3-11 #NoAnger : Apple is expected to introduce the iPhone ahead of schedule in 2024; realme will launch its first foldable mobile phone later in 2023; Apple is unlikely to move Face ID components under the iPhone’s display until 2025; etc.

Samsung Electronics will allegedly enter competition to develop more advanced chips for smartphones and PCs by starting again to develop cores for central processing units (CPUs). Samsung is planning to lower its reliance on ARM and face off with Apple by loading CPUs of its own design into smartphones, tablets, and laptops. Samsung Electronics recently assembled an internal team to develop CPU cores. These will be ARM-based initially, and will be featured in a Galaxy-branded chipset in 2025. Samsung has recently denied the rumor. Samsung will keep working with ARM to use its stock CPU cores in future smartphones. (GSM Arena, Business Korea)

In 2022, Samsung Electronics’ investment reached a record high of about KRW53.12T (USD40.25B). Of the amount, more than 90% was concentrated on the semiconductor sector alone. It climbed by 10.1% from KRW48T (USD36.53B) the previous year, which was previously the highest-ever investment amount. Samsung Electronics has decided to maintain facility and R&D investments at a level similar to those in the past as well. To this end, it recently borrowed KRW20T (USD15B) from its subsidiary Samsung Display. Samsung Electronics also significantly increased R&D investment in future growth drivers. In 2022, its R&D expenses totaled KRW24.9292T (USD18.88B), up 10.3% from the previous year. (CN Beta, Techpowerup, Business Korea)

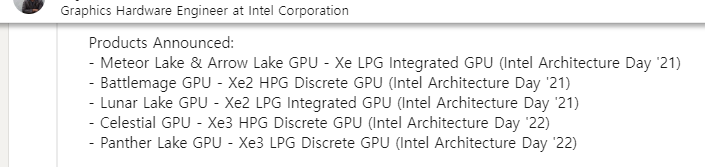

Intel’s plans for next-generation integrated Xe GPUs integrated on their Core CPU lineup have been leaked out. Other than Alchemist, there are Xe – Alchemist GPU, Xe2 – Battlemage GPU and Xe3 – Celetistal GPU. The first generation of Intel’s Xe Alchemist architecture has yet to be incorporated by any consumer CPU but we will see it in the action later 2022 with the Meteor Lake chips which are expected to carry 128 EUs while Arrow Lake will follow up with to 192 EUs. The follow-up to the Xe Alchemist iGPUs will come with Lunar Lake as the Xe2 LPG which will utilize the Battlemage graphics architecture while the Xe3 LPG chips featured on Panther Lake will adopt a brand new Celestial architecture.(CN Beta, WCCFtech, Twitter)

Intel is reportedly seeking an additional EUR4B-5B in subsidies from the German government to move ahead with a chip manufacturing complex in the eastern part of the country. The company postponed the start of construction at the plant — which it had previously agreed to build in Magdeburg with EUR6.8B (USD7.2B) in government aid — at the end of 2022 because of economic headwinds, and is now looking for more funds.(CN Beta, Bloomberg, Yahoo)

Apple has invested huge resources in the research and development of 5G modem chips, and it is expected to introduce the iPhone 16 series mobile phones ahead of schedule next year. Apple currently purchases the 5G modem chips used in the iPhone from Qualcomm, but Qualcomm CEO Cristiano Amon has recently said that Apple may carry self-made 5G modem in the iPhone 16 series. TSMC is expected to take all 3nm wafer foundry orders. Apple’s self-made 5G modem chip research and development code is Ibiza, which will use TSMC’s 3nm process, and the supporting RF IC will use TSMC’s 7nm process. TSMC will reportedly start trial production for Apple in 2H23 at the earliest, and gradually increase the production volume in the 1H24, which means entering a new wave of growth cycle after 3Q24.(Phone Arena, CTEE, WCCFtech)

Qualcomm Snapdragon 7+ Gen 1 will reportedly be manufactured using TSMC’s 4nm process instead of Samsung Foundry’s 4nm LPE process used to make the Snapdragon 7 Gen 1. TSMC’s 4nm process has proven to be more efficient than Samsung Foundry’s 4nm process, which means the Snapdragon 7+ Gen 1 will be more power efficient than its predecessor. The Snapdragon 7+ Gen 1 reportedly features one Cortex-X2 CPU core clocked at 2.92GHz, three Cortex-A710 CPU cores clocked at 2.5GHz, and four Cortex-A510 CPU cores running at a maximum frequency of 1.8GHz. For graphics processing, the chipset reportedly features the Adreno 725 GPU clocked at 580MHz. (SamMobile, Gizmo China)

T-Head, the chip unit of Alibaba Group, is putting more effort into RISC-V chips, as China bets on the open-source chip design architecture as a means of achieving greater self-sufficiency in the semiconductor space in the face of US sanctions. Separately, Alipay, the payment service of Alibaba affiliate Ant Group, said it plans to introduce chips that will enable secure payment functions on wearable devices. The chips, also based on RISC-V, are being jointly developed by Alipay and T-Head.(Laoyaoba, SCMP, Yahoo, OfWeek)

