1-5 #SoWhat : ASML’s export license for the shipment of some chip-making equipment to China has been partially revoked; Huawei has reportedly issued a “purchasing order” for the foldable phone supply chain; Huawei allegedly will not launch a 5G phone below CNY3,000 in 2024; etc.

Dutch semiconductor equipment company ASML said that an export license for the shipment of some chip-making equipment to China has been partially revoked by the Dutch government. A license for the shipment of NXT: 2050i and NXT: 2100i lithography systems in 2023 has recently been revoked, impacting a small number of customers in China. The company also said it has held discussions with the US government about the scope and impact of its export control regulations, without elaborating further details. In 2023, the US government announced new rules giving Washington the right to restrict the export of ASML’s Twinscan NXT1930Di machine if it contains any US parts. (CN Beta, Engadget, Bloomberg, Reuters, China Daily, ASML)

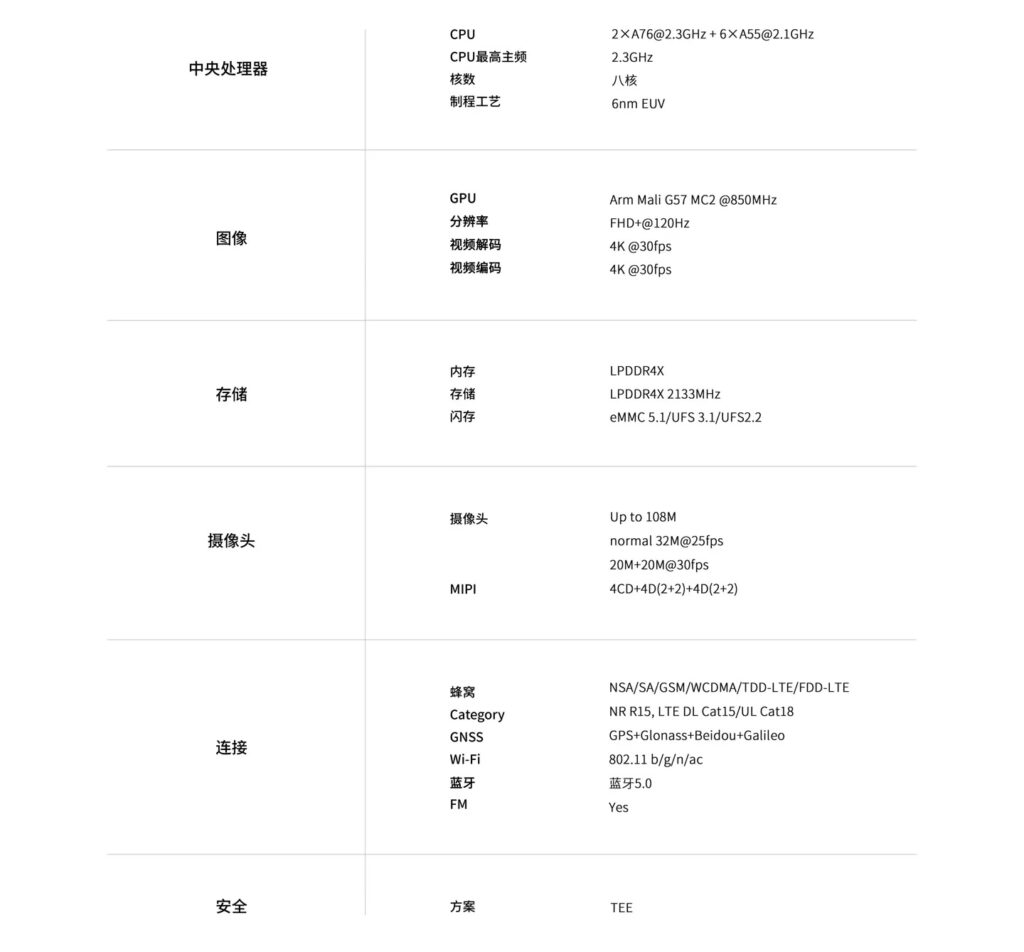

Unisoc has unveiled its latest mid-range 5G SoC T765, which is built on a 6nm EUV (TSMC) process and features two A76 cores clocked at 2.3GHz and six A55 cores at 2.1GHz. There is LPDDR4x memory support up to 2133 MHz and can use eMMC5.1 / UFS 3.1 / UFS 2.2 standards for storage. This combination should ensure smooth performance for everyday tasks and even some light gaming. The graphics department is handled by an Arm Mali-G57 MC2 GPU running at 850MHz. The chip also supports FHD+ displays with a 120Hz refresh rate and there is even support for HDR 10+ and VRR (Variable Refresh Rate) technology. As for the optics, The T765 is equipped with Unisoc’s latest Vivimagic 6.0 image engine and a 4-core ISP (2 main + 2 auxiliary) architecture. This translates to support for high-resolution cameras, up to 108MP main sensor, or a versatile triple-camera setup with 64MP, 20MP, and 13MP sensors.(Gizmo China, CN Beta, IT Home)

