5-7 #OfftheGrid : Honda Motor collaborates TSMC to ensure a “stable” supply of chips; iPhone 15 Pro models will no longer feature solid-state buttons; Tesla has begun producing the Model Y SUV with a Blade battery from BYD; etc.

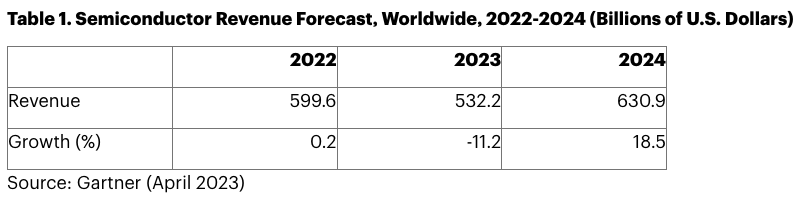

Global semiconductor revenue is projected to decline 11.2% in 2023, according to the latest forecast from Gartner. In 2022, the market totaled USD599.6B, which was marginal growth of 0.2% from 2021. The short-term outlook for the semiconductor market has deteriorated further. Global semiconductor revenue is forecast to total USD532B in 2023. (Gartner, CN Beta)

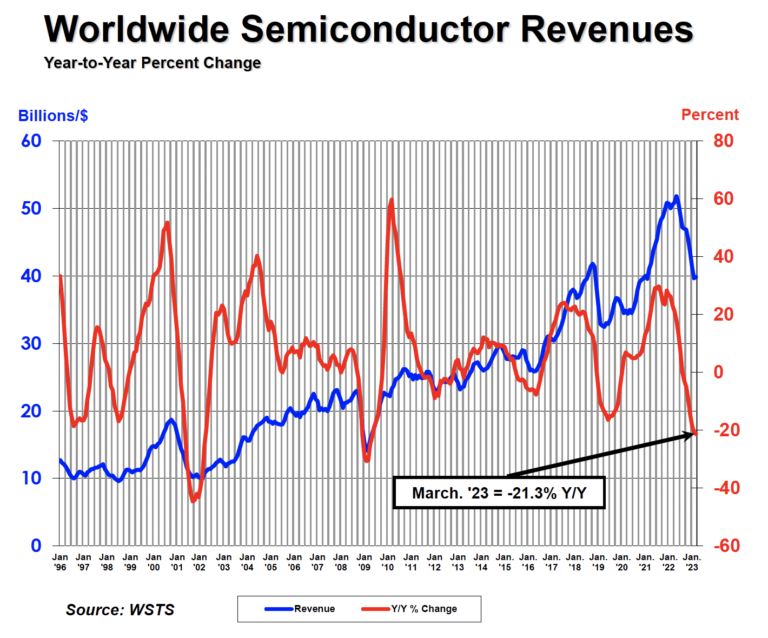

The Semiconductor Industry Association (SIA) has announced worldwide sales of semiconductors totaled USD119.5B during 1Q23, a decrease of 8.7% compared to 4Q22 and 21.3% less than 1Q22. Sales for the month of Mar 2023 increased 0.3% compared to Feb 2023. (Laoyaoba, Evertiq, SIA)

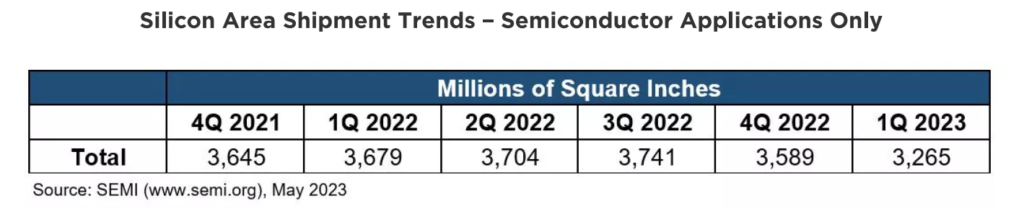

Worldwide silicon wafer shipments slipped 9.0% QoQ to 3,265M square inches in 1Q23 and 11.3% from the 3,679M square inches recorded during the same quarter last year, according to SEMI Silicon Manufacturers Group (SMG). The decline in silicon wafer shipments reflects softening semiconductor demand since early 2023. Memory and consumer electronics have seen the largest drops in demand while the market for automotive and industrial applications remains more stable. (SEMI, Laoyaoba)

Microsoft is reportedly working with Advanced Micro Devices (AMD) on the chipmaker’s expansion into artificial intelligence (AI) processors, part of a multipronged strategy to secure more of the highly coveted components. Microsoft is providing support to bolster AMD’s efforts, including engineering resources, and working with AMD on a homegrown Microsoft processor for AI workloads, code-named Athena. (The Verge, Reuters, Bloomberg, Yahoo)

Microsoft spokesman Frank Shaw has indicated that AMD is not involved in the development of Athena, the internal codeword for Microsoft’s project to build a processor for artificial intelligence (AI) applications. Shaw did not say anything whether Microsoft was working with AMD to help finance a further push into AI processors.(Tip Ranks, Seeking Alpha, MSN, CN Beta)

