9-10 #PoorWeekend : Intel plans on taking the help of TSMC in the future; Samsung will allegedly equip its future mid-range chips with AMD GPU; China is reportedly set to launch a new state-backed investment fund that aims to raise about USD40B for its semiconductor sector; etc.

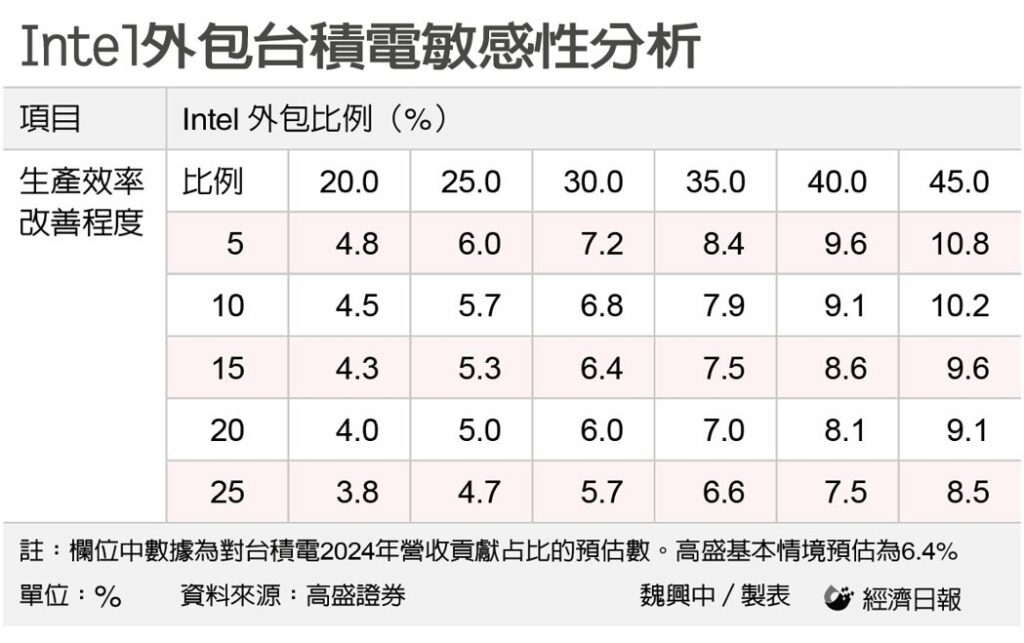

Intel plans on taking the help of TSMC in the future, as its foundry division becomes a victim of delays and process inefficiencies. Goldman Sachs Securities has noted that Intel has been consistently grappling with process upgrade delays since the 10-nanometer fabrication process. Recently, the company has decided to establish a foundry-like relationship between its manufacturing groups and internal product business units. With the market scale growing increasingly substantial, it is anticipated that Intel will expand its outsourcing to TSMC in 2024 and 2025. In the rising trend of outsourced manufacturing, TSMC stands as the major beneficiary. Goldman Sachs’ analysis reveals that the total addressable market of Intel’s outsourcing orders for 2024 and 2025 is set at USd18.6B and USD19.4B, respectively. During the same period, the total addressable market scope for TSMC’s wafer fabrication services amounts to USD5.6B and USD9.7B, approximately accounting for 6.4% and 9.4% of TSMC’s overall revenue in the corresponding years.(CN Beta, UDN, UDN, Yahoo, LTN, WCCFtech, TrendForce)

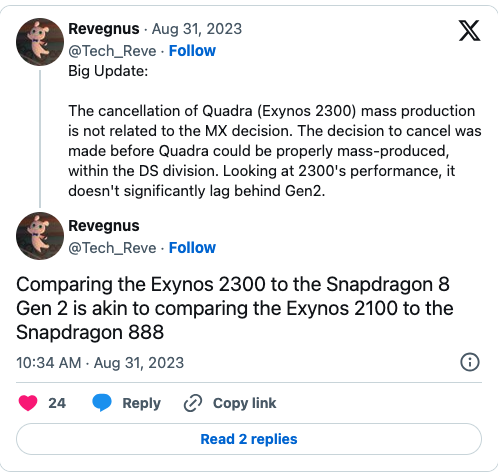

Samsung has reportedly cancelled the Exynos 2300 chipset, which was codenamed “Quadra.” The decision was made before the SoC entered mass production in 4Q23, but the reason for the cancellation is unknown. It is said Exynos 2300 to be comparable in performance to Qualcomm Snapdragon 8 Gen 2. With Samsung’s 4nm process seemingly going strong with improved yields, the company can focus on increasing Exynos 2400 production accordingly. (CN Beta, WCCFtech, Gizmo China, Twitter)

