6-10 #Driving : TSMC’s 3nm process is currently quoted at USD19,865 per wafer; TSMC is planning price rises for its chip fabs as soon as Jan 2024; Samsung plans to increase the price of NAND wafers; etc.

Qualcomm Snapdragon 8 Gen 2 and Apple A16 Bionic are mass produced on TSMC’s N4 (4nm) process. The Snapdragon 8 Gen 2 is allegedly priced higher than what Qualcomm’s clientele would like to pay because, for USD160, flagship smartphone makers will have to raise the prices of their devices to generate any meaningful margins. Apple’s A16 Bionic price, and even though it is more than twice as expensive to produce compared to the A15 Bionic, at USD110 apiece, it is still USD50 cheaper than what Qualcomm is charging. Looking at the Snapdragon 8 Gen 2’s price, it is possible Qualcomm charges more for the Snapdragon 8 Gen 3, especially given that it is expected to be mass produced on TSMC’s slightly more advanced N4P process and is rumored to deliver more performance without sacrificing efficiency.(Android Headlines, Gizmo China, WCCFtech, Twitter)

STMicroelectronics and Sanan Optoelectronics have signed an agreement to create a new 200mm silicon carbide (SiC) device manufacturing joint venture (JV) in Chongqing, China. The new SiC fab is targeting to start production in 4Q25 and full buildout is anticipated in 2028, supporting the rising demand in China for car electrification as well as for industrial power and energy applications. In parallel, Sanan Optoelectronics will build and operate separately a new 200mm SiC substrate manufacturing facility to fulfill the JV’s needs, using its own SiC substrate process. The JV will make SiC devices exclusively for STMicroelectronics, using ST proprietary SiC manufacturing process technology, and serve as a dedicated foundry to ST to support the demand of its Chinese customers. (Laoyaoba, Reuters, Globe Newswire, EE Times)

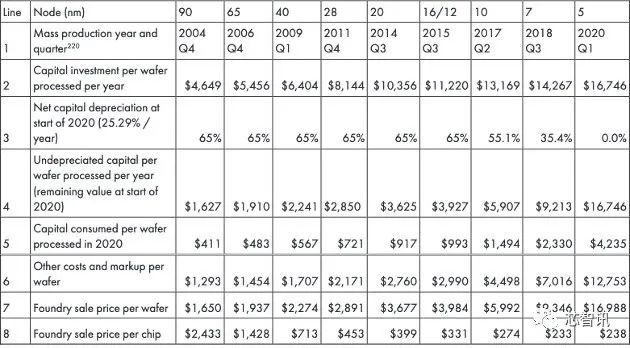

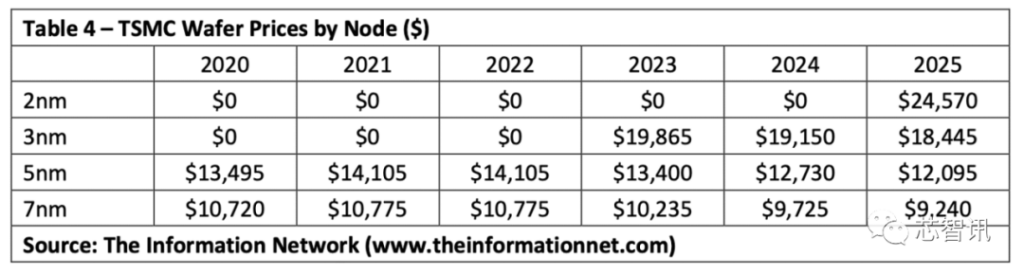

From the perspective of foundry prices, TSMC’s 90nm process was mass-produced in 4Q04, and the quotation was USD1,650 per wafer; 28nm was mass-produced in 4Q11, and each wafer was quoted at USD2,891; 5nm process was mass-produced in 1Q20, and the quotation was USD16,988. Compared with the USD9,346 for the 7nm process, the price of 5nm has increased by 81.77%. Statistics from The Information Network show that TSMC’s 3nm process is currently quoted at USD19,865 per wafer, and the 2nm process that will be mass-produced in 2025 is quoted at USD24,570 per wafer. Since each of TSMC’s process nodes will have multiple different versions, and the cost of foundry for different versions is also different. In addition, even for the same version of the process node, there will be different discounts for customers with different order levels. Therefore, the data for 2023 given by The Information Network should be the average price forecast data for the entire year. After all, since 2H22, the global semiconductor market has continued to decline, making the capacity utilization of some wafer foundries continue to decline since 4Q22 , hence TSMC had to start reducing prices to deal with. (Twitter, IT Home, CN Beta)

