6-2 #HeKnows : TSMC has scheduled its N3P node to enter mass production in 2H24; Samsung will allegedly implement a thicker UTG on new Flip; T-Mobile is buying U.S. Cellular’s wireless operations and certain spectrum assets; etc.

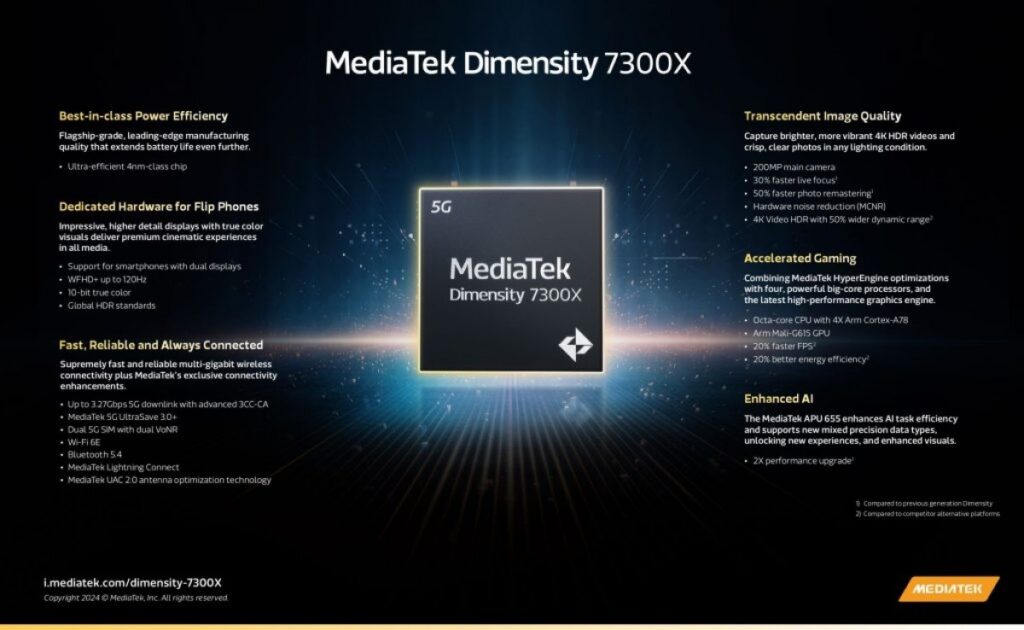

MediaTek has announced two new midrange chips – the Dimensity 7300 and Dimensity 7300X. Both the MediaTek Dimensity 7300 and Dimensity 7300X are fabricated on a 4nm process node and offer an octa-core CPU. It consists of 4 x Cortex-A78 cores clocked at 2.5GHz paired with 4 x Cortex-A55 cores clocked at 2.0GHz. For those unfamiliar, the Dimensity 7050 offered a (2+6) core architecture with 2 x Cortex-A78 cores clocked at 2.6 GHz for demanding tasks and 6 x Cortex-A55 cores clocked at 2 GHz. The new series also supports LPDDR5 RAM and UFS 3.1 storage for faster loading time and overall better experience. For graphics, the chipsets are equipped with the latest Arm Mali-G615 GPU, which the company has enriched with a suite of its HyperEngine optimizations. (Android Authority, MediaTek, Android Headlines, Android Central, GSM Arena)