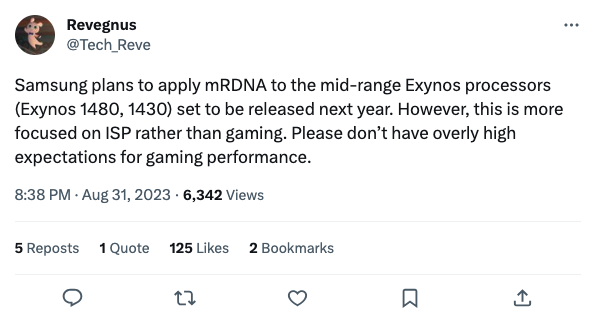

Samsung will allegedly equip its future mid-range chips, namely Exynos 1430 and Exynos 1480 with an AMD mRDNA-based GPU. Both these processors are expected to be announced sometime early 2024, and they could debut inside the Galaxy A55 and the Galaxy A15, respectively. Samsung is focused more on improving the ISPs on its future mid-range Exynos chips rather than bringing powerful GPUs. Samsung’s next flagship chipset, the Exynos 2400, is rumored to be used in some Galaxy S24 and Galaxy S24+ units. It reportedly features a 10-core CPU with one Cortex-X4 CPU core clocked at 3.16GHz, two Cortex-A720 CPU cores clocked at 2.9GHz, three Cortex-A720 CPU cores clocked at 2.6GHz, and four Cortex-A520 CPU cores clocked at 1.9GHz. The Xclipse 940 GPU inside the Exynos 2400 is expected to have six WGPs (Work Group Processors). (GizChina, SamMobile, Twitter)

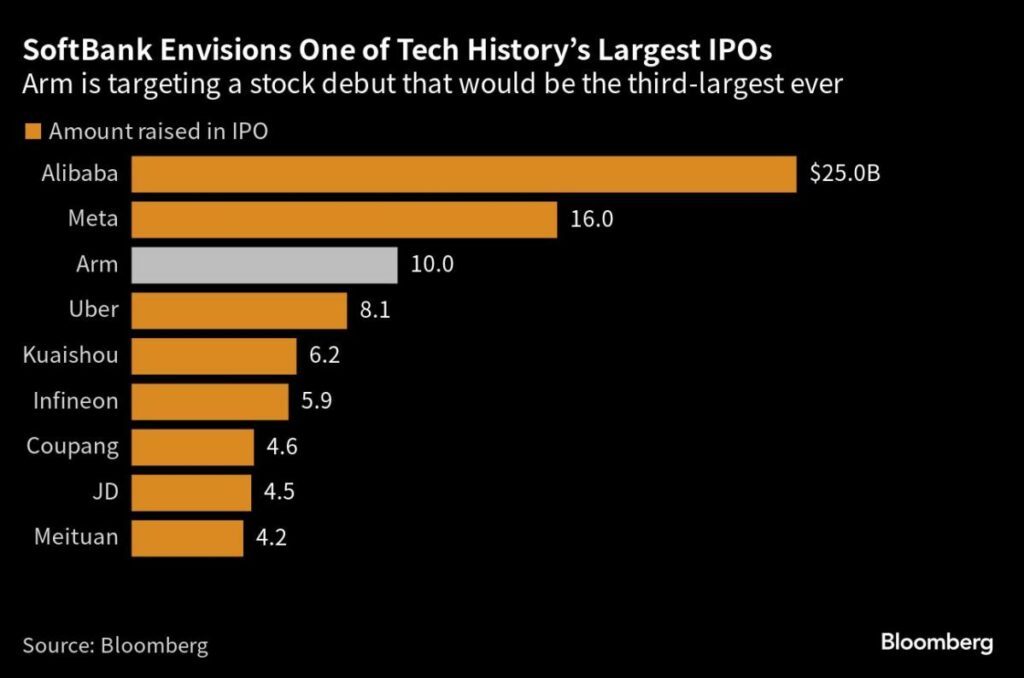

Customers of Arm including Apple, Nvidia, Alphabet and Advanced Micro Devices (AMD) have reportedly agreed to invest in the chip designer’s initial public offering. Intel, Samsung Electronics, Cadence Design Systems and Synopsys have also agreed to participate as investors in the offering. The talks are ongoing and some other potential investors are also in discussions to invest in the IPO. SoftBank Group, which owns Britain-based Arm, is targeting a valuation of USD50B-55B. (Gizmo China, Reuters)