Samsung Electronics will invest around JPY40B (USD280M) over 5 years in a facility for research into advanced chip packaging it will set up in Japan. Samsung is reportedly looking at establishing a packaging facility in Kanagawa prefecture, where it already has a research and development centre, to deepen ties with Japanese makers of chipmaking equipment and materials. Japan’s industry ministry said it would provide Samsung subsidies worth up to JPY20B as it looks to support the revitalisation of domestic chip manufacturing. (CN Beta, Asia Nikkei, Reuters, TrendForce)

Global semiconductor capacity is expected to increase 6.4% in 2024 to top the 30M wafers per month (wpm) mark for the first time after rising 5.5% to 29.6 wpm in 2023, according to SEMI. The 2024 growth will be driven by capacity increases in leading-edge logic and foundry, applications including generative AI and high-performance computing (HPC), and the recovery in end-demand for chips. The capacity expansion slowed in 2023 due to softening semiconductor market demand and the resulting inventory correction. Covering 2022 to 2024, SEMI shows that the global semiconductor industry plans to begin operation of 82 new volume fabs, including 11 projects in 2023 and 42 projects in 2024 spanning wafer sizes ranging from 300mm to 100mm. (CN Beta, SEMI, PR Newswire)

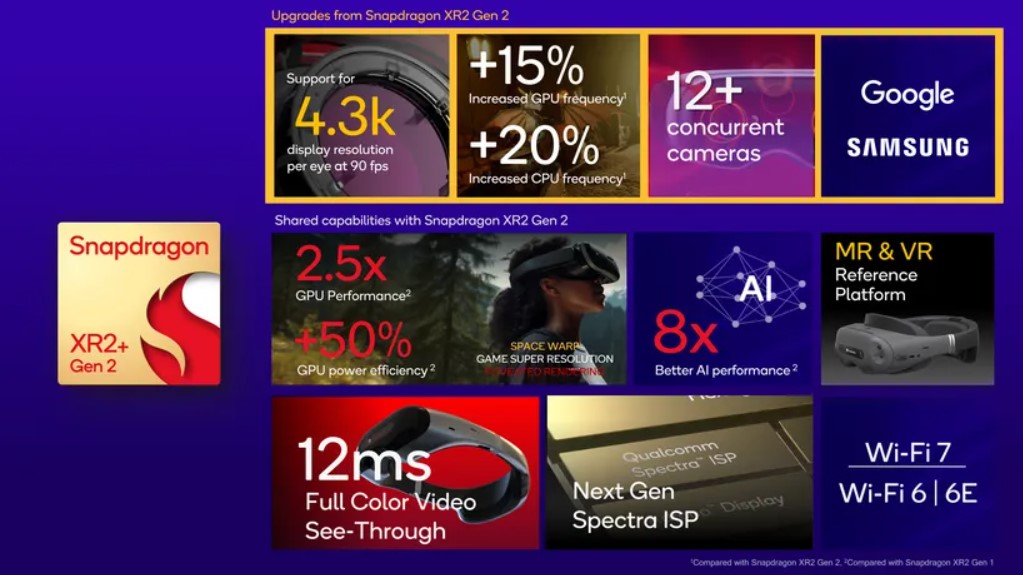

Qualcomm has launched the new Snapdragon XR2 Plus Gen 2 processor and confirmed that it will allow “Samsung and Google to provide leading XR experiences”. The XR2 Plus Gen 2 supports 4.3K resolution at 90fps per eye, which is a cut above the XR2 Gen 2’s 3K-per-eye rendering. It also supports 12 concurrent cameras to handle passthrough video as well as body and face tracking. Qualcomm says that the new chipset offers a 15 percent increase in GPU frequency compared to the standard XR2 Gen 2 and 20 percent greater CPU frequency — all in service of “spatial computing in 4K”.(Android Authority, The Verge, XDA-Developers, Qualcomm)

