10-19 #NeverForget : Nvidia is collaborating with Hon Hai to accelerate the AI industrial revolution; Xiaomi has announced HyperOS; Apple is reportedly working with suppliers to develop a foldable iPad; etc.

Qualcomm has announced that they are building on their long-standing collaboration with Google by bringing a RISC-V based wearables solution for use with Wear OS by Google. Qualcomm refers to its chips as platforms and sums up the benefit of RISC-V as an open-source instruction set architecture (ISA), RISC-V encourages innovation by allowing any company to develop completely custom cores. This allows more companies to enter the marketplace, which creates increased innovation and competition. RISC-V’s openness, flexibility, and scalability benefits the entire value chain – from silicon vendors to OEMs, end devices, and consumers.(Android Authority, Qualcomm, Reuters, 9to5Google, Yahoo)

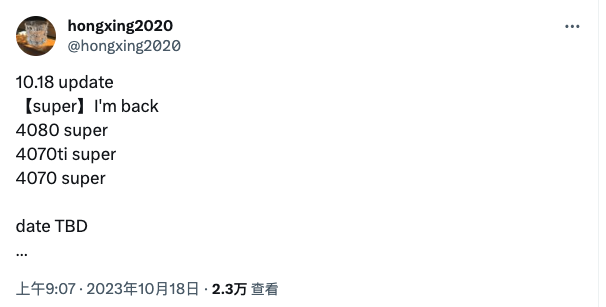

Nvidia is allegedly introducing a SUPER refresh for some of their current models. At least three graphics cards are in consideration for updates. The rumored NVIDIA refresh is said to include three cards: the RTX 4080 SUPER, RTX 4070 Ti SUPER, and RTX 4070 SUPER. NVIDIA may also be introducing its first Ti SUPER card, which would represent a departure from their traditional naming conventions. The “SUPER”, on the other hand, was used for mid-series updates when NVIDIA aimed to refresh multiple SKUs, like in this case. (Android Headlines, Twitter, VideoCardZ)

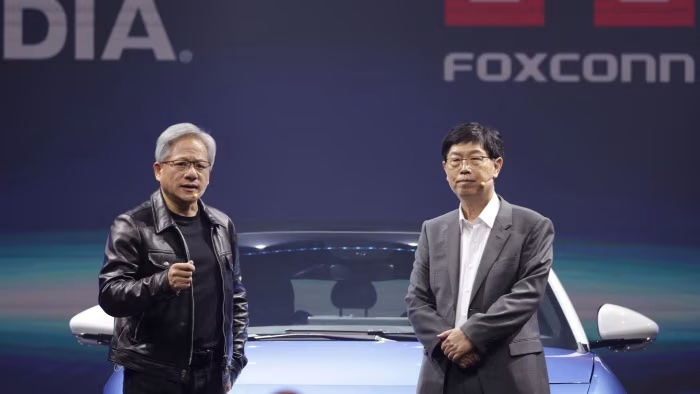

Nvidia has announced that it is collaborating with Hon Hai Technology Group (Foxconn) to accelerate the AI industrial revolution. Foxconn will integrate NVIDIA technology to develop a new class of data centers powering a wide range of applications — including digitalization of manufacturing and inspection workflows, development of AI-powered electric vehicle and robotics platforms, and a growing number of language-based generative AI services. The collaboration starts with the creation of AI factories — an NVIDIA GPU computing infrastructure specially built for processing, refining and transforming vast amounts of data into valuable AI models and tokens — based on the NVIDIA accelerated computing platform, including the latest NVIDIA GH200 Grace Hopper Superchip and NVIDIA AI Enterprise software. Foxconn is also developing its smart solution platforms based on NVIDIA technologie.(CN Beta, BBC News, SCMP, Nvidia, TechCrunch)

US Commerce Secretary Gina Raimondo has announced that the US government is tightening its restrictions on the export of artificial intelligence (AI) chips and manufacturing equipment to China. The revisions come roughly a year after the export controls were first launched to counter the use of the chips for military applications that include the development of hypersonic missiles and artificial intelligence. She has explained that these export controls are intended to protect technologies that have clear national security or human rights implications. The vast majority of semiconductors will remain unrestricted. But when they identify national security or human rights threats, they will act decisively and in concert with US allies. (CN Beta, AP News, Axios, Washington Post, RFI)

