6-15 #GoodARGlasses : Samsung Foundry has unveiled its new roadmap for chipmaking process technologies; Samsung has demonstrated its color e-paper display; Apple is expanding the capabilities of its satellite messaging on the iPhone; etc.

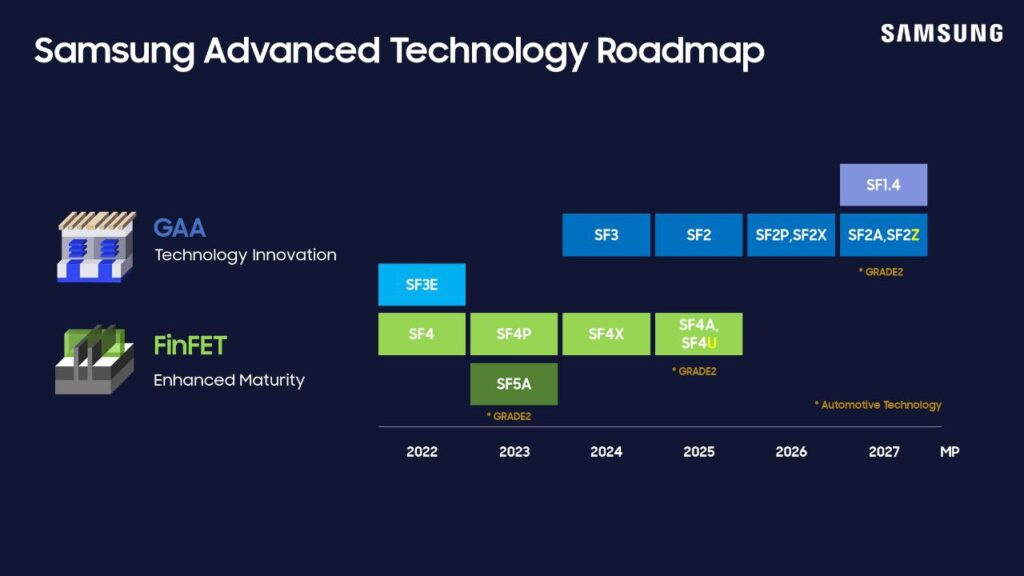

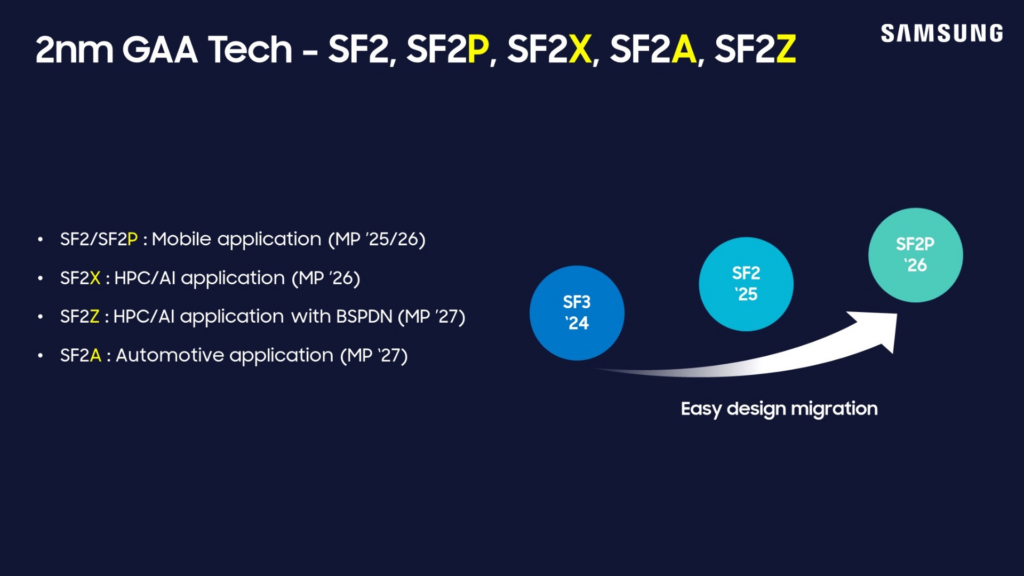

Samsung Foundry has unveiled its new roadmap for chipmaking process technologies outlining plans for 2nm-class nodes, a 1.4nm-class node. In 2025, Samsung will launch its SF2 node, previously known as SF3P, which demonstrated power, performance, and area (PPA) which the company attributes to 2nm-class process technologies. The following year, in 2026, Samsung plans to introduce SF2P, a performance-enhanced version of SF2. This node will further refine SF2, featuring faster but less dense transistors. In 2027, Samsung will release SF2Z, which will incorporate backside power delivery, something that will enable it to improve performance and increase transistor density. Also scheduled for 2027 is Samsung Foundry’s SF1.4 node, marking the company’s entry into the 1.4nm-class. Unlike SF2Z, SF1.4 will not include backside power delivery, setting Samsung apart from its industry peers Intel and TSMC, which will introduce backside power delivery with their 2nm-class (20A) and 1.6nm-class (A16) nodes.(CN Beta, Linkedin, AnandTech, Tom’s Hardware, Samsung)

