7-30 #ThinkofLovedOnes : Samsung is confident the shipments of its foldables are on track to outsell the Galaxy Note in 2023; Samsung will continue to reduce semiconductor output during 2H23; Samsung’s Galaxy Ring could enter mass production as early as Aug 2023; etc.

Intel has unveiled its new ambitious plans to incorporate artificial intelligence (AI) into every product it creates. Intel CEO Pat Geslinger has stated that the company would take a more comprehensive approach, with the expectation that AI will eventually become a ubiquitous feature in all Intel products, serving a wide range of use cases and customers. Furthermore, Geslimger predicted that AI would eventually permeate all business domains, including the client-facing consumer electronics market, enterprise data centers, and even manufacturing. Geslinger also hinted that AI could play a significant role in the next iteration of Windows, opening up a new era for AI-powered computing and transforming how users interact with their devices. (Android Headlines, The Verge, CRN)

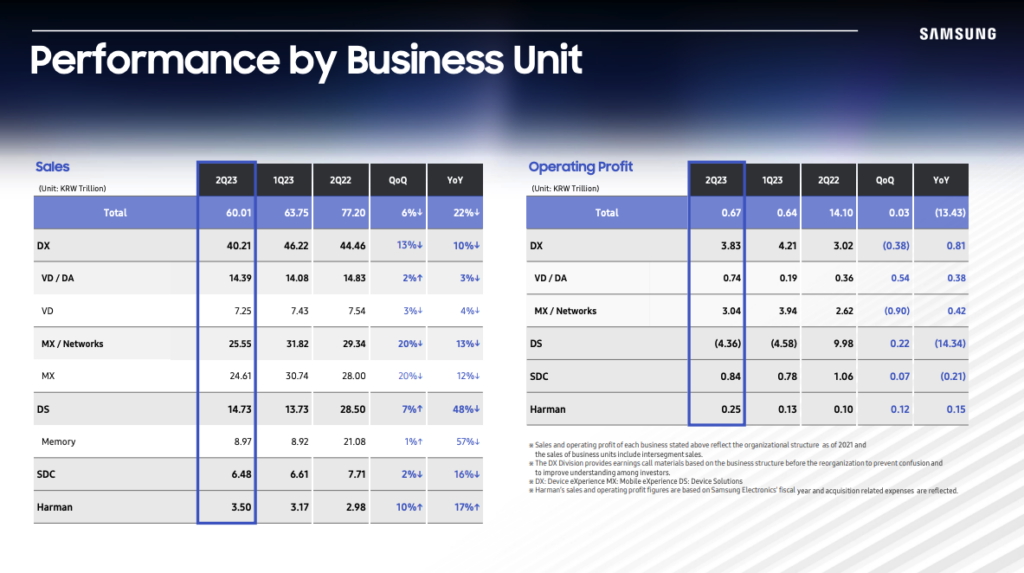

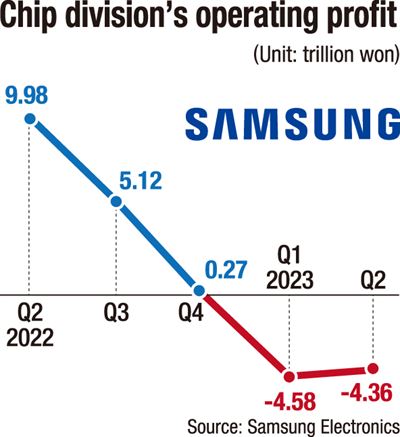

Samsung has reported their financial results for 2Q23, closing the book on an especially bleak quarter of the year with a massive USD3.4B operating loss. The losses, stemming from its semiconductor business, come amid a continued slump in 3D NAND and DRAM sales volumes and prices. The company has started to produce its third 3nm chip design with stable yield. Samsung revenue dropped sharply, with the company recording a 22% YoY decline to USD6.915B. Earnings of Samsung’s semiconductor divisions — including memory, SoCs, and foundry operations — declined to USD29.86B, 48% YoY drop. The company also revealed that it has started production on its third 3nm (GAAFET) chip. It recently transpired that Samsung Foundry has been producing the Whatsminer M56S++ cryptocurrency mining ASIC on its SF3E node (formerly known as 3GAE, 3nm gate-all-around early) for some time. It turned out a bit later that there is PanSemi, another developer of cryptocurrency mining hardware, that uses Samsung’s SF3E to make its mining ASIC. Now, Samsung confirms that there is another customer that uses its latest production node.(CN Beta, AnandTech, Samsung, Samsung, Techspot, Nikkei)

