12-9 #Turbulance : Huawei is allegedly testing two image sensors; LG Innotek has begun development of under panel camera; Tecno has showcased 3 innovative camera technologies; etc.

Chinese artificial intelligence (AI) chip company Shanghai Biren Intelligent Technology has recently received a commitment of CNY2B (about USD280M) from investors backed by the Guangzhou government. The support comes after the company faced blacklisting by the U.S. government. The US government added 13 Chinese entities, including Biren, Moore Threads, and their mainland subsidiaries, to the Entity List. These entities, involved in the development of advanced computing chips, may now encounter restrictions on accessing advanced foundries and US chip design software. (CN Beta, Bloomberg, Mpost)

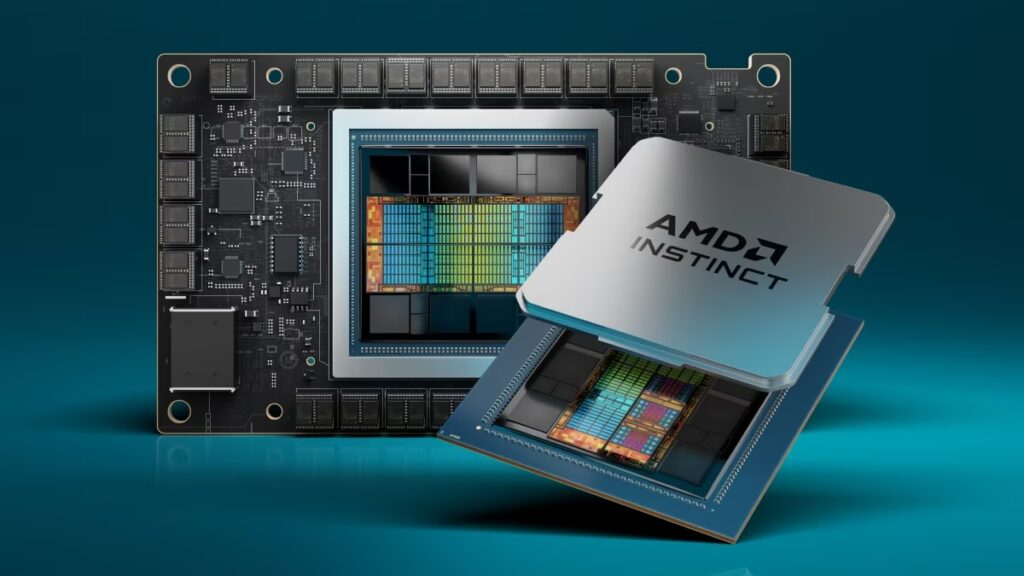

AMD has unveiled the Instinct MI300X accelerator and the Instinct M1300A accelerated processing unit (APU), which the company said works to train and run LLMs. The company said the MI300X has 1.5 times more memory capacity than the previous M1250X version. Both new products have better memory capacity and are more energy-efficient than their predecessors. AMD MI300X is comparable to Nvidia’s H100 chips in training LLMs but performs better on the inference side — 1.4 times better than H100 when working with Meta’s Llama 2, a 70B parameter LLM. AMD partnered with Microsoft to put MI300X in its Azure virtual machines. Meta has also announced it will deploy MI300 processors in its data centers. (CN Beta, AMD, AMD, The Verge)

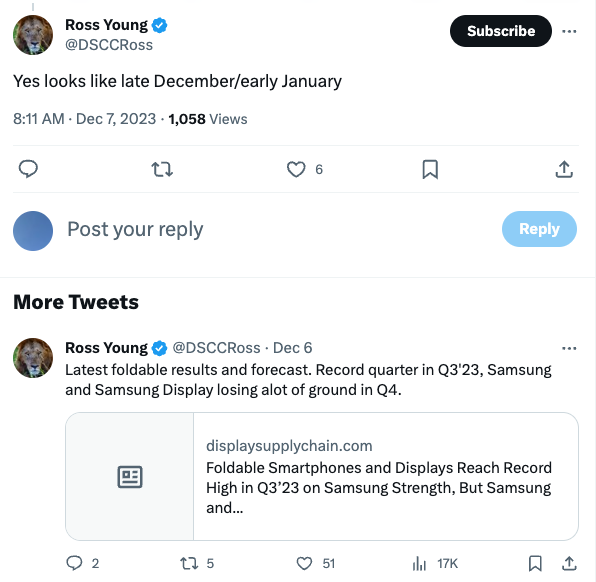

DSCC analyst Ross Young has indicated that Huawei could launch its budget foldable Android smartphone in late Dec 2023 or early Jan 2024. This phone could launch under the company’s ‘nova’ brand. The phone is tipped to cost CNY4,000-5,000 (USD563-703). (Twitter, Android Headlines)

