6-23 #DragonBoat : Qualcomm has announced significant job cuts; Intel will spend USD25B on a new factory in Israel; BOE, CSOT, Tianma, and Visionox have teamed up and filed a trial for patent invalidation of Samsung; etc.

Qualcomm has announced significant job cuts as it aims to reduce expenses in light of a persistent slowdown in smartphone sales. As per the Worker Adjustment and Retraining Notification Act (WARN) paperwork, the company has not only eliminated 415 positions at its San Diego headquarters but also let go of 84 employees at the Bay Area office. Amongst the layoffs, the engineering department was the most affected, with approximately 300 positions eliminated, as indicated by the WARN notice. (Android Headlines, San Diego Union-Tribune)

Qualcomm has announced that its S3 Gen 2 sound platform, which was introduced in 2022, can now support sub-20 millisecond (ms) latency on Snapdragon Sound-equipped devices. In the past, Qualcomm’s aptX Low Latency codec has been able to deliver around 42ms of latency, which was already far better than 100ms to 300ms lag times exhibited by traditional Bluetooth headphones and earbuds. Now the company says its latest addition to the Snapdragon Sound platform is “optimized for gaming”, with its ability to offer low-latency audio over Bluetooth without the need for a separate, proprietary chip for back-channel voice connections. Qualcomm says that its Snapdragon Sound S3 Gen 2 platform has less than 20ms latency for both wireless audio and a voice back-channel, allowing gamers to hear and react to sounds nearly instantly while also talking to their teammates in real-time.(Liliputing, Digital Trends, Qualcomm)

Qualcomm Technologies has announced that it has extended its collaboration with Snapdragon platforms powering Sony’s future smartphones. The companies agreed to work together on the next generations of premium, high-, and mid-tier smartphones. The joint efforts will focus on the integration of Qualcomm Technologies’ advanced Snapdragon mobile platforms into Sony’s future smartphone lines. (Engadget, CN Beta, Qualcomm)

The Israel Prime Minister Benjamin Netanyahu has revealed that Intel will spend USD25B on a new factory in Israel. The factory will be based in the city of Kiryat Gat and is expected to open in 2027. Israel’s finance ministry said Intel will pay a 7.5% tax rate as part of the deal – up from the current 5% figure. In 2022, Intel acquired Israeli AI workload optimisation start-up Granulate at a USD65M valuation as well as chipmaker Tower Semiconductor for USD5.4B. (Neowin, Bloomberg, Globes, Silicon Republic, Times of Israel, Reuters)

TF Securities analyst Ming-Chi Kuo has indicated that Apple’s iPhone 15 lineup will feature a new, upgraded ultra-wideband (UWB) chip that will improve the integration with the Vision Pro headset. Apple has used the same U1 UWB chip since the iPhone 11. Per Kuo, the U2 will make the move from 16nm (on the U1) to 7nm, improving performance and power consumption. Apple’s U1 chip is also in the Watch Series 6 and newer, the HomePod mini, the second-gen HomePod, the new AirPods Pro’s case, and in the AirTags. The U1 allows for Find My features, Handoff, Precision Finding, and AirDrop. (GSM Arena, Twitter)

Intel is joining hands with European miniaturization expert CEA-Leti to develop layer transfer technology for two-dimensional transition-metal dichalcogenides (2D TMDs) on 300-mm wafers in a quest to extend Moore’s Law beyond 2030. Intel will bring decades of R&D and manufacturing expertise to this project while CEA-Leti will offer bonding and transfer-layer expertise along with large-scale characterization. 2D-layered semiconductors, such as molybdenum- and tungsten-based TMDs, are promising candidates to extend Moore’s Law and ensure ultimate scaling of MOSFET transistors, because 2D-FETs provide innate sub-1nm transistor channel thickness. They are suitable for high-performance and low-power platforms due to their good carrier transport and mobility, even for atomically thin layers. In addition, their device body thickness and moderate energy bandgap lead to enhanced electrostatic control, and thus, to low off-state currents.(My Drivers, Inside.com, EDN, HPC Wire, eeNews)

