5-28 #Old : MediaTek will form an alliance with Nvidia; TSMC is in talks with German authorities for up to 50% subsidies; Sony has announced its plan to acquire a land in Kumamoto Prefecture; etc.

MediaTek will form an alliance with Nvidia and announce related cooperation such as Windows on Arm PC chips. Through this cooperation, Nvidia will return to the Arm-based PC market and the long-coveted mobile phone chip market, and MediaTek will also compete with Qualcomm in the Arm chip field with the help of Nvidia. The cooperation between Nvidia and MediaTek focuses on the development of Arm architecture chips for Windows PCs, integrating Nvidia’s GPU into MediaTek’s 5G SoC processor.(CN Beta, Laoyaoba, Yahoo, Bnext)

Xiaomi’s President Lu Weibing jas expressed regret over the closure of OPPO’s chip business. He has also said that Xiaomi’s determination to invest in chips has not wavered, and that the company will continue to invest in the chipsets market. In the past few years, Xiaomi has developed a number of chips for use in its smartphones, including the Surge S1, Surge S2, Surge V1, P1, and G1. These chips are designed to improve the performance, battery life, and camera quality of Xiaomi smartphones.(Gizmo China, UDN, IT Home)

Huawei has recently announced a breakthrough in 14nm semiconductor EDA tools and a new report reveals that other Chinese companies are also preparing even advanced chipset nodes such as 7nm and 5nm. China’s largest EDA company, Empyrean Technology is preparing to work on advanced EDA software for 7nm and 5nm. However, specifics are yet to be known. It mainly focuses on three key aspects of the EDA tech. First, it will complete the new products and production line. Second, Empyrean Tech will improve support for advanced processing and upgrade them to support 5nm and 7nm technologies. Third, the company wants to focus on continuous breakthroughs and the promotion of new products. It will also optimize and upgrade the existing tools and strengthen the support capabilities of EDA products and related technologies.(GizChina, Huawei Central, My Drivers, Sohu)

Malaysia, ranked among the top 10 global hubs for semiconductors and electronics, is looking to increase its market share to 15% by 2030. Deputy Prime Minister Datuk Seri Dr Ahmad Zahid Hamidi said the semiconductor industry was projected to grow into a trillion-dollar industry by the end of this decade, double its current value. He said Malaysia was now ranked the 7th largest exporter of semiconductors in the world, with a market share of 7%. He said the country was a key player in semiconductor assembly, testing and packaging activities, with a market share of 13%. To achieve this, Zahid said, one should focus on science, technology, engineering, and mathematics (STEM) education, which Prime Minister Datuk Seri Anwar Ibrahim had often emphasised. (Laoyaoba, Malay Mail, New Straits Times)

Taiwan Semiconductor Manufacturing Company (TSMC) is in talks with German authorities for up to 50% subsidies for its proposed plant in the country. NXP Semiconductors, Robert Bosch and Infineon Technologies are TSMC’s partners in the project. The talks around the construction of the Dresden plant, which could cost up to EUR10B (USD10.7B) to build, highlight the increasing competition for semiconductor manufacturing capacity. The potential subsidies being considered would place the German government’s support for the facility on par with Japan’s offer to TSMC for building a factory there. TSMC senior vice president Kevin Zhang has revealed that if they do build a fab in Dresden, likely they would start at the 28nm generation.(Reuters, Verdict, Taipei Times, Laoyaoba, Bloomberg, UDN)

Yuki Kusumi, CEO of Panasonic, said China remains a high-priority market for the company even as geopolitics have highlighted the need for robust supply chains elsewhere. Leaders at the Group of Seven (G7) summit in Hiroshima on 19-21 May 2023 stressed the need for firms to “de-risk” but not “decouple” from China. Kusumi said that they will continue to develop their businesses in China as we have done in the past, adding that there was “no doubt” that it was a high-priority market. China made up about 11.5% of Panasonic’s sales in the business year to end-Mar 2023 at JPY964.7B (USD7.14B).(Laoyaoba, Reuters, Financial Post)

