2-24 #ChapGohMei2024 : Samsung has secured a 2nm AI chip order from Preferred Networks; Western Digital and Kioxia are allegedly progressing in their merger talks; Meizu is quitting the smartphone business; etc.

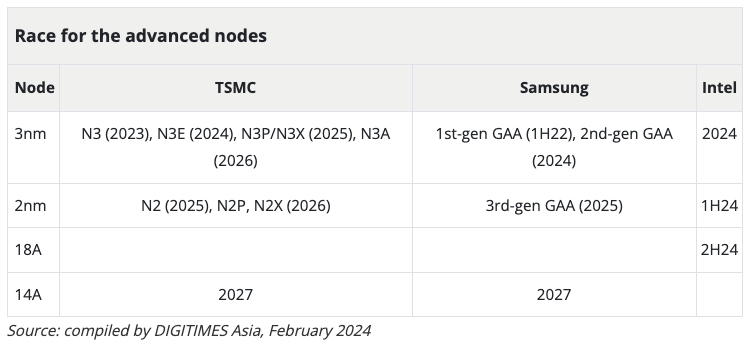

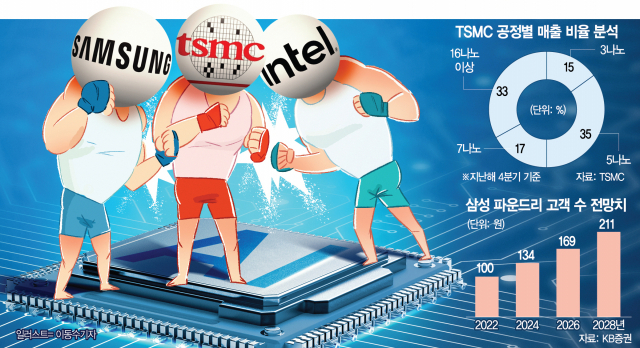

TSMC is on track to move 2nm process technology to risk production at its new fab on the Baoshan campus of the Hsinchu Science Park (HSP) in northern Taiwan in 4Q24, followed by volume production in the 2Q25, according to Digitimes. its 2nm node has seen better-than-expected progress as Apple is set to be the first customer for the 2nm process, commanding a contract chipmaking quote of almost USD25,000 per wafer. Other big tech firms, such as Intel, MediaTek, Qualcomm, Nvidia, AMD, and Broadcom, are also working with TSMC to make chips using the 2nm process. TSMC has also made initial plans for fab expansions in 2024-2029, with Baoshan and the southern city of Kaohsiung being the main production bases for the 2nm node. The foundry house is also seeking to build 2nm or A14 (1.4nm) capacity in Taichung in 2027, and fabs for A14 and the next-generation A10 processes will be built mainly in Taichung and Kaohsiung in 2029. (Digitimes, CN Beta)

Samsung Electronics has reportedly secured a 2nm AI chip order from Japan-based startup Preferred Networks (PFN), possibly the first customer of Samsung’s 2nm node other than Samsung. PFN has been TSMC’s customer since 2016, and the startup allegedly switched its partner in favor of Samsung because the latter provides a comprehensive chip-making service on a turnkey basis, from design, production, and advanced packaging. PFN, which provides chips for Toyota, NTT, and FANUC, said it was ramping up investments in customized AI chips amid the global AI boom. (CN Beta, Evertiq, Digitimes, TrendForce)

British AI chip startup Graphcore is rumored to be for sale, with the asking price estimated at USD500M. Arm, SoftBank, and OpenAI are said to be among potential buyers. Graphcore documents show that its losses increased by 11% in 2022, exceeding USD200M, while revenue declined from USD5M to USD2.7M. Graphcore is expected to complete a new round of fundraising in 3Q23. However, no information has been publicly disclosed about it. Graphcore was once seen as a potential competitor to Nvidia. In the second half of 2020, Graphcore raised USD700M in funding, valuing the company at USD2.8B, with investors including Microsoft and Sequoia Capital. However, the investors have significantly reduced the value of their investments in Graphcore. (CN Beta, Digitimes, Techspot, Tom’s Hardware, Yahoo)