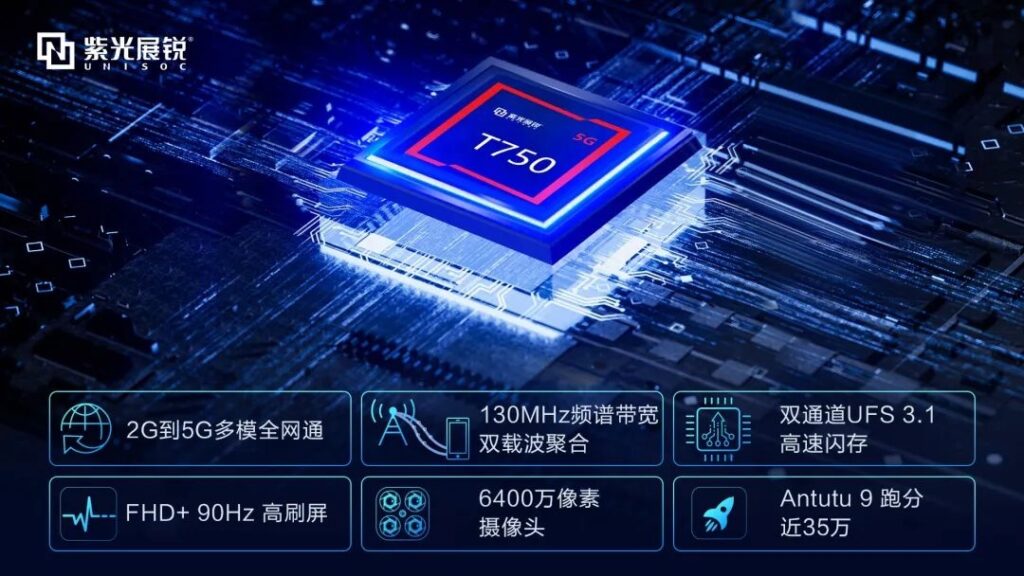

Unisoc has officially announced the official launch of the 5G mobile platform T750, which supports 2G to 5G multi-mode full Netcom, SA and NSA networking modes, supports dual-carrier aggregation technology with a bandwidth of 130MHz. It can connect two 5G frequency bands at the same time. T750 adopts an eight-core CPU architecture, two large-core Arm Cortex-A76, and the main frequency reaches 2.0GHz. The advanced 6nm EUV process enables the T750 to have higher performance and lower power consumption. T750 supports TDD+FDD CA in the Sub-6GHz spectrum, SA and NSA networking modes, 5G+5G dual SIM dual standby. T750 supports up to 64MP camera, 90Hz refresh rate and FHD+ display resolution. (My Drivers, IT Home, Sohu, Unisoc)

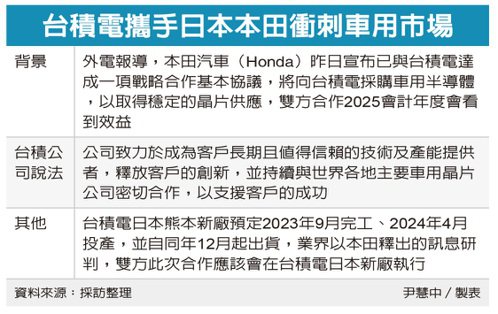

Honda Motor will collaborate with Taiwan Semiconductor Manufacturing Co (TSMC) to ensure a “stable” supply of chips. Honda has not had direct dealings with TSMC before, but the company expects their collaboration to start having an impact from fiscal 2025. The agreement also covers other components besides chips. The carmaker also unveiled new EV launch plans as it aims to sell only electric or fuel cell vehicles by 2040. Its plans to produce at least 2M EVs by 2030. Honda will introduce four new EV models by 2026 in Japan, its third-largest market after the U.S. and China.(Laoyaoba, CTEE, UDN, Reuters, Nikkei Asia)

Kyung Kye-hyun, president and head of Samsung’s semiconductor business, is confident that Samsung will be able to overtake bigger foundry rival Taiwan Semiconductor Manufacturing Co (TSMC) at the leading edge of chip processing within 5 years. While Samsung is currently behind TSMC in chip processing technology, it expects to get ahead of the Taiwanese company from the 2nm processing node. In 2022, Samsung, as a global first, applied a 3nm process node to the manufacture of advanced chips based on the gate-all-around (GAA) transistor architecture. Samsung aims to mass produce 2nm chips based on the GAA architecture from 2025.(Laoyaoba, KED Global, Korea Herald, SamMobile)

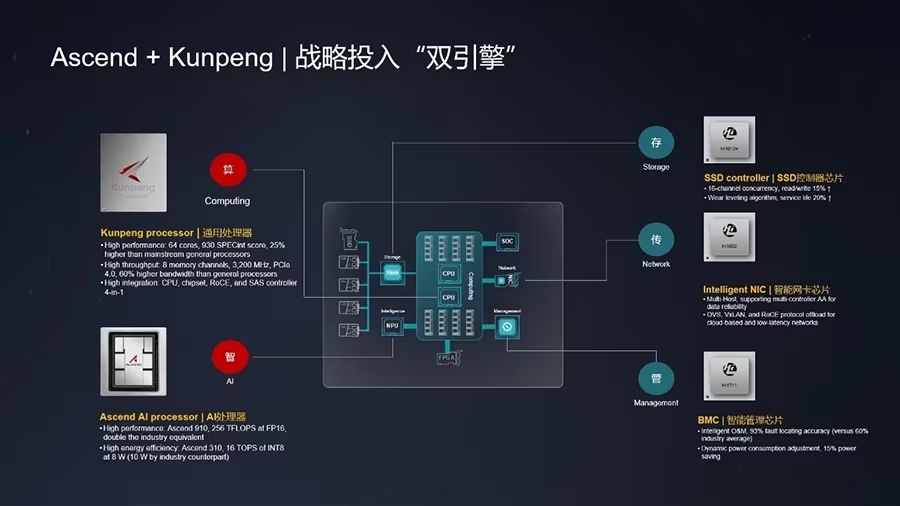

Ma Haixu, President of Huawei’s ICT Product Portfolio Management and Solutions Department, said that the Kunpeng ecosystem has 4,500 partners, more than 2M developers, and more than 13,500 solutions that have passed the Kunpeng adaptation certification. Commercial and other industries have been applied on a large scale. (Sina, Laoyaoba)

Apple supplier Cirrus Logic has seemingly confirmed that iPhone 15 Pro models will no longer feature solid-state buttons. Cirrus Logic’s HPMS refers to the company’s high-performance, mixed-signal chips, which includes haptic drivers for the Taptic Engine in iPhones. In Nov 2022, the Texas-based company said it has continued to “engage with a strategic customer” and expected to “bring a new HPMS component to market in smartphones in 2023”. Barclays analysts Blayne Curtis and Tom O’Malley said Cirrus Logic’s aforementioned comments likely refer to the solid-state buttons.(MacRumors, Cirrus Logic)

Honor is reportedly set to release a new toughened glass panel called “Giant Rhinoceros Glass,” which is expected to compete with Huawei’s “Kunlun Glass” in terms of strength and durability. While there is currently no additional information available on the “Giant Rhinoceros Glass” panel, Huawei’s “Kunlun Glass” has been widely touted for its strength and durability. Huawei claims that the panel is created using advanced technology that involves 24 hours, 108 processes, and 1600 degrees of melting. This process creates a panel that is as hard as a rock and contains billions of high-strength nano-crystals, making it resistant to impact and preventing cracking. (Gizmo China, Weibo, IT Home)