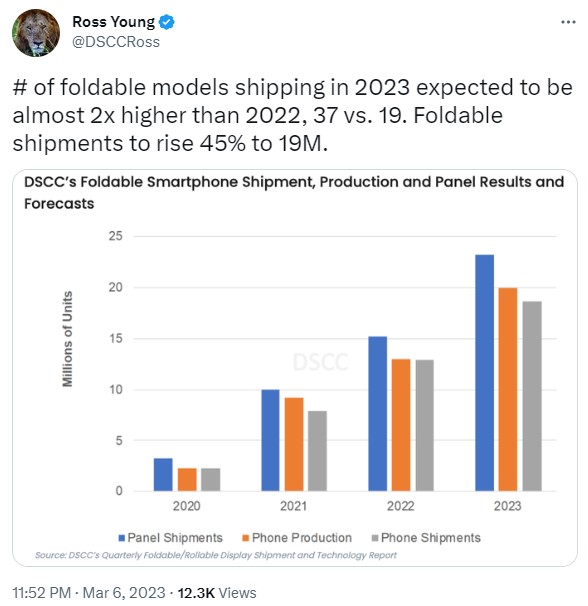

According to DSCC, 7 companies sold foldable smartphones in 2022: Samsung, Huawei, Xiaomi, Honor, OPPO, Motorola, and vivo. Google, OnePlus, and Tecno will join this roster in 2023. DSCC broke down the share of each foldable form factor in 2023: 16 clamshell foldable devices like Samsung’s Flip series, 20 inward foldable devices like Samsung’s Fold series, and 1 new outward foldable device. DSCC is expecting total foldable shipments to just about reach 20M units in 2023. (Android Headlines, Twitter)

Apple will release a redesigned HomePod with a 7” display in 1H24, according to TF Securities analyst Ming-Chi Kuo. Tianma is set to debut in Apple’s supply chain, becoming a new beneficiary of Apple’s revamped smart home strategy. Tianma’s long-term prospects in Apple’s supply chain look promising. It’s poised to follow the growth path of BYD Electronics or BOE by starting with low-end products and gradually increasing its shipment allocation, and obtaining higher-end products through technology capacility upgrades. Tianma’s next orders from Apple may be iPad panels if the shipment goes well. (Apple Insider, Twitter, Medium, MacRumors)

Madhav Sheth, realme VP and President of Realme International has hinted that the company will launch its first foldable mobile phone later in 2023, and it is expected that the small vertical foldable Flip and horizontal foldable Fold are under development.(GizChina, GSM Arena, Twitter, My Drivers, Phone Arena)

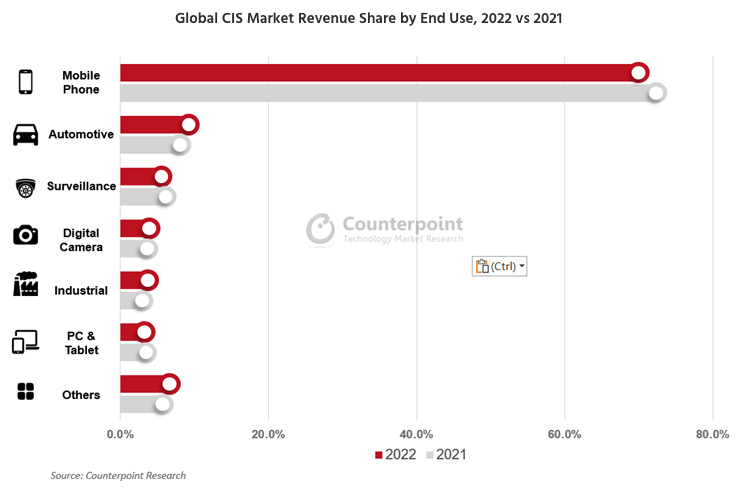

The global CMOS image sensor (CIS) market evenue fell YoY for the first time in a decade to reach USD19B, a decline of 7% YoY, according to Counterpoint Research. Sluggish demand from the mobile phone, surveillance and PC and tablet segments led to this weaker-than-expected market performance. The mobile phone segment entered a period of contraction and its CIS revenue share fell below 70%. Automotive CIS share rose to 9% driven by strong demand for ADAS and autonomous driving. Looking into 2023, Counterpoint Research expects the global CIS industry to slowly recover and see a low-single-digit YoY growth driven by strong demand from automotive and industrial markets and a modest recovery of the mobile phone market. (Counterpoint Research)

