12-1 #Thanksgiving : Xiaomi is allegedly preparing a self-designed mobile processor; Northvolt has just filed for insolvency; Apple is actively working to build an ecosystem of Indian suppliers for components; etc.

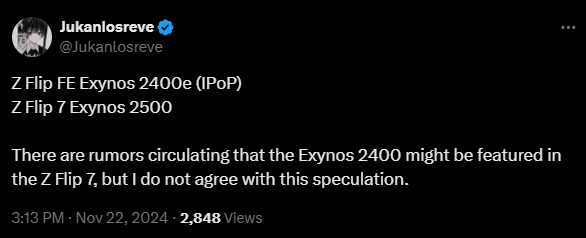

Samsung is expected to launch Galaxy S25 series in early 2025 and the Galaxy Z Fold 7 and Galaxy Z Flip 7 in 2H25. There are also Galaxy Z Fold 7 Special Edition and a Galaxy Z Flip FE. The Galaxy Z Flip 7 could come with the Exynos 2500 SoC. Samsung could power the FE edition of the Galaxy Z Flip with the Exynos 2400e.(Android Authority, Twitter)

MediaTek has unveiled Dimensity 8350. The 8350 seemingly changes little compared to the existing 8300. The chip is fabbed on a 4nm node and has an eight-core processor with 3.35GHz Cortex-A715 prime cores. The Dimensity 8350’s StarSpeed is credited with a 10% reduction in power consumption (24% in high frame and full frame), a 24% increase in scene transition speed, and low jitter. The Dimensity 8350 brings the aforementioned four Cortex-A715 cores alongside four Cortex-A510 units. A Mali-G615 MC6 is in charge of graphics. The SoC supports Quad-channel LPDDR5X with a frequency of up to 8533Mbps. Storage support is up to UFS 4.0. There’s a multi-core MediaTek NPU 780 for AI tasks, Bluetooth 5.4, 5G, and Wi-Fi 6E. The chip supports displays up to 180Hz (in FullHD+) or 120Hz (WQHD+). For imaging, there’s a 320Mp limit for a single camera or a triple 32Mp. Video is capped at 4K at 60 frames per second.(Phone Arena, GSM Arena, MediaTek, MediaTek)

Xiaomi is allegedly preparing a self-designed mobile processor for its upcoming smartphones in an effort to reduce its reliance on foreign suppliers Qualcomm and MediaTek. Mass production of the chip designed in-house is expected to begin in 2025. Xiaomi will invest around CNY30B (approx. USD4.1B) in research and development in 2025, up from CNY24B in 2024, according to Chairman and CEO Lei Jun. The research will focus on core technologies such as artificial intelligence, operating system improvements, and chips, according to Lei, who co-founded Xiaomi almost 15 years ago. (Android Central, Bloomberg, Digitimes, 9to5Google)

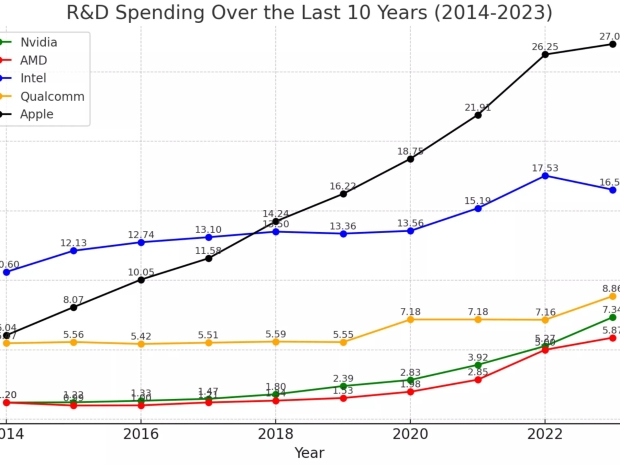

Tech Fund has revealed a significant disparity in research and development (R&D) budgets between competing hardware makers AMD and Nvidia. Intel appears weaker than both despite its vast R&D expenditure. According to Tech Fund’s analysis of R&D expenditures over the past decade, Nvidia now spends twice as much as AMD. In 2013, their R&D budgets were roughly equal, but Nvidia’s has since surged to approximately USD12B, while AMD’s has grown to around USD6B. Nvidia focuses nearly all its R&D efforts on artificial intelligence (AI), while AMD’s smaller budget is spread across GPUs, CPUs, AI, and FPGA chips. (CN Beta, Techspot, Fudzilla)

