3-10 #PricelessSmile : Apple is working on a 20.3” foldable screen MacBook; Huawei and vivo have signed a global patent cross-licensing agreement; Sony might be considering an exit from the Chinese smartphone market; etc.

The Centre for Development of Telematics (C-DOT) has signed an MoU with Qualcomm to provide wireless IC designers to stimulate innovation and accelerate commercialization as Qualcomm India is ramping up investments under a newly appointed leader. Under the partnership, C-DOT, a public-funded research institution under the Ministry of Communications, and Qualcomm will facilitate local startups’ access to advanced chip technologies and accelerate the pace of commercialization and business development for those engaged in building indigenous telecom products and solutions. (Digitimes, Live Mint, PIB, ET)

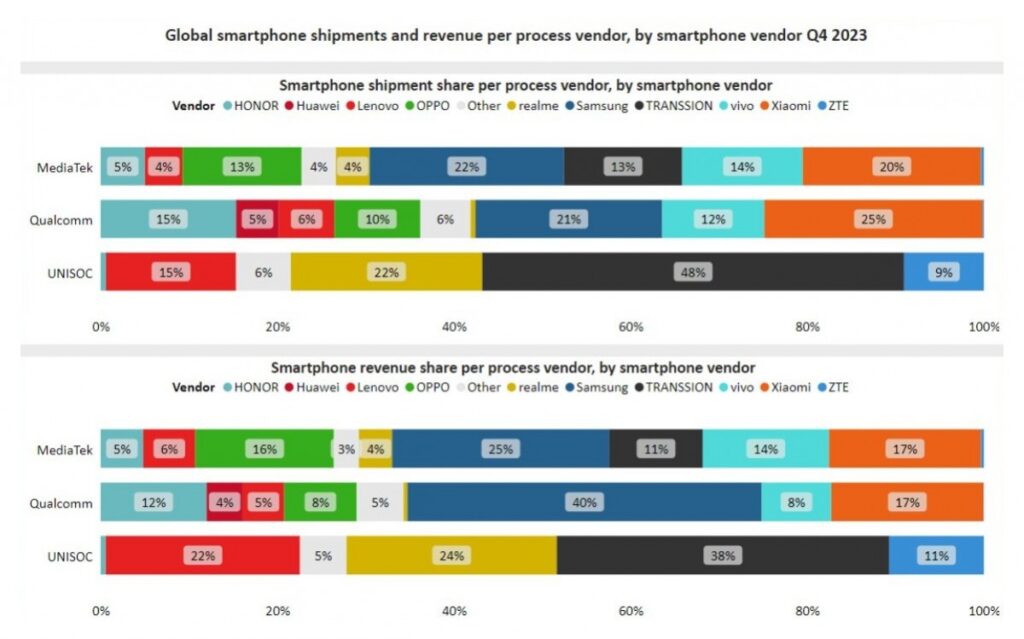

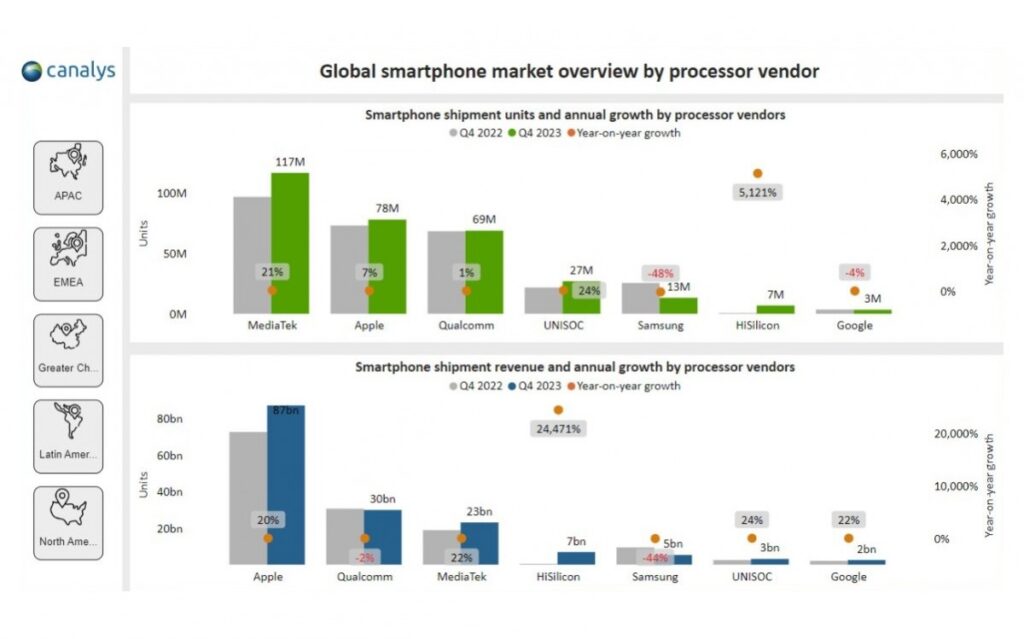

Canalys has revealed Mediatek powered more devices than any chip maker in 4Q23, with a 21% increase YoY. In terms of revenue, it is Apple that took the crown in 4Q23. Apple’s silicon