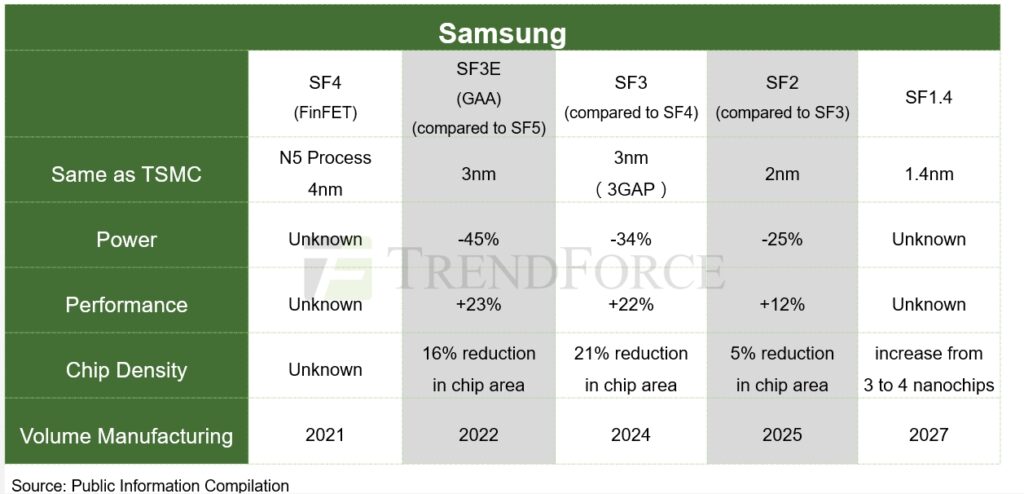

Samsung has announced that it will deliver the next generation Arm Cortex-X CPU optimized on Samsung Foundry’s latest Gate-All-Around (GAA) process technology. This initiative is built on years of partnership with millions of devices shipped with Arm CPU intellectual property (IP) on various process nodes offered by Samsung Foundry. The companies have bold plans to reinvent 2nm GAA for next-generation data center and infrastructure custom silicon, as well as a groundbreaking AI chiplet solution that will revolutionize the future generative artificial intelligence (AI) mobile computing market. (CN Beta, Samsung, ZDNet, Anandtech)

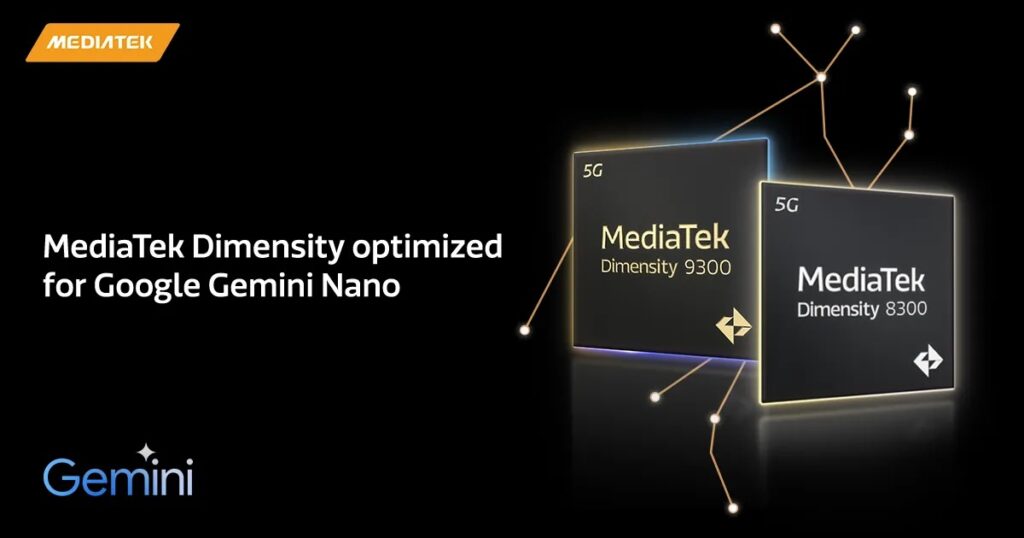

MediaTek has revealed that it has worked with Google to support and optimize Gemini Nano on Dimensity 9300 and 8300 phones. Both MediaTek’s NeuroPilot toolkit and the Dimensity 9300 and 8300’s APU made running Gemini Nano possible. MediaTek also noted what it views as the benefits of on-device AI processing, such as “seamless performance, greater privacy, better security and reliability, lower latency, the ability to work in areas with little to no connectivity, and lower operation cost”. (Android Central, Mediatek)

