5-21 #SummerHeat : Seven largest semiconductor makers have set out plans to increase manufacturing and deepen tech partnerships in Japan; Canon is allegedly looking to partner up with a smartphone maker; Samsung has notified its distributors that it will no longer sell DRAM chips below the current price; etc.

Seven of the world’s largest semiconductor makers have set out plans to increase manufacturing and deepen tech partnerships in Japan as western allies step up efforts to reshape the global chip supply chain amid rising tensions with China. Micron said it expected to invest up to JPY500B (USD3.7B), including Japanese state subsidies, to build a plant to produce cutting-edge extreme ultraviolet lithography technology in Hiroshima. Samsung is also discussing setting up a JPY30B research and development centre in Yokohama with pilot lines for semiconductor devices. TSMC also expressed the possibility of more investment in Japan after it agreed to build a new plant in the south-western prefecture of Kumamoto. Yasutoshi Nishimura, Japan’s minister of economy, trade and industry, said the government would use JPY1.3T earmarked in Japan’s supplementary budget in 2022 to support the pledges made by foreign chipmakers. (Apple Insider, Financial Times, Twitter)

MediaTek has partnered with Xiaomi to introduce the Dimensity 8200-Ultra mobile platform. This collaboration aims to deliver a high-performance chip that excels in imaging capabilities. The Dimensity 8200-Ultra, fabricated on TSMC’s cutting-edge 4nm process, boasts 4 Cortex A78 cores and 4 Cortex A55 cores, resulting in a powerful chipset that achieves an impressive Antutu benchmark score surpassing 900,000 points. The Dimensity open architecture facilitates seamless integration between MediaTek’s platform and Xiaomi’s imaging capabilities. Xiaomi’s Imaging Brain, powered by advanced algorithms, has achieved industry recognition and success in areas such as portrait photography, snapshot capturing, and night scenes.(Gizmo China, Sina)

FNS Tech it will spend KRW12.7B to build a new production line for cleaners of Gen 8.6 OLED masks. Masks are components used during the deposition and encapsulation process in OLED panel production. It is used in the deposition of red, green and blue organic materials as well as various layers. The new factory at Cheonan is FNS Tech’s first for cleaners to be used for Gen 8 OLED masks and in preparation for Samsung Display’s expected investment into Gen 8 OLED production.(The Elec)

Hanwha Solution is planning to complete the construction of its OLED fine metal mask (FMM) factory being built at Asan within the year 2023. However, the company is yet to secure a customer. FMM is used to form the red, green and blue subpixels of an OLED panel. Japan’s Dai Nippon Printing is the dominant supplier of FMM. In Oct 2023, Hanwha Solution said it plans to spend KRW201.7B on building its new OLED FMM factory in Asan. The company said at the time that OLED panel use was expanding from smartphones to larger IT products and claimed its FMM will be price competitive.(The Elec)

Japan’s Sharp was not part of Apple’s project to develop camera modules for the iPhone 16 Series at the current time. Sharp has been the second largest camera module supplier to Apple after rival LG Innotek. But the Japanese company lost momentum when its camera module factory in Vietnam halted production back in Sept 2021 due to the pandemic. Sharp continued to see its supply of high-end models drop since then. LG Innotek is currently the dominant supplier of 3D time of flight modules in iPads and iPhones over its Japanese rival, with over 70% market share in Apple’s camera module supply chain. LG Innotek is also expected to be the main supplier of folded zoom camera modules Apple plans to introduce on its iPhone 15 Pro Max in 2023. Sharp’s removal means only three main camera suppliers remain for Apple: LG Innotek, Foxconn and Cowell. (The Elec)

According to TF Securities analyst Ming-Chi Kuo, Sharp is likely to exit Apple’s iPhone 16 CCM supply chain. Existing CCM suppliers, including LG Innotek, Foxconn, and Cowell, will benefit. In comparison, Cowell will benefit more than LG Innotek and Foxconn because (1) Luxshare-ICT is a potential acquirer of Sharp’s CCM business, which will significantly increase Cowell’s orders if it comes to fruition; and (2) Cowell’s revenue is relatively small. (Twitter, Medium)

The famous camera brand Canon is allegedly looking to partner up with a smartphone maker. Some of the most well-known partnerships between smartphone manufacturers and camera makers include OnePlus with Hasselblad, Xiaomi with Leica, and Vivo with ZEISS, among others. (My Drivers, IT Home, XDA-Developers, GSM Arena, Weibo)

It is rumored that Samsung Electronics has notified its distributors that it will no longer sell DRAM chips below the current price. As a leading memory company, Samsung, if its DRAM prices can stop falling, other manufacturers will most likely follow suit. For example, the price quotations of leading Chinese companies have started to rise since last week. When the price of leading enterprises has stopped falling, perhaps more manufacturers will follow suit, then the spot price may stabilize soon, and the price increase is also a high probability event. (CN Beta, Sina, Yicai)