Xiaomi 14 series is expected to launch in Nov 2023 and it will likely feature three models — Xiaomi 14, Xiaomi 14 Pro, and Xiaomi 14 Ultra. Xiaomi 14 Pro is allegedly going for a flat display instead of a curved one. The Xiaomi 14 Pro will measure 161.6 x 75.3 x 8.7mm based on these renders, and the camera module is going to be up to 13.1mm high. The Xiaomi 14 Pro will feature a 6.6-inch flat 2.5D display with a punch-hole camera placed at the centre.(Android Authority, 91Mobiles)

According to Digitimes, Apple is working with suppliers to develop a foldable iPad, and small-scale production could begin as early as the end of 2024. This suggests that Apple may be announcing this product in late 2024 or early 2025. Apple has apparently been working on foldable products for 4 years and continuously made design changes in this time, planning to release a foldable iPad before working on a foldable iPhone. Apple chose to focus on the iPad because it makes up a comparatively small proportion of the company’s sales, meaning that potential issues are easier to manage and less impactful. A main issue is said to be the device’s panel and hinges, with Apple being particularly concerned about the display creasing. The company is purportedly looking to Samsung and LG to provide a display that mitigates the creasing effect using mechanical design solutions. (Digitimes, CN Beta, MacRumors)

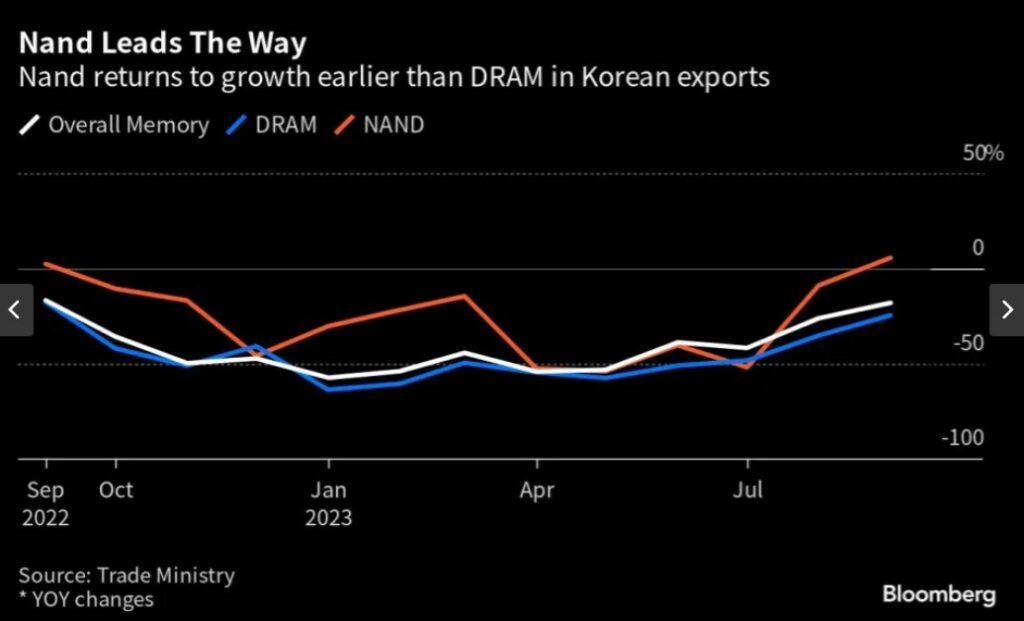

South Korea’s exports of Nand flash memory rose for the first time in a year, adding to evidence that the slump in semiconductor demand is bottoming out. Shipments increased 5.6% from a year earlier in Sept 2023, compared with a 8.9% fall in Aug, according to the trade ministry. Exports of dynamic random access memory, the other pillar of the memory-chip market, declined 24.6% in the same period, less than 35.2% a month earlier. Total semiconductor exports to China remained in the doldrums, falling 22.7% from a year earlier in Sept, the trade ministry data showed. Shipments to the European Union jumped 56.5% while those to the US slid 30.5%. (CN Beta, Bloomberg, BNN, Yahoo)