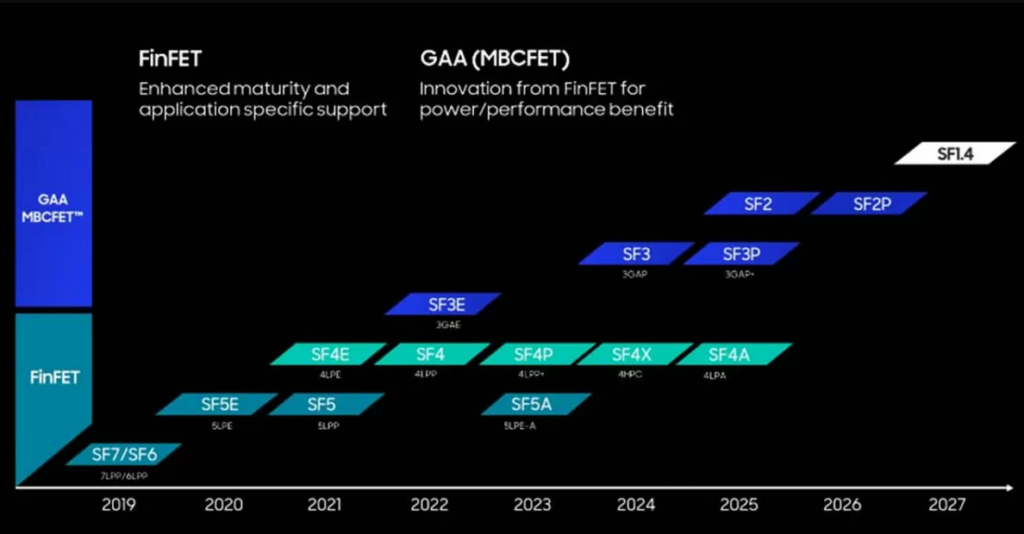

Samsung Foundry has revealed that it is working on a very advanced SF2 GAAFET process, it is hoping to outmuscle its main rival in a future 2nm node category. Samsung Electronics is taking advantage of these advantages to win orders for the 2 nm project. Samsung Electronics took its first step by winning an order to produce a 2nm AI accelerator from Preferred Networks (PFN), Japan’s largest AI company. Qualcomm, the world’s largest system semiconductor design company, has entered into discussions with Samsung Electronics’ System LSI Division, which designs high-performance chips, to produce 2nm prototypes. (CN Beta, Sedaily, WCCFTech, IT Home, Samsung)

Samsung has reportedly formed a new semiconductor development organization in Silicon Valley, aimed at developing next-generation AGI chips. The AGI Computing Lab boasts a group of the world’s most talented researchers and engineers in the tech sector. The new facility suggests Samsung Electronics’ shift beyond memory chips to produce next-generation AI features, with other global tech firms already on the path toward AGI chip development. (CN Beta, Korea JoongAng Daily, Pulse News, WCCFtech, MK)

Samsung Display’s current-generation 7” foldable display has successfully passed the highly stringent military standard ‘MIL-STD 810G’ test that the U.S. Department of Defense recognizes. Also known as the American ‘Military Specification’ (MilSpec), several parts are evaluated and then taken through a series of tests to see if they qualify for this certification. Samsung has requested UL Solutions, a global applied safety science institute, to verify the durability of its 7” foldable panel. To receive the ‘-STD 810G’ certification, products or other components need to pass tests based on temperature and shock that are typically encountered in daily life scenarios or when performing specific outdoor activities. (CN Beta, SamMobile, WCCFTech, The Elec)