LG Display (LGD) is struggling looking for an exit strategy for its Chinese business amid a prolonged slump in the liquid crystal display (LCD) panel industry. LGD has reportedly approached Chinese panel makers about selling off the Guangzhou LCD facility to them. LGD is drastically reducing the production capacities of the GP1-GP2 line at its Guangzhou factory, which produces LCD panels for Chinese TVs. As of the end of 2022, the Guangzhou plant’s utilization rate had fallen to 92.5%. This is the first time since 2014, when LGD launched its Gen-8.5 LCD panel plant in Guangzhou, China that its utilization rate has fallen below 100%. It is analyzed as a result of the company’s drastic reduction in LCD panel production for TVs by more than half. (Laoyaoba, Business Korea)

Universal Display Corporation (UDC) has acquired the Phosphorescent OLED Emitter IP assets of Merck KGaA, Darmstadt, Germany. Representing more than 15 years of R&D, this portfolio has an average lifetime of 10 years and includes over 550 issued and pending patents around the world in 172 patent families. In addition, the companies entered into a new multi-year collaboration agreement that pertains to UDC’s green and yellow phosphorescent emitters and Merck KGaA transport and host materials to create advanced PHOLED stacks.(Laoyaoba, Business Wire, Evertiq)

Wallace Kou, President & CEO of Silicon Motion has indicated that market conditions are currently extremely challenging, a view shared by all our NAND flash maker and other key customers. End-markets for PCs and smartphones remain soft and many suppliers into these products have focused on working down inventory, including client SSD and eMMC/UFS embedded storage devices, which has had a negative effect on our sales. Despite this, they are encouraged to see some of our customers’ order patterns improving in 2Q23, and combined with our strong design win momentum, he is optimistic that this could lead to a stronger market rebound towards the end of 2023. (Laoyaoba, iFeng, Yahoo, UDN, Digitimes, GlobeNewswire)

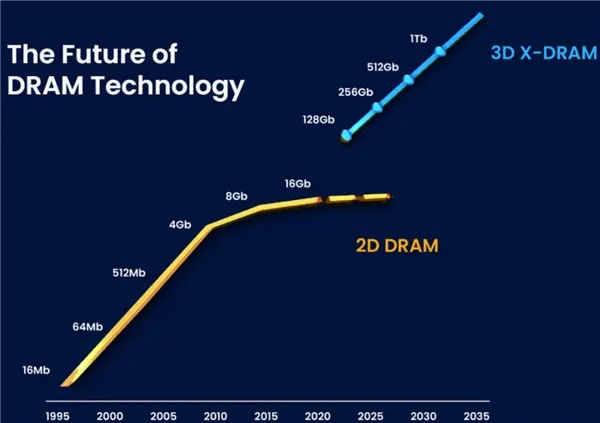

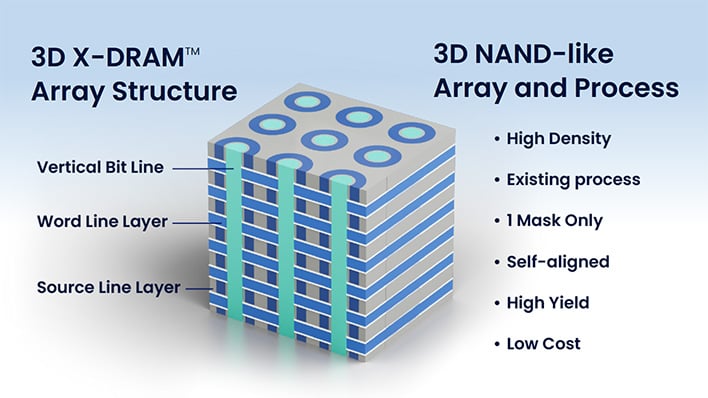

Neo Semiconductor has announced the world’s first 3D stackable DRAM technology, called 3D X-DRAM, that could revolutionize the memory industry as we know it today. Neo estimates that its 3D X-DRAM tech can achieve 128Gb density which is 8 times greater compared to today’s best solutions with DDR5 technology. Compared to current 2D solutions, 3D-XDRAM allows DRAM modules to be vertically (3D) stacked on top of each other to enhance density and overall memory capacity. Neo’s new 3D X-DRAM technology uses a 3D NAND-like DRAM cell array structure. It is reportedly cheap to make and easy to produce, yet features substantially greater memory capacity compared to today’s DRAM designs.(CN Beta, Tom’s Hardware, Blocks and Files, Hot Hardware)

TDK plans to double production capacity for high-precision magnetic sensors for automobiles by mid-2025. TDK will invest approximately JPY35B (USD260M) in its Nagano Prefecture plant in an effort to stay ahead of competing U.S. and Chinese manufacturers, and sensors will also become a pillar in its earnings in addition to its mainstay lithium-ion rechargeable batteries. TDK has developed a new high-precision sensor that uses the tunnel magnetoresistance effect, and is known as a TMR sensor. This type of sensor measures angles and detects movement, and can be incorporated into steering wheels, brake systems and other automotive components. (Laoyaoba, Asia Nikkei)

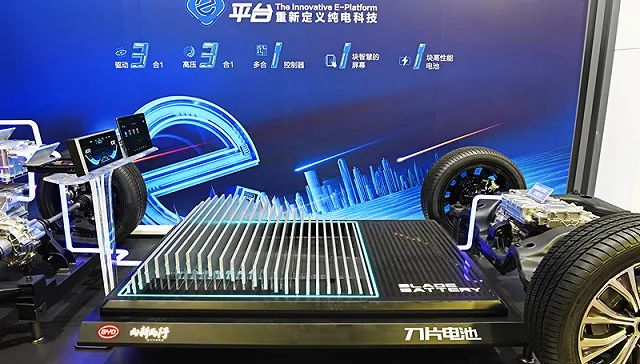

Tesla has begun producing the Model Y SUV with a Blade battery from BYD at its German plant. The BYD battery is expected to be used in the entry-level Model Y RWD, while the imported China-made Model 3 will feature an LFP battery from CATL. BYD is a vertically integrated company that covers the entire EV supply chain, from owning lithium mines to manufacturing batteries and producing electric vehicles, as well as developing software and ADAS for its vehicles. The Blade battery is a next-generation battery that offers several advantages over traditional lithium-ion batteries.(Gizmo China, Teslamag, Guancha, 36Kr)

