7-13 #Rage : Foxconn has withdrawn from a semiconductor JV with Vedanta; Huawei is reportedly plotting a return to the 5G smartphone industry by the end of 2023; Micron Technology has inked a pact with the Gujarat government for setting up a semiconductor manufacturing facility; etc.

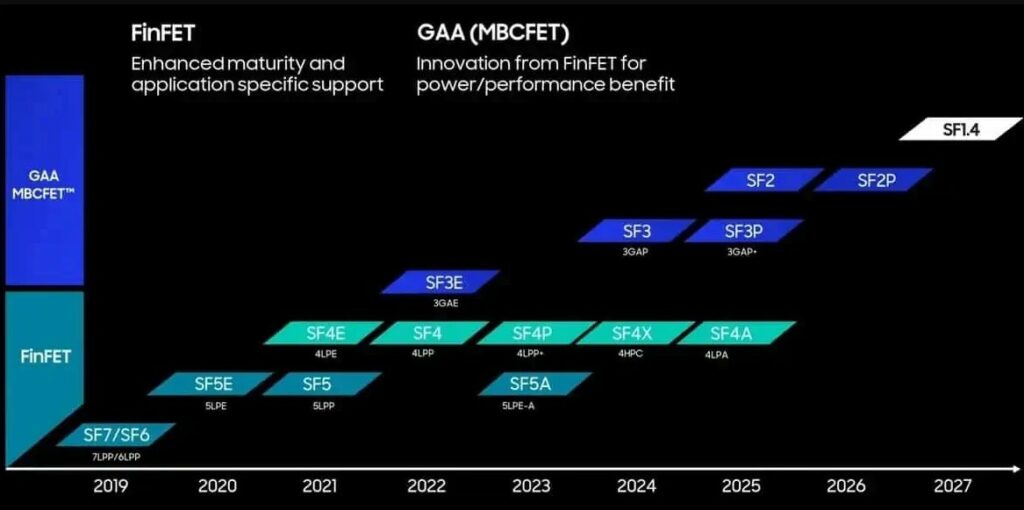

Samsung Electronics has laid out its road map to expand its chip manufacturing business, including leading-edge semiconductors, as it looks to catch up with leader Taiwan Semiconductor Manufacturing Co (TSMC). Samsung said it will begin mass production of the 2nm process for mobile applications in 2025, then expand to high-performance computing in 2026 and to automotive in 2027. Samsung said it is continuing to expand its chip manufacturing capacity with factories in Pyeongtaek, South Korea, and Taylor, Texas.(Android Authority, CNBC, Android Headlines)

Qualcomm has introduced the Snapdragon 4 Gen 2 chipset as a successor to the Snapdragon 4 Gen 1. Built with Samsung’s 4nm processor, the Snapdragon 4 Gen 2 (part number SM4450) is equipped with two performance cores (Cortex-A78) working at 2.0GHz and six efficiency cores (Cortex-A55) operating at 2.0GHz. As a result, the Snapdragon 4 Gen 2 promises 10% better performance than its predecessor. The Snapdragon 4 Gen 2 comes with support for up to 3,200MHz LPDDR5x RAM, UFS 3.1 storage (2-lane), and up to a FHD+ resolution display at 120fps. The 4 Gen 2 supports cameras up to 108-megapixel or 32Mp (16Mp + 16Mp dual-camera setup) or zero shutter lag. The chip features Multi-Camera Temporal Filtering (MCTF) for improved noise reduction while shooting videos. It supports 1080p video at 60fps, 720p slow motion at 120fps, and includes Electronic Image Stabilization (EIS).(Digital Trends, Qualcomm, Gizmo China)

Unisoc has unveiled its first ultra-high-definition smart display chip platform, the M6780, at MWC Shanghai. The chip platform supports 8K decoding and HDR full format, and claims to have highly integrated CPU, GPU, NPU, VDSP, ADSP AI computing power. In terms of specific configuration, UNISOC M6780 integrates Arm Cortex-A762 + Arm Cortex-A552, equipped with Arm Mali-G57 4 cores GPU, and supports mainstream decoding protocols such as H.264 / H.265 / VP9 / AV1 / AVS . Unisoc M6780 chip platform supports mainstream HD formats: Dolby Vision, HDR10, HDR10+, HLG, and adopts AI-SR super-resolution technology, AI-PQ intelligent image enhancement, and MEMC dynamic compensation technology.CN Beta, Techgoing, IT Home)

