12-28 #PostHolidayMood : UMC has no immediate plans to set up a production site in the United States; Huawei’s outward foldable smartphone project has allegedly been suspended; Foxconn has announced a partnership with Porotech to enter the AR glasses market; etc.

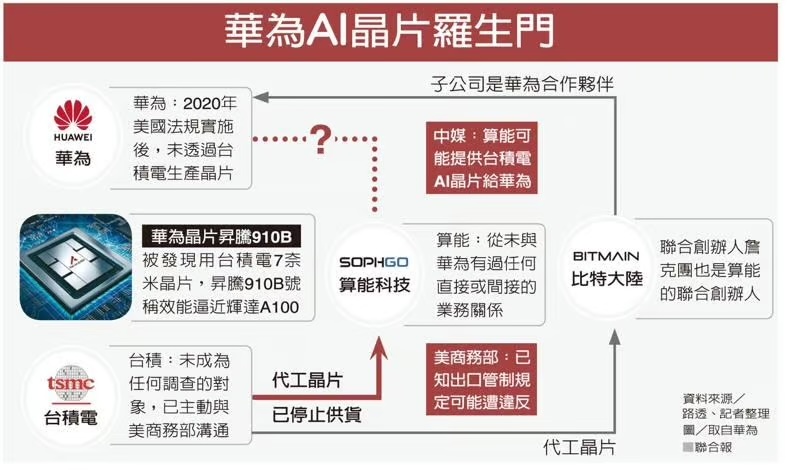

The US government plans to blacklist a Chinese company whose TSMC-made chip was illegally incorporated into a Huawei artificial-intelligence processor. The Chinese company, Sophgo, drew attention after a chip found on Huawei’s Ascend 910B multi-chip system matched one it ordered from Taiwan Semiconductor Manufacturing Company (TSMC). Sophgo is the latest Chinese company slated to be punished by the U.S. for helping Huawei. Sophgo, an affiliate of bitcoin mining equipment supplier Bitmain, is in the process of being placed on the list, known as the Entity List. (Phone Arena, Reuters, Tom’s Hardware)

AMD and Intel have formed the “x86 Ecosystem Advisory Group” in partnership with Broadcom, Dell, Google, HP, Lenovo, Microsoft, and other tech companies. The goal is to ensure x86 as a hardware platform “continues evolving as the compute platform of choice for both developers and customers”. The group will help standardize x86 instructions and other architecture designs, ensuring processors from Intel and AMD remain hardware-compatible and gain new features together. Intel has apparently “given up”” on the x86 alliance, which included AMD, Google, and many others, citing that they have ended development of the “x86-S” initiative. (CN Beta, MSN, Forbes, WCCFTech, Tom’s Hardware)

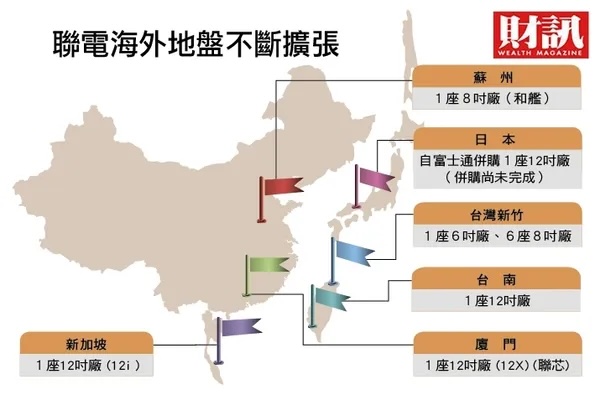

United Microelectronics Corp (UMC) said that it has no immediate plans to set up a production site in the United States amid speculation that the Taiwanese company may come under pressure to invest in the U.S. market. UMC reiterated that it has no plans to invest in the U.S. at the moment. It said it was focusing its resources on its ongoing project with U.S. chipmaker Intel. In Jan 2024, UMC and Intel announced they would develop a 12nm semiconductor process platform. Production at Intel’s Ocotillo Technology Fabrication site in Arizona is set to begin in 2027. (CN Beta, Focus Taiwan, Taipei Times, UDN)