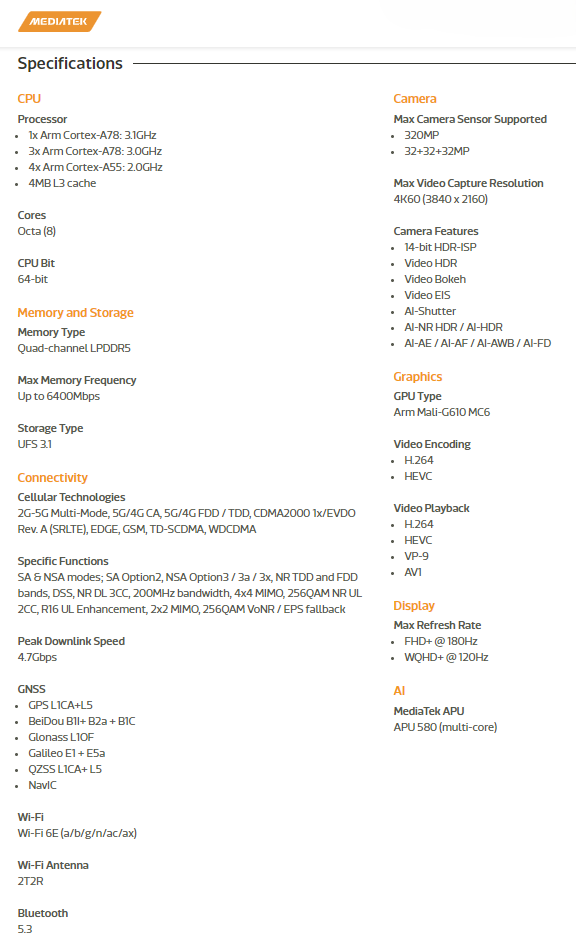

MediaTek has refreshed the Dimensity 8200 chipset from late 2022 under the name “Dimensity 8250”. The chipset is built on a 4nm TSMC node (N4). The chip is still a solid mid-range offering with four Cortex-A78 cores (one at 3.1GHz, the other three at 3.0GHz) and four Cortex-A55 (at 2.0GHz). The GPU is more impressive with a Mali-G610 MC6 configuration. The display driver supports up to FHQ+ displays at 180Hz or QHD+ displays at 120Hz. Phones with the Dimensity 8250 (as with the 8200) can be configured with quad-channel LPDDR5 RAM (up to 6,400Mbps) and UFS 3.1 storage. (GizChina, GSM Arena, MediaTek)

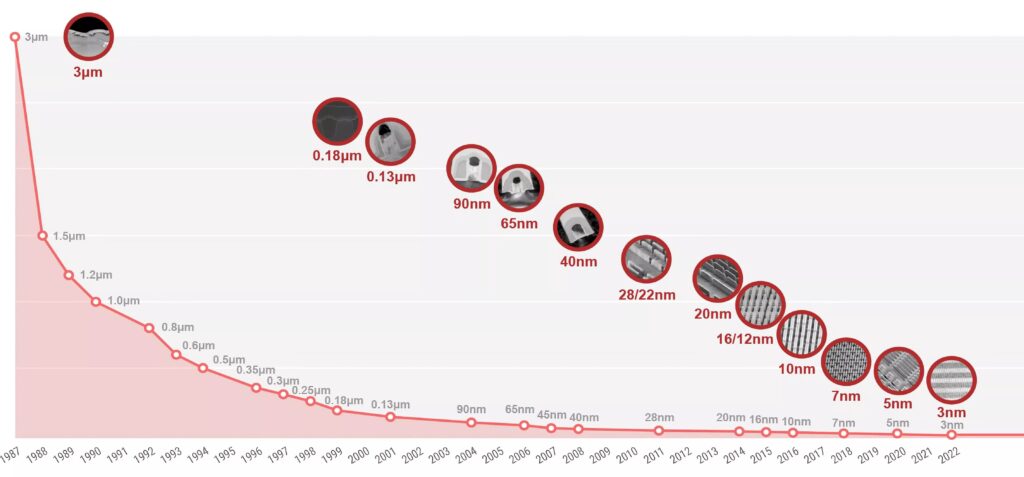

Samsung Electronics achieved the world’s first successful mass production of 3nm foundry in Jun 2022. TSMC is confident about its 2nm process, claiming it will secure more customers than the 3nm process. The rumors about TSMC delaying its 2nm process arose from the first-time application of a current control technology called “Gate-All-Around (GAA)”. This technology, introduced by Samsung Electronics in its 3nm process in Jun 2022, reduces leakage current in transistors, which act as semiconductor switches, thereby improving chip power efficiency. Vice President Zhang Xiaogang explained that “the yield (the ratio of good products to the total produced) when applying GAA has reached 90% of the target”. (Android Headlines, Business Korea, UDN, Yahoo)

As previous subsidies of a total of JPY920B (nearly USD6B) may not be sufficient to help Rapidus achieve its goal of mass-producing 2nm chips, Japan’s Ministry of Economy, Trade and Industry (METI) plans to propose legislation to provide loan guarantees for the chipmaker. Rapidus is projected to need JPY2T for trial production of 2nm chips in 2025 and an additional JPY3T for mass production by 2027, bringing the total to JPY5T. Investments from 8 Japanese companies, including Toyota, amount to only JPY 7.3B. Combined with government subsidies, these funds are insufficient for the trial production phase in 2025. Rapidus is constructing its first factory in Chitose, Hokkaido, and has over 100 engineers sent to IBM’s Albany NanoTech Complex in New York to learn about producing 2nm chips using EUV lithography. Rapidus plans to send more engineers, totaling around 200. (CN Beta, Nikkei Asia, Digitimes)

In addition to the aggressive overseas expansion plans recently, TSMC also demonstrates its ambition of increasing specialty capacity, targeting to be expanded by 50% by 2027. A key driver of this demand will be TSMC’s forthcoming specialty node, N4e, a 4nm-class ultra-low-power production node. Citing Kevin Zhang, TSMC’s Senior Vice President of the Business Development and Overseas Operations Office, the report revealed that TSMC plans to expand its specialty capacity by up to 1.5 times in the next 4-5 years. To accomplish this goal, it would not only convert existing capacity, but construct new fab space dedicated to specialty processes. (CN Beta, TrendForce, AnandTech)

