7-22 #BurnOut : Apple is allegedly running into difficulties with iPhone 15 big display manufacturing; Apple iPhone 16 Pro Max will allegedly feature a “Super Telephoto” periscope zoom camera; Apple’s iPhone 15 lineup will reportedly feature stacked battery technology; etc.

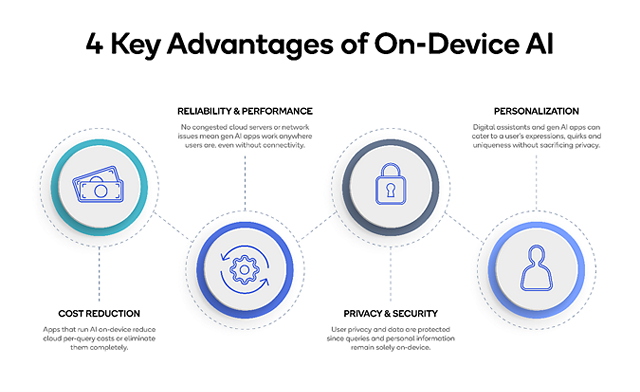

Qualcomm Technologies and Meta are working to optimize the execution of Meta’s Llama 2 large language models directly on-device – without relying on the sole use of cloud services. Qualcomm is scheduled to make available Llama 2-based AI implementations on flagship smartphones and PCs starting from 2024 onwards to enable developers to usher in new and exciting generative AI applications using the AI-capabilities of Snapdragon platforms. On-device AI implementation helps to increase user privacy, address security preferences, enhance applications reliability and enable personalization – at a significantly lower cost for developers compared to the sole use of cloud-based AI implementation and services.(Android Authority, Qualcomm)

Unisoc has demonstrated its first system on chip (SoC) chip for satellite communications, the V8821, which will soon be launched on the market. The SoC is based on the 3GPP NTN R17 standard, which defines the technical specifications for non-terrestrial networks (NTN), i.e. networks that use satellites as communication nodes. These networks can provide global coverage and reliable connectivity in areas where traditional cellular networks are difficult or impossible to reach, such as oceans, deserts, mountainous and polar areas. The V8821 supports access to other high-orbit satellite systems via L-band maritime satellites and S-band Tiantong satellites. L-band refers to the electromagnetic wave frequency band with the frequency range of 1GHz ~ 2GHz, while S-band refers to the electromagnetic wave frequency band with a frequency range of 2GHz ~ 4GHz. These bands are widely used in satellite and terrestrial cellular communications.(CN Beta, Unisoc)

Taiwan Semiconductor Manufacturing Company (TSMC) has said production at a planned facility in Arizona will be postponed from late 2024 until 2025, an ominous delay as Washington tries to establish a more robust chip industry. Chairman Mark Liu said there are several challenges that TSMC faces at the US facility, including a shortage of skilled workers and expenses running higher than in Taiwan. The company is shifting some employees to Arizona to help with the development. (The Verge, WSJ, Seeking Alpha, Asia Nikkei, Yahoo, CNA)

Samsung Electronics is gearing up to make next-generation FSD (Full Self-Driving) chips that will power Tesla’s Level-5 autonomous driving vehicles. The chips, to be manufactured on Samsung’s 4nm node, will go into Tesla’s Hardware 5 (HW 5.0) computers, which the EV maker plans to mass-produce 3-4 years from now. Tesla chose Taiwan Semiconductor Manufacturing Co (TSMC) as its sole partner for the production of the HW 5.0 auto chip in 2022. Tesla plans to work with both TSMC and Samsung, or could switch from TSMC to Samsung altogether, for mass production of the fifth-generation auto chips. (CN Beta, The Register, KED Global, Android Headlines, IBT)