Samsung Electronics may consider partnering with external foundries to produce its Exynos 2500 processor for the first time. While TSMC is not explicitly mentioned, it remains the only alternative for mass-producing Exynos chips. Samsung’s 3nm GAA process has struggled with low yield rates. As a result, the Exynos 2500 is unlikely to feature in Galaxy S25 smartphones launched in 2025. Instead, the Galaxy S25 will rely entirely on Qualcomm’s Snapdragon 8 Elite processor. Following confirmation that the Exynos 2500 will not be included in the Galaxy S25, Samsung’s semiconductor division, LSI, is showing a greater willingness to collaborate with external foundries. Samsung is reportedly considering adopting a multi-foundry strategy to diversify production and ensure supply chain stability, and it might be extended to categories beyond mobile, automotive, and communications to stabilize performance. (CN Beta, TrendForce, WCCFTech, The Bell, Twitter)

Russia has unveiled a roadmap to develop its own lithography machines, aiming to create less costly and complex equipment than ASML’s systems. These machines will use lasers operating at a wavelength of 11.2 nanometers instead of the standard 13.5 nm used by ASML. This wavelength will be incompatible with existing EUV infrastructure and require Russia to develop its own lithography ecosystem, which will likely take years, if not a decade or more. The Russian semiconductor initiative is led by Nikolay Chkhalo from the Russian Academy of Sciences’ Institute of Microstructure Physics. The plan is to build EUV machines that offer competitive performance while lowering manufacturing and operational expenses compared to ASML’s EUV tools. Unlike ASML’s EUV lithography systems, Russian EUV scanners will use a xenon-based laser source with an 11.2 nm wavelength instead of ASML’s tin-based systems. Chkhalo says the 11.2nm wavelength offers a 20% improvement in resolution, allowing for finer detail while simplifying the design and reducing the costs of optical components. (CN Beta, Notebook Check, MSN, CNEWS)

Samsung Foundry is allegedly facing difficulties in securing chip orders from clients. This is due to the perception that its 3nm process node does not have enough yield to make millions of chips. It has failed to increase the yield to a level where it can make its own Exynos 2500 chips for the Galaxy S25. t Qualcomm’s next flagship chip, the Snapdragon 8 Elite Gen 2 (tentative name), will reportedly be made by TSMC using its third-generation 3nm (N3P) process. The chip will be announced in 2H25. Samsung Foundry attempted to win this order but failed, reportedly due to yield-related issues. Apparently, Samsung Foundry negotiated with Qualcomm to make the Snapdragon 8s Elite, which is a cut-down version of the company’s current flagship chip. However, that attempt failed as well. And that chip will likely be made by TSMC as well. (Android Headlines, SamMobile, The Bell)

Huawei’s outward foldable smartphone project has allegedly been suspended. After all, Huawei already has a tri-fold smartphone. Looking back at Huawei’s foldable product line, Huawei has successively launched outward-fold, inward-fold, flip and tri-fold products. Among them, the benchmark outward-fold models include Huawei Mate X, Mate Xs and Mate Xs 2. The last external folding Mate Xs 2 was released on 28 Apr 2022. (CN Beta, Sina)

Hon Hai Technology Group (Foxconn) has announced a partnership with Porotech to enter the augmented reality (AR) glasses market. Leveraging Porotech’s cutting-edge gallium nitride (GaN) technology and Foxconn’s vertically integrated services, from MicroLED wafer processing to packaging and optical modules, the collaboration aims to meet the demands for micro-display chips and AR glasses production. Together, they will provide high-performance, high-brightness, compact, and lightweight AR display solutions to advance global AR and micro-display technology development. As part of the partnership, Foxconn will accelerate its strategic expansion in AR and MicroLED technologies. The company plans to establish a MicroLED wafer processing production line in Taichung, with mass production slated to begin in 4Q25. (Apple Insider, Foxconn, Yahoo, TrendForce, Digitimes, Sina, IT Home)

Richard Yu, the Chairman of Huawei’s Consumer Business Group is promising “beyond imagination” products for 2025. It could be the flagship Pura 80 series or a brand-new tri-fold handset. The company will unveil the curtain from this mystery in the time ahead. Yu says that the company worked on the idea of making products that others want but cannot make. One such is the world’s first tri-fold – Mate XT which is now in the market. The creation “rewrote the history of the smartphone industry”.(Android Headlines, Weibo, Huawei Central)