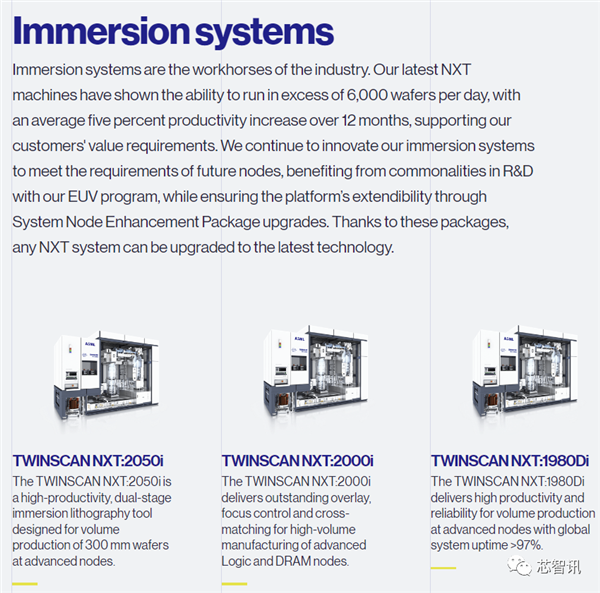

As new Dutch export control regulations take effect, the Netherlands’ chipmaking equipment giant ASML has indicated that it has obtained licenses to be able to continue shipments of chip tools to China until the end of 2023. The Dutch licensing authorities have issued the licenses they need as of 1 Sept 2023 to be able to continue shipments of the NXT:2000i and subsequent systems in 2023. Under the Netherlands export control rules, it expects 24 permits to be applied for once and 20 permits on an annual basis. ASML sells about 80 DUVs to China per year, accounting for around 15% of the company’s revenue. (My Drivers, SCMP, Seeking Alpha, China Daily, Bloomberg, Global Times)

Mustafa Suleyman, chief executive of Inflection and a co-founder of Google’s DeepMind, has indicated that Washington should restrict sales of the Nvidia chips that play a dominant role in training advanced AI systems to buyers who agree to safe and ethical uses of the technology. At a minimum, he added, that should mean agreeing to abide by the same undertakings that some of the leading US AI companies made to the White House in July, such as allowing external tests before releasing a new AI system.(Financial Times, CN Beta)

The traditional semiconductor packaging production line usually needs a large amount of manpower. Samsung Electronics has set a goal of converting its packaging plants to be human labour-free by 2030. According to Samsung TSP (Test & System Package) Head Kim Hee-rye, starting in June 2023, Samsung is building manless production lines for its packaging plant. Samsung’s packaging factories are located in Cheonan and Wonyang, South Korea, where the unmanned production lines are built. However, the proportion of unmanned production lines accounts for only about 20% of the current Samsung packaging production lines. Samsung plans to convert the entire packaging factory into an unmanned factory by 2030. The company has achieved complete automation through transportation equipment such as wafer transfer devices, elevators, and conveyor belts. This has significantly reduced waiting time and movement time during the process and has also improved production efficiency.(CN Beta, Equipment News, ICSmart, Posten)

China is reportedly set to launch a new state-backed investment fund that aims to raise about USD40B for its semiconductor sector, as the country ramps up efforts to catch up with the U.S. and other rivals. It is likely to be the biggest of three funds launched by the China Integrated Circuit Industry Investment Fund, also known as the Big Fund. Its target of CNY300B (USD41B) outdoes similar funds in 2014 and 2019, which according to government reports, raised CNY138.7B and CNY200B respectively. One main area of investment will be equipment for chip manufacturing. (Engadget, Reuters, DW, VOA Chinese, Zaobao)