Samsung Display is planning to apply its hybrid OLED technology in automotive display panels. The hybrid OLED panel is a step up from rigid OLED panels in that while it uses glass substrates like them it also uses thin-film encapsulation (TFE). Instead of using two glass boards, the top board is replaced with TFE while the bottom board is made thinner. TFE is usually reserved for flexible panels that use a plastic board. Because of the application of TFE and a thinner glass substrate, hybrid OLED can be made into curved panels, something that is difficult for rigid OLED panels. Samsung Display is planning to mass-produce hybrid OLED panels for its Gen 6 A3 line. (Laoyaoba, The Elec)

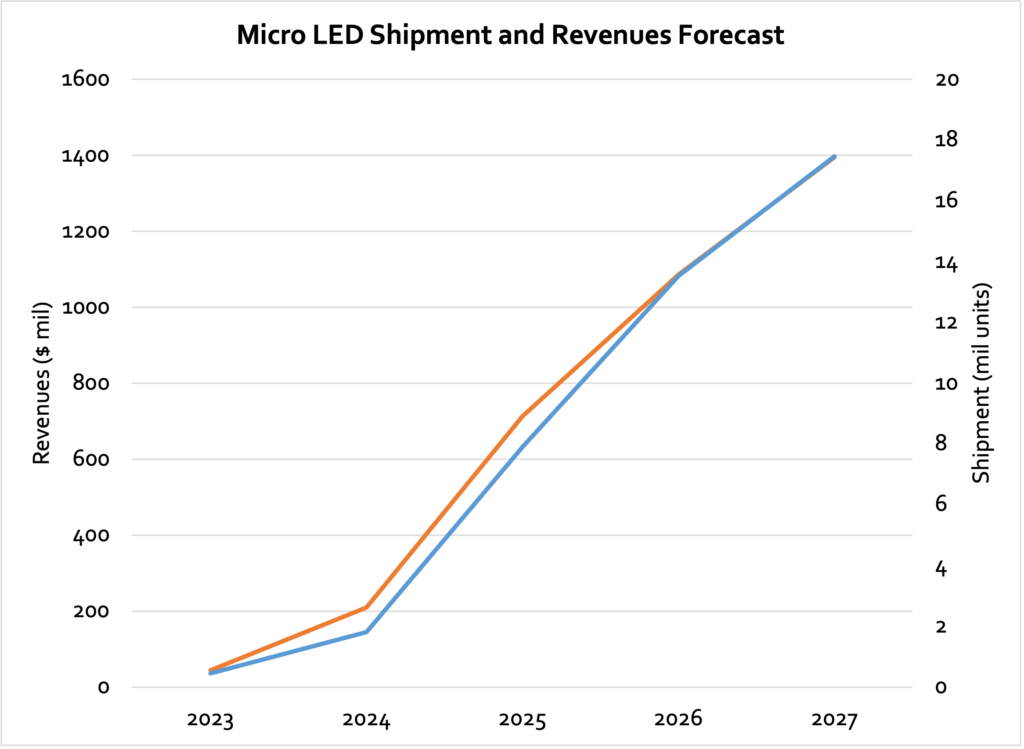

DSCC, a market research firm, predicts that micro LED display shipments would increase from 450,000 units in 2023 to 1.81M units in 2024, 7.98M units in 2025, 13.54M units in 2026, and 17.47M units in 2027. Sales over the same period are expected to grow to USD44M in 2023, USD210M in 2024, USD713M in 2025, USD1.086B in 2026, and USD1.395B in 2027. DSCC has also predicted that LG Display is building a small-scale backplane line for the Micro LED Apple Watch, but that the line will only be operational in the second half of 2024. The expected release date of the Micro LED Apple Watch is also 2025. MicroLED wearable products, including the Apple Watch, are expected to reach 7.9M units in 2026 and 10.5M units in 2027, starting with shipments of 4.2M units in 2025. In micro LED display shipments, wearable products are expected to take the top spot from 2025. (Laoyaoba, EET-China, Patently Apple, iPhone Wired)