Yoshihiro Yamaguchi, president of Sony Semiconductor Manufacturing has revealed that that Sony has shipped more than 20B image sensors to date. Sony is currently building a new factory in Kumamoto Prefecture, Japan, and the company’s semiconductor business is still developing rapidly. It is understood that from 2010 to 2019, Sony image sensors achieved a shipment target of 10B units. Since then, this number has grown exponentially. It took only five years for Sony to reach from 10B to 20B units. The main reason for the growth is the significant increase in the number of cameras installed on each smartphone. (GSM Arena, Nikkei Asia)

China’s leading memory chip manufacturer, ChangXin Memory Technologies (CXMT), has reportedly started mass production of DDR5. Chinese storage manufacturers KingBank and Gloway unveiled DDR5 products with 32GB capacities. These companies assemble DRAM chips into modules for use in PCs and servers, promoting them as containing “China-made DDR5 chips”. Although the manufacturers did not disclose their supplier, online product documentation identifies CXMT as the chipmaker. CXMT has allegedly begun reaching out to potential clients, touting a yield rate of approximately 80%—close to the 80–90% range achieved by South Korean competitors. CXMT’s DDR5 memory is believed to be produced using CXMT’s G3 process, which has a line width of 17.5nm. (CN Beta, Tom’s Hardware, WCCFTech, Chosun, ZDNet)

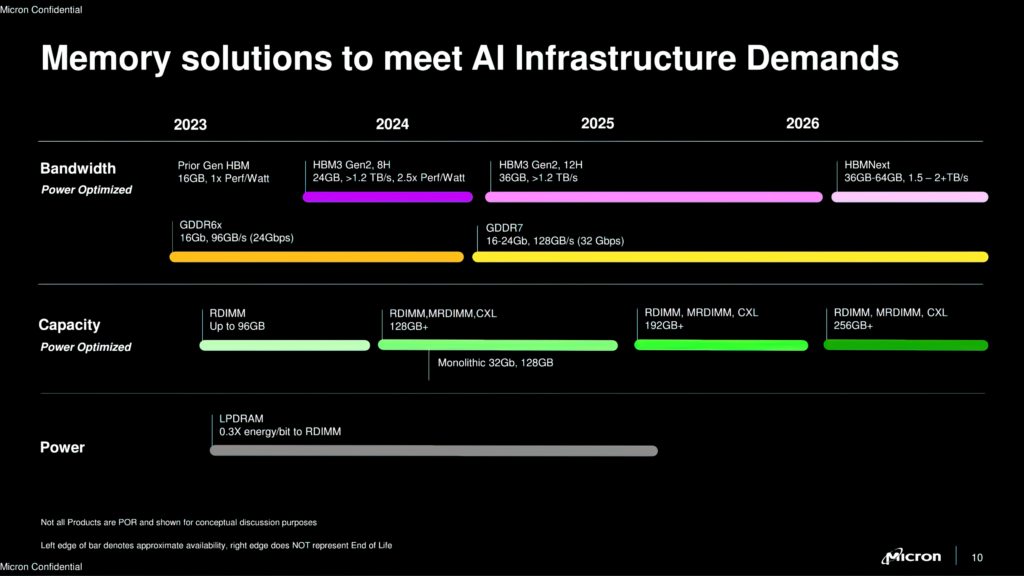

Micron has provided an update on its HBM4 and HBM4E programs. The next-generation HBM4 memory, with a 2048-bit interface, is on track for mass production in calendar year 2026, with HBM4E to follow in subsequent years. Leveraging the strong foundation and continued investments in proven 1β process technology, we expect Micron’s HBM4 will maintain time to market and power efficiency leadership while boosting performance by over 50% over HBM3E. We expect HBM4 to ramp in high volume for the industry in calendar 2026. Development work is well underway with multiple customers on HBM4E, which will follow HBM4. HBM4E will introduce a paradigm shift in the memory business by incorporating an option to customize the logic base die for certain customers using an advanced logic foundry manufacturing process from TSMC. We expect this customization capability to drive improved financial performance for Micron. (CN Beta, WCCFTech, Tom’s Hardware)