According to Taiwan’s Minister of the Science and Technology Council Wu Cheng-wen statements, the Taiwan Semiconductor Manufacturing Company (TSMC) can shift its next-generation 2nm chip manufacturing process technology to other countries after 2025. TSMC’s 2nm process technology will compete with Intel’s 18A process, which is also due for production in 2025, and according to the minister, the Taiwanese government will be open to shifting the new technology to friendly nations once TSMC has started working on 2nm successors. (Android Headlines, WCCFtech, Phone Arena, LTN, UDN)

The Japanese government is preparing a budget amendment for fiscal year 2024 (Apr 2024 – Mar 2025) to allocate additional support for the semiconductor and AI sectors, with funding directed toward Rapidus, which is working toward mass production of 2nm chips. This budget amendment for the fiscal year 2024 will allocate JPY1.5T-1.6T (approx. USD9.8B-10.5B) to support advanced semiconductor development and AI initiatives. Rapidus is set to receive JPY800B of the nearly JPY1.6T allocated. The JPY1.0514T of the nearly JPY1.6T will be allocated to develop and validate advanced semiconductor and AI technologies. Additionally, JPY471.4B will promote private investment in semiconductor manufacturing plants in Japan, including those for Rapidus. (CN Beta, Digitimes, Evertiq)

Amazon is expected to announce widespread availability of its proprietary AI chips, Trainium2, which are used to train large language models. Amazon’s journey into the realm of chip production is driven by its desire to bolster its cloud computing services, operated under the banner of Amazon Web Services (AWS). This strategic move into hardware began with the acquisition of Annapurna Labs in 2015, creating the foundation for its bespoke silicon solutions. Amazon is developing two types of AI chips, Trainium2 and Inferentia2. The Trainium AI accelerator is a machine learning chip built for deep learning training of models with more than 100b parameters. The Trainium2 chip, Amazon’s third-generation AI processor, aims to deliver four times the performance and three times the memory capacity of its precursor, Trainium1. Inferentia was developed as a high-performance low-cost AI chip for deep learning and GenAI applications, according to GlobalData’s Artificial Intelligence Executive Briefing (fourth edition). (CN Beta, Nasdaq, Technology Magazine, Yahoo, Guru Focus)

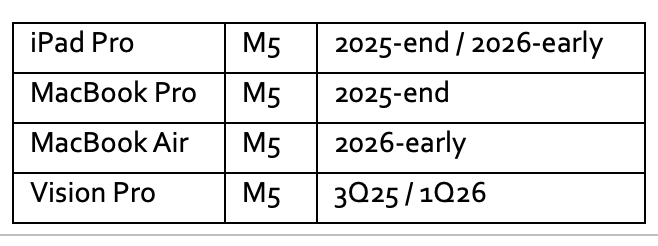

Apple has reportedly already ordered M5 chips for iPad Pro and Macs from TSMC. The M5 chips are slated to feature enhanced ARM architecture and will be fabricated on TSMC’s advanced 3nm process technology. The company’s current M4 chips are also built on the 3nm process, but the forthcoming variants will bring additional performance gains. Apple’s decision to forgo TSMC’s more advanced 2nm process for the M5 chip is believed to be primarily due to cost considerations. Despite this, the M5 will feature significant advancements over the M4, notably through the adoption of TSMC’s System on Integrated Chip (SoIC) technology. (CN Beta, MacRumors, WCCFTech, The Elec)

Samsung is accelerating the development of a 27” QHD (2560 x 1440) resolution QD-OLED panel with an ultra-high refresh rate of 500Hz. The project is now nearing completion and will be available as early as 1H25. Samsung Display has currently launched a 27” QHD resolution QD-OLED display panel with a refresh rate of up to 360Hz. The successful development of this 500Hz panel will undoubtedly refresh the industry benchmark again and further consolidate Samsung’s leading position in the field of high refresh rate display technology. Currently, the 2K OLED panel with the highest refresh rate on the market comes from LG, which has been used in models such as LG UltraGear 27GX790A and ASUS ROG Swift PG27AQDP, providing a refresh rate of 480Hz.(CN Beta, WCCFtech, IT Home)