on iPhone brought USD87B in revenue for the US company, 20% more than the same period last year. Mediatek, Apple, and Qualcomm were the top three chipset providers across the market, while Huawei-owned HiSilicon saw USD7B in revenue for 7M units. Unisoc chipset saw a 24% YoY increase both in revenue and volume. Half of the phones with an SoC from this vendor were under the Transsion umbrella, which includes brand Infinix, Tecno, and iTel, which are popular in emerging markets. (Android Headlines, Twitter, GSM Arena, CN Beta)

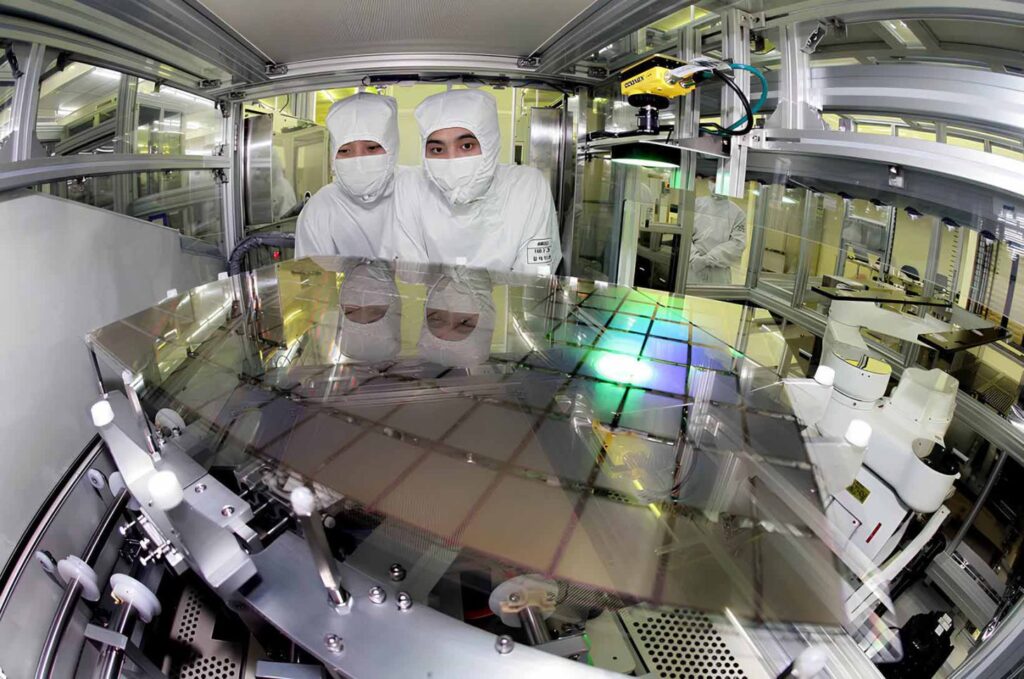

Samsung Foundry is renaming its second-generation 3nm node 2nm. Samsung also recently completed a 2nm order for a Japanese startup called Preferred Networks (PFN). The completed order was allegedly actually a shipment of the manufacturer’s second-generation 3nm wafers. Qualcomm also recently requested Samsung and TSMC to provide their 2nm samples, likely for the upcoming Snapdragon 8 Gen 5, but it is possible that Qualcomm would be evaluating a 3nm SoC and not a 2nm one. (Android Headlines, Phone Arena, WCCFTech, ZDNet)

