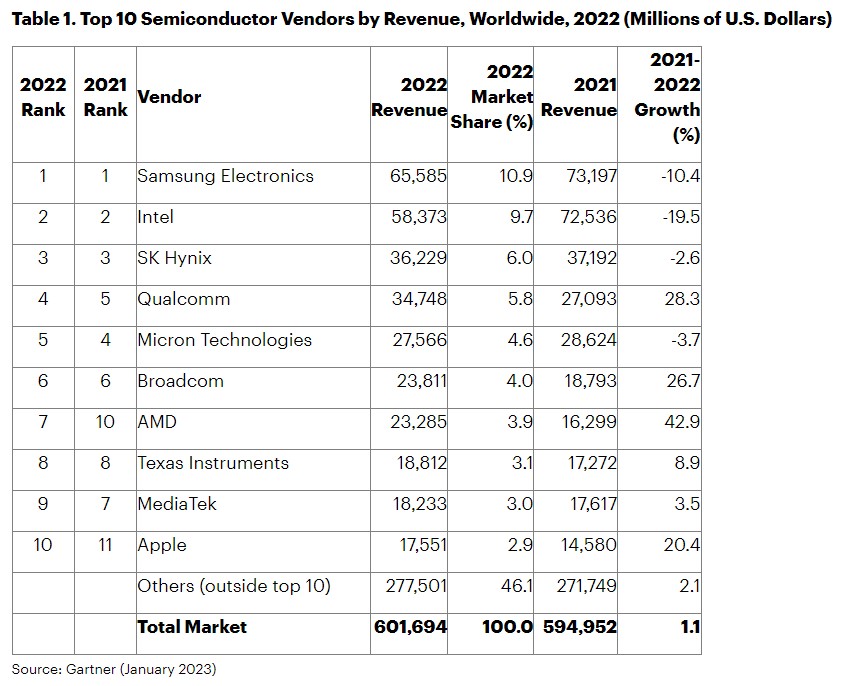

Worldwide semiconductor revenue increased 1.1% in 2022 to total USD601.7B, up from USD595B in 2021, according to Gartner. The combined revenue of the top 25 semiconductor vendors increased 2.8% in 2022 and accounted for 77.5% of the market. Samsung Electronics maintained the top spot although revenue declined 10.4% in 2022, primarily due to declines in memory and NAND flash sales. Intel held on to the No. 2 position with 9.7% market share. The company was impacted by the significant decline of the consumer PC market and strong competition in its core x86 processor businesses and revenue growth declined 19.5%. (Gartner, CN Beta)

Tsinghua Unigroup’s new owners are exploring ways to stave off creditors after completing a USD9B takeover, including industrial property sales and floating fast-growing business units such as a local rival to Qualcomm. Executives at Unigroup have discussed initial public offerings (IPOs) for three subsidiaries including Unisoc, which develops 5G chips for smartphones and drones. This could lead to one of the more prominent debuts in China’s semiconductor industry, where advanced home-grown chips are scarce. In 2022, Unigroup endured a contentious restructuring, which former chairman Zhao Weiguo fought against, before JAC Capital led a consortium that acquired the embattled firm and sold off Yangtze, the nation’s biggest maker of memory chips for servers, PCs and mobile devices.Laoyaoba, Now, UDN, UDN, Bloomberg, The Strait Times)

South Korean chipmakers Samsung and SK Hynix are planning to procure fewer silicon wafers used in chip production than they initially planned going forward. The chipmakers discussed the issue with their respective wafer suppliers sometime during 4Q22. Silicon wafers are cut out from crystallized silicon. The chips used in electronics are cut out from these wafers. There are 5 major suppliers of these wafers; Japan’s Shin-Etsu and Sumco, Taiwan’s GlobalWafers, Germany’s Siltronic and South Korea’s SK Siltron. During the 2 years of the pandemic at its height, the supply of these wafers was tight and in short supply for chipmakers. This continued in 2022 when the global economic downturn started. This is because the silicon wafer is a back-end industry and the effects of the consumer market come later to them than front-end industries that sell products directly to customers. (The Elec, Laoyaoba)