According to data from CINNO Research, in 3Q23, the sales volume of foldable smartphones in the Chinese market reached 1.98M units, a YoY increase of 175% and a MoM increase of 70%. This is the 12th consecutive quarter of positive YoY growth. In the future, as folding screen product technology further matures, costs further decrease, and more applications are adapted, especially after the development of applications that can take advantage of the unique advantages of foldable display, folding display products are expected to occupy more market shares. In terms of market share, Huawei ranked No. 1 in the domestic market share in 3Q23, mainly due to the good market performance of Mate X3 / Pocket S and the launch of the Mate X5 series; Honor ranked second, with the Top 7 brands having the largest sales growth. Mainly due to its Magic V2 launched in Jul 2023; vivo ranked third in the country, and its first vertical foldable product X Flip performed well in the market; Samsung / OPPO ranked fourth and fifth in terms of market share. (CN Beta, CINNO Research)

Meizu has reportedly initiated a project to develop its first foldable smartphone, which is expected to be launched in 1H24. It is speculated that the phone may feature a “book-style” design with an 8-inch display, targeting the business market. (Gizmo China, 163.com, 36Kr, Sohu)

TF Securities analyst Ming-Chi Kuo indicates several key high-end growth drivers will boost Genius over the next 1-2 years. These include a significant upgrade to Apple’s iPhone 17’s front camera lens, the periscope lens (which Apple calls a tetraprism) for the iPhone 16 Pro series, the high-unit price pancake for Vision Pro, the ultra-wide lens for the iPhone 16 Pro series, and the ultra-wide lens for the Huawei P70 series. The front camera of the iPhone 17 will be upgraded to 24Mp / 6P lens (vs. the 12MP/5P lens of iPhone 15 and iPhone 16). Genius’ progress on the iPhone 16 Pro’s periscope lens is on track. It will start shipping by the end of 2Q24 or early 3Q24. Genius is the supplier of the ultra-wide lens for Huawei’s 1H24 new P70 series. With the P70 series’ ultra-wide camera upgrade and an estimated 100-120% YoY shipment growth (vs. P60 series), Genius can mitigate the impact of the off-season effect. (Android Headlines, Medium, Twitter)

LG Innotek will allegedly be the exclusive supplier of camera modules to Tesla for Cybertrucks. Tesla plans to manufacture Cybertrucks only in the US and the South Korean parts maker will be supplying the modules from its factory in Mexico. Approximately 1M units of electric trucks are expected to be made. LG Innotek likely won the deal as its factory is close to Tesla’s in Austin, Texas. LG Innotek is also competing with Samsung Electro-Mechanics in Tesla’s ‘Berlin Project’. The Project will determine which company would supply camera modules for electric sedans that Tesla plans to sell in Europe. (The Elec, Digitimes)

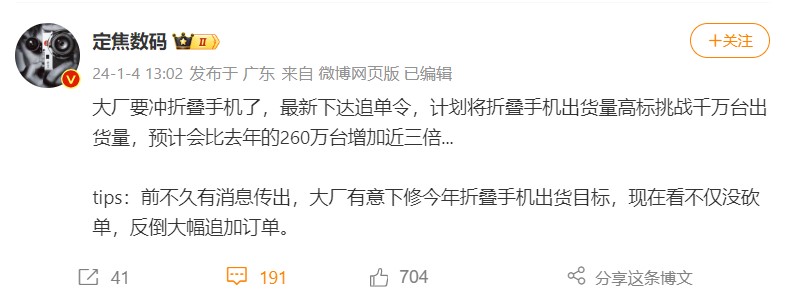

Huawei has reportedly issued a “purchasing order” for the foldable phone supply chain and significantly increased its procurement of key components CMOS image sensors (CIS). The reason for this move is that Huawei has set a very aggressive foldable phone shipment target for 2024, planning to significantly increase from 2.6M units in 2023 to 7-10M units, with a maximum increase of nearly 3 times. Due to the recovery in market conditions, the price of CIS has begun to rise, and Samsung has raised its quotation by 25-30%. To avoid further price increases in the future, CIS has become Huawei’s primary target for stocking up, mainly purchasing from OmniVision. Due to the substantial increase in the shipment target of the complete machine, the inventory of related parts has also increased several times, which has driven huge demand for back-end packaging and testing. (CN Beta, Huawei Central, Weibo, CNMO)