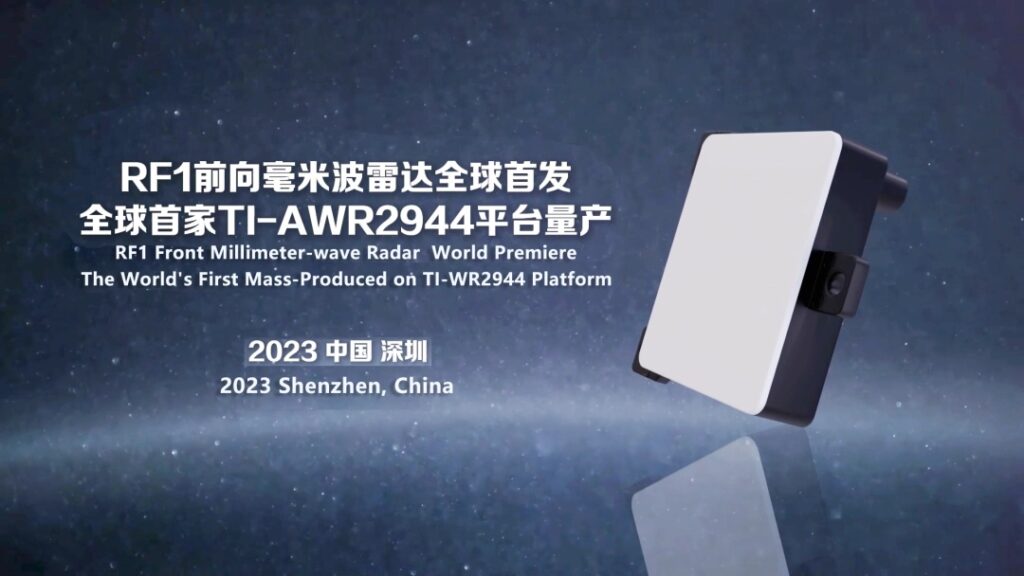

BYD has announced that its subsidiar FinDreams Technology has rolled out its new generation of RF1 front millimeter-wave radar. The RF1 front millimeter-wave radar has passed rigorous testing and will be mass-produced and installed in vehicles in Mar 2023. FinDreams was officially registered in 2019. Its R&D team for millimeter-wave radar products started in 2016 and released its first 24GHz corner millimeter-wave radar in 2017. After mass production and several product iterations, its RB1 corner radar shipments exceeded 1M units by the end of 2022, meeting most of BYD’s demand for corner radar currently.(Laoyaoba, IT Home, Sohu)

Apple is unlikely to move Face ID components under the iPhone’s display until 2025 at the earliest, according to display industry consultant Ross Young. Young had previously expected Apple to launch its first iPhone with under-display Face ID in 2024, but he now believes the timeframe has been pushed back to 2025 at the earliest due to “sensor issues”. (CN Beta, MacRumors, My Drivers, 9to5Mac, Twitter)

Transsion’s Infinix has introduced its 260W wired and 110W wireless All-Round FastCharge. The new solution can fill a battery from 0 to 25% in one minute over the wire and can reach 100% in under 8 minutes. Wirelessly, 0 to 100% can be achieved in 16 minutes. The charging efficiency is 98.5%, and the 4,400 mAh test battery could retain 90% of its initial capacity after 1,000 cycles. The charger uses a combination of GaN material and AHB circuit infrastructure with high power density, small size, and safe charging control. The cable is also important, and Infinix developed one that can carry a current of up to 13A to ensure the 260W charging. The 110W wireless charging is using custom-made small-sensitive coils with different architectures – there are fewer but wider coils in the same space, reducing internal resistance and subsequently lowering phone temperature increase when charging.(GSM Arena, IT Home)

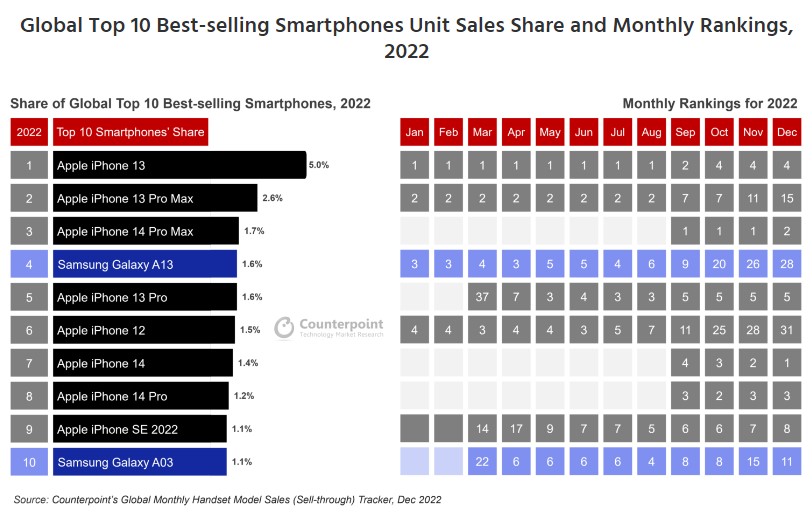

In 2022, Apple became the first brand to capture 8 spots in the list of top 10 best-selling smartphones, according to Counterpoint Research. The remaining 2 spots were taken by Samsung. The top-10 list contributed 19% of the total global smartphone sales in 2022, the same as in 2021. Apple’s iPhone 13 was the best-selling smartphone of 2022, contributing 28% of iPhone sales. It was the best-selling smartphone in major markets such as China, US, UK, Germany and France. Further, the iPhone 13 remained the number one smartphone each month from its launch in Sept 2021 till Aug 2022. (GSM Arena, Counterpoint Research)

Meta said that its flagship platform Facebook has recently seen 2B daily active users (DAU), showing that “Facebook is not dead nor dying, but in fact alive and thriving”. Meta has said that it is testing the ability to access your Messenger inbox from within the Facebook app, and it plans to expand this to more people soon. Outlining the importance of messaging apps to Meta, the company revealed that 140B messages are sent across its apps each day. Meta said that it will build more ways to integrate messaging features into Facebook in 2023. Its target is to make connecting and sharing easy and convenient across its whole library of platforms.(Neowin, Meta)