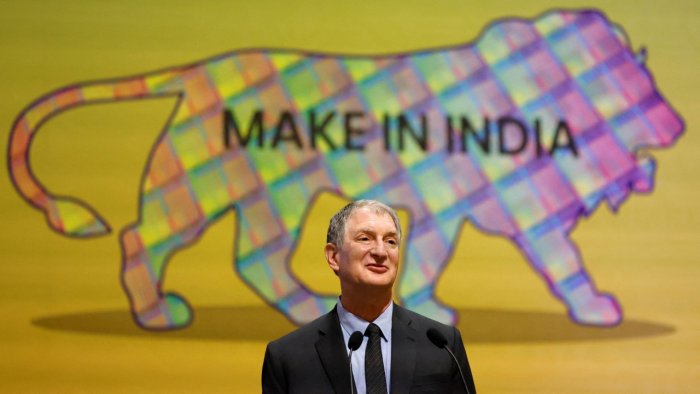

U.S. chipmaker Advanced Micro Devices (AMD) Chief Technology Officer, Mark Papermaster, has announced its plan to invest approximately USD400M in the country over the next 5 years. The company aims to set up its largest design center in Bengaluru, the southern tech hub of India, marking a major milestone in its long-standing presence in the country. Presently, the company has offices in Delhi, Gurugram, Hyderabad, and Mumbai. (Gizmo China, Outlook India, India Times, TechCrunch)

T.M. Roh, the president and head of Samsung’s mobile experience division, has indicated that he is confident that with the launch of Galaxy Z Flip5 and Fold5, the shipments of foldable smartphones are on track to outsell the Galaxy Note in 2023. Samsung sold 10M foldable smartphones in 2022. Roh’s words suggest the company is on its way to selling more than 12M foldables in 2023.(Android Headlines, CNET)

Samsung mobile chief TM Roh has revealed that the company is working on bringing dust resistance to its foldables. The executive added that consumers need to “wait a little longer” for this feature to come to foldables, noting that early foldable phones did not have water resistance at first, either. He has indicated that the company has set the proportion of Flip and Fold sales on a global basis at 60% and 40%, respectively, but in 2023, they are cautiously predicting 65% and 35% as the proportion of Flip will increase. (Android Authority, Bizwatch, Maeil)