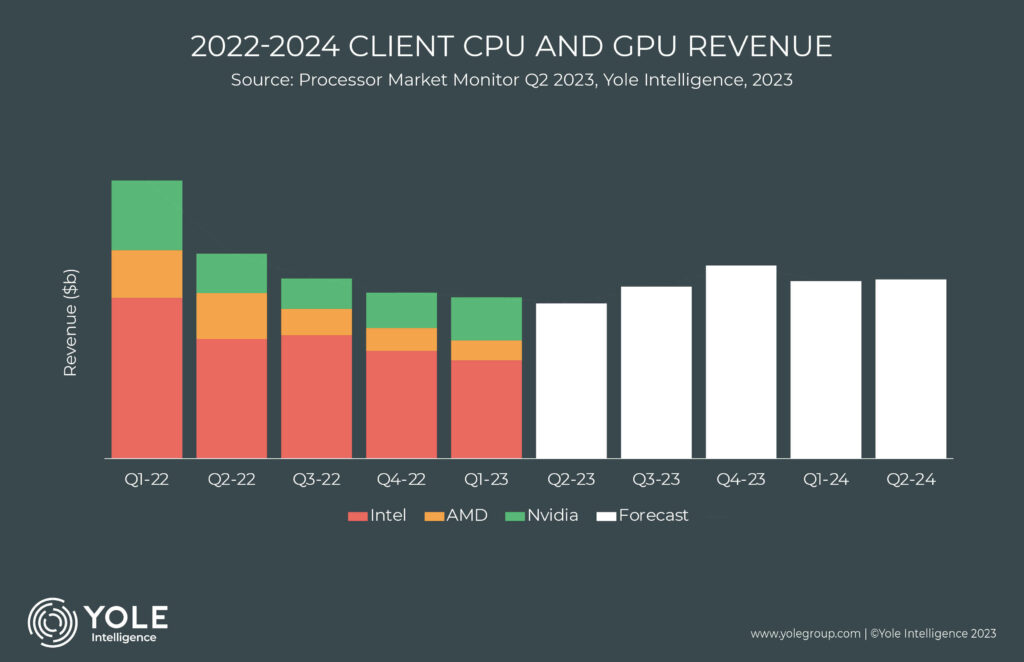

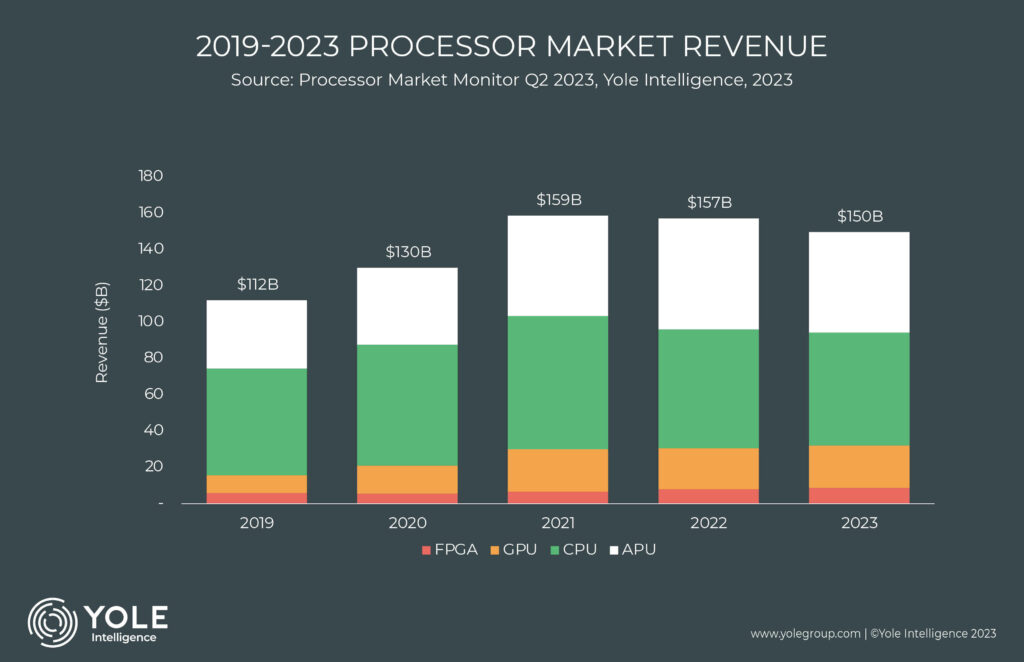

According to the latest report from Yole Intelligence, the market for processors, including CPUs, GPUs, APUs, and FPGAs, fell to USD157B in 2022 from USD159B in 2021 due to weak consumer electronics demand. And it is expected to continue to decline to USD150B in 2023. Due to the current focus on generative AI applications, there is strong demand for machine learning hardware. Such trends are beneficial to the acceleration chip market for high-performance processing computers (HPC). For example, in the field of data center GPU, Yole Intelligence expects Nvidia to reach the highest revenue in history in the second quarter of fiscal year 2024. (SemiMedia, Laoyaoba)

Apple is allegedly running into difficulties with iPhone 15 Pro and iPhone 15 Pro Max display manufacturing, which could lead to a limited number of devices being available at launch in Sept 2023. The iPhone 15 Pro and iPhone 15 Pro Max will have slimmer bezels than the iPhone 14 Pro models, and it is this decrease in bezel size that is creating issues. Apple suppliers are using a new display manufacturing process to shrink the bezel size, and it is causing problems with displays made by LG Display. The LG displays are failing reliability tests during a process where the display is fused to the metal shell. Apple is tweaking the design of the LG display so it can pass the tests, and it still has displays from Samsung that it can use for assembly. Apple may delay the launch of the iPhone 15 Pro and iPhone 15 Pro Max, but will instead have fewer units available at launch, leading to shortages. (Digital Trends, The Information, NY Post, MacRumors)

Apple iPhone 16 Pro Max will allegedly feature a “Super Telephoto” periscope zoom camera. The label of “super” or “ultra” telephoto is usually afforded to cameras with a focal length over 300mm, drastically magnifying and pulling in distant subjects. Super telephoto cameras are often used for sports and wild animal photography, but the extremely soft backgrounds they create also make them useful for portrait photography, providing there is enough distance between the subject and the photographer. The iPhone 16 Pro Max will feature a 12% larger camera sensor that is 1/1.14” in size. For comparison, the iPhone 14 Pro and iPhone 14 Pro Max both boast a 1/1.28” sensor. (CN Beta, Pocket Lint, MacRumors, GSM Arena, Weibo)

ZTE has just announced its nubia Z50S Pro camera flagship, which features a 35mm lens. The 35mm lens uses one glass and six plastic elements and has a wide f/1.59 aperture. Inside the camera module is a 1/1.49” 50MP sensor, smaller than the 1” sensors inside the Xiaomi 13 Ultra and Xiaomi 13 Pro (both of which have f/1.9 apertures). The aperture on the nubia measures 5.21mm across, compared to 4.97mm and 4.10mm on the Xiaomi’s. (GSM Arena, Sina, My Drivers, IT Home)

