11-25 #Drive : Honor is preparing for an IPO; Baidu has reportedly ordered AI chips from Huawei; Nvidia is reportedly delaying the launch of a new AI chip; etc.

MediaTek has announced Dimensity 8300, which is fabed on TSMC’s second-generation 4nm process. Dimensity 8300 features 4x Arm Cortex-A715 performance cores clocked at up to 3.35GHz alongside 4x Arm Cortex-A510 efficiency units at up to 2.2GHz clock speeds. All eight cores are based on the Armv9 CPU architecture and MediaTek claims up to 20% faster CPU performance and 30% peak gains in power efficiency compared to the outgoing Dimensity 8200. The new chip also boasts an Arm Mali-G615 MC6 GPU which brings up to 60% performance gains and 55% improved power efficiency at peak speeds compared to its predecessor. (GSM Arena, MediaTek, Liliputing)

Chip technology design maker Imagination Technologies allegedly plans to lay off 20% of the company’s staff. The U.K.-based company, which signed an agreement to supply Apple with chip technology in 2020, said it was cutting the staff because of a challenging “business environment” over the last 18 months. Imagination makes technology that competes with Arm, which recently went public, and had 559 staffers at the end of 2022. (CN Beta, Reuters, Design-Reuse)

Nvidia has introduced an AI foundry service to supercharge the development and tuning of custom generative AI applications for enterprises and startups deploying on Microsoft Azure. The Nvidia AI foundry service pulls together three elements — a collection of NVIDIA AI Foundation Models, NVIDIA NeMo framework and tools, and NVIDIA DGX Cloud AI supercomputing services — that give enterprises an end-to-end solution for creating custom generative AI models. Businesses can then deploy their customized models with NVIDIA AI Enterprise software to power generative AI applications, including intelligent search, summarization and content generation. (Nvidia, Electronics Weekly, VentureBeat)

