4-22 #MissHim : TSMC seeks up to USD15B from US government; GlobalFoundries has filed a lawsuit against IBM; Alphabet is merging an internal Google Research team called Brain with DeepMind; etc.

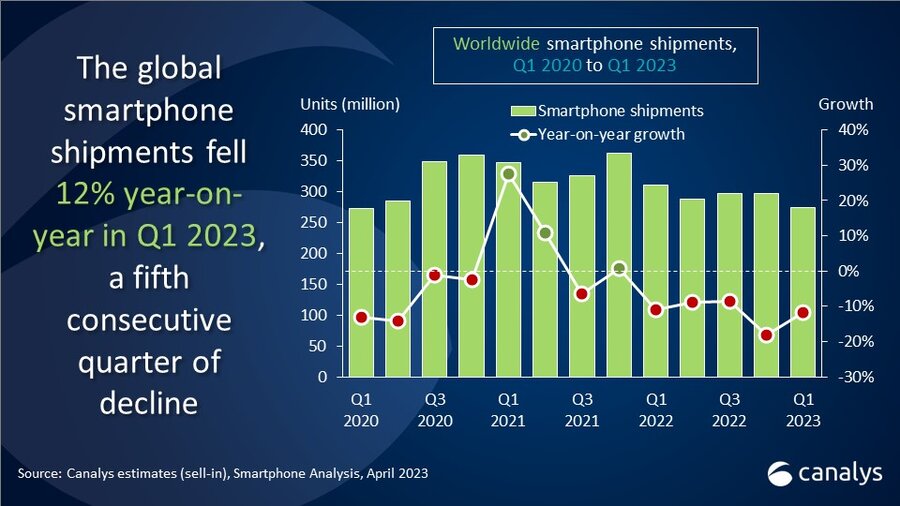

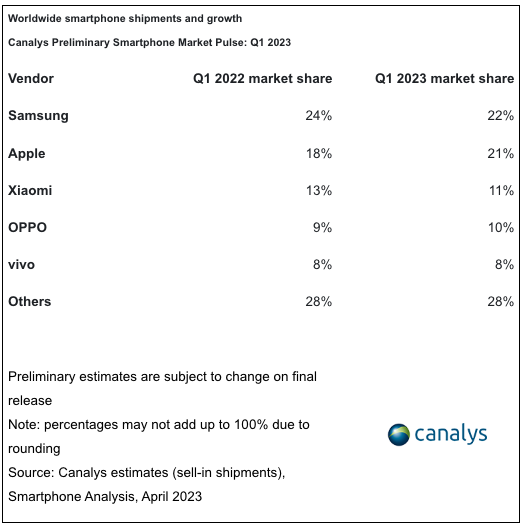

The global smartphone market experienced a fifth consecutive quarter of decline, falling by 12% YoY in 1Q23. Despite limited improvements in major unfavorable macro factors, the market is yet to recover. Samsung was the only leading vendor to achieve a QoQ recovery and struggled back to number one with a 22% market share. Meanwhile, Apple dropped to second place with a 21% market share, narrowing the gap between itself and Samsung, driven by solid demand for its iPhone 14 Pro series in 1Q23. Xiaomi held on to the number three position with an 11% market share, helped by new product launches toward the end of the quarter while inventory adjustment continued. OPPO and vivo strengthened their positions in the Asia Pacific region and their home markets, accounting for 10% and 8% of the market share respectively. (Canalys)