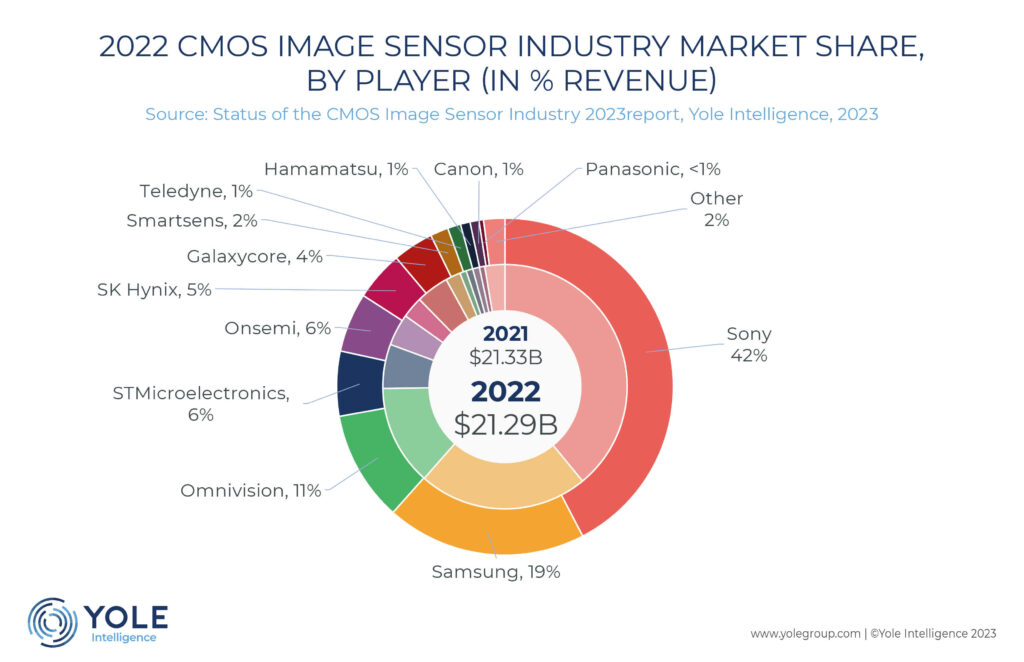

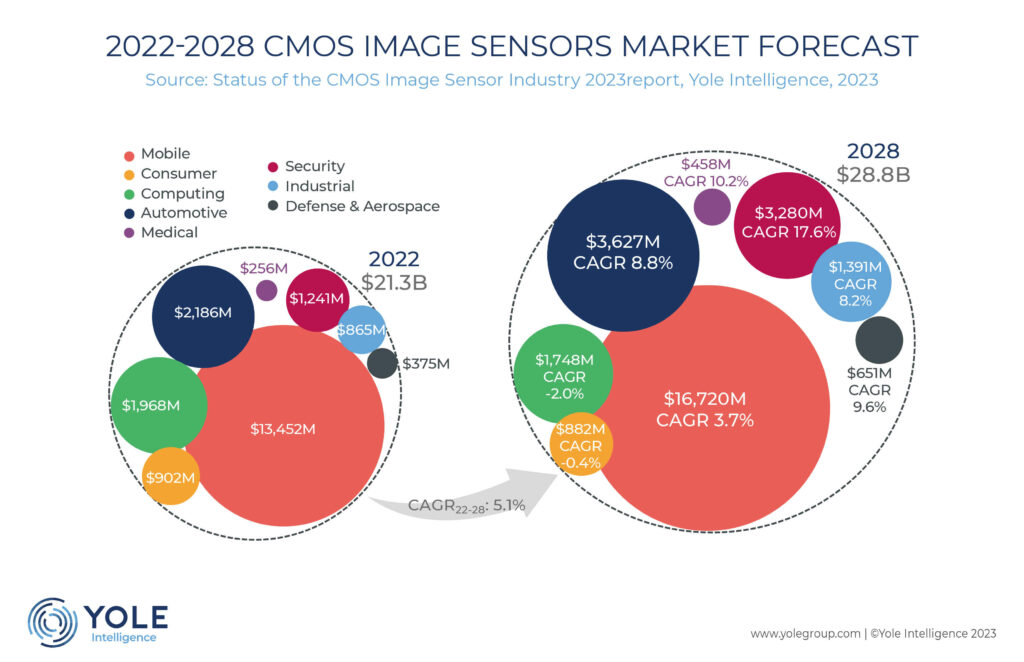

From a market perspective, Yole Intelligence announces a return to steady growth. CIS revenues stagnated in 2022, at USD21.3B, in the continuity of a soft-landing situation compared to the largely inflated growth experienced in previous years. The general inflation in 2022 translated to a significant slowdown in consumer product sales, such as smartphones: Yole Intelligence’s imaging analysts estimate a 10% decrease. However, higher-end CIS products and new sensing opportunities will sustain the mobile CIS market in the coming years. In addition, automotive cameras are experiencing good growth enabled by in-cabin, viewing, and ADAS applications, promoted further by safety regulations. There are no changes in the Top 5 compared to the year before. Sony is still leading the market with a 42% market share. (Yole Group)

