8-26 #Headache : Huawei has been accused of building a a series of secret chip-making facilities across China; Samsung will allegedly launch a phone with a rollable OLED display sometime in 2025; Intel’s expanding fab site in Oregon will serve as a foundry for MediaTek; etc.

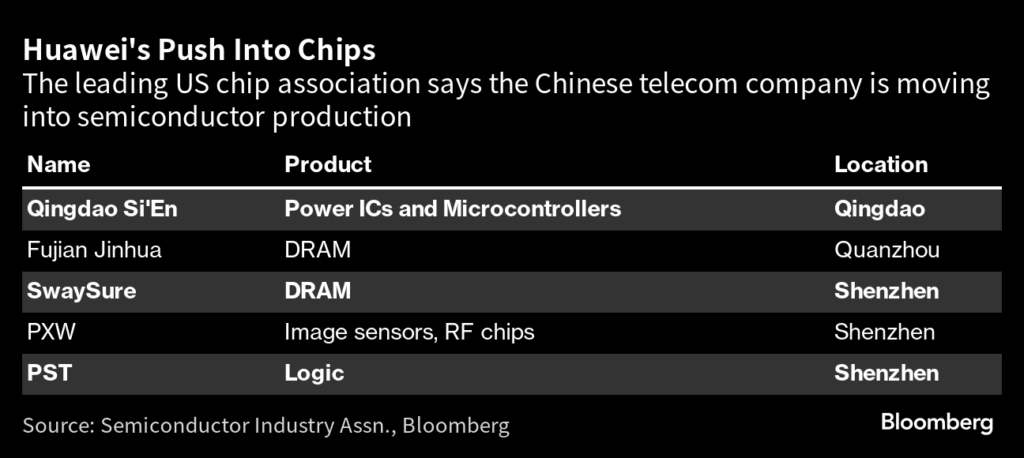

Huawei has been accused of building a a series of secret chip-making facilities across China, under the names of other companies, to help the technology company bypass US sanctions. Huawei reportedly moved into chip production in 2022 and was receiving an estimated USD30B in state funding from the government. The association claims Huawei has acquired at least 2 chip plants and is overseeing the construction of 3 additional facilities. By building the facilities under names of other companies, the company could be able to indirectly purchase American chip-making equipment, circumventing the sanctions.(GizChina, Bloomberg, The Guardian, Yahoo, Reuters, Fox Business)