According to Digitimes, TSMC is planning price rises for its chip fabs as soon as Jan 2024. TSMC intends to push prices of advanced process output up between 3%-6%. These rises would be in addition to the 10%-20% increase in quotes for 2022. Digitimes’ sources assert that numerous large clients have been in these price discussions with TSMC. Apparently, TSMC is softening the potential pain from price rises by saying that those that accept the increases will be better placed to reserve production capacity in advance. This tactic should appeal to the most successful customers for whom time is of the essence. (Digitimes, Tom’s Hardware, The Register)

Samsung is reportedly working on an ‘ultra-large AI system’ that is being led by the research division, and of course, it will be done in-house. Samsung appears to be using all the GPU resources that the company has access to. The AI system will debut as an initial release sometime in Jul 2023. It is the company’s take on LLM (large language model), so this could mean that Samsung wants to come up with something that can battle the likes of Bard and ChatGPT. (CN Beta, WCCFtech, Chosun)

Japanese automakers are making progress in reducing delivery times for new cars, thanks to easing chip shortages sparked by the COVID pandemic. For mainstay Toyota and Nissan models, delivery times have been cut in half from 6 months ago. Take Toyota’s Yaris subcompact. In Nov 2022, it took up to 6 months for a vehicle to be shipped after an order was placed. In May, wait times had fallen to 3 months. Delivery times for Nissan’s Ariya electric sport utility vehicle have fallen by half to 6 months in May, versus a year six months earlier. (Laoyaoba, Asia Nikkei)

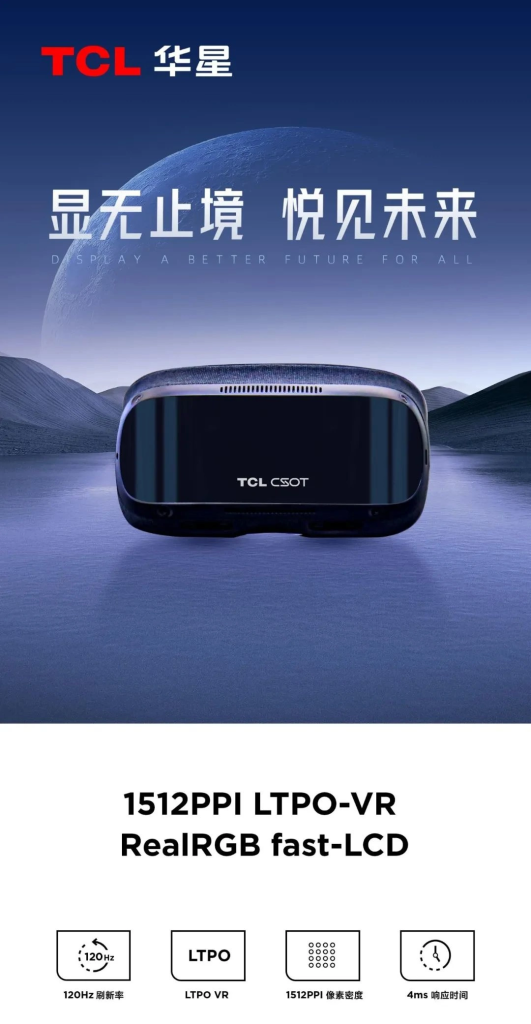

TCL CSOT has announced that its LTPO VR technology has made a breakthrough. TCL CSOT stated that it has developed a more advanced LTPO-VR technology based on LTPO technology, which can maintain industry-leading levels in terms of high penetration rate, high refresh rate, narrow frame, and low power consumption. LTPO VR technology can reach 1512PPI, support 120Hz refresh rate, and 4ms response time. LTPO technology is driven by the combination of LTPS and oxide TFT technologies. Not only has the advantages of LTPS high mobility, high resolution, and high response speed, but also has the advantages of IGZO’s low leakage current, low refresh rate, high aperture rate, and high brightness, which can reduce product quality without affecting the quality of VR equipment.(CN Beta, Techgoing, FPDisplay)