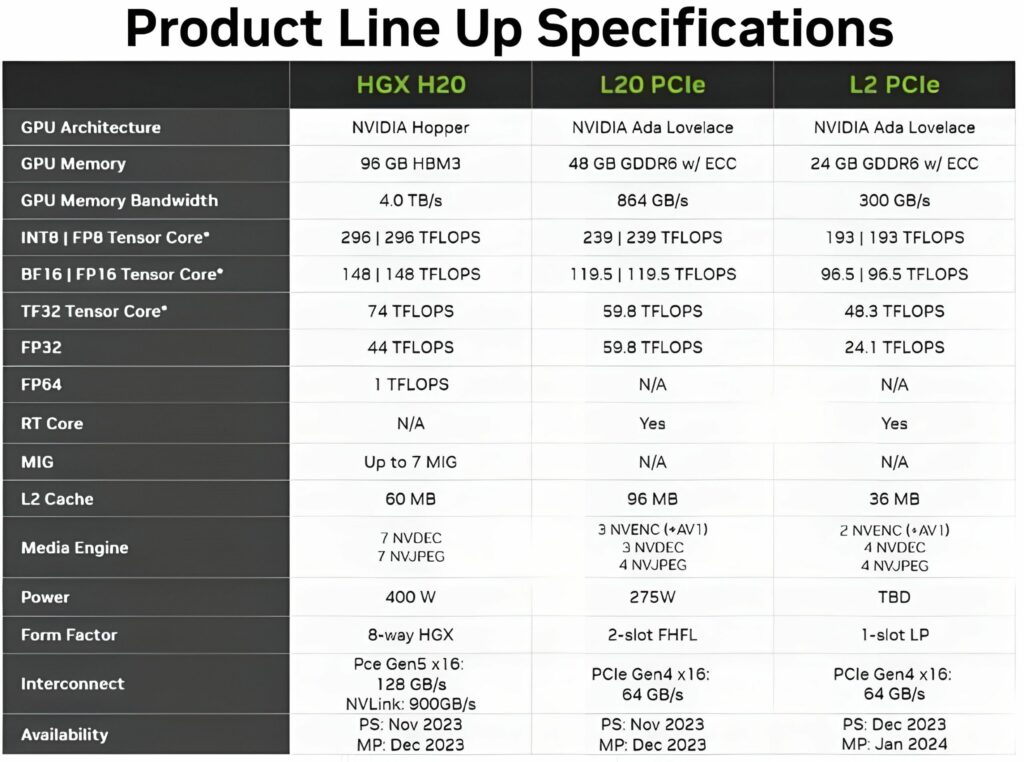

Nvidia has allegedly told customers in China it is delaying the launch of a new artificial intelligence chip it designed to comply with U.S. export rules until 1Q24. The delayed chip is the H20, the most powerful of three China-focused chips Nvidia has developed to comply with fresh U.S. export restrictions, and could complicate its efforts to preserve market share in China against local rivals like Huawei. (Neowin, Reuters)

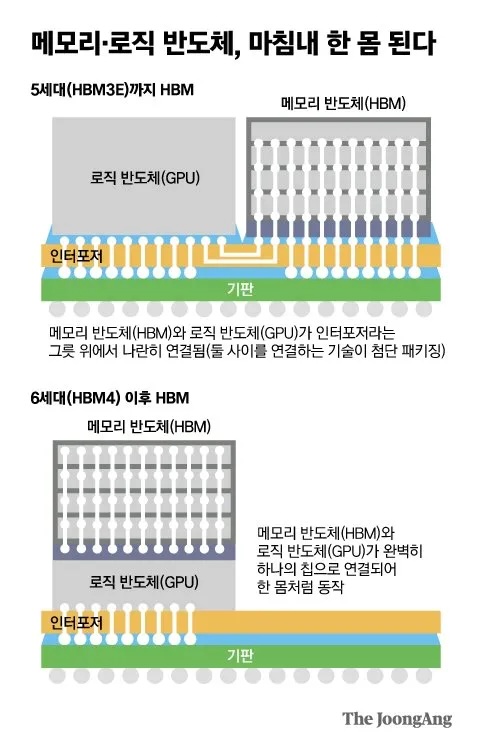

SK Hynix and Nvidia are engaging in a technical collaboration to redesign GPU architecture through the integration of HBM4 memory with processing cores. This technical initiative aims to alter the existing framework of logic and memory device interconnections, as well as the semiconductor industry’s manufacturing processes. Currently, HBM stacks integrate multiple memory devices, typically between 8 and 16, with a logic layer that serves as a central hub. Positioned on interposers, these stacks connect to CPUs or GPUs via a 1024-bit interface. SK Hynix’s strategy involves direct placement of HBM4 stacks onto processor dies, thereby eliminating the use of interposers.(CN Beta, Guru3D, Hot Hardware, Tom’s Hardware, Joongang)

Microsoft has announced two new in-house chips for enterprises: Azure Maia 100 and Azure Cobalt 100. Maia, as the company explained, is its AI accelerator, designed to run cloud-based training and inference for generative AI workloads. Meanwhile, Cobalt is an Arm-based chip designed to handle general-purpose workloads with high efficiency. Both offerings will be deployed in Azure in 2024, starting with Microsoft’s own data centers driving its Copilot and Azure OpenAI services. (VentureBeat, Microsoft, ZDNet, 36Kr)

Baidu has reportedly ordered artificial intelligence chips from Huawei. Baidu placed an order for 1,600 of Huawei’s 910B Ascend AI chips. These chips, developed as an alternative to Nvidia’s A100 chip, were intended for 200 servers. By Oct 2023, Huawei had reportedly delivered over 60% of the order. This approximates to 1,000 chips, to Baidu. The total value of the order was around CNY450M (USD61.83M). Huawei was expected to complete the delivery of all the chips by the end of 2023. The collaboration between Huawei and Baidu began in 2020. This was to ensure compatibility between Baidu’s AI platform and Huawei hardware. In August, both companies announced plans to enhance compatibility between Baidu’s Ernie AI model and Huawei’s Ascend chips. Baidu has created its own line of Kunlun AI chips. The Kunlun chip will support large-scale AI computing. However, for training its Ernie large language model (LLM), the company has predominantly depended on Nvidia’s A100 chip. (Reuters, GizChina, Zaobao, RFI)