Yusuf Mehdi, Microsoft’s VP for Modern Life, Search, and Devices, said that the new Bing has already surpassed 100M daily active users (DAU) after the announcement of the new ChatGPT-enabled Bing. Mehdi attributed the growth in Bing to a unique value proposition, as the combination of search, answers, chat, and creation into one experience has proven successful. He further stated that this surge in users serves as a validation of their view that the search industry is due for a reinvention. Bing still has a long way to go before catching up with Google, which has over 1B DAU and dominates the search market.(Android Headlines, Bing)

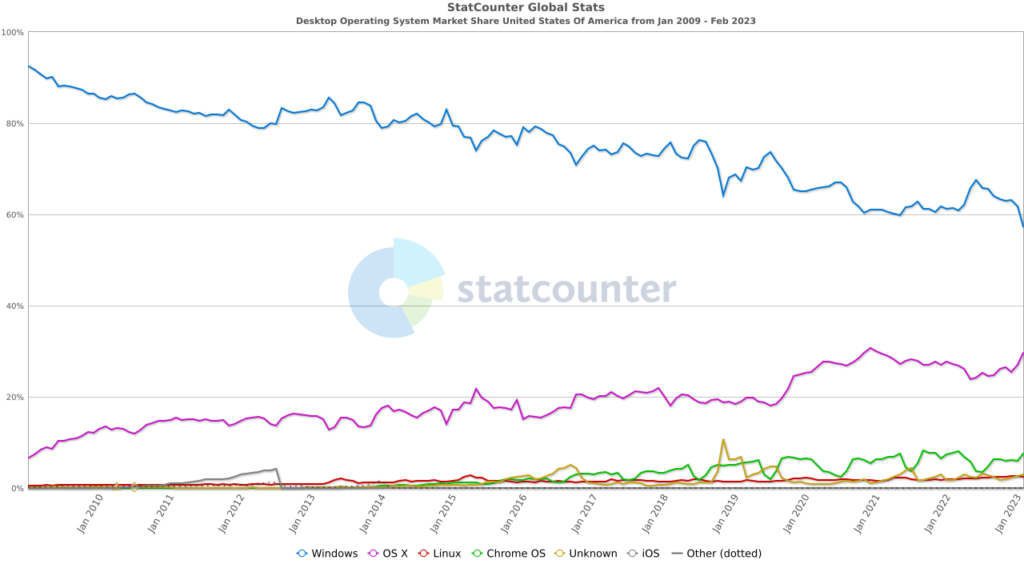

Microsoft’s Windows has always dominated the desktop OS space globally, as the operating system is widely available with many PC manufacturing partners such as Dell, HP and Lenovo. However, a recent trend shows that Windows, the operating system by Microsoft, is rapidly losing popularity in the US, due to the rise of macOS and ChromeOS in the country. Statcounter by GlobalStats shows that Windows has dropped to a historic low desktop OS market share of 57.37% in the United States of America in Feb 2023, a far cry from its all-time high of 92.37% in Jan 2009. And the trend line does not show signs of slowing down, as Windows is expected to lose more market share in the country throughout 2023.(GizChina, StatCounter)