Memory chip vendors such as Samsung Electronics and Micron Technology are considering raising DRAM prices by 15-20% in 1Q24, according to Digitimes. Korean DRAM chip vendors have reportedly lowered their utilization rates for DRAM in 2H23. Samsung’s DRAM output in 4Q23 was only about 70% of that in 1Q23, adding that Samsung increased the proportion of output from its advanced manufacturing processes. DRAM output is expected to continue being under strict control in 1Q24. The top-3 DRAM chip vendors used to adopt the 1X nm or 1Y nm processes for DDR4, but in 2023, Samsung and SK Hynix moved their 8Gb and 16Gb products to the 1Z nm processes, while Micron moved its DDR4 production to the 1α node. Memory chip makers have also migrated from the 1α node to 1β node for 16Gb DDR5. (CN Beta, Digitimes)

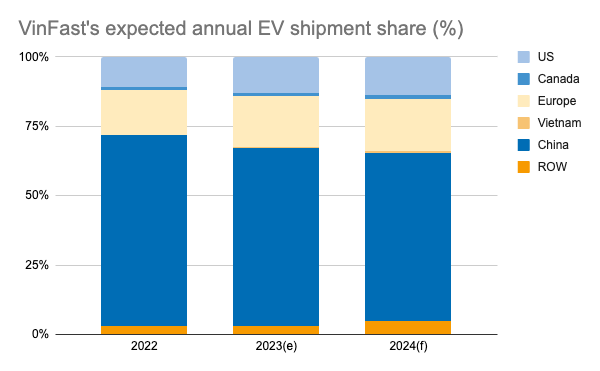

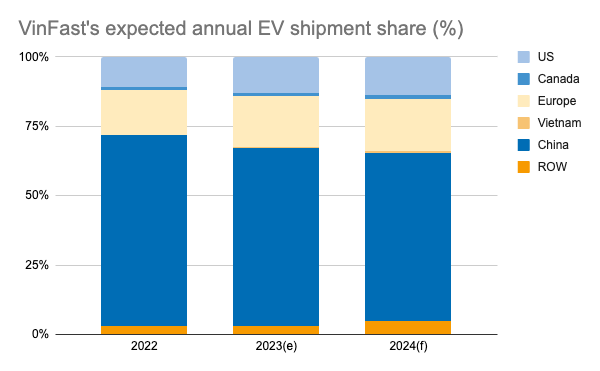

Vietnam-based Vinfast is reportedly looking to set up a battery manufacturing plant in southern India, as the company plans to make cars in the country by 2026. VinFast may establish a battery manufacturing facility in Thoothukudi, Tamil Nadu. According to a company filing released in Dec 2023, VinFast plans to establish local manufacturing facilities in strategic markets, including the US, Indonesia, and India, to take advantage of local tax benefits and local sourcing, adding that commissioning of the Indonesia and India facilities is expected in 2026 with a total capacity of up to 50,000 cars a year in phase 1 for each facility. (Digitimes, Bloomberg, Reuters, Sohu, 163.com)

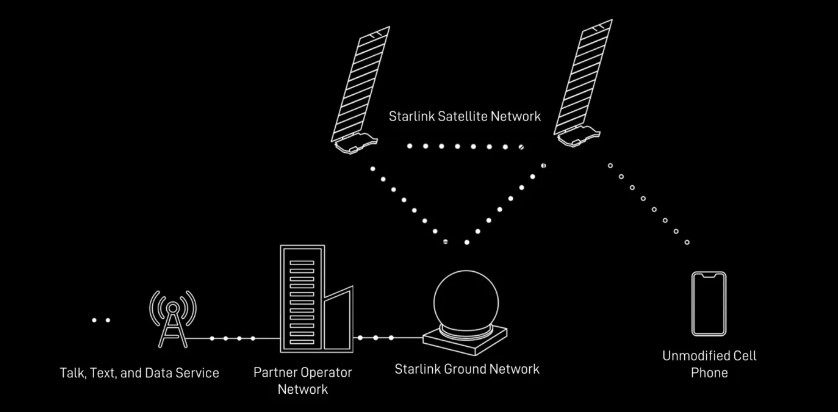

SpaceX launched its first batch of Starlink satellites that will be able to connect directly to cell phones ahead of planned testing later 2024. The company has launched 6 Starlink satellites with this capability with a batch of 15 other Starlink birds aboard a Falcon 9 rocket. SpaceX obtained approval from U.S. regulators in Dec 2023 to test the satellites in partnership with T-Mobile. SpaceX has several other partnerships with native telecom companies in countries including Australia, Canada and Japan. The approval, which was granted by the U.S. Federal Communications Commission, was for a 180-day period. SpaceX said the tests would eventually involve 840 satellites transmitting 4G connectivity to around 2,000 unmodified smartphones. The satellites will act as “cell phone towers in space”.(TechCrunch, Starlink)