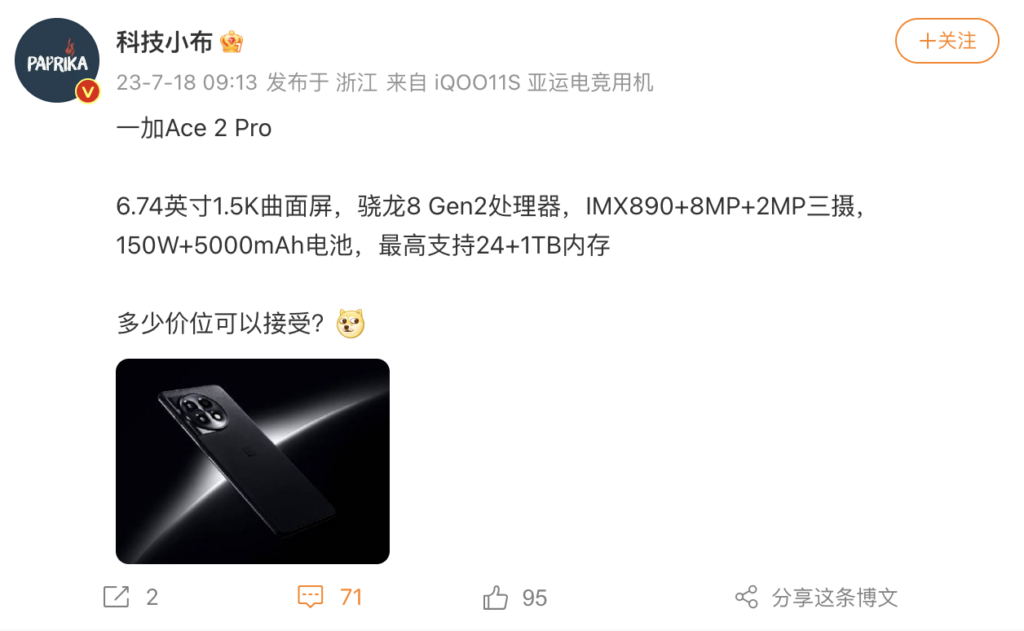

OnePlus Ace 2 Pro is to feature 24GB RAM and 1TB storage, and will be launched in China. The device will be running the potent Qualcomm Snapdragon 8 Gen 2 chipset. It will feature a rear camera setup that includes a Sony IMX890 50Mp main camera with OIS support. The phone will pack a 5,000mAh battery with support for 150W fast charging technology.(Android Central, GizChina, Weibo)

Nvidia is reportedly working to diversify its sourcing of HBM3 and 2.5D packages used in AI GPUs for data centers. Nvidia is negotiating deals with potential suppliers, which includes Samsung. Currently, Nvidia, for its A100, H100, and other AI GPUs, uses TSMC for the front-end process of manufacturing the wafers and 2.5 package work. The HBM, or high bandwidth memory, chips used with the AI GPUs are being exclusively supplied by SK Hynix. However, TSMC does not have the capacity to handle all the workload of the 2.5D packaging these chips need to go through. Nvidia is holding talks on volume and price with secondary and alternative suppliers. These include Amkor Technology of the US and SPIL of Taiwan. SK Hynix will continue to supply the HMB3 used. Samsung’s advanced package team (AVP) is another potential supplier.(The Elec, CN Beta)

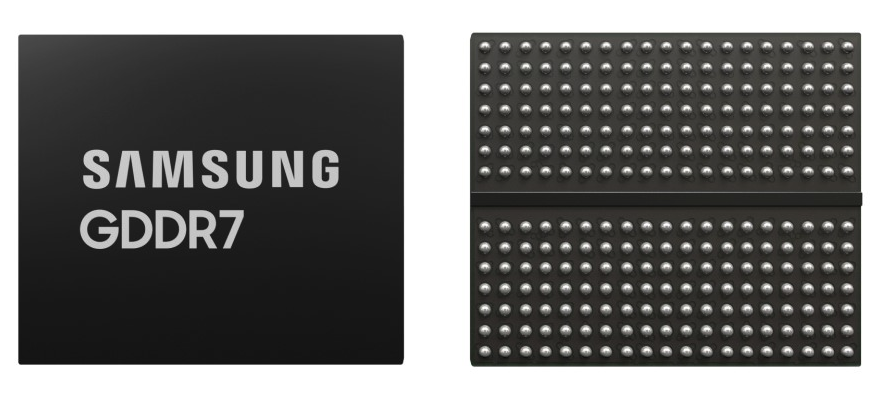

Samsung has announced that it has completed development of the industry’s first Graphics Double Data Rate 7 (GDDR7) DRAM. Samsung’s GDDR7 achieves an impressive bandwidth of 1.5-terabytes-per-second (TBps), which is 1.4 times that of GDDR6’s 1.1TBps and features a boosted speed per pin of up to 32Gbps. The enhancements are made possible by the Pulse Amplitude Modulation (PAM3) signaling method adopted for the new memory standard instead of the Non Return to Zero (NRZ) from previous generations. PAM3 allows 50% more data to be transmitted than NRZ within the same signaling cycle.(The Verge, Samsung, CN Beta)