The industry predicted that the resistance to panel quotations in Jun 2023 may increase slightly, mainly because the end of 2Q23 is approaching, and there are many variables in the global economy, customers are cautious and conservative in placing orders. However, it is reported that Taiwanese manufacturers are planning to increase the quotations of the three major applications in Jun, including TVs, monitor displays and notebook computers. Affected by the epidemic, the situation in Russia and Ukraine, and global inflation, the TV market demand will drop sharply in 2022, resulting in a high inventory of LCD panels and a sharp drop in prices. In the past few months, LCD panel manufacturers have lowered utilization rates, shifted their focus to controlling production, selling inventory, and received urgent orders for entry-level models of TVs and notebook computers. In Apr, LCD panel prices rose across the board. Among them, the large-size LCD panels in Mar increased by 5% compared with Feb 2023, and the small-size LCD panels also increased by 3% YoY. (MoneyDJ, Laoyaoba)

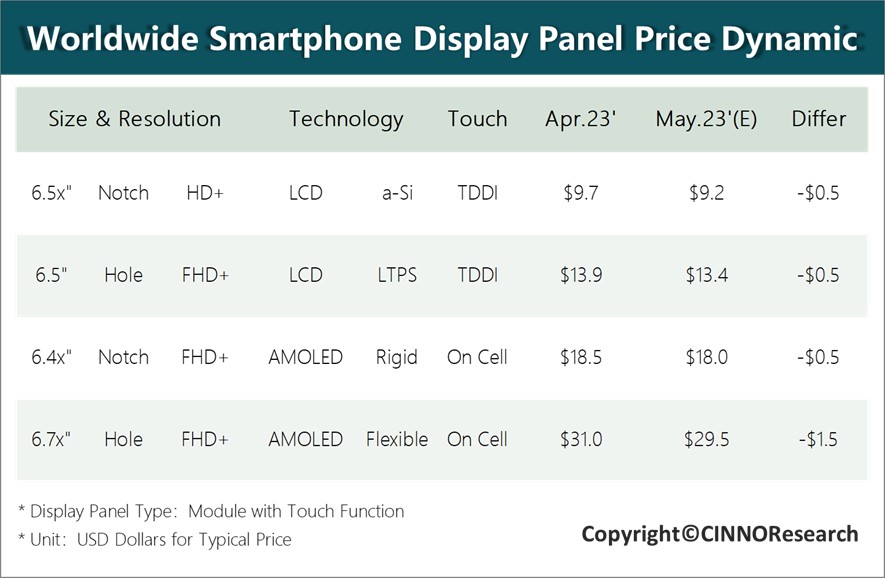

According to the latest forecast from CINNO Research, the price of mobile phone panels is still in a downward cycle in the short term. In May and Jun 2023, the price of a-Si/LTPS panels will drop by USD0.5 per month; the price of rigid AMOLED panels will continue to drop by USD0.5 in May, and the price of flexible The price of AMOLED panels may drop by USD1.5. Whether the price can rise will depend on the continued demand in 2H23. According to CINNO Research, with the arrival of the mid-year promotion season, terminal brands have increased their stocking momentum, and demand for panels in 2Q23 continues to be strong. However, in order to reduce costs, brand customers mostly stock up at low prices in advance, and the continued decline in panel prices will continue throughout 2Q23. Whether the price will bottom out in 2H23 still depends on the follow-up demand situation. (MoneyDJ, CINNO Research)