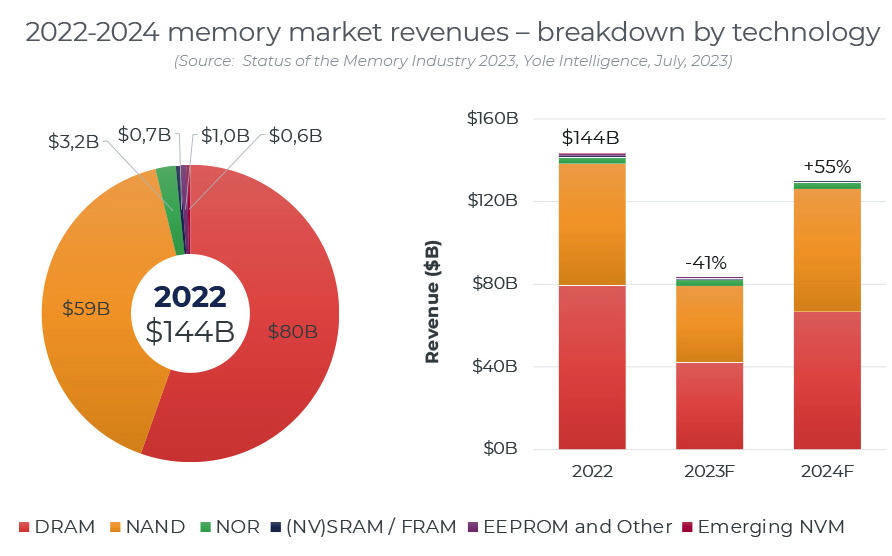

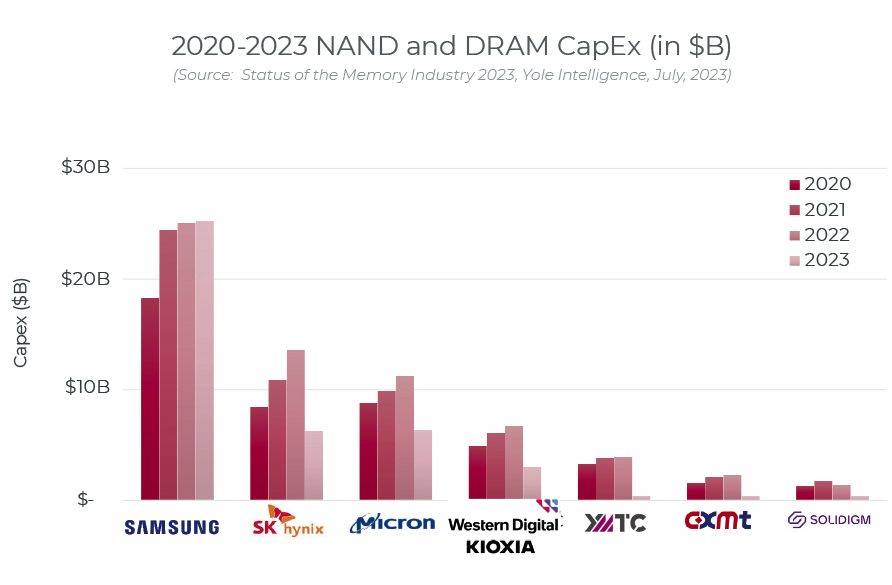

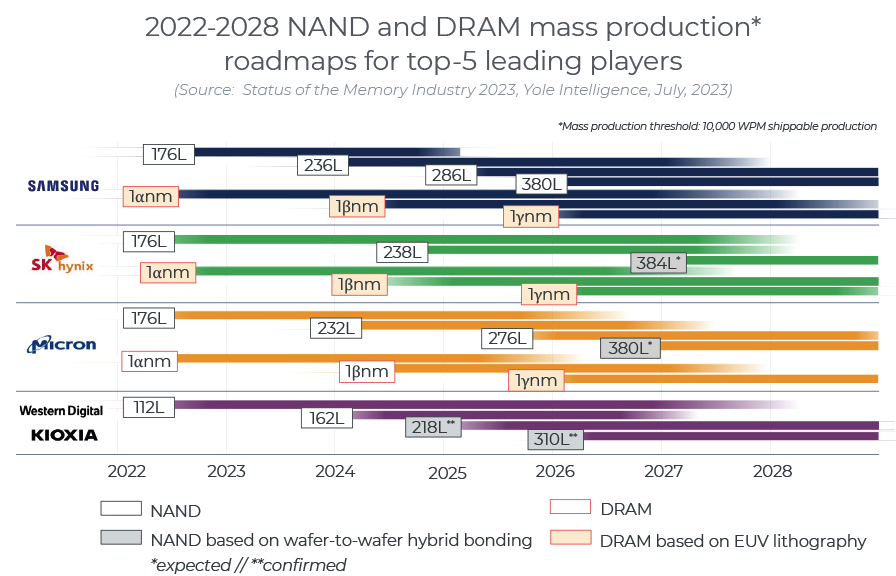

DRAM and NAND prices have fallen 57% and 55%, respectively, since 3Q21. The most severe drop started in the final weeks of 2Q22 when a perfect storm of demand-side developments (global conflicts, high inflation, China Covid lockdowns, etc.) crashed into the memory markets. The results for the full year 2022 were as follows: DRAM and NAND revenues, which account together for 96% of the overall memory market, decreased to USD79.7B (-15% YoY) and USD58.7B (-12% Y0Y), respectively; NOR flash declined 8% YoY to USD3.2B. Production cuts have set up suppliers to reach a market balance by the end of 2023. However, the financial losses incurred so far have been massive, and a recovery time longer than usual will be needed before suppliers increase their investments again. As such, 2024 and 2025 will be marked by undersupply and climbing prices, and revenues are expected to soar: after declining to USD42B for DRAM (-47% YoY) and USD37B for NAND (-37% YoY) in 2023, combined memory revenues are expected to grow to a new record-high of over USD200B by 2025.(Storage Newsletter, Yole Group)

