11-30 #TooOld : Samsung is allegedly rebranding its Exynos to “Dream Chip”; Samsung reportedly will increase prices of its CIS in early 2024; Nvidia CEO Jensen Huang has said that AI will be “fairly competitive” with humans in 5 years; etc.

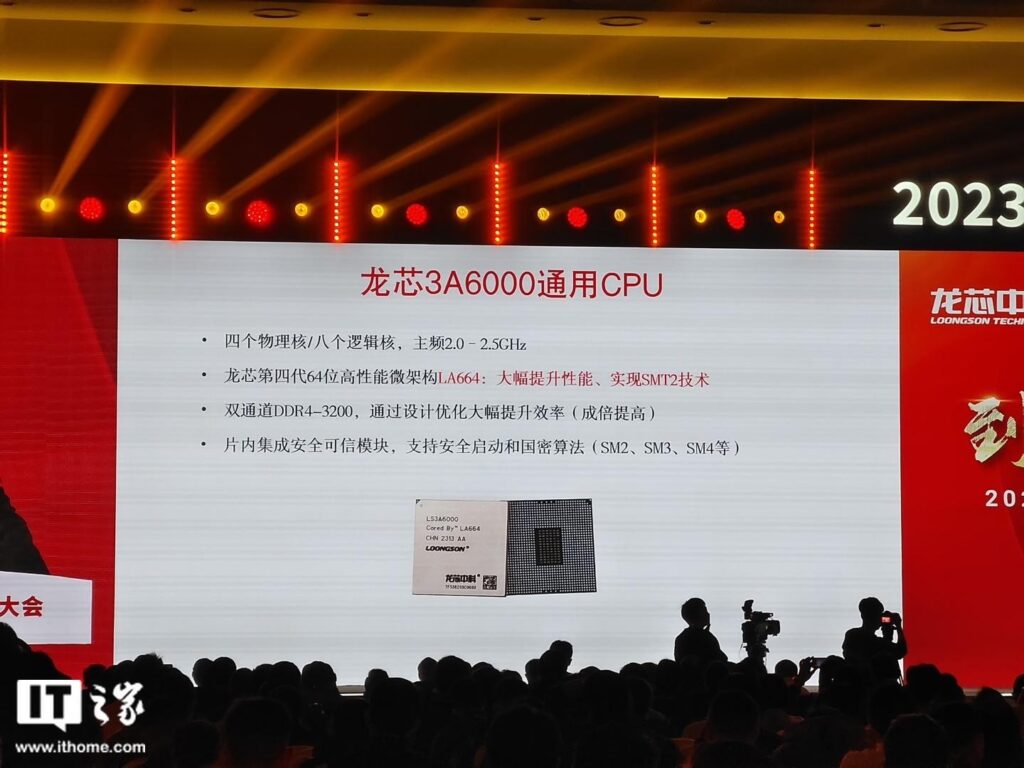

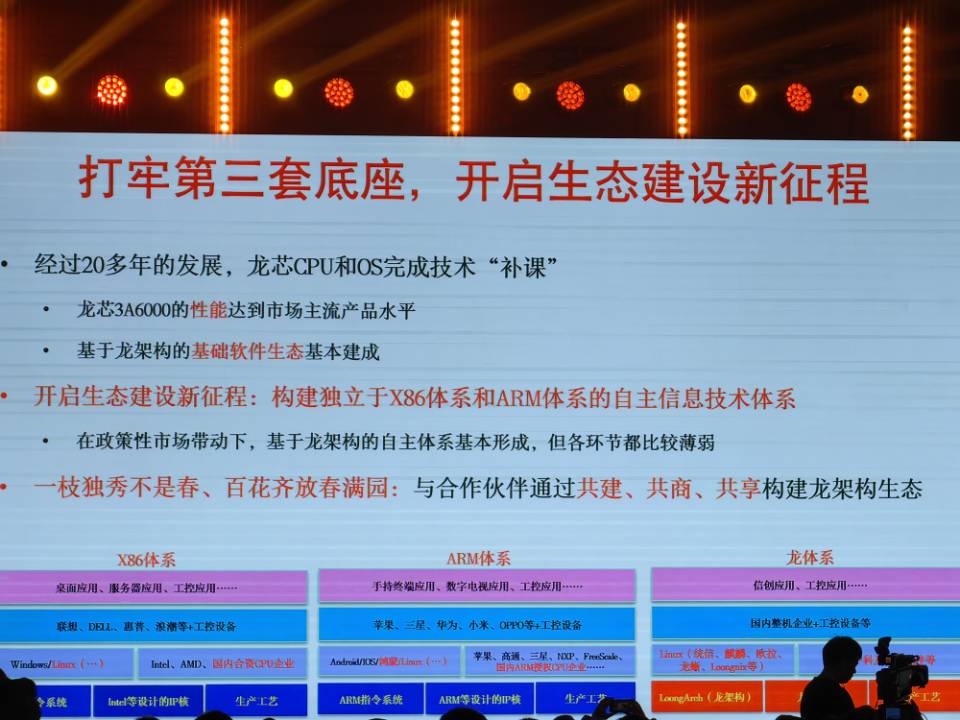

Chinese chip company Loongson Technology has unveiled its latest self-developed central processing unit (CPU) 3A6000, which can be used in multiple applications across different platforms. It has 4 physical cores / 8 logic cores, main frequency 2.0-2.5GHz. Loongson 3A6000 adopts 4th generation 64th place microstructure LA664, actual SMT2 technology, support double passage DDR4-3200 internal existence, Katanai assembly safety reliable model, support safety operation Japanese secret calculation method (SM2, SM3, SM4) etc. In addition, the main end of the dragon core is completed 3B6000, 3B7000, etc., and the end of the service is completed. (My Drivers, CN Beta, IT Home, Loongson, China Daily, Nasdaq)

Samsung is allegedly rebranding its Exynos to “Dream Chip” – a name that sounds heavily inspired by the aforementioned “Dream Team”. Samsung possibly wanting to rebrand its chip line in 2024. Similarly before this, Qualcomm has actually renamed its platform after Snapdragon 888 with “8 Gen 1” naming. (CN Beta, SamMobile, Twitter)

Apple allegedly pays British chip architect Arm less than USD0.30 per chip in royalties. Apple licenses the underlying technology used in the iPhone, iPad, Mac, Apple Watch, Apple TV, and HomePod from Arm. Despite being one of its biggest and most important customers, Apple represents less