Samsung Electro-Mechanics has developed two new multi-layer ceramic capacitors (MLCC) for automotive applications. The new MLCCs are 250V, 33nF and 100V, 10microF for 125 Celsius, respectively, in specifications. The South Korean component maker said the two new MLCCs had the highest capacity in the industry in their voltage range. The two new MLCCs are aimed at power systems and LED headlamps, respectively, of electric vehicles.(The Elec, PRNasia, Business Korea)

Hyundai Motor Group will spend some KRW2T (USD1.59B) to build a plant dedicated to manufacturing electric vehicles in the southeastern coastal city of Ulsan, in a move to strengthen its footing as a “first mover” in the EV sector. The new EV plant will be equipped with big data-based intelligent smart systems, automation, and eco-friendly production facilities. The facility is expected to produce up to 150,000 units in the first full year when mass production begins in 2H25. It is the latest plan announced by the group to beef up domestic EV production. Hyundai’s smaller affiliate Kia broke the ground for its new EV production plant with a yearly capacity of 150,000 units in Hwaseong, Gyeonggi Province, in Apr 2023.(The Elec, Reuters, Electrive, Korea Herald)

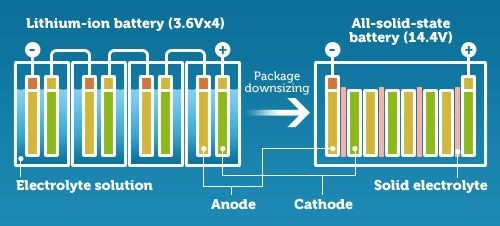

Samsung Electro-Mechanics (SEMCO) is conducting research into developing and manufacturing oxide solid-state batteries aimed at IT devices. Solid-state batteries use solid electrolytes rather than liquid ones in currently commercialized batteries. The electrolyte, which is between the cathode and anode, being solid means a separator is not needed. This reduces the possibility of battery fires while also increasing the energy density of batteries, allowing them to last longer. Research into solid-state batteries is focused on ceramic (sulfide and oxide) and polyimide types, while some combine both materials. Samsung Electro-Mechanics is focusing on ceramic oxide type in its research. (The Elec,Gizmo China, SamMobile)

Battery equipment maker Philenergy is preparing to launch battery equipment aimed at 4680 cylindrical batteries. The standard was popularized by Tesla and is being adopted by other automakers BMW, Volvo and Stellantis as well. South Korean battery maker Samsung SDI invested KRW5B for equity in Philenergy, a subsidiary of Philoptics, back in Sept 2020. Its main battery equipment being prepared for 4680 batteries is a winding machine or winder. South Korean company KOEM is effectively the sole supplier of the equipment for 4680 batteries. Its equipment is used by Tesla, Samsung SDI, LG Energy Solution and other major cylindrical battery makers. (The Elec)