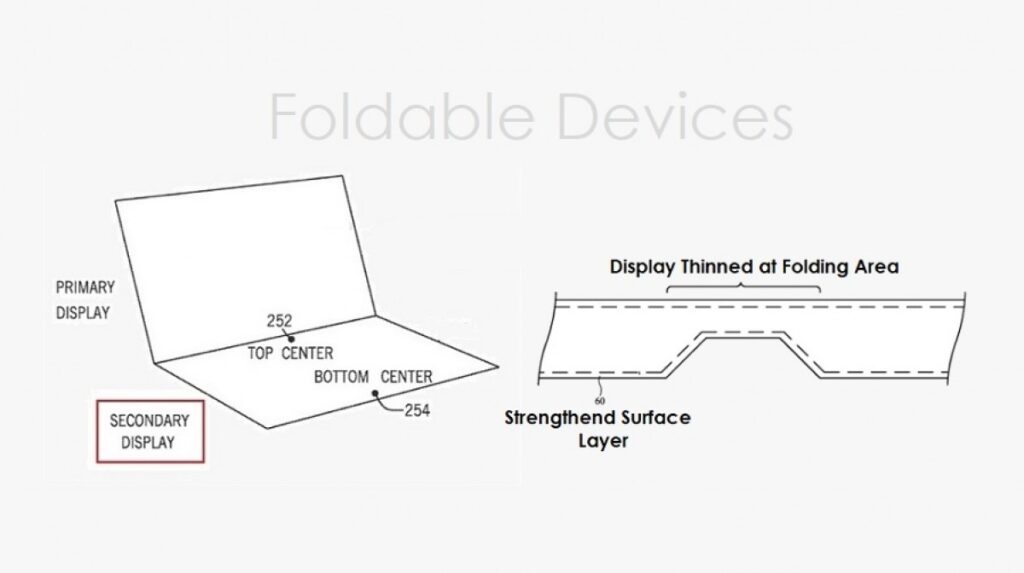

TF Securities analyst Ming-Chi Kuo has revealed Apple is working on a 20.3” foldable screen MacBook and will launch the device in 2027. Apple will not mass-produce foldable iPhones or iPads in 2025 or 2026. Samsung Display is reshifting its focus on mass production of foldable panels, likely to adapt to Apple’s requirements and future plans. (Twitter, GSM Arena)

Apple owns a patent on technology that prevents displays from creasing. The patent covers a means of chemically creating textured glass near the fold to keep it from cracking and more. The display is thinned at the folding area through chemical processing and might use different materials to keep the area smooth at all times. Apple’s patent claims grooves in the display area can be countered with a transparent cover layer that overlaps the display panel. An elongated groove or other recess may be formed in the layer of glass that runs parallel to the bend axis, while overlapping the bend axis. The locally thinned portion will be strengthened by a polymer deposited as a liquid in the groove, formed from the thinned portion, and subsequently cured by applying UV light, heat, catalyst, and other curing techniques. The patent revealed that the entire composition of the glass might have to be changed. (CN Beta, GSM Arena, Patently Apple)