TSMC has scheduled its performance-optimized N3P node to enter mass production in 2H24, but it’s not too soon to see what else the chipmaker has in store for the future. N3X, N2, N2P and A16 nodes, are coming in 2025 and 2026, bringing different strengths to the market, such as TSMC’s first use of gate-all-around (GAA) nanosheet transistors in N2. Then there is A16, introduced only in Apr 2024, that will be ideal for HPC products with complex signal routes and dense power delivery networks. Its performance-optimized N3P node is coming, set to enter mass production in 2H24 and will be the company’s most advanced node for a while. In 2025, however, TSMC will introduce two production nodes that will enter high-volume manufacturing in 2H25, promising to accelerate the advantages of N3P. These nodes are N3X, a 3nm-class process, and N2, a 2nm-class process. (CN Beta, Techspot)

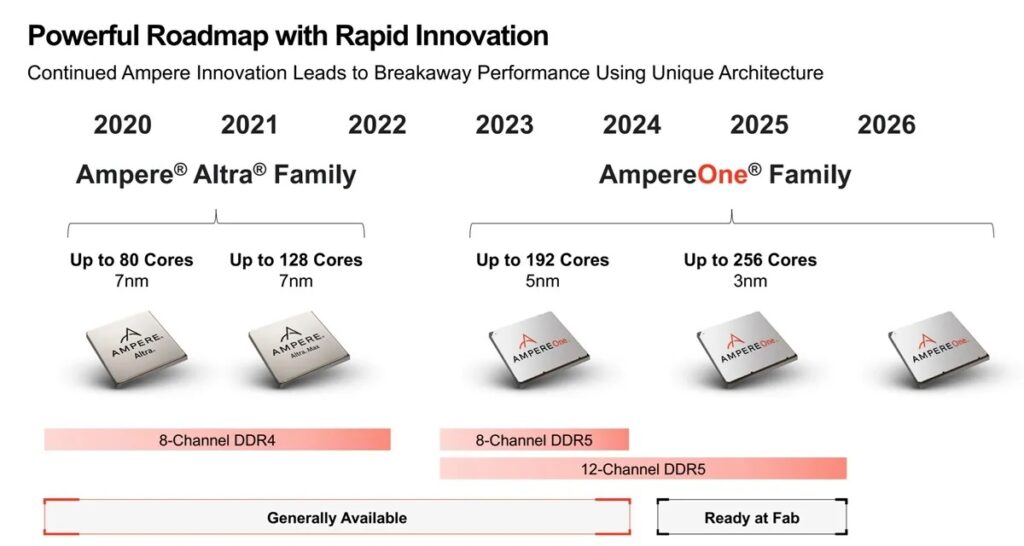

Ampere Computing has introduced its roadmap for the coming years, including new CPUs and collaborations with third parties. The company said it would launch its all-new 256-core AmpereOne processor in 2025, made on TSMC’s N3 process technology. Also, Ampere is teaming up with Qualcomm to build AI inference servers with the company’s accelerators. In 2025, the company will use this platform for its 256-core AmpereOne CPU, which will be made using one of TSMC’s N3 fabrication processes. Ampere says that its 128-core AmpereOne CPU with its two 128-bit vector units per core (and supporting INT8, INT16, FP16, and BFloat16 formats) can offer performance comparable to Nvidia’s A10 GPU, albeit at lower power. Qualcomm and Ampere plan to build platforms for LLM inferencing based on Ampere’s CPUs and Qualcomm’s Cloud AI 100 Ultra accelerators. There is no word when the platform will be ready, but it demonstrates that Ampere’s ambitions do not end with general-purpose computing. (CN Beta, CRN, Tom’s Hardware, Ampere)

