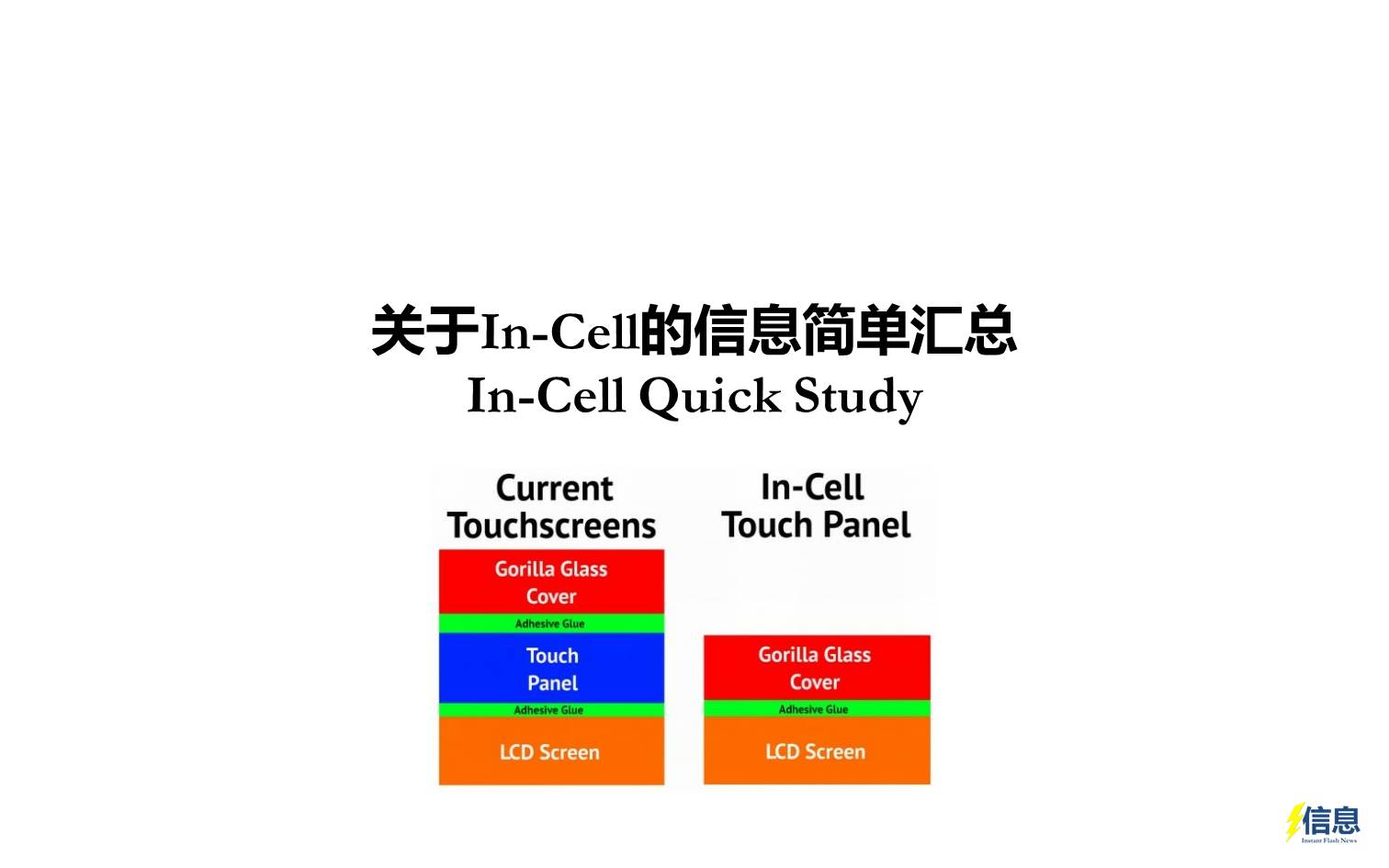

In-Cell Touch Quick Study

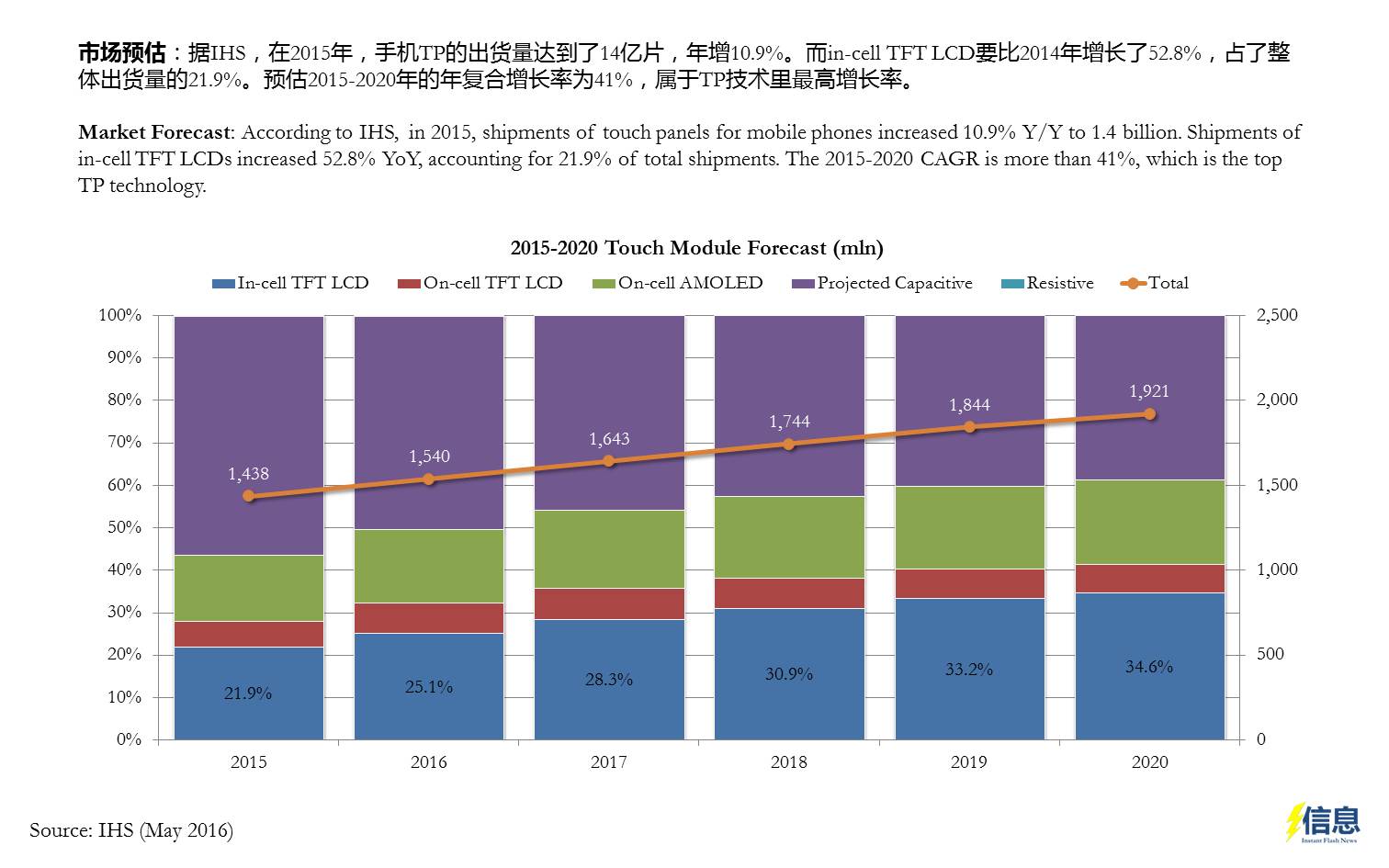

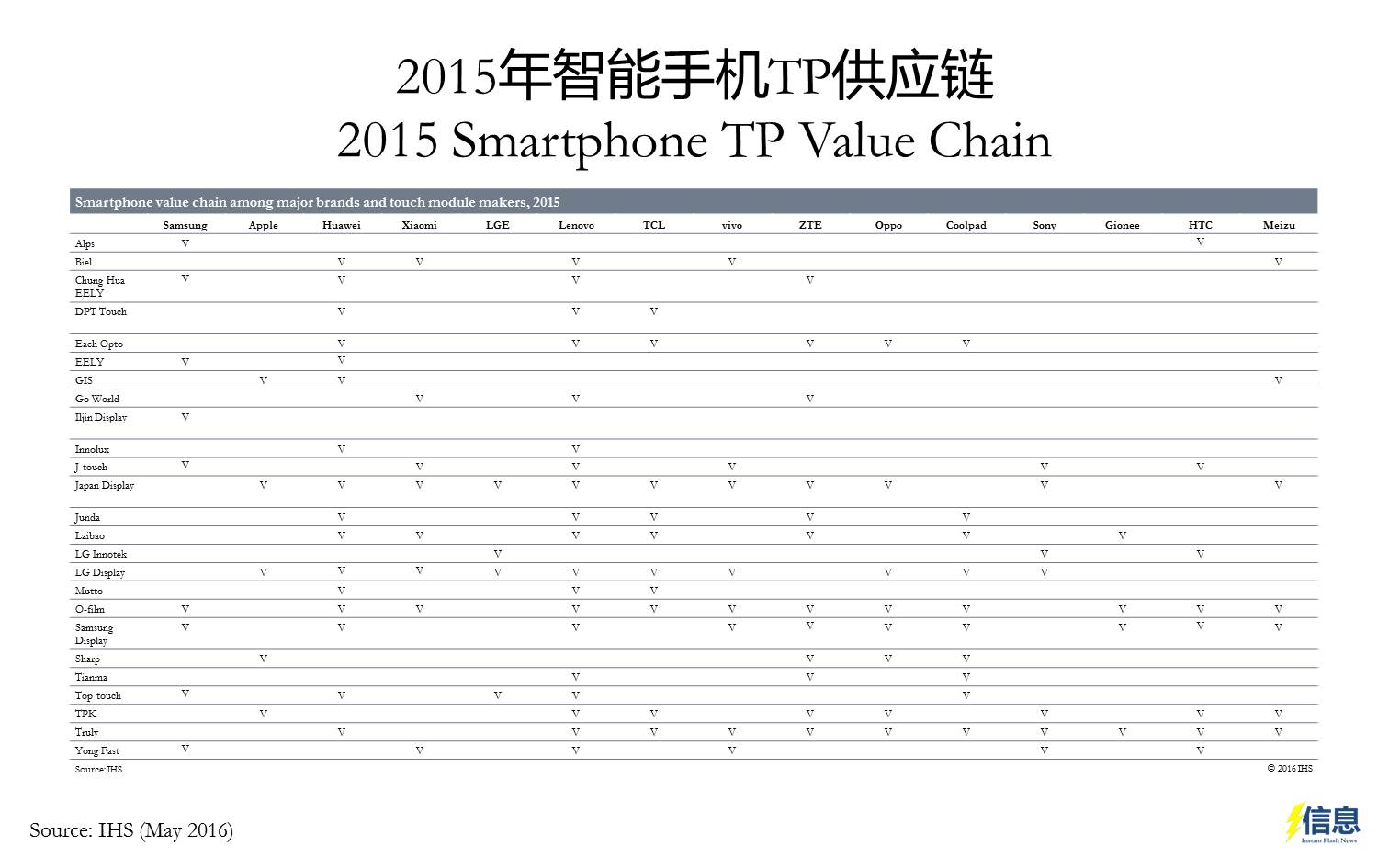

- According to IHS, in 2015, shipments of touch panels for mobile phones increased 10.9% Y/Y to 1.4 billion. Shipments of in-cell TFT LCDs increased 52.8% YoY, accounting for 21.9% of total shipments. The 2015-2020 CAGR is more than 41%, which is the top TP technology.