Nokia has announced it has signed a new patent cross-license agreement with Honor covering both parties’ fundamental inventions in 5G and other cellular technologies. Nokia’s industry-leading patent portfolio is built on more than EUR140B invested in R&D since 2000 and is composed of around 20,000 patent families, including over 6,000 patent families declared essential to 5G. (GizChina, CN Beta, IT Home, Nokia)

Huawei lays out its vision for 2024, reflecting on the challenges faced and outlining strategic priorities for the future. Despite returning to normal operations after years of hard work, Huawei acknowledges the challenges, including geopolitical uncertainties and the impact of technical sanctions. The company emphasizes its belief in digitalization, intelligence, and low-carbonization as certain development trends. Huawei aims to embrace opportunities and invest resources strategically to achieve significant milestones in various business units. Huawei’s 2023 achievements set the stage for its vision in 2024. The company anticipates achieving sales revenue exceeding CNY700B, with notable stability in the ICT infrastructure business, better-than-expected performance in the terminal business, and significant growth in digital energy and cloud segments.(Android Headlines, Huawei)

Samsung has announced its strategic priorities for the new year, emphasizing the strengthening of the company’s competitiveness through technological supremacy and adaptability to future changes. The company co-CEO and Vice Chairman Han Jong-hee and co-CEO and President Kyung Kye-hyun has outlined the strategic focus on core values, including the pursuit of “super-gap technologies”, to maintain a competitive edge. They urged its signature chipmaking business, a leader in semiconductor technology for the past 5 decades, to further enhance its position by improving and widening the technological cap with its competitors. For its mobile, home appliances and software division, a customer-first strategy was emphasized, with a focus on performance and quality. The two leaders also called for proactive measures to address future changes, such as artificial intelligence (AI), eco-friendly practices and lifestyle innovation, calling for a need for a fundamental shift in thinking and the application of generative AI to work processes.(Android Headlines, Korea Bizwire)