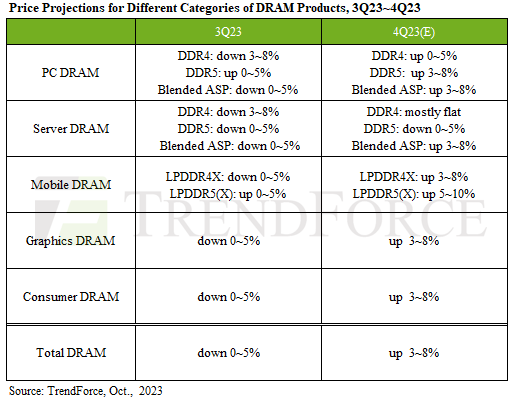

TrendForce reports indicate a universal price increase for both DRAM and NAND Flash starting in 4Q23. DRAM prices, for instance, are projected to see a quarterly surge of about 3-8%. Whether this upward momentum can be sustained will hinge on the suppliers’ steadfastness in maintaining production cuts and the degree of resurgence in actual demand, with the general-purpose server market being a critical determinant. Inventories of mobile DRAM have bounced back to healthy levels sooner than other sectors, thanks to price elasticity driving an increase in per-device capacity, and revitalizing purchasing enthusiasm in 2H23. On the other hand, although 4Q23 smartphone production has not reached the previous year’s levels for the same period, a seasonal increase of over 10% is still supporting demand for mobile DRAM. However, it is crucial to note that current manufacturer inventories remain high, and production cuts haven’t yet altered the oversupply situation in the short term. LPDDR4X or those from older manufacturing processes, the estimated contract price increase will be about 3–8% for the quarter. In contrast, LPDDR5(X) appears to be in tighter supply, with projected contract price increases of 5–10%. (TrendForce, TrendForce)

The rapid growth of Compute Express Link (CXL) – emerging as the next-generation DRAM standard – is capturing the semiconductor industry’s attention. Both Samsung Electronics and SK hynix view CXL as a game-changing technology for the next-gen memory market, the next step after High Bandwidth Memory (HBM). Consequently, they are investing aggressively to secure an early foothold in this domain. According to market research firm Yole Group, the global CXL market is predicted to reach USD15B by 2028. While currently less than 10% of CPUs are compatible with the CXL standard, it is anticipated that by 2027, all CPUs globally will be designed to interface with CXL. At the heart of the CXL market is DRAM. Yole Group projects that by 2028, USD12B, or 80% of total CXL market revenue, will come from DRAM. This significant DRAM market potential is due to its “scalability”. (CN Beta, Business Korea, Yole Development)

Samsung Electronics has confirmed naming its 5th generation HBM3E product “Shinebolt.” As Samsung speeds up the development and marketing of HBM3E, it is expected to closely trail the leader in this sector, SK hynix. Samsung Electronics is sending Shinebolt prototypes, a product of HBM3E, to client companies for quality approval tests. The prototype stacks 24 gigabit (Gb) chips in 8 layers, and it is reportedly soon to finish the development of a 36 gigabyte (GB) product with 12 layers. The Shinebolt’s maximum data transfer speed (bandwidth) is approximately 50% higher than HBM3, reaching 1.228 terabytes (TB). (CN Beta, WCCFTech, IT Home, Tweak Town, Business Korea)

Seagate has announced the Exos X24 at 24TB, the highest capacity nearline disk drive using conventional perpendicular magnetic recording (PMR) technology, giving it a 2TB capacity advantage over rivals Toshiba and Western Digital. The X24 succeeds the Exos X20, a 20 TB maximum capacity drive announced at the end of 2021. Both drives are helium-filled, with ten platters spinning at 7,200 rpm, and use single-port 6 Gbps SATA or dual-port 12 Gbps SAS interfaces. They have five-year warranties and a 2.5 million hour mean time before failure (MTBF) rating. The X20 is fitted with a 256 MB cache, which the X24 doubles to 512 MB. (CN Beta, Seagate, Block and Files, Techgoing)