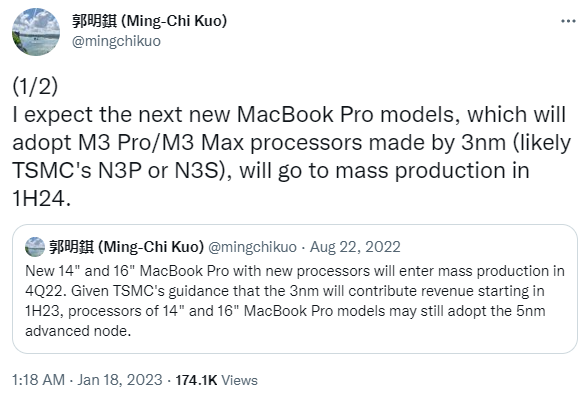

According to Digitimes, Apple intends to release a new MacBook Air in 2H23, possibly with a 3nm chip made by TSMC,most likely be Apple’s next-generation M3, providing faster performance and better power efficiency than Apple’s current 5nm chips. According to TF Securities analyst Ming-Chi Kuo, Apple’s 14” and 16” MacBook Pro will get 3nm M3 Pro and M3 Max chips in 2024.(GizChina, Digitimes, Laoyaoba, Twitter)

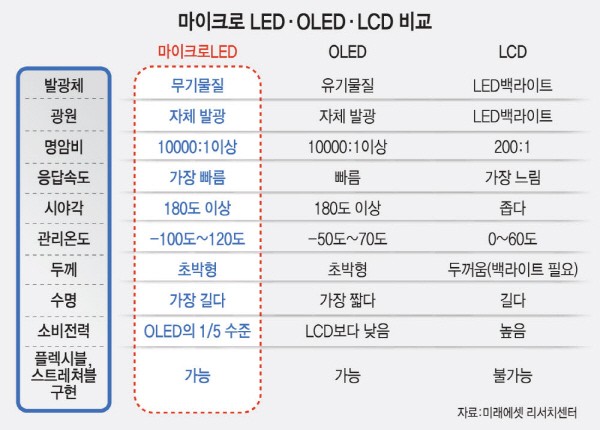

Samsung Display has reportedly begun to commercialize micro light emitting diode (Micro LED) displays for smart watches. Aiming to complete the development within 2023, it is under the spotlight as the micro LED replaces organic light emitting diode (OLED), which is applied to Apple Watch and Galaxy Watch. A micro LED display refers to a panel using micrometer µm)-sized subminiature LEDs as pixels. It excels in brightness, contrast ratio, and color reproduction, and has exceptionally good visibility under sunlight. (Phone Arena, The Elec, ET News, SamMoibile)

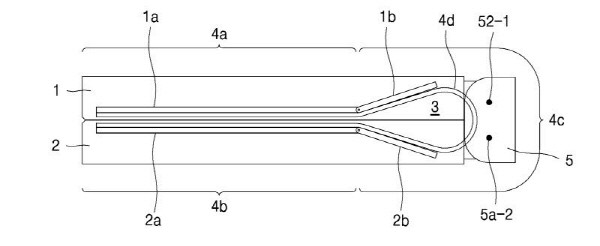

For the next foldable phones, Samsung Electronics implements a design that makes complete contact between the screens when folded. The new design is targeted for the “Galaxy Z Fold 5”, which is scheduled to be released in fall 2023. It has been confirmed that Samsung Electronics plans to apply a “teardrop” type display to the Galaxy Z Fold 5. The display is rolled inside the main structure in a teardrop shape to form wrinkles spread widely. The biggest feature of the structure is that both sides of the screens come into contact without gaps when the phone is folded. Samsung Electronics used a “U-shaped” structure that the foldable display lifts slightly from the first generation products to 2022 products, Galaxy Fold 4 and Flip 4. (ET News)