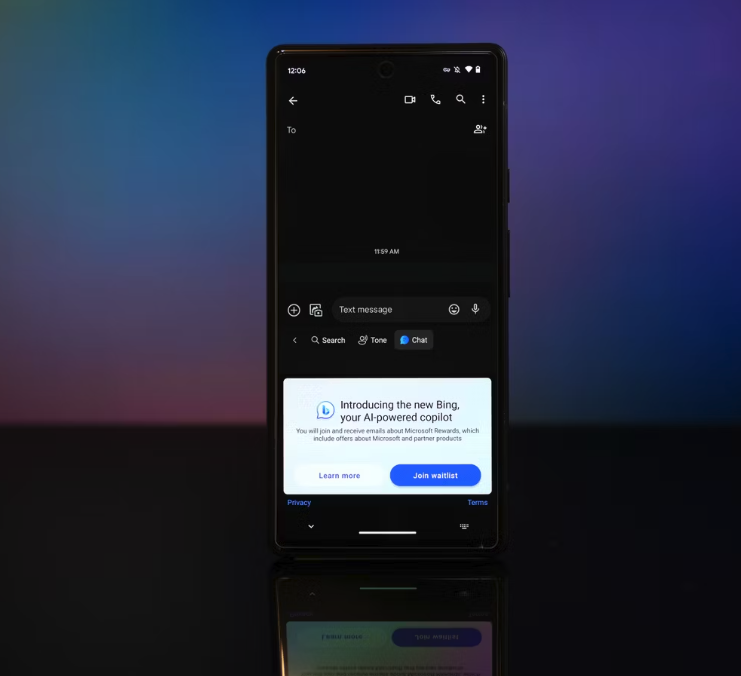

Samsung Electronics is reportedly considering replacing Google with Microsoft-owned Bing as the default search engine on its devices. Samsung has kept Google as the default search engine on Galaxy devices for the past 12 years. The growing popularity of the new AI-powered Bing is seen as the reason behind Samsung considering a change. Google, this would mean a potential loss of an estimated USD3B in annual revenue. For years, Google has hardly had any competition in the search business, which was worth USD162B in 2022. It is the default search engine on Samsung’s Galaxy devices and Apple’s iPhones. (Android Headlines, NY Times, XDA-Developers, Ars Technica, Reuters)

In Jun 2021, Google won approval to build an 80-acre campus, spanning 7.3 million square feet of office space, in San Jose, California, the third-largest city in the country’s most populous state. The estimated economic impact: USD19B. The construction project, which was supposed to break ground before the end of 2023, has been put on pause, and no plan to restart construction has been communicated to contractors. Google representatives have expressed a commitment to it, they are concerned the project may not reach the scale promised in the original master plan. (Engadget, CNBC)

Apple is reportedly planning an iPhone app to let users compile their daily activities as part of its efforts in the market for mental and physical health technology. The Apple journaling app, code-named Jurassic, is designed to help users keep track of their daily lives. The app will compete in a category of so-called journaling apps, such as Day One, which lets users track and record their activities and thoughts. (Engadget, WSJ, Live Mint)

Alphabet’s Google has received a mixed ruling from a San Francisco federal judge in a patent lawsuit brought by Sonos over wireless audio technology, failing to invalidate all of the patents before a trial but narrowing Sonos’ claims. The case, set for trial 5 May 2023, is part of a contentious intellectual property dispute between the former business partners over their smart speakers that includes lawsuits in the United States, Canada, France, Germany and the Netherlands. Sonos won a limited import ban on some Google devices from the U.S. International Trade Commission (ITC) in 2022, while Google has sued Sonos for patent infringement at the ITC and in California. (Android Central, Thurrott, Reuters)

Vietnam’s electric vehicle maker VinFast has announced the shipment of the second batch of 1,879 VF 8 vehicles to the US and Canada. The vehicles are expected to be delivered to US customers in May and to Canadian customers in Jun 2023. The company said it aimed to export a first batch of 700 VF 8 vehicles to Europe in mid-Jul 2023 and would also soon open global reservations for 2 new models. The automaker delivered 865 VF 8 units domestically in 1Q23 and has an annual production capacity of 250,000. VinFast has said it secured 55,000 orders globally as of Dec2022, of which 12,000 are from the U.S. market. (CN Beta, Cleans Technica, Reuters, VinFast)

Volkswagen Group, the German car company behind marques such as Porsche and Audi, intends to invest EUR1B (USD1.1B) to build 100% TechCo, a research and development center for connected electric vehicles in eastern China’s Hefei. The 100% TechCo is expected to be ready by early 2024 to develop and procure vehicles and parts to ensure the company’s products respond to the needs of Chinese customers. The project is to combine vehicle and component development and procurement when launching in 2024. Volkswagen expects this to reduce development times for new products and technologies by around 30%. Moreover, the joint ventures mentioned include the cooperations Volkswagen upholds with SAIC, FAW-VW, and Volkswagen Anhui.(CN Beta, Financial Times, Electrive, Yicai Global)

Alphabet is merging an internal Google Research team called Brain with DeepMind, a move designed to bring 2 groups focused on artificial intelligence closer together as the battle for AI heats up. Google acquired DeepMind in 2014 for a reported USD500M and has until now run it as an independent unit out of the U.K. According to Alphabet CEO Sundar Pichai, combining all this talent into one focused team, backed by the computational resources of Google, will significantly accelerate our progress in AI.(Android Central, Google, Google, CNBC, Ars Technica)