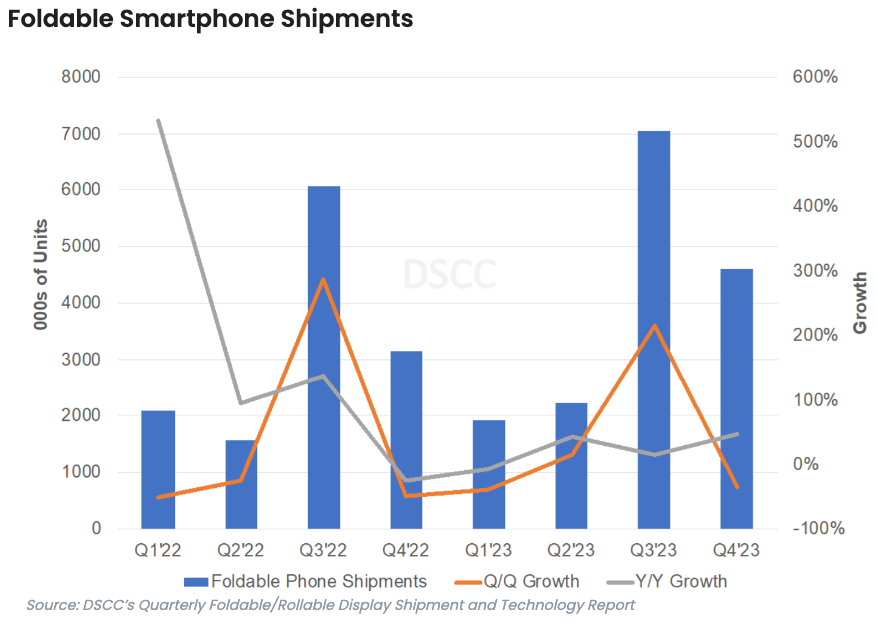

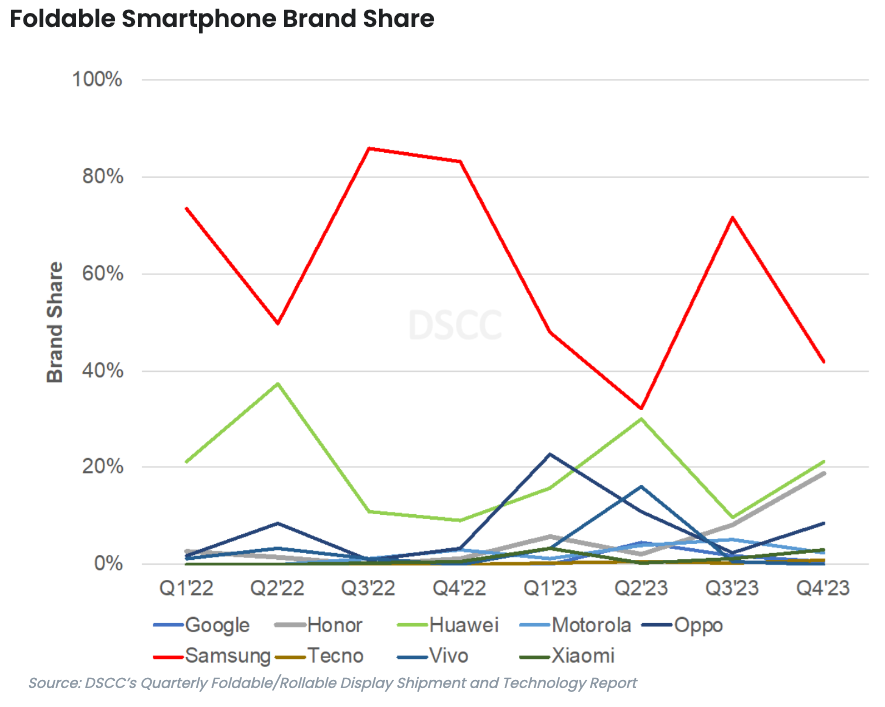

According to Display Supply Chain Consultant (DSCC), foldable smartphones surged 215% QoQ and 16% YoY in 3Q23 to 7.0M units. Samsung enjoyed its traditional peak market share in 3Q23 with European demand dominating, reaching 72% which was down from last year’s 86% as its competitors launch more models and aim for higher volumes. Huawei was #2 with a 9% share followed by Honor at 8%. As expected, Samsung had the top two best-selling models with the Galaxy Z Flip 5 earning a 45% share and the Galaxy Z Fold 5 accounting for a 24% share. Huawei and Honor accounted for the next best-selling models with the Mate X3 and Magic V2 each earning a 6% share. In 4Q23, DSCC expects foldable phones to fall 35% QoQ while rising 47% YoY to 3.6M. Samsung’s brand share is expected to fall to 42%, well below last year’s 83% on lower than expected shipments for the Z Flip 5 and Z Fold 5. Huawei and Honor are expected to take significant share in 4Q23, with Huawei’s share surging to 21% and Honor at 19%. Samsung Display (SDC) led the way with a dominant 74% share, up from 63% in 2Q23 but down from 91% in 3Q22. BOE was #2 with an 18% share. In 4Q23, we see BOE overtaking SDC on significant volume at Huawei, Honor and OPPO. (CN Beta, DSCC, Android Central)

Huawei is allegedly testing two image sensors, one is Sony IMX989 and the other is Omnivision’s OV50H. Among them, Huawei’s P70, which will be launched in 2024, will be equipped with an OV50H main camera, which has a 1/1.3-inch outsole, 50Mp, and a single pixel size of 1.2μm. At the same time, OV50H supports H/V QPD, which means it can achieve horizontal + vertical four-pixel phase focusing. This is also OmniVision’s first CMOS to support H/V QPD. As for the IMX989, this sensor may be applied to the Huawei P70 series super-flagship P70 Art, which will be Huawei’s most powerful photography smartphone. (CN Beta, My Drivers, QQ)