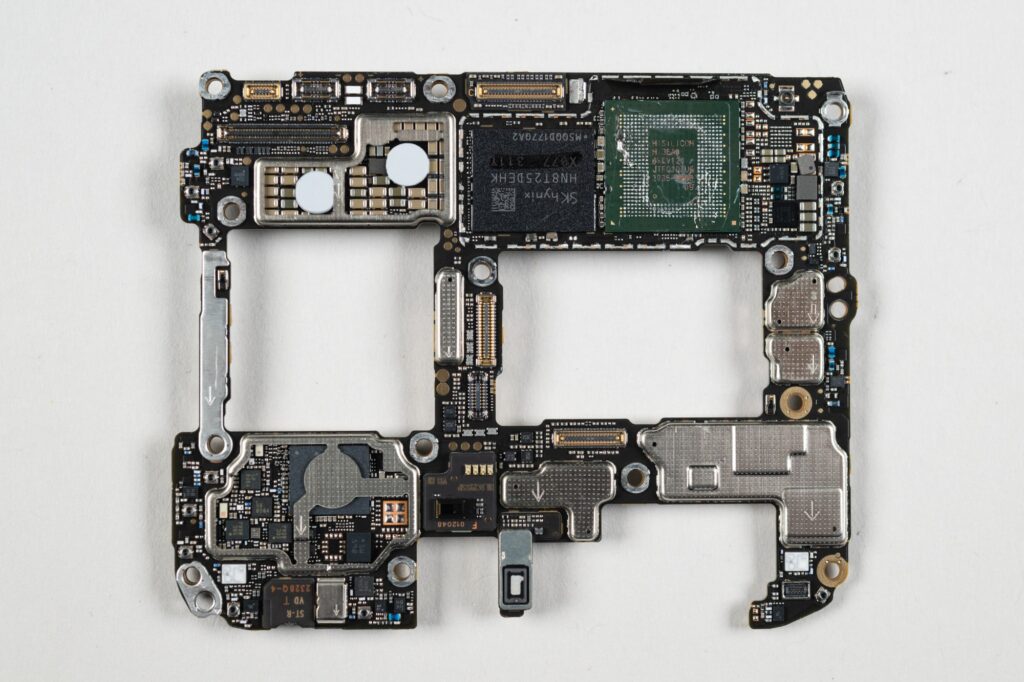

Huawei Technologies and China’s top chipmaker SMIC have built an advanced 7nm processor to power its latest smartphone, according to a teardown analysis by TechInsights. Huawei’s Mate 60 Pro is powered by a new Kirin 9000s chip that was made in China by Semiconductor Manufacturing International Corp (SMIC). From 2019, the U.S. has restricted Huawei’s access to chipmaking tools essential for producing the most advanced handset models, with the company only able to launch limited batches of 5G models using stockpiled chips. The Kirin 9000S made by SMIC’s 7nm process was thought to be impossible given the import ban on key manufacturing equipment — namely the EUV lithography machines from Dutch firm ASML (Advanced Semiconductor Materials Lithography). ASML CEO Peter Wennink has recently expressed that “the Mate 60 Pro should not come as a surprise to anyone, as the restrictions essentially forced the Chinese to double down on innovation”. (Engadget, Bloomberg, Bloomberg, Bits and Chips)

According to Samsung’s Chief Marketing Officer for Europe, Benjamin Braun, the actual sales of their foldable devices have exceeded those of the Note series in Europe. The head of Samsung’s mobile division, TM Roh, has said that sales globally were almost on par between its foldable series and what it used to sell each year in Galaxy Note models. He has also said the company expected to beat that target with the Z Flip5 and Z Fold5.(Android Central, Android Police, CNET)

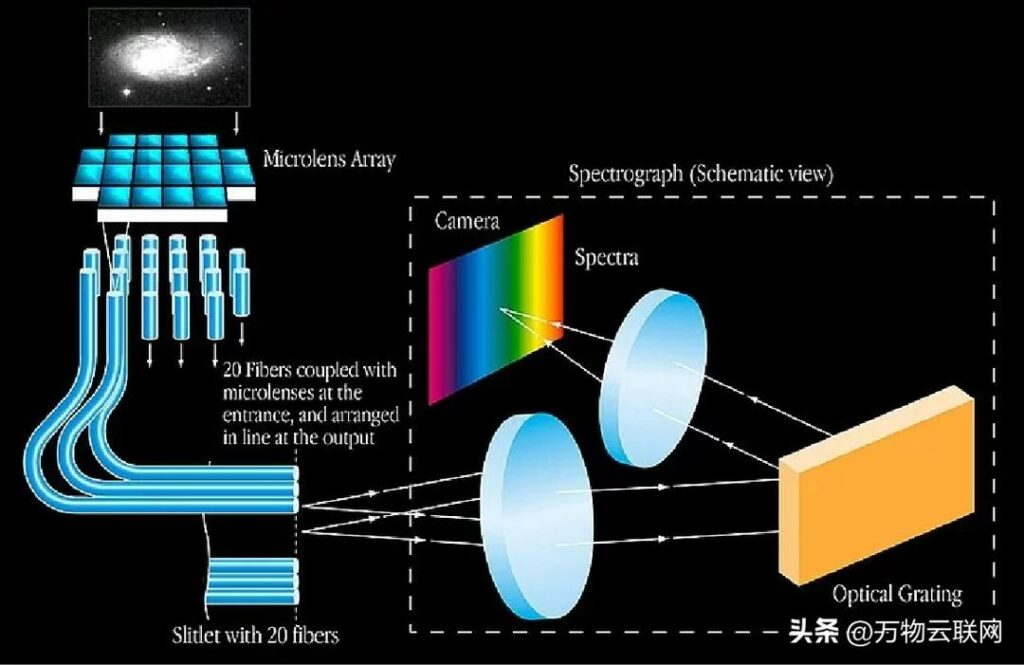

Samsung Display and LG Display have reportedly approached Apple to prove their micro-lens array (MLA) OLED display technology that could make iPhone screens consume way less power at the current brightness levels, or, alternatively, drastically increase their brightness at the same power consumption. The MLA displays use tiny lenses to alter the light path directly towards the surface of the display panel and to the user’s eyes instead of having it refracted in other directions. This significantly increases the brightness of the display and consumes much less battery to achieve one and the same luminance. (Phone Arena, The Elec)

Visionox will reportedly showcase a new display with rounded corners and extra-thin bezels on at least three sides. The prototype panel also has an advanced refresh rate and dimming specs, and it saves power thanks to LTPO technology. Visionox reportedly uses “0.8mm BM black border” technology to shrink the borders to just 1.5mm thick, even at the corners. The new panel is also rumored to support both DC-like and PWM dimming, with a dimming frequency of up to 3,840Hz. It also integrates LTPO technology for features such as an always-on display and has a 1.5K resolution.(Gizmo China, Notebook Check, Weibo, PC Home, QQ.com)