than five percent of Arm’s annual revenue, with the company paying the least of any of Arm’s smartphone chip customers. Apple. While Apple is unlikely to sever its ties with Arm, the company has apparently explored the long-term possibility of using a competing open-source technology for its chips called RISC-V. Apple’s current licensing agreement with Arm was signed in Sept 2023 and it “extends beyond 2040”, but the chip architect is said to have continually attempted to renegotiate its financial terms.(MacRumors, The Information, CN Beta)

Apple might shelve its plans for an in-house 5G modem chip due to challenges in the development process. Apple is allegedly “reorganizing” its development efforts. Apple’s iPhone currently uses 5G modems made by Qualcomm, and it is expected to continue doing so until 2026. In 2019 Apple spent USD1B in buying Intel’s entire modem business. That got Apple all of Intel’s research, technology, and over 2,000 staff. (Phone Arena, Apple Insider, Naver, Twitter)

MediaTek has has announced a substantial investment of GBP10M (USD12.59M) over the next 5 years. MediaTek, already operating in the UK with offices in Cambridge and Kent, focusing on research and development, has solidified its commitment to the region through recent collaborations. MediaTek’s recent investments in the U.K. included a joint project with the Bullitt Group to develop the world’s first two-way satellite communications technology for use in smartphones and other devices. MediaTek has also partnered with Inmarsat plc in the U.K. to provide satellite communications services to customers. (Gizmo China, Focus Taiwan, UDN, TechNews)