CATL is showcasing “Shenxing” superchargeable batteries, Kirin batteries and sodium-ion batteries. The reason why sodium-ion batteries have attracted much attention is that they are cheap, stable in energy, more resistant to low temperatures, and have good charge and discharge rate performance. They can meet the energy density requirements of two-wheeled electric vehicles, power tools, energy storage, and A00-class electric vehicles. , giving full play to the excellent safety characteristics of sodium-ion batteries. In addition, sodium resources are abundantly in the nature. Data show that the abundance of sodium in the earth’s crust is as high as 2.75%, and it is distributed around the world. The amount of resources in China is not low, so the cost of sodium ore resources is extremely low, only 2 yuan/kg. CATL is already developing second-generation sodium-ion batteries. The energy density can be increased to 200Wh/kg. This level is similar to the energy density of the current mainstream lithium iron phosphate batteries. It is beginning to approach ternary lithium batteries and is more practical.(CN Beta, My Drivers, Benchmark Source)

BMW, parent company to Mini and Rolls-Royce, has announced its intention to adopt Tesla’s electric vehicle charging standard for its future EVs. BMW said that owners of electric vehicles with the Combined Charging System (CCS) outlet will get access to Tesla’s Supercharger network in early 2025, most likely through the use of an adapter. BMW will also start producing EVs with Tesla’s charging standard built into the vehicle that same year. BMW’s current EV lineup includes the iX, i4, and i7 as well as Mini Cooper electric models and the ultra-luxury Rolls-Royce Spectre. All currently come with the CCS plug for DC fast charging. (The Verge, InsideEVs, Electrek, Engadget)

Netflix plans to open new destinations where fans can immerse themselves in the worlds of their favorite TV shows, shop for clothing, eat themed food and maybe even try a Squid Game obstacle course. Dubbed Netflix House, the venues will feature a mix of retail, dining and live experiences, according to Josh Simon, the company’s vice president of consumer products. The streaming TV pioneer plans to open the first two in the US in 2025 and then expand the concept around the world.(Digital Trends, Android Authority, Bloomberg)

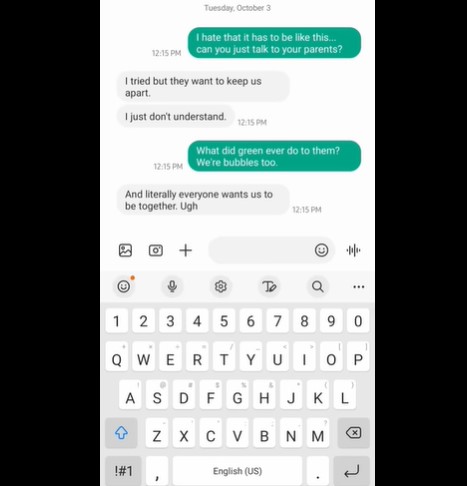

Samsung is joining Google in urging Apple to support RCS. The company has released a short video that shows how people might feel when they are left out of group chats when their phone does not support Apple’s iMessage. The video shows not to distinguish between blue bubbles and green bubbles. While Apple supports SMS, it has not adopted RCS, which Google developed to replace the age-old SMS standard. RCS supports a lot of advanced and modern messaging features, such as group chat, read/sent receipts, the ability to send high-resolution images and videos, stickers, modern emojis, voice messages, and more.(GSM Arena, SamMobile, Gizmo China)

Apple has come up with a way to update an iPhone still in its packaging, with a system allowing for iOS updates to be applied to unopened smartphones while still in an Apple Store. Bloomberg’s Mark Gurman claims that Apple has a system that can update the operating system of iPhones before they get sold. Crucially, it can do so without opening the box. Consisting of a “pad-like device”, store employees place unopened iPhone boxes onto it to trigger an update. The pad wirelessly turns on the iPhone, runs the software update, then turns it off again.(Apple Insider, Bloomberg, CN Beta)