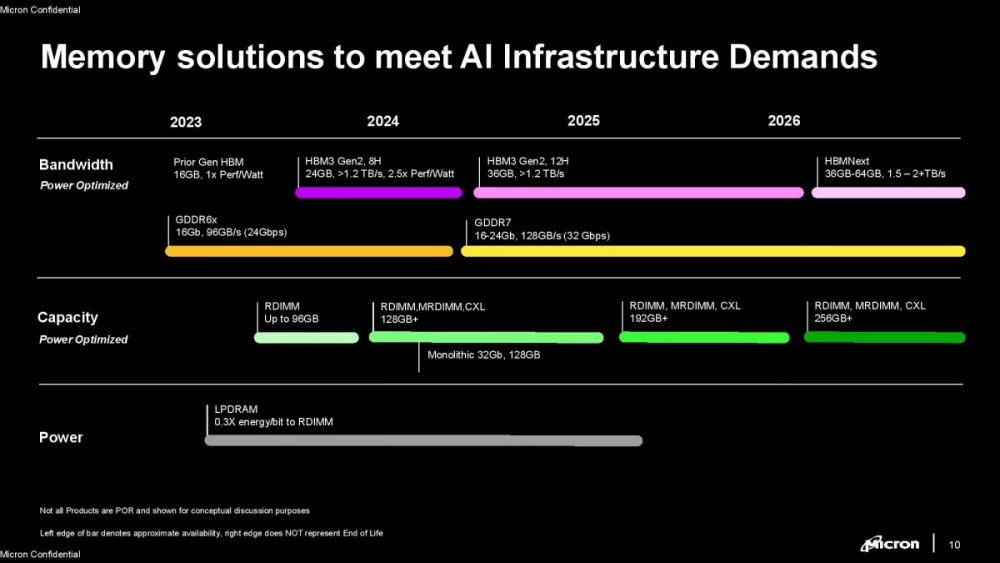

Micron has begun sampling the industry’s first 8-high 24GB HBM3 Gen2 memory with bandwidth greater than 1.2TB/s and pin speed over 9.2Gb/s, which is up to a 50% improvement over currently shipping HBM3 solutions. With a 2.5 times performance per watt improvement over previous generations, Micron’s HBM3 Gen2 offering sets new records for the critical artificial intelligence (AI) data center metrics of performance, capacity and power efficiency. These Micron improvements reduce training times of large language models like GPT-4 and beyond, deliver efficient infrastructure use for AI inference and provide superior total cost of ownership (TCO). The foundation of Micron’s high-bandwidth memory (HBM) solution is Micron’s industry-leading 1β (1-beta) DRAM process node, which allows a 24Gb DRAM die to be assembled into an 8-high cube within an industry-standard package dimension.(CN Beta, Micron, Hot Hardware, AnandTech)

Samsung Electronics will continue to reduce semiconductor output during 2H23, to accelerate an earnings recovery by reducing inventory. Samsung Electronics Executive Vice President Kim Jae-joon, who is in charge of the memory business, has revealed that the company will make an additional adjustment to the production of both DRAM and NAND flash. They will especially carry out a large-scale reduction in NAND production. His remarks came after the tech giant suffered a KRW4.36T (USD3.4B) operating loss from its semiconductor business during 2Q23, narrowing slightly from a KRW4.58T loss in 1Q23, thanks to a decreasing inventory level since May 2023.(CN Beta, Business Korea, Reuters, Korea Times, Payspace Magazine)