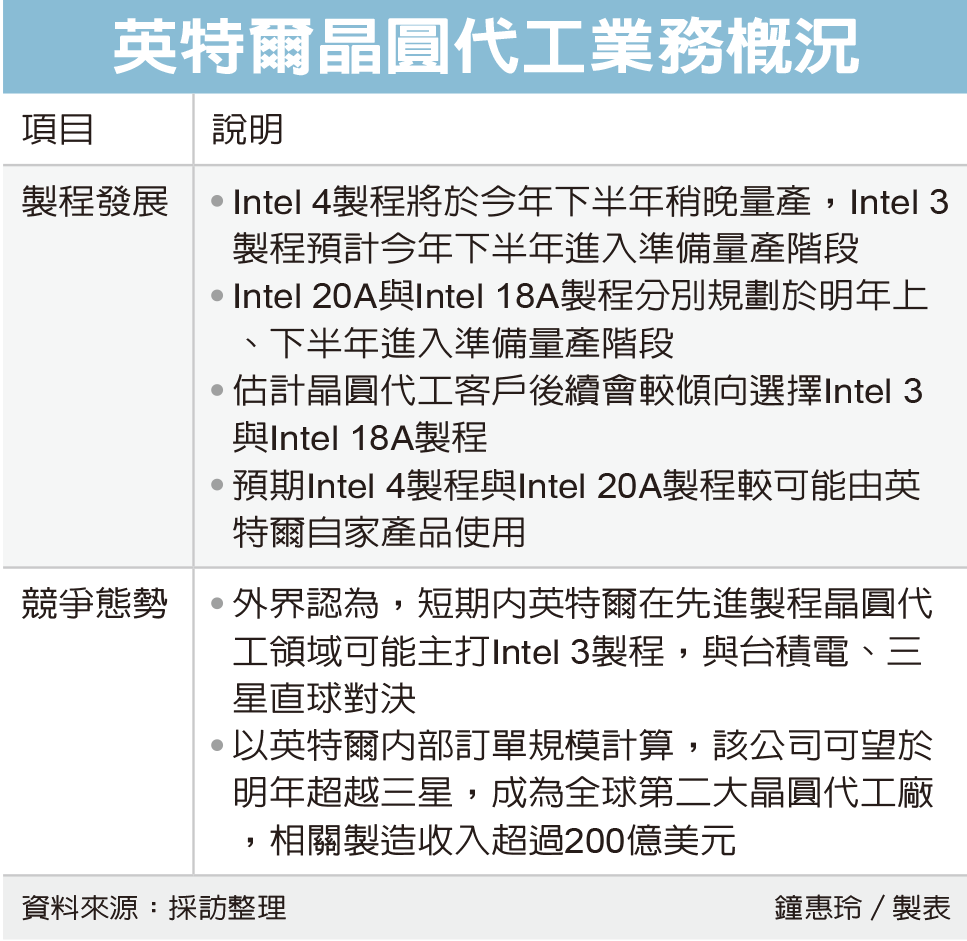

Speculation has emerged that Intel’s expanding fab site in Oregon will serve as a foundry for MediaTek using the Intel 18A technology, with production beginning as early as 2025. MediaTek mainly relied on TSMC before, and announced the adoption of Intel 16 process in 2022. This is a new “Intel 16” process specially developed by Intel for MediaTek, based on the improvement of 22nm FFL, which is very mature. MediaTek’s 16nm chips are expected to start mass production in early 2025, mainly digital TV and WiFi chips with mature processes will be handed over to Intel for OEM. (CN Beta, Digitimes, Digitimes, UDN)

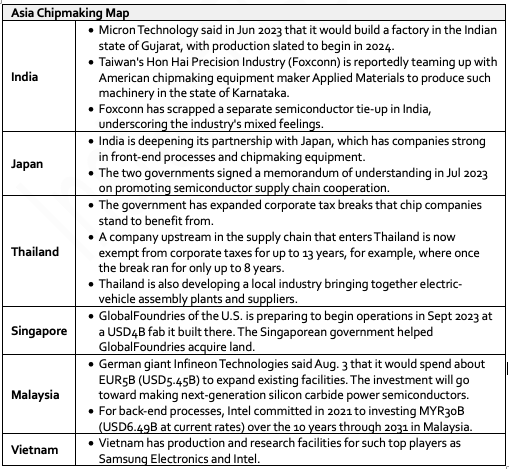

The full-fledged entry of India and Thailand into the race for semiconductor-manufacturing investment has symbolized the flurry of activity to redraw the industrial map in Asia. In 2021, Indian Prime Minister Narendra Modi’s cabinet approved a INR760B (USD9.14B at current rates) program to support domestic semiconductor and display manufacturing. As the U.S. and China wrangle over controls on transfers and exports of advanced semiconductor technology, India has been angling for opportunities to benefit from major players reorganizing the supply chain. (CN Beta, Asia Nikkei)

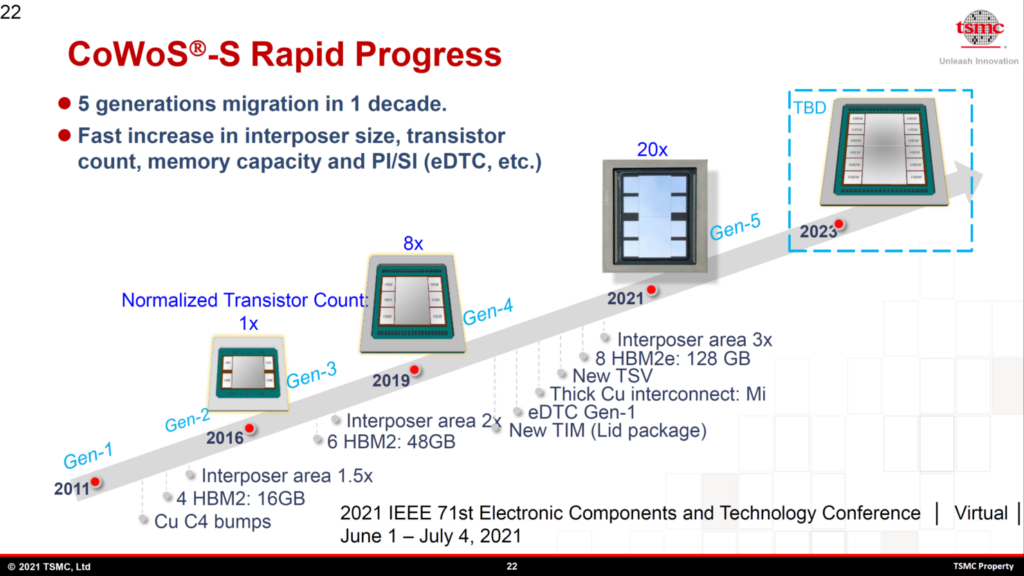

Nvidia is actively building a non-TSMC CoWoS supply chain. According to the supply chain, UMC has recently expanded the production capacity of silicon interposer by 2 times. The annual production capacity is expected to be the same as that of TSMC, which will greatly ease the pressure of CoWoS process in short supply. It is reported that a few months ago, the rapid growth of Nvidia AI GPU demand led to a serious shortage of TSMC CoWoS advanced packaging production capacity. Equipment manufacturers estimate that TSMC’s total CoWoS production capacity will exceed 120,000 units in 2023, and will reach 240,000 units in 2024, of which Nvidia will obtain 144,000 to 150,000 units. (CN Beta, IT Home, CTEE, UDN, TechNews)