Sony has announced its plan to acquire approximately 27 hectares (270,000 square meters) of land in Kumamoto Prefecture, Japan. The company intends to construct its second manufacturing plant in Kumamoto, with a potential investment reaching hundreds of billions of yen. The primary objective behind this expansion is to accelerate Sony’s development in the competitive chip business sector and cater to the growing demand for Sony semiconductors in the global market. Sony is building a new factory in Kumamoto Prefecture specifically for producing smartphone image sensors. The initial timeline proposed breaking ground in 2024, with production commencing as early as 2025.(Gizmo China, IT Home, Japan Times, Reuters, Yahoo)

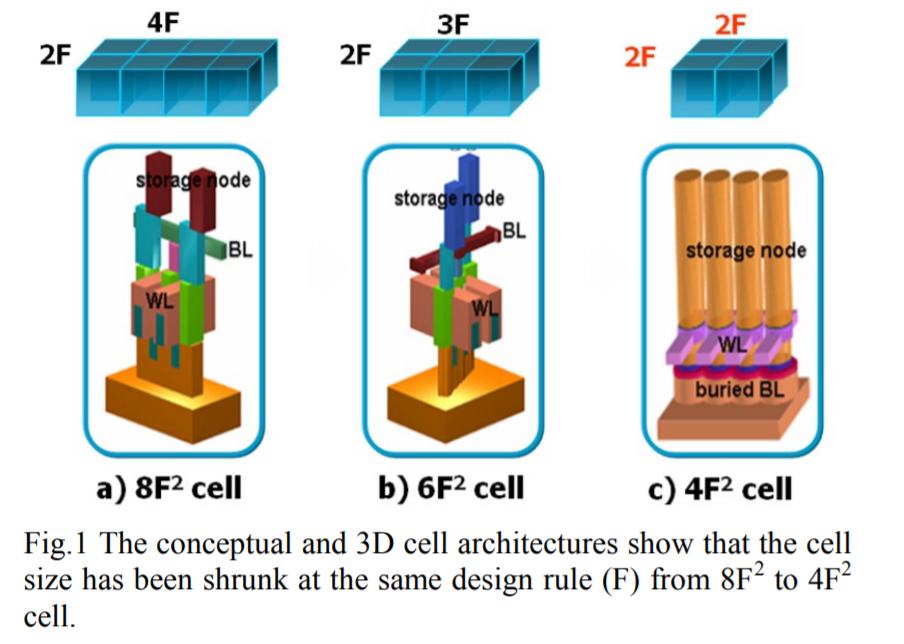

Samsung has formed a team to develop a 4F2(feature square) DRAM. If Samsung succeeds, it will be able to reduce the surface of die by 30% compared to 6F2 DRAM. Memory chipmakers attempted to commercialize 4F2 10 years ago but failed at the time. But now Samsung believes the structure is more achievable compared to 3D DRAM being developed by rivals SK Hynix and Micron. Samsung is aiming to start applying the 4F2 structure for DRAM made with 10-nanometer (nm) or under nodes as it believes how much it can narrow the channel length from then on will be limited. A DRAM consists of billions of cells made out of transistors and capacitors aligned in a square array. A transistor has a source, gate and drain depending on where the current flows in and out. The capacitor that stores the charge to determine 1 or 0 is above the drain. The word line and bit line are connected to the gate and source, respectively. The word line handles the switching (on/off) and bit line reads and writes the data. (CN Beta, The Elec)

China’s top server makers, including Inspur Group and Lenovo Group, have allegedly asked suppliers to suspend shipments of modules containing chips made by US-based Micron Technology, after Beijing imposed a partial ban on the firm’s products. DRAM chips used in memory modules for servers are a commoditised component that is commonly supplied by Micron and Samsung Electronics, said the source, who declined to be named to protect relationships with clients. It would take some time for the suppliers to make technical adjustments for newly-sourced alternatives. (Laoyaoba, EET-China, HKEJ, Yahoo, HK01, SCMP)