ZTE’s nubia is working on a smartphone featuring Sony’s IMX989 1” sensor. nubia will release the phone after it manages to optimize its volume. Its rear lens protrusion is very obvious. After all, this is the first 35mm lens phone with IMX989 sensor, and it still focuses on portrait photography. (GSM Arena, Weibo, My Drivers)

OnePlus’ newest Oxygen OS 14 Closed Beta references a new “Dedicated RAM for games” feature. This feature could allocate some dedicated RAM space to games, improving the startup speed for the game and minimizing loading time. The feature could be an extension of the existing “Quick Startup” feature present within the “Games” app on Oxygen OS 14.(Android Headlines, Twitter)

Samsung has announced that it has developed the industry’s first and highest-capacity 32-gigabit (Gb) DDR5 DRAM1 using 12nm class process technology. Previously, DDR5 128GB DRAM modules manufactured using 16Gb DRAM required the Through Silicon Via (TSV) process. However, by using Samsung’s 32Gb DRAM, the 128GB module can now be produced without using the TSV process, while reducing power consumption by approximately 10% compared to 128GB modules with 16Gb DRAM. This technological breakthrough makes the product the optimal solution for enterprises that emphasize power efficiency, such as data centers.(Samsung, GizChina, Neowin, IT Home)

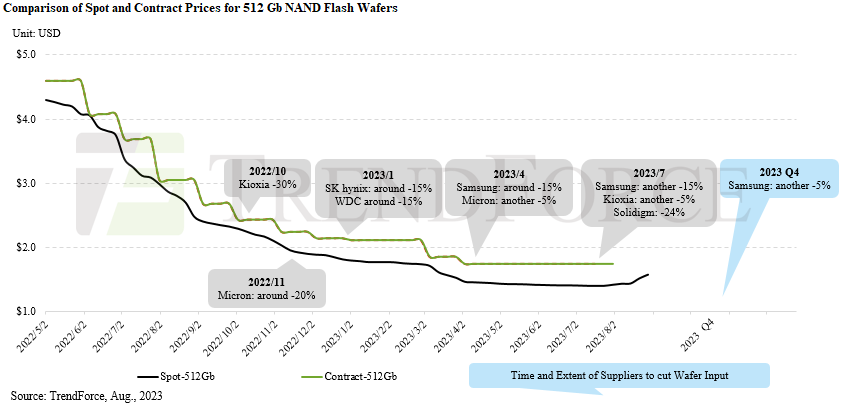

Recently, the spot market for NAND Flash chips has seen a rise in active price inquiries for certain products, a movement driven by successful increases in wafer contract prices. TrendForce reports this uptick primarily stems from negotiations in late Aug 2023 between NAND Flash suppliers and key Chinese module makers. These discussions led to a new wafer contract that successfully boosted the price of 512 Gb wafers by about 10%. Other suppliers have also raised prices for their comparable products, signaling a shift in supplier sentiment: they are now less inclined to finalize deals at lower prices. This change has contributed to a short-term surge in the wafer spot market. Nevertheless, whether this surge in procurement is supported by actual end-user demand remains uncertain, as these orders have arisen in reaction to adjustments in supply-side pricing. (TrendForce, TrendForce)