Major chip making giants like Nvidia, Qualcomm, MediaTek, and others are apparently turning to TSMC for the fabrication of its next generation of high end chipsets, based on TSMC’s advanced 3nm process. MediaTek and Qualcomm are reportedly turning to TSMC for its second generation 3nm process (N3E). This will be used to fabricate the Dimensity 9400 and Snapdragon 8 Gen 4. Apple is relying on TSMC’s first gen 3nm process (N3B) for its A17 Pro processor, which powers the iPhone 15 Pro series. Samsung Foundry has yet to receive major clients for its 3nm chip fabrication technology.(Gizmo China, Android Headlines, CTEE)

LG Display (LGD) is expected to get out of the red in 2024earlier than expected, by supplying organic light-emitting displays for Apple’s upcoming iPad Pro, of which the panels are to be three times more expensive than that of the iPhone. LGD will start OLED production for the upcoming iPad Pro in Feb 2024 at its plant in Paju, Gyeonggi Province. Apple is targeting a total of 10M OLED iPad panels in 2024. LGD is expected to supply 60% of the supply, while Samsung Display is responsible for producing the rest.(Apple Insider, Korea Herald)

Samsung Display (SDC) and LG Display (LGD) are progressing in their negotiations with Apple for the supply of OLED panels for Apple’s next-generation iPad devices. Apple is aiming to buy around 10M units in 2024, and each panel is expected to cost around 3 times as much as of Apple’s iPhone OLED panels. SDC and LGD are both planning to start production in Feb 2024, earlier than expected. The panels will be produced at the companies’ existing Gen-6 lines. LGD will get 60% of the orders (6M displays), and SDC will get the rest. (Phone Arena, OLED-Info, Chosun, Apple Insider)

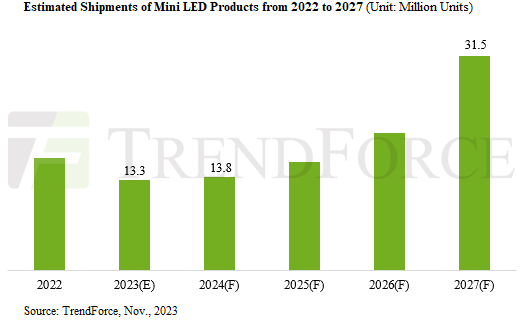

TrendForce reveals that due to declining demand in consumer electronics, shipments of Mini LED products are expected to decrease to 13.337M units in 2023. However, the market is projected to rebound in 2024, with shipments estimated at 13.792M units, and the growth trend is expected to continue through 2027. This decline is part of a larger trend of decreasing prices for Mini LED products, setting the stage for sustained growth in shipments. The report predicts that by 2027, shipments could reach as high as 31.453M units, with a CAGR of approximately 23.9% from 2023 to 2027. Notably, as RGB OLED continues to expand, both Mini LED tablets and notebooks are facing potential threats and both applications are expected to reach an inflection point in 2023. The shipment volume for Mini LED notebooks is estimated to decrease by approximately 39% YoY. Meanwhile, with the 12.9” iPad Pro expected to be discontinued in 2024, the shipment volume of Mini LED tablets is expected to decrease by about 15.6% YoY, making these two the only applications expected to decline. (Apple Insider, CN Beta, TrendForce, TrendForce)

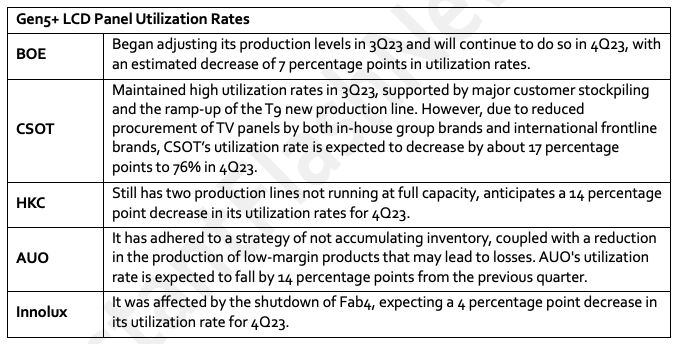

TrendForce reports that the utilization rates for the Gen5+ LCD panel industry (by area) are estimated to decrease by nearly 9.2 percentage points from 3Q23, reaching 72.2% in Q4. This forecast comes amid a backdrop of reduced TV panel procurement by TV brands, who are adjusting to operational pressures and rising inventory levels that began in the third quarter. Additionally, signs of weakening IT panel demand emerged at the end of 3Q23. To prevent inventory carryover into 2024, panel makers have continued to regulate production throughout 4Q23. (TrendForce, TrendForce)