Tecno is showcasing the foldable Phantom Vision V concept. It has a display on the front, while on the rear it has a triple camera. Tecno has added a small display on the back, which it calls a reverse-side back cover. It will display notifications, reminders, and an always-on display-styled clock. The inner foldable display is made up of 11 functional layers, giving it both flexibility and durability. The casing is made of “aerospace-grade” titanium so it is also very durable.(My Drivers, GSM Arena, Gizmo China)

LG Display (LGD) may continue to scale down its LCD TV panel production, having closed its Gen-7.5 fab in Paju, South Korea, at the end of 2022, according to Digitimes. It expects to halve the production of large LCD panels for TVs at its panel factory in Guangzhou. This is one of LGD’s moves to gradually exit the large LCD business. Specifically, LGD plans to reduce TV LCD production at its Guangzhou factory from 210,000 units per month to 100,000 units for its GP1 and GP2 production lines. LGD Guangzhou factory has 3 production lines, GP1 and GP2 produce LCD panels respectively, and GP3 produces OLED panels. It is reported that at present, the capacity utilization rate of GP1 and GP2 is less than 50%, and the company has no further production increase plan. (Laoyaoba, Digitimes)

Micron has introduced new DDR5 memory modules in 24GB and 48GB capacities. The modules are compatible with AMD EXPO and Intel XMP 3.0 profiles, making them easy to set up and use with desktop PCs running the AMD Ryzen 7000 series And Intel 12th and 13th Gen Core processors. Micron’s new DDR5 memory modules feature 5200 MT/s and 5600 MT/s data transfer rates and CL46 latency at 1.1V. DDR5-5600 DIMMs come in traditional 8GB, 16GB and 32GB versions, but the new 24GB and 48GB models stand out because they’re based on 24Gb memory chips, while traditional Dimensions may use 16Gb DRAM ICs. Meanwhile, DDR5-5200 modules are only available in 8GB, 16GB, and 32GB sizes.(Gizmo China, Tom’s Hardware, Digitimes)

Samsung Electronics reportedly is quietly reducing NAND flash production by lowering capacity utilization for the chips to 90% in response to sluggish demand, after resisting doing so for a while, according to Digitimes. Market in 1Q23 has reached the bottom of the NAND Flash market, and the price decline will gradually converge. The demand for material preparation will gradually pick up from 2Q23 at the earliest, and the momentum of market recovery in 2H23 will be tested. (My Drivers, Digitimes, Digitimes)

Samsung SDI is reportedly planning to build a third electric vehicle battery factory in Hungary. The factory is being built to supply auto giant BMW with batteries. The new factory will be built near Goed, where Samsung SDI already operates 2 factories. Samsung converted the facilities there, which originally manufactured display panels, to those for batteries in 2016. These new batteries will be shorter but wider than its Gen 5 batteries. Gen 5 batteries have a height of around 90 to 100mm; the new ones will be 60mm. These are also called low height prismatic cells. Samsung SDI’s will also have the positive and negative tabs on the sides instead of on the top. Samsung SDI is also expected to use high-nickel for the cathode. For the anode, it is expected to increase the amount of silicon it uses by applying silicon carbon nanocomposites. (The Elec, Sohu, TechWeb)

LG Energy Solution (LGES) and Honda Motor have announced the formal establishment of the joint venture (JV), which will produce lithium-ion batteries for electric vehicles (EV) produced by Honda. The JV will begin construction of a new battery plant early 2023 with the goal of completion by the end of 2024. The parties aim to start mass production of advanced lithium-ion battery cells by the end of 2025, with a production capacity of 40GWh. LGES and Honda have committed to investing USD3.5B. The companies’ overall investment related to the JV is projected to reach USD4.4B.(Yahoo, Benzinga, Honda)