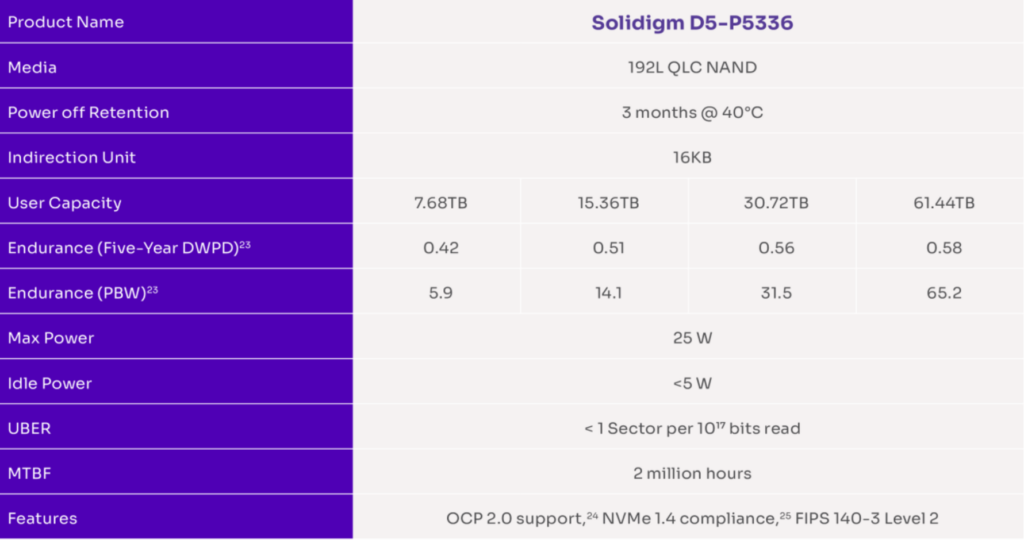

Solidigm has introduced its D5-P5336 drives that boast capacity of up to 61.44TB and feature a PCIe 4.0 x4 interface to enable read speeds of up to 7,000 MB/s. The device is designed to ultra-high-density read-intensive storage applications, such as AI inference on the edge or content delivery. Solidigm’s D5-P5336 SSD is based on SK Hynix’s inexpensive 3D QLC NAND memory as well as a proprietary platform that ensures strong performance and very good endurance in addition to a rather extreme capacity. Solidigm says that its D5-P5336 provides sequential read speed of up to 7,000 MB/s, sequential write speed of up to 3,300 MB/s as well as random read/write speed of up to 1.005 million/38K 4K IOPS.(CN Beta, Tom’s Hardware, Business Wire)

BMW boss Frank van Meel has revealed that it is looking into simulated gears, acoustic cues, and vibration feedback as ways the M’s EV could communicate with the driver. According to Meel, drivers do not have time to look at an EV’s speedometer when on the track. In a gas car, the sound and feel of the engine, the placement of the gear shifter, and the rev indicator can tell the driver a lot about what the car is doing at the limit without the need to focus on the car’s instruments. Hyundai’s recently revealed Ioniq 5 N has a one-speed gearbox, but the automaker uses software to enhance it. The Hyundai EV features two technologies designed to inform the driver about the car’s energy usage. N e-shift simulates the brand’s eight-speed dual-clutch automatic transmission by controlling the motors’ torque output. (Gizmo China, Motor1, Motor1, WhichCar)

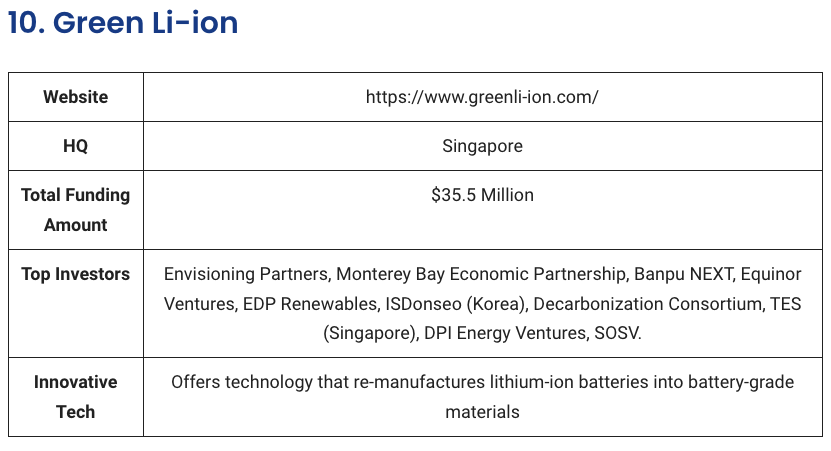

Battery recycling startup Green Li-ion plans to enter the South Korean market. The Singapore-based company was founded in 2020 and has investors such as GS, Envisioning Partners, and TES. It has received USD36M in funding so far. Most battery recycling companies use their own technologies to manage recycling equipment. As each material in the battery has a different recycling efficiency, the recycling of each required different tailored equipment. Green Li-ion offers a general-purpose equipment of sorts called GLMC-1 that it says can extract nickel, cobalt, and manganese from the black mass and scraps left over from batteries with 99.9% efficiency. With lithium, the machine offers 99.5% efficiency. (The Elec, GreyB)

Apple’s iPhone 15 lineup will reportedly feature stacked battery technology. A stacked battery cell uses a manufacturing technique called lamination, where the elements and separators are folded into zig-zag layers instead of being rolled up. Since there is less wasted space within the packaged cell, more active material can be included, resulting in a greater overall capacity. This allows a stacked battery to achieve higher energy density compared to a wound battery. Heat is also distributed more uniformly across the cell, rather than being concentrated in a single area, prolonging the battery’s lifespan. Apple is allegedly exploring 40W wired charging and 20W charging via MagSafe for the iPhone 15 or iPhone 16 lineup. (MacRumors, Twitter)