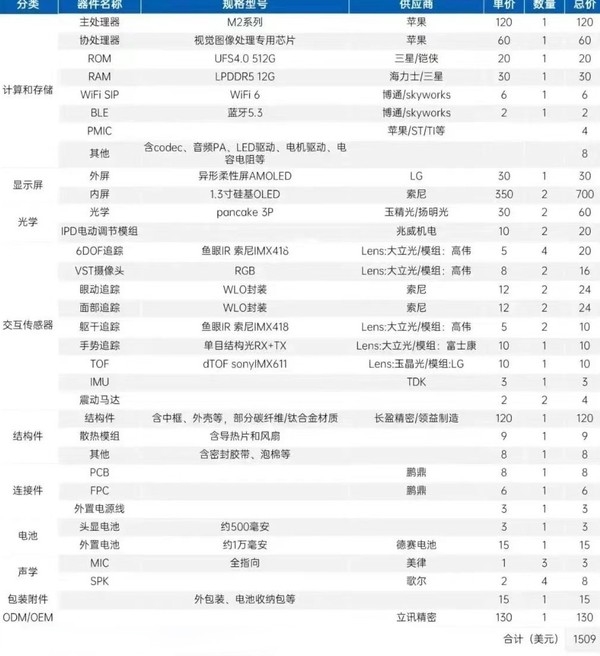

Apple Vision Pro BOM allegedly costs USD1,509. The most expensive component is its display. The total cost of one external screen plus two internal screens is USD730, accounting for almost 50% of the cost expenditure. One of the external screens costs USD30, which is provided by LG. Special-shaped flexible screen AMOLED, the inner screen is from Sony’s 1.3” silicon-based OLED, the unit price is USD350. (My Drivers, HSW, The Paper)

Samsung’s Galaxy Z Fold 5 and the Galaxy Z Flip 5 may feature support for dust resistance. They will be IP58 rated, which means water and dust resistance. Based on the ratings, the water resistance will be up to 1.5 meters deep for up to 30 minutes.(Gizmo China, Twitter)

TXD Technology has revealed that its subsidiary Kunshan TXD and ASE Semiconductor officially signed a “Cooperation Agreement on Packaging and Testing Projects”. According to the content of the agreement, TXD and Kunshan ASE will contribute capital separately to cooperate in the “chip advanced packaging and testing (Gold Bump) full-process packaging and testing project”. The specific investment amount is subject to the actual cooperation and project progress in the future. Kunshan Tongxingda will invest in the equipment required for the Gold Bumping section, the testing machine for the wafer testing section, and the special equipment required for the COF/COG section to the location of the production line, with a production capacity of 20,000 pieces per month; Kunshan ASE will invest in Gold Bumping Equipment other than those invested by Kunshan Tongxingda in the block segment + wafer test segment, including but not limited to the wafer test segment Prober, with a production capacity of 20,000 pieces/month.(Laoyaoba, SEMI.org, DramX, EE Focus)

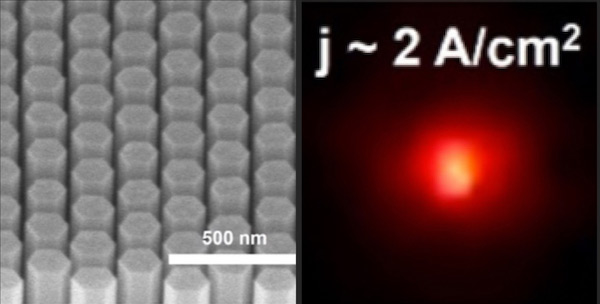

NS Nanotech of Ann Arbor, MI, USA has reported record performance for its nano-LED technology, demonstrating the first submicron-scale red LED efficient enough for commercial applications. The red nano-LED, with external quantum efficiency (EQE) greater than 8% was fabricated in the University of Michigan laboratory directed by NS Nanotech co-founder professor Zetian Mi. The LED is based on patented technology enabling fabrication of components that will be smaller and draw far less power than existing LED solutions, it is reckoned, while emitting brighter, more saturated, more stable and more directional light.(Laoyaoba, Semiconductor Today, OfWeek, MicroLED-Info)

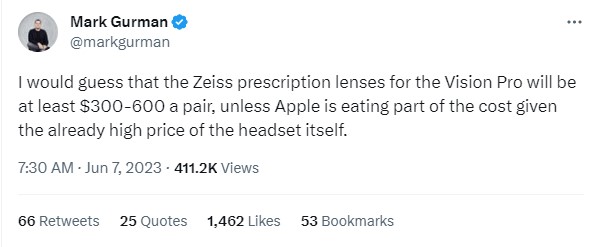

Bloomberg correspondent Mark Gurman guesses that a pair of Zeiss lenses for Apple’s Vision Pro could cost USD300-600. Zeiss already makes add-on lenses for VR headsets and they range in the EUR70-100 range. (GSM Arena, Twitter)