Huawei Technologies is reportedly plotting a return to the 5G smartphone industry by the end of 2023, signalling a comeback after a U.S. ban on equipment sales decimated its consumer electronics business. Huawei should be able to procure 5G chips domestically using its own advances in semiconductor design tools along with chipmaking from Semiconductor Manufacturing International Co (SMIC). (Reuters, GSM Arena)

MediaTek Dimensity 6100+ is announced for future mid-range smartphones. Its CPU has two Cortex-A76 cores and six Cortex-A55 cores. MediaTek has equipped the Dimensity 6100+ with an enhanced 5G modem with support for 3GPP Release 16 standard. The standard can reach up to 140MHz 2CC 5G Carrier Aggregation and supposedly reduces power consumption thanks to the company’s UltraSave 3.0+ technology, which can reduce 5G power consumption by 20% when compared to its competitor.(GSM Arena, MediaTek, Android Central)

Google is reportedly working on new custom chipsets for Pixel phones, one of which was apparently delayed. The chipset in regard is codenamed “Redondo”, for the alleged Tensor G4 that was believed to power the next iteration of Pixel phones, the Pixel 9 series. Google is allegedly sticking to Samsung-made semi-custom chipsets for the Pixel phones in 2024. However, since the Redondo chipset is not seeing the light of day, Google has other plans with yet another processor codenamed “Laguna”, which is said to be built on a 3nm process and presumably named Tensor G5, aiming to release in 2025. The Tensor G5 would have several advantages when it lands on Pixel phones, as Google will have full authority to mold the chipset per its preferences. The company that makes current-generation Tensor chipsets — Samsung Semiconductor — will likely be ousted in favor of TSMC for future Tensor chipset fabrication. (GSM Arena, Android Central, Android Authority, The Information)

Foxconn has withdrawn from a USD19.5B semiconductor joint venture with Indian metals-to-oil conglomerate Vedanta, in a setback to Prime Minister Narendra Modi’s chipmaking plans for India. Foxconnand Vedanta signed a pact in 2022 to set up semiconductor and display production plants in Modi’s home state of Gujarat. Vedanta-Foxconn had got STMicro on board for licensing technology, but India’s government had made clear it wanted the European company to have more “skin in the game”, such as a stake in the partnership. STMicro was not keen on that and the talks remained in limbo. These were from the Vedanta-Foxconn joint venture, a global consortium ISMC which counts Tower Semiconductor as a tech partner and from Singapore-based IGSS Ventures. The USD3B ISMC project has stalled too due to Tower being acquired by Intel, while another USD3B plan by IGSS was also halted as the firm wanted to re-submit its application.(Apple Insider, Reuters, Economic Times)