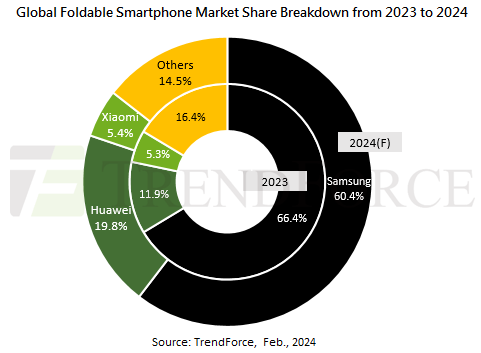

TrendForce reports that global shipments of foldable phones reached 15.9M units in 2023, marking a 25% YoY increase and accounting for approximately 1.4% of the overall smartphone market. In 2024, shipments are expected to rise to about 17.7M units, growing by 11% and slightly increasing the market share to 1.5%. However, this growth rate remains below market expectations, with the segment’s share predicted to exceed 2% only by 2025. The slowdown in the growth of foldable phones is attributed to two main factors: Firstly, consumer retention is low due to frequent maintenance issues faced by first-time foldable phone users, leading to a lack of confidence in the product. As a result, users may opt for high-end flagship smartphones when considering replacements. Secondly, the current price points of foldable phones have yet to reach the sweet spot for consumers, making it challenging to meet sales targets based solely on pricing. (GSM Arena, TrendForce, TrendForce)

Western Digital and Kioxia are allegedly progressing in their merger talks and have figured out a rough structure that would eventually involve a dual-listing in Japan. Under the terms being discussed, Western Digital would spin off its flash business and merge it with Kioxia, creating a publicly traded company in the US, the company would also plan a second stock listing in Japan. Western Digital management is expected to run the combined company. (CN Beta, Investing, Yahoo, BNN Bloomberg)

Kioxia has reportedly offered its investor SK Hynix the opportunity to produce semiconductors at its plants in Japan in a bid to revive its merger talks with Western Digital (WD). Kioxia attempted to integrate with its long-term partner WD to form a new memory company. However, SK Hynix, through indirect investment from Bain Capital, expressed concerns that successful integration would diminish its influence over Kioxia. Therefore, SK Hynix opposed the integration plan between Kioxia and Western Digital, ultimately terminating the plan in Oct 2023. The proposed cooperation from Kioxia involves allowing SK Hynix to utilize the joint NAND factory owned by Kioxia and WD in Japan for memory production. Kioxia proposed a cooperation plan to SK Hynix, hoping to persuade SK Hynix to agree to the merger between Kioxia and Western Digital, thus restarting merger negotiations between the two. (Digitimes, PC Gamer, Reuters)

Kioxia and Western Digital (WD) have announced that their joint venture manufacturing facilities at Yokkaichi and Kitakami plants have been approved to receive an up to JPY150B (USD1B) subsidy, including facilities that will produce its latest generation of 3D flash memory based on the innovative wafer bonding technology and future generation advanced nodes. This brings the total amount of subsidy it is providing up to JPY243B (USD1.63B). Investment from Kioxia and Western Digital is expected to total JPY729B (USD4.9B) for two factories producing NAND flash memory near the Japanese cities of Yokkaichi and Kitakami. The joint venture partnership has been going for about 20 years. (Nikkei Asia, Yahoo, Kioxia, The Register)

SK Hynix has confirmed record-breaking sales of High Bandwidth Memory (HBM) over the past few months, driving profitability in the fourth quarter and predicting an industry-wide recovery. SK Hynix Vice President Kim Ki-tae has stated that the demand for HBM, as an AI memory solution, is experiencing explosive growth as generative AI services become increasingly diverse and continue to evolve. He has also mentioned that despite ongoing external uncertainties, the memory market is expected to gradually warm up in 2024. SK Hynix is reportedly set to establish an advanced packaging plant in Indiana, with the US government aiming to reduce dependence on advanced chips from Taiwan.CN Beta, Korea IT Times, TrendForce, WCCFTech)