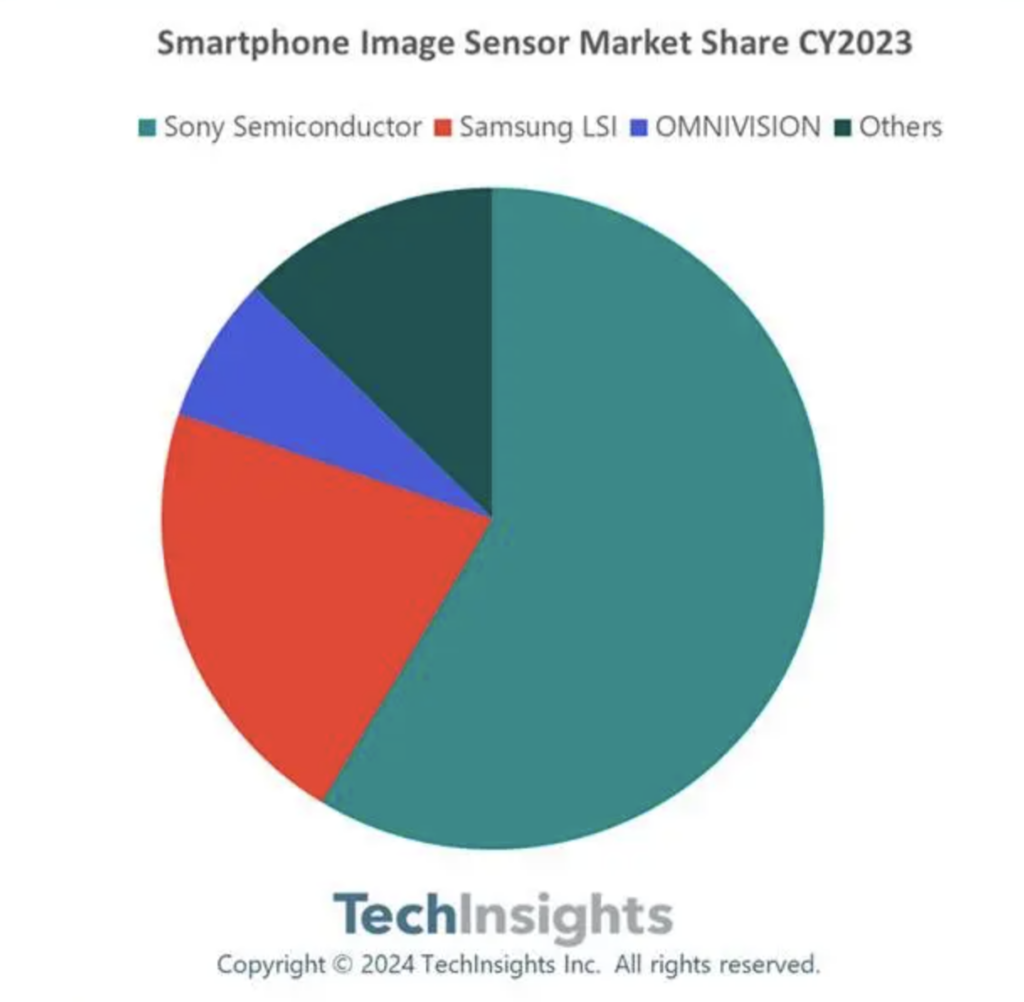

The latest research from market research firm TechInsights shows that the global smartphone image sensor (CIS) market will grow slightly in 2023, with total revenue exceeding USD14B. Sony has a market share of 55%, Samsung System LSI ranks second with a share of less than 25%, and OmniVision ranks third. Sony has established a strong leadership position in the image sensor market in 2023, with more than 55% revenue share. Thanks to demand for high-end smartphones, Sony is able to dominate the supply chain with its relatively large-format CIS product portfolio. Sony’s CIS product portfolio has been greatly improved with the launch of dual-layer transistor pixel CIS products on top smartphone products. At the same time, the weakness of Chinese smartphones has also affected the CIS orders of OmniVision and GalaxyCore. However, OmniVision made strong progress in 2H23 with its high-resolution 50MP CIS products. (Zhihu, Baike, CN Beta)

Nikon announces its entry into an agreement to acquire 100% of the outstanding membership interests of RED whereby RED will become a wholly-owned subsidiary of Nikon. Since its establishment in 2005, RED has been at the forefront of digital cinema cameras, introducing industry-defining products such as the original RED ONE 4K to the cutting-edge V-RAPTOR [X] with its proprietary RAW compression technology.(Gizmo China, GSM Arena,Nikon)