University of California (UC) San Diego has developed a wireless ultrasound-system-on-a-patch that can continuously monitor vital signs in real time, even when someone is moving. Ultrasound uses high-frequency sound waves to form an image of internal body structures such as abdominal organs, muscles and tendons, or the heart and blood vessels. The fully integrated wearable ultrasound system developed by UC San Diego engineers is made for deep-tissue monitoring. And it does not tether someone to a bulky device. The new ultrasound-system-on-a-patch (USoP) contains a miniaturized, flexible control circuit that interfaces with an ultrasound transducer array that collects and transmits data wirelessly to a smartphone app. The circuit is powered by a commercial lithium-polymer battery. (CN Beta, UC San Diego, Phys.org, New Atlas)

RobotSweater, developed by a research team from Carnegie Mellon University’s Robotics Institute, is a machine-knitted textile “skin” that can sense contact and pressure. The process of creating the RobotSweater draws parallels to the flexible, adaptive nature of knitting. Much like how a skilled knitter can shape yarn into any form – be it a sock, hat, or sweater – the RobotSweater’s textile skin can be tailored to snugly fit robots with uneven three-dimensional surfaces. Once fabricated, the RobotSweater lends a new dimension of sensitivity to robots. It equips them to “feel” human touch – a feature of utmost importance in industrial settings where safety is key. Existing solutions for human-robot interaction detection often resemble rigid shields, which can’t cover the entire robot body due to the necessity for certain parts to deform. (CN Beta, Earth.com, CMU, CMU, New Atlas)