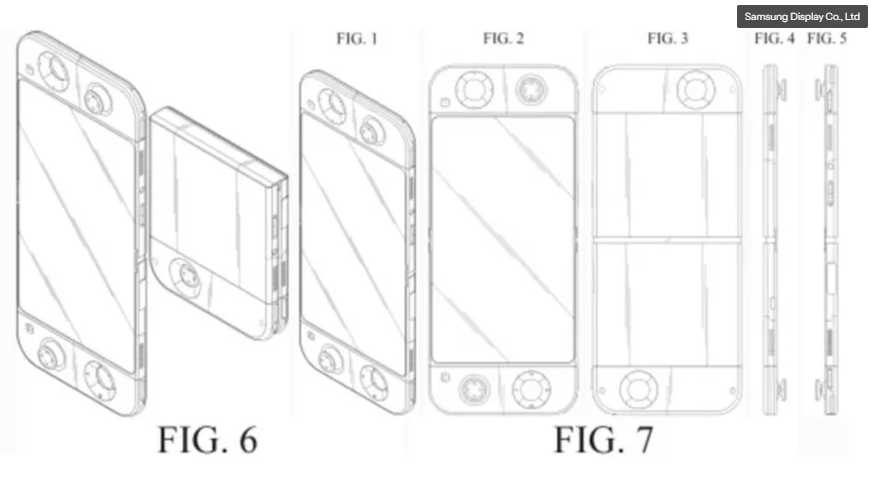

Samsung Display has filed a patent describing a gaming device that features a foldable display. The two controllers are on either end, with a recession that allows the joysticks to fit neatly into the device while closed. When folded, the screen sits on the inside of the device, protected from harm. The display on top could sport Samsung’s Ultra-Thin Glass found on the folding phones. This is for the foldability. There may be a protective film on top.(Android Authority, 91Mobiles, WIPO)