SK hynix, the world’s second-largest memory chip maker, has finalized a deal with the US government to secure direct funding of up to USD458M for building its advanced chip packaging plant in the US. As the US Commerce Department finalizes chip grants for all four major chip manufacturers, including SK hynix, attention now shifts to when the crosstown rival Samsung Electronics will also complete the deal for federal funding of USD6.4B, as it signed a preliminary agreement earlier in 2024. The US Commerce Department announced that it would provide direct funding and a government-backed loan of up to $500 million to SK hynix under its CHIPS and Science Act — the bipartisan program signed by US President Joe Biden to attract foreign chipmakers to invest in the US. (CN Beta, Bloomberg, Asia Nikkei, Korea Herald)

Samsung Electronics has embarked on establishing a test line to improve the yield of its 7th generation (1d) DRAM. Samsung has started building the 10nm-level 7th generation DRAM test line at its Pyeongtaek Plant 2 (P2) from 4Q24. The industry also refers to this test line as a “one path” line. This line is expected to be fully established by 1Q25. Although the exact scale of the 10nm-level 7th generation DRAM facility in Pyeongtaek is not confirmed, test lines are typically installed to process around 10,000 wafers per month. Samsung plans to bring in semiconductor equipment centered on Pyeongtaek Plant 4 (P4) from early next year to produce the 10nm-level 6th generation DRAM. Samsung is currently accelerating yield improvement with the goal of obtaining internal mass production approval (PRA) for the 6th generation DRAM by May 2025. Samsung Electronics is also accelerating its investment in another memory, NAND flash. It is recently installing the industry’s first 400-layer NAND (V10) test line at Pyeongtaek Plant 1 and filling the Pyeongtaek Plant 4 NAND fab with 286-layer (V9) equipment. (CN Beta, Digitimes, TrendForce, Business Korea)

JD Health (JDH) has released a “mobile phone blood pressure measurement” product last night. It is China’s first smartphone-based multi-modal technology application blood pressure detection product that is independently developed by JDH. No additional hardware is required and blood pressure can be measured anytime and anywhere. jDH said that the measurement accuracy of this technology fully complies with international standards and has been certified by the China Academy of Information and Communications Technology. The test flagship has served more than 1.5M people. It should be noted that the official emphasized that this function needs to be calibrated with a professional blood pressure monitor to ensure higher accuracy, and it is best to repeat it at least three times in different time periods to ensure that the measurement results of the mobile phone and professional equipment are basically consistent. (CN Beta, IT Home)

Samsung is teaming up with Netflix to bring its streaming app to the Galaxy Store, just in time to unwrap new content with friends and family for the holidays. Samsung Galaxy Store is the one-stop destination for trending apps, games and rewards. Galaxy device owners can unwrap additional exclusive promotions with Peacock. Galaxy device owners can unwrap additional exclusive promotions with Peacock. In addition to the recent launch of Netflix and Peacock, Spotify is now available on the Galaxy Store. (Samsung, Phone Arena)

The thickness of Samsung Galaxy S25 Slim will allegedly be under 7mm. For reference, the current Galaxy S24, Galaxy S24 Plus, and Galaxy S24 Ultra are 7.6mm, 7.7mm, and 8.6mm thick, respectively. So, the device could be noticeably thinner than any recent Galaxy S models. The Galaxy S25 Slim aims to achieve a more balanced ratio between thinness and tech specs. It will reportedly inherit at least some sensors and photography capabilities from the Galaxy S25 Ultra. (Gizmo China, Weibo, Android Headlines)

Bloomberg’s Mark Gurman says that Apple’s aim to add a camera to the AirPods is to power Apple Intelligence features, and that the device is due to gain many more health features. AirPods could become much more significant in Apple’s drive toward health. Reportedly, Apple is now chiefly concentrating on finding how to make AirPods reliably measure heart rate. Apple is also said to be working on adding temperature sensing to AirPods, plus other unspecified physiological measurements.The new health measures follow 2024’s addition of a hearing test to the AirPods Pro 2. (Apple Insider, Bloomberg)