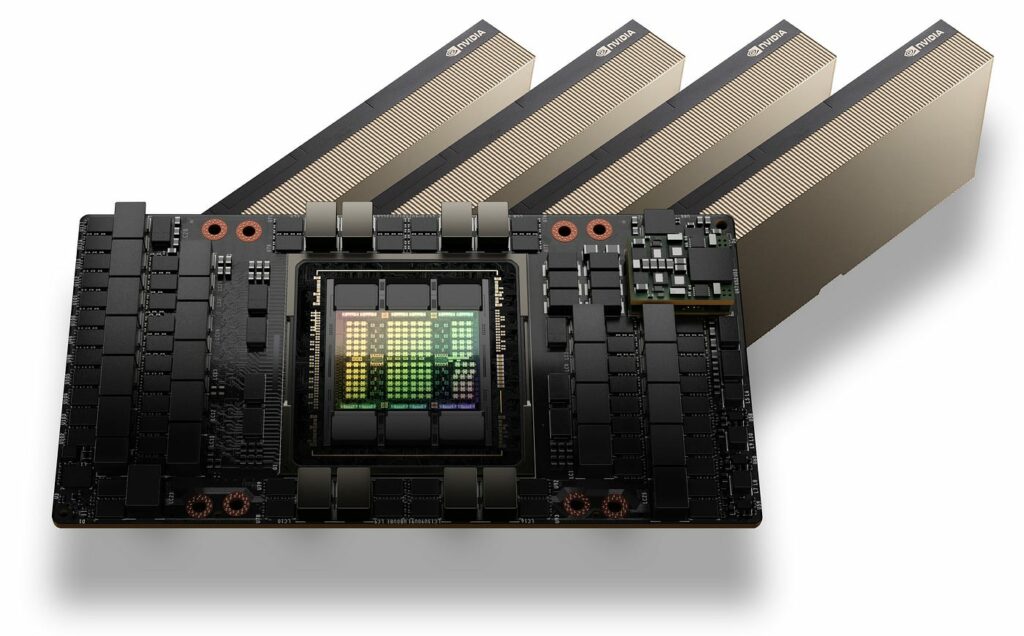

Nvidia is preparing to triple the production of a USD40,000 processor powering the generative AI revolution as the threat of shortages weighs on the ambitions of companies seeking to capitalize on the AI boom. Nvidia wants to boost production of its hotly pursued H100 processor, named after computer scientist Grace Hopper, with the aim of shipping 1.5M-2M units in 2024, up from the 500,000 target in 2023. Nvidia soared to a USD1T market capitalization in May 2023, with AI companies driving huge demand for its processors also known as GPUs – a fundamental component in the development of large language models underlying buzzy AI tools such as ChatGPT. (CN Beta, Business Insider, Financial Times, Bnext)

The Biden administration is seeking a short-term extension to a landmark science and technology agreement with China despite pressure from some U.S. lawmakers who say Beijing could exploit it to gain a security and military advantage. A 6-month extension will keep the Science and Technology Agreement in force as the U.S. seeks “authority to undertake negotiations to amend and strengthen the terms”. Signed in 1979 by President Jimmy Carter and Chinese leader Deng Xiaoping, the STA was the first accord between the two countries after they normalized diplomatic relations. It has historically been renewed roughly every 5 years and was due to lapse. A lapse in the pact would not only imperil government-to-government collaboration in vital areas such as climate change and public health; it would also inhibit academic cooperation between the world’s two leading economies. (CN Beta, NBC News, CNBC)

Advanced Micro Devices (AMD) has acquired Mipsology, an artificial intelligence (AI) software company focused on computer interpretations and responses to photos and videos. Mipsology is focused on “image inference computation,” or how a computer interprets and responds to visual input like a photo or a video. Zebra is software that customers can deploy on preexisting hardware, though Mipsology has experience tailoring and optimizing for AMD components.(CN Beta, Investopedia, AMD)