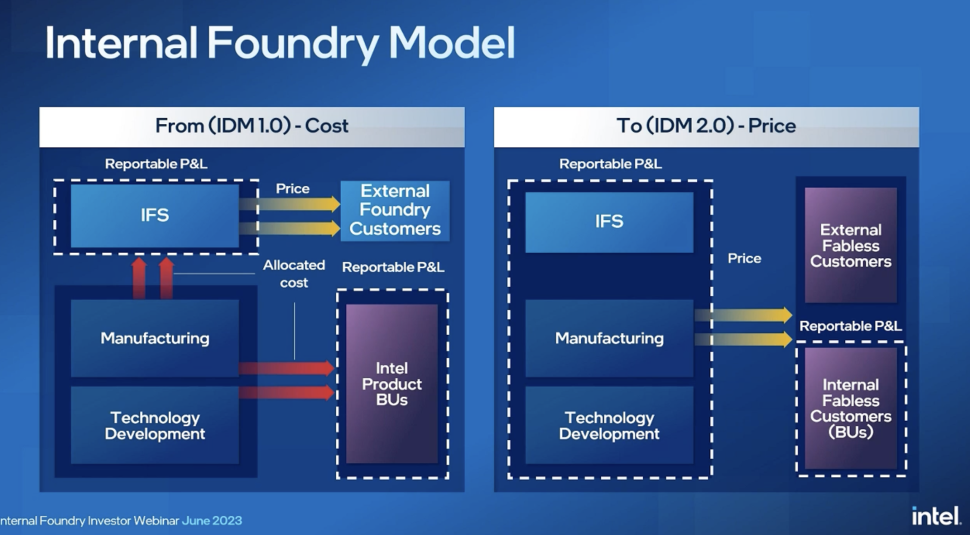

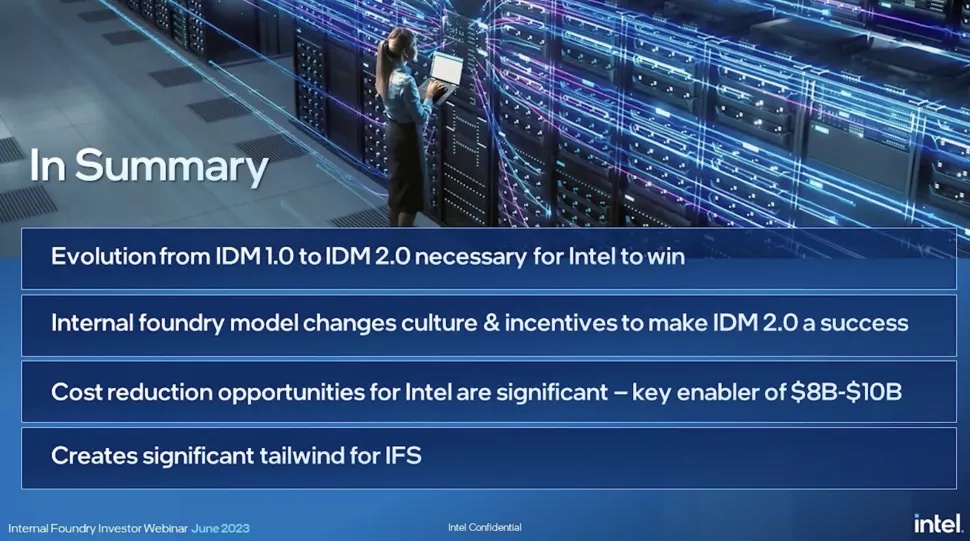

Intel’s Chief Financial Officer David Zinsner explaining how the company would soon change the way it reports its financial results to give its foundry business, known as IFS, its own profit-and-loss statement, which would reveal the company’s manufacturing margins. Intel’s new reporting structure could also help control costs at the chipmaker, which is seeking to trim as much as USD10B from its costs over the next 3 years. Separately, Intel said that it planned to sell 20% of an Austrian subsidiary, IMS Nanofabrication, to private equity firm Bain Capital in a deal that valued the unit at USD4.3B. (Laoyaoba, Tom’s Hardware, Intel, CNBC)