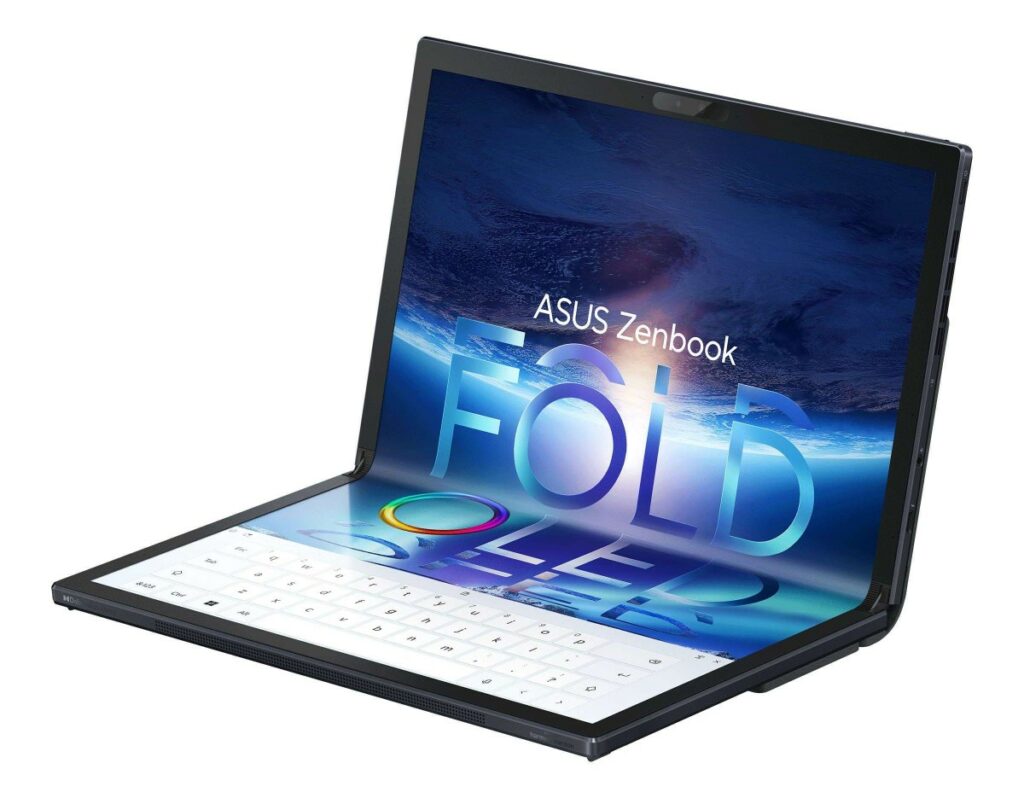

Apple is reportedly to launch a foldable laptop as soon as 2026. Apple is in talks with suppliers to launch the foldable MacBook model and plans to launch it in 2026 after taking the wraps off of it in 2025. Korean companies are also coordinating development and production plans for foldable OLED panels for laptops in line with the opening of the foldable panel market for IT devices. Samsung Display has decided to invest KRW4.1T (USD3.1B) to produce Geb-8.6 OLED panels from 2025 to 2026. LG Display is also investing in medium-sized OLED panels, including those for tablet PCs. (GSM Arena, Business Korea)

Samsung has updated its Expert RAW camera app, which improves image quality and fixes some errors. The improvements and fixes are available with version 2.0.10.6 of Expert RAW on the Galaxy Store. Most Samsung flagships launched since 2020 are supported by Expert RAW.(GSM Arena, Samsung, SamMobile)

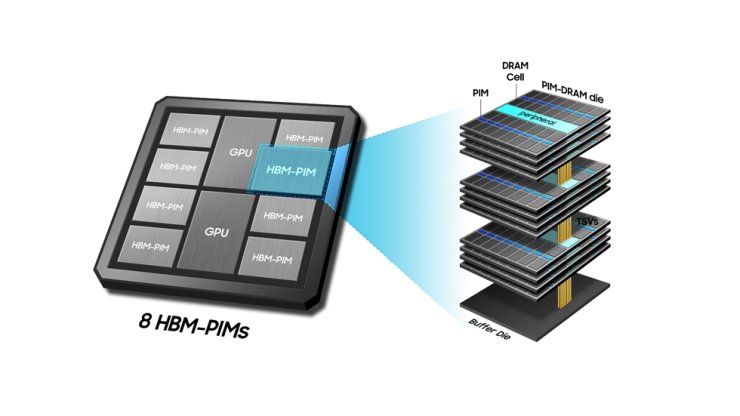

Samsung Electronics will begin mass-producing high-bandwidth memory (HBM) chips for the booming artificial intelligence (AI) market in 2H23 to catch up with SK hynix, the market leader in the nascent AI memory chip market. As the market for generative AI services continues to grow, HBM chips used for AI servers are gaining traction in the memory chip industry, which has been struggling with falling demand. By vertically connecting multiple DRAMs, HBM has superior performance, in terms of data processing speeds, over conventional DRAM. It is, however, more expensive at around 2-3 times the price of a standard DRAM. SK hynix is currently leading the HBM market. According to TrendForce, SK Hynix had about a 50% market share in 2022, with Samsung accounting for 40% and Micron accounting for 10%.(Gizmo China, Korea Times, SamMobile)

Micron Technology has inked a pact with the Gujarat government for setting up a semiconductor manufacturing facility at Sanand worth USD2.75B ( INR22,500 crore approximately). Micron Technology will establish an Assembly and Test facility wherein it will focus on transforming wafers into ball grid array (BGA) integrated circuit packages, memory modules, and solid-state drives. The company said that it will receive 50% fiscal support for the total project cost from the Government of India and incentives comprising 20% of the total project cost from Gujarat government.(CN Beta, Reuters, Mint, Hindustan Times, Business Today)