Apple says the batteries in the iPhone 15, iPhone 15 Plus, iPhone 15 Pro, and iPhone 15 Pro Max are designed to retain 80% of their original capacity at 1,000 complete charge cycles under ideal conditions, compared to the 500 charge cycles it advertises for all older iPhone models. Its latest testing for iPhone 15 models involved charging and discharging the battery 1,000 times under specific conditions, but it did not provide any exact details about the process. Apple added that it has continually made improvements to iPhone battery components and its power management system. (CN Beta, Apple, MacRumors)

Qualcomm has unveiled the industry’s first Automotive Grade Wi-Fi 7 Access Point solution, Qualcomm QCA6797AQ. Qualcomm’s platform offers a comprehensive suite of solutions, including Cellular 5G/4G, Wi-Fi, Bluetooth, C-V2X, and precise positioning technologies. Wi-Fi 7 enhances link reliability and lowers latency through features like High Band Simultaneous Multi-Link Radio, virtually eliminating dropped connections due to external interference. By being able to operate on the 5GHz and 6GHz channels simultaneously, it optimizes communication channels, resulting in more reliable connections for uninterrupted data transfers and reduced latency, crucial for latency-sensitive applications like streaming and gaming. The increased capacity of Wi-Fi 7, enabled by the 6GHz spectrum and 320 MHz channels, coupled with features like 4K QAM and Adaptive Puncturing, allows peak throughputs of up to 5.8 Gbps, enabling faster downloads of High-Definition Maps and supports the growing number of Wi-Fi devices in vehicles.(CN Beta, Qualcomm, Autofutures, Ubergizmo)

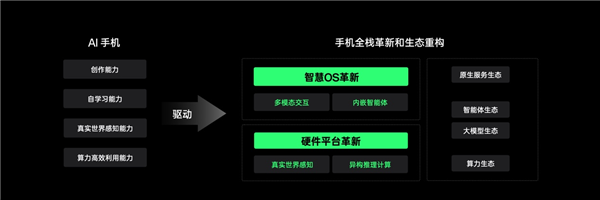

OPPO has announced it has created an “AI Center”, capable of bringing generative AI features to its devices as it looks to the future. OPPO plans to bring generative AI features to its Reno 11 series in 2Q24 once it launches globally. OPPO states that “an array” of features will appear in the series when it launches globally. Such features include OPPO AI Eraser and more. OPPO adds the arrival of its generative AI features will vary depending on the market release of its Reno 11 series. (Android Central, SCMP, Digitimes, Global Times, Sina, IT Home)

Meizu Technology is quitting the smartphone business. The company, owned by car maker Geely, said AI is the future and will invest “All in AI”. the FlymeOS team will be restructured into working on new AI terminal devices that will use globally available LLM (large language model) such as Open AI. A new mobile OS tailored for the AI era will be launched in 2024, and the first AI-enabled hardware product will also be released later in 2024. Shen Ziyu, Chairman and CEO of Xingji-Meizu, once stated that the smartphone business would mainly be revitalized through the Meizu brand. Despite the difficulties in operating in the mid-to-high-end market, Meizu will focus on deeply operating mid-to-high-end flagship smartphones after its return. In addition, AI-driven smartphones or future new hardware will likely drive rapid updates and evolution in consumer electronics. Xingji-Meizu aims to seize this LLM wave. (Global Times, Qooah, Sina, 36Kr, Digitimes, TechNode, Meizu)