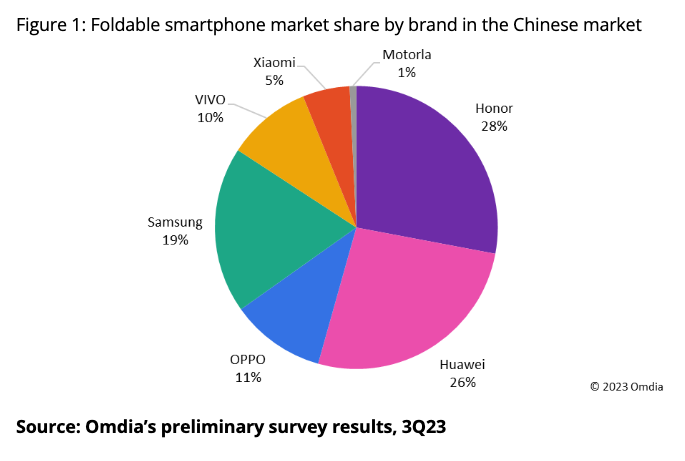

According to Omdia, China’s foldable smartphone segment continues to experience robust growth. In 3Q23, shipments of foldable smartphones in China surpassed 1.7M units, marking a remarkable 77% YoY increase and a substantial 46% QoQ growth. Notably, 3Q23 coincides with the introduction of new foldable products from major brands. Honor’s foldable Magic V2, unveiled in Jul 2023, boasts multiple leading upgrades and strong market demand. It has played a pivotal role in helping Honor secure the top spot in China’s foldable smartphone market for a third quarter with an impressive 28% market share. Compared with the same period last year, Honor has achieved a remarkable 17-fold increase in shipments. The Honor Magic V2 also claimed the title of the leading product in China’s foldable phone market for the quarter with a 25% market share. Thanks to the success of the Magic V2, Honor experienced a 107.5% YoY growth and a 20% QoQ growth in shipments for its Magic high-end series during this period. Cumulatively, the Magic high-end series achieved a nearly 30% YoY growth from 1Q23 to 3Q23. (Omdia, CN Beta, GSM Arena)

Samsung reportedly will increase prices in early 2024. Samsung’s CMOS image sensor components will see an average price hike of 25% in 4Q24. Some products will see a bigger hike (up to 3 %) than others. Components for high-resolution sensors (32Mp and higher) will be affected more. Chinese distributors Qingya and Supreme are expecting to benefit from Samsung’s decision. (Android Headlines, UDN, Twitter)

Samsung Electronics aims to dominate the automotive memory market by 2025, with plans to roll out AI-related products starting 2024. The company will release a new “561-ball package” Low Power Double Data Rate 5X (LPDDR5X) automotive memory module in 1H24. This new memory is half the size of the previous generation (441-ball package) but offers 20% greater power efficiency. It also plans to release a detachable Auto Solid State Drive (SSD) in 2024. This product increases data efficiency by enabling storage virtualization, allowing a single SSD to be partitioned for use by multiple Systems-on-Chip (SoCs). It supports a maximum continuous read speed of 6500 MB/s and offers a capacity of 4 TB. In 2025, Samsung also plans to release the GDDR7 high-speed Graphic DRAM, capable of 32 Gbps. This product, developed by Samsung Electronics in 2023, allows for the transfer of large data volumes at 128 GB/s and is suitable for applications such as autonomous vehicles. It also supports ultra-low-voltage options to match the requirements of its applications. (CN Beta, WCCFTech, Sammy Fans, Business Korea)