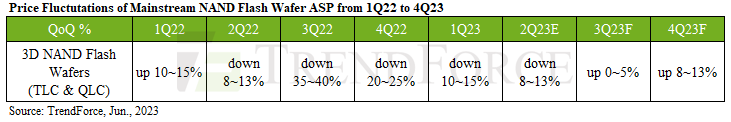

According to digitime, Samsung plans to increase the price of NAND wafers. In addition, if the consumer electronics market demand improves in 2H23, NAND wafer contract quotations may pick up. Samsung and SK Hynix have sought to raise prices of NAND flash memory by 3%-5% to test market reaction, saying the price of NAND flash memory has fallen below variable costs, the report said. It is noticed that some brands of SSD prices are approaching HDD prices. TrendForce research reveals that following significant production reductions by US and Korean manufacturers beginning in May 2023, some suppliers have increased their wafer prices. This development has led to a slight elevation of market prices in China compared to those seen in Mar and Apr 2023. TrendForce has further projected a rise in prices starting in 3Q23, with an expected increase of around 0-5%. The rate of price growth is anticipated to expand further to 8%-13% in 4Q23. However, for products such as SSDs, eMMC, and UFS, inventories still need promotional efforts to be cleared, and there are currently no indications of price increases. (Laoyaoba, Digitimes, Techgoing, TrendForce, TrendForce)

LG Energy Solution and Hyundai Motor Group are reviewing a plan to apply Z-stacking in their joint battery factory in the US. The pair’s joint factory in Indonesia, HLI Green Power, has already applied the method, which stacks battery materials cathodes and anodes alternatively on the separator. The separator is stacked in a “Z” shape, hence the name. LG Energy Solution’s current preferred method is lamination and stacking, or L&S, in which the battery materials cathode, anode and separator are laminated together first before being stacked. (The Elec, Hyundai, Yole)

General Motors (GM) has announced a collaboration with Tesla to integrate the North American Charging Standard (NACS) connector design into its EVs beginning in 2025. Additionally, the collaboration will expand access to charging for GM EV drivers at 12,000 Tesla Superchargers, and growing, throughout North America. This agreement complements GM’s ongoing investments in charging, reinforcing the company’s focus on expanding charging access across home, workplace, and public spaces and builds on the more than 134,000 chargers available to GM EV drivers today through the company’s Ultium Charge 360 initiative and mobile apps.(The Verge, General Motors, Twitter)

Toyota Motor North America has announced that it will invest nearly USD50M to construct a new laboratory facility at its North American R&D headquarters in York Township, Mich. to evaluate batteries for electric and electrified vehicles in North America. As part of its evaluation process, the new Michigan battery lab will ensure that Toyota’s batteries meet North American customer requirements by confirming performance, quality and durability of automotive batteries made by Toyota. Operations at the new battery lab are expected to begin in 2025.(TechCrunch, Toyota)

NASA will award funding to more than 200 small business teams to develop new technologies designed to protect the health of astronauts, lower the risk of collision damage to spacecraft, and more. The new awards from NASA’s Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) program invests in a diverse portfolio of American small businesses and research institutions to support NASA’s future missions. NASA selected 300 proposals from 249 small businesses and 39 research institutions – including 8 Minority Serving Institutions (MSIs) – for first-round funding. Each proposal team will receive USD150,000 to establish the merit and feasibility of their innovations for a total agency investment of USD45M.(TechCrunch, Space Coast Daily, Business Standard, NASA, GeekWire)

China Unicom has introduced a small base station based on the 5.5G network, which integrates the communication network and the perception network. Through it, vehicles can sense pedestrians and nearby vehicles in time, and avoid vehicles in accidents in time. According to experts, 5.5G, which is 10 times faster than 5G, is expected to be commercially available in 2025. 5.5G, also known as 5G-Advanced, is the next development stage of 5G. Currently, Huawei is vigorously promoting the realization and commercialization of 5.5G. Yang Chaobin, senior vice president of Huawei and president of ICT products and solutions, previously mentioned that 5.5G is the only way for the next step of 5G network upgrade and evolution. Huawei’s 5.5G can provide a downlink rate of 10Gbps, which is equivalent to a 10-fold increase from the original 5G’s 1Gbps, and also has a 10-fold increase in delay, positioning, and reliability.(Sina, My Drivers, EE World, HKET)

vivo has announced a temporary suspension of product sales in the German market, after losing a patent infringement lawsuit to Nokia in Apr 2023. The decision was communicated through vivo’s official German website, which now only displays its homepage and support page, with all product listings removed. Vivo has assured customers that it will continue to provide relevant services for previously purchased products. (Yicai Global, Foss Patents, vivo.de, TechNode, Laoyaoba)