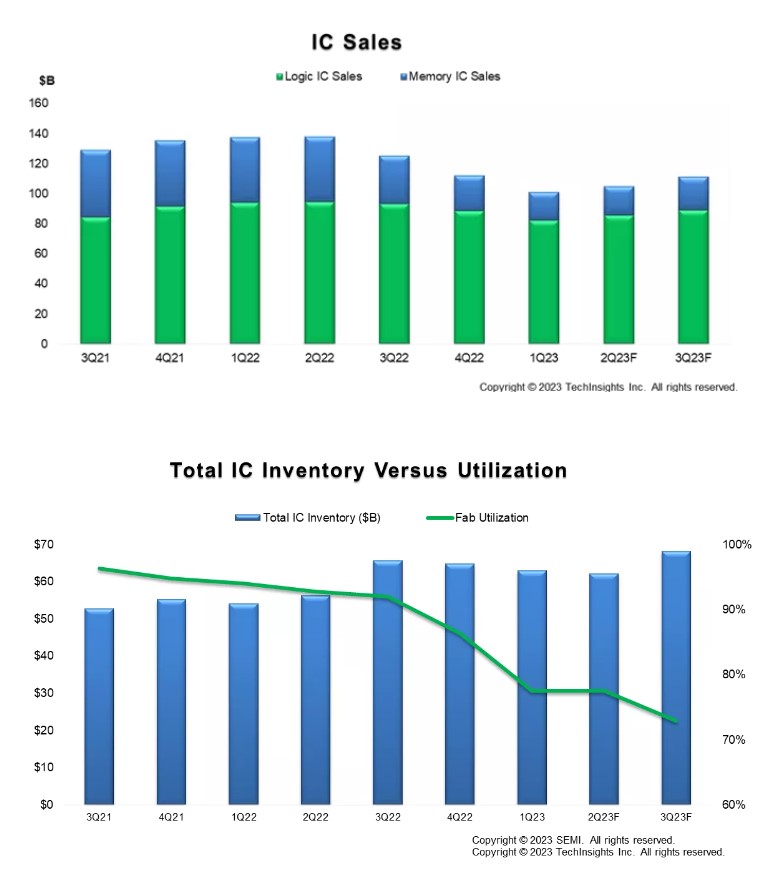

With sequential IC sales declines beginning to moderate, the global semiconductor industry appears to be nearing the end of a downcycle and is expected to begin to recover in 2024, SEMI, in partnership with TechInsights. In 3Q23, electronics sales are projected to post healthy QoQ growth of 10%, while memory IC sales are expected to log double-digit growth for the first time since the downturn started in 3Q22. Logic IC sales are predicted to remain stable and improve as demand gradually recovers. Market indicators point to a semiconductor industry bottoming at the end 1H23, and the industry has since started a recovery, setting the stage for continued growth in 2024. All segments are projected to log year-over-year increases in 2024, with electronics sales surpassing its 2022 peak. (Digitimes, SEMI.org)

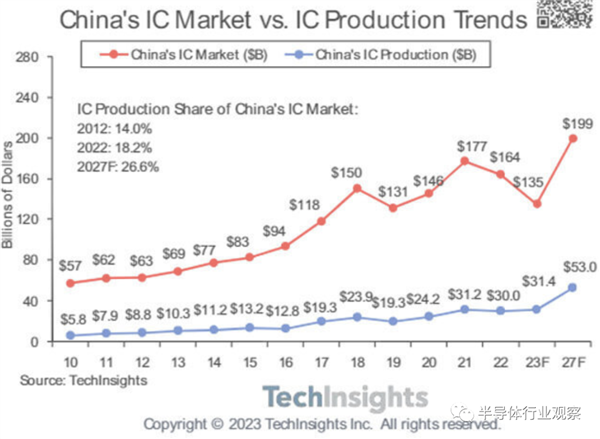

According to TechInsights, China has maintained its position since becoming the world’s largest IC consumer market in 2005, reaching a peak of USD177.3B in 2021, but declined by 7.3% YoYin 2022. In addition to the USD164.4B in 2023, it is expected to shrink by 18% to USD135B in 2023 due to the impact of the global economic slowdown, China’s COVID-19 policy, and the US’s tightening of semiconductor regulations in China. Meanwhile, China’s share of the global IC market is expected to decline from 34% in 2021 to 31% in 2022 and 29% in 2023. However, even with the decline in market share, China remains the world’s largest consumer market for semiconductors. On the other hand, in 2022, the output value of China’s IC manufacturing industry (the sum of the output value of foreign-funded manufacturing industry and the output value of Chinese-funded manufacturing industry) will reach USD30B, of which the output value of Chinese-funded manufacturing industry headquartered in China will reach USD15.2B, up 13% over the previous year. (CN Beta, My Drivers, EE World)

The shipments of the global smartphone market have declined for 8 consecutive quarters. A number of market research institutions have released reports that the decline in smartphone market shipments in 1H23 has narrowed. Some phone supply chain giants, including BOE and Sunny Optical, have seen an increase in shipments of some products, and public opinion on the recovery of the smartphone market has continued to ferment. The performance of phone supply chain companies is not optimistic. Zhidongxi has sorted out the 1H23 performance of 31 core companies and found that 18 companies had a sharp decline in 1H23 net profit YoY. There are 9 companies that suffered losses in performance. The long-awaited recovery in the phone market has yet to come. At the same time, the mobile phone market is still facing the problem of destocking and weak terminal sales. Zhidongxi has learned from the supply chain that the total demand for electronic products at home and abroad in 1H23 was in a decline. From Jan to Feb, it was affected by the demand of customers to clear the inventory. Although it gradually improved in Mar, the overall weak trend is still difficult to change in the short term. (CN Beta, Zhidx, Sina)

Huawei might be working on a new type of foldable phone. The foldable phone has asymmetrical halves, with the left side being higher than the right side. The asymmetric length of one portion of the device is likely due to the placement of the camera module, which is located on the top of the left side of the phone when the phone is unfolded. When it is unfolded, the camera module faces the user directly from the upper left corner of the screen. This means that users can use it as a front-facing camera. When the phone is folded, the same camera setup can be used as a rear-facing camera. (Gizmo China, Sina)