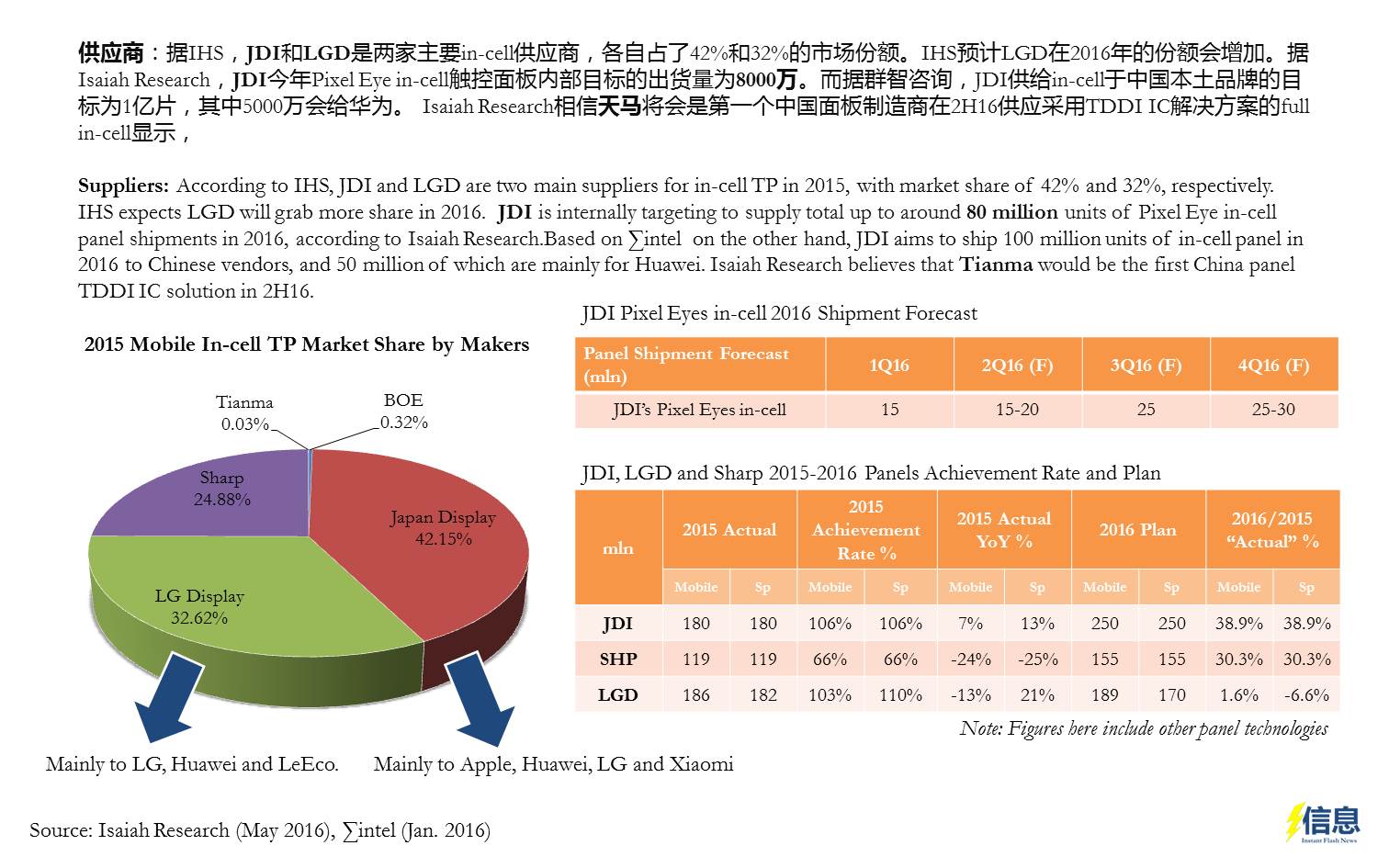

- According to IHS, JDI and LGD are two main suppliers for in-cell TP in 2015, with market share of 42% and 32%, respectively. IHS expects LGD will grab more share in 2016. JDI is internally targeting to supply total up to around 80 million units of Pixel Eye in-cell panel shipments in 2016, according to Isaiah Research.Based on ∑intel on the other hand, JDI aims to ship 100 million units of in-cell panel in 2016 to Chinese vendors, and 50 million of which are mainly for Huawei. Isaiah Research believes that Tianma would be the first China panel TDDI IC solution in 2H16.