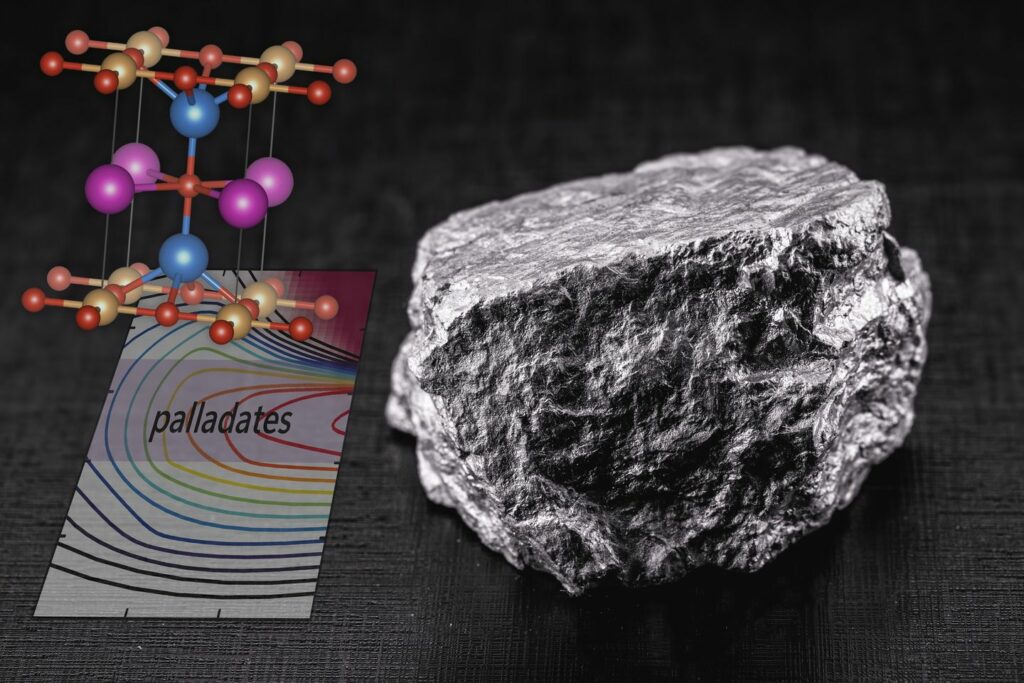

Researchers from TU Wien and universities in Japan have used computer simulations to identify the “golden zone” for optimal superconductivity. This zone, where the interaction between electrons is strong but not too strong, is reached with a new class of material called palladates, which could lead to a new era of superconductivity research. TU Wien has performed calculations that suggest the use of the precious metal palladium as a “Goldilocks” material for creating superconductors that remain superconductive even at relatively high temperatures. The foundation of these superconductors lies in nickel, prompting numerous scientists to refer to this period of superconductivity research as the “nickel age.” In numerous aspects, nickelates are similar to cuprates, which were found in the 1980s and based on copper. But now a new class of materials is coming into play: In a cooperation between TU Wien and universities in Japan, it was possible to simulate the behavior of various materials more precisely on the computer than before. (CN Beta, SciTech Daily, Science Daily)

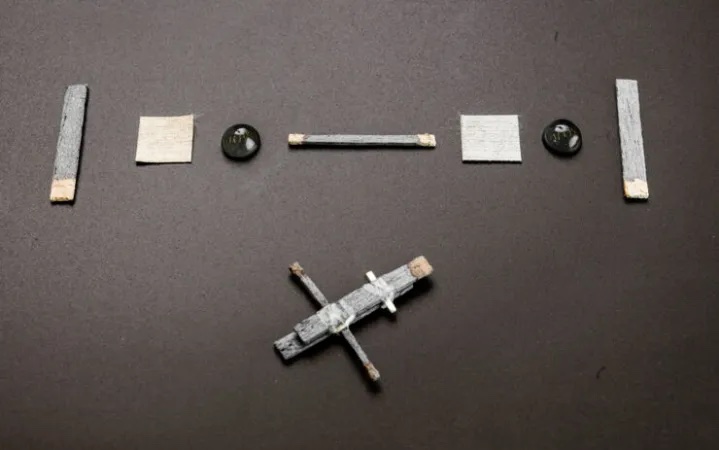

Linköping University in Sweden managed to use not silicon, but wood for creating a working transistor. They published their findings in a paper titled “Electrical current modulation in wood electrochemical transistors”. The wood electrochemical transistor (WECT) itself was made out of special conductive wood. To create this type of wood, they had to remove a component called lignin and then replace it with a conducting polymer. Next, they used three pieces of this conductive wood to create the WECT. The transistor works, however, silicon transistors are measured in nanometers, but the WECT measures 3cm. It also only has a switching frequency of just under a hertz. While WECT cannot help with the scaling problem of silicon at all, it creates a much more sustainable and biodegradable alternative that could find its uses in the future. (Digital Trends, PNAS)

In 2022, the EU passed legislation that will require Apple iPhone and many other devices with wired charging to be equipped with a USB-C port in order to be sold in the region. Apple has until 28 Dec 2024 to adhere to the law, but the switch from Lightning to USB-C is expected to happen with iPhone 15 models later in 2023. Apple may be planning to limit charging speeds and other functionality of USB-C cables that are not certified under its “Made for iPhone” program. Like the Lightning port on existing iPhones, a small chip inside the USB-C port on iPhone 15 models would confirm the authenticity of the USB-C cable connected. European Commissioner Thierry Breton has sent Apple a letter warning the company that limiting the functionality of USB-C cables would not be permitted and would prevent iPhones from being sold in the EU when the law goes into effect. (GizChina, MacRumors, My Drivers, Zeit Online)