Vietnam’s rolling power cuts have hit industrial parks in the country’s northern provinces where top global manufacturers such as Foxconn and Samsung have factories. The frequent and often unannounced power cuts prompted EuroCham, which represents European companies in the country, to send a letter to the industry and trade ministry urging quick measures to address the emergency. Some industrial parks in the northern provinces of Bac Ninh and Bac Giang have been facing blackouts. The blackouts threaten efforts to avert an economic slowdown due to weak demand in key export markets, after 1Q23 growth slipped to 3.3% from 5.9% in 4Q22. (Apple Insider, WSJ, Yahoo, Bloomberg)

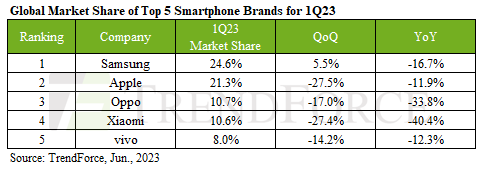

The ongoing global economic downturn continues to impact consumer confidence in the market. TrendForce reports that the global production volume of smartphones in 1Q23 was only 250M units—marking a 19.5% YoY decrease. This represents not only the greatest annual decrease but also a historic low in quarterly production since 2014. Samsung observed a slight surge in 1Q23 production thanks to the launch of its Galaxy S23 series, reaching 61.5M units—a 5.5% QoQ rise. However, TrendForce predicts a nearly 10% drop in 2Q23 production due to weakening demand for new models. Apple faced a substantial 27.5% QoQ drop in smartphone production in 1Q23, delivering a total of 53.3M units. The new iPhone 14 series accounted for approximately 78% of this figure, an improvement from the same period in 2022. Nonetheless, as the company navigates the transition period between model launches, a projected decrease of 20% is expected in 2Q23. (TrendForce, TrendForce)

Apple has unveiled macOS Sonoma. The headline features are support for widgets on the desktop, a new game mode, and moving aerial screensavers. Widgets can be dragged from Notification Center to the desktop or can effectively be imported from an iPhone via Continuity if a device is on the same Wi-Fi network. They can be interactive (allowing you to tick items off a to-do list, for example, or control media playback or connected smart home devices), and are designed to fade into the background when you open a window.(GSM Arena, Apple.com, The Verge, MacRumors)

Apple has announced watchOS 10, its “milestone” next-gen smartwatch platform. Widgets are back on the menu, friends. Turning the digital crown will bring up your widget stack and let user scroll through for quick and easy access to information. It’s a major shift in how users have thus far interacted with the Apple Watch and is reminiscent of the Siri watchface introduced a few years ago in watchOS 3. Apple Watch apps — including Weather, Stocks, Home, Maps, Messages, and World Clock — are also getting a more glanceable look. In essence, apps will be able to show you more information that utilizes the entirety of the watch’s display. (MacRumors, Apple.com, The Verge, Gizmodo)

Apple has allegedly lowered the sales target of its new mixed reality device Vision Pro from 300,000 units to 150,000 units, which is far less than the previous market forecast of 1M units. According to a number of parts manufacturers in the United States, Apple only placed an order for 150,000 units from the supply chain before releasing the Vision Pro. It is reported that Apple hopes to sell all 150,000 units, observe the sales progress, and then decide whether to add more purchase orders. (Laoyaoba, IT Home, UDN, WCCFtech, Twitter)

TrendForce anticipates a modest shipment volume of approximately 200,000 units for Apple Vision Pro in 2024. The market’s response will heavily depend on the subsequent introduction of consumer-oriented Apple Vision models and the ability of Apple to offer enticing everyday functionalities that will drive the rapid growth of the AR market as a whole. (TrendForce, TrendForce)