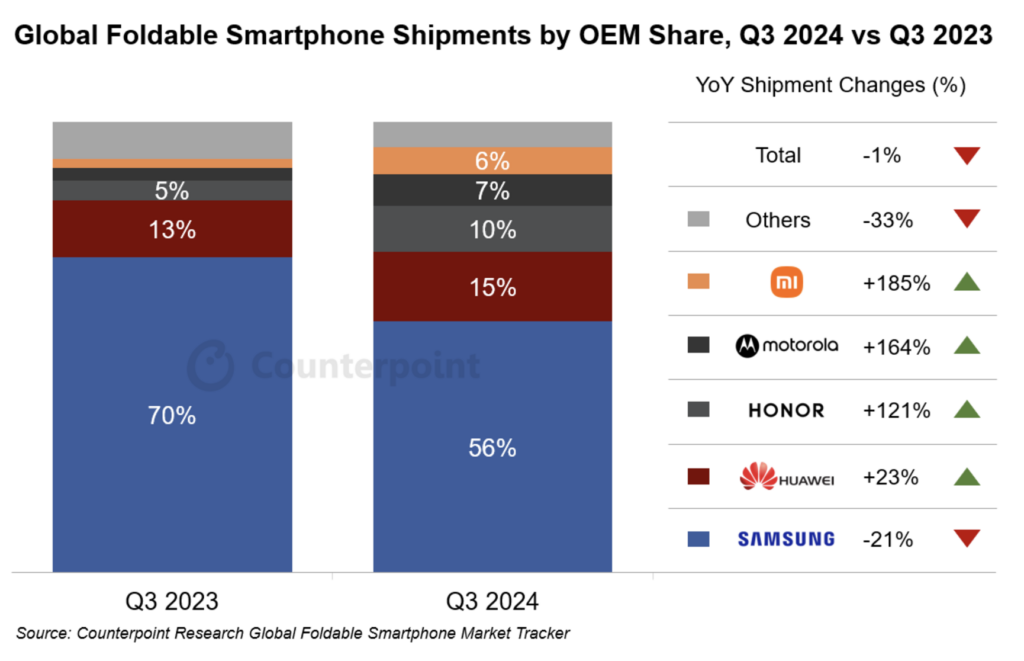

Global foldable smartphone shipments saw a 1% YoY decline in 3Q24 after six consecutive quarters of YoY growth, according to Counterpoint Research. This was also the first-ever Q3 decline in the segment’s history, mainly due to Samsung’s relatively underwhelming performance with its new Galaxy Z6 series. Samsung regained its position as the global market leader with a 56% share, driven by the Z6 series launch. However, the brand’s unit shipments fell 21% YoY. Huawei continued its YoY growth in foldable shipments, supported by the steady popularity of the Mate X5 and Pocket 2 in China. Honor and Motorola remained among the fastest-growing brands in the foldable market, both benefiting from their flagship devices launched in Jun and Jul 2024. (Android Headlines, Counterpoint Research)

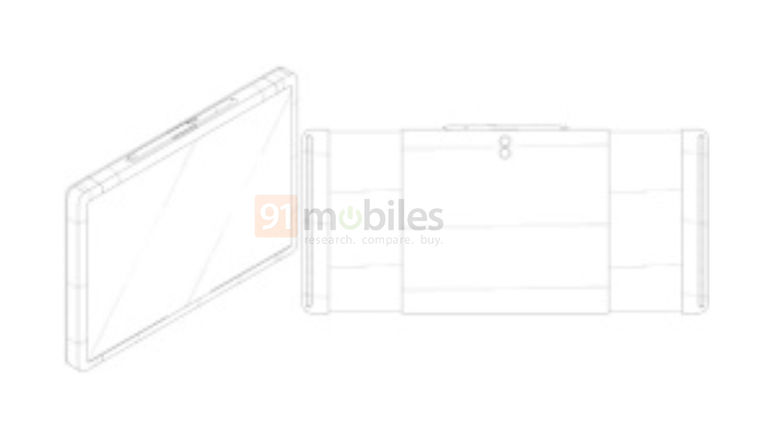

Samsung Display’s patent reveals that they have considered using the rollable screen technology in a tablet. Samsung’s rollable tablet could be noticeably thicker than modern tablets. However, this might be necessary to house the hidden part of the display. The display extends further from both the left and right sides, offering a large viewing area. The tablet’s display could be completely expanded automatically during certain tasks and it might go back to normal when there is no need for the extra display area. For the display to be extended, there could be a motor present under the screen. (Android Headlines, WIPO, 91Mobiles)

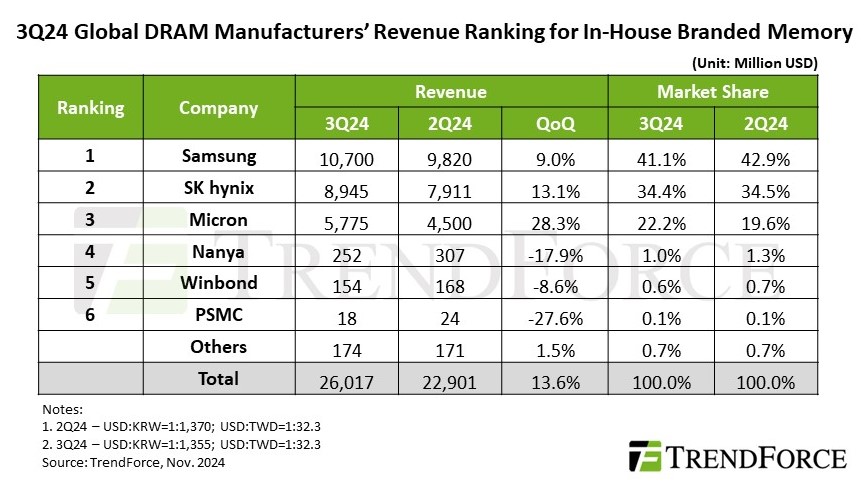

TrendForce’s latest investigations reveal that the global DRAM industry revenue reached USD26.02B in 3Q24, marking a 13.6% QoQ increase. The rise was driven by growing demand for DDR5 and HBM in data centers, despite a decline in LPDDR4 and DDR4 shipments due to inventory reduction by Chinese smartphone brands and capacity expansion by Chinese DRAM suppliers. ASPs continued their upward trend from the previous quarter, with contract prices rising by 8% to 13%, further supported by HBM’s displacement of conventional DRAM production. Looking ahead to 4Q24, TrendForce projects a QoQ increase in overall DRAM bit shipments. However, the capacity constraints caused by HBM production are expected to have a weaker-than-anticipated impact on pricing. Additionally, capacity expansions by Chinese suppliers may prompt PC OEMs and smartphone brands to aggressively deplete inventory to secure lower-priced DRAM products. As a result, contract prices for conventional DRAM and blended prices for conventional DRAM and HBM are expected to decline. (CN Beta, TrendForce, TrendForce)