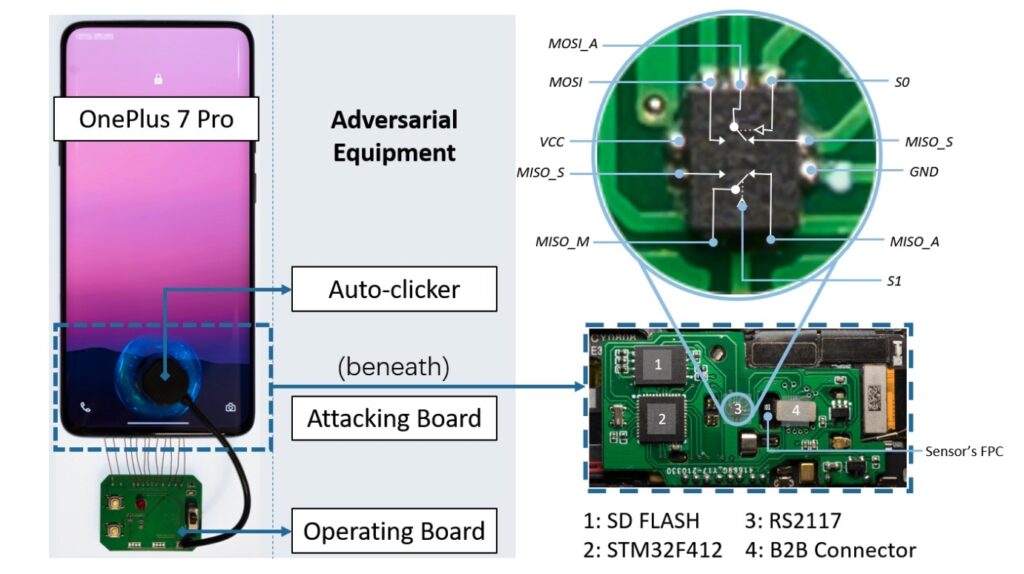

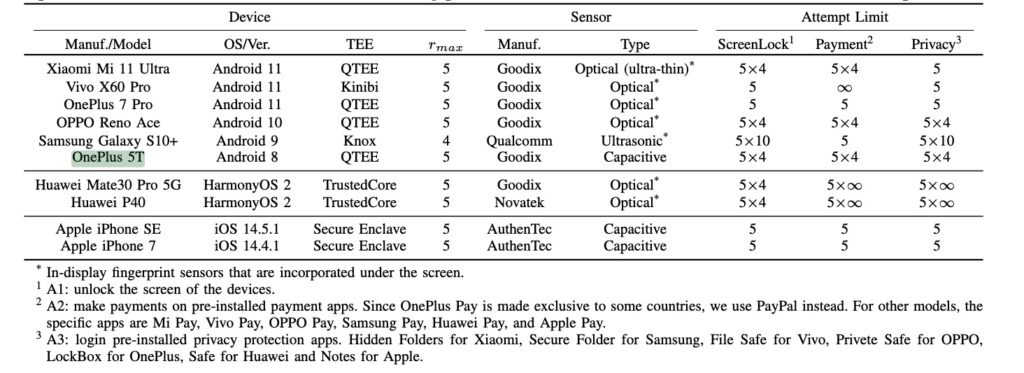

Researchers have devised a low-cost smartphone attack that cracks the authentication fingerprint used to unlock the screen and perform other sensitive actions on a range of Android devices in as little as 45 minutes. Dubbed BrutePrint by its creators, the attack requires an adversary to have physical control of a device when it is lost, stolen, temporarily surrendered, or unattended, for instance, while the owner is asleep. The objective is to gain the ability to perform a brute-force attack that tries huge numbers of fingerprint guesses until one is found that will unlock the device. The attack exploits vulnerabilities and weaknesses in the device SFA (smartphone fingerprint authentication). The core of the equipment required for BrutePrint is a USD15 circuit board that contains (1) an STM32F412 microcontroller from STMicroelectronics, (2) a bidirectional, dual-channel analog switch known as an RS2117, (3) an SD flash card with 8GB of memory, and (4) a board-to-board connector that connects the phone motherboard to the flexible printed circuit of the fingerprint sensor. (Gizmo China, Android Authority, Ars Technica)

LG Energy Solution and Hyundai Motor will build a joint electric vehicle battery factory in the US. It is their second joint EV battery factory after Indonesia. The factory in the US will be located at Brian County in Georgia where Hyundai Motor Group Metaplant America, the auto giant’s EV factory, is located. The battery factory will be completed in 2025 and have a 30GWh annual production capacity, enough to power 300,000 EV units. The pair will spend USD4.3B and each owns 50% stock of the joint venture.(Engadget, The Elec, LG)

Ford CEO Jim Farley and Tesla CEO Elon Musk have announced that in early 2024 more than 12,000 Tesla Superchargers will be operational with Ford vehicles. Farley also announced that next-generation Ford vehicles would come equipped with the North American Charging Standard (NACS) port, Tesla’s standardized version of its proprietary charging system. According to Ford, Tesla will develop an adapter that will be provided to customers who buy any of Ford’s EVs, including the F-150 Lightning truck, Mustang Mach-E, and E-Transit delivery van. Like the vast majority of EVs in North America, Ford’s EVs are compatible with EV chargers with CCS (Combined Charging System) plugs.(The Verge, Ford)

Ford CEO Jim Farley has criticized the bigger-is-better approach to EV range. He has recently pointed a finger at General Motors (GM) saying he is puzzled by what is happening in the auto industry right now as he sees EVs with monumental battery packs. For example, the GMC Hummer EV with its 205 kWh pack. He has expressed doubt that making ever-bigger batteries in pursuit of superlative range is the winning strategy it may appear and stated outright that Ford will not play the max range game.(My Drivers, The Verge, InsideEVs, Green Car Reports)

LG is expanding its electric vehicle (EV) charger solutions business, a move expected to further solidify the company’s position in the fast-growing EV charger segment. HiEV Charger, an EV charging solution company, was acquired by LG, GS Energy and GS Neotek in 2022. HiEV Charger has unveiled its product portfolio, which features 4 different chargers: 2 7kW models (wall-mounted and stand-type) and 2 fast-charging models (100kW and 200kW). All of the new products offer convenient installation and are suitable for use in multiple environments, such as homes, office buildings and a diverse range of other commercial facilities.(Neowin, LG)