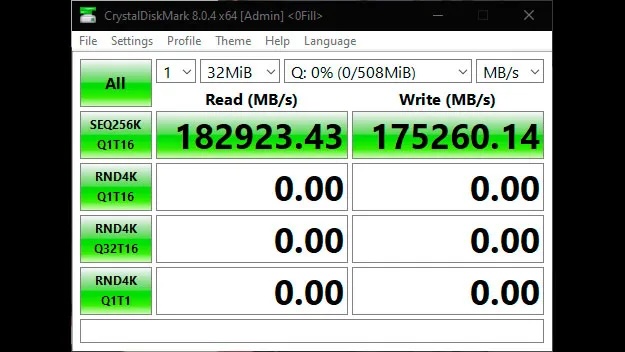

AMD’s 3D V-Cache technology utilizes blocks of SRAM stacked on top of the CPU logic die, where CPU cores reside, and allows the processor to access massive pools of cache for applications. However, using this extra level 3 (L3) cache as a RAM disk appears possible, where the L3 SRAM behaves similarly to a storage drive. With AMD Ryzen 7 5800X3D, the speeds of this RAM disk are over 182GB/s for reading and over 175GB/s for writing. (CN Beta, Tom’s Hardware, Hot Hardware, TechPowerup)

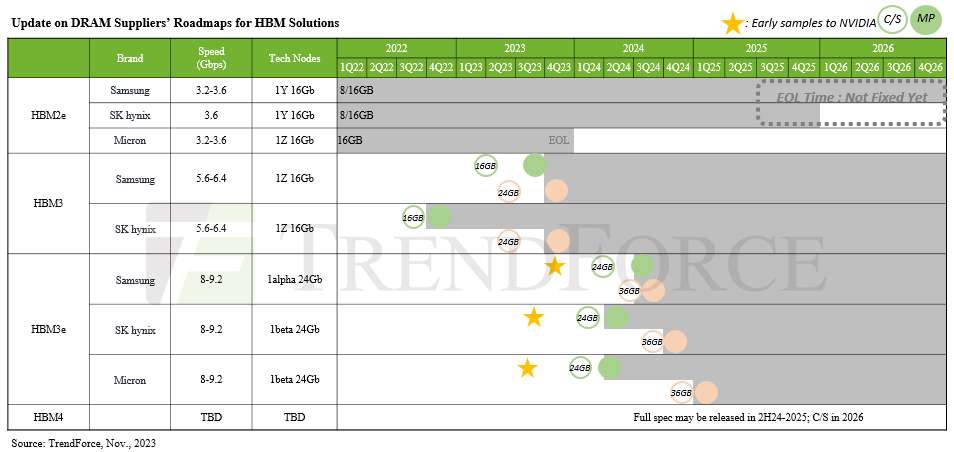

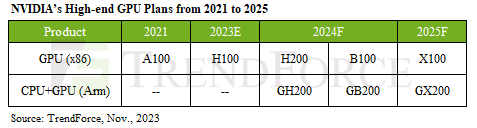

TrendForce’s latest research into the HBM market indicates that Nvidia plans to diversify its HBM suppliers for more robust and efficient supply chain management. Samsung’s HBM3 (24GB) is anticipated to complete verification with NVIDIA by Dec 2023. The progress of HBM3e, as outlined in the timeline below, shows that Micron provided its 8hi (24GB) samples to Nvidia by the end of Jul 2023, SK hynix in mid-Aug, and Samsung in early Oct 2023. Given the intricacy of the HBM verification process—estimated to take 2 quarters—TrendForce expects that some manufacturers might learn preliminary HBM3e results by the end of 2023. Nvidia’s current high-end AI lineup for 2023, which utilizes HBM, includes models like the A100/A800 and H100/H800. In 2024, Nvidia plans to refine its product portfolio further. New additions will include the H200, using 6 HBM3e chips, and the B100, using 8 HBM3e chips. NVIDIA will also integrate its own Arm-based CPUs and GPUs to launch the GH200 and GB200, enhancing its lineup with more specialized and powerful AI solutions. (CN Beta, WCCFtech, TrendForce, TrendForce)