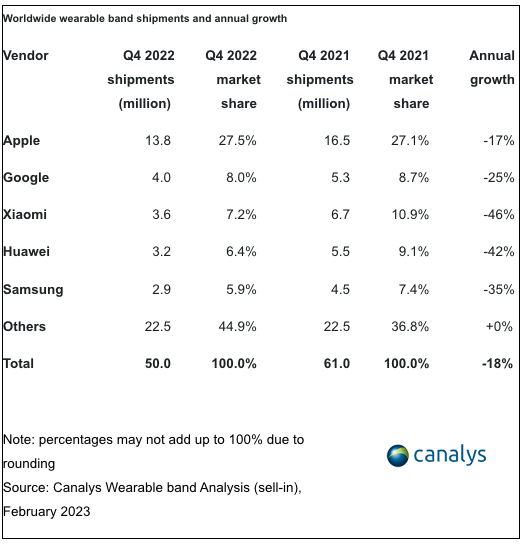

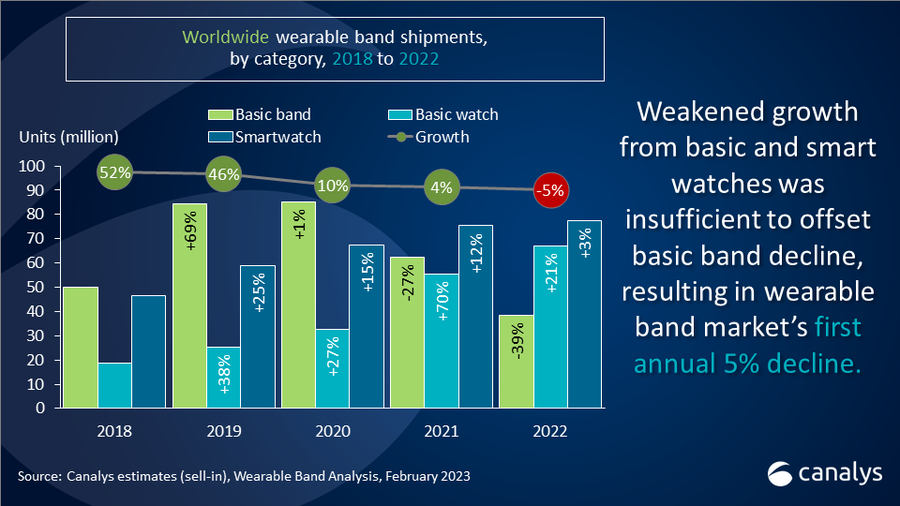

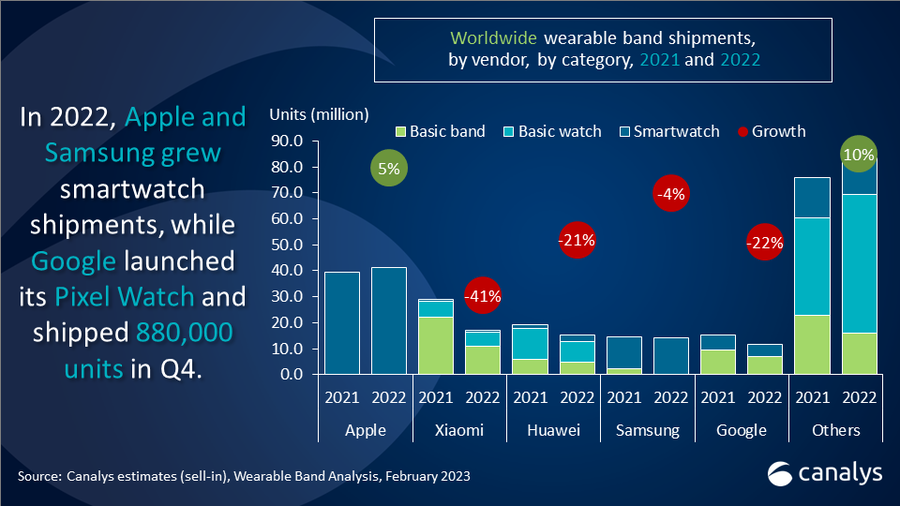

Canalys has released its latest estimates on the wearable band market, revealing a challenging 4Q22 with an 18% shipment decline to reach 50M units. This marks the first double-digit decline for the market in a typically seasonally strong 4Q22. The smartwatch category suffered a similar fate with a double-digit decline of 17%. Basic bands experienced their ninth consecutive decline with a 43% drop, while basic watches grew only 3%, with the growth engine India slowing significantly. Apple, the leader of the smartwatch category and the overall wearable band market, declined 17% on top of a tough comparison to its stronger quarter in 2021 as it returned to its regular launch schedule. Despite falling 25% due to waning Fitbit shipments, Google rose to second place as it was able to soften its decline with 16% smartwatch growth with the release of its Pixel Watch. (Android Headlines, Canalys)

The pendulum for AR/VR headsets swung the other way through the course of 2022 as global shipments declined 20.9% year over year to 8.8M units, according to IDC. The decline was not completely unexpected, however, given the limited number of vendors in the market, a challenging macro-economic environment, and a lack of mass market adoption from consumers. Despite the downturn, the overall market was led by Meta with nearly 80% share. In second place was ByteDance (Pico) with 10% share as the company continued to ramp up its product portfolio and focus on markets where Meta was notably absent or a lesser known brand. The remaining top 5 spots were held by DPVR, HTC, and iQIYI. (GSM Arena, IDC)

Honda has unveiled a new 3rd-generation version of Autonomous Work Vehicle (AWV) designed to transport up to two palettes worth of goods around worksites with no human assistance. Compared to the 2nd-generation version, the latest AWV has a larger bed size (two pallets) and higher capacity (2,000 pounds); a higher self-driving speed of up to 10 MPH; a larger battery that offers up to 10 hours and 28 miles of endurance; better avoidance functions; and a lower bed for easier loading. It can operate autonomously or via remote control through challenging terrain like construction sites, thanks to a suite of sensors on the mast.(Engadget, Honda)

Faraday Future has said it plans to start production of its all-electric FF 91 Futurist SUV at the end of Mar 2023 after years of delay, lack of capital and internal drama that threatened the company’s existence. Faraday Future has previously indicated that production would start in Mar 2023, but had yet to select a date. There are two caveats to this milestone, however. The company said in its 2022 full-year and 4Q22 earnings report that start of production will begin 30 Mar 2023 if it receives the remaining funds expected from investors and if suppliers are able to meet its requirements. Faraday Future said in Feb 2023 that it had reached financial commitments of USD135M in convertible secured notes, capital that the company said would allow it to start production. About USD111.6M of funds have been received. The company is expecting to more incremental payments of USD38.4M and USD58.4M.(TechCrunch, IT Home, Sina)