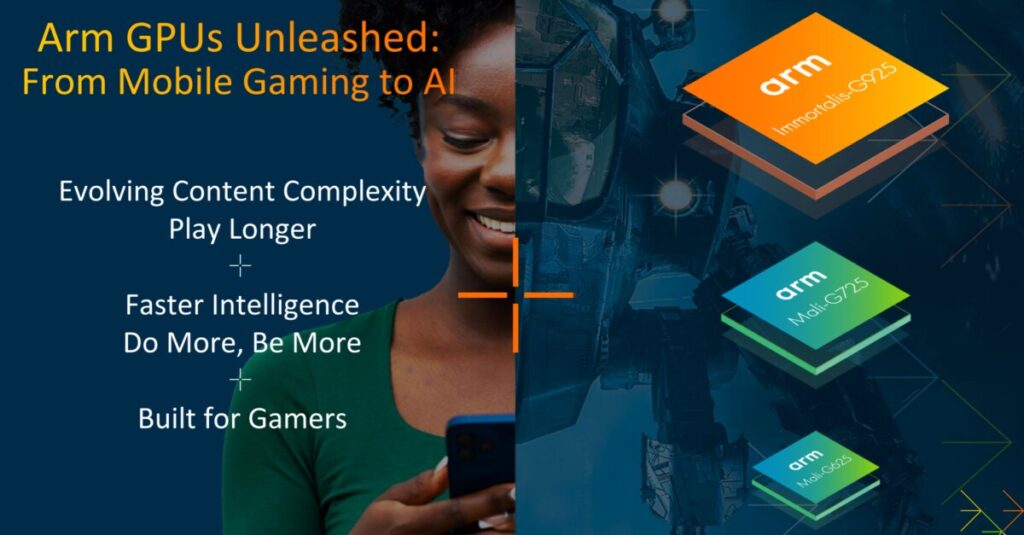

ARM has introduced new and improved GPUs for future chipsets. They cover three segments: the flagship market will be served by the Immortalis-G925, the premium segment is getting the Mali-G725, while entry-level phones and smartwatches will use the Mali-G625. Immortalis is ARM’s ray tracing focused GPU and this is its third iteration. Compared to the Immortalis-G720, the G925 can render games at 37% higher frame rate. Alternatively, smartphone makers can optimize for efficiency – when both GPUs target the same performance level, the G925 uses 30% less energy. (CN Beta, GSM Arena, ARM, Fonearena, XDA-Developers)

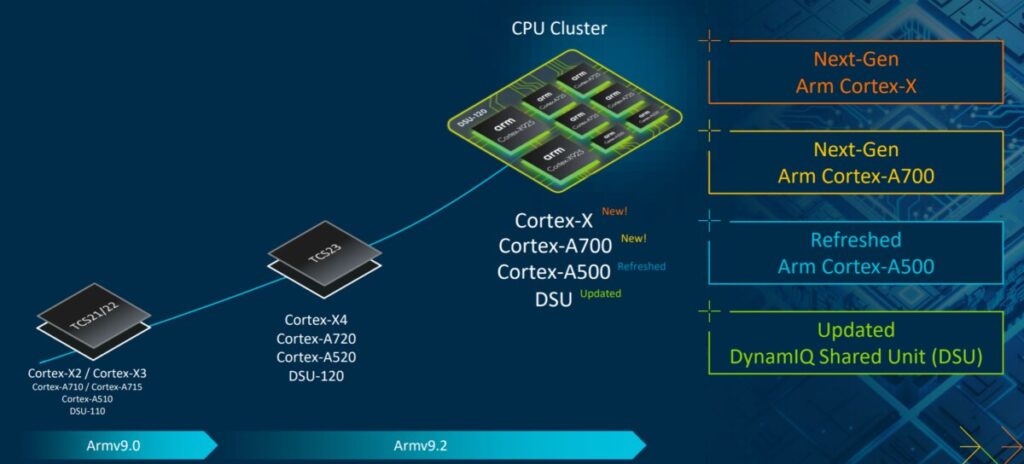

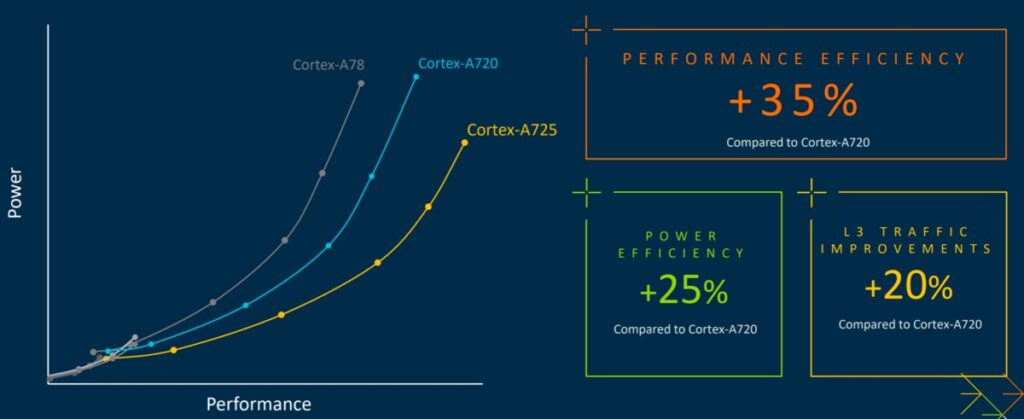

ARM has unveiled its next-generation CPU cores ahead of the next generation of flagship chipsets. The new CPU cores are a refinement of ARM v9.2 design, and are focused on AI. The new ARM Cortex-X925 is the successor to the Cortex-X4 and changes the nomenclature to keep in sync with the rest of ARM’s lineup. The new core promises 15% higher IPC performance. The move to a 3nm process and the higher 3.6 GHz clock brings another 36% performance increment. The AI Performance is 46% faster compared to the ARM Cortex-X4. That performance boost certainly makes the 2025 flagships way more powerful for AI. Down in the ladder, we have the new ARM Cortex-A725, which stands as a performance core but is more energy-efficient than the Cortex-X925. It is 25% more efficient than the A720, and the move to a 3nm process provides a higher performance at a lower power draw.(Fonearena, CNX Software, GizChina, GSM Arena, ARM)