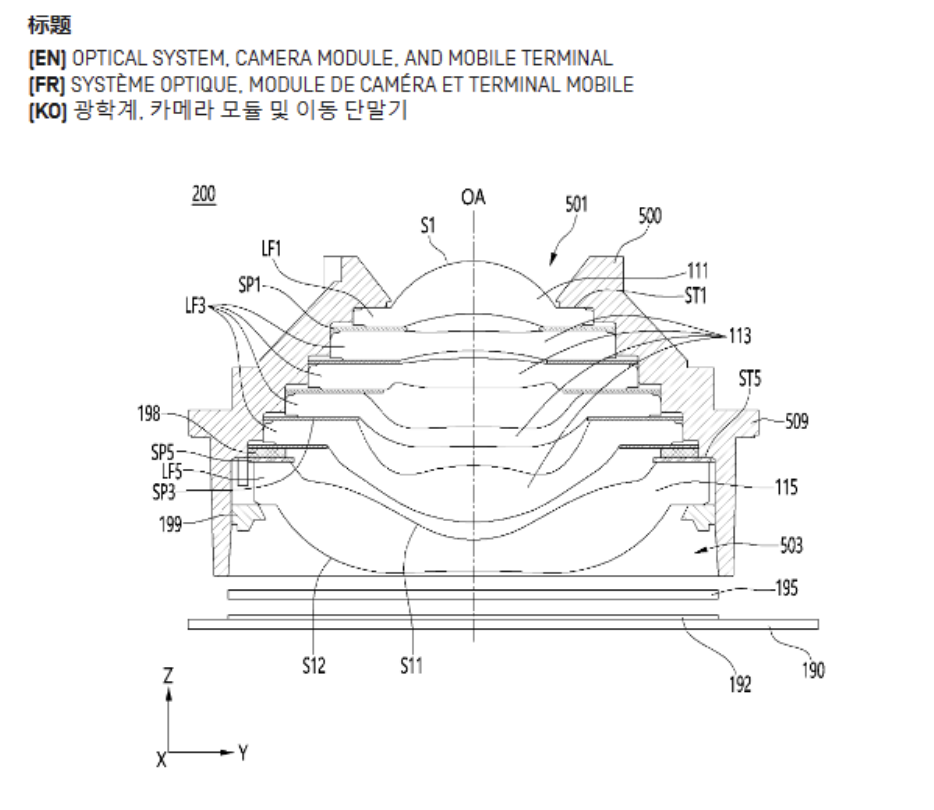

LG Innotek has begun development of under panel camera, in which the camera lens is not visible on the screen of smartphones. The move is being made most certainly for its main customer Apple, which is expected to launch smartphones with the technology within the next few years. UPC is applied to smartphones to present the screen on smartphones as “full screen” to increase immersion. It is alternatively called under display camera. As the camera is under the display, the image sensors get to absorb less light needed to form images. This prevents UPC from offering high-resolution images and fast, consecutive shots. To overcome these challenges, LG Innotek is developing a special lens called “prism optic”. The technology uses conventional lenses with curved surfaces and those with freeform surfaces. LG Innotek’s sister company LG Display is also developing its own UPC technology. LG Display is planning to use transparent material in the area where the front camera will be.(Apple Insider, The Elec, The Elec, iPhone Wired)

Tecno has showcased 3 innovative technologies in future Phantom X smartphones. The first is a unique variable aperture, which Tecno calls a W-shaped adjustable aperture. It is inspired by the eye of a cuttlefish and is designed to eliminate glare in harsh lighting conditions, like in strong backlight. Tecno has also shown off the industry’s first liquid telephoto macro lens. Tecno’s approach uses voltage to adjust the lens curvature, thus dynamically adapting it from long to narrow, achieving 5cm macro focusing. Tecno has also detailed its Universal Tone technology, which uses three AI-powered engines to perfect skin tones in photos. The Multi-Skin Tone Restoration Engine calibrates and adjusts skin tones using a colour spectral matrix, that’s based on skin colour chromatic research. The Local-Tuning Engine identifies people within an environment and plays around with tone mapping for a more striking image. Finally, the Computational Portrait Engine finishes it all with a pleasing aesthetic.(Forbes, GSM Arena)

TF Securities analyst Ming-Chi Kuo’s latest survey indicates that Apple’s all iPhone 16 models will feature a significant upgrade in microphone specifications. In addition to better water resistance, the key specification upgrade is a better signal-to-noise ratio (SNR) to improve the Siri experience significantly. It could indicate that Apple expects to integrate more AI/AIGC capabilities into Siri as a key selling point of the iPhone 16. AAC and Goertek are the microphone suppliers for the iPhone 16 (with a similar shipment allocation). Benefiting from the specification upgrade, the ASP of microphones for each iPhone 16 will be at least 100-150% higher than that of the iPhone 15. As AI devices emerge as a critical trend in consumer electronics in 2024, other Apple products and high-end Android phones will likely upgrade their microphones, potentially serving as a source of growth momentum for AAC and Goertek. (Neowin, Medium, MacRumors)