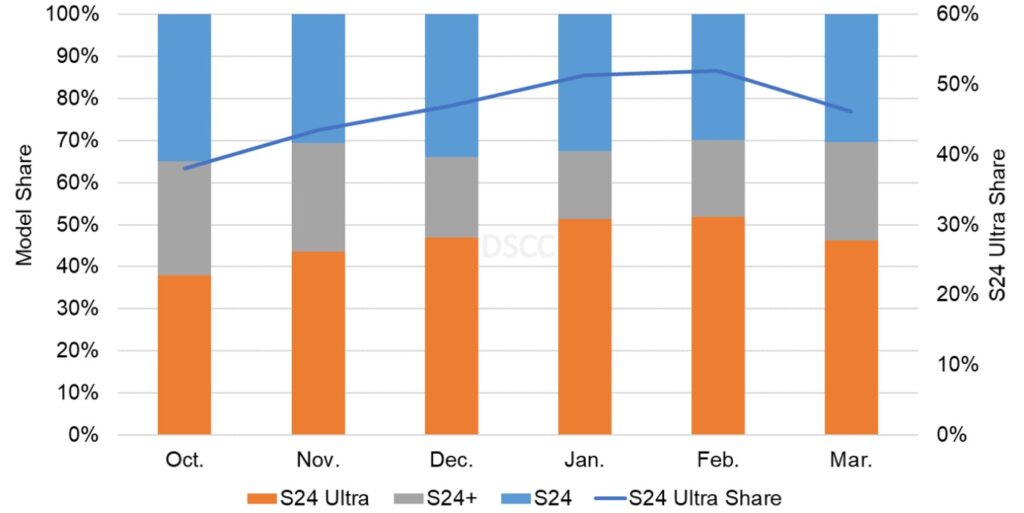

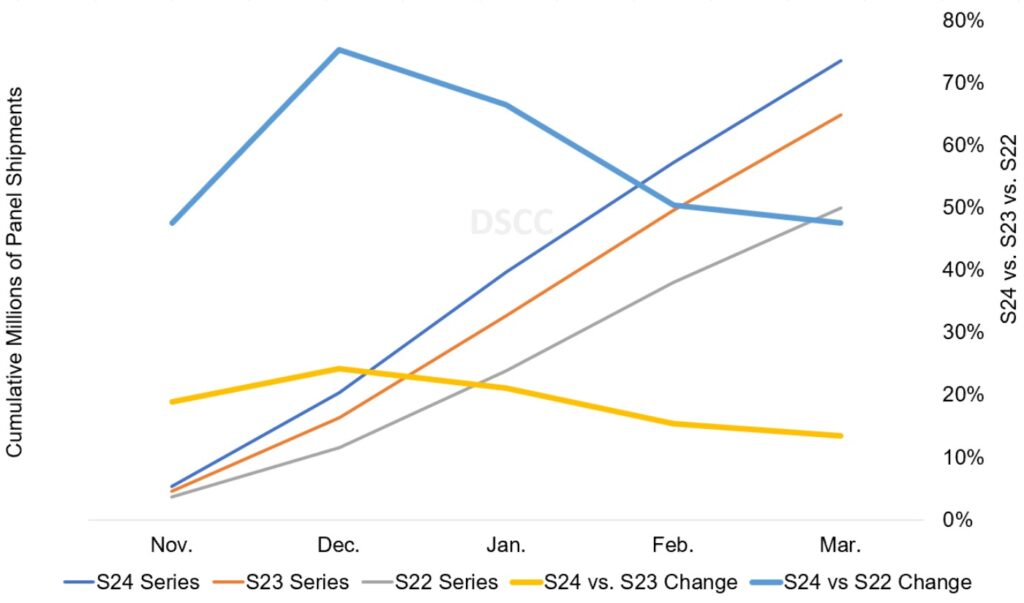

Samsung Galaxy S24 series is announced in Jan 2024. According to DSCC, the S24 series cumulative panel shipments in Jan 2024 were 21% higher than the S23 series and 66% higher than the S22 series during the same 3 month period of Nov–Jan leading up to the launch. For Mar 2024, the S24 series cumulative panel shipments are estimated to be 13% higher versus the S23 series and 47% higher versus the S22 series during the same time 5-month period of Nov–Mar.(CN Beta, DSCC, WCCFtech, Aroged)

Google has told suppliers to start making its Pixel smartphones in India by 2Q24 at the earliest. The supply chain strategy is part of Google’s ambitious target of shipping more than 10M Pixel phones in 2024, after shipping around 10M its for the first time in 2023 amid a global economic slowdown. Google will first prepare the production line for its high-end Pixel 8 Pro in the southern part of India in the coming weeks, then begin turning out phones in the Apr-Jun quarter.(Android Authority, Asia Nikkei)

Honor has announced a partnership with Porsche Design in earlier 2024, and the assumption was that the German marque’s deal with Huawei was over. Porsche Design has confirmed that its deal with Huawei ended in Jun 2023. Honor’s tie-up with the German designer is off to a seemingly ho-hum start with the Honor Magic V2 RSR Porsche Design foldable. (CN Beta, Android Authority)