Samsung Electronics is reportedly promoting Molded Underfill (MUF) materials in its advanced packaging processes. Samsung has used thermal compression non-conductive film (TC NCF) in its existing registered dual in-line memory module (RDIMM). Samsung is attempting to adopt MUF materials in its Through-Silicon-Via (TSV) process. Hence, it recently procured MUF molding equipment from Japan. MUF material is injected at the last stage of the TSV process, functioning as an adhesive to ensure that multiple chips will be interconnected in the stacking process. (Digitimes, The Elec, The Elec, Gizmo China)

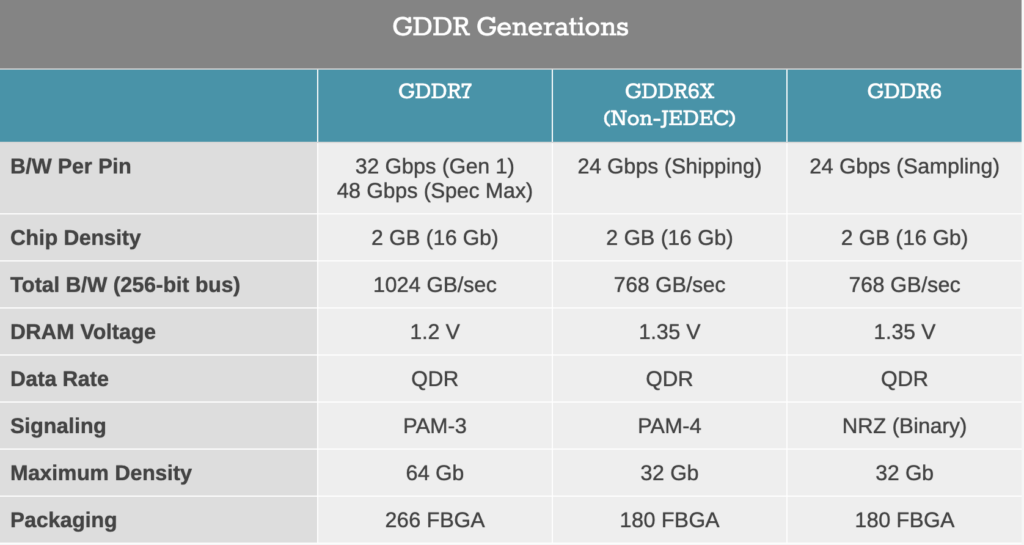

JEDEC has published the official specifications for GDDR7 DRAM, the latest iteration of the long-standing memory standard for graphics cards and other GPU-powered devices. The newest generation of GDDR brings a combination of memory capacity and memory bandwidth gains, with the later being driven primarily by the switch to PAM3 signalling on the memory bus. The latest graphics RAM standard also boosts the number of channels per DRAM chip, adds new interface training patterns, and brings in on-die ECC to maintain the effective reliability of the memory. (CN Beta, JEDEC, AnandTech, TechNews)

SK Hynix is ramping up its spending on advanced chip packaging, in hopes of capturing more of the burgeoning demand for a crucial component in artificial intelligence (AI) development: high-bandwidth memory (HBM). The company is investing more than USD1B in South Korea to expand and improve the final steps of its chip manufacture, said Lee Kang-wook, a former Samsung Electronics engineer who now heads up packaging development at SK Hynix. (CN Beta, Bloomberg, Strait Times, Business Times)

Samsung SDI has reportedly finalized its plan to build a third battery factory in Hungary. The company is expected to spend over KRW6T in expanding its overall facilities in 2024, over KRW1T on of that will go into building the third factory. Samsung SDI is expanding its existing second factory in Hungary with completion expected in Sept 2024. Samsung SDI is building factories in Hungary to supply them with batteries from 2026 to 2032 for Hyundai Motor’s EVs launching in Europe. These batteries will be prismatic and use a high-nickel cathode with over 91% nickel and an anode with over 10% silicon in it, or si-carbon-nanocomposite. (The Elec)