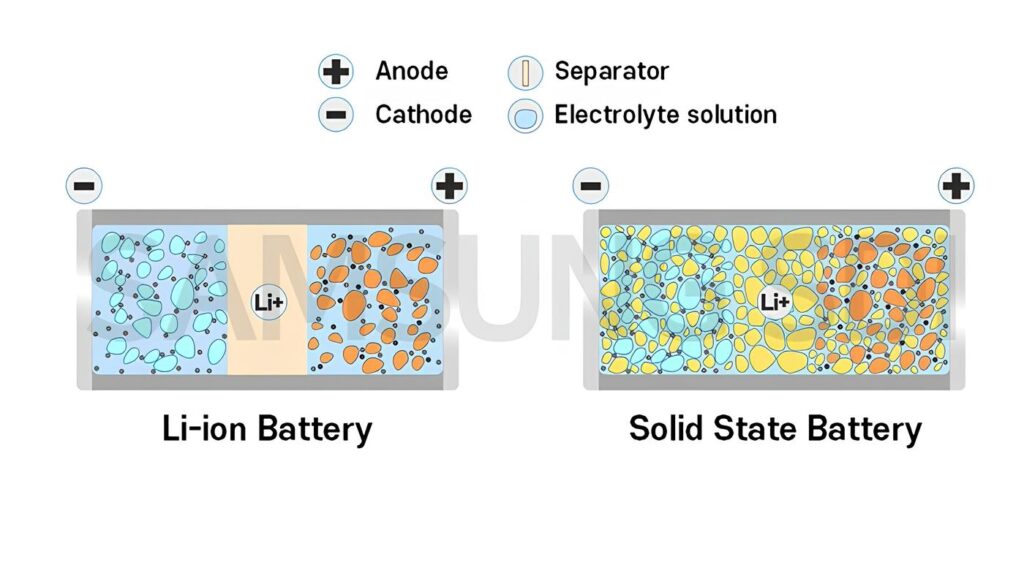

Samsung SDI has formed a new team to promote the commercialization of the all-solid-state battery (ASB), the so-called “battery of dream”. The ASB is a next-generation battery that replaces the electrolyte, which transfers ions between the positive and negative electrodes, from liquid to solid, improving safety and performance. It has advantages such as higher energy density than conventional lithium-ion batteries and lower risk of fire or explosion. Samsung SDI aims to commercialize ASB by 2027. In March 2023, the company established the ASB test production line at its Suwon research center. Samsung SDI is focusing on the development of all-solid-state batteries with an energy density of over 900 Wh/L by adopting sulfide-based technology. (Android Headlines, CN Beta, KED Global)