According to TF Securities Ming-Chi Kuo, Largan has now improved the yield of the tetraprism lens to 70% or more significantly. Looking ahead to 2024, the two fastest-growing brands in global periscope camera smartphone shipments are Apple and Huawei. Apple is expected to include a tetraprism camera in the iPhone 16 Pro, leading to a 160% YoY growth in iPhones with this camera in 2024. Huawei’s flagship P70, P70 Pro and P70 Art, which are expected to start mass shipments in 1H24, will also feature periscope cameras. The P70 series, which benefits from using its own Kirin chips, is expected to see 100% YoY shipment growth in 2024 (compared to the P60 series 2023).Largan is the primary supplier of periscope lenses for Apple and Huawei in 2024, with supply shares of 85-90% and 50–60%, respectively. (GSM Arena, Medium, Twitter)

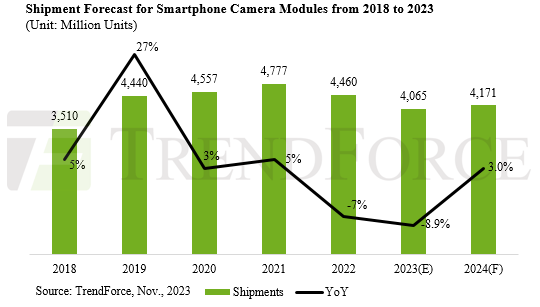

TrendForce reports a significant 8.9% decrease in shipments of smartphone camera modules in 2023, totaling around 4.065B units. This downturn is attributed to a decline in smartphone production and evolving trends in camera integration by major brands. However, after a year of depleting inventories, a rebound in smartphone production is expected in 2024, potentially leading to a resurgence in the smartphone camera module market with an estimated 3% YoY growth to approximately 4.171B units. 2023 has seen the smartphone sector grappling with slower-than-expected post-pandemic recovery in China and rampant global inflation. (TrendForce, TrendForce)

Sony Electronic confirms that it has been testing an in-camera authenticity technology with the Associated Press. The company has revealed that it has completed the second round of testing for the technology that will be used to verify that the images were captured on its cameras and has not been altered. Sony said that the digital signature is created inside the camera at the moment of capture in the hardware chipset. Sony said that this security feature is aimed at professionals wanting to safeguard the authenticity of their content and provides an extra layer of security to aid news agencies.(CN Beta, India Times, Business Standard, New Atlas, Sony)

Samsung could start the mass production of LPDDR5T DRAM chips in 2024. Samsung Electronics Vice President Ha-Ryong Yoon explained the company’s plans and ideas for the future. When an investor asked about the technologies Samsung is working on for the future, the executives revealed the information about LPDDR5T DRAM.(Phone Arena, SamMobile, MK)

China has launched the world’s first next-generation internet service, surpassing industry predictions by a staggering two years. This new backbone network, a critical data highway connecting major cities, boasts an impressive data transmission speed of 1.2 terabits per second. This speed is over 10 times faster than most current major internet routes. Spanning over 3,000 kilometers, the network links Beijing, Wuhan, and Guangzhou through an extensive optical fiber cabling system. Officially operational since Jul 2023, the network’s reliability and efficiency have been thoroughly tested and proven. This ground-breaking achievement results from a collaborative effort involving Tsinghua University, China Mobile, Huawei Technologies, and Cernet Corporation. (Gizmo China, SCMP, CNN, Korea Times, Digitimes)