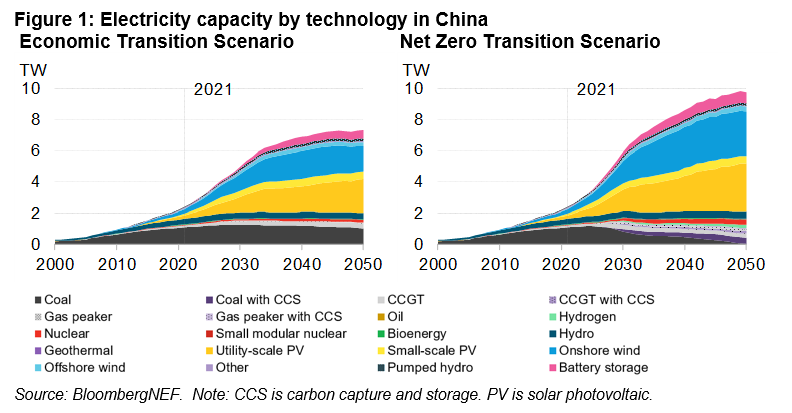

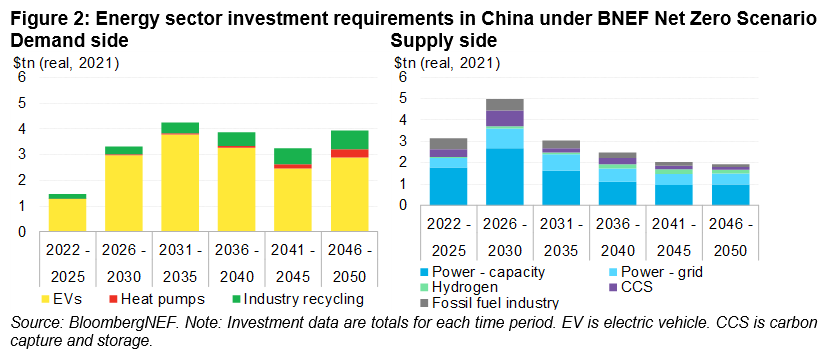

China’s transition to a net-zero economy by 2050 represents at least a USD37.7T investment opportunity in the country’s energy system, according to BloombergNEF (BNEF). China is already the world’s largest market for renewables, however it also remains the largest consumer of coal and, as a result, the world’s largest CO2 emitter. BNEF’s analysis finds that maximizing deployment of solar and wind, complemented by targeted additions of energy storage, nuclear and carbon capture and storage (CCS) for thermal power plants, is the cheapest way for China to decarbonize its power supply. In BNEF’s Net Zero Scenario (NZS), which charts a pathway for China to reach net zero by 2050 while keeping global temperature rise well below 2 degrees Celsius, wind and solar cumulative installations reach over 6,700 gigawatts by 2050, up from 800 gigawatts in 2022. By 2050, China’s NZS requires 352 gigawatts of nuclear power capacity, up from 57 gigawatts in 2022. (IT Home, GizChina, Bloomberg)

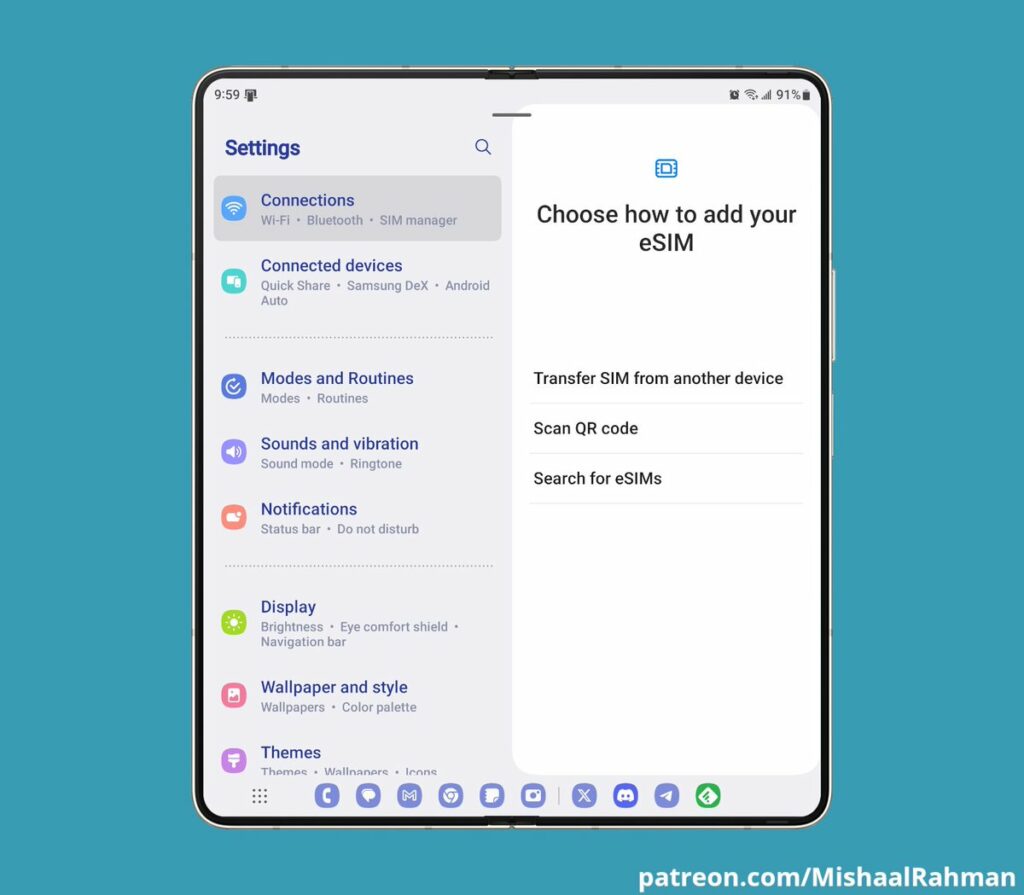

Samsung has developed its own eSIM transfer feature. Samsung’s One UI 5.1 now supports device-to-device eSIM transfer as well as pSIM-to-eSIM (physical SIM to an eSIM) conversion. Firstly, open the Settings app on the phone you want to transfer your eSIM to. Now go to Connections > SIM Manager and tap on “add eSIM”, followed by “other ways to connect to a mobile network.” You should now see an option to “transfer SIM from another device”. Tap on it and go to your old phone, which must have a secure lock screen and be close to your new phone. Unlock your old phone and tap on “Transfer” to confirm. (Android Headlines, Twitter)