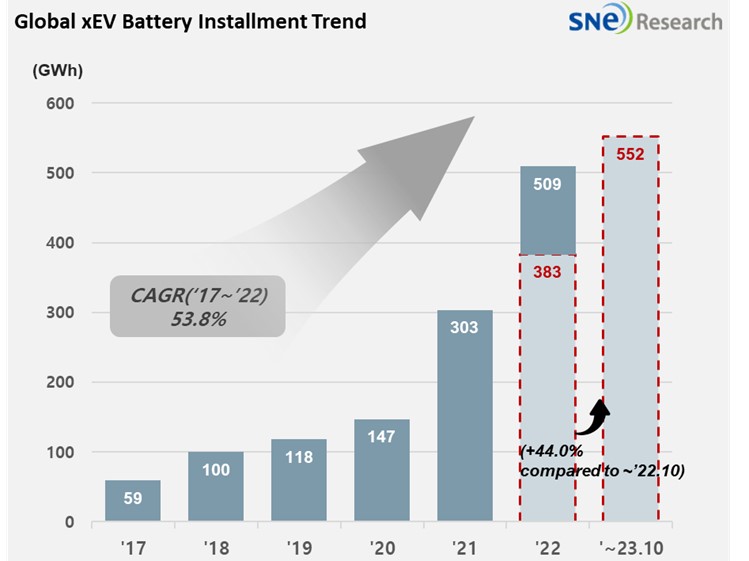

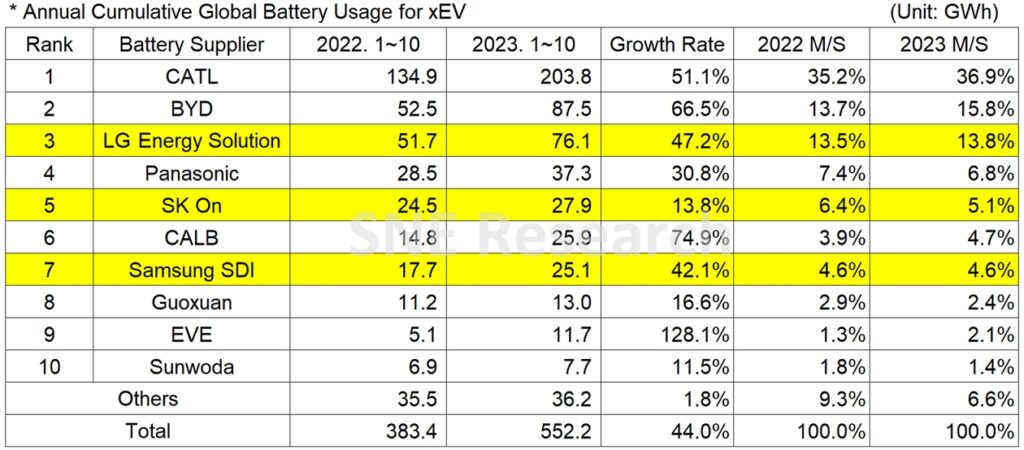

According to SNE Research, in Jan-Sept 2023, the amount of energy held by batteries for electric vehicles (EV, PHEV, HEV) registered worldwide was approximately 552.2GWh, a 44.0% YoY growth. The combined market shares of K-trio companies were 23.4%, declined by 1.1%p compared to the same period of 2022, but all of them stayed in the upward trend in terms of battery usage. Samsung SDI remained in a growth trend based on the increasing sales of BMW i4/i7 and Audi Q8 e-Tron as well as decent sales of Rivian R1T/R1S/EDV and FIAT 500. SK On also recorded growth thanks to solid sales of Hyundai IONIQ 5, KIA EV6, Mercedes EQA/B, and Ford F-150 Lightning. CATL posted 51.1%(203.8GWh) YoY growth, taking up more than 35.0% of the global market share, which made it the only battery maker in the world who recorded such a high market share. (CN Beta, Business Korea, China Daily, SNE Research)

Stellantis is partnering with California-based startup Ample on EV battery swapping, potentially allowing EVs to swap depleted battery packs for fully charged ones in just a few minutes. That will start with a fleet of 100 Fiat 500e hatchbacks that will be deployed by Stellantis’ Free2Move car-sharing service in Madrid in 2024. Ample currently has four battery-swapping stations in the Spanish capital, with a further nine planned. Ample has primarily worked with fleet operations so far, applying its tech to Nissan Leafs for Uber in San Francisco, as well as Fuso eCanter commercial trucks. Those applications, along with the Free2Move car-sharing service, are likely an easier fit for a service that requires EVs to use dedicated batteries.(CN Beta, Digital Trends, Stellantis)

Apple and its suppliers have ambitious plans to manufacture over 50M iPhones in India every year within the next 2-3 years. The construction of a Foxconn plant in Karnataka is expected to begin operations in April and aims to produce 20M mobile handsets annually, predominantly iPhones, within the next 2-3 years. Additionally, plans for another iPhone-producing megaplant are in the early stages. Tata Group is also planning to build a significant iPhone assembly plant in Tamil Nadu. The facility is expected to have approximately 20 assembly lines and employ 50,000 workers within the next 2 years. The goal is to have the plant operational within 12-18 months. This move will strengthen Apple’s partnership with Tata, which already owns an iPhone factory in Karnataka.(Engadget, GizChina, WSJ, Forbes, Times of India, India Times)

Apple is allocating product development resources for iPad to Vietnam. Apple is working with China’s BYD, a key iPad assembler, to move new product introduction (NPI) resources to Vietnam, adding that this is the first time the company has shifted NPI resources to Vietnam for such a core device. Engineering verification for test production of an iPad model will start around mid-Feb 2024 and the model will be available in 2H24. (Apple Insider, Asia Nikkei, Gizmo China)