Samsung has enhanced its 5nm process technology, which would be benefiting the upcoming Pixel 8 and Galaxy Watch6 devices. Samsung is expected to introduce Exynos 2400 based on 4nm in 2023, while rumors about its 3nm chipsets have started to appear. Samsung would introduce its first 3nm process-based smartphone processor in early 2025. The Exynos 2500, which could debut with the Galaxy S25 series will be manufactured by Samsung 3nm process technology.(Android Headlines, Twitter, Gizmo China, SammyFans, Samsung)

Taiwan Semiconductor Manufacturing Co (TSMC) is pushing back on some of the conditions the United States has attached to chip-factory subsidies as it seeks up to USD15B from the U.S. government. TSMC, which in Dec 2022 more than tripled its planned investment at its new Arizona plant to USD40B, is concerned about rules that could require it to share profits from the factories and provide detailed information about operations. (Apple Insider, WSJ, Reuters, Yahoo)

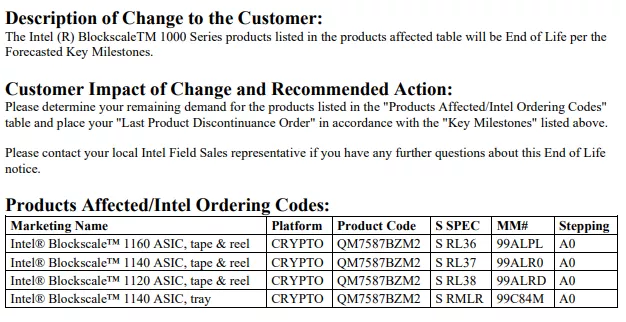

In Apr 2022, Intel announced a new Blockscale series of application-specific integrated circuits (ASIC) meant for “energy-efficient blockchain hashing”. The company positioned the Blockscale 1000-series ASICs to lower power usage and help ease the then-ongoing shortage of GPUs. Intel has quietly discontinued the Blockscale 1000 chips, and the company told Tom’s Hardware that it has no immediate plans to introduce any upgrades or replacements. The company will “continue to support” companies that have already purchased Blockscale chips, but it looks like the project is fading away barely a year after its original announcement. The Blockscale project came from Intel’s “Custom Compute Group”, a specialized team inside Intel’s Accelerated Computing Systems and Graphics Group (AXG).(CN Beta, Tom’s Hardware, The Register, Ars Technica)

Chip manufacturer GlobalFoundries has filed a lawsuit against International Business Machines (IBM), accusing it of unlawfully sharing confidential intellectual property and trade secrets. GlobalFoundries said in its complaint that IBM had shared IP and trade secrets with Rapidus, a new state-backed Japanese consortium that IBM is working with to develop and produce cutting-edge two-nanometer chips. It also asserted that IBM had unlawfully disclosed and misused its IP with Intel, noting that IBM had announced in 2021 it would collaborate with Intel on next-generation chip technology. (CN Beta, TechRadar, Reuters, GlobalFoundries, CNBC)

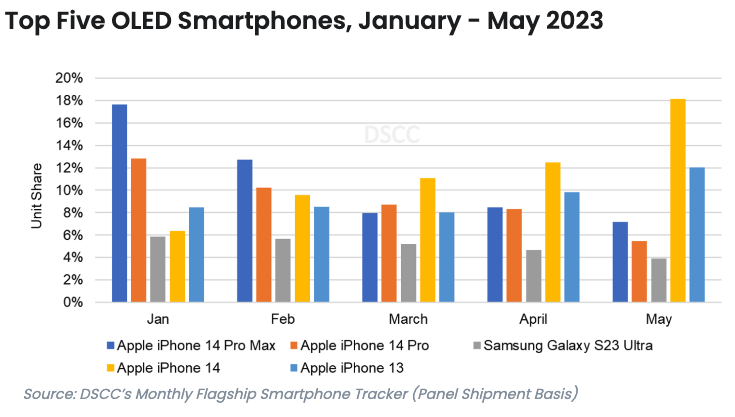

According to Display Supply Chain, of the top 5 models, 3 models, Apple iPhone 14 Pro Max, iPhone 14 Pro and Samsung Galaxy S23 Ultra use an LTPO backplane. LTPO share is between 33% – 42% share with some of the highest share for panel shipments occurring in the months of Jun and Aug 2022-Feb 2023, with new iPhone Pro models and Galaxy S Ultra models launching in Sept 2022 and Feb 2023. For refresh rates, 120Hz continues to have the majority share as most flagship smartphones start at 120Hz. In Mar 2023, 120Hz had a 63% share. (Apple Insider, DSCC, DSCC)