Northvolt, a Swedish vendor of traction batteries, has just filed for insolvency. The startup firm has accumulated what amounts to USD5.84B in debt while only having a petty USD30M left on the operational account – barely enough to run its factory for another week. The reason for this dire financial situation partly lies in the company’s failure to deliver the goods on time. BMW concluded an agreement worth EUR2B with Northvolt several years ago, but never received a single battery pack and ultimately had to withdraw from the deal in Jun 2024. The struggling battery vendor says it is still hopeful that a restructuring in early 2025 brings it back on track. However, it will have to attract at least USD900M in new investments before it can proceed with this plan. (CN Beta, CN Beta, Northvolt, Reuters)

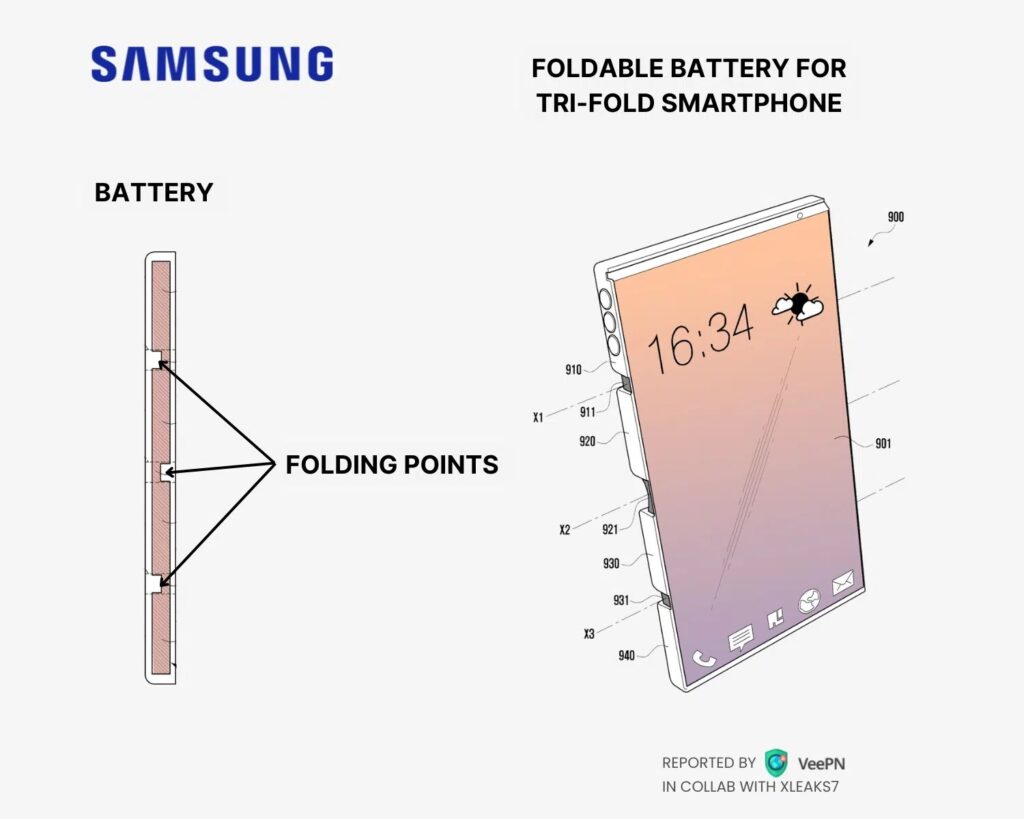

Samsung has patented a foldable battery for a tri-fold smartphone. Samsung’s patented foldable battery that can take full advantage of the available space in multi-fold devices. This innovation could enable devices with multiple folds to be powered by a single battery cell, potentially offering longer battery life without sacrificing the slim design. Samsung’s patented single-cell foldable battery works by using flexible materials that allow the battery to fold along with the smartphone’s display. The key to this system is the battery’s ability to fold multiple times without damaging its structure or reducing its capacity. (Android Headlines, Veepn)