LG Energy Solution (LGES) is reportedly in talks with Japan’s Toyota to supply the auto giant with electric vehicle batteries. LGES and Toyota are expected to announce their collaboration within 1H23. The most likely outcome is for them to build the battery factory in North America with an annual capacity of 20GWh. Toyota already has an EV battery joint venture with compatriot Panasonic. The venture, Prime Planet Energy, will be manufacturing prismatic batteries. As LG Energy Solution’s expertise lies in pouch batteries, this joint venture will likely manufacture that battery type. Toyota’s subsidiary Toyota Tsusho, its trading arm, has already announced that it will spend JPY325B to build a battery factory in North Carolina. Toyota is a relative latecomer to the pure EV space as it had focused on hybrid cars in the past. (The Elec, Pulse News, Business Korea)

Ford Motor is expected to replace South Korea’s SK On as its partner for a new electric vehicle battery plant in Turkey, teaming instead with LG Energy Solution (LGES). SK On has responded by acknowledging difficulties with the negotiations. The talks following the basic agreement in Mar 2022 have become protracted, and no decision has been made on exiting the deal. Meanwhile, Ford is in discussions with LG Energy about a battery plant. The automaker contacted LG Energy about joint production in Turkey around Nov 2022. Ford and SK On are building three EV battery plants in the U.S. states of Kentucky and Tennessee. Their joint venture, BlueOval SK, is on track to field production capacity totaling about 130 gigawatt-hours a year, meaning Ford will become SK On’s biggest customer.(CN Beta, Market Screener, Korea JoongAng Daily, Electrek, Asia Nikkei)

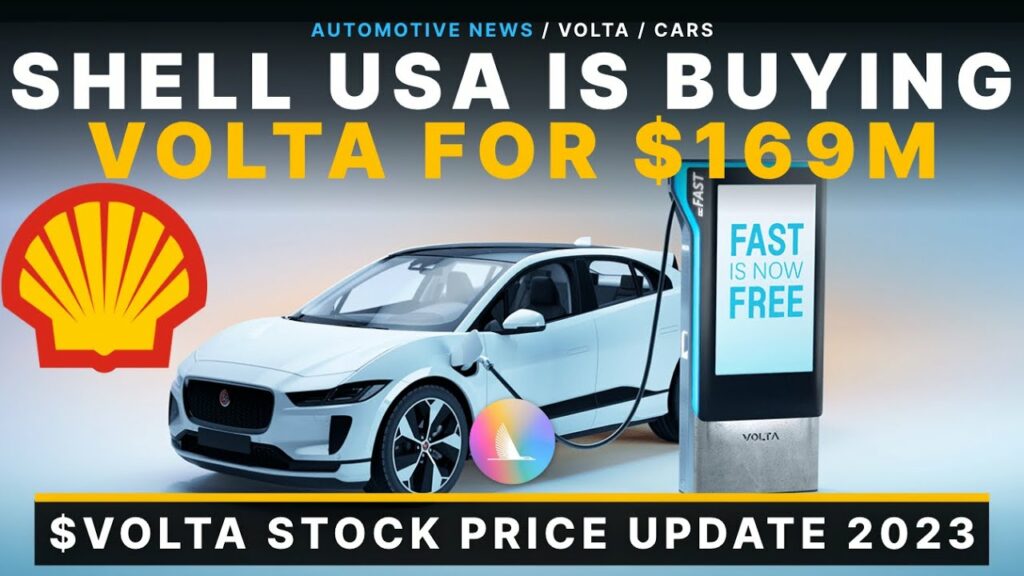

Volta has revealed that a unit of Shell would take over the electric vehicle (EV) charging network operator in an all-cash deal valued at about USD169M. Shell and other companies such as France’s EDF and Norway’s Statkraft have been investing in EV charging infrastructure to cash in on the growing demand for EVs. The announcement follows other investments in the EV charging infrastructure space, including Mercedes-Benz , which is poised to invest billions of euros to build 10,000 fast-charging points in North America, Europe and China by 2030.(TechCrunch, The Verge, Reuters)