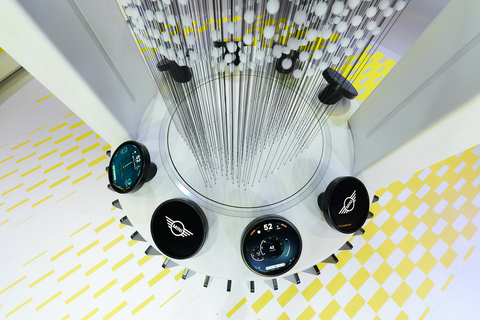

Samsung Display has showcased 9.4” round OLED display partnering with MINI. Samsung Display’s round OLEDs are featured on a cylindrical display tower called the MINI Incubator at the MINI booth. In addition to the MINI Incubator, Samsung Display is also showcasing its OLED products optimized for automotive displays, featuring an eco-friendly structure that minimizes the use of plastic, true black enabling infinite contrast ratio, design flexibility and blue light-minimizing technology.(Android Headlines, BMW Group, Business Wire)

Samsung will allegedly launch a phone with a rollable OLED display sometime in 2025. The company could unveil the phone alongside the Galaxy Z Flip 7 and Galaxy Z Fold 7 in 2H25. The rollable display phone has an improved UPC (Under Panel Camera), which means it will not have any cutout for the front-facing camera. The device is also claimed to feature zero bezels, which could mean it would have an edge-to-edge display. (Android Headlines, Twitter, SamMobile)

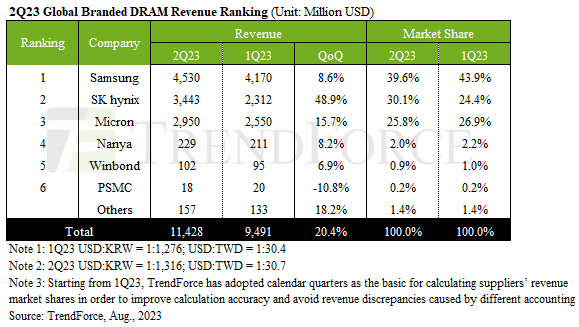

TrendForce reports that rising demand for AI servers has driven growth in HBM shipments. Combined with the wave of inventory buildup for DDR5 on the client side, the second quarter saw all three major DRAM suppliers experience shipment growth. 2Q23 revenue for the DRAM industry reached approximately USD11.43B, marking a 20.4% QoQ increase and halting a decline that persisted for three consecutive quarters. Among suppliers, SK hynix saw a significant quarterly growth of over 35% in shipments. The company’s shipments of DDR5 and HBM, both of which have higher ASP, increased significantly. As a result, SK hynix’s ASP grew counter-cyclically by 7–9%, driving its 2Q23 revenue to increase by nearly 50%. With revenue reaching USD3.44D, SK hynix claimed the second spot in the industry, leading growth in the sector. Samsung, with its DDR5 process still at 1Ynm and limited shipments in 2Q23, experienced a drop in its ASP by around 7–9%. (CN Beta, TrendForce, TrendForce)

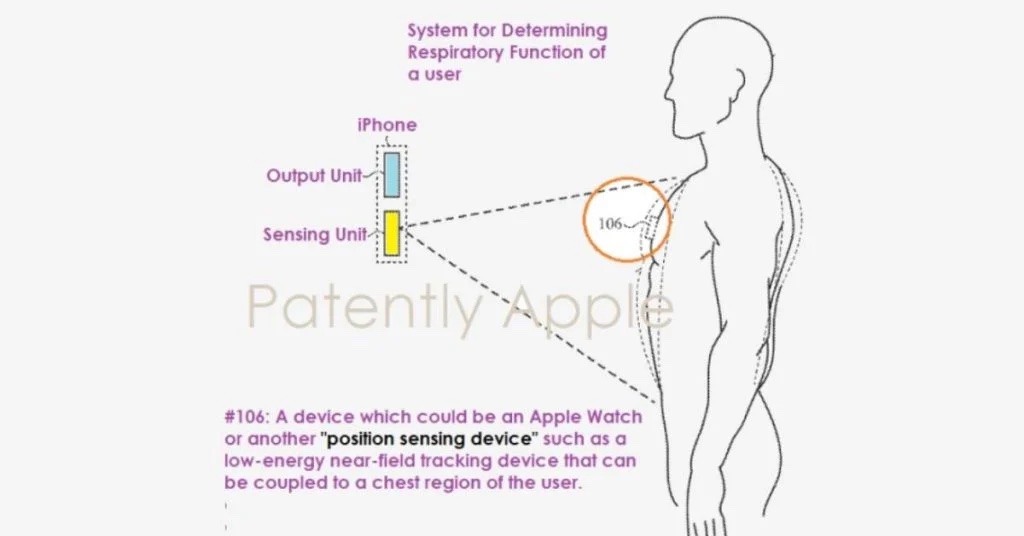

Apple has filed a patent application for a system that uses guided breathing to analyze a user’s respiratory function. This system could be used to assess lung health and identify airway obstruction, which can be a symptom of conditions like COPD and asthma. The patent application notes that people with chronic obstructive pulmonary disease (COPD), asthma, or other airway-related conditions may experience reduced airflow when breathing. This can make them difficult to breathe. Apple is developing new ways to track respiratory health using the iPhone and Apple Watch. One method involves using the iPhone’s optical sensor to track chest movements during breathing. Algorithms would then interpret the motion to determine respiratory characteristics. Another method involves attaching an Apple Watch to the chest area with a dedicated adhesive sticker. The watch would then be able to directly monitor breathing mechanics from this vantage point.(Gizmo China, Patently Apple, USPTO)