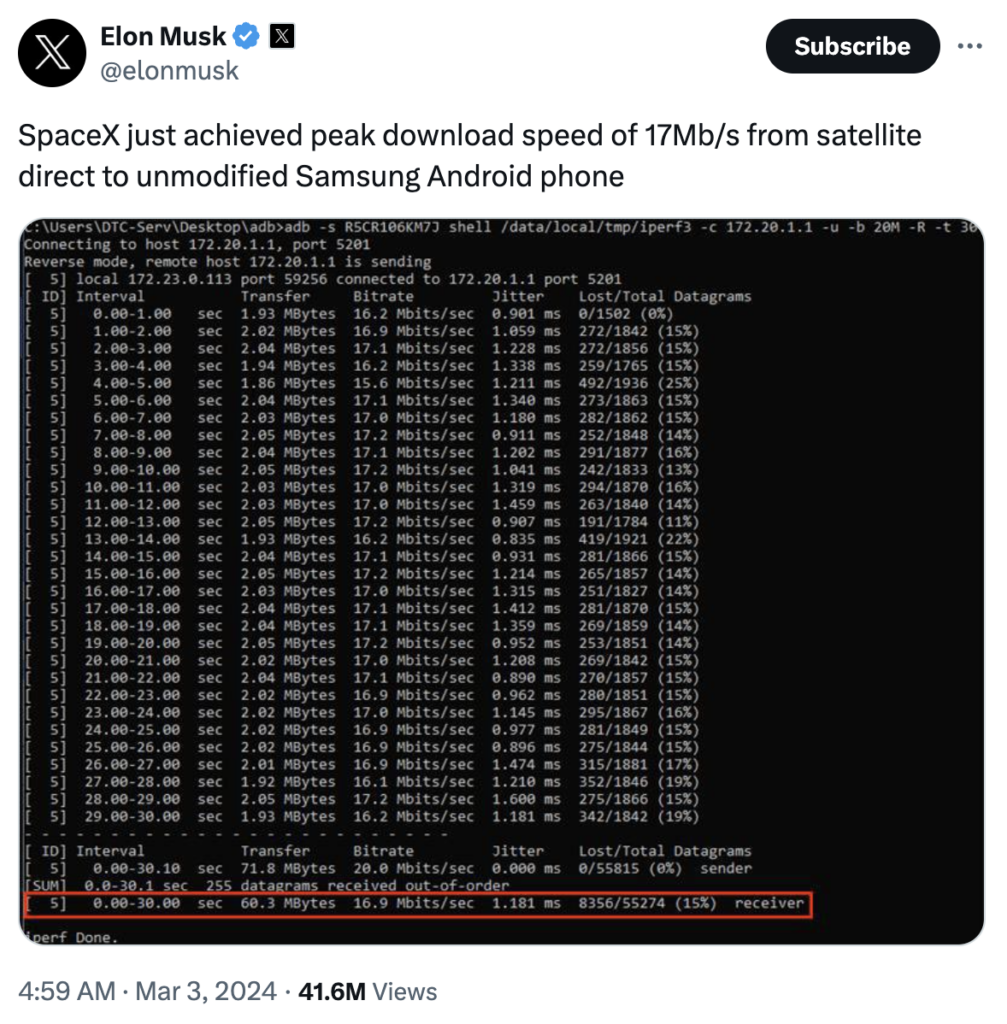

SpaceX CEO Elon Musk has announced that Starlink achieved peak download speeds for its satellite-to-phone service using a Samsung phone. It was then revealed that the test was done using a Galaxy S21 Ultra and in collaboration with one of the cellular service providers in the USA. According to Elon Musk, Starlink’s direct satellite-to-phone service achieved peak download speeds of up to 17Mbps. This testing started a couple of months ago when the company partnered with T-Mobile for a satellite-to-phone telecommunication service for calls and messages. (SamMobile, Twitter, Android Headlines)

Samsung Galaxy S24, S24+, and Galaxy S24 Ultra are the first devices for which Samsung promised 7 years of OS and security updates. However, Samsung says that Galaxy A55 and A35 will get 4 major OS upgrades and security updates for 5 years like their predecessors. The Galaxy A55 and Galaxy A35 will also miss out on the Galaxy AI experience that is available on the Galaxy S24 lineup and will get on Samsung’s 2023 flagships after the One UI 6.1 update. (GizChina, SamMobile)