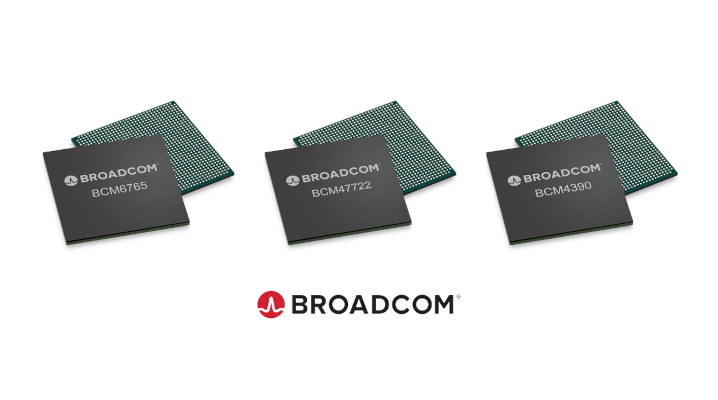

Broadcom has debuted 3 new Wi-Fi 7 chips that can be used to equip routers and handsets with wireless networking capabilities. Wi-Fi 7 is the latest version of the eponymous wireless networking technology. It can provide up to 46 gigabits per second of bandwidth, twice the maximum amount that was supported before. The technology also promises to lower connection latency significantly. The first two Wi-Fi 7 chips that Broadcom debuted, the BCM6765 and BCM47722, are both designed for use in networking equipment. The former chip is optimized to power home routers. Broadcom says its BCM6765 and BCM47722 chips both support 320 MHz Wi-Fi connections. They also support Multi-Link Operation, another enhancement introduced with Wi-Fi 7.(CN Beta, Broadcom, Silicon Angle, IT Home)

Samsung has reportedly set an internal target to sell 1.3 times more foldable smartphones in 2023 than it did in 2022, which would be a 30% annual growth. (Android Headlines, Twitter)

ThundeRobot and BOE have entered into a strategic partnership, jointly establishing the “Jing-Lei” joint innovation laboratory. This collaboration will strengthen the integration of technologies and product designs in the e-sports display domain, aiming to create high-end display solutions. The joint lab will bring together BOE and ThundeRobot to collaborate on all aspects of e-sports display technology, from research and development to product design. The goal is to create high-quality, immersive gaming experiences that take advantage of the latest display technologies. (Gizmo China, IT Home, Sohu)

Chinese display manufacturers BOE, CSOT, Tianma, and Visionox have teamed up and filed a trial for patent invalidation with the Patent Trial and Appeal Board. The four display makers from China are going against one Samsung Display patented technology. They are trying to invalidate U.S. Patent No. 7,414,599. It concerns “Organic Light Emitting Display (OLED) Device Pixel Circuit and Driving Method”. This is one of the patents Samsung Display included in its investigation with the US International Trade Commission in Dec 2022 when the company fought against imports of OLED panels that infringe on its patents and technologies. (Gizmo China, The Elec, SamMobile)