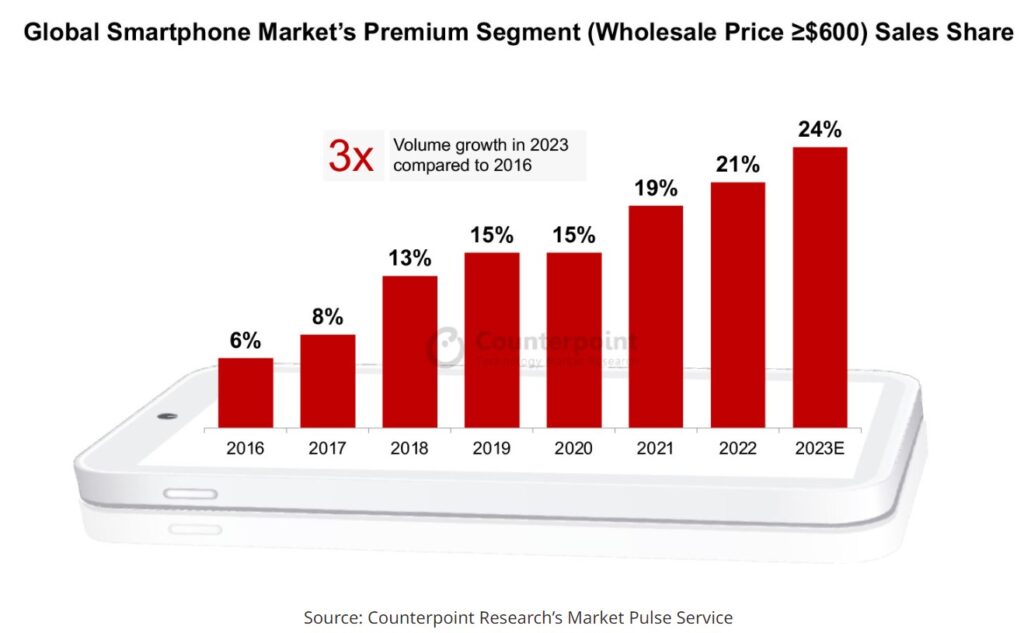

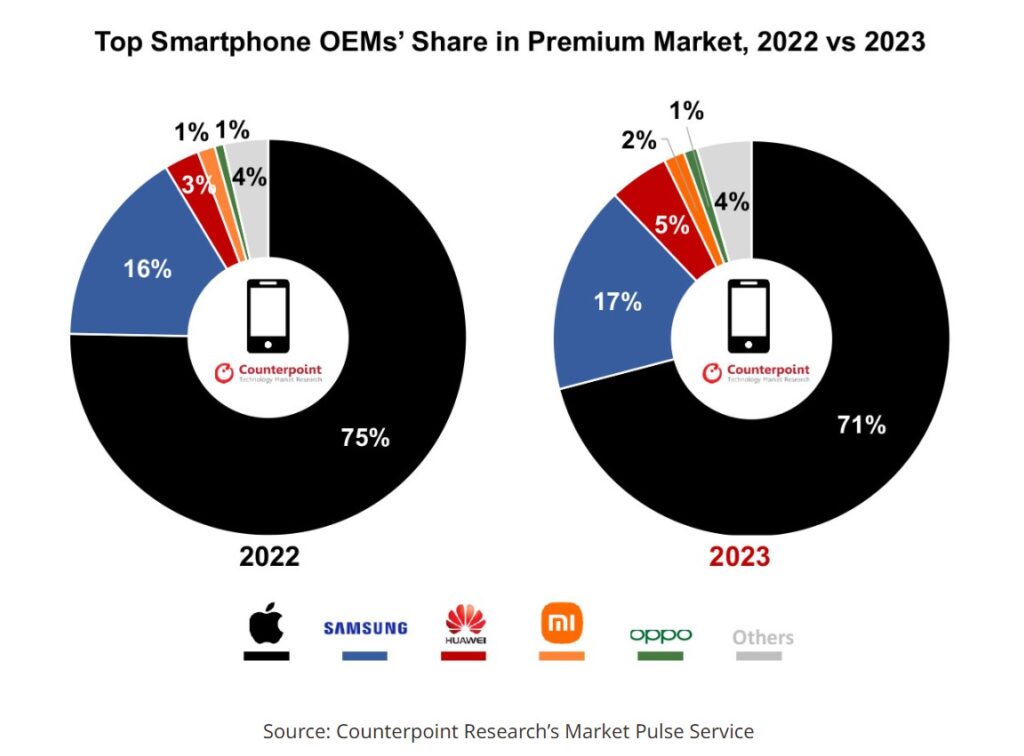

The global premium smartphone (wholesale price USD600>) market’s sales are likely to grow 6% YoY in 2023 to hit a new record, according to Counterpoint Research. This contrasts with the decline projected for the overall global smartphone market in 2023. The premium segment is likely to capture close to one-fourth of the global smartphone market sales and 60% of the revenues in 2023. Over the past few years, the premium segment has emerged as a growth area in the otherwise weak market. Apple continues to be the premium market’s undisputed leader. However, compared to 2022, its share has declined in 2023. (GSM Arena, Counterpoint Research)

Samsung has reportedly shipped 27.26M units of Galaxy S23 series in the first 10 months of 2023, Marking a remarkable 23% increase compared to the sales of the Galaxy S22 during the same period in 2022. Notably, the Galaxy S23 Ultra stands out as the shining star of the lineup. Boasting a staggering 12.6M units sold within the first 10 months of 2023. Projections suggest that by the end of the 2023, the total sales for this particular model could approach the impressive milestone of 15M units. (GizChina, IXBT, Weibo)

Huawei allegedly will not launch a 5G mobile phone priced below CNY3,000 yuan in 2024. Due to production constraints, Kirin chips will give priority to flagship models. The latest Huawei nova 12 Pro and Ultra are equipped with the new Kirin 8000 chip and Kirin 9000SL chip, respectively, with prices starting at CNY3,999 and CNY4,399. However, the nova 12 “youth” version is still equipped with Qualcomm Snapdragon 778G 4G processor, with a starting price of CNY2,499. This means that the lower-priced Maimang, Changxiang series and other models will maintain 4G network support for the time being. (My Drivers, CN Beta)

realme has announced a change in its slogan, and it will be “Make it real”. The company explains how 2024 will bring a redefined brand standard across the realme portfolio. The company will transition from an “opportunity-oriented” to a “brand-oriented” approach, aiming to be a brand that resonates with young users. The strategy transition will move from a trendy-based company to a more inclusive and expansive one with long-term investment and growth.(GSM Arena, realme)