Samsung will allegedly implement a thicker Ultra Thin Glass (UTG) on the Z Flip6’s foldable display. The new UTG is rumored to be 50 microns thick, compared to the 30 microns of the Z Flip5. This increase in thickness is said to make the crease on the foldable screen less noticeable and improve the display’s overall durability. The Z Flip6 will use the same hinge as its predecessor. (CN Beta, The Elec, Gizmo China, WCCFtech)

According to TrendForce, HBM production will be prioritized due to its profitability and increasing demand. However, limited yields of around 50–60% and a wafer area 60% larger than DRAM products mean a higher proportion of wafer input is required. Based on the TSV capacity of each company, HBM is expected to account for 35% of advanced process wafer input by the end of this year, with the remaining wafer capacity used for LPDDR5(X) and DDR5 products. Regarding the latest developments in HBM, TrendForce indicates that HBM3e will become the market mainstream in 2024, with shipments concentrated in 2H24. Currently, SK hynix remains the primary supplier, along with Micron, both utilizing 1beta nm processes and already shipping to NVIDIA. Samsung, using a 1alpha nm process, is expected to complete qualification in 2Q24 and begin deliveries mid-year. (CN Beta, TrendForce, TrendForce)

SK Hynix has for years been the top supplier of HBM chips to Nvidia, which controls over 80% of the market for graphics processing units (GPUs), the core of AI computing tasks. Currently, SK Hynix is Nvidia’s only supplier of the fourth-generation HBM3 chip. Samsung is currently undergoing a process to pass Nvidia’s tests to supply its latest HBM chips. Jun Young-hyun, who assumed the helm of Samsung Electronics’ semiconductor business unit, DS (Device Solutions), reportedly focuses not only on diagnosing the semiconductor business itself but also on rectifying the lax organizational culture that has developed over the past few years. He has expressed his determination to reclaim the position of the top semiconductor company in the AI era.(CN Beta, Chosun, KED Global, Bloomberg)

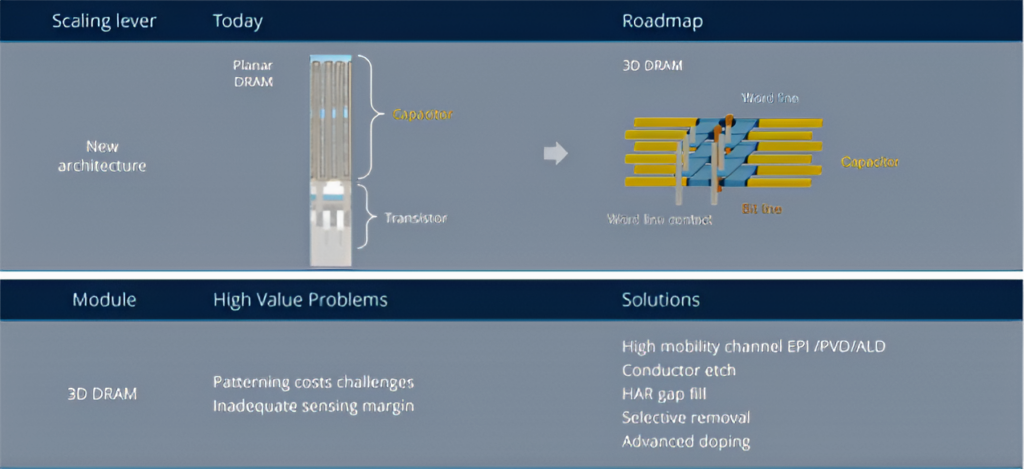

Samsung Electronics EVP Lee Si-woo has mentioned that they have successfully stacked 3D DRAM to 16 layers. In contrast, Micron has only achieved 8 layers Samsung is scheduled to complete initial development on it in 2025, with 3D DRAM seeing commercialization by 2030. The 3D DRAM uses vertical stacking, which can increase the capacity per unit area by 3 times, thus enabling the rapid processing of large amounts of data. The 3D DRAM Lee Si-woo referred to is the vertically stacked cell array transistor (VS-CAT). One such innovation is the arrival of 4F Square VCT DRAM, the most compact DRAM design yet. The 4F Square design will utilize vertical stacking to reduce DRAM cell sizes by around 30% from today’s standard 6F Square DRAM cell structure. Vertical DRAM stacking, like 4F Square and eventually truly 3D DRAM, are the next steps for innovation in capacity increase and efficiency in DRAM.(CN Beta, The Elec, Taiwan News, Tom’s Hardware, ZDNet)