Huawei CEO of the Consumer Business Division, Richard Yu, has demoed HarmonyOS NEXT features, including the Air Transmission and Gesture Control technologies, which are specifically tailored for the Mate 70 series, Mate X6, and the MatePad Pro 13.2. The new Air Transmission feature enables seamless content transfer between devices. Using Connected Access Screen Gesture Trigger Recognition, users can “grab” content from one device—such as a phone—and “release” it onto another, like a tablet, through intuitive air gestures, bridging the gap between devices in a fluid and futuristic manner. Moreover, the Mate 70 series introduces Magic Gesture Operations for hands-free interactions. This advanced feature leverages an Always-On (AON) camera to enable seamless, intuitive content sharing through air gestures, setting a new benchmark for smart device interaction. (GSM Arena, Weibo, Innogyan, 163.com)

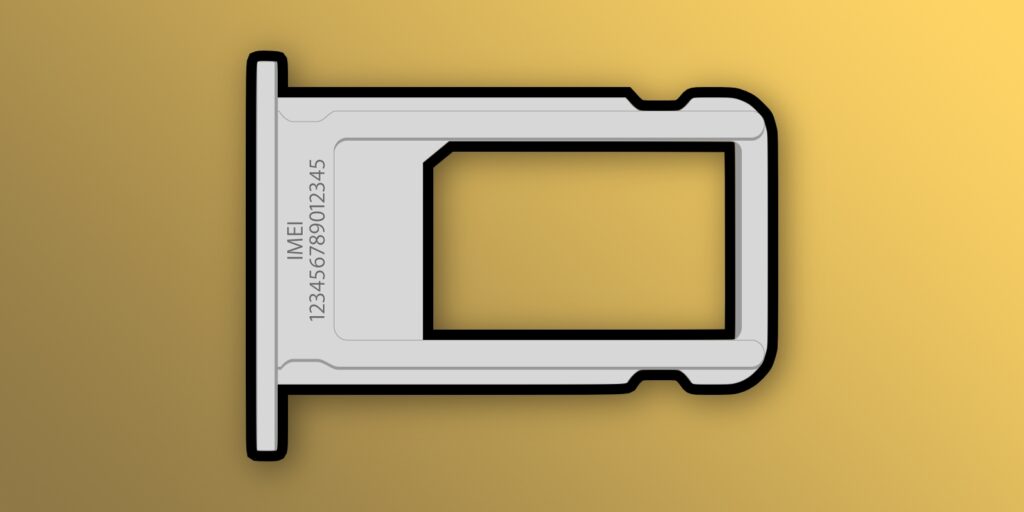

Apple iPhone 17 Slim or Air may not have a SIM card tray because due to its slimness, and it probably will not have mmWave. The iPhone could be 6mm thick, which would make it an extremely narrow device. Due to its size, compromises will have to be made for some components, such as the camera bump. All current “iPhone 17 Air” prototypes lack a SIM card tray.(MacRumors, The Information, Apple Insider)