According to Ming-Chi Kuo, Qualcomm’s SM8750 (Snapdragon 8 Gen 4), which will enter mass production in 2H24, is expected to be priced 25–30% higher than the current flagship chip SM8650 (Snapdragon 8 Gen 3) at USD190–200. This price increase is primarily due to adopting TSMC’s latest and more expensive N3E node. The X Elite and X Plus chips, used for Windows on ARM (WOA), will reach about 2M unit shipments in 2024, with expected YoY growth of at least 100–200% in 2025. The X Elite and X Plus will have modified versions in 2025, with a reduction in end product prices. Additionally, Qualcomm plans to launch a low-cost WOA processor codenamed Canim for mainstream models (priced between USD599–799) in 4Q25. This low-cost chip, manufactured on TSMC’s N4 node, will retain the same AI processing power as the X Elite and X Plus (40 TOPS). (Medium, CN Beta)

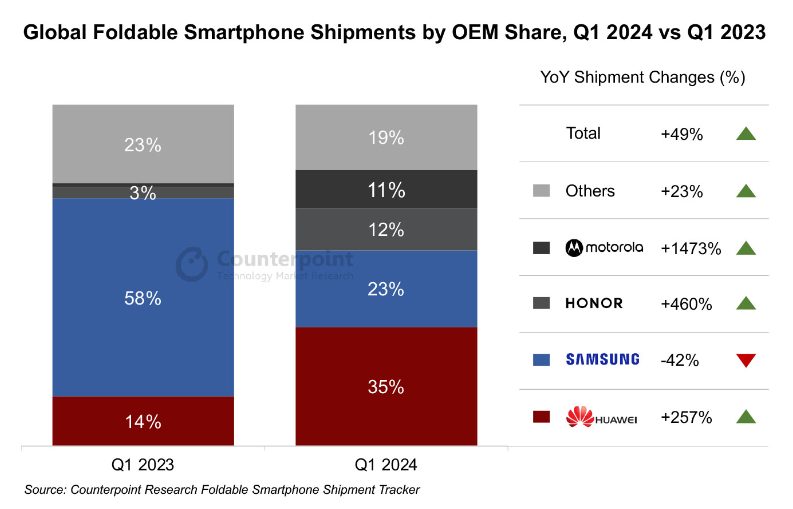

The global foldable smartphone market grew 49% YoY in 1Q24, marking its highest rate of increase in six quarters, according to Counterpoint Research. This surge was primarily driven by significant shipment increases at several Chinese OEMs. Notably, Huawei ascended to the top spot in quarterly global shipments for the first time, overtaking Samsung, which had consistently led the market. Huawei’s transition to 5G in foldables was a key driver of its 257% YoY growth this quarter. A year ago, Huawei’s foldable portfolio consisted solely of LTE devices. However, by 1Q24, the proportion of 5G-enabled foldables surged to 84% of the brand’s total foldable shipments. (CN Beta, Asia Nikkei, Counterpoint Research)