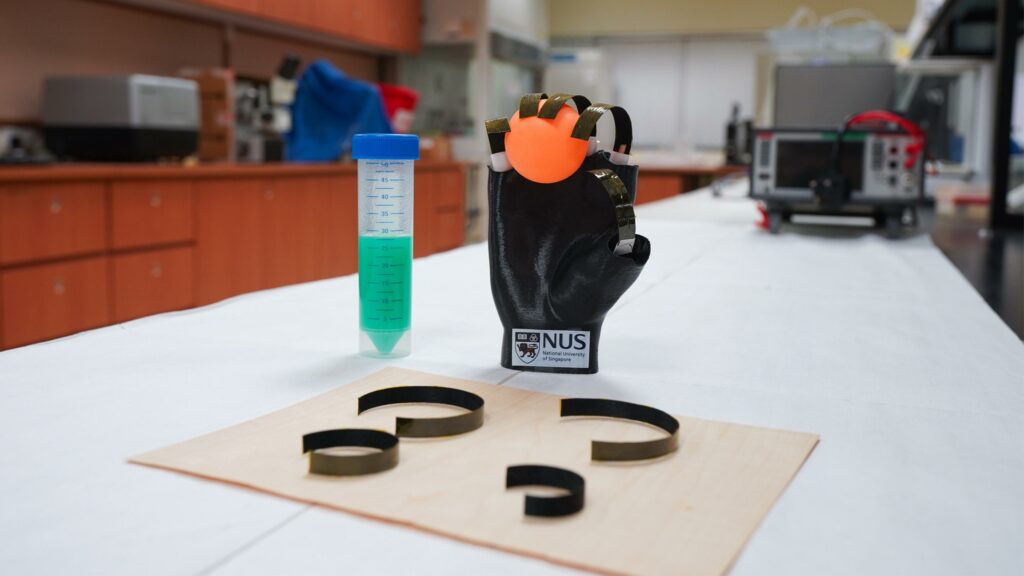

Most robotic grippers are made using either soft plastics – to pick up objects without damaging them – that melt at high temperatures, or metals which are stiff and costly. A team of researchers from the National University of Singapore (NUS), together with their collaborators from the Northeast Forest University, have created a wooden robotic gripper that could be used in a very hot environment and yet maintain a tender touch. This innovative wooden robotic gripper also has another advantage – it is driven by changes in moisture, temperature and lighting in the environment, hence lowering energy consumption. The wooden gripper opens up when exposed to high humidity (above 95% RH), and closes tightly when the temperature of the surroundings increases beyond 70 deg C or when they are exposed to solar radiation. (CN Beta, NUS, News8Plus)

Created by Prof. Arnaldo Leal-Junior and colleagues at Brazil’s Federal University of Espirito Santo, the POF (polymer optical fiber) Smart Pants incorporate two 1-mm-thick optical fibers which run vertically along the back of each leg. At 30 points along each fiber, a small length of the cladding has been removed. The cladding is the outer layer of an optical fiber, and it has a lower refractive index that the light-carrying core. Therefore, as light travels through bends in the fiber, the reflective cladding/core boundary keeps that light confined to the core, maintaining a strong signal. In the Smart Pants, the fibers bend as the wearer moves around throughout the day. And wherever they do bend, some light escapes from the cladding-free points in that area. This causes the total strength of the optical signal to drop – the degree to which it does drop corresponds to certain known activities. (CN Beta, New Atlas, Mirage News)

CATL‘s M3P battery may be released in 3Q23 for the facelifted Model 3 produced at Tesla‘s Shanghai factory. The battery pack capacity will be upgraded from the previous 60kWh lithium iron phosphate battery pack to 66kWh. In addition, the battery pack using CATL M3P battery is not only used for the remodeled Model 3, but also a platform solution for the subsequent Model Y remodeled models. The cathode material of CATL’s M3P battery is a ternary material of phosphate system doped with metal elements such as magnesium, zinc, aluminum, and lithium manganese iron phosphate material, which is used to improve the charge and discharge capacity of lithium iron manganese phosphate battery. and cycle stability.(CN Beta, Linkedin)

Stellantis has launched Free2move Charge, a 360-degree ecosystem that will seamlessly deliver charging and energy management to address all EV customer needs, anywhere and in any way. Managed by the new Stellantis Charging & Energy Business Unit, Free2move Charge addresses electric vehicle customer needs at home, in their business and on-the-go. Making it easy to Always Be Charged (the e-ABC Promise), Free2move Charge also makes it smart, understanding users’ needs and optimizing overall energy management to improve efficiency, reliability, and access, reducing the total cost of ownership and maximizing environmental benefits.(TechCrunch, Stellantis, Automotive World)

Nothing has announced that it has raised a sizeable USD96M in a fundraising round led by Highland Europe. The company recently teased that it is collaborating with the known music group, Swedish House Mafia, for its Glyph Composer feature on the Phone (2). The company states it is seeking to bring cutting edge products to the market that bring innovation and community collaboration as well. Nothing has held two community financing rounds and has attracted over 8,000 private investors so far.(Gizmo China, CNBC, CrunchBase)