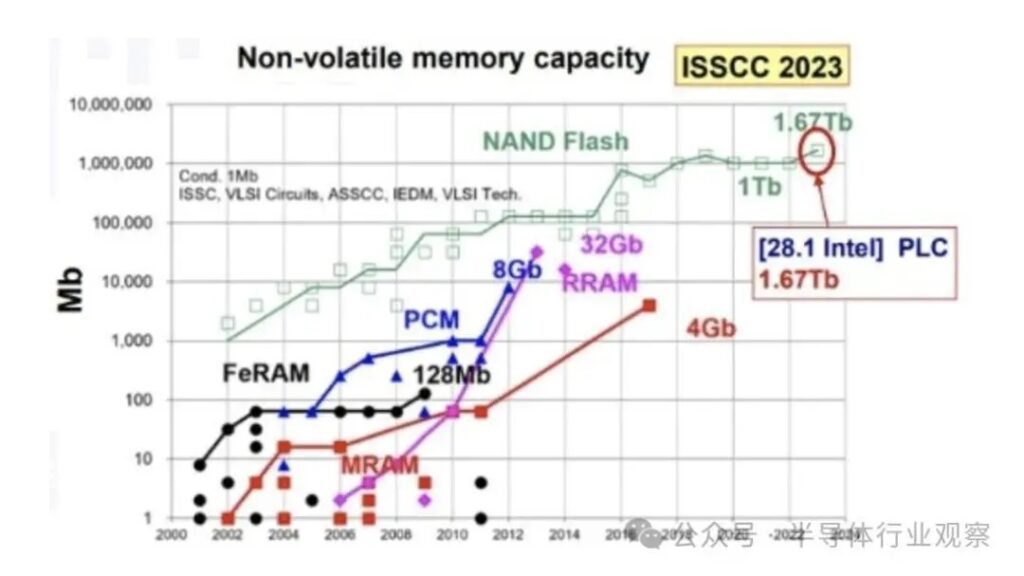

Samsung Electronics is keenly exploring “hafnia ferroelectrics” as a next-generation NAND flash material, with the hope that this new material will enable stacking over 1,000 layers of 3D NAND and achieving petabyte-level SSDs. The hafnia ferroelectrics material is expected to replace the oxide-based thin films currently used in 3D NAND stacking technology, improving chip durability and stability. Samsung executives predict that its 3D NAND could stack over 1,000 layers by around 2030. Samsung is intensifying the development of hafnia ferroelectrics-based 3D NAND technology in collaboration with the Korea Advanced Institute of Science & Technology (KAIST). (CN Beta, Digitimes, Chosun Daily, Extreme Tech, VLSI)