Huawei and Ericsson have signed a long-term global patent cross-licensing agreement that covers patents essential to a wide range of standards such as 3GPP, ITU, IEEE, and IETF standards for 3G, 4G, and 5G cellular technologies. The agreement covers the companies’ respective sales of network infrastructure and consumer devices, granting both parties global access to each other’s patented, standardized technologies.(CN Beta, Ericsson, Huawei, SCMP)

Motorola has announced it will release a Tiantong satellite phone module. The module will support two-way satellite phone calls and text messaging. With a single click, users will be able to make a satellite phone call using their phone. The name suggests the satellite connectivity will be provided by Tiantong-1— China’s space-based information infrastructure and the country’s answer to the Inmarsat network.(Gizmo China, My Drivers, IT Home)

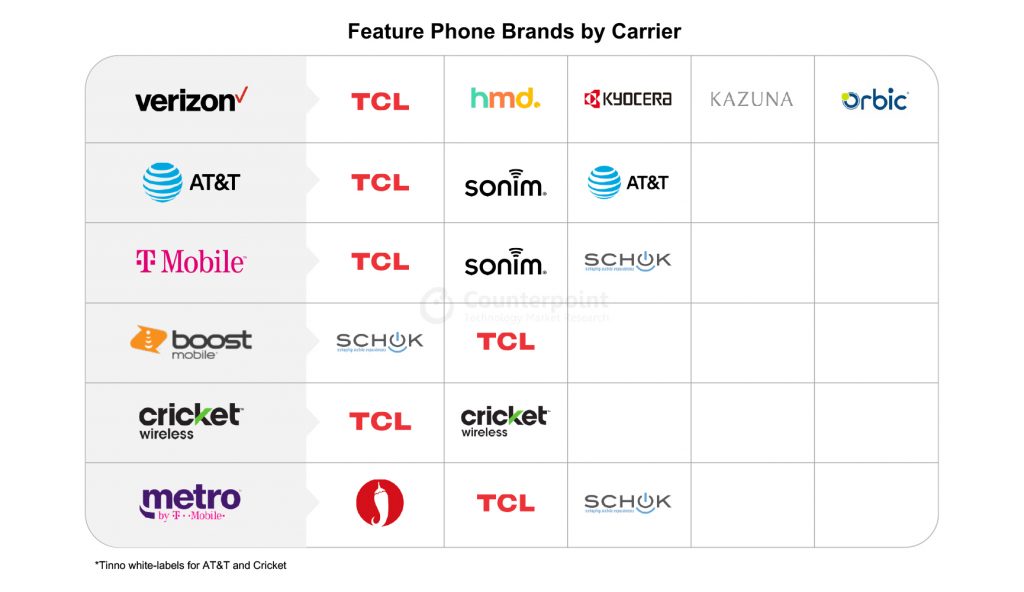

Feature phones in the US market have made a resurgence as Gen Z and millennials are advocating for digital detoxes due to the mental health concerns brought on by smartphones and social media. Hashtags like #bringbackfliphones on TikTok have garnered millions of views leading to the increased adoption of feature phones by younger consumers looking to adhere to movements like digital detoxing, minimalist lifestyles and unplugging. Given the relatively cheap price point of feature phones (USD20-50 with a prepaid carrier and USD50-100 unlocked), more people are trying out these devices and sharing their experiences on social media. Feature phone sales are forecast to reach 2.8M in 2023 with continued stable sales in the near term as niche demand drivers maintain sales. (Counterpoint Research)