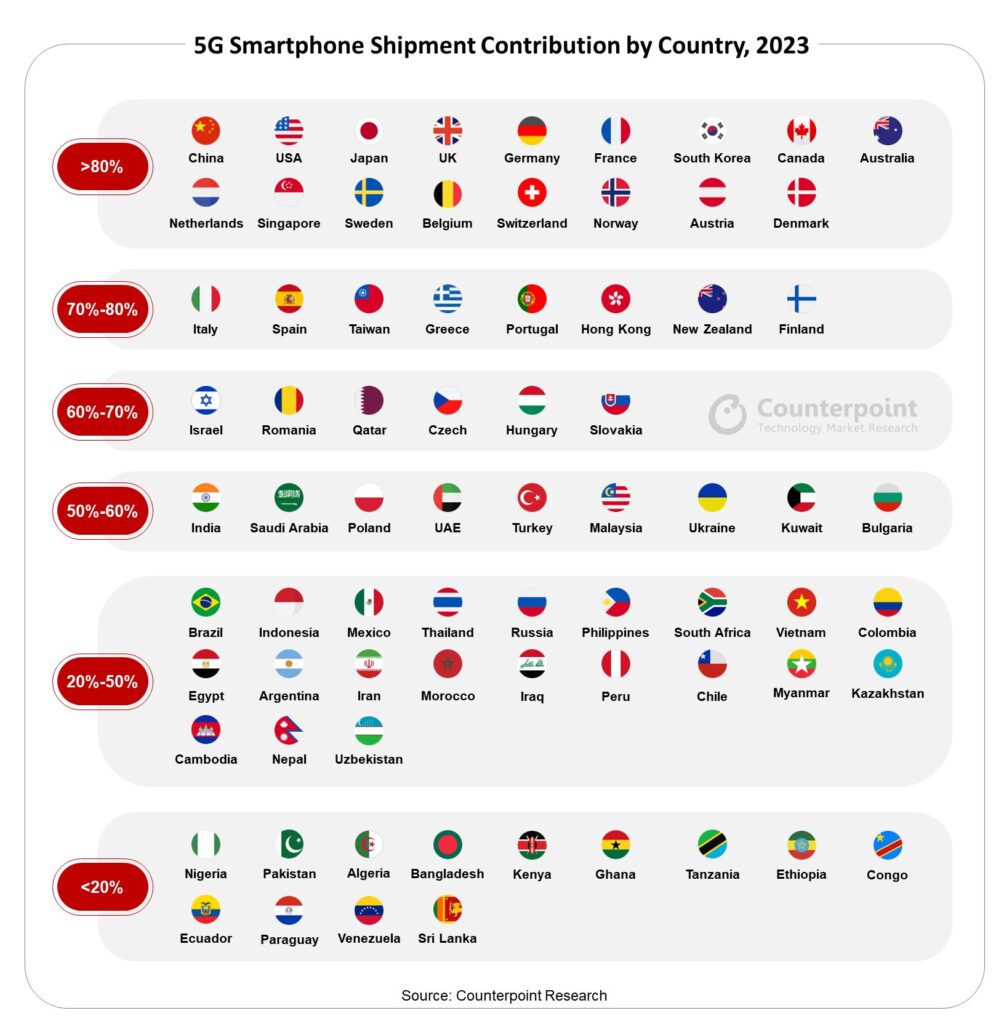

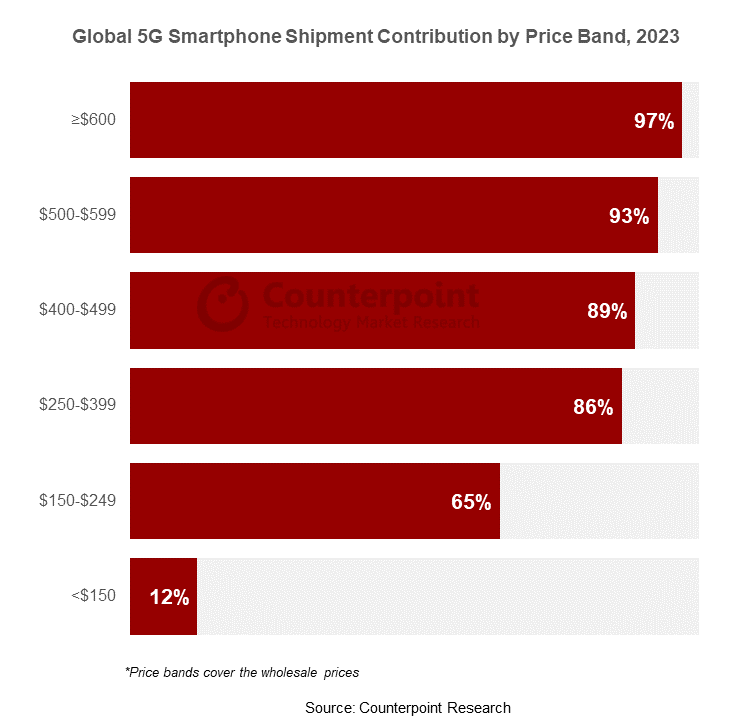

Global cumulative shipments of 5G smartphones surpassed 2B units in 4Q23, according to Counterpoint Research. This milestone was achieved in less than 5 years, the shortest period when compared to previous technologies like 4G or 3G. It took 4G smartphones 6 years to reach this mark. Nearly 70% of all 5G shipments came from developed smartphone markets such as China, US and Western Europe. Apple and Samsung were the top 5G smartphone brands, shipping over 1B units cumulatively. The launch of the iPhone 12 series, the first 5G-capable iPhones, significantly accelerated 5G adoption, taking global 5G shipments to above 100M units in a single quarter for the first time in 4Q20. The momentum continued and the shipments hit a new record in 4Q23, reaching 200M units in a single quarter. (Counterpoint Research, CN Beta)