Samsung has demonstrated its color e-paper display. The product is currently a prototype, utilizing color e-ink screen technology, and is primarily designed for advertising displays. The EMDX 32” color electronic paper display boasts ultra-low power consumption. The screen can display advertisements or other content stored on the device. It has a QHD resolution and can display 60,000 colors. Additionally, it is only 17.9 mm thick and weighs only 2.9 kg (excluding batteries), making it a compact and lightweight option. The color e-paper display comes with 8GB of storage space, Bluetooth, Wi-Fi functions, and is equipped with two USB Type-C ports (for power supply and file transfer). It also features a Frame Deco frame design similar to Samsung’s The Frame TV, which can be easily replaced.(GSM Arena, GizChina, IT Home)

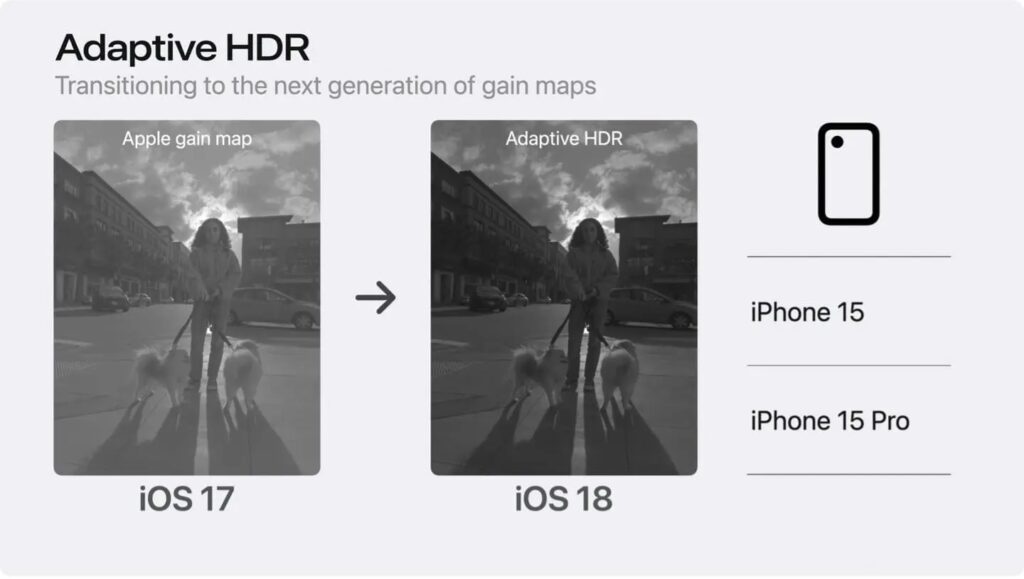

Apple has announced the launch of its new Adaptive HDR standard. This new standard is backwards compatible with SDR systems, decoders, and applications. This innovative technology allows for the storage of both SDR and HDR information in a single file and can adapt to different displays by mapping between HDR and SDR. HDR (High Dynamic Range) and SDR (Standard Dynamic Range) are two different display technologies used to enhance the visual quality of video content. The iPhone 15 series will be the first device to utilize the Adaptive HDR standard after upgrading to iOS 18. This means that users of these devices will be able to take advantage of the enhanced HDR capabilities and enjoy a more immersive visual experience. (GizChina, Apple)