Xiaomi has announced a new Android-based operating system called HyperOS. The company has confirmed that it will be available globally and debut on the upcoming Xiaomi 14 series. HyperOS will also gradually replace Xiaomi’s legacy MIUI operating system, which has been around for 13 years. HyperOS is designed to cater to Xiaomi’s wide product range that goes beyond smartphones. The company says the new software will tie in its entire ecosystem of products across 200 categories, including smart home devices, cars, and more. Xiaomi’s founder Lei Jun has explained that HyperOS is “based on the integration of the deeply evolved Android and the self-developed Vela system, completely rewriting the underlying architecture, and preparing a public base for the Internet of Everything for tens of billions of devices and tens of billions of connections in the future.(Android Authority, Yahoo, IT Home)

Sony has announced that it has established “Sony Innovation Fund: Africa” as an initiative to support the growth of the entertainment businesses in Africa. Since 2016, Sony has run a variety of funds, including the Sony Innovation Fund (2016), the Innovation Growth Fund (2019), and the Sony Innovation Fund: Environment (2020). Its latest initiative, the Sony Innovation Fund: Africa, aims to support the growth of the entertainment businesses in Africa. It will invest in seed to early-stage startups in the entertainment industry in Africa, including startups in the gaming, music, movie and content distribution sectors. Sony is initially allocating USD10M towards such investments.(VentureBeat, Disrupt Africa, Sony, Business Explainer)

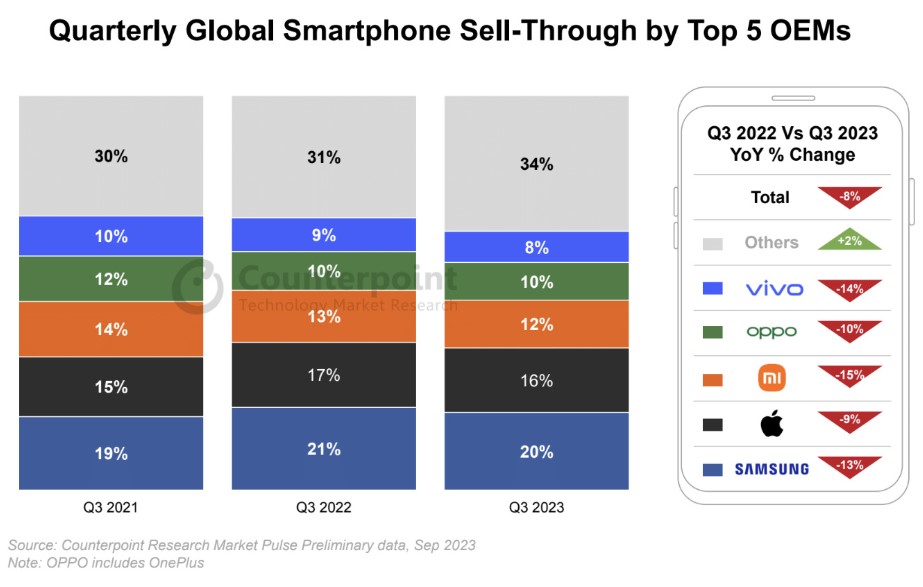

Global smartphone sell-through volumes fell 8% YoY in 3Q23, the ninth consecutive quarter to record a decline, but grew 2% QoQ, according to Counterpoint Research. Samsung continued to lead the global market, capturing a fifth of the total sales in Q3. The new generation of foldables received a mixed response, with the Flip 5 outselling its counterpart by nearly twice as much. However, Samsung’s A-series models remained market leaders in mid-price bands. Apple came in second with a 16% market share despite the limited availability of iPhone 15 series, which has been received well so far. (GSM Arena, Counterpoint Research)