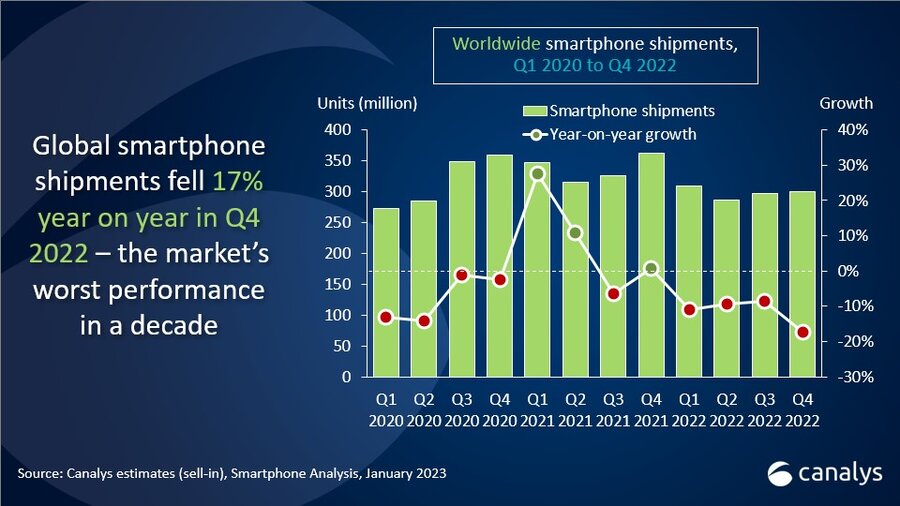

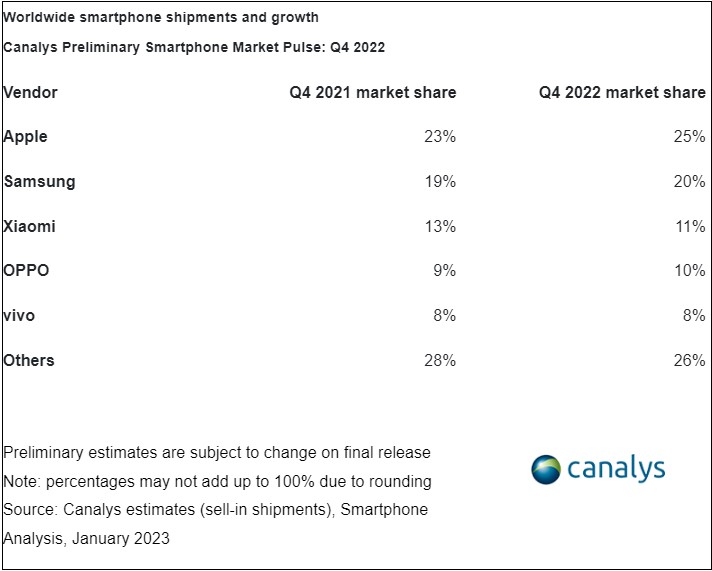

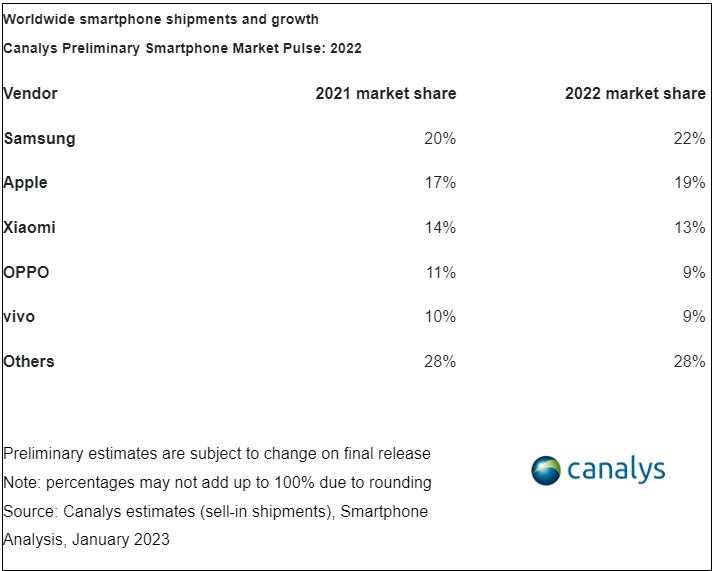

According to Canalys, worldwide smartphone shipments fell 17% year on year in 4Q22. Full-year 2022 shipments declined by 11% to fewer than 1.2B, reflecting an extremely challenging year for all vendors. Apple reclaimed the top spot in 4Q22 and achieved its highest quarterly market share ever at 25%, despite facing shrinking demand and manufacturing issues in Zhengzhou. Samsung finished the quarter second with a 20% market share but was the largest vendor for the full year. Xiaomi retained third place despite its share falling to 11% in 4Q22, largely due to challenges in India. OPPO and vivo rounded out the top five, taking 10% and 8% market shares respectively. (Android Headlines, Canalys)

In 2022, Meizu Technology and Xingji Times will complete strategic synergy, integrate into the travel technology ecosystem led by Li Shufu, and work together to create a new track for multi-terminal, full-scenario, and immersive fusion experience. Recently, Meizu Technology and Aisidi officially reached a strategic cooperation. The two parties will work together to build Meizu offline stores and improve service quality, actively improve the offline layout, and aim to build 1,000+ experience stores in 3 years. (Laoyaoba, iPhoneWired, Sohu, ChinaZ)

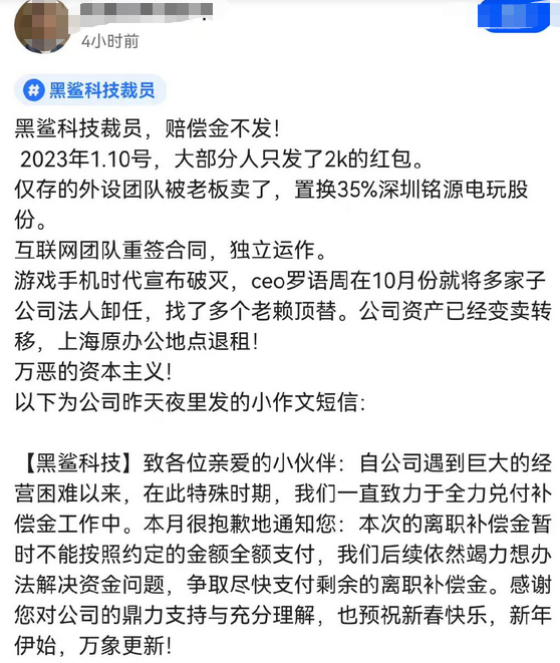