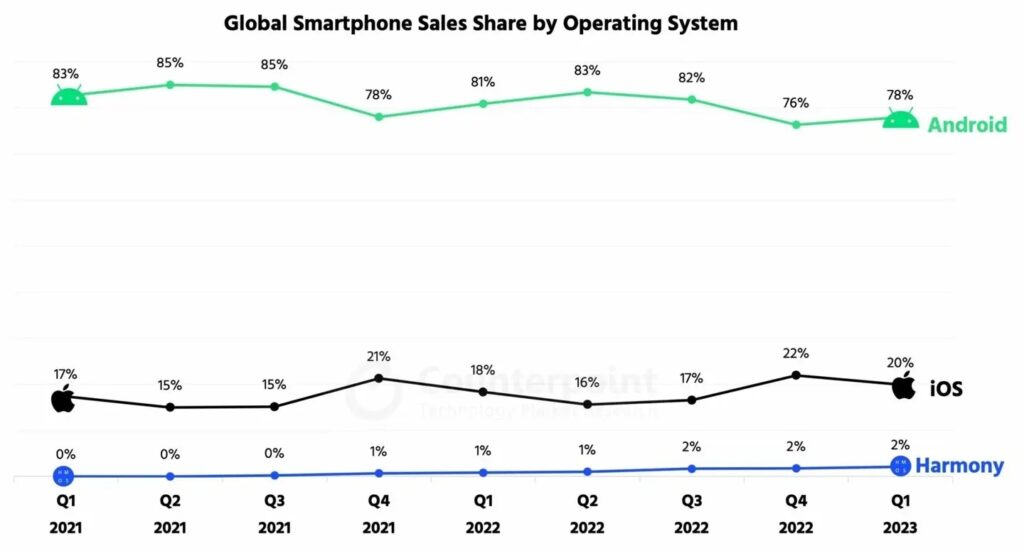

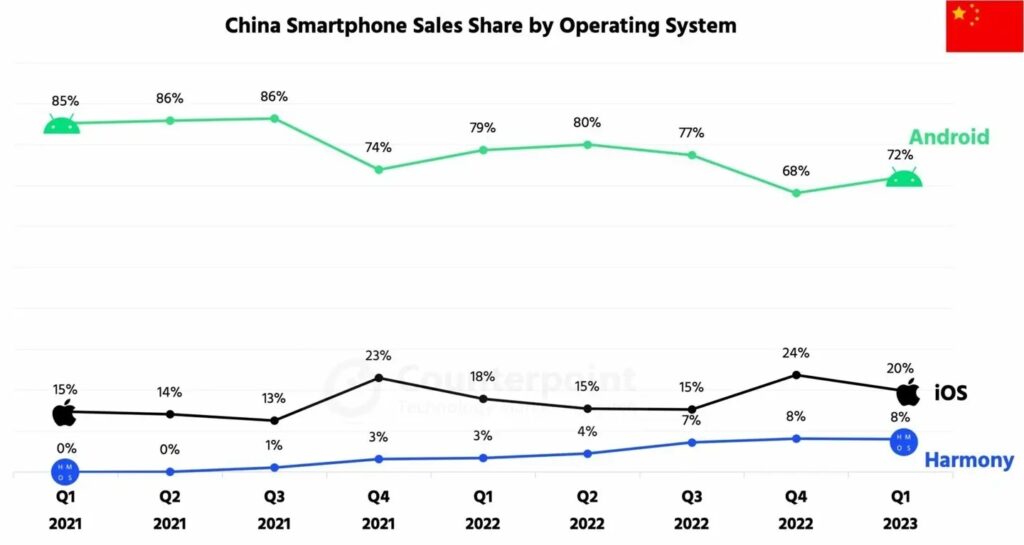

According to Counterpoint Research, the market share of Huawei HarmonyOS in China has hit 8% in 1Q23. This makes it the third-largest mobile operating system after Android and iOS. In 4Q22, the global mobile phone sales reveal a 14% YoY decline. However, iOS performed better than Android in the market with a YoY decrease of 12%, Android, on the other hand, had to cope with a 16% YoY decline. Counterpoint also shows that the share of Huawei’s HarmonyOS system has been growing. Its share in the global market remains at around 2% in the first quarter of 2023. However, its share in China will reach 8%. (GizChina, IT Home)

According to American Customer Satisfaction Index (ACSI), Apple leads all cell phone manufacturers overall after improving 1% to an ACSI score of 81. Samsung, which shared the top spot a year ago, is stable at 80. Google inches forward 1% to 78, while Motorola slumps 3% to 75. For the first time, ACSI compares cell phones with 5G capability to other models. Overall, 5G phones outpace non-5G phones by a score of 80 to 72. Apple and Samsung lead all 5G cell phones at 81 apiece followed by Google (80) and Motorola (76). Among cell phones without 5G capability, Apple earns the highest mark with an ACSI score of 78. Samsung is next at 74, followed by Motorola at 72. (Android Authority, ACSI, Yahoo)

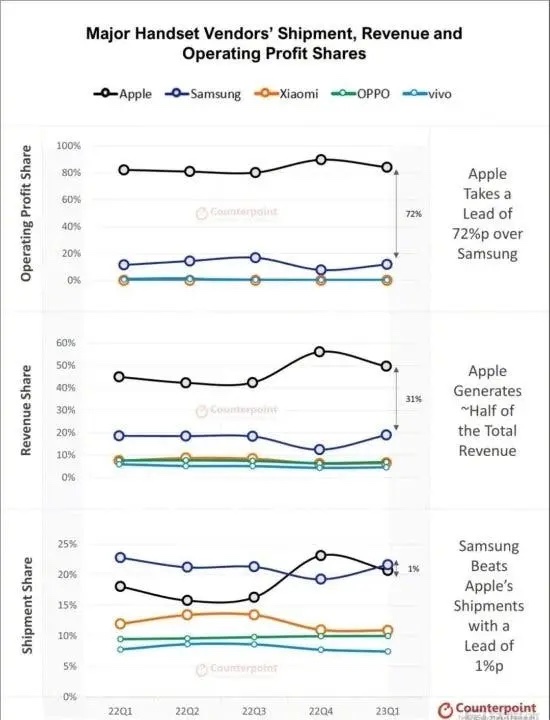

According to Counterpoint Research, Apple’s 20% market share in China is that it claims 80% of the profits in 1Q23. Though there is a general decline in the mobile phone industry, Apple sales continue to increase. It has a 6% YoY increase with a market share of 19.9%. Also, the company account for about half of the mobile phone market. Counterpoint also reveals that iPhone profits account for over 80%. This is also 72 percentage points more than the second-ranked Samsung. (GizChina, My Drivers)

Strava, the subscription platform at the center of connected fitness, has announced a partnership with Nike that will, for the first time, give members the ability to track and share their activity, inspiration and community across both platforms. The partnership will enable members to share activity details from the Nike Run Club and Nike Training Club apps to Strava, allowing athletes an aggregated way to seamlessly track their workouts and connect with their community. (Engadget, PR Newswire)