Xiaomi posted its financial report for 1Q23, and the numbers look promising for the Chinese manufacturer that is about to join the EV game as well. The company had 594.8M monthly active users in 1Q23, and it managed to reach the 600M milestone by the time the announcement was published. The smartphone business reached CNY 35B (just under USD5B) in revenue, shipping 30.4M devices. The ASP was CNY 1,152 (USD163), increasing 2.7% over the previous quarter.(GSM Arena, Mi.com)

TrendForce reports that the global pandemic and extended average device replacement cycles of 36 – 42 months have curtailed smartphone production growth. Consequently, production levels have yet to rebound to pre-pandemic levels. Despite these challenges, the market for refurbished phones has been expanding, representing about 11% of the total market share in 2022 with about 167M devices. The largest market for these pre-owned devices remains China, with Europe following behind in second place. Interestingly, India’s burgeoning market, bolstered by its vast population, is developing rapidly and is projected to potentially rival China’s sales of refurbished phones by 2026. As far as brand performance goes, Apple dominated the market in 2022, capturing 45~50% of sales, while Samsung claimed the runner-up position with a 25~30% market share. (TrendForce, TrendForce, Laoyaoba)

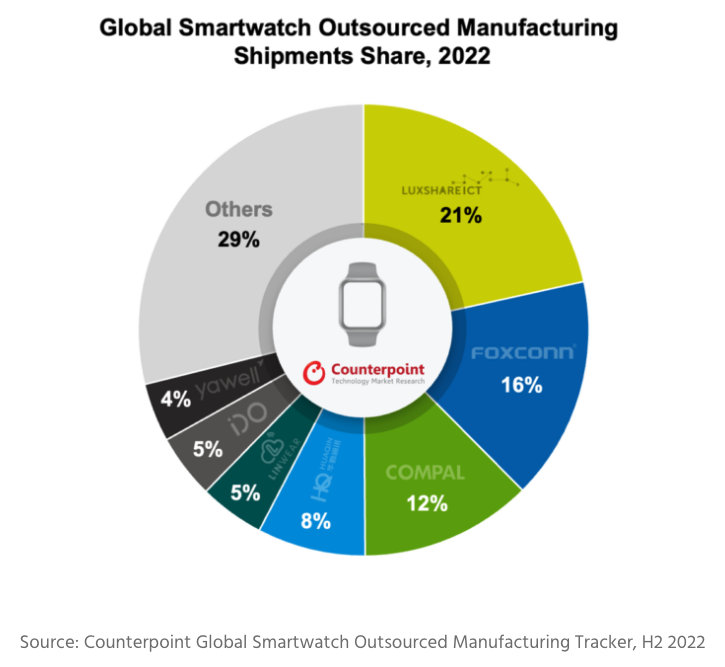

Global smartwatch outsourced manufactured shipments increased 15% YoY and accounted for 69% of overall global shipments in 2H22, according to Counterpoint Research. As global smartwatch shipments continue to grow, the contribution of outsourced manufacturing sources has also increased. 69% of global smartwatches were produced by ODM/EMS in H2 2022, compared with 63% in 2H21. Luxshare, Foxconn and Compal were the top 3 outsourced manufacturers in 2H22. The 3 players were responsible for half of the global smartwatch outsourced shipments during the period. Luxshare ranked first in 2H22 as it undertook around 40% of Apple Watch orders. (Laoyaoba, Counterpoint Research)