Amazon and Huawei have entered into a multi-year patent cross-license agreement that resolves pending litigation between them. Huawei has previously sued Amazon in Germany over Wi-Fi patent infringement. However, Alan Fan, Head of Huawei’s Intellectual Property Rights Department, has confirmed that the recent partnership resolved the pending lawsuit. (Android Headlines, Huawei)

Huawei and vivo have announced that they have signed a global patent cross-licensing agreement that covers cellular Standard Essential Patents, including those for 5G. Alan Fan, Head of Huawei’s Intellectual Property Department, said the agreement reflects the “mutual respect for the value of each other’s patents”. It will pave the way for both companies to work together in the future. (GSM Arena, Huawei)

Sony might be considering an exit from the competitive Chinese smartphone market. Sony allegedly will not release its next Xperia smartphone in China, and its mobile division might completely pull out of the mainland China market. (Gizmo China, My Drivers, BNN)

Microsoft has announced it is ending support for Windows Subsystem for Android (WSA). The service will continue to work until 2025, but will be shut down on 5 Mar 2025. WSA is a service that allows Windows 11 to run Android applications that come from the Amazon Appstore. (Android Authority, Microsoft)

Samsung will reportedly only make about 400,000 Galaxy Rings in the first batch of mass production. The company will decide on the production volume for the second batch depending on the market response. Since the Galaxy Ring is a small product and there is no shortage of components, it can quickly ramp up inventory if the demand is high. The company may also want to evaluate which sizes sell more before expanding production. The wearable will reportedly come in nine sizes. Mass production of the Galaxy Ring will begin in May 2024. Samsung plans to launch the ring alongside its sixth-gen foldables in Jul 2024. (Android Headlines, The Elec)

Nissan is allegedly in advanced talks to invest in electric vehicle maker Fisker in a deal that could provide the Japanese automaker with access to an electric pickup truck while giving the struggling startup a financial lifeline. Nissan investing more than USD400M in Fisker’s truck platform and building Fisker’s planned Alaska pickup starting in 2026 at one of its U.S. assembly plants. Nissan would build its own electric pickup on the same platform. Nissan has U.S. assembly plants in Mississippi and Tennessee. (CN Beta, Reuters, CNBC, Autoblog)