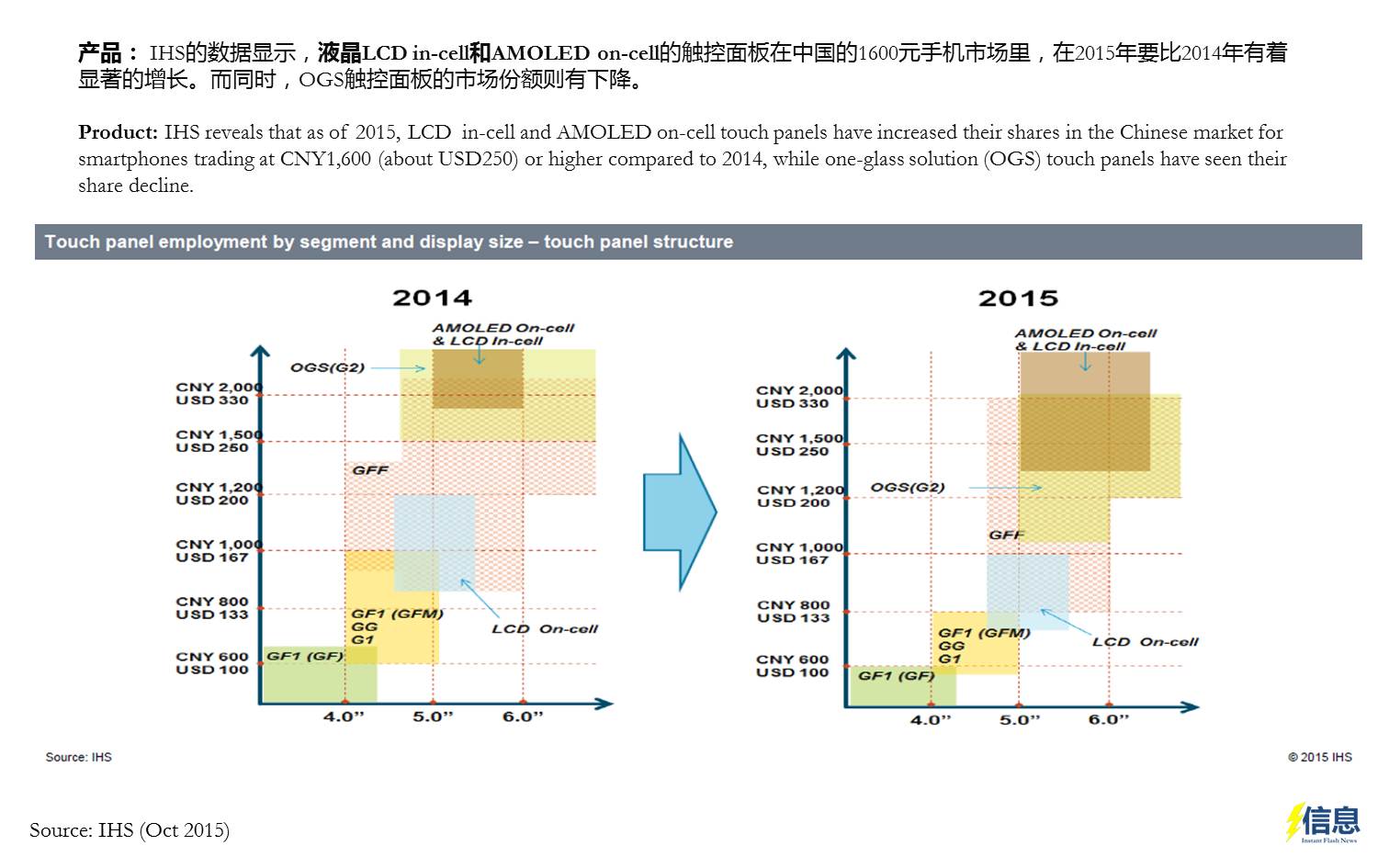

- IHS reveals that as of 2015, LCD in-cell and AMOLED on-cell touch panels have increased their shares in the Chinese market for smartphones trading at CNY1,600 (about USD250) or higher compared to 2014, while one-glass solution (OGS) touch panels have seen their share decline.