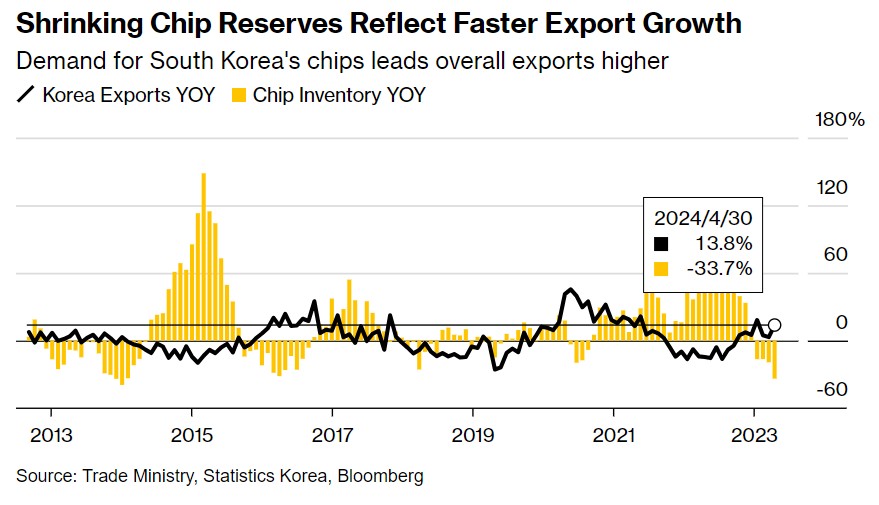

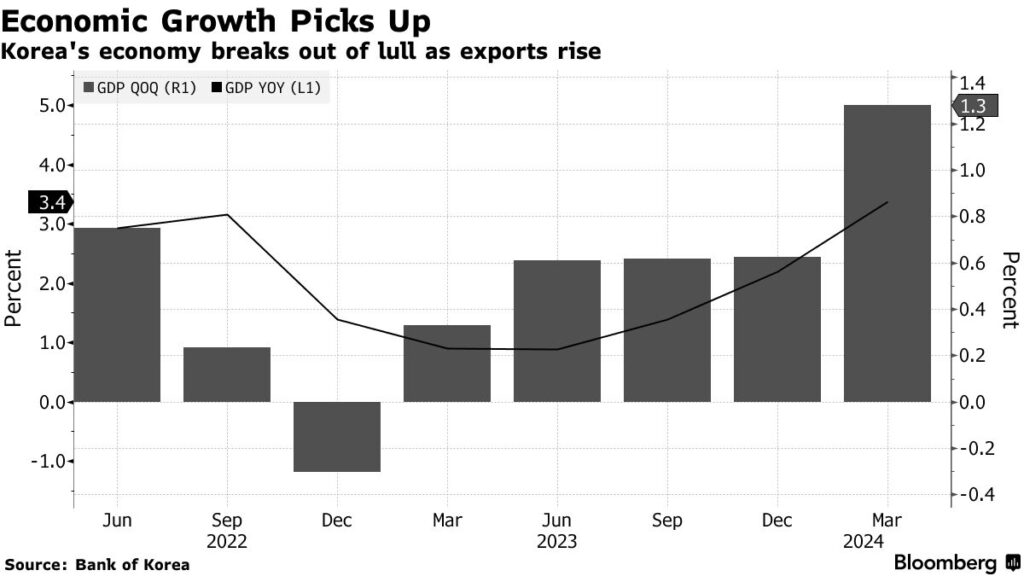

South Korea’s semiconductor inventories dwindled by the most since 2014, underscoring the pace at which demand is outstripping supply as customers rev up their purchases of devices needed to develop artificial intelligence (AI) technologies. Chip stockpiles dropped 33.7% from Apr 2023 in the largest decrease since late 2014, according to data released by the national statistical office. It also marked the fourth month of declines in inventories, which coincided with a pickup in South Korea’s semiconductor exports. Separately, chip production rose 22.3% in Apr 2024, a slower pace than 30.2% a month earlier. Factory shipments increased 18.6%, also moderating from 16.4% in Marc 2024. During the 2013-2015 boom in memory chips, inventories did not increase for about a year and a half. In the 2016-2017 cycle, inventory decreases lasted almost a year. The latest chip rally is expected to last at least through the 1H25 as an “AI boom” fuels demand in a manner similar to the way cloud-server expansions did in 2016, according to a report from South Korea’s central bank. (MSN, CN Beta, Bloomberg, SCMP, Futubull)

Amazon claims it is committed to building a sustainable business for its customers, communities, and the world, and that focus extends to Project Kuiper. In Oct 2023, an Atlas V rocket launched into space the first pair of prototype satellites for Amazon’s Kuiper constellation, the future rival of SpaceX’s Starlink service which just turned profitable. Since then, United Launch Alliance’s Vulcan rocket finally flew for the first time, and Europe’s Ariane 6 is also near its inaugural flight. Kuiper satellites will communicate through infrared lasers, thus creating a giant mesh network in orbit. This communication was also successfully tested. When finished, the Kuiper constellation will consist of 3,236 satellites, half of which have to be operational by the summer of 2026 to meet the criteria of the license approved by the FCC. The beta tests of the Kuiper space network are planned for 2H24. Early partners like Vodafone and Verizon will be among the first to participate in those service pilots. (CN Beta, Bloomberg, Amazon, Florida Today, Neowin)

AT&T appears to be closer to letting every Apple iPhone since the iPhone 12 make voice calls and texts via satellite, using 5G. AT&T has been working on bringing satellite broadband and specifically voice calls to smartphones for at least 6 years. In that time, Apple became the first smartphone maker to introduce an Emergency SOS via Satellite service. Apple’s service is confined to text messaging, but AT&T is claiming full 5G broadband via its system. The companies say that they have achieved voice calls in testing, but have offer no details about performance as of yet. (CN Beta, Mac DailyNews, Apple Insider)

T-Mobile is buying U.S. Cellular’s wireless operations and certain spectrum assets in a deal valued at USD4.4B, and further consolidating the industry. T-Mobile would get more than 4 million new customers and control of U.S. Cellular’s wireless operations and about 30% of spectrum assets across several spectrum bands. T-Mobile will also enter into a new master license agreement on more than 2,000 towers and extend the lease term for the approximately 600 towers where T-Mobile is already a tenant. T-Mobile said Tuesday that U.S. Cellular customers will gain access to its 5G network, giving them better coverage and speed. The company said the deal will particularly benefit those that live in underserved rural areas of the country. (CN Beta, T-Mobile, UScellular, CNBC, Reuters)

According to Bloomberg’s Mark Gurman, Apple and OpenAI have reached a deal for OpenAI to provide chatbot functionality in iOS 18. Gurman says Apple is still working on a deal with Google to offer Gemini as an “option”. Apple is allegedly working on its own Ajax AI model for on-device text analysis, smart replies, and summaries. So it stands to reason that ChatGPT and other OpenAI tech will be used for analyzing longer bodies of text, image generation, and similarly demanding tasks. (Android Authority, Bloomberg)

Samsung is planning to increase the number of smartphones made through joint development manufacturers (JDM) in China in 2024. Samsung has initially planned to manufacture 44M units through its JDM partners in 2024, but this has increased by 23M units to 67M units. JDM partners usually handle low-end smartphones. They handle the design and component procurement and Samsung provides the brand. In addition to an increased reliance on Chinese companies for outsourced production, 28M units will be outsourced to factories in Vietnam. (Android Authority, The Elec, ZOL)