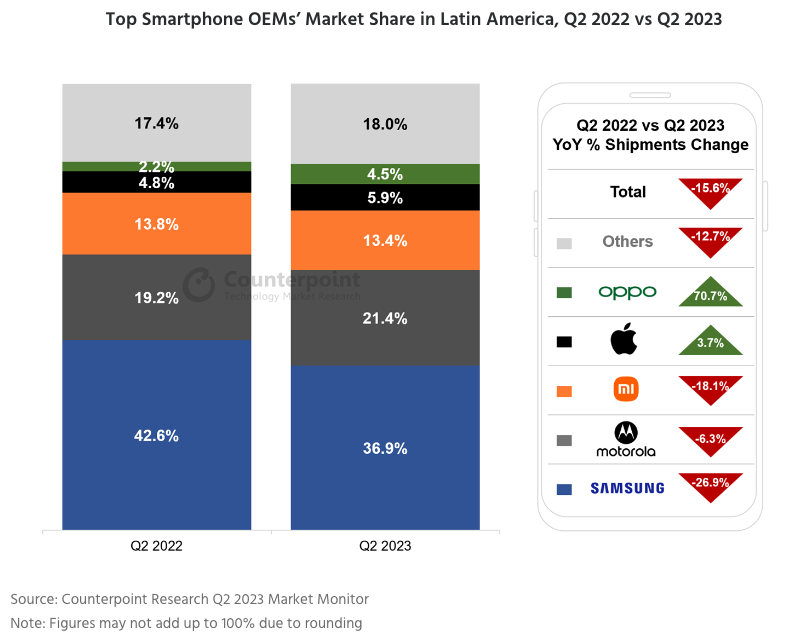

Smartphone shipments in Latin America (LATAM) dropped 15.6% YoY but climbed 2.4% QoQ in 2Q23, according to Counterpoint Research. LATAM’s economic growth in 2023 is actually slightly higher than forecast. However, this recovery has not yet inspired an increase in the rate of smartphone replacement. Low consumer demand continued to affect the region during the quarter. Although most countries in the region are seeing declining inflation, consumer confidence is yet to bounce back, as political turmoil continues to constrain the general economy. Samsung was once again the absolute leader in the LATAM market in 2Q23. However, its shipments and market share declined YoY with weakened performance in most of the countries in the region. (Counterpoint Research)

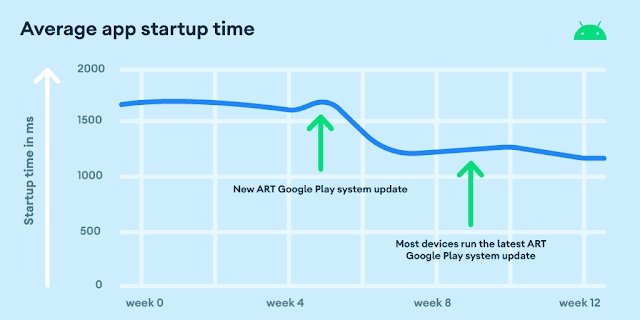

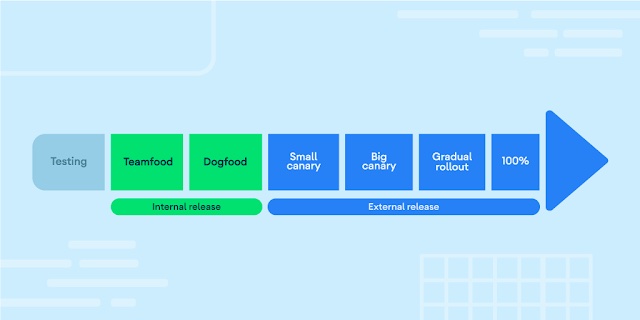

Google has shared some achievements of the Android Runtime (ART) compiler. The ART is responsible for literally running applications on the OS and has been updated via Google Play system updates since Android 12. ART is the engine behind the Android operating system (OS). It provides the runtime and core APIs that all apps and most OS services rely on. Both Java and Kotlin are compiled down to bytecode executed by ART. ART updates result in faster app startup times, execution speed, improved memory usage, and more efficient bytecode compilation, as well as security fixes. With the latest ART 13 update, runtime and compiler optimizations resulted in app startup time “improvements of up to 30% on some devices”. The testing process for Android Runtime updates involves “compiling over 18M APKs and running app compatibility tests, and startup, performance, and memory benchmarks on a variety of Android devices that replicate the diversity of our ecosystem as closely as possible”.(CN Beta, Ars Technica, Techspot, Gizmo China, 9to5Google, Google)

Samsung has announced the launch of new “Samsung Eco-Friends” lineup, which features various accessories with recycled materials and unique designs. Samsung Eco-Friends are accessories such as product cases and wearable straps that contain a minimum of 40% Post Consumer Material (PCM). The Samsung Eco-Friends lineup was planned by Samsung’s Future Generation Lab, which comprises global employees in their 20s and reflects the values and tastes of the younger generation. Future Generation Lab also helps partners expand their sales through the Samsung Mobile Accessory Partnership Program (SMAPP). (GSM Arena, Samsung)

The world’s first laptop designed for RISC-V development, the Roma laptop, has been officially delivered to customers. The laptop is powered by a high-quality RISC-V processor with a quad-core 1.5GHz 64-bit CPU and a dual-core GPU. It also has 8GB of RAM, 128GB of eMMC storage, and a 1TB SSD. The Roma laptop was developed by Deep Digital Intelligence and debugged by Jianshi Technology. It is a collaborative project spearheaded by the RISC-V Foundation.(CN Beta, Gizmo China, Sohu)

Sony Interactive Entertainment (SIE) has announced that it has entered into an agreement to acquire Audeze, a leading audio technology brand and pioneer of high-end gaming headphones. The acquisition will strengthen SIE’s efforts to continue innovating when it comes to the audio experience of PlayStation games. Audeze will continue to operate independently and develop multi-platform products, while benefiting from being a part of the PlayStation ecosystem.(Neowin, Business Wire, TechCrunch)