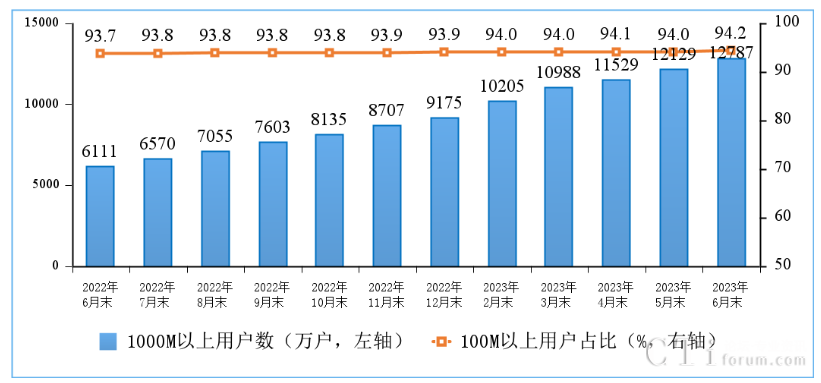

China’s Ministry of Industry and Information Technology (MIIT) has revealed impressive progress in the country’s 5G telecommunications sector. In 1H23, the cumulative revenue of telecom business reached CNY868.8B, a YoY increase of 6.2%; the total amount of telecom business calculated at constant prices in 2022 increased by 17.1% YoY. The number of mobile phone users has increased steadily, and the scale of 5G users has accelerated. As of the end of Jun 2023, the total number of mobile phone users of the three basic telecommunications companies reached 1.71B, a net increase of 26.53M compared to the end of 2022. Among them, 5G mobile phone users reached 676M, a net increase of 115M from the end of the previous year, accounting for 39.5% of mobile phone users, an increase of 6.2 percentage points compared to the end of 2022. In the first 6 months of 2023, telecom business revenue will increase by 6.2%, and total business volume will increase by 17.1% YoY. A total of 2.937M 5G base stations will be built. (CNMO, Gizmo China, CTI Forum)

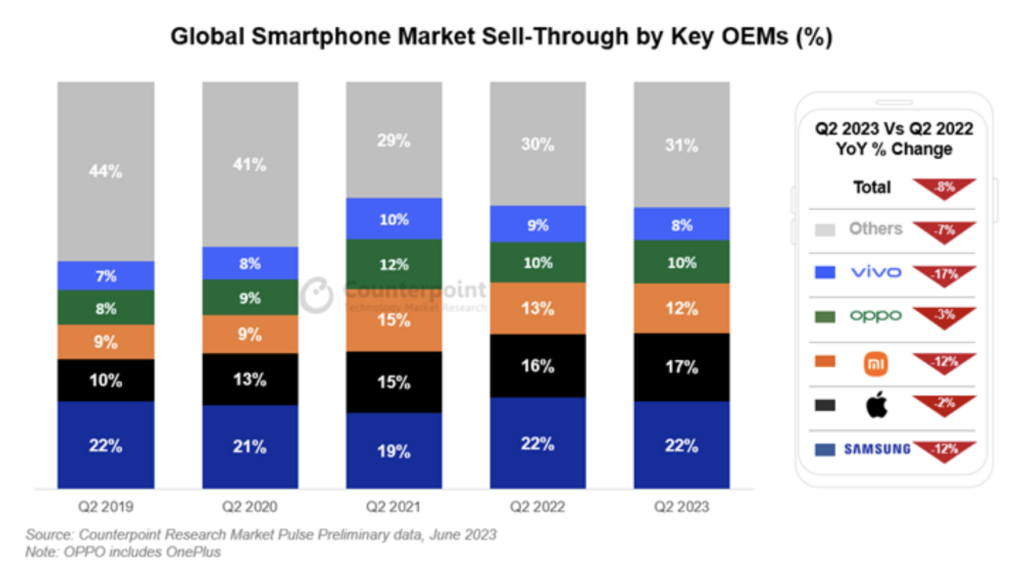

The global smartphone market’s sell-through declined 8% YoY and 5% QoQ in 2Q23, according to Counterpoint Research. Samsung led the quarter with healthy A-series demand as Xiaomi and vivo faced headwinds. Apple came in second with its share growing to 17% despite unfavorable seasonal factors. Premium segment demand remained resilient, with the segment’s share reaching a Q2 record. The premium segment (USD600+ wholesale price), however, continues to grow immune to broader constraints, as the mature consumer is opting for a superior experience, supported by the easy availability of finance options across key geographies. (Android Headlines, Counterpoint Research)

Foxconn Technology Group has bought USD33M worth of equipment from an Apple unit for its operations in India over 2022, signaling the key iPhone assembler’s accelerating expansion in the country. An Indian subsidiary of the Taiwanese company acquired equipment from Apple Operations for operational needs, according to a filing from Foxconn’s Taipei-listed flagship unit Hon Hai Precision Industry Co. Apple tripled iPhone production and assembled more than USD7B of iPhones in India fiscal year 2022, making almost 7% of its handsets in the country. Meanwhile, Foxconn is planning to invest about USD700M to build a new plant in the southern Indian state of Karnataka partly to ramp up local production of iPhone parts.(Apple Insider, India Times, Financial Express)

Apple’s launch of the iPhone 15 series could be delayed by a “few weeks”, pushing the debut of the company’s next-generation smartphone lineup beyond its usual Sept timeframe, according to Wamsi Mohan, a global securities analyst at Bank of America. Mohan said the launch looked like it could slip into 4Q23. Apple unveiled the iPhone 14 series on 7 Sept 2022. Following the announcement, the iPhone 14, iPhone 14 Pro, and iPhone 14 Pro Max were made available for purchase on 16 Sept 2022. However, the iPhone 14 Plus release was delayed, and it was not launched until 7 Oct 2022. (Neowin, MacRumors, Barron’s)