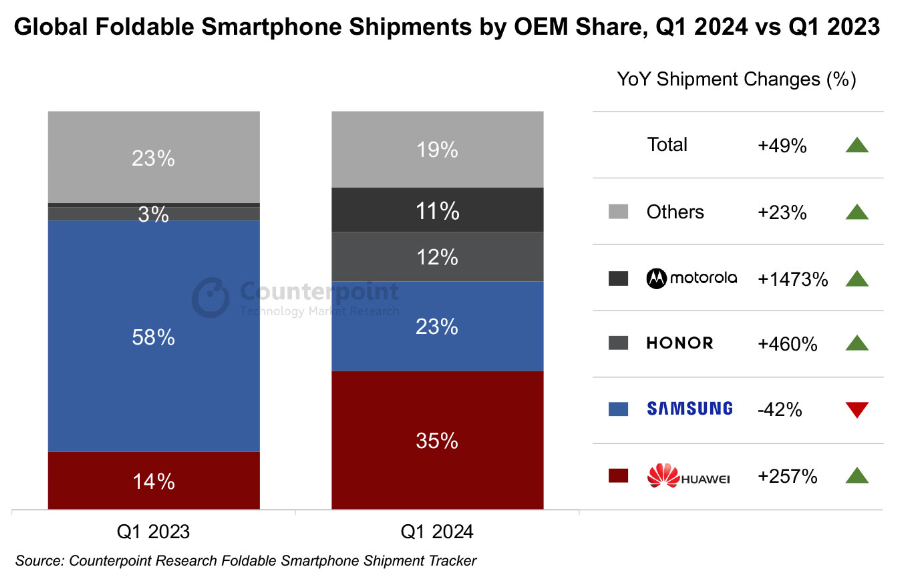

The global foldable smartphone market grew 49% YoY in 1Q24, marking its highest rate of increase in six quarters, according to Counterpoint Research. This surge was primarily driven by significant shipment increases at several Chinese OEMs. Notably, Huawei ascended to the top spot in quarterly global shipments for the first time, overtaking Samsung, which had consistently led the market. Huawei’s transition to 5G in foldables was a key driver of its 257% YoY growth in 1Q24. A year ago, Huawei’s foldable portfolio consisted solely of LTE devices. However, by 1Q24, the proportion of 5G-enabled foldables surged to 84% of the brand’s total foldable shipments. (Android Headlines, Sammy Fans, 9to5Google, Counterpoint Research)

Magic Leap announces a multi-faceted, strategic technology partnership with Google. The companies will combine Magic Leap Augmented Reality (AR) expertise and optics leadership with Google’s technology platforms to collaborate on AR solutions and experiences. While Google may have shelved plans to create its own AR hardware, the company has been working on creating a “micro XR” platform. This platform is said to be designed for AR glasses, and like its mobile OS, Google plans to license it to manufacturers.(Android Authority, Magic Leap)

LG is reportedly pausing its partnership with Meta to develop an extended reality (XR) device that would take on Apple’s Vision Pro headset. The Meta partnership has allegedly broken down entirely due to a lack of “synergy” between the companies, LG has denied terminating the deal. It was intended to bring together Meta’s mixed reality platform, already popularized through the Quest headset series, and content from LG’s TV business. LG Electronics’ manufacturing capabilities and global sales network were also expected to create a win-win effect. LG Electronics CEO William Cho had expected products resulting from the collaboration to hit the market as early as 2025. (CN Beta, The Verge, Korea Joongang Daily)

Apple intends to process data from AI applications inside a virtual black box. The concept, known as “Apple Chips in Data Centers” (ACDC) internally, would involve only Apple’s hardware being used to perform AI processing in the cloud. The idea is that it will control both the hardware and software on its servers, enabling it to design more secure systems. While on-device AI processing is highly private, the initiative could make cloud processing for Apple customers to be similarly secure. (Android Headlines, The Information, TechRadar, Apple Insider)

Volvo has revealed its first “production-ready” self-driving truck that it’s making with Aurora, the autonomous driving technology company founded by former executives from Google, Uber, and Tesla. The truck is based on Volvo’s new VNL, which is a Class 8 semi truck built for long-haul transportation. The autonomous version of the truck features an array of sensors and cameras to power Aurora’s Level 4 autonomous driving system, which enables the truck to operate without a human behind the wheel. The companies say the truck is “purpose-designed and purpose-built” for Aurora’s self-driving hardware and software stack. (CN Beta, MoneyDJ, Aurora, The Verge)

Alphabet’s Google will allegedly pick up a minority stake worth USD350M in Walmart-backed Flipkart, valuing the Indian e-commerce firm at USD37B. The Google investment is part of a nearly USD1B funding round that Flipkart kicked off in 2023. Walmart has led the round, having invested USD600M in it late 2023. Microsoft is also an investor in Flipkart. Flipkart competes with Reliance Retail, Amazon, SoftBank-backed Meesho and increasingly a number of quick-commerce apps. Reliance Retail — run by Asia’s richest man, Mukesh Ambani — operates the largest retail chain in India and is increasingly attempting to put together an e-commerce play. Reliance Retail was valued at USD100B in a nearly USD2B investment by QIA, ADIA and KKR in 2023. (Gizmo China, IT Home, TechCrunch, Reuters, Twitter)