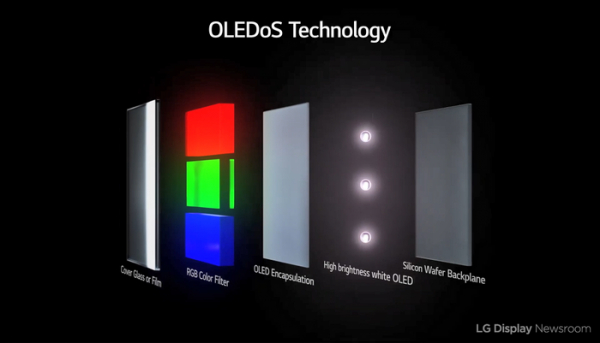

Sony is the leader in OLED On Silicon (OLEDoS) displays, while LG Display and Samsung Display are pumping up their efforts to develop related technologies. LG Display has already succeeded in making a WOLED prototype display in the same way as Sony’s OLEDoS displays. The WOLED prototype is made by placing a layer of OLEDs that emit white light on a silicon wafer substrate and covering it with red, green, and blue color filters. Along with developing OLEDoS displays in the WOLED method, Samsung Display is developing an OLEDoS display through a new method that does not use color filters. In May, the company signed a deal to acquire eMagin, a U.S. company that owns the original technology for patterning OLED devices onto silicon wafers, for USD218M(KRW290B). Chinese companies such as BOE have also entered the OLEDoS market, which is bad news to Korean display makers. (Business Korea, UDN, Laoyaoba)

Display production equipment maker Sunic System will be supplying its deposition machine for OLED on silicon (OLEDoS) to Chinese display panel maker SeeYa. The deal is worth KRW32.2B (USD24.6M) and the contract will last until Jun 2024. Sunic System has so far supplied its deposition machine for OLEDoS 3 times. It supplied to SeeYa for the first time in 2018 through a deal worth KRW29.5B. In 2020, it also supplied the machine to BOE for KRW27.6B. Meanwhile, SeeYa is increasing its supply of OLEDoS to the market. It collaborates with drone maker DJI and is also reportedly aiming to supply the panels to Apple. (The Elec, Display Daily, IT Home, Sina)

SK Hynix’s 1a (4th-gen 10nm, belonging to the 14nm class) DDR5 DRAM product yield rate is as high as 90%, which is much higher than that of competitors. The DDR5 DRAM market, which is considered to be one of the largest battlegrounds for memory semiconductor companies in 2023, is developing around high-capacity products such as 128GB DDR5 for servers. Samsung Electronics and Micron are currently unable to produce 128GB DDR5 large-capacity DRAM products. SK Hynix Supply 100% of the market volume in this field.(CN Beta, Techgoing)

Micron Technology has announced that it is now delivering qualification samples of its Universal Flash Storage (UFS) 4.0 mobile solution, built on its advanced 232-layer 3D NAND. This product is Micron’s first mobile solution built on the company’s innovative 232-layer triple-level cell (TLC) NAND, which delivers 100% higher write bandwidth and 75% higher read bandwidth. Micron’s 232-layer 3D NAND architecture provides more bits per square millimeter of silicon by stacking the NAND bit cell array into more layers, allowing greater density, performance improvements and capacity growth. (GSM Arena, Micron)

An app dubbed FeverPhone has been developed by researchers at the University of Washington that turns smartphones into thermometers without adding new hardware. It uses the phone’s touchscreen and repurposes the existing battery temperature sensors to gather data that a machine learning model uses to estimate people’s core body temperatures. Clinical-grade thermometers use thermistors to estimate body temperature. Off-the-shelf smartphones contain thermistors that are mostly used to monitor the temperature of the battery. The UW researchers realised they could use these sensors to track heat transfer between a person and a phone. The phone touchscreen could sense skin-to-phone contact, and the thermistors could gauge the air temperature and the rise in heat when the phone touched a body. (CN Beta, University of Washington, The Engineer, New Atlas, ACM)

Contemporary Amperex Technology (CATL) has announced the signing of a strategic cooperation framework agreement with the Shenzhen Municipal People’s Government. The two parties will focus on key areas such as new energy vehicle replacement, electric ships, new energy storage, green parks, financial services and trade, and carry out all-round cooperation. (Laoyaoba, MarkLines)