Xiaomi-backed gaming phone brand Black Shark is facing fresh challenges after it laid off most of its employees and failed to pay severance payments. Black Shark has conducted multiple rounds of lay-offs since Aug 2022, cutting its workforce from over 1,000 employees to just over 100 currently. The company has told affected employees via a text message on that it has experienced “tremendous operational difficulties” and has failed to pay severance in full for the time being. Black Shark will continue to find ways to solve its funding problems and pay the remainder of severance payments owed to employee. (My Drivers, Sina, 163.com, SCMP)

Russia’s federal anti-monopoly service (FAS) has fined Apple about USD17.4M over what it said was the U.S. company’s abuse of its dominant market position. The regulator said it has previously found that Apple forced Russian developers to use Apple’s payment services with the iOS App Store, in violation of Russia’s competition rules. (Gizmo China, Reuters, Euro News)

Microsoft plans to 10,000 jobs through its third fiscal quarter, which ends in Mar 2023. According to the company CEO Satya Nadella, the move is meant to “align cost structure” with demand and revenue. Customers boosted their digital spending during the height of the pandemic, Nadella says, but they are now scaling back. Numerous countries are either in the midst of recessions or expecting them. Microsoft will continue to hire in “key strategic areas”. The company is taking on a USD1.2B restructuring charge for the severance costs, consolidating building leases and unspecified changes to its hardware lineup. (Engadget, Microsoft, GeekWire)