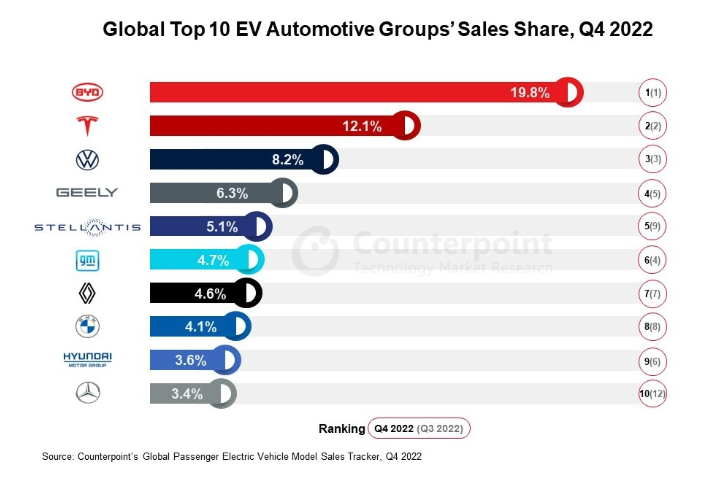

Global passenger electric vehicle (EV) sales in 4Q22 rose by 53% YoY to bring the 2022 total to over 10.2M units, according to Counterpoint Research. During 4Q22, battery EVs (BEV) accounted for almost 72% of all EV sales, while plug-in hybrid EVs (PHEVs) accounted for the rest. The top 3 EV markets were China, Germany and the US. The top 10 EV automotive groups, which hold more than 39 passenger car brands, contributed to almost 72% of all EV sales in 4Q22. EV sales were at an all-time high during 4Q22. The annual total for 2022 would have reached close to 11M units had fresh COVID-19 infections not surfaced in China. (CN Beta, Counterpoint Research)