Samsung Semiconductor has revealed “a special type of DRAM” that the company claims is perfect for mobile AI (artificial intelligence) and gaming applications. It is called Low Latency Wide IO (LLW) DRAM. According to Samsung, LLW DRAM increases bandwidth and latency limits, making it significantly more efficient than standard LPDDR DRAM. The company is touting a massive 70% boost in power efficiency, while simultaneously increasing the processing speed. The advanced solution achieves this by increasing the number of input/output (I/O) terminals in a semiconductor circuit.(Samsung, Android Headlines, SamMobile, Twitter)

The founder of realme, Sky Li has announced that realme has reached 200M shipments in just over 5 years. this is over 40M per year. (GSM Arena, Twitter, Yahoo)

Taiwan-based manufacturing giant Hon Hai Precision Industry, also known as Foxconn globally, is planning to invest almost NTD50B (USD1.59B) in India. The company said subsidiary Foxconn Hon Hai Technology India Mega Development Private will spend INR128.21B (about USD1.59B) to build a new plant to “meet its operational needs”. In May 2023, Hon Hai said, the subsidiary spent INR3B to purchase a piece of land located in the industrial hub of Bengaluru in the southern Indian state of Karnataka, borders Maharashtra. The subsidiary also spent about USD33.27M to buy production equipment from Apple Operations, a move said to be for Hon Hai to roll out the latest iPhone 15 series unveiled in Sept 2023.(CN Beta, Business Today, Money DJ, Focus Taiwan)

William Lu, a Partner and President of Xiaomi Group, has announced that the company has sold 1B Redmi smartphones to date. It took Xiaomi 10 years to do it, as the first handset, the Xiaomi Redmi, arrived way back in 2013.(My Drivers, Android Headlines, Twitter, Twitter)