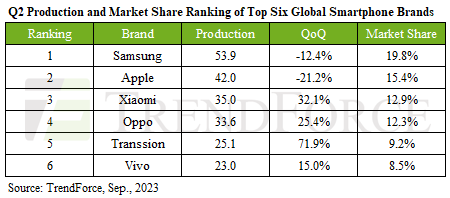

TrendForce reports global smartphone production has faced back-to-back quarterly declines. After plunging nearly 20% in 1Q23, 2Q23 numbers dwindled further by approximately 6.6%, settling at a modest 272M units. The 1H23 clocked in at a mere 522M units—marking a 13.3% YoY decline and setting a ten-year low for both individual quarters and the first half of the year combined. TrendForce identifies three key reasons behind this slump in production: The easing of pandemic restrictions in China failed to spur demand; The demographic dividend from the emerging Indian market has yet to translate into tangible demand. Initially, it was estimated that brands would return to normal production levels as excess inventory was cleared. However, the current economic downturn has kept consumer spending in check—undermining first-half production more than expected. (CN Beta, TrendForce, TrendForce)

According to CEO Thomas Ingenlath, the Swedish electric vehicle maker Polestar plans to launch a smartphone in Dec 2023. This is part of the joint venture announced in Jun with Chinese smartphone maker Xingji Meizu. Geely founder and chairman Eric Li’s smartphone company Xingji Technology acquired Meizu in Jul 2022. The two companies will jointly develop a user interface in Polestar EVs sold in China. The phone is being designed by the design team at Polestar and manufactured by Meizu.(Android Authority, TechCrunch, CNBC, Android Headlines, 36Kr)

Wedbush’s Dan Ives has commented on the reported China government Apple iPhone sales ban, and he feels that not only is it just a small speed bump on the road, but sales in the country will be up in 2024. In a worst case, Ives is expecting maybe a sales impact from the ban to be about 500,000 units. This is relative to what he says is 45M units sold in total in China. (Apple Insider, Apple Insider, CNBC, RFI)

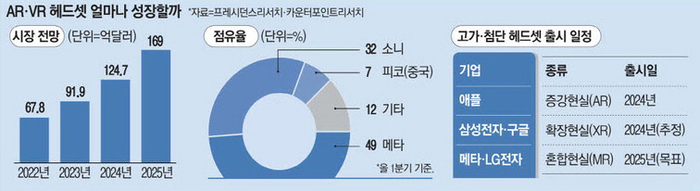

Meta has reportedly partnered with LG Electronics to develop advanced Mixed Reality (MR) headsets. MR combine Augmented Reality (AR), which overlays virtual objects on the real environment, with Virtual Reality (VR), which creates a completely virtual world. Meta has signed a non-disclosure agreement (NDA) with LG Electronics to develop advanced headsets with the goal of unveiling them in 2025. Meta has announced a 4-year development plan: plans to upgrade the Quest 3 headset at the end of 2023; plans to launch an AR headset for internal demonstrations only in 2024, code-named Orion; plans to release the first in 2025 Smart glasses with a display, while releasing a neural interface smartwatch designed to control those glasses; plans to launch a consumer AR headset, code-named Artemis, in 2027. (CN Beta, Pulse News, Patently Apple, UploadVR, MK)

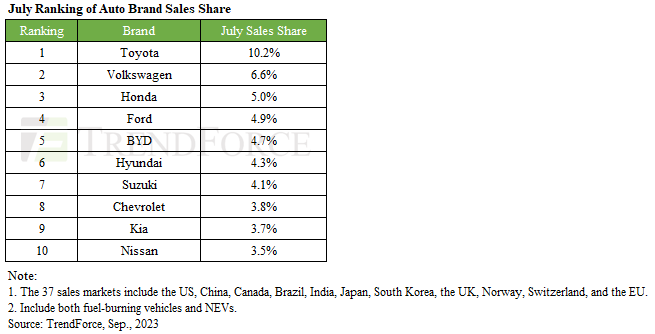

In Jul 2023, global car sales faced a noticeable downturn, with 5.44M vehicles rolling off the lot across 37 key markets—a 10% dip compared to Jun’s figures, according to TrendForce. However, the top 10 car brands managed to tighten their grip on the market, commanding 50.7% of total sales for an increase of 2.3 percentage points from the previous month. This trend indicates a growing concentration of power among leading auto brands. Leading the pack were Toyota and Volkswagen, clinching the first and second spots respectively for another month. Toyota snagged 10.2% of the global market share. Despite witnessing a 5% sales decline MoM, the automotive giant saw a sales uptick in the US market, buoyed by a replenishment of inventory. (TrendForce, TrendForce)