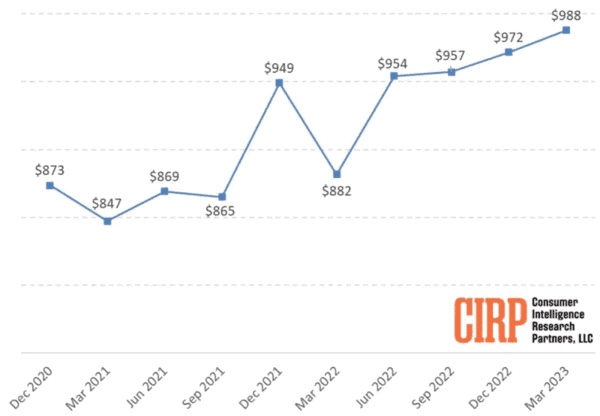

A new survey from Consumer Intelligence Research Partners (CIRP) has found that the average selling price (ASP) of Apple iPhones has hit an all time high of USD988 as of Mar 2023. Along with iPhone 14 Pro and Pro being the most popular models for 2023 which of course was a major factor in the increased average selling price, CIRP noted upgraded storage and customers going for the 14 or 14 Plus as compared to the 13 mini a year ago as two more tailwinds. (GizChina, My Drivers, Gizmo China, 9to5Mac, CIRP)

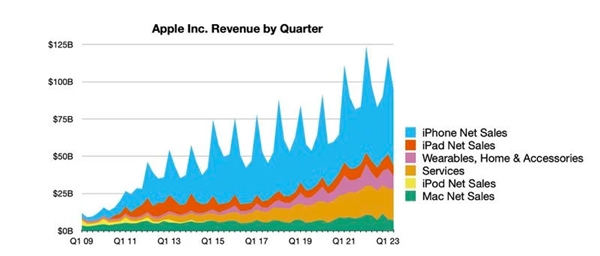

Apple has announced financial results for its fiscal 2Q23 ended 1 Apr 2023. Apple posted quarterly revenue of USD94.8B, down 3% YoY. The financial report shows that Apple’s revenue in the Greater China region hit USD17.812B. This is a decrease of 3% compared with USD18.343B in the same period last year.(GizChina, My Drivers, Apple)

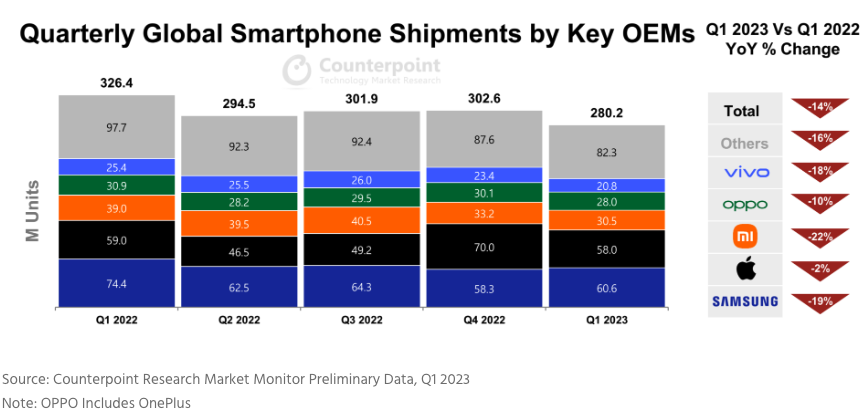

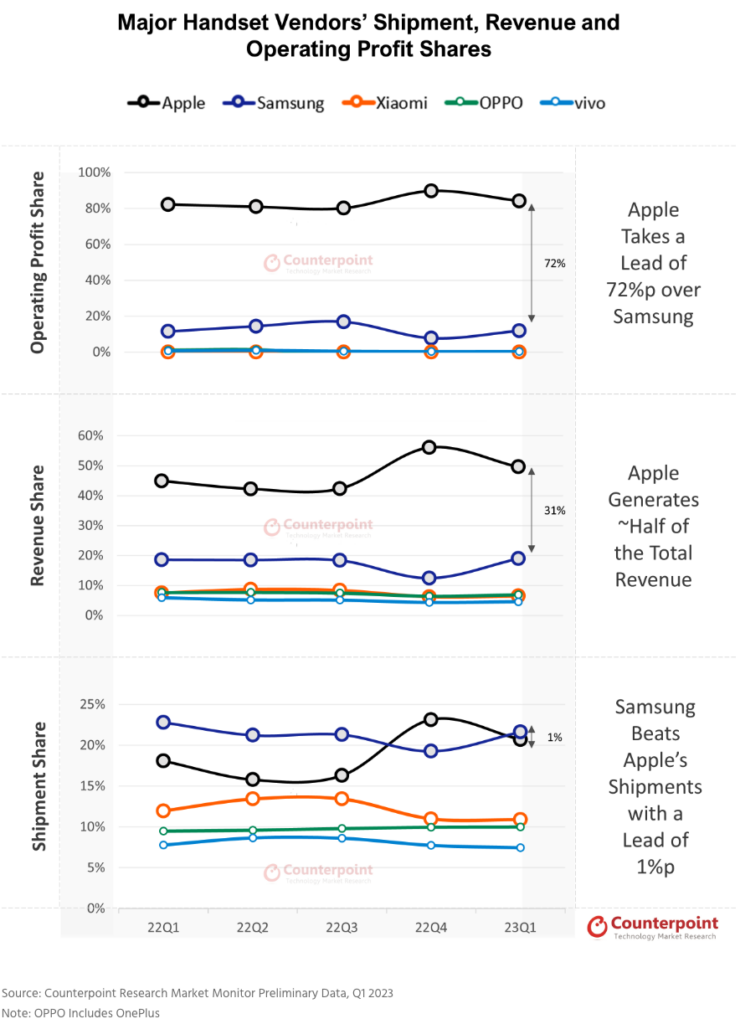

The global smartphone market faced further contraction in the post-holiday-season quarter with shipments declining by 14% YoY and 7% QoQ to 280.2M units in 1Q23, according to Counterpoint Research. Consequently, global smartphone revenue and operating profit also declined, although not as much as shipments. This was due, in part, to the lower-than-usual decline in Apple’s shipments, to 58M units in 1Q23. Apple thereby managed to capture nearly half of all smartphone revenues. While Samsung’s shipments declined 19% YoY despite growing by 4% QoQ to 60.6M units, the launch of the Galaxy S23 series enabled Samsung’s ASP to increase to USD340, up 17% YoY and 35% QoQ, which in turn contributed to global revenues falling relatively less. Apple and Samsung also remain the most profitable brands, together capturing 96% of global smartphone operating profits. (Android Authority, Counterpoint Research)