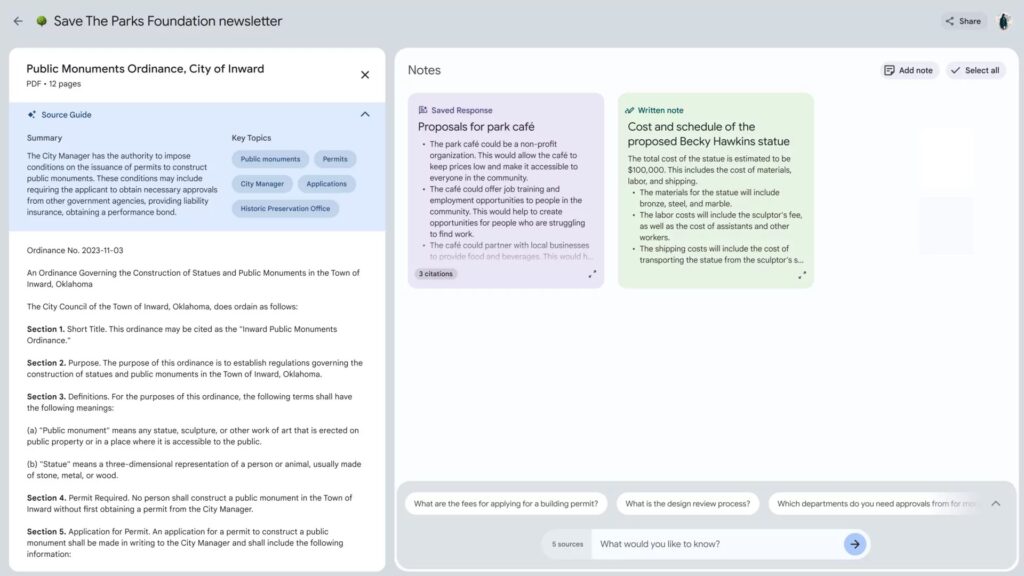

Google has announced that NotebookLM, a notebook that uses AI to help users work smarter, will be publicly available to U.S. users starting 8 Dec 2023. The AI assistant is starting to use Gemini Pro, the large language model released by Google just days ago. Aside from the public rollout, NotebookLM is getting 16 new features based on feedback from the software’s early access testers. NotebookLM is a “personalized AI collaborator”, according to Google. It works as a chatbot similar to Google Bard or ChatGPT but differs in a big way from those services. NotebookLM is all about sources, which are files or text uploaded to NotebookLM that will be used to provide answers to user queries. (Android Authority, Android Central, Google, CN Beta)

Meta is launching Imagine, its AI image generator, as a standalone product for users in the US. Meta’s Imagine AI image generator is currently free to use, and it opts for a simpler interface that presents the user with nothing but a text box and a generate button. Imagine uses tech from Emu, Meta’s image foundation model. Meta will be adding invisible watermarking to Imagine for increased transparency and traceability around the AI origins of the images it generates. The watermark is applied with a deep-learning model and can be detected by a corresponding model. It is also resilient to common image manipulations like cropping, color change, screenshots, and more. In the future, Meta will also bring its invisible watermarking to its other products that deploy AI-generated images. (Android Authority, Meta, CN Beta)

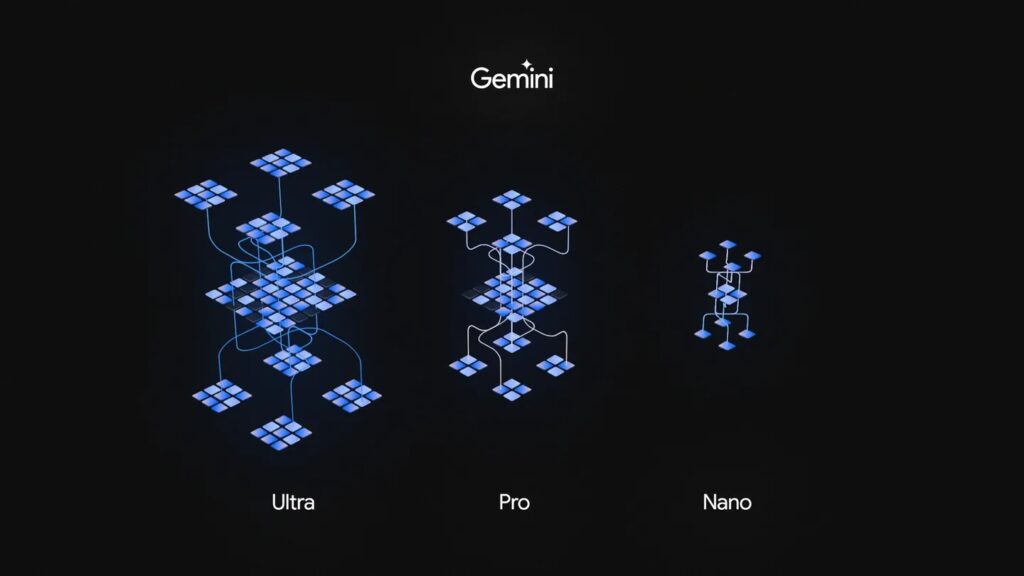

Google has announced Gemini, which is Google’s latest large language model. Gemini is more than a single AI model. There is a lighter version called Gemini Nano that is meant to be run natively and offline on Android devices. There is a beefier version called Gemini Pro that will soon power lots of Google AI services and is the backbone of Bard starting today. There is an even more capable model called Gemini Ultra that is the most powerful LLM Google has yet created and seems to be mostly designed for data centers and enterprise applications. Bard is now powered by Gemini Pro, and Pixel 8 Pro users will get a few new features thanks to Gemini Nano.(Android Headlines, Google, Google, CN Beta, CNBC, Wired, The Verge)