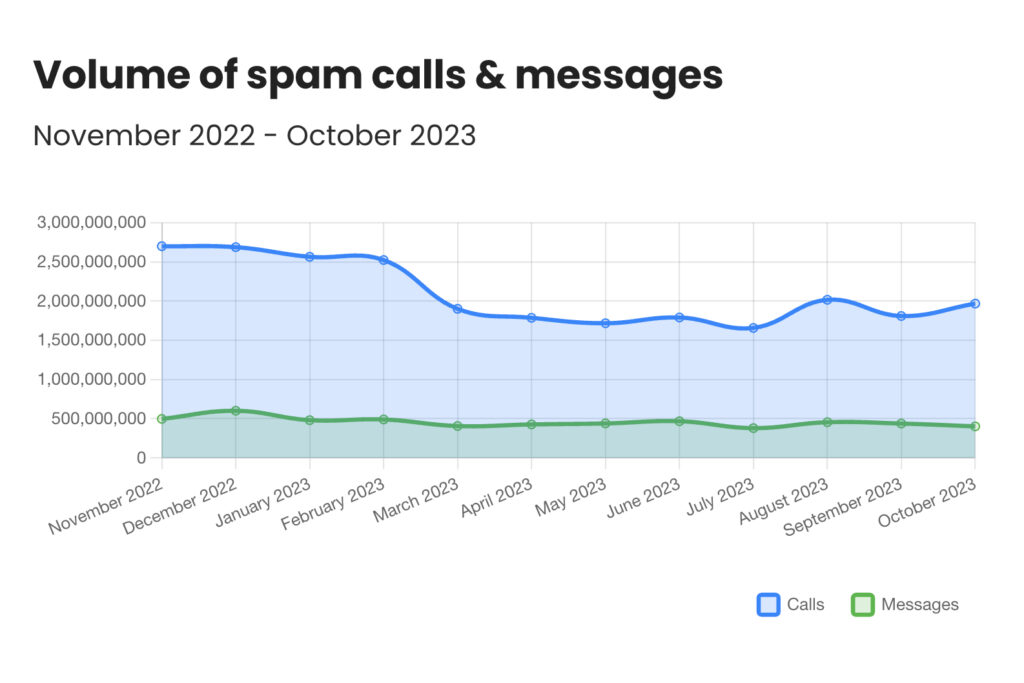

According to the findings of Truecaller, the world’s leading global communications platform, the types of spam and scam calls users receive, states that receive the most spam and scam calls, the average number of spam calls users receive per month, and more. Americans receive an average of 2.1B spam calls per month, with nearly 6 spam calls per person per month, each lasting over 4 minutes. Throughout 2023, Americans wasted approximately 195M hours answering these incoming calls. Every year, these numbers peak during the holidays, with scams such as charity donations, fake deliveries, and vacation upgrades. With AI, scammers have more tools than ever to easily target victims and impersonate voices of loved ones, authority figures, and government officials. (Android Headlines, Truecaller)

Redmi, a subsidiary of Xiaomi has announced that as it heads into a new decade of business, it will collaborate with its domestic supply chain partners to jointly launch the “2 Trillion New Ambition Project”, with the goal of creating CNY2T in integrated output value in the next 5 years through co-creation and sharing. The Project includes AAC, BYD Electronic, Sunny Optical, Tianma, Visionox, OFilm, TCL CSOT, Omnivision, Lens Technology, Bielcrystal, and other domestic supply chain companies.(CN Beta, AAStock, My Drivers, EET China)

Wellsenn XR has conducted a teardown analysis on Meta’s latest VR headset, Quest 2. The BOM cost of Meta Quest 2 is approximately USD264.2, and the comprehensive hardware cost is approximately USD279.2. Calculated based on the US dollar exchange rate of 6.7, the comprehensive after-tax price of Meta Quest 2 The cost is approximately CNY2,114 (excluding mold opening fees, defects, shipping damage, etc.). The comprehensive hardware cost is divided by type. The cost of the SOC chip XR2 is about USD80, accounting for 29%, and the cost ratio is close to 30%; the cost of the screen is about USD38, accounting for 14%; the cost of the camera module is about USD20. Accounting for 7%; RAM cost is about USD18, accounting for 6%; ROM cost is about USD12, accounting for 4%. Overall, the total core cost of SOC chip, screen, camera, RAM and ROM is USD168, accounting for 60% in total. (Wellsenn report)

Xingji Meizu Group has officially announced a brand new AR product brand, namely MYVU. MYVU is the main product of the product, which is the first product of the technologically advanced AR glasses, which can be used in all weather conditions. The main body of the work is dual AR operation system, a fusion of Flyme AR, an advanced AR technology, an implementation of sensing, and a simple intelligent alternating experience. The company has officially claimed that the MYVU AR smart glasses has exceeded 20,000+ large pre-orders with CNY1. (My Drivers, GizChina, IT Home)

Huawei allegedly intends to enter the mixed-reality headset segment with the launch of an Apple Vision Pro competitor. Huawei is allegedly attempting to one-up Apple’s USD3,500 headset with one of its own that may feature a less ludicrous price tag to entice consumer demand. Honor is also pursuing an AR headset launch, though the details concerning its design and other hardware are currently unknown. (CN Beta, WCCFTech, Twitter)

Apple’s first generation XR headset Vision Pro, priced at USD3,499, is anticipated to ship 400,000 units at launch in 1Q24. Its target in 2024 would be to ship 1M units, and in its third year it will ship 10M units. However, industry experts, including TF Securities analyst Ming-Chi Kuo, express skepticism about these ambitious targets. Kuo suggests that for a more affordable version of the Apple Vision Pro to succeed, substantial price reductions would be necessary, and even then, the successor might not enter mass production until 2027. (Android Headlines, Jiemian, WCCFtech)