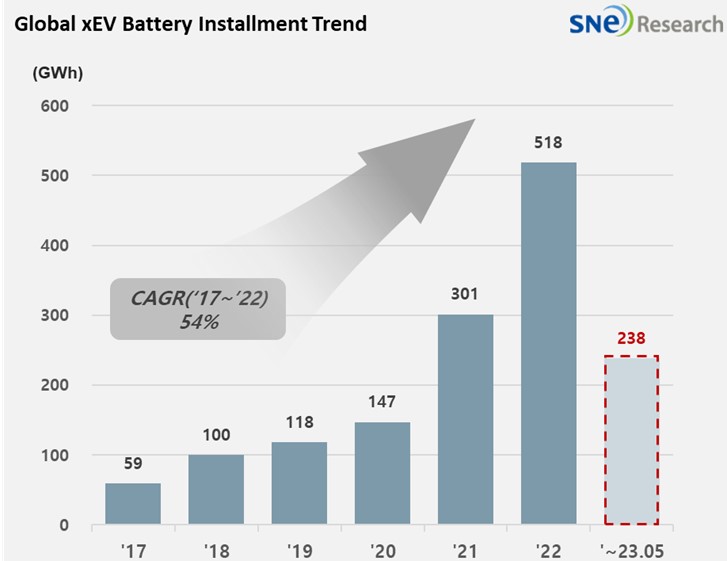

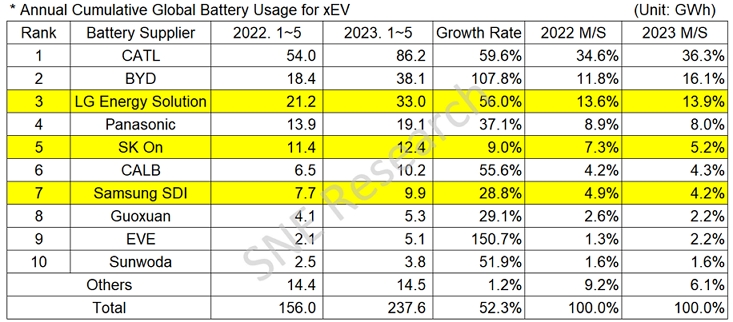

According to SNE Research, from Jan to May 2023, the amount of energy held by batteries for electric vehicles (EV, PHEV, HEV) registered worldwide was about 237.6GWh, a 52.3% YoY growth. Driven by the increasing shares in the Chinese domestic market, BYD continued to be ranked 2nd with a triple-digit growth compared to 2022. The combined market shares of K-trio companies were 23.3%, declined by 2.5%p compared to the same period in 2022, but all of them witnessed an increase in terms of battery usage. LG Energy Solution took the 3rd position, exhibiting a 56.0% (33.0GWh) YoY growth, while SK-On ranked 5th with a 9.0%(12.4GWh) growth and Samsung SDI ranked 7th with a 28.8% (9.9GWh) growth. (SNE Research, Laoyaoba)