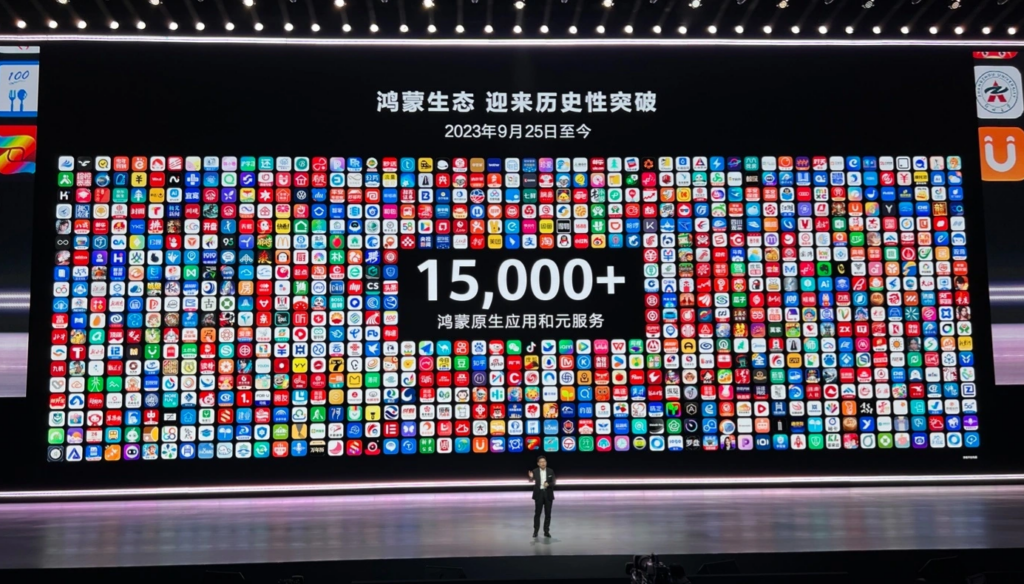

Huawei’s rotating chairman Eric Xu has revealed that more than 15,000 HarmonyOS native applications and meta-services have been launched, covering 18 vertical fields. He said frankly that according to analysis, 100,000 applications are a sign of the maturity of the HarmonyOS ecosystem in meeting consumer needs, which is the key goal of the HarmonyOS ecosystem in the next six months to a year.(Android Headlines, IT Home)

First launched in beta in 2023, Samsung has officially launched its own cloud gaming services for Galaxy devices in the US. Samsung has officially rolled out cloud gaming services via the “Gaming Hub” on Galaxy devices. Samsung’s version of cloud gaming for Galaxy devices simply allows for Android games to be played without a full download being needed. Samsung also notes that in addition to bringing such benefits to the players, it will also reduce latency and increase efficiency and scale for game publishers. (Android Central, 9to5Google, Samsung)

The Industry Ministry expects Apple to invest more than USD100M in Indonesia. A larger investment would facilitate the development of Indonesia’s domestic manufacturing sector, helping the country become a part of Apple’s global supply chain, the ministry spokesperson Febri Hendri Antoni Arif emphasized. He also stated that Indonesia’s domestic industry is capable of meeting Apple’s needs for supporting devices, such as chargers and accessories. The Indonesian government has also invited Apple to establish a research and development center for Industry 4.0, which is focused on artificial intelligence development. (CN Beta, Apple Insider, Antara News)

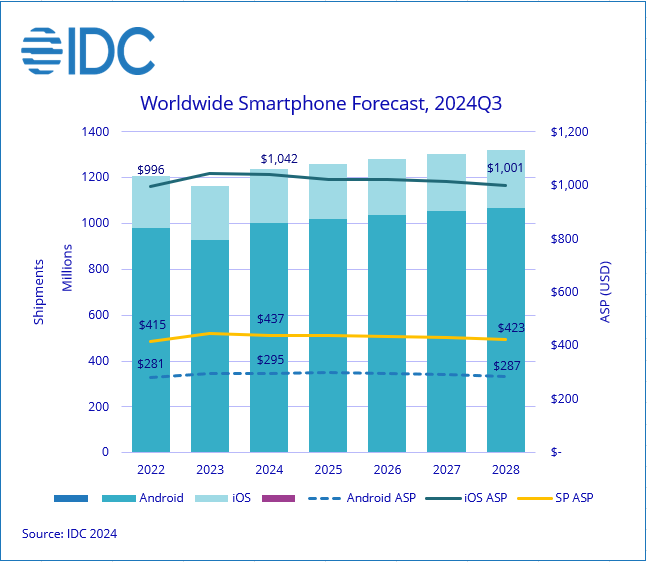

Worldwide smartphone shipments are forecast to grow 6.2% YoY in 2024 to 1.24B units, according to IDC. This strong growth follows two years of steep declines and is fueled by pent-up demand for device upgrades. While 2024 marks a strong rebound, growth is expected to slow to low single digits from 2025 onward, with a 2.6% CAGR (2023-2028). Contributing factors include increasing smartphone penetration, lengthening refresh cycles, and headwinds from rapidly growing used smartphone market. In 3Q24, foldables declined by 7.4%, even as most of the world’s prominent vendors launched new models. Still foldables will grow 10.5% in 2024 and maintain a double digit growth through 2028 with a five-year CAGR of 15.9%. However, the pace of growth is slowing down as Chinese vendors (who are driving this segment) are realigning focus and investments towards GenAI smartphones. Durability concerns and lack of unique use cases are also dampening growth. (Apple Insider, IDC)