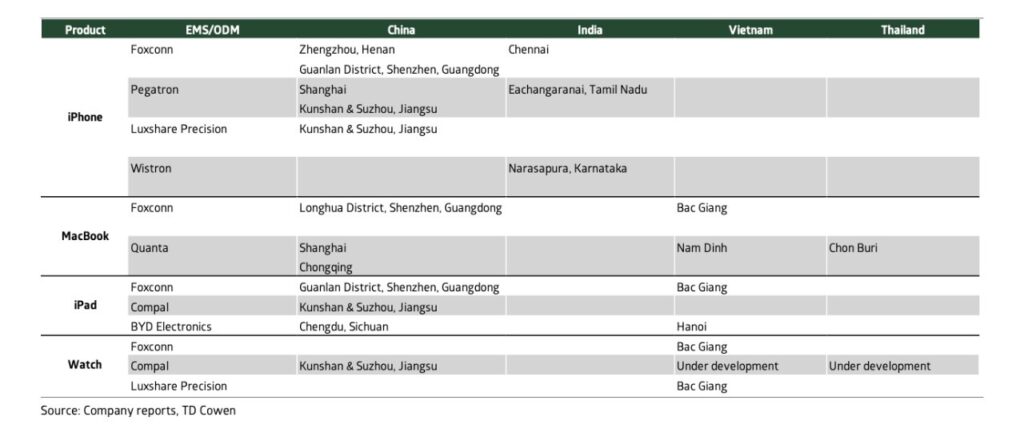

According to TD Cowen, Apple’s suppliers including iPhone manufacturer Foxconn have invested USD16B since 2018, in an increasing plan to move or reshore manufacturing away from over-reliance on China. Over the last 4 years since the start of the pandemic, TD Cowen estimates Apple’s revenues have been impacted by over USD30B. This comes from “undersupplying the market due to production disruptions stemming from component supply, available labor pool, and/or government-mandated movement restrictions”. Having “analyzed over 1,000 financial filings” from key firms such as Foxconn, TD Cowen estimates that “iPhone production is still captive to China [although] India’s Tata Electronics has potential as a future iPhone exporter”. TD Cowen estimates that Vietnam capacity can support ~40% of annual US Mac / iPad demand. TD Cowen estimates that it takes up to 18 months for a company to establish a new manufacturing plant, and potentially even longer to organize the whole supply chain. (CN Beta, ReadWrite, Apple Insider)

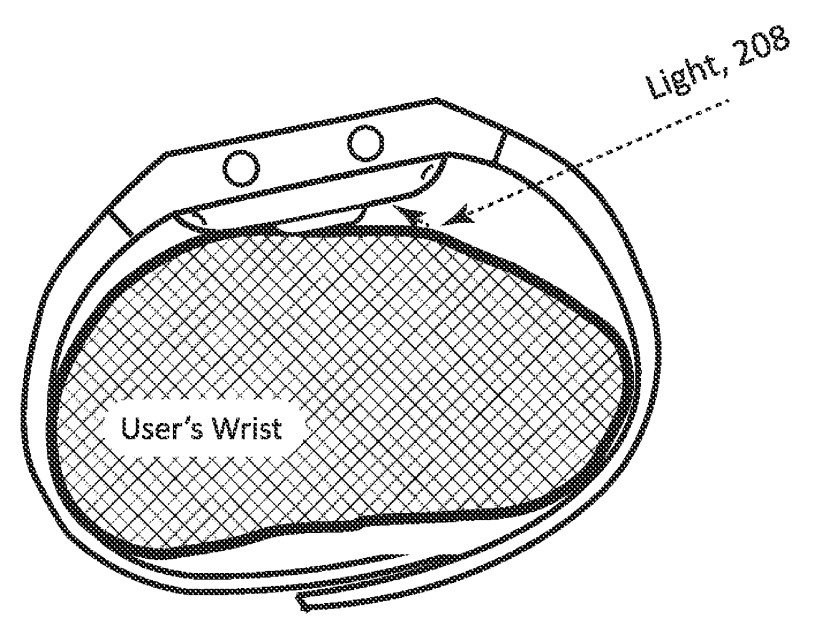

Fitbit plans to implement a “Fit score” that will tell wearers how well the wearable is fitted to their wrists. Using pressure sensors, it could tell the wearer whether the biometric signal quality is high enough to deliver accurate heart rate results. If the Fitbit detects a poor fit, it can “calibrate” blood oxygen data to take this into account. Fitbit has filed a patent for registering how well a smartwatch or fitness band is fitted, judging whether the health sensors are sitting flush against wearer wrist skin for accurate data. The patent suggests that different people have different fits that will work for them based on “differences in wrist size, skin color, hair density, BMI, fat percentage, and the likes”. The Fit Score would then take this data into account when suggesting adjustments. (Android Central, USPTO)