Meta’s (formerly Facebook) next Ray-Ban Stories smart glasses will reportedly let users livestream video to viewers who can talk back to them. The second-generation Ray-Ban Stories will not only allow users to stream video directly to Facebook and Instagram but will also allow viewers to whisper in their ear. Ray-Ban Stories devices of the current generation can capture photos and short video clips but do not support live streaming. (Android Central, The Verge, DNA, Lowpass)

After Google’s Project Iris augmented reality (AR) glasses were reportedly discontinued in Jun 2023, it is rumored that Google and Samsung are encountering challenges in their joint endeavor to launch a mixed reality (XR) headset. The rumored device, which is called Project Moohan internally, is supposed to offer a XR experience powered by the Android platform. Project Moohan has become a “political headache” at Google. The partnership allegedly makes it more likely for Samsung “to call the shots on product features” and that it does not want Google’s other hardware divisions to have knowledge of the project over concerns that they might try to build a rival product. Samsung is already starting to take control of the project. Google is still exploring ways it can use AI with AR glasses and is also incorporating Iris’ software into another project called Betty, which Google will use to “build a ‘Micro XR’ software that it intends to pitch to manufacturers building glasses”. Betty may be monocular, which means it projects an image in front of one lens, but a second project, codenamed Barry, will make use of both lenses. (The Verge, Business Insider, TechTimes, India Times)

Hybrid gasoline-electric vehicles may not be dying as fast as some predicted in the auto sector’s rush to develop all-electric models. Ford Motor is the latest of several top automakers, including Toyota and Stellantis, planning to build and sell hundreds of thousands of hybrid vehicles in the U.S. over the next 5 years. S&P Global Mobility estimates that hybrid car sales will more than triple over the next 5 years. The estimate claims that it will account for 24% of new U.S. car sales by 2028. The sales of pure electric cars will account for about 37%, and the remaining gas cars will account for nearly 40%.(GizChina, Reuters, India Times, IT Home)

Changan Auto has completed the registration of its subsidiary in Thailand, as required by the country’s Department of Business Development. The company, which is based in China’s southwestern Chongqing province, will spend CNY1.83B (USD251M) to set up a plant with an annual capacity of 100,000 units, which will be sold in Thailand, Australia, New Zealand, the United Kingdom and South Africa. This is part of the state-owned carmaker’s goal to achieve annual sales of 1.2M cars in the overseas markets by 2030.(My Drivers, IT Home, SCMP, TechNode, Yahoo, Changan)

Xiaomi has reportedly won the approval of China’s state planner to manufacture electric vehicles (EVs), marking a major step towards the smartphone maker’s goal of producing cars by early 2024. The National Development and Reform Commission (NDRC), which regulates new investments and production capacity in China’s auto industry, gave the nod for EV manufacturing to Beijing-based Xiaomi earlier Aug 2023. Xiaomi’s venture is only the fourth since end-2017 to win NDRC approval. While NDRC’s nod brings Xiaomi closer to mass production of EVs more than 2years after it first announced the plans, the venture still needs clearance from the Ministry of Industry and Information (MIIT), which assesses new automakers and models for technical and safety requirements. Xiaomi had pledged a USD10B investment over a decade in the automobile business and set a goal of mass producing its first cars in 1H24. (Laoyaoba, Reuters, Twitter)

Snapchat is set to unveil a new generative artificial intelligence (AI) feature called ‘Dreams’. This upcoming feature will allow users to take or upload selfies, which the app will then use to generate new pictures of them in imaginative backgrounds. The ‘Dreams’ feature will not only allow users to create AI-generated selfies but also gives permission to their friends to create dream-like images featuring both themselves and their friends. In addition to this, Snapchat recently introduced the ‘Lens Creator Rewards’ program, aimed at Snap AR creators in India. This new program offers rewards to developers, teams, and creators for building high-performing lenses on the platform. (TechCrunch, Hypebeast, TS2)

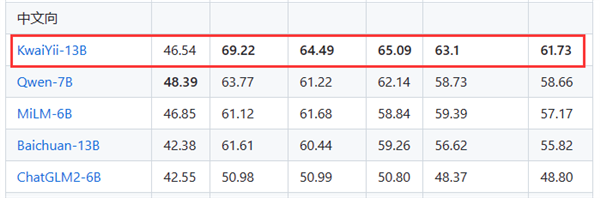

Kuaishou’s self-developed large model “KuaiYii” has appeared in the list of AI comprehensive Chinese evaluation benchmark CMMLU. At present, KuaiYii covers the pre-training model (KwaiYii-Base) and the dialogue model (KwaiYii-Chat). The main features include: the KwaiYii-13B-Base pre-training model has excellent general-purpose technical base capabilities, and is used in most authoritative Chinese/ English effect under the same model size was obtained on the Benchmark. The KwaiYii-13B-Chat dialogue model has excellent language understanding and generation capabilities, and supports a wide range of tasks such as content creation, information consultation, mathematical logic, code writing, and multiple rounds of dialogue. The manual evaluation results show that KwaiYii-13B-Chat exceeds the mainstream open source model , and approach the equivalent level of ChatGPT (3.5) in content creation, information consultation and mathematical problem solving. (CN Beta, My Drivers, ZOL)