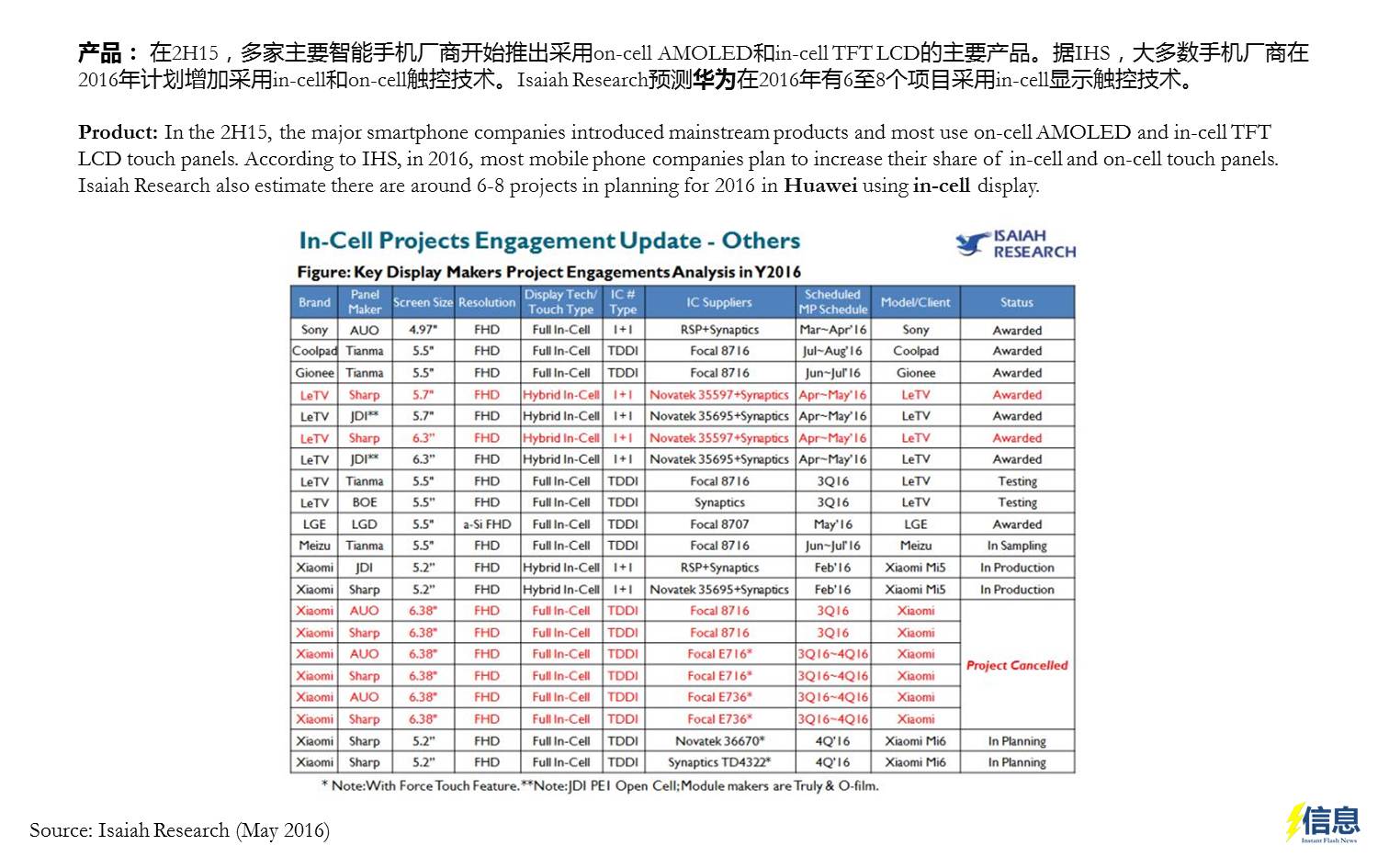

- In the 2H15, the major smartphone companies introduced mainstream products and most use on-cell AMOLED and in-cell TFT LCD touch panels. According to IHS, in 2016, most mobile phone companies plan to increase their share of in-cell and on-cell touch panels. Isaiah Research also estimate there are around 6-8 projects in planning for 2016 in Huawei using in-cell display.

Please download the PDF version via this link. Thank you.