POSCO will spend KRW1.5T with China’s CNGR to build nickel and precursor factories in Pohang, South Korea. Posco and CNGR will own 60% and 40% of the stock, respectively, of the nickel processing factory that will produce nickel sulfate. For the precursor factory, Posco will own 20% stock while CNGR will own 80%. The nickel processing factory will have an annual capacity of 50,000 metric tonnes while the precursor factory’s will be 110,000 metric tonnes. The combined amount is enough to be used on batteries that can power 1.2M electric vehicles. The factories are expected to start mass production in 2026.(The Elec, CNA, KEDGlobal, 36Kr, NBD, Sina)

The U.S. President Joe Biden has announced USD930M in grants aimed at expanding access to broadband access in rural America. The “Enabling Middle Mile Broadband Infrastructure” grants cover 35 states and Puerto Rico as part of the Department of Commerce’s program to bring high-speed internet access and large amounts of data across long distances. Verizon, Spectrum, AT&T, and Optimum are among the 20 internet providers that have partnered with the White House on the Affordable Connectivity Program (ACP) to bring high-speed internet access to people in need for USD30 per month or less, but for qualifying households, there will be no cost. (Engadget, Twitter, Gizmodo, Commerce.gov)

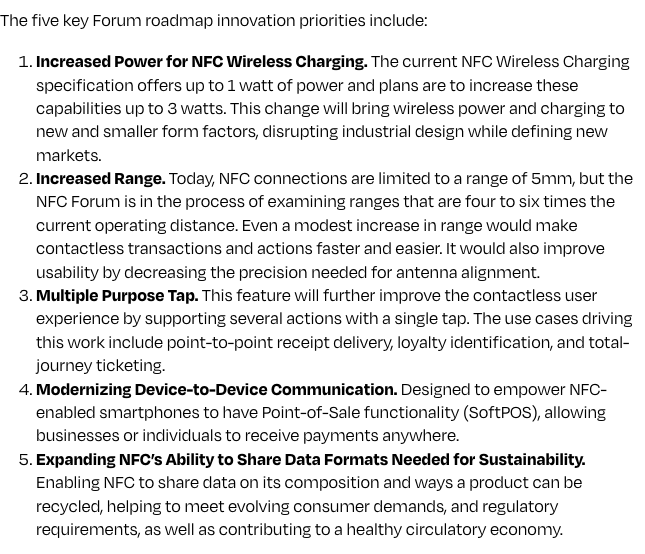

The NFC Forum, the leading standards body for Near Field Communication (NFC) technology, has announced that it has unveiled its Technology Roadmap outlining key plans and research efforts through 2028. The technology roadmap was collaboratively developed by leading Forum members, including Board representatives from Apple, Google, Huawei, Identiv, Infineon, NXP, Qualcomm, Sony, and STMicroelectronics as well as the Forum’s 400-member company community. The 5 key Forum roadmap innovation priorities include: Increased Power for NFC Wireless Charging, Increased Range, Multiple Purpose Tap, Modernizing Device-to-Device Communication, as well as Expanding NFC’s Ability to Share Data Formats Needed for Sustainability.(Gizmo China, Android Authority, Business Wire)

Samsung is expanding its repair program to Belgium, France, Germany, Italy, the Netherlands, Poland, Spain, Sweden, and the UK. Customers can easily purchase spare parts and repair kits for Galaxy S20, S21, and S22 series and select laptops. Starting today, owners of the Galaxy S20, S21, and S22 series phones in the United Kingdom can replace the phone screen, back glass, and charging ports themselves.(Android Central, Android Authority, Samsung)