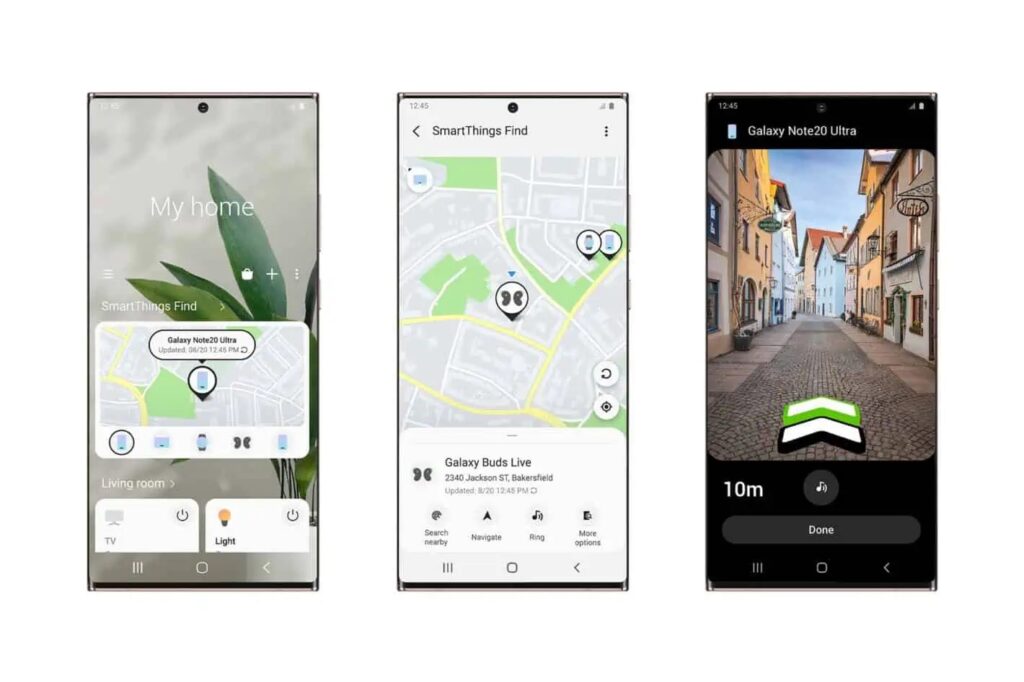

Samsung’s SmartThings Find service has amassed over 300M registered and opted-in devices globally. The company achieved the milestone in about 2.5 years since debuting the in-demand device location service in late 2020. Samsung launched SmartThings Find at the end of Oct 2020. The service is a crowd-sourced network of Galaxy devices that helps other Galaxy users find their lost devices. SmartThings Find comes with several privacy and security features. It encrypts user data, so no one on the network can see your information. Samsung’s Knox security platform further safeguards data.(Android Headlines, Samsung)

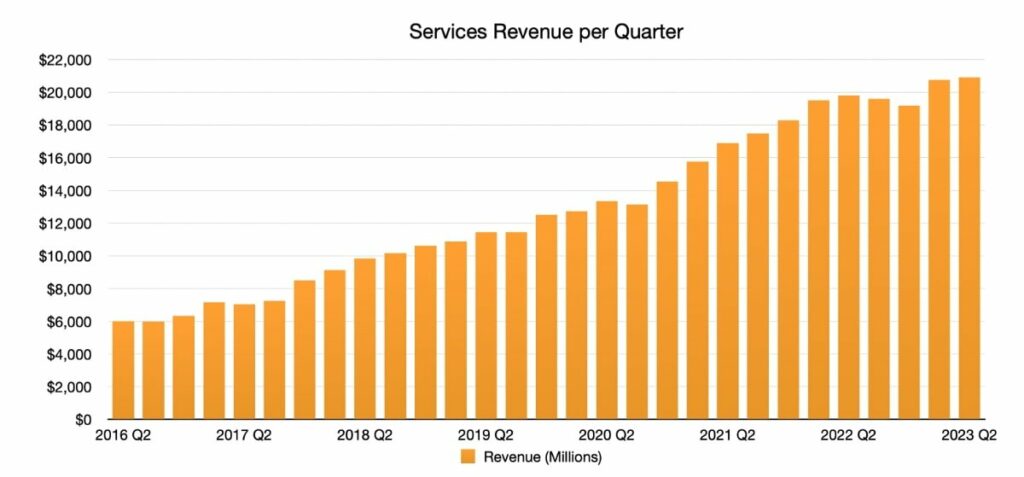

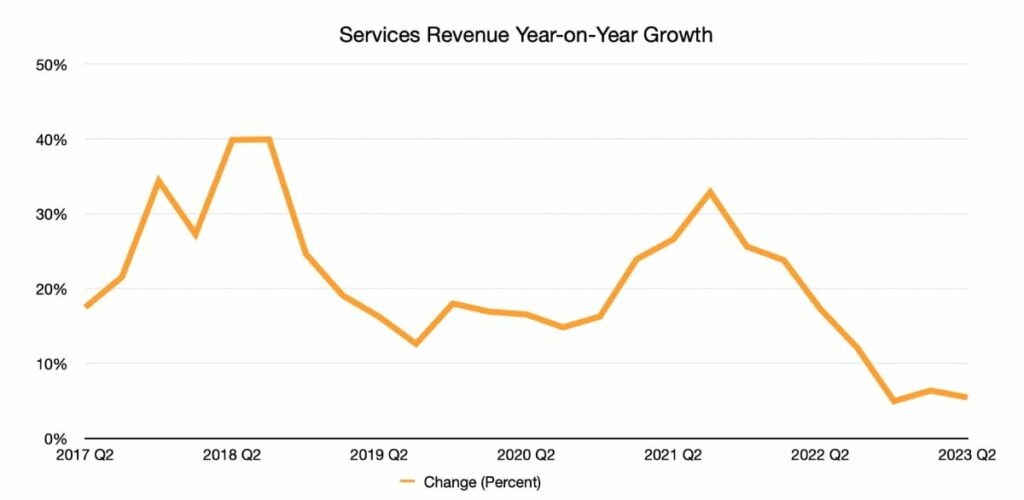

Apple CEO Tim Cook has mentioned that the company had reached 975M subscriptions. The Services business comprises the App Store, Apple Music, Apple TV+, iCloud, and other products. The Services division exhibited steady growth in the 2Q23, generating USD20.9B in revenue, up from USD19.8B in 1Q23. On the other hand, the Wearables, Home, and Accessories segment experienced a minor decline, decreasing from USD8.8B to USD8.76B YoY. Apple CFO Luca Maestri has said the new results for Services is an increase of 150M in 2022, nearly double what the company had 3 years ago.(Apple Insider, Apple, 9to5Mac)