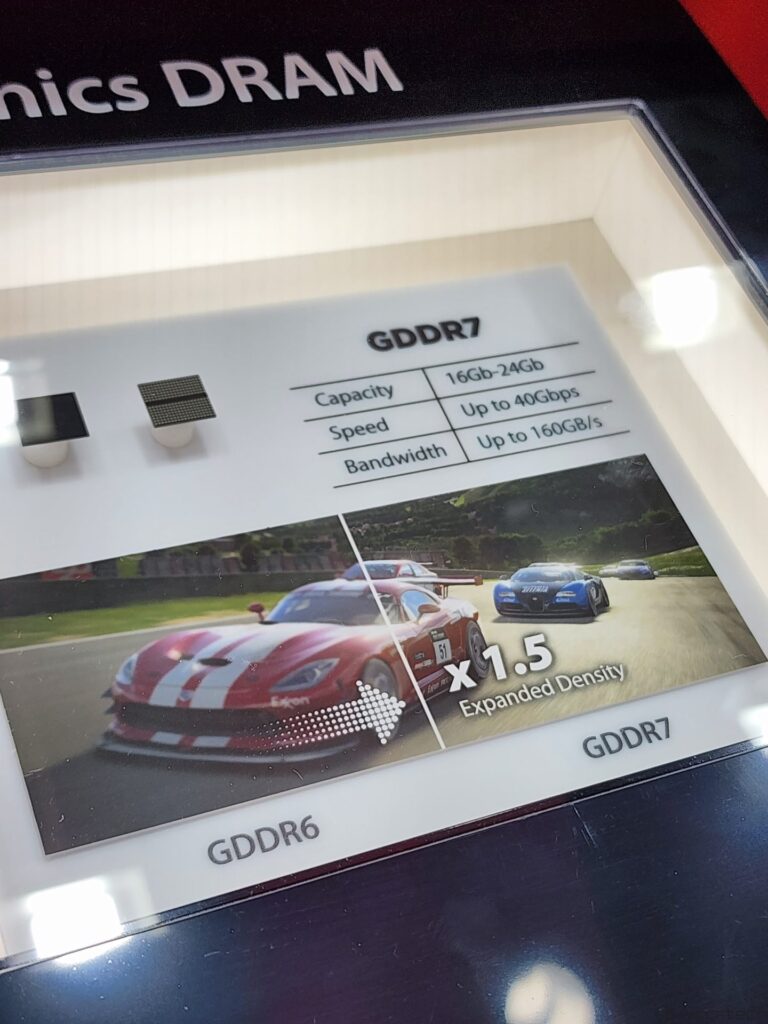

SK Hynix has showcased its latest GDDR7 samples and revealed that it plans to officially start mass production in 1Q25. This progress seems to be slightly behind its two major competitors in the industry, Samsung and Micron. Both Samsung and Micron plan to achieve mass production of GDDR7 in 2024. Samsung’s GDDR7 product page has been launched in Mar 2024, and Micron recently announced that it has provided samples to partners and is expected to start supplying in 2H24. (CN Beta, Sina, Sohu)

Apple is expanding the capabilities of its satellite messaging on the iPhone. The new iOS 18 update will broaden the availability beyond emergency messaging, and Messages via satellite will be an option when cellular and Wi-Fi connections are not available. However, it is only for phones that already enable the emergency satellite messaging, which includes the iPhone 14 and subsequent models. Messages via satellite will automatically prompt users to connect to the nearest satellite right from the Messages app when they are out of reach of cellular service. This will allow iPhone users to send and receive texts, emoji, and tapbacks over iMessage and SMS. Messages sent via satellite will have the same end-to-end encryption as typical iMessages.(CN Beta, CNET, Satellite Today)

China has decried an EU decision to hike tariffs on Chinese electric vehicles as “a blatant act of protectionism”. The European Commission, the EU’s executive arm, said that starting from early Jul 2024, it would impose provisional tariffs that would slap Chinese automakers with additional duties as high as 38%, up from the current level of 10%, if talks with China do not lead to an effective solution. The EU Commission said an investigation it opened in 2023 found that the Chinese electric vehicle industry “benefits from unfair subsidisation, which is causing a threat of economic injury to EU (battery electric vehicle) producers”. The proposed extra tariffs would vary by company. BYD would face an additional 17.4% charge; Geely, which owns Sweden’s Volvo, would be hit with a further 20%, while SAIC it would face a rate of 38.1%. (Engadget, Financial Times, New York Times, Euro News)

General Motors (GM) said it will invest USD850M into Cruise, the robotaxi and self-driving business it bought in 2016. GM has decided it’s pot committed, despite having lost over USD8B on a business that forced to stop on-street operations after a robotaxi in its fleet hit a pedestrian last fall in San Francisco. The automaker’s goal is to prove safety, including via the cautious reintroduction of its robotaxis in three markets, so that longer-term capital might hop a ride. (The Verge, Axios, Forbes)