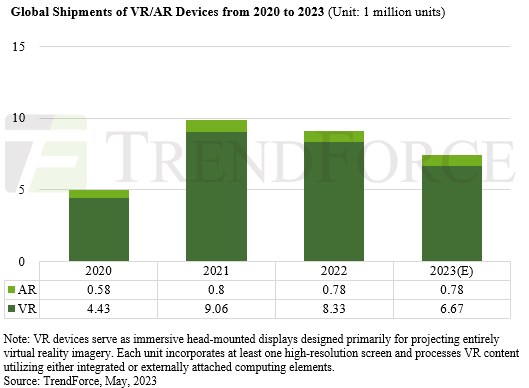

TrendForce forecasts a global downturn in AR and VR device shipments for 2023, predicting a shipment total of roughly 7.45M units—an 18.2% YoY decrease. VR devices are expected to shoulder the majority of this decline, with projected shipments hovering around 6.67M units. This dip is primarily attributed to weaker-than-expected sales of newly released high-end devices. Consequently, manufacturers are likely to pivot their sales strategies, shifting their focus to more cost-effective offerings. Conversely, shipments of AR devices are expected to remain stable, with projected shipments exceeding 780,000 units. While Apple’s latest offerings could stimulate some demand, the high price tags attached to these units continue to pose a significant barrier to broader market growth. (MacRumors, TrendForce, TrendForce)

Google has been hit with a USD32.5M penalty for infringing on a patent held by Sonos. The case was built around Sonos’ patent that enables synchronized audio playback across multiple speakers, a core feature of Sonos’ technology for years. Google has responded by highlighting that the dispute focused on specific features with limited usage. Google clarified that out of the 6 patents initially asserted by Sonos, only one was deemed infringed, while the remaining patents were either invalidated or found non-infringing.(Engadget, Law360, Gizmo China)

As part of its efforts to go green in India, Uber Technologies is adding more electric vehicles to the fleet. The company is planning a partnership with more EV operators, expanding financing options, and giving its users the option of hiring electric vehicles during the booking process. A 10,000 electric two-wheeler fleet will be deployed by 2024 as part of Uber Green’s launch in Jun 2023, in partnership with Zypp Electric. Delhi, Mumbai and Bengaluru will be the first cities to receive the services, prior to other places. In addition, it will provide INR1,00 crore (USD122.3M) in electric vehicle financing through SIDBI and expand its partnership with EV fleet providers Lithium, Everest and Moove. It is with a goal of going all-electric by 2040 that Uber India intends to deploy 25,000 four-wheelers and 10,000 two-wheelers in the market at the earliest. (Gizmo China, Twitter, Uber, First Post)

China’s automaker Great Wall Motor has filed a report with the country’s regulators against its rival BYD, the biggest EV manufacturer in China, alleging that its two top-selling hybrid models did not meet emissions standards. BYD denies the accusations and responded saying that its products and testing meet national standards and that the company is firmly opposed to any form of unfair competition. BYD has also added that it welcomes any investigations and inspections by authorities.(Laoyaoba, Sina, Wallstreet CN, My Drivers)

Vietnamese automaker VinFast has issued its first recall for some of its 2023 VF8 vehicles over a software glitch that causes the dashboard screen to go blank. The recall was issued after federal regulators warned that drivers were at an increased risk of crashing because a blank display does not show critical information such as the speedometer or warning lights. VinFast said it can fix the problem with an over-the-air software update. (TechCrunch, Vinfast)

Wingcopter, a startup out of Germany that has made a name for itself in the world of delivery drones used primarily for delivery of medicine and other goods to remote areas, has picked up some more financing to expand its business. The European Investment Bank is putting EUR40M (close to USD44M) into the startup, funding that it will use in two areas: further developing its hardware line; and to kick off a new business in logistics and delivery services, anchored by a fleet of its drones.(TechCrunch, EU-Startups, Wingcopter)

TikTok is reportedly conducting tests on a new AI chatbot named Tako, which will not only recommend videos to users based on their queries but also allow them to ask various questions about a video using natural language processing. When a user taps on the icon, Tako will open up a chat screen where the chatbot interacts with users and responds to various queries. Additionally, the chatbot will also suggest prompts to initiate conversations. (Android Headlines, Watchful.ai)