LG Electronics sold its US standard patents to vivo. LG Electronics is profiting from the sale of patents after exiting the mobile phone business in 2021. Most of them are standard patents for codecs required for video signal compression. Codecs refer to technologies for compressing and decompressing digital video and audio. Specifically, these 46 patents cover a series of key technical fields such as intra-frame prediction, inter-frame prediction, transform coding, motion vector prediction, chroma format, affine motion prediction, bitstream signal processing, and high-frequency zeroing, which are essential to improving video processing efficiency and quality. (CN Beta, IT Home)

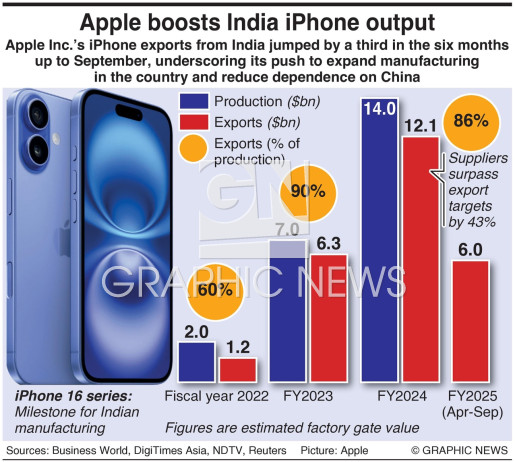

Apple is actively working to build an ecosystem of Indian suppliers for components used in products like iPhones, MacBooks, iPads, and AirPods. Apple has engaged more than 40 Indian companies, including large conglomerates, IT firms, and electronics manufacturing service providers (EMS), in the project. It has roped in major tech companies like Dixon Technologies, Amber Electronics, HCLTech, Wipro, and Motherson Group. Apple is bullish on Indian partners as the company’s Chinese component suppliers have been reluctant to invest significantly in India because of the ongoing tax and legal challenges Chinese smartphone companies are facing. (Apple Insider, Money Control)

American all-electric automaker Rivian Automotive has announced it has received conditional commitment from the U.S. Department of Energy’s Advanced Technology Vehicle Manufacturing (ATVM) Loan Program for a loan of up to USD6.6B (including USD6B of principal and approximately USD600M of capitalized interest) to accelerate its growth and leadership of electric vehicle design, development and manufacturing in the United States. The loan would support the construction of Rivian’s upcoming assembly plant located outside of Atlanta. Rivian paused development of the site back in March due to concerns about its capital position. At the time, Rivian said building its upcoming R2 vehicles at its existing Normal, Ill., plant instead would save the company over USD2B in costs. If finalized, the new DOE loan would restart Rivan’s plans to develop the Georgia assembly plant. (CN Beta, Yahoo, Business Wire, Yahoo)

Chinese autonomous driving startup Pony AI has gone public on the Nasdaq, making it the largest initial public offering (IPO) in the autonomous driving space on the US stock market in 2024. Pony AI’s IPO offering was priced at USD13 per ADS (American Depositary Share), which is at the upper end of the USD11-13 price range. Each ADS corresponds to one ordinary share. After expanding the size of the offering by 33.3% from the originally planned 15M shares, the company issued 20M ADSs to raise a total of USD260M. (CNEVPost, TechCrunch, Yahoo, Bloomberg, Reuters)

Uber Technologies has announced it has launched its own data labelling and testing service named Scaled Solutions and is recruiting independent contractors in order to help enterprise customers label and train their respective Gen AI solutions as part of the launch. Should Uber Scaled Solutions successfully ramp its operations, the firm believes the company will increasingly compete with BPO providers such as Telus International and TaskUs in the data annotation services market, adding that it thinks Uber’s foray into the data annotation market will increase competition for talent and believes any potential market share shifts will be contingent on contractor wages.(CN Beta, TechCrunch, Yahoo, Nasdaq)