Samsung, LG, and other tech companies are reportedly pushing movie theater chains to adopt LED displays. Hollywood executives have recently seen a demonstration of technology like the Onyx Cinema LED screen Samsung debuted a few years ago. Currently, the company’s technology has made it into relatively few theaters worldwide, but it and similar screens from competing manufacturers like LG could spread if Hollywood is receptive. The proposed screens would replace projectors with technology fundamentally similar to OLED TVs consumers can get in their living rooms, just a lot bigger. They would be much brighter than traditional projectors and offer HDR support. (CN Beta, Techspot, Hollywood Reporter)

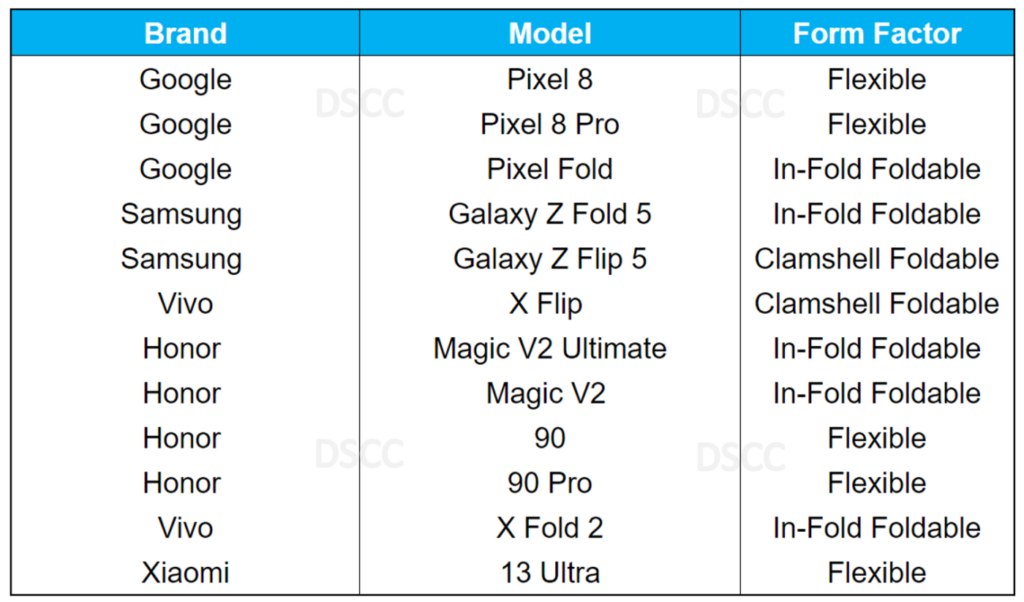

Google is reportedly planning to launch its first foldable smartphone codenamed “Felix” at upward of USD1,700, making it the highest price-point product in Google’s smartphone series. The company claims the Pixel Fold, which will compete with Samsung’s phones, will have “the most durable hinge on a foldable” phone and will offer a phone trade-in option. (Gizmo China, CNBC, MacRumors)

Seagate Technology has agreed to pay a USD300M penalty in a settlement with US authorities for shipping over USD1.1B worth of hard disk drives to Huawei in violation of US export control laws, according to the Department of Commerce. Seagate sold the drives to Huawei between Aug 2020 and Sept 2021 despite an August 2020 rule that restricted sales of certain foreign items made with US technology to the company. Huawei was placed on the Entity List, a US trade blacklist, in 2019 to reduce the sale of US goods to the company amid national security and foreign policy concerns. (Android Headlines, BIS, Reuters, CNN)

SK hynix has developed a 12-layer high-bandwidth memory (HBM) with a 24-gigabyte (GB) capacity. The latest HBM3 is the first of its kind with the largest memory capacity in the industry. HBMs stack layers of dynamic random access memory (DRAM) vertically to better support high-performance computing. The HBM products specialize in data-heavy tasks, such as running generative artificial intelligence (AI). SK hynix stacked 12 DRAMs, a first in the industry, by reducing each DRAM’s thickness by 40 percent. The memory capacity was enhanced to 24 gigabytes, compared to the previous maximum capacity of 16 gigabytes of an 8-layer HBM3.(CN Beta, Korea JoongAng Daily, Dong-A)

Several Samsung Galaxy S21, S22 series users and Galaxy Z Fold3 / Fold2 users have reported battery drain issues. The problem came to light following the new One UI 5.1 update. Evidently, Samsung Keyboard has been the root cause of the battery drain. Samsung has acknowledged and fixed the issue.(Android Central, SamMobile, Samsung)