Spotify Premium is the highest subscription tier available on the streaming service. It offers plenty of benefits like music downloads, offline listening, and no advertisements. That will eventually change as Spotify plans to introduce a new, more expensive tier. The streaming company will allegedly debut a new subscription plan later in 2023. The new tier is known as “Supremium” internally. This new plan will replace the Premium plan as the most expensive tier available. Spotify initially announced an intention to bring Hi-Fi audio to its platform back in 2021. However, those plans fell by the wayside as the feature was delayed for unknown reasons. It looks like Spotify is finally going back to that well.(MacRumors, Bloomberg, Android Authority, The Verge)

realme will reportedly become the fourth member of the BBK group to exit the German market. Following the OPPO and OnePlus sales ban from 2022 and vivo Germany’s recent website closure comes news that realme is heading in the same direction. realme must have realized that apart from potentially low consumer demand, they would do well to shift their focus to different core markets like Italy, Poland, Spain and the Balkans. (GSM Arena, Nextpit)

Alphabet’s subsidiary, Google, is exploring the possibility of shifting a portion of its Pixel smartphone production to India. The company has initiated early discussions with domestic suppliers as it looks to capitalise on India’s growing potential as a manufacturing hub. This move comes as global tech giants, including Google, are seeking alternatives to China due to the geopolitical shifts and impact of strict COVID-related restrictions on production. Google has initiated preliminary discussions with various companies, including domestic players like Lava International and Dixon Technologies India, as well as Foxconn Technology Group’s Indian unit, Bharat FIH. (GSM Arena, Bloomberg, First Post, Reuters, Business Today)

Google has filed a complaint alleging that Microsoft has abused its dominant position in the enterprise space to push customers towards its cloud offerings. As per Google’s filing, Microsoft has used licensing terms in Office 365 contracts to capture and lock customers into separate Azure contracts. This is not the first instance where Microsoft’s customer acquisition has been called into question. In 2022, Microsoft was forced into making changes to its licensing terms in the European Union (EU) based on a then 3-year-old complaint. As part of the settlement, Microsoft made it easier for customers to carry over their software to the cloud as well as “provide more flexibility for their customers”. However, the company did not implement these changes in the US.(The Information, Neowin)

Nothing has products in the smartphone and TWS segment and it could expand its product portfolio by entering into a new segment. Nothing has a device with the model number D395 on Bureau of India Standards (BIS) certification website. It has been listed under the smartwatches category. This suggests that the brand might foray into the wearables segment. The smartwatch could also debut under a sub-brand called CMF by Nothing.(Gizmo China, Twitter)

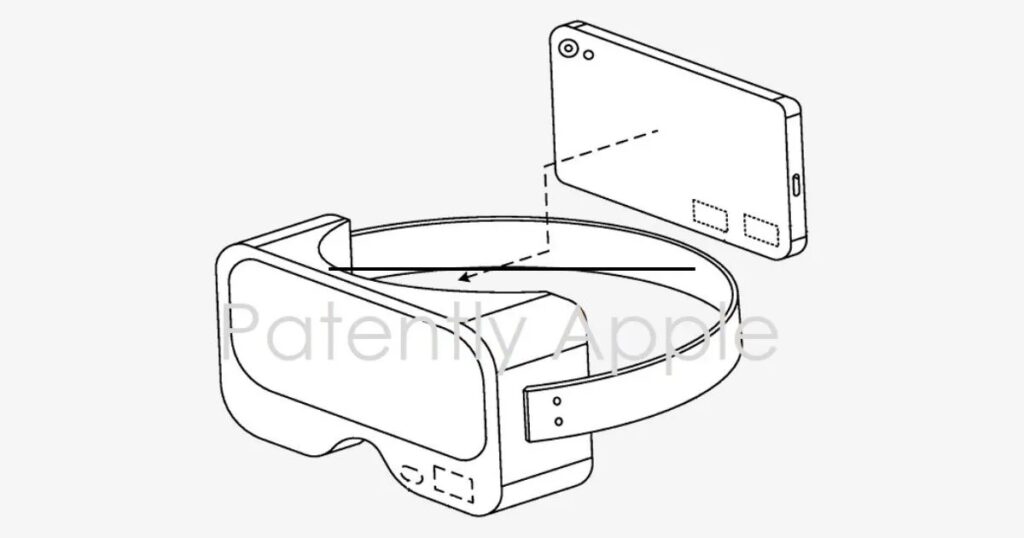

Apple has secured a patent allowing the company to work on a head-mounted display (HMD) style accessory that encases iPhones. The HMD accessory could allow users to momentarily convert their iPhones into virtual or augmented reality headsets. Apple’s new patent suggests that users can place their iPhones or iPads in a receptacle that is configured to a headband with an adjustable strap. The patent also suggests that the iPhone should have a detection mechanism to communicate with a target on the headband to establish a wireless connection.(Android Headlines, ZDNet, Android Authority, MySmartPrice, Patently Apple)