Germany is the second largest electric car maker globally, with a significant production volume in 2023. According to the German Association of the Automotive Industry (VDA), the country produced 1.27M pure electric vehicles and plug-in hybrid vehicles in 2023, ranking second in the world after China. In 2023, a total of 995,000 pure electric vehicles rolled off German production lines. This number is substantial, indicating the country’s commitment to electric vehicle production. China dominates global EV production, but most of its cars are sold domestically. By contrast, 76% of German EVs are sold abroad. The US holds the spot for the world’s third-largest EV maker. And Germany, the home of key automakers such as Volkswagen, BMW, and Mercedes-Benz, leads Europe with more EVs produced than second-placed Spain (256,000) and France (225,000) combined. (Clean Energy Wire, GizChina, Electrek, IT Home)

Samsung has launched flight, bus, movies and events ticket bookings on Samsung Wallet, in partnership with One97 Communications that owns the Paytm brand, India’s leading payments and financial services distribution company. The partnership aims to enhance consumers’ convenience by offering a seamless and integrated booking experience directly through the Samsung Wallet, facilitating access to a wide range of services through Paytm. With this partnership, Galaxy smartphone users will now have seamless access to Paytm’s suite of services, including flights and bus bookings, movie ticket purchases, and event bookings, all integrated within the Samsung Wallet. (GSM Arena, Samsung)

Apple is reportedly not paying OpenAI nor is OpenAI paying Apple. The current arrangement relies on Apple providing exposure to OpenAI’s ChatGPT to millions of users who want access to the tool — a mutually beneficial arrangement. While it appears that this is the arrangement for now, it could change into a kind of revenue share deal in the future. Apple is talking with other LLM providers like Google to give customers more options. Eventually, Apple will likely make a cut of any monetization options offered by third-party LLMs. (Apple Insider, Bloomberg)

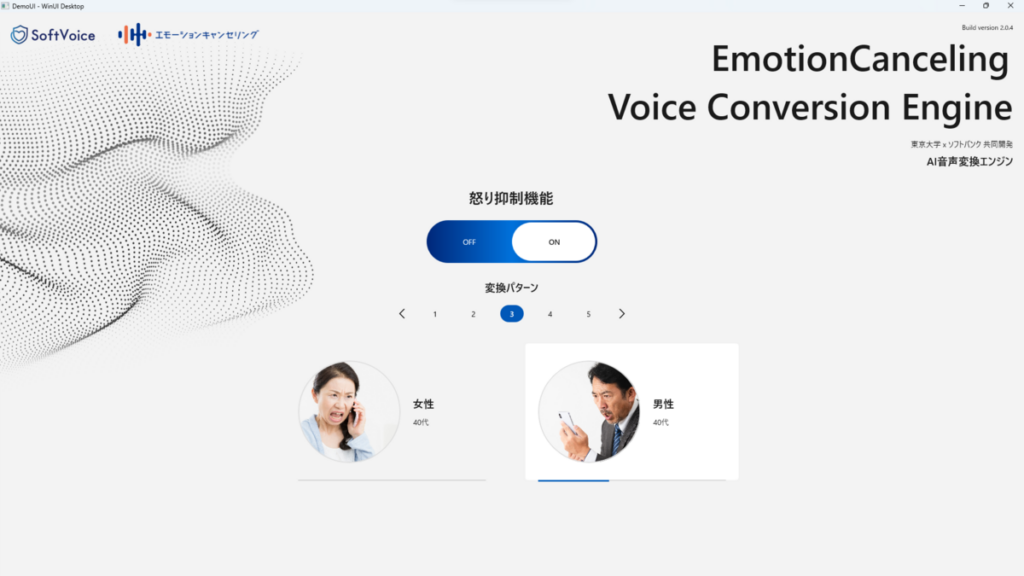

Softbank Japan has unveiled an AI designed to alleviate the harassment of call center staff by automatically softening angry customer voices during calls. The AI automatically replaces threatening, angry, and abusive-sounding speech with a gentler, calmer version. This technology helps protect the mental state of staff under ever stricter employee work regulations focused on ensuring a safe, healthy workplace. The Softbank Emotion Canceling Voice Conversation Engine AI was designed jointly with the University of Tokyo to counter angry customer calls that make call center representatives miserable. With a single click, the AI automatically converts hostile calls into a calmer version that allows staff to address issues without blowing their own tops. This also counters potential employee lawsuits accusing companies of poor work environments. The company anticipates commercial rollout in fiscal 2025. (CN Beta, Notebook Check, Asahi, Japan Times, Softbank)