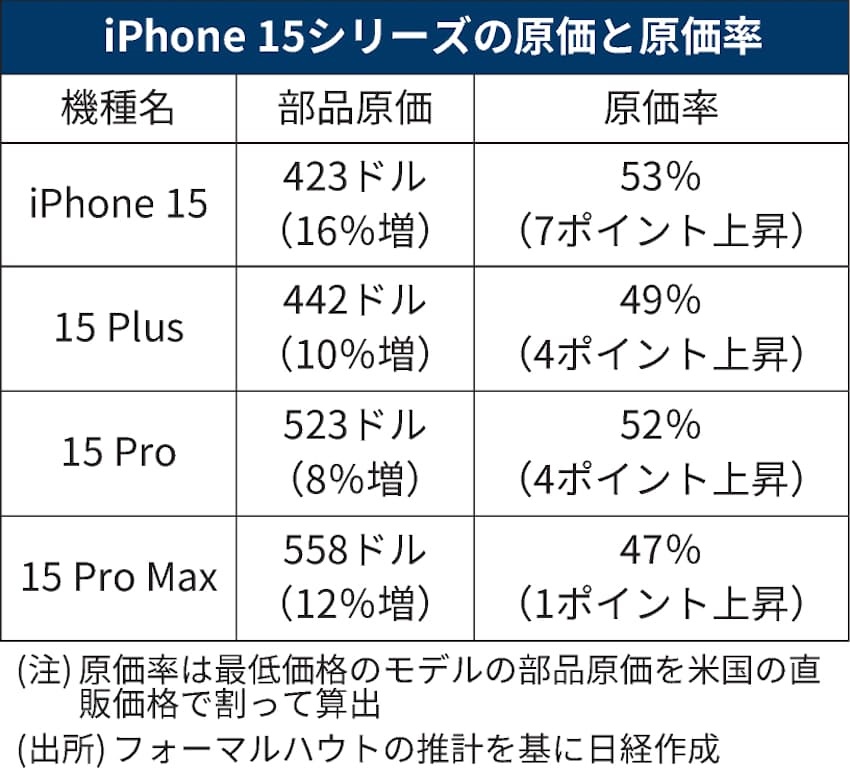

According to a teardown between Nihon Keizai Shimbun and Fomalhaut Techno Solutions of Japan, Apple iPhone 15 Pro Max costs a lot more than the iPhone 14 Pro Max to produce. The bill of materials (BoM) for the iPhone 15 Pro Max is USD558, with a 47% parts-to-cost ratio. The figure is claimed to be about 12% more expensive than the iPhone 14 Pro Max. The display is 10% more expensive in the iPhone 15 Pro Max than the iPhone 14 version, while the titanium frame pushed costs up by 43%, and the A17 Pro chip costs 27% more than the A16 Bionic. The telephoto camera and its tetraprism system is also a massive 3.8 times more expensive than its predecessor. The iPhone 15 Pro costing Apple USD523 to produce, up 8% from its year-ago counterpart. The iPhone 15 Plus costs USD442, about 10% higher than the iPhone 14 Plus. The iPhone 15 is deemed to have the highest change in cost, with its USD423 BoM approximately 16% more expensive than the iPhone 14. (CN Beta, Tom’s Guide, Nikkei, Apple Insider)

India’s Trade Minister, Sunil Barthwal, has announced that India has decided not to put any restrictions on the import of laptops and other electronic devices. In August 2023, India announced new import restrictions. The restrictions imposed import license requirements on notebooks, tablets and other products. However, the latest news is that the Indian government has now decided to abandon this import restriction plan. The initial plan would have had big implications for brands such as Apple, Samsung, Dell, Lenovo, and HP. (GizChina, Economic Times, Money Control, IT Home)

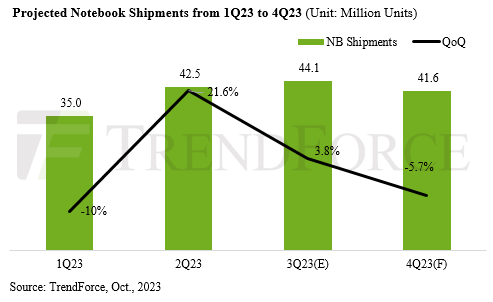

TrendForce reports that 2Q23 revealed notebook inventory channels displaying healthy levels. Both North America and Asia-Pacific regions are demonstrating a healthy appetite for mid and low-tier consumer models. This isn’t just a race to restock; it’s a strategic move to gear up for the anticipated back-to-school wave in 3Q23. And here is the zinger—just as Google prepped to roll out its licensing fees, Chromebook shipments hit a peak. This surge propelled 2Q23 notebook shipments to 42.52M units, marking a 21.6% quarterly leap. However, a look at the overall picture reveals a total of 77.5M units shipped in 1H23 —down 23.5% YoY. TrendForce further points out that for 2H23, growth momentum is anchored in the purchasing power of end consumers. 3Q23 notebook shipments are forecast to witness a moderate growth of 3.8%, tallying up to 44.13M units. Annual notebook shipments are projected to hit 163M units, marking a YoY decline of 12.2%. (TrendForce, TrendForce)