Hyundai Motor will raise average annual investment in electrification by nearly two thirds to USD28B in the next decade and further restructure its struggling China business as part of a broader strategy to boost electric vehicle (EV) sales. According to Hyundai CEO Jaehoon Chang, its product line-up in China will also be reduced to 8 from 13, focusing on high-end and SUV models including the Genesis luxury brand. Hyundai sold one China plant in 2021 and plans to sell two more, including one that it shut down in 2022 and another that it plans to close in 2023. The remaining two other plants will be further rationalised and used for exports to emerging markets. Hyundai Motor said it plans to introduce competitive lithium-iron-phosphate batteries, a cheaper alternative to lithium ion batteries that have spurred EV adoption in China, for the first time around 2025. (CN Beta, Reuters, Asia Financial, Nasdaq)

Stellantis and Hon Hai Technology Group (Foxconn) have announced the creation of SiliconAuto, a 50/50 joint venture dedicated to designing and selling a family of state-of-the-art semiconductors to supply the automotive industry, including Stellantis, starting in 2026. SiliconAuto will provide customers an auto industry-centric source of semiconductors for the growing number of computer-controlled features and modules, particularly those needed for electric vehicles. (CN Beta, Stellantis, eeNews, Electrive)

Ford Motor Executive Chairman Bill Ford Jr. said the US is “not quite yet ready” to compete with China in the production of electric vehicles and said his company is taking an “all hands on deck” approach to prepare. Ford announced in 2023 it will invest USD3.5B in an electric-vehicle battery plant in Michigan, stirring political controversy by saying it will operate with technology and support from China’s Contemporary Amperex Technology (CATL). Ford pushed back on the idea that US-based production will force prices to rise, arguing that making things in America matters and that manufacturing jobs have a multiplier effect that can lead to a stronger economy.(Bloomberg, InsideEVs, Yahoo)

Nikola is laying off 270 employees, or about 23% of its workforce, and restricting its electric truck efforts to North America as it seeks to preserve cash. The company will lay off 150 workers who were supporting the company’s European programs. Another 120 employees based at the company’s Phoenix and Coolidge, Ariz., sites will also lose their jobs. About 900 employees will remain. (CN Beta, TechCrunch, Reuters)

Chinese electric vehicle (EV) builder Nio will receive USD738.5M in fresh capital injection from an Abu Dhabi government-backed firm CYVN Holdings as the company beefs up its balance sheet at a time of a bruising price war in the industry which has seen price-sensitive investors migrating to cheaper models. CYVN, which focuses on strategic investment in smart mobility, will also buy more than 40M shares which are currently owned by an affiliate of Chinese technology firm Tencent.(SCMP, Yahoo, MSN, 36Kr, Sohu)

Midea Group has dropped its pursuit of Electrolux AB after finding the Swedish home appliance maker unreceptive to a deal, highlighting the persistent difficulties of Chinese takeovers. Midea is not able to fulfill all the demands from Electrolux and its top shareholder Investor AB. Electrolux and Investor AB had requested assurances on pricing and regulatory issues, with discussions coming against a backdrop of growing protectionist measures in Europe and the US — even if the business of making dishwashers and refrigerators can’t necessarily be deemed a national security risk. The companies wanted to be sure any takeover would proceed even in the event of regulatory hurdles.(CN Beta, Bloomberg, Yahoo)