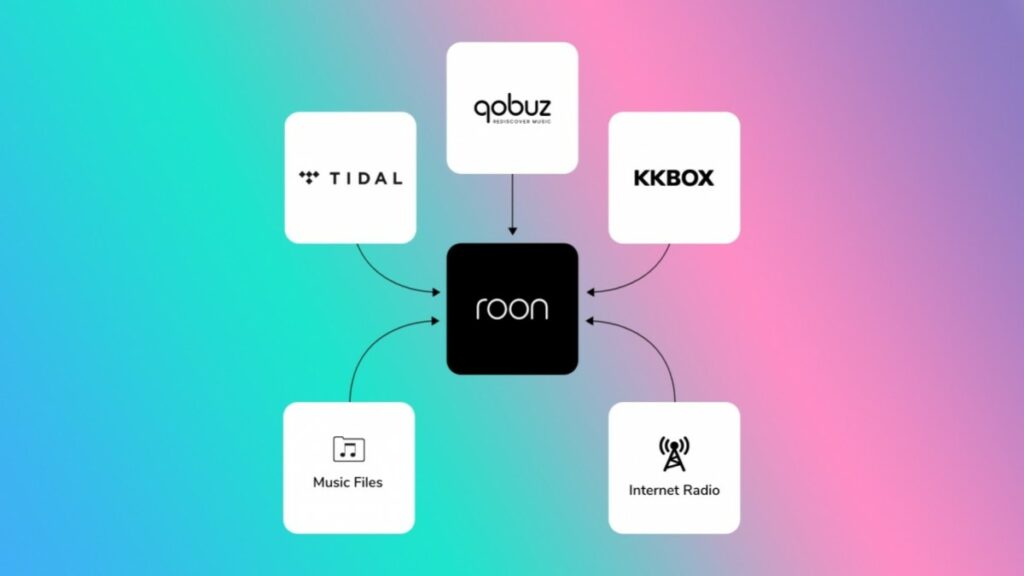

Harman, a wholly-owned subsidiary of Samsung Electronics, focused on connected technologies for automotive, consumer, and enterprise markets, has announced the acquisition of Roon, the music management, discovery, and streaming platform for music enthusiasts. Roon is a music player platform for music enthusiasts, which features a rich interface for browsing and discovering music, compatibility with almost any audio device, and a playback engine designed to deliver the best possible sound. Roon is available for all popular operating systems and manufactures a line of hardware server appliances called Nucleus. (CN Beta, GSM Arena, Samsung)

Huawei has signed a memorandum of cooperation with Changan Automobile, a major state-owned carmaker based in the southwestern city Chongqing. Huawei said it plans to transfer its smart-car system business to a new unit with investments from Changan Automobile and “integrate the core technologies and resources of Huawei’s smart car solutions into the new company”. Huawei said it is open to selling equity in its joint venture with Changan Automobile to other strategic partners in the car industry. (CN Beta, Huawei, Yicai, Reuters, SCMP)