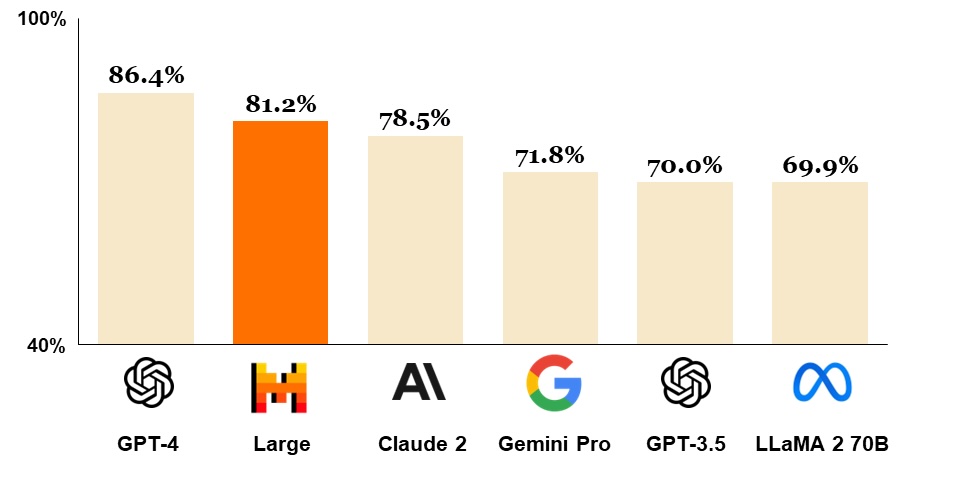

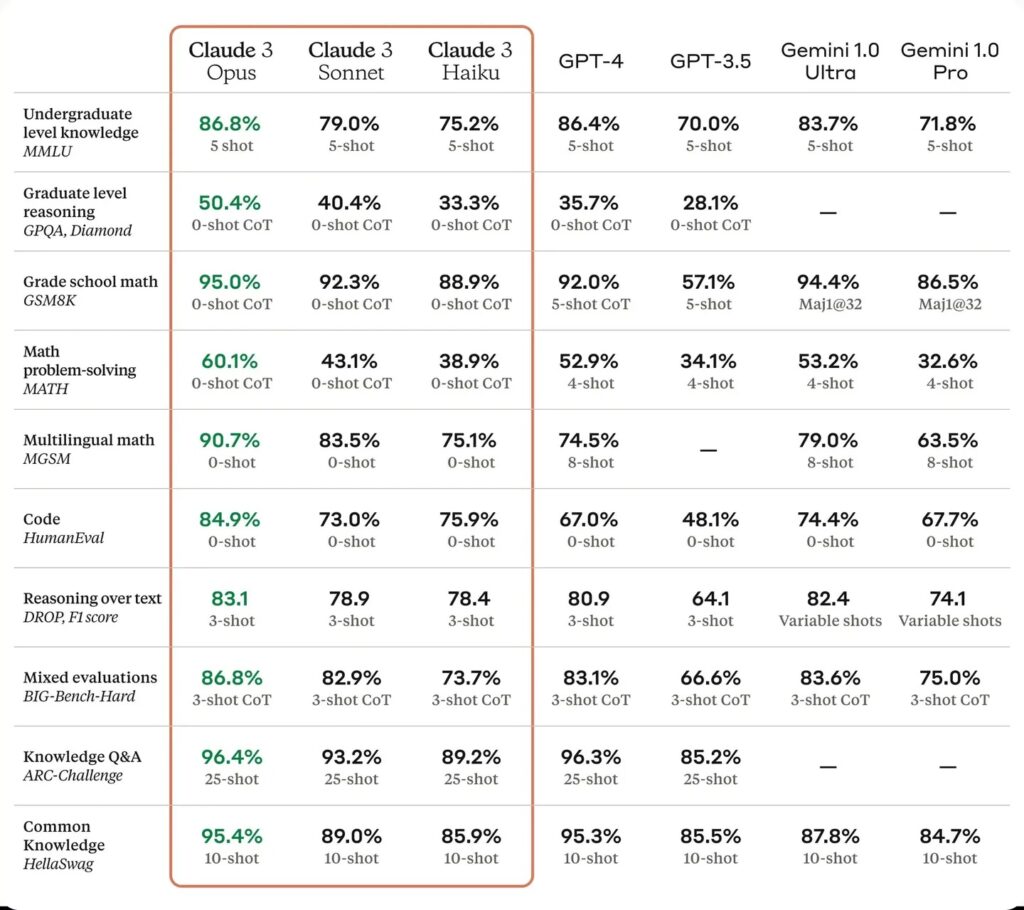

Anthropic has debuted Claude 3, a chatbot and suite of AI models that it calls its fastest and most powerful yet. The company, founded by ex-OpenAI research executives, has backers including Google, Salesforce and Amazon, and closed five different funding deals over the past year, totalling about USD7.3B. The new chatbot has the ability to summarize up to about 150,000 words, or a lengthy book, compared to ChatGPT’s ability to summarize about 3,000. Anthropic is also allowing image and document uploads for the first time. (CN Beta, The Verge, CNBC)

IBM has announced the availability of the popular open-source Mixtral-8x7B large language model (LLM), developed by Mistral AI, on its watsonx AI and data platform. It is designed for developers and businesses in mind, allowing them to deploy the model on the cloud or on-premises. IBM offers an optimized version of Mixtral-8x7B that, in internal testing, was able to increase throughput — or the amount of data that can be processed in a given time period — by 50% when compared to the regular model. This could potentially cut latency by 35-75%, depending on batch size — speeding time to insights. This is achieved through a process called quantization, which reduces model size and memory requirements for LLMs and, in turn, can speed up processing to help lower costs and energy consumption.(CN Beta, IBM, Techopedia, VentureBeat)