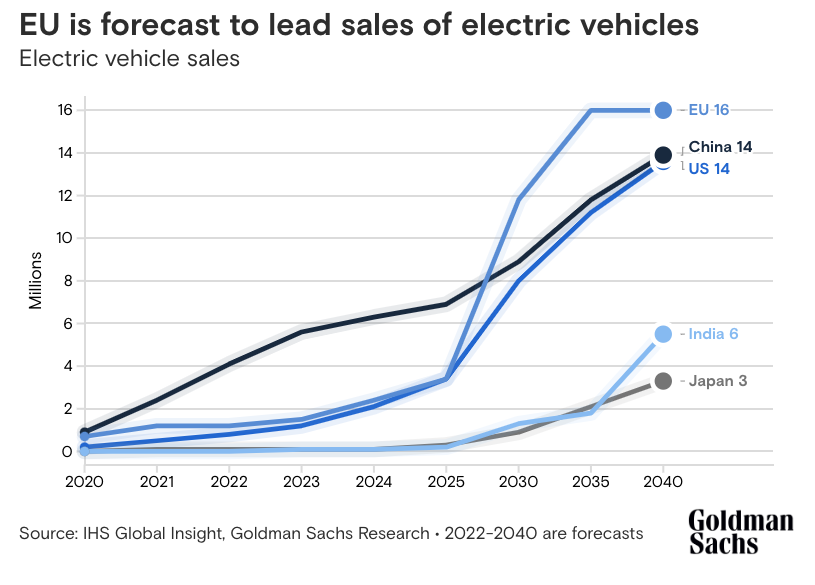

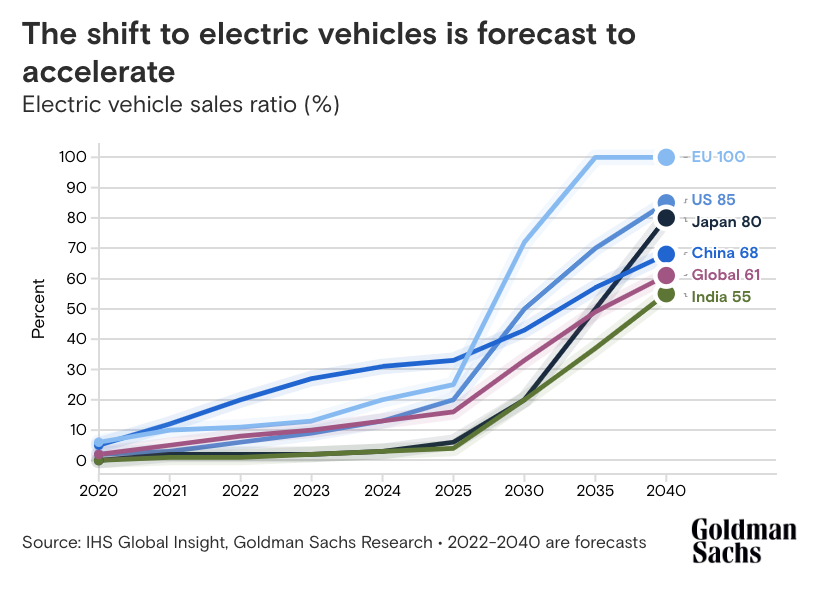

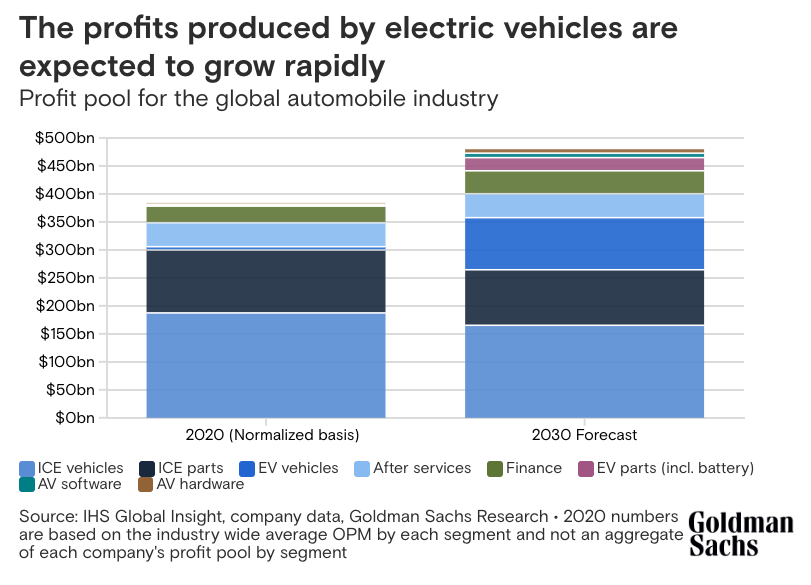

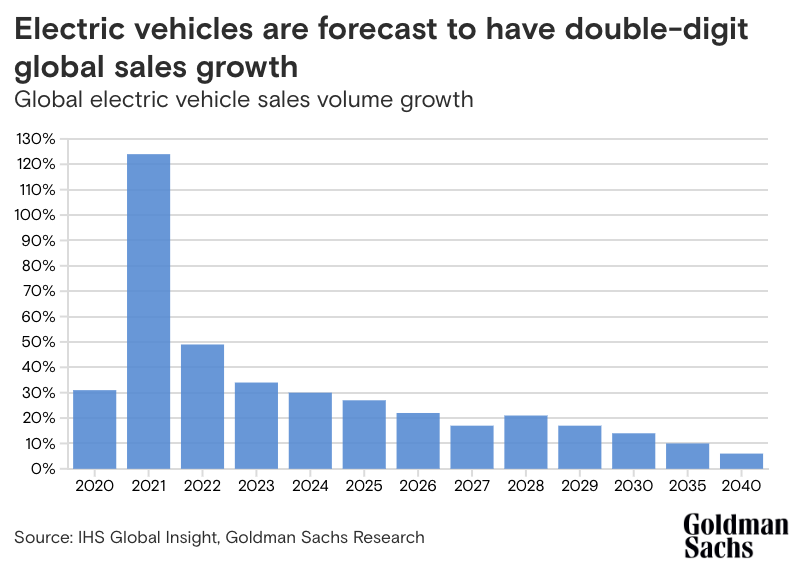

Electric vehicle (EV) sales will soar to about 73M units in 2040, up from around 2M in 2020, according to forecasts by Goldman Sachs Research. The percentage of EVs in worldwide car sales, meanwhile, is expected to rise to 61% from 2% during that span. The share of EV sales is anticipated to be well over 80% in many developed countries. Goldman Sachs forecast sales of EVs to grow by 32% annually this decade, even as sales of products related to gasoline engines slump. The global car industry’s operating profits are expected to rise to USD418B in 2030, up from USD315B in 2020, while the pool of profits for EVs is forecast to increase to USD110B from USD1B. In the meantime, the market for EV batteries, which account for as much as 40% of the car’s cost, is becoming concentrated. The top five battery makers had more than 80% of the global market share in 2020. (Goldman Sachs, CN Beta)

Huawei and its smart car partner AITO have revealed that both companies to open a new chapter of a partnership for “Wenjie” cars, as well as new technologies. “Wenjie” is Huawei’s ecosystem car brand and a new business model created by Huawei. Huawei provides core software and hardware technologies such as electrification and smart components. The cooperation also includes product definition, user experience, quality control, channel retailing, and brand marketing to help car companies sell good cars. (Gizmo China, Huawei Central, Weibo, 36Kr, IT Home)