The president of Xiaomi’s International Department and the general manager of the Redmi brand, Lu Weibing, has indicated that the company has achieved a monumental milestone, celebrating the sale of 1B Redmi phones over the past decade. The journey of Redmi began under the Xiaomi umbrella on 31 Jul2013, as a new product line aimed at offering high-quality smartphones at affordable prices. Recognizing the potential and distinct identity of Redmi, Xiaomi, in a strategic move on 3 Jan 2019, elevated Redmi to an independent sub-brand, giving it more autonomy and focus within the Xiaomi portfolio. (Gizmo China, IT Home)

Honor is preparing for an initial public offering (IPO), 3 years after it was sold by U.S. sanctions-hit Huawei Technologies. Honor did not specify a time frame for the listing or where it would be, but said in a statement that its market position had greatly improved in the past 3 years and an IPO would be the next step in its development. The company said that it will “continue to optimize its shareholding structure, attract diversified capital, and enter into the capital market through IPO”.(Android Headlines, Reuters, C114)

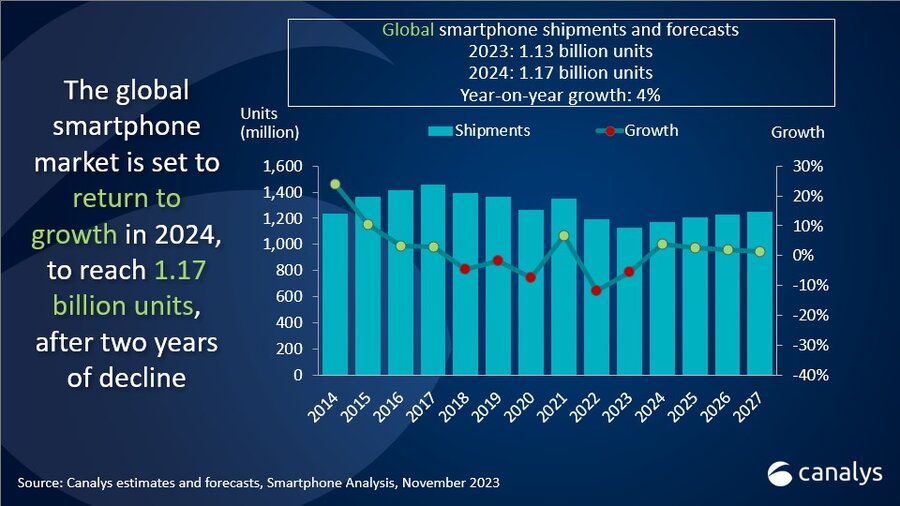

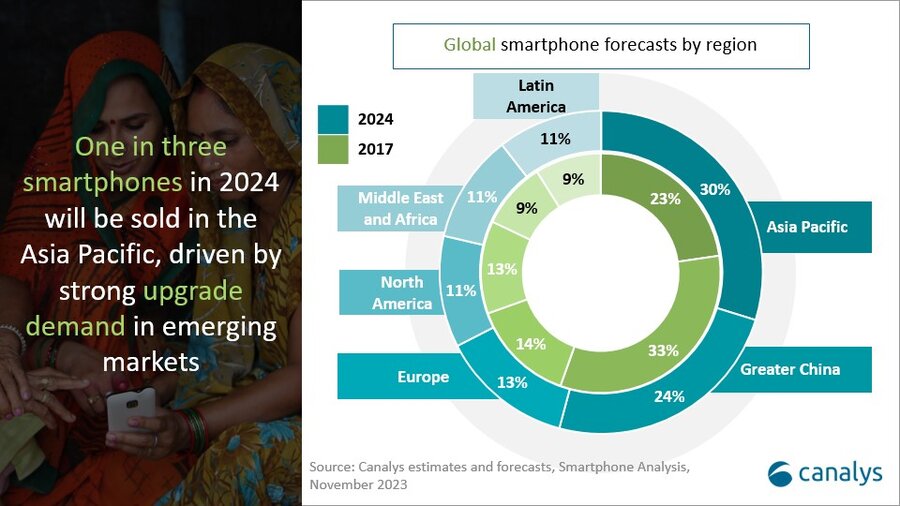

The global smartphone market hints at early signs of recovery after declining 12% in 2022, according to Canalys. While shipments are still expected to drop 5% in 2023, the softening decline points at stabilization as regions like the Middle East, Africa and Latin America return to growth at 9%, 3% and 2%, respectively this year. In the full year 2023, 1.13B smartphones will be shipped, which is expected to grow 4% to reach 1.17B units in 2024. The smartphone market is expected to ship 1.25B units in 2027, achieving a CAGR (2023-2027) of 2.6%. (GSM Arena, Canalys, GizChina, CN Beta)