Sony’s PlayStation VR2 headset is designed to work exclusively with a PlayStation 5, but the company is now testing out support for PC. While the original PSVR headset got unofficial support for PC, Sony now says it is working on allowing PSVR 2 owners to connect the headset to a PC gaming rig. (CN Beta, The Verge, UploadVR, Playstation)

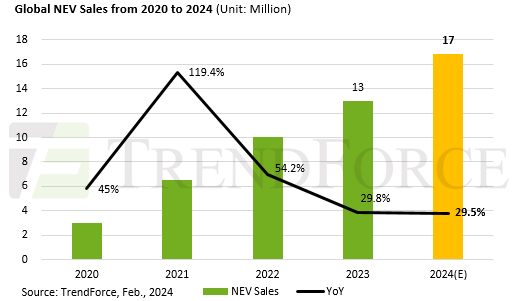

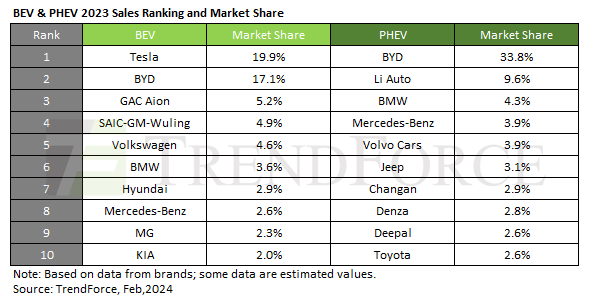

TrendForce reports that global sales of NEVs, including BEVs, PHEVs, and FCVs, reached 13.03M units in 2023—marking a growth rate of 29.8%. This represents a significant slowdown from the 54.2% growth rate in 2022. Of these, BEVs accounted for 9.11M units with a growth rate of 24%, and PHEVs reached 3.91M units, growing at 45%. TrendForce further notes that China remains the largest market for NEVs, commanding about 60% of the global market share. However, growth is slowing down due to a high base effect, and limited sales growth in other regions cannot compensate for the gap left by the Chinese market. As a result, the growth rate of NEV sales is expected to slow down, with an estimated 16.87M units sold in 2024 and achieving a growth rate of 29.5%. (TrendForce, TrendForce, CN Beta)