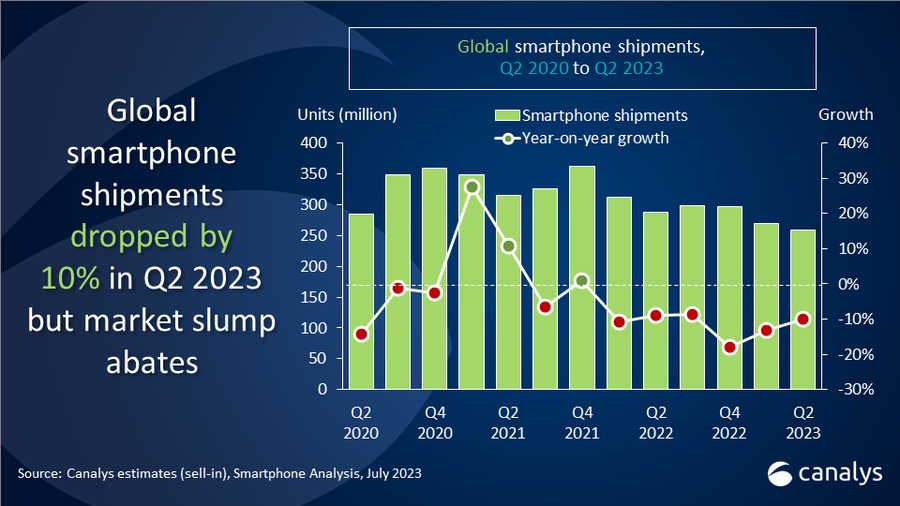

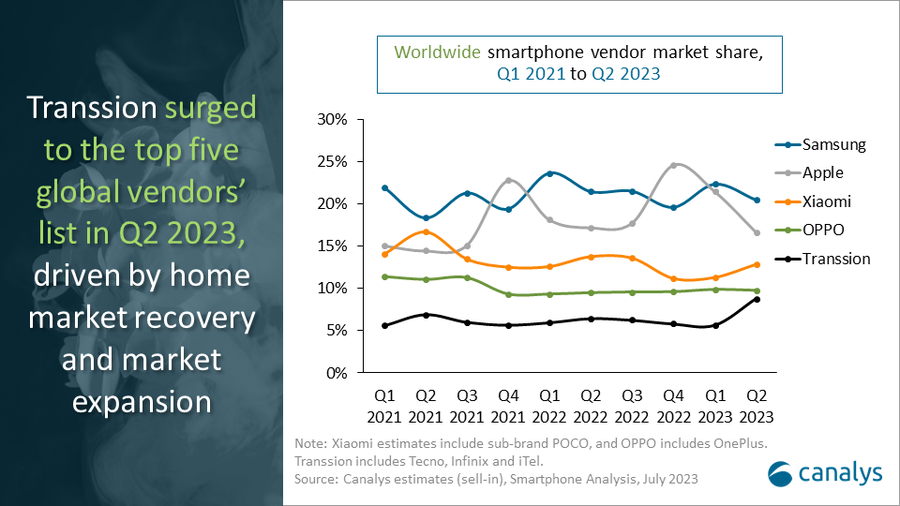

Canalys’s latest research reveals that the worldwide smartphone market fell by 10% to 258.2M units in 2Q23, showing a slowdown in decline. Samsung secured the top spot by shipping 53.0M units. Apple retained the second spot with 43.0M units of shipments and a 17% market share. With a normalized inventory level, Xiaomi ranked third with 33.2M units of shipments. OPPO (including OnePlus) defended its number four position with a 10% market share. Transsion Group (includes Tecno, Infinix and iTel brands), benefiting from recovery opportunities in the African market and other emerging markets they recently expanded into, leaped into the top 5 for the first time and shipped 22.7M units, experiencing 22% annual growth. (Canalys, CN Beta)

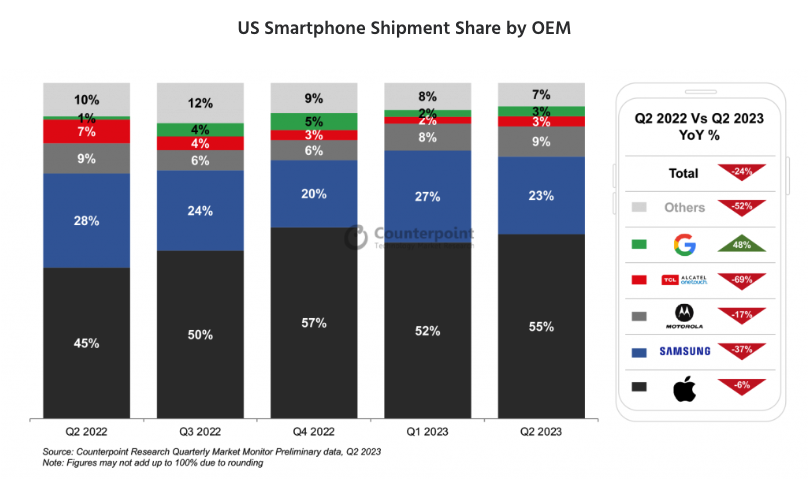

US smartphone shipments declined 24% YoY in 2Q23, according to Counterpoint Research. Android smartphone shipments declined 38% while Apple shipments fell 6% YoY. Consumers hesitated to purchase smartphones amid economic uncertainty. Google and Motorola launched new foldable models during the quarter. Low smartphone upgrade rates are likely to persist in 3Q23. (CN Beta, Counterpoint Research)