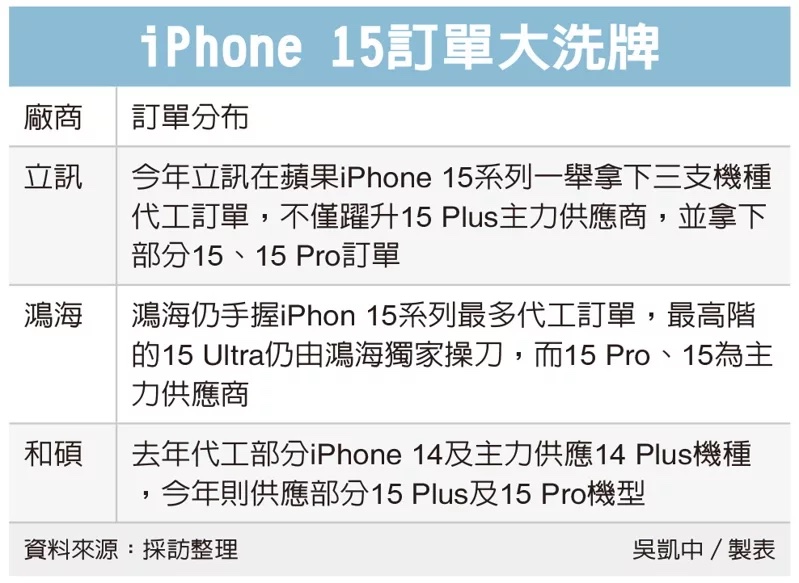

For the first time, Luxshare has won the OEM order for three new Apple iPhone models of the year, and it was also the first time in history that the high-end iPhone Pro was shared by three manufacturers on both sides of the Taiwan Strait, including Hon Hai, Pegatron, and Luxshare. However, Hon Hai is still the largest foundry for the new iPhone 15 series. Luxshare’s 2022 new iPhone order allocation will mainly be responsible for the iPhone 14 and 14 Plus, but in 2023 Luxshare has also won some iPhone 15 and 15 Pro assembly orders. It depends on the volume production rate. Hon Hai still holds the most orders for the iPhone 15 series. Although the 15 Pro business is divided by Pegatron and Luxshare, it is still the largest supplier of this model, and the highest-end 15 Ultra is still exclusively operated by Hon Hai , Hon Hai also holds the largest order volume of 15 entry-level models.(UDN, UDN, Yahoo, CN Beta, CN Beta, SCMP, Yahoo)

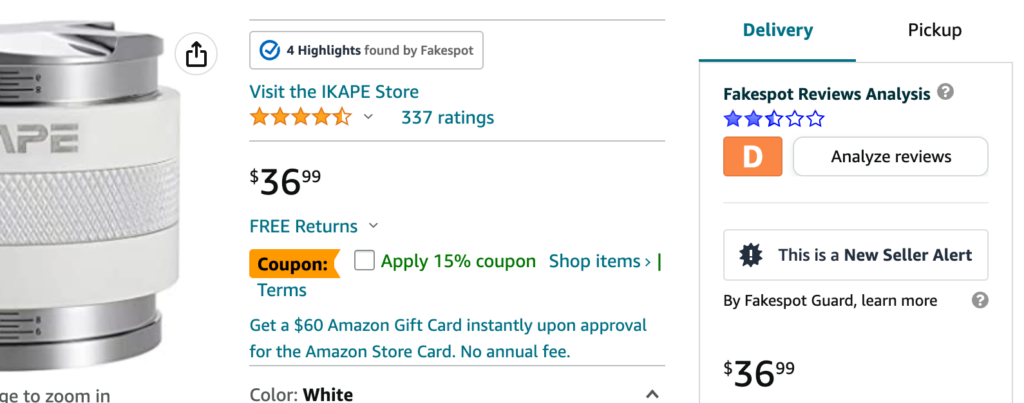

Mozilla has announced that it has acquired Fakespot, a startup that offers a website and browser extension that helps users identify fake or unreliable reviews. Fakespot’s offerings can be used to spot fake reviews listed on various online marketplaces including Amazon, Yelp, TripAdvisor and more. Founded in 2016, New York-based Fakespot uses an AI and machine learning system to detect patterns and similarities between reviews in order to flag those that are most likely to be deceptive. Fakespot provides a rating or grade for the product’s reviews in order to help consumers make more informed decisions when making a purchase.(TechCrunch, Neowin, Mozilla)

The successor to Google’s Pixel Watch will be released in the fall of 2023. It will launch alongside the company’s next major smartphones, the Pixel 8 series. (Neowin, 9to5Google)

In addition to the Google’s next generation Pixel Watch, Google is actually planning the launch of a second smartwatch in 2023 specifically aiming for kids. However, it will “more than likely” be branded as Fitbit. (Twitter, Android Headlines)

Samsung has announced its latest smartwatch OS – One UI 5 Watch and it brings improvements in three main areas – sleep tracking, activity tracking and user safety. One UI 5 Watch brings Sleep Insights UI which complies a sleep score for each night’s rest with specific metrics on sleep phases, blood oxygen levels and snoring hours. Sleep Coaching will now be available on the Galaxy Watches directly and will help users with building healthier sleeping habits. One UI 5 Watch devices will also bring seamless integration with SmartThings-compatible devices to help switch off connected devices when the watch detects you are asleep.(Engadget, GSM Arena, Samsung)

Apple is reportedly working on its most significant software overhaul to watchOS. According to Bloomberg’s Mark Gurman, the company is redesigning the Apple Watch’s user interface to make widgets a “central part” of how user will interact with the wearable. In describing the new UI, Gurman says it brings back elements of the Glances system that was part of the original watchOS while borrowing the “style” of widgets Apple introduced alongside iOS 14 in 2022. He adds the new interface will be “reminiscent” of the Siri watch face that the company introduced with watchOS 4 in 2017 but will function as an overlay for whatever watch face. (Engadget, Bloomberg, Twitter)