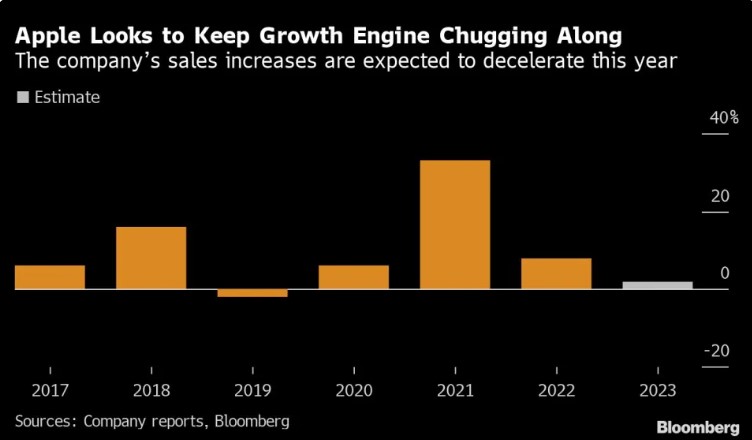

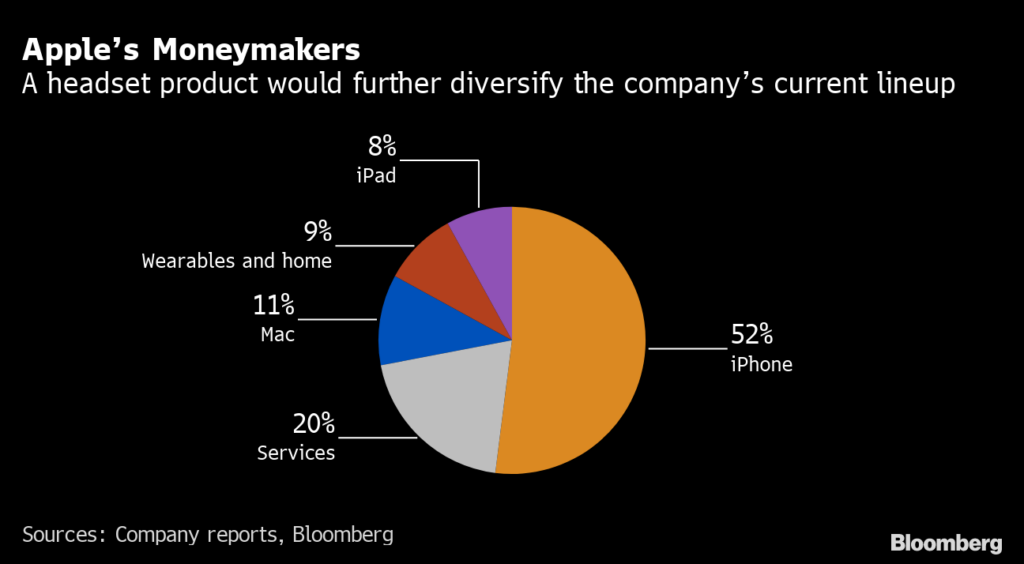

Apple has previously been expected to launch at least 2, more likely 3, headsets for AR, VR, or MR. Most recently, it has been reported that one, called Apple Glass, has been shelved. That device is believed to have had an codename of N421. There has also been an N301, called “Apple Reality Pro”, and an N602 which included a lower-cost variant. Now, however, the existence of what is called N109 has emerged. Although reportedly still in its early stages and not yet at the working prototype stage, it is specifically aimed at being made more budget-friendly. It is intended to be priced around the same as an iPhone, meaning up to around a possible maximum of USD1,600. Previous reports have claimed the first Apple AR headset will cost in the region of USD3,000. (Apple Insider, The Information)