Mercedes-Benz has unveiled its “close-to-production” Concept CLA Class EV, boasting of very long range and rapid charging via an 800-volt architecture. The four-door sedan is the first in the company’s line of Mercedes-Benz Modular Architecture (MMA) EVs, which will include a shooting brake and a pair of SUVs. The CLA Class is slated to go into production as a real EV in late 2024. MMA was conceived for the automaker’s entry-level CLA Class vehicles as an all-new “electric first” design.(Engadget, Mercedes-Benz)

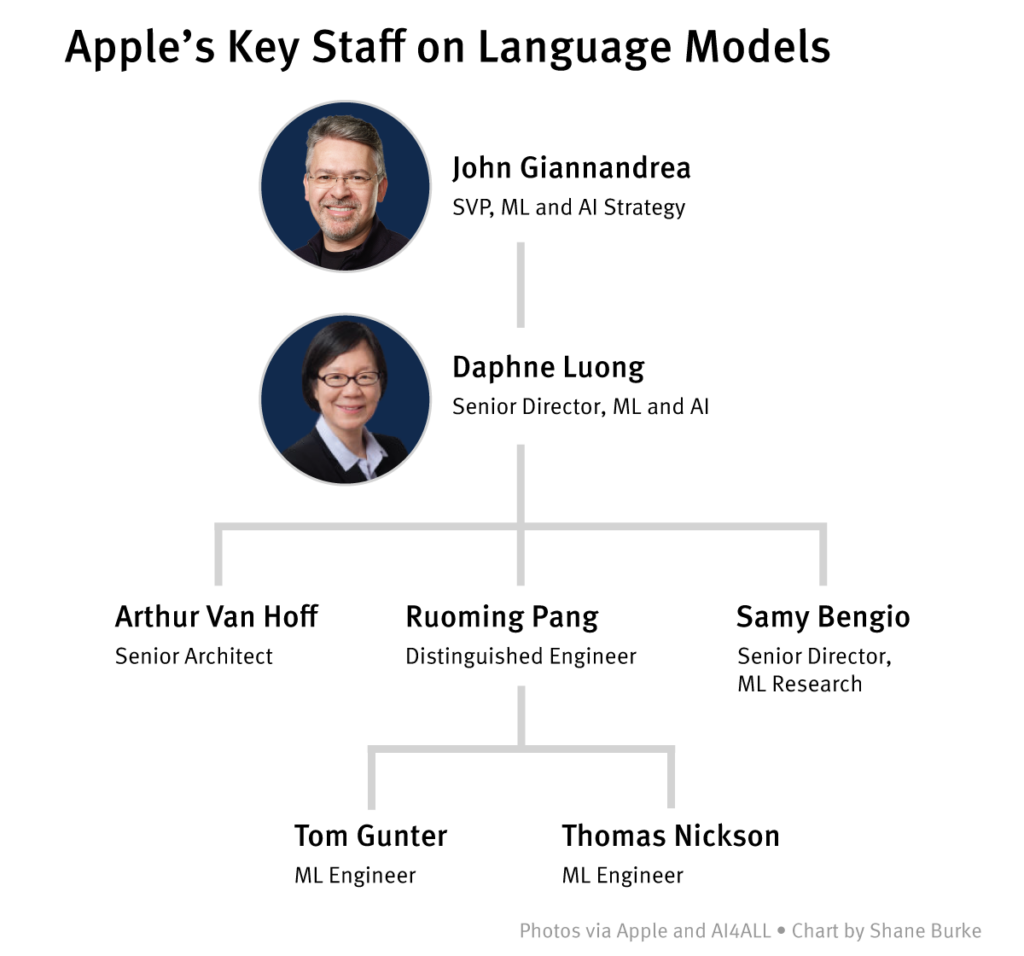

Apple is reportedly spending millions of dollars on research and development daily in order to boost the conversational features of Siri. Apple’s unit working on conversational AI is called Foundation Models, while the company has created two other teams working on developing image or language models. Apple’s visual intelligence unit is working on generating images, videos and 3D scenes, similar to the likes of Midjourney or OpenAI’s Dall-E 2, while another team is working on multimodal AI that could recognise and produce images, videos and text. One of these models could be used to create a chatbot aimed at users of AppleCare. Meanwhile, the company is working on features for Siri that will allow iPhone users to automate multi-step tasks with a simple voice command. Apple’s voice assistant could be used to create a GIF using the last five photos taken and send it to a friend. (CN Beta, Apple Insider, The Information, Live Mint)

Hyundai Motor America is bringing in-vehicle payments to customers with the introduction of Hyundai Payi. The Hyundai Pay system allows customers to find and pay for things with their vehicle’s touchscreen using securely stored credit card information. Hyundai has partnered with Parkopedia to launch Hyundai Pay’s first service, a new parking payment system. This system enables U.S. drivers to locate, reserve and pay for parking at 6,000 locations – all from inside their vehicle, after an initial set-up. Hyundai Pay launches with the all-new 2024 Hyundai Kona available in dealerships fall 2023. (CN Beta, The Verge, PR Newswire)