According to Bloomberg’s Mark Gurman, Apple has a total of 18 new devices expected to be launched in the near future: (1) four models of iPhone 15, including a iPhone 15 (6.1”), iPhone 15 Pro, iPhone 15 Max (6.7”), and iPhone 15 Pro Max (6.7”); (2) two additional models of the MacBook Air with 13” diplay, codenamed “J613” and “J615”; (3) three new models of the Apple Watch, codenamed “N207”, “N208”, and “N210”, which are said to include two Series 9 models and a new Ultra 2; (4) a new iPad Air “J507” alongside two iPad Pros “J717” and “J720”. (5) three new iMac models, one features 30” display and two models “J433” and “J434” with 24” display; and (6) three new MacBook Pro codenamed “J504” (13”), “J514” (14”), and “J516” (16”), and all three models will untilize M3 chip. (Bloomberg, Gizmo China, Upday)

Google has revealed a partnership with iFixit for Pixel Fold. This collaboration addresses one of the biggest concerns surrounding foldable devices—their durability and repairability. Since 2022, Google has been working with iFixit to offer official repair parts and comprehensive guides for the Pixel lineup, and the Pixel Fold will be no exception. Google has emphasized that its partnership with iFixit will provide users with “genuine spare parts” specifically designed for the Pixel Fold. This will include essential components such as batteries, screens, and charging assemblies.(Neowin, 9to5Google, iFixit)

Samsung’s new Extended Reality (XR) headset that was expected to launch in Feb 2024 has allegedly been delayed by 3-6 months. Samsung has allegedly decided to review all the specs and design of the XR headset due to the specifications of the Apple Vision Pro, pushing its launch further. Apple is also reportedly planning a slow rollout of the Vision Pro, and it will be available for purchase by appointment only. (GSM Arena, Android Central, SBS)

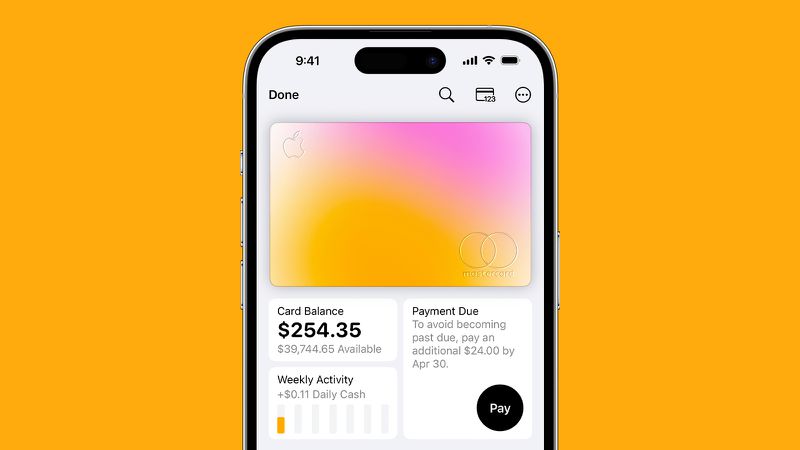

Apple is reportedly in talks with banks and regulators to launch its credit card, dubbed “Apple Card”, in India. The company’s CEO, Tim Cook, met with HDFC Bank CEO and MD Sashidhar Jagdishan during his trip to India in Apr 2023. Apple is also holding discussions with the National Payments Corporation of India (NPCI) to possibly launch Apple Pay in the country. (MacRumors, Money Control)

PayPal has introduced Tap to Pay on Android for Venmo business profile users in the U.S., allowing them to accept contactless payments directly on their Android mobile devices without any additional hardware or upfront costs. With Tap to Pay through Venmo, businesses can now start accepting contactless cards and digital wallets within minutes, using their existing mobile devices. This not only eliminates the need for additional hardware but also streamlines operations and cash flow management, as all funds settle into their Venmo accounts.(Gizmo China, Pay-Pal)

Credit card giant Visa is acquiring Brazilian payments infrastructure startup Pismo for USD1B in cash in what is likely one of the largest fintech M&A deals taking place in 2023 so far. Pismo’s cloud-native issuer processing and core banking platform is aimed at giving banks, fintechs and other financial institutions “flexibility and agility”, the company shared when it raised USD108M in Series B funding in Oct 2021. It does things like allow customers to launch products for cards and payments, digital banking, digital wallets and marketplaces. Pismo also claims to allow financial institutions to “take charge of their core data and use it intelligently”. (TechCrunch, Business Wire, Reuters)