While Apple is set to release its Vision Pro mixed reality (MR) headset with virtual reality (VR) and augmented reality (AR) capabilities in 2024, Samsung Electronics, Google, and Qualcomm of the Android group are also working on the development of new MR devices. Industry insiders are expecting a confrontation between Apple and an anti-Apple group just like the current smartphone race. The Android group, including Samsung Electronics, Google, and Qualcomm, is reportedly developing MR products with the aim of unveiling them within 2023 at the earliest. Google will develop an MR-specific operating system (OS), Samsung MR hardware and Qualcomm MR-specific chipsets.(GizChina, IT Home, Business Korea)

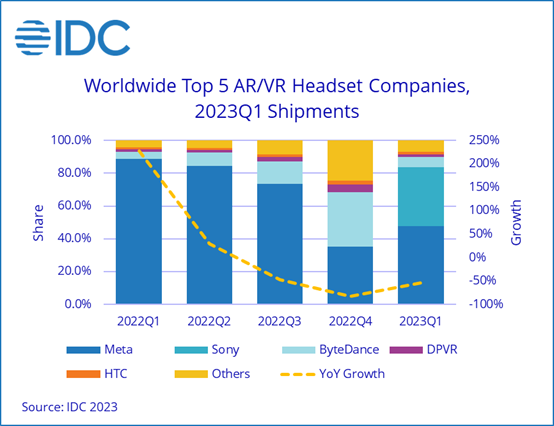

Global shipments of augmented reality (AR) and virtual reality (VR) headsets slowed significantly in 1Q23 as macroeconomic conditions worsened and the market cooled compared to the pandemic driven highs seen in 2022. According to IDC, the overall AR / VR headset market declined 54.4% YoY in 1Q23 with VR headsets representing 96.2% of headsets shipped. Among the top 5 AR/VR headset makers, Meta continued to lead with 47.8% share although it did lose ground to Sony’s PSVR 2, which captured 35.9% share during the quarter. ByteDance (Pico) managed to grow its share from 4.4% in 2022 to 6.1% in 2023 thanks to new products and new markets. DPVR and HTC rounded out the top 5 with each having less than 2% share. (IDC)

BYD, a prominent Chinese automaker, has raised the maintenance fees for several of its models, leading to a surge in dissatisfaction among car owners. The increase in maintenance costs, which reportedly amounts to around 50% for certain models, has been observed in various cities across China. Hybrid models witness a larger upward adjustment compared to pure electric ones. For instance, in major cities such as Beijing, Shanghai, Shenzhen, Guangzhou, Hangzhou, and new first-tier cities, maintenance prices have significantly risen. The minimum maintenance price for Song and Qin hybrid models has surged from 325 yuan to 485 yuan, indicating a notable 49.2% increase. (Gizmo China, IT Home)

Segway-Ninebot is partnering with Drover AI and Luna Systems — two startups that build computer vision technology to detect and correct improper electric scooter riding — to integrate their technologies into its AI-enabled e-scooters. In 2022, the scooter manufacturer launched an AI-powered scooter, the S90L, as the vertically integrated solution to scooter advanced rider assistance systems (ARAS). Powered by Qualcomm’s latest AI technologies and Segway’s own capabilities in computer vision and deep learning, Segway Pilot is a system that autonomously senses and detects diverse elements in an urban setting – such as sidewalks, parking slot, and pedestrian density – meanwhile safeguarding privacy by blurring facial characteristics at the time of image capture.(TechCrunch, PR Newswire)

Google Cloud has said Mayo Clinic is using a new generative AI search tool that lets companies create customized chatbots. In health care, the technology should allow workers to interpret data such as a patient’s medical history, imaging records, genomics or labs more quickly and with a simple query. Google Cloud said Mayo Clinic is testing a new service called Enterprise Search on Generative AI App Builder. Mayo Clinic, one of the top hospital systems in the U.S. with dozens of locations, is an early adopter of the technology for Google, which is trying to bolster the use of generative AI in the medical system.(Android Headlines, CNBC)

Cohere, an enterprise-focused generative artificial intelligence (AI) startup, has raised USD270M in a Series C round of venture capital which includes AI giant Nvidia as an investor. Cohere, which has developed multilingual language models trained on data from native speakers, among other AI, aims to stand out in the ocean of generative AI startups by focusing on enterprise use cases. Cohere’s AI platform is cloud agnostic, able to be deployed inside public clouds (e.g., Google Cloud, Amazon Web Services), a customer’s existing cloud, virtual private clouds or on-site. The startup takes a hands-on approach, working with customers to create custom LLMs based on their proprietary data. (Laoyaoba, TechCrunch, Reuters, Bloomberg, CNBC)