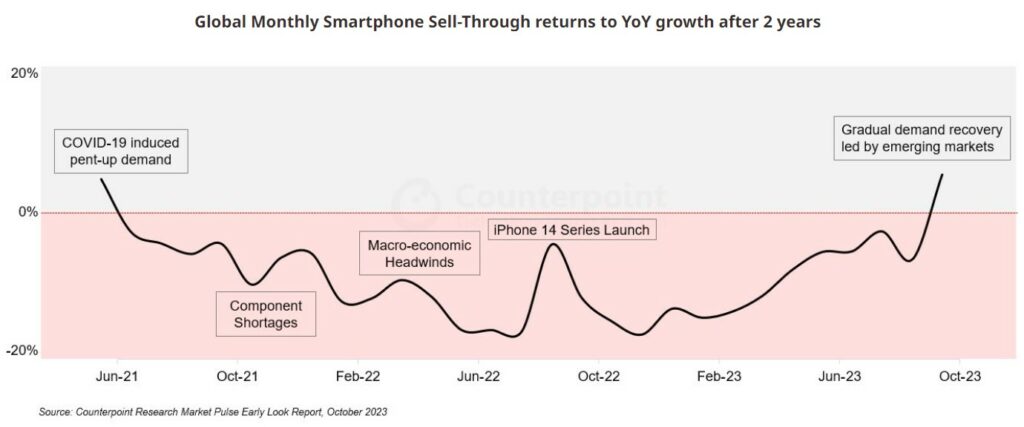

Global monthly smartphone sell-through volumes grew 5% YoY in Oct 2023, the first month to record YoY growth since Jun 2021 and break the streak of 27 consecutive months of YoY declines, according to Counterpoint Research. Global smartphone sales have been under stress for the last two years due to factors including component shortages, inventory build-up and lengthening of replacement cycles. Following this strong growth in Oct 2023, they expect the market to grow YoY in 4Q23 as well, setting out on a path to gradual recovery in the coming quarters. (GSM Arena, Counterpoint Research)

Animoca Brands, a company that has invested in hundreds of blockchain game startups, said it will collaborate with Ubisoft’s Strategic Innovation Lab to support its Web3 initiatives on Mocaverse, the metaverse project created by Animoca Brands. Mocaverse will collaborate, support, and amplify Ubisoft’s Strategic Innovation Lab Web3 initiatives, including Champions Tactics Grimoria Chronicles, a brand-new experimental player-versus-player tactical RPG in which mythical Champions engage in tactical battles against other players and discover the legends of the dark and mystical world of Grimoria.(VentureBeat, Mocaverse, Animoca Brands)

Google DeepMind has unveiled its newest and “most advanced” music AI system yet, called Lyria. The company says the model can generate high-quality vocals, lyrics, and musical backing tracks that mimic the style of popular artists. DeepMind announced Lyria alongside new music creation experiments launching on YouTube Shorts. One of the experiments called “Dream Track” will let creators generate 30-second songs sung in the voices of artists such as Alec Benjamin, Charlie Puth, Charli XCX, Demi Lovato, John Legend, Sia, T-Pain, Troye Sivan, and Papoose.(VentureBeat, Google, Twitter)

Anthropic has announced that the latest update of its chatbot, Claude 2.1, can digest up to 200,000 tokens at once for Pro tier users, which it says equals over 500 pages of material. The company also says Claude will hallucinate — or lie — half as often as before, and it can do things like search the web or use a calculator through customizable tools. The chatbot also now supports custom, persistent instructions and has a new test window for trying out prompts. The 200,000-token feature doubles what Claude could handle before, and it’s a significantly higher limit than the 32,000-token ceiling of the priciest version of GPT-4. Anthropic calls this an “industry first” and says it enables the chatbot to pore over uploads of entire codebases or works like the “Iliad”. (The Verge, Anthropic, Twitter)