Samsung Electronics has announced that it will open seven interactive Galaxy Experience Spaces around the world, including locations in Seoul, South Korea and New York, U.S. At these spaces. Samsung invites consumers to “Join the flip side” and explore a new way of thinking and living, built on a foundation of openness and inclusion that goes beyond the boundaries of what was previously possible.(GSM Arena, Samsung)

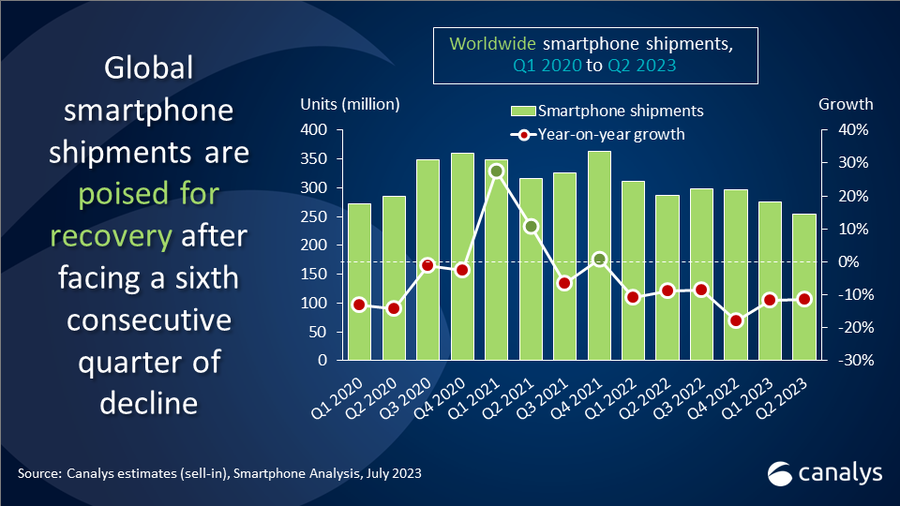

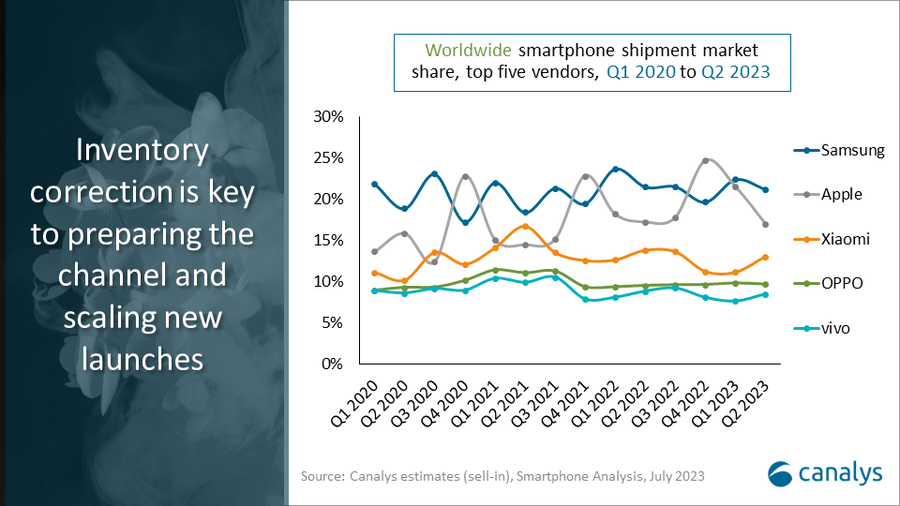

The global smartphone market declined by 11% year on year in 2Q23 as gloomy demand started to impact market leaders like Samsung and Apple which had to reduce their sell-in the same quarter. Samsung maintained the leading position with a 21% market share, while Apple held second place with a 17% market share. Outside of the top two, the decline in smartphone shipments reveals signs of improvement as most vendors’ inventory returns to healthier levels while macroeconomic conditions stabilize. Xiaomi secured third place with a 13% market share as supply for its newly launched Redmi series recovered. OPPO (including OnePlus) secured fourth place with a market share of 10% after a strong performance in the core markets of Asia Pacific, while vivo came in fifth with an 8% market share, driven by the new Y-series launches. (GSM Arena, Canalys)

Samsung has reportedly started the development of a new smart device that will come in the form of a ring,. The so-called Galaxy Ring will use circuit boards made by Japan’s Meiko. Printed circuit boards are usually developed first for electronic devices, followed by the components that will be mounted on them. Smart rings are wearable devices that customers can wear like a ring. They contain various sensors that can collect the health data of wearers and send them to their smartphones. (Android Authority, The Elec)

Microsoft is delivering improved IVAS (Integrated Visual Augmentation System) 1.2 devices to the Army before the end of Jul 2023. These HoloLens-based headsets are, according to Microsoft, “slimmer, lighter and more balanced” compared to previous models of the IVAS. The Army will test 20 of these new headsets in August to see if they really are improved models. In addition to testing the hardware itself, the Army wants to see if they do not make the soldiers who wear them physically ill.(Neowin, Engadget, Bloomberg)