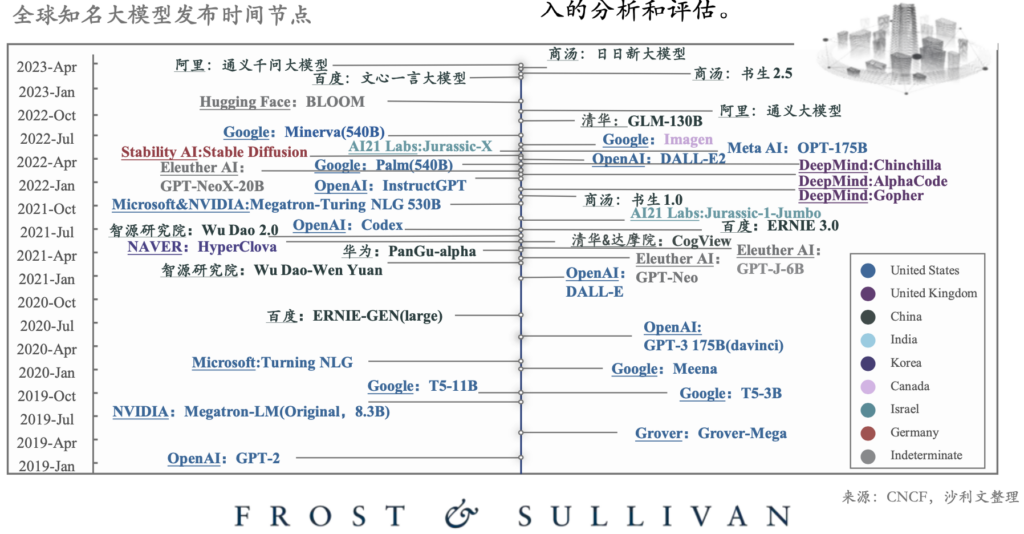

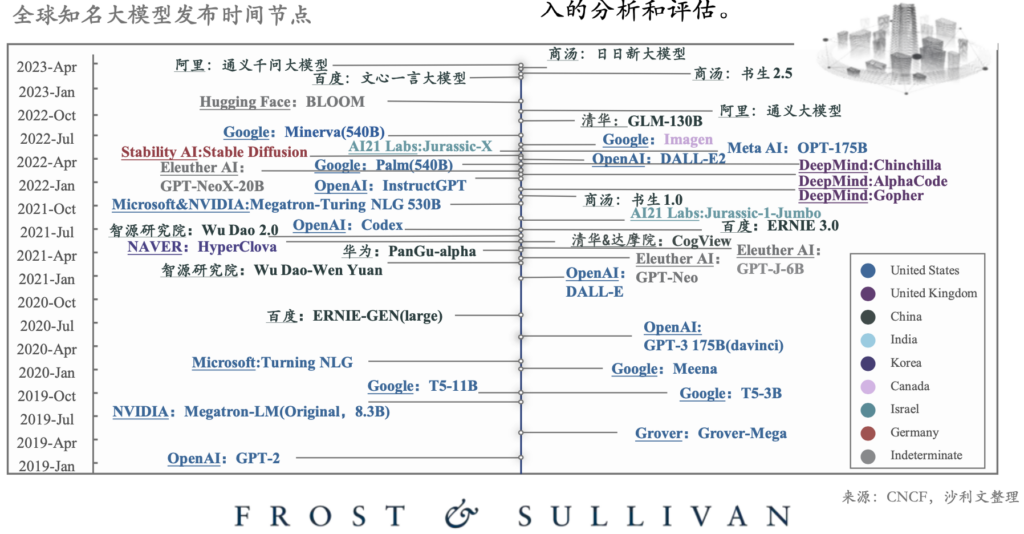

With the explosion of various applications based on the development of large models, especially generative AI, it provides users with breakthrough innovation opportunities and breaks the situation where creation and art are the exclusive domain of humans. AI is no longer just “classification”, but has begun to “generative”, further upgrading the value brought by large models to disruptive innovations in human productivity tools. At the same time, the organic improvement of data scale and parameter scale has given large models the ability to continuously learn and grow, and has begun to possess emergent capabilities, gradually kicking off the development of general artificial intelligence (AGI). In the past few years, domestic and foreign AI manufacturers have made plans in the field of large models. OpenAI released the GPT-2 large model in 2019, and China’s domestic Internet technology manufacturers also released their own large models during the three-year period from 2020 to 2022.(Frost & Sullivan report)

Nvidia CEO Jensen Huang has said that artificial intelligence will be “fairly competitive” with humans in as few as 5 years. Huang sees an emergence in off-the-shelf AI tools that companies will tune according to their needs, from chip design and software creation to drug discovery and radiology. Huang predicted that competition in the AI space will lead to the emergence of off-the-shelf AI tools that companies in different industries will tune according to their needs, from chip design and software creation to drug discovery and radiology. (Android Headlines, CNBC, CN Beta)