Apple has allegedly indefinitely delayed work on the long-rumored AR glasses and pared back the scope of the project. Apple will instead target 2024 for the release of its lower-cost (but still likely expensive) mixed reality (MR) headset with its new M2 chip. While the mixed-reality headset is expected to cost around USD3,000, Apple is planning to follow up with a lower cost mixed reality headset priced around USD1,500. (Apple Insider, Bloomberg, ZDNet, Yahoo)

Adeia has announced that Samsung Electronics has entered into a long-term agreement at the end of 2022, renewing its licence to Adeia’s media intellectual property (IP) portfolio for Samsung’s Smart TVs and related offerings. Adeia has spent decades investing in advanced research and development to create market-leading technologies for the media and entertainment industry. Adeia’s innovative solutions touch practically every aspect of consumers’ day-to-day interaction with their entertainment, enabling Adeia’s customers to build customized, next-generation digital entertainment solutions for users around the globe.(Laoyaoba, Advanced Television, Globe Newswire)

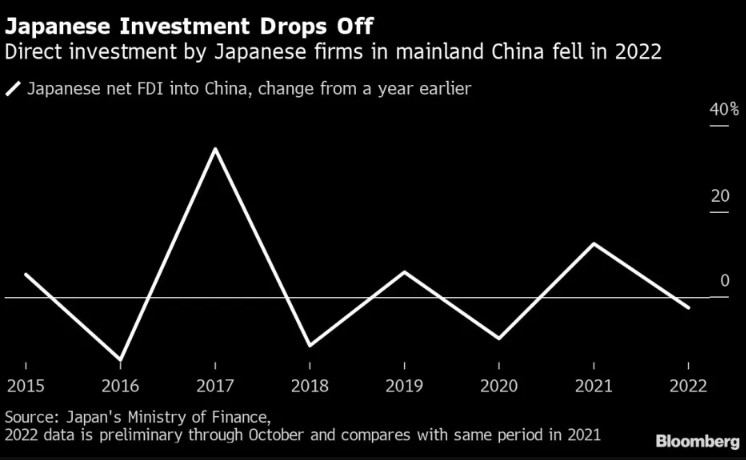

Panasonic plans to invest more than JPY50B (USD375M) over 3 years to expand production in China. The Osaka-based company will bring its first new Chinese appliance factory in 19 years online in 2024. The Zhejiang province plant will have the capacity to ship an annual JPY2B (USD290M) worth of microwave ovens, rice cookers and other small kitchen appliances. In Guangdong province, Panasonic will build a new wing at a beauty appliance factory and expand an air conditioner factory. Panasonic is among the Japanese manufacturers bucking a trend of relying less on China.(Bloomberg, Asia Nikkei, Laoyaoba, Yahoo)

Apple is reportedly working on a brand-new slew of smart home devices. Apple appears to be pushing deeper into the home space with a smaller display akin to a Google Nest Hub or Amazon’s Echo Show. The device would be similar to an iPad but less expensive, oriented toward home use, and would include a magnet for mounting. The device would appear to be more limited in scope than an iPad and would mainly be used for FaceTime chats, as well as controlling other smart home devices. (Bloomberg, The Verge, Business Times)

Federal regulators from the Occupational Safety and Health Administration (OSHA) found that 3 Amazon warehouse facilities had violated legislation designed to require employers to provide safe working environments. Investigations found that Amazon workers are at high risk for back injuries and other musculoskeletal disorders (MSDs), especially in warehouse environments that prioritize speed over safety. Amazon must pay a USD60,269 fine for the violations at warehouses in Deltona, Florida; Waukegan, Illinois; and New Windsor, New York. As part of the same investigation, OSHA found in Dec 2022 that 6 Amazon warehouse facilities had failed to record and report worker injuries and illnesses. There are 3 similar, ongoing investigations at Amazon facilities in Colorado, Idaho and New York. (TechCrunch, OSHA)