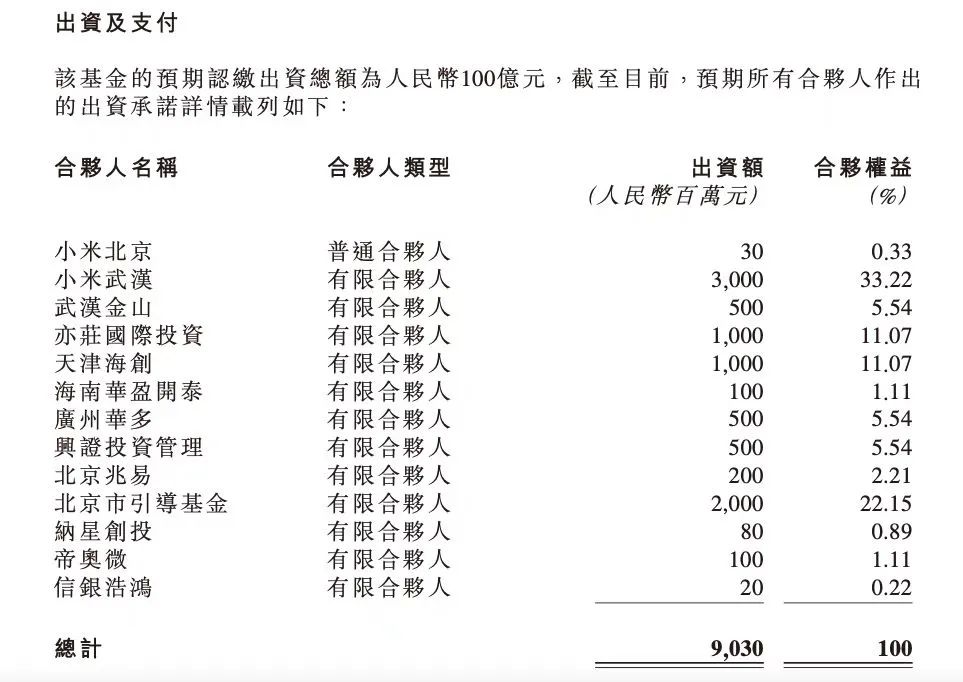

An equity investment fund backed by China’s consumer electronics giant Xiaomi raised CNY10B (USD1.44B) recently, with leading investors including Xiaomi, software company Kingsoft, and a handful of government-backed investment vehicles, according to a Kingsoft regulatory filing announcing the fund. The fund, Beijing Xiaomi Zhizao Equity Investment Fund Partnership, mainly focuses on the automotive and semiconductor industry supply chain, including auto parts, manufacturing equipment, and automobile chips. Other investors include entities backed by the Tianjin and Beijing governments. Many investors are Xiaomi’s partners. Up to now, the investment scale of all partners has exceeded CNY9B (USD1.3B).(Laoyaoba, 36Kr, Sina, EET-China)

Momenta, a Chinese autonomous vehicle startup backed by General Motors and SAIC, is looking to raise USD1B in a US or Hong Kong initial public offering. Founded in Sept 2016, Momenta is building intelligent systems for autonomous driving, aiming to provide solutions for Tier 1 suppliers and OEMs. The company is in the process of collecting data through its own Level 2 products to support the R&D and commercialization of Level 4 products. Strategy is focused on both Mpilot, a mass-production-ready autonomous driving solution, and Momenta Self-Driving (MSD), a driving solution targeting full autonomy. A number of models including SAIC-backed EV startup IM Motors have already been equipped with the Mpilot system. (TechNode, Momenta, Laoyaoba, The Standard)

Lenovo has invested in intelligent car security company Callisto Technology, as it is shown on Tianyancha, provider of Chinese corporation data and due diligence platform. Callisto was founded in 2021 devoted to automotive safety technology . The company provides efficient car safety solutions based on artificial intelligence and big data technologies. It has given cybersecurity support to the world’s leading companies in the field of intelligent vehicles, autonomous driving and advanced driver assistance systems. (Laoyaoba, Laoyaoba, Sohu, CN Stock)

A subsidiary of Alphabet, which owns Google, hopes to develop drone delivery-network technology able to handle millions of orders, within 12 months. Operating drones as a network, Wing says, will improve efficiency. The technology is being tested “at scale” in Logan, Australia, where Wing delivers up to 1,000 packages a day. The company has also started trial drone deliveries in the Dublin suburb of Lusk. And it says it and other companies are in talks with the Department for Transport and the Civil Aviation Authority about agreeing regulations to allow drone deliveries in the UK.(CN Beta, BBC, Yahoo)

Snapchat has implemented OpenAI’s ChatGPT into its service, dubbed “My AI”. A subscription to Snapchat+, which costs USD3.99 per month, is needed to access “My AI”. To connect with My AI, visit its profile on Snapchat and add it as a friend. My AI will be a friendly personal sidekick for Snapchat users accessible within the Snapchat app. Users can ask the chatbot for answers to trivia questions, travel ideas, recipes, gifts for a specific person, poetry, and more.(Android Headlines, Snap, Search Engine Journal)

Apple is planning to “re-examine” its development of artificial intelligence (AI), according to Digitimes. Digitimes suggests that the growing interest in generative AI catalyzed by ChatGPT has motivated a re-evaluation of how the technology is developed at major companies like Apple, Meta, and Amazon. These companies are purportedly making efforts to ensure Microsoft does not maintain its lead in AI. Apple and Tesla, in particular, are said to be reconsidering their approach to AI. (MacRumors, Digitimes)

Salesforce said that it will release software incorporating artificial intelligence (AI) to help salespeople, customer service agents and marketers do their jobs. Salesforce is calling the offering Einstein GPT. Einstein GPT will integrate with Salesforce’s widely-used customer relationship management (CRM) system. The bot will let users type in prompts to generate client summaries, personalized emails, marketing copy or code. The software can also create images, like promo headers, for businesses to use in campaigns. For the service, Salesforce partnered with ChatGPT maker OpenAI, allowing the model to pull from the enterprise version of ChatGPT, as well as other sources including public information and Salesforce data. Clients can also train Einstein GPT using their own company data. (CN Beta, Salesforce, Fast Company, Forbes, CNBC)