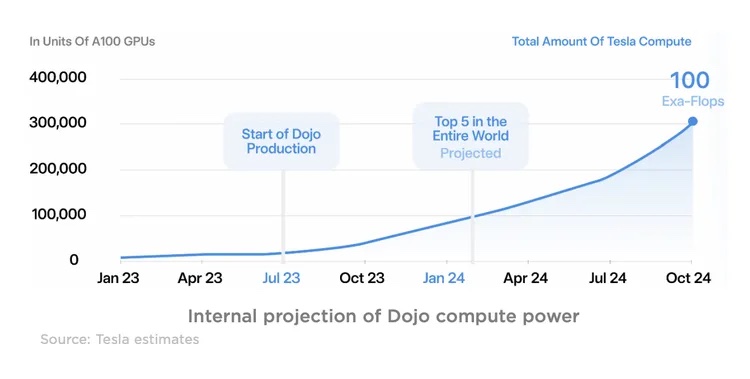

Tesla’s CEO Elon Musk has said that the company plans to invest more than USD1B on its so-called Project Dojo by the end of 2024. The in-house supercomputer is being designed to handle massive amounts of data, including video from Tesla cars needed to create autonomous-driving software. Zachary Kirkhorn, Tesla’s chief financial officer, has clarified that the investment is split between R&D and capital expenditures, and is in line with a previously stated 3-year expense outlook.(The Verge, Fortune, BNN Bloomberg, Yahoo, Mint)

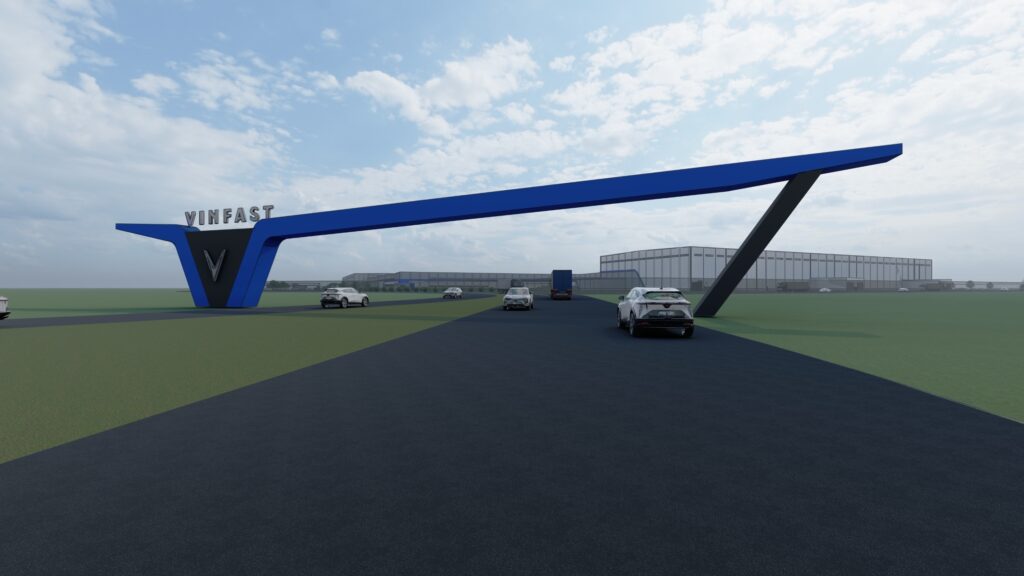

Vietnamese car maker VinFast will break ground on its USD4B Chatham County factory. The plans include the general assembly building, a body shop, a paint shop, and several other buildings on the campus. VinFast announced in 2022 that they were interested in building a plant for their electric vehicles in the state. The company said the factory is designed to reach a capacity of 150,000 vehicles per year in phase one. The factory is expected to start production in 2025. (CN Beta, WRAL News, CBS17, Axios, Vinfast)

Ecojet, styled as a “flag carrier for green Britain”, will launch early 2024 with a 19-seater plane travelling on a route between Edinburgh and Southampton. The planes will run initially on kerosene-based fuel for the first year, before being retrofitted with engines that convert green hydrogen into electricity. The first retrofits are slated for 2025, a year after flights begin. Onboard meals will be plant-based, and single-use plastic will be scrapped. To further reduce Ecojet’s environmental impact, the company intends to serve customers only plant-based in-flight meals, pledges to use no single-use plastics and has employees wear eco-friendly uniforms. More information is not yet available, but other companies that are researching hydrogen as a green aviation fuel include Airbus, ZeroAvia and Rolls-Royce.(CN Beta, The Guardian, CNBC)

OpenAI is committing USD5M to the American Journalism Project (AJP) under a partnership that will look for ways to support local news through artificial intelligence (AI). The deal will also give the non-profit and related organizations up to USD5M in OpenAI credits for the use of the technology popularized by ChatGPT. The move is part of a broader push by OpenAI to partner with media organizations. The startup has also struck an agreement with news publisher the Associated Press (AP) to license a part of AP’s archive of stories and explore generative AI’s use in news. The AJP funding will help create a studio that allows local news outlets try out OpenAI’s technology. It will also distribute grants to around 10 of its portfolio organizations to pilot and experiment with the AI applications.(CN Beta, VentureBeat, OpenAI, Reuters)

Amazon is expanding its Amazon One palm-recognition payment system to all 500 of its Whole Foods Market stores in the U.S., with the rollout to be completed by the end of 2023. It means that, once signed up, shoppers at the store will no longer have to mess about with their phone or card at the checkout, instead simply waving their palms over the reader to pay for their items. Savings will automatically be applied to goods for Prime members who link their Amazon One profile with their Amazon account. (Digital Trends, Forbes, CBS News, The Verge)