Garmin has announced that it is expanding its electrocardiogram (ECG) app to the epix Pro series, fēnix 7 Pro series, Venu 3 series and tactix 7 – AMOLED Edition smartwatches. The ECG App is an FDA-cleared app that allows users to record their heart rhythm and check for signs of atrial fibrillation (AFib) right from their smartwatch. Customers in the United States can use the app to record a 30-second electrocardiogram (ECG) and view their heart rhythm results immediately on the watch or, optionally, later in the Garmin Connect smartphone app.(Android Authority, Garmin)

General Motors’ plan to make more electric trucks has run into another snag. The company had originally planned to kick off production of its EV trucks at its Orion facility in Detroit in 2024. GM said it is delaying production “to better manage capital investment while aligning with evolving EV demand.” Another reason cited is “engineering improvements” aimed at improving profitability. Orion is where GM currently builds its Chevy Bolt EV and EUV, both of which are ceasing production at the end of 2023. GM has said it will build a new Chevy Bolt based on the automaker’s Ultium battery and drive technology — but has yet to say when that vehicle will go into production.(The Verge, NY Post, Bloomberg)

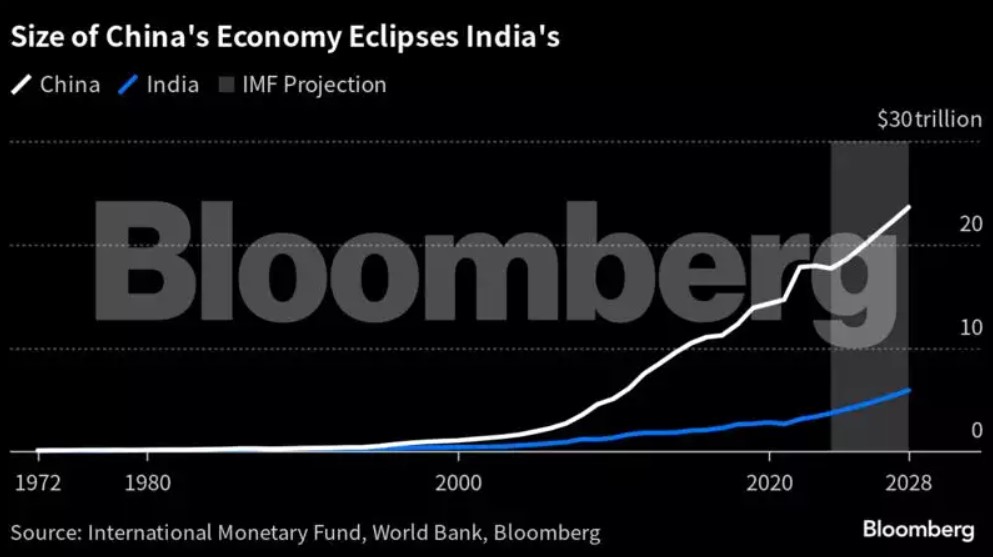

India’s impressive recent economic gains are unlikely to displace China as the world economy’s main growth engine anytime soon, according to HSBC. According to economists Frederic Neumann and Justin Feng, the numbers do not exactly add up, and runs on too few cylinders, while China is “simply too large to have its importance for the world economy readily eclipsed”. HSBC expects the gap between the two economies to continue to widen in the foreseeable future, expanding to USD17.5T by 2028, based on IMF forecasts. That is equal to the current size of the European Union’s economy. The gap between the two stood at USD15T in 2022. Even assuming zero growth in China, and a tripling of investment spending growth in India from its recent average, it would take another 18 years before India’s investment spending catches up to China’s, the economists wrote. Currently, China accounts for around 30% of world investment, while India’s share is less than 5%. Its share in global consumption also stands below 4%, compared to Beijing’s 14%. (CN Beta, Economic Times, Bloomberg, Sina)