Israel-headquartered extreme fast charging high energy battery solution for electric vehicles company StoreDot has inked a joint development agreement with VinES, a transformative energy solution provider and a member company of Vingroup. The agreement follows the already announced strategic investment of VinFast into StoreDot; marking a new milestone in the cell technology development between both companies and helping them to promote advanced battery technology and prepare to introduce XFC (Extreme Fast Charging) battery solutions for the green mobility market, including VinFast’s smart electric vehicles. (Electrek, PR Newswire, Financial Express)

Chinese battery giant CATL will begin construction of a new battery factory in Debrecen, Hungary in summer 2023. In Aug 2022, CATL announced that it would invest no more than EUR7.34B to build a new 100GWh battery factory in the city of Debrecen, which will become the largest battery factory in Europe after completion. This will also be CATL’s second overseas factory following its Thuringia plant in Germany. The battery factory will produce battery cells and modules after it is put into operation. The factory will become a service center for European car factories and supply approximately 30 electric vehicle brands including BMW, Mercedes-Benz, and Volkswagen.(CN Beta, Pandaily, Digitimes, Shanghailist, The Paper)

South Korea President Yoon Suk Yeol has announced that the company will invest KRW20T (USD15.1B) in the rechargeable battery sector by 2030 to widen its technology gap with global competitors. The government will invest in 3 top battery makers, LG Energy Solution, Samsung SDI and SK On, to set up facilities in Korea to produce solid-state battery prototypes. Solid-state batteries are regarded as a game changer in the battery industry as have less of a fire hazard and a longer life compared to existing lithium-ion batteries. The Yoon administration is also planning to kick off manufacturing next-generation 4680-type cylindrical batteries, featured with larger capacity and higher output than conventional ones, and cobalt-free batteries in Korea. (CN Beta, Reuters, Bloomberg, Pulse News, KED Global)

Samsung Galaxy Z Fold5 and Galaxy Z Flip5, expected to launch in 3Q23, will reportedly pack batteries sourced from LG Energy Solution. In addition to LG Energy Solution, Samsung will also source the batteries for its 2023 foldable smartphones from Samsung SDI and China’s Amperex Technology Limited (ATL), which should help it avoid any delays that might occur due to issues with the supply chain for the batteries. The cost of a single battery is expected to be around USD10-15, and since the Galaxy Z Fold5 and Galaxy Z Flip5 will use two cells due to their folding design, the total cost of batteries will be up to USD30 per smartphone. (GSM Arena, The Elec)

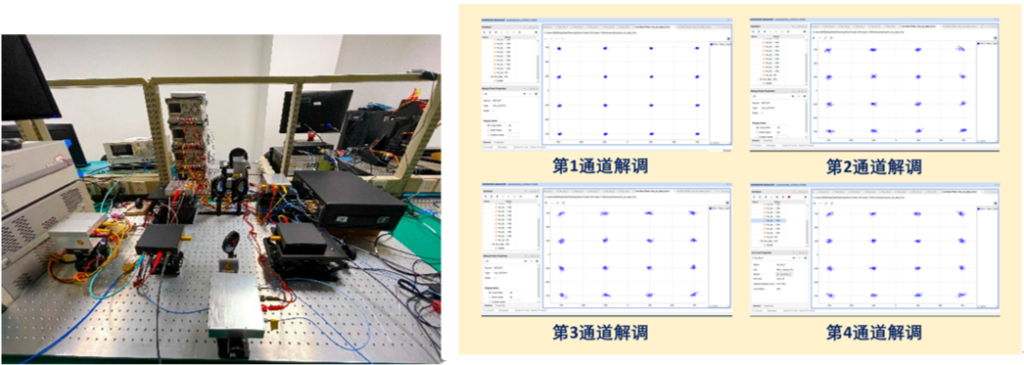

An institution called “No. 25” has recently announced an important milestone in 6G communication technology. They achieved a 100Gbps wireless transmission that delivers an experience almost on par with fiber connectivity. No. 25 Institute recently announced a significant milestone in 6G communication technology. The team completed the first-ever real-time wireless transmission of data at the terahertz frequency level. Wireless technology is expected to become more dominant in the future, with over 62% of global base stations projected to use it by 2023. The No. 25 Institute’s achievement in terahertz communication involved the use of advanced antennas and multiple beam modes to maximize bandwidth utilization. (CN Beta, Gizmo China)