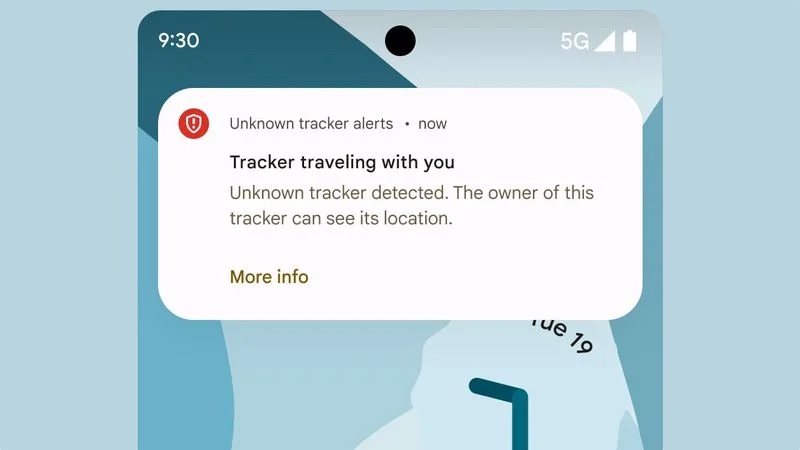

Google has announced plans to introduce a new safety feature that would alert Android users about nearby unknown Bluetooth trackers, including AirTags, preventing people from being stalked with tracking accessories. The tracking alert functionality is rolling out starting today. Android smartphones will provide automatic alerts if an unknown Bluetooth tracker is separated from its owner and traveling with the smartphone user. The notification can be tapped to view a map of where the tracker was last seen, and using a “Play sound” function will cause the tracker to make noise. (MacRumors, CN Beta, Google)

The European Commission has opened a formal investigation to assess whether Microsoft may have breached EU competition rules by tying or bundling its communication and collaboration product Teams to its popular suites for businesses Office 365 and Microsoft 365. Microsoft is a global technology company offering productivity and business software, cloud computing and personal computing. Teams is a cloud-based communication and collaboration tool. It offers functionalities such as messaging, calling, video meetings, file sharing and brings together Microsoft’s and third-party workplace tools and other applications. (TechCrunch, The Verge, Neowin, Europa)

Samsung’s Galaxy Ring could enter mass production as early as Aug 2023. Samsung is reportedly nearing the final development stage of the tiny fitness-tracking wearable device and is expected to decide the mass production schedule in Aug 2023. The ring will be equipped with various sensors to measure health data, including a temperature sensor, heart rate sensor, PPG (Photoplethysmography) sensor, and an ECG (Electrocardiogram) sensor. The plan is to make a comprehensive yet unintrusive mobile health and fitness tracker that offers better accuracy than wrist-worn smartwatches. Its market release may take another year, though. Samsung will be required to obtain medical approvals for the product before selling it. This process can reportedly take 10 to 12 months. So the first-gen Galaxy Ring may not arrive until mid-2024 at the earliest. (Android Headlines, The Elec)

According to Sony Playstation CEO Jim Ryan, the company has officially sold 40M units of Playstation 5. In addition to the number of PS5 consoles sold, Ryan has also shared some metrics surrounding games. There are now reportedly over 2,500 PS5 games available. (Android Headlines, Sony)

Extended reality (XR) company Virnect is planning to expand from offering XR solutions to customers to launching XR platforms. Virnect was founded in 2016 is a software company that offers XR solutions for industrial use. It offers a variety of solutions in a variety of different brands. Its products include computer vision engine Track; in XR solutions it offers Remote, Make, View, and Twin, which are for remote collaboration, content production, content viewer and 3D monitoring, respectively. Earlier 2023, the company launched XR-based platform called SQUARS in Europe. Its customers include LG Chem, LG Energy Solution, and Samsung SDI. It has secured KRW39B in funding so far; Hanwha Corporation is a major investor that accounted for KRW10B of the total. (The Elec)