According to 2024 predictions from Deepwater Asset Management, Apple will acquire Peloton. Apple will look to bolster their workout segment in 2024 by adding fitness equipment to compliment the Watch and fitness tracking software. Peloton has a loyal subscriber base of about 3M users that will add about USD1.7B to Apple’s subscription revenue, additionally this fits well into Apple’s continued investment in health and wellness. (MacRumors, Deepwater, Connect the Watts)

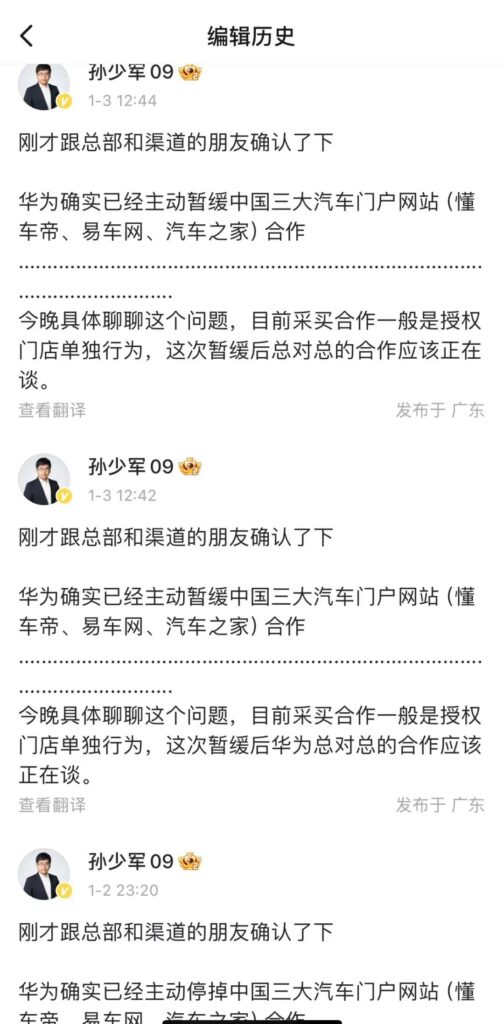

The reason why consumers cannot see detailed information about Aito and Luxeed vehicle models on Chinese platforms Dongchedi, Autohome, and Yiche anymore is because of expired partnerships, Huawei Technologies explained. Until new agreements are reached via negotiations, certain partnerships are halted because cooperation agreements between Harmony Intelligent Mobility Alliance and multiple auto information providers expired, the Shenzhen-based telecoms giant told Yicai. It provides software for Seres Group’s Aito and Chery Automobile’s Luxeed brands via the alliance. CN Beta, 36Kr, STCN, Yicai Global, AAStocks)

Samsung Electronics has announced a collaboration with Hyundai Motor Group to expand its SmartThings platform to support connected cars, including electric vehicles (EVs). The two companies will work together for the next-generation smart home to connect Samsung’s SmartThings with Hyundai and Kia’s connected cars, including EVs, to develop the “Home-to-Car” and “Car-to-Home” services as well as an integrated home energy management service. Through the SmartThings platform, users will be able to perform a variety of actions pertaining to their cars while at home — starting them, controlling smart air conditioning, opening and closing windows and checking their charging status. And from cars, the control of home appliances such as TVs, air conditioners and EV chargers will also be possible.(Android Headlines, Samsung)

Baidu has announced that its state-of-the-art generative AI tool ERNIE Bot has now reached over 100M users. This bot is a product of the ERNIE Foundation Model. Since its debut in late Aug 2023, ERNIE Bot has rapidly become a go-to solution for a wide range of tasks. Its versatility is evident in its usage statistics: it has produced 3.7B words in workplace settings, aided over 2M professional users, penned 300M lines of code, and processed 400M words in contracts.(Gizmo China, Sina, MoneyDJ, 163.com)