Waymo is doubling the operational area for its fleet of self-driving taxis, making what the company calls “the largest fully autonomous service area in the world”. The rapid growth is limited to Phoenix and San Francisco, but Waymo has big plans for both territories. According to Saswat Panigrahi, Waymo Chief Product Officer, Waymo One remains the only and largest 24/7 fully autonomous ride-hailing service in the world — serving thousands of rides in multiple key markets.(Engadget, Waymo)

EV startup Lordstown Motors is still in trouble after pausing production earlier 2023. The startup has said that it expects to stop producing the vehicle “in the near future” if it cannot find a partner to keep it afloat. Due to the production delays from early Jan-mid-Apr 2023, the failure to identify a strategic partner for the Endurance, and extremely limited ability to raise capital in the current market environment, they anticipate production of the Endurance will cease in the near future. (Lordstown, Engadget)

Lordstown Motors has warned that it might have to file bankruptcy after Hon Hai Precision Industry affiliate Foxconn Ventures sought to withdraw from an agreement for a USD170M investment. In 2021, Foxconn purchased an Ohio factory that Lordstown Motors had, itself, bought from General Motors in 2019. Foxconn also agreed to handle the manufacturing of Lordstown’s electric pickup at the site and to make further investments pending certain milestones being met. Foxconn has claimed that Lordstown has not met the agreed- upon requirements and, so, Foxconn is refusing to follow through with agreed-upon future investments.(CNN, Business Journal, Benzinga, Laoyaoba)

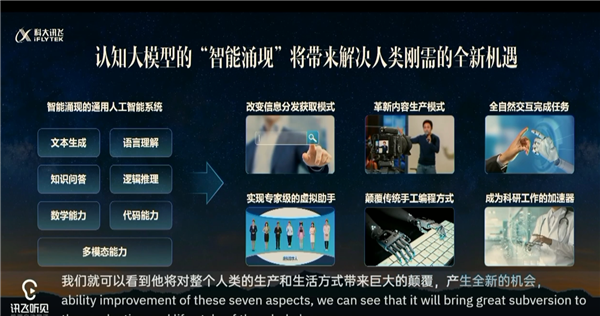

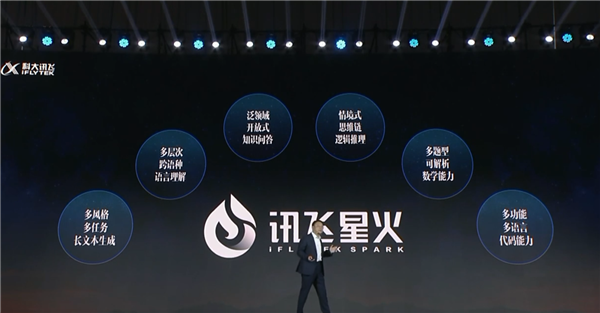

Liu Qingfeng, chairman of iFlytek, has introduced its homegrown AI large language model SparkDesk. SparkDesk supports multi-style and multi-task long text generation, multi-level cross-lingual language understanding, pan-domain open knowledge question and answer, situational thinking chain logical reasoning, multi-question analytical mathematics ability, and multi-functional multi-language coding ability. While the large model can automatically generate content, it can also automatically perform speech synthesis on the generated text content and perform intelligent broadcasting. In addition, it has multi-level and cross-language comprehension capabilities, and has reached the industry-leading level in multi-language comprehension and error correction capabilities. (My Drivers, Bloomberg, CGTN, Straits Times, China Daily)

Google is reportedly preparing to make its Bard AI easier to access on Pixel phones and tablets, starting with an upcoming homescreen widget exclusive to the company’s devices. Google has steadily worked to make Bard and other LaMDA-powered tech more readily available through options like generated drafts in Gmail, text generation in Docs, and more. The Bard AI is set to arrive on Android in the near future, complete with a homescreen widget. (Neowin, 9to5Google)

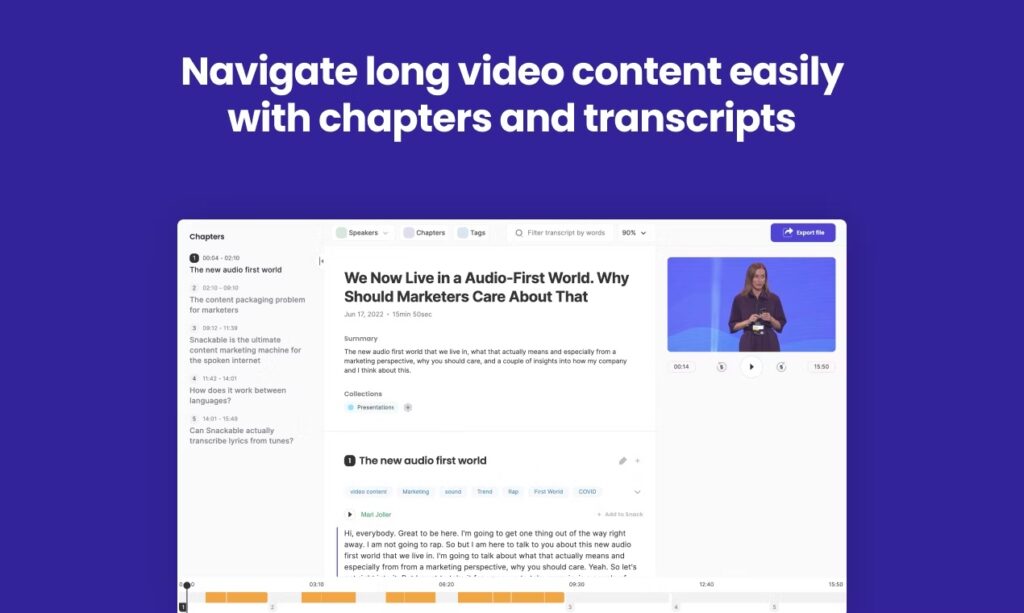

Amazon acquired a small audio-focused artificial intelligence firm called Snackable.AI in end 2022to bolster user features for its podcasts. Snackable AI founder and CEO Mari Joller is now an AI and machine learning product leader at Amazon Music. Founded in 2018, Snackable AI specialized in using AI to add structure and metadata to video and audio easily with AI-generated chapters, highlights and more. The company’s technology provides an “at a glance” view to make consuming content fast and efficient.(CN Beta, TechCrunch, NY Post)