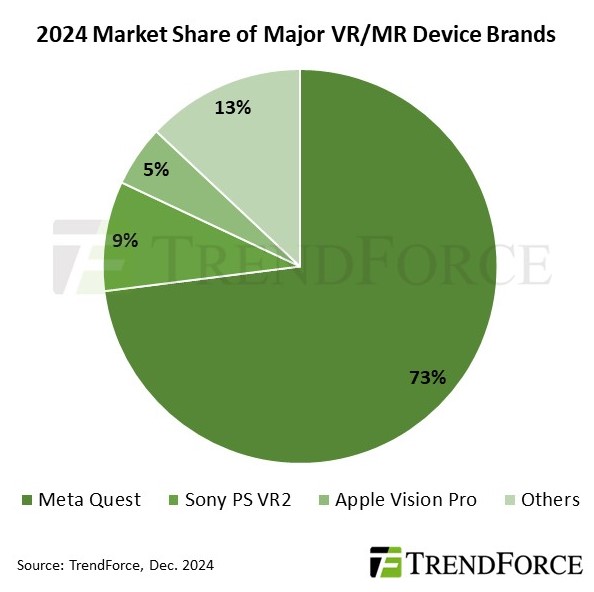

TrendForce’s latest report estimates that global shipments of VR and MR headsets are expected to reach approximately 9.6M units in 2024, representing a YoY increase of 8.8%. This year’s shipment performance highlights three key industry trends that are shaping the global VR and MR ecosystem: The dominance of low-cost devices, the shift from entertainment accessories to productivity tools, and OLEDoS emerging as the preferred display technology for high-end near-eye devices. These three trends are expected to continue influencing the global VR and MR market over the next several years. Meta retains its position as the global leader in VR and MR device shipments with a 73% market share in 2024. The primary growth driver is the affordable Quest 3S—priced at just USD299—contributing to an 11% YoY increase in shipments. (Apple Insider, TrendForce, TrendForce)

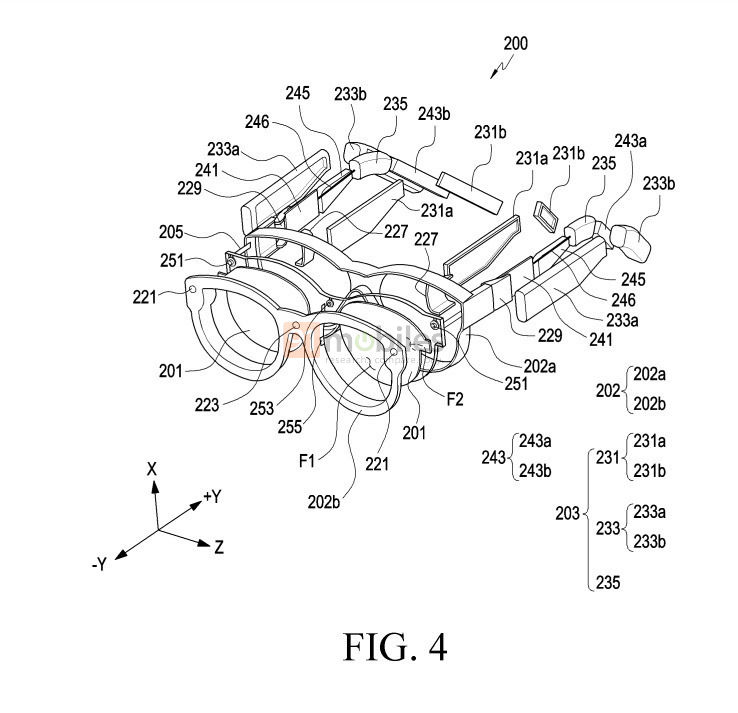

Samsung’s patent reveals the potential design of the Samsung smart glasses, along with interesting features such as speakers protected by electromagnetic interference. The patent document says the wearable has a housing, which includes a speaker, battery, power transmission structure and light output modules. The latter is configured to display /o utput an image. As for the design of the Samsung wearable, it is like any other smart glass with two oval-shaped lenses on the front and dual legs that accommodate the required sensors. The wearable device will house a touch sensor that will detect touch and a pressure sensor to measure the intensity of the force from touch. (USPTO, 91Mobiles, Android Headlines)

Japanese automakers Honda Motor and Nissan Motor along with Mitsubishi Motors have announced that they have signed a memorandum of understanding (MoU) to begin discussions on a potential merger. The proposed business integration, which includes establishing a joint holding company, is seen as a strategic move to enhance their competitiveness in the electric vehicle (EV) market and counter the dominance of Tesla and Chinese rivals. The merger aims to achieve combined annual sales of JPY30T and an operating profit exceeding JPY3T. According to the companies, they plan to finalize discussions by Jun 2025, with the holding company expected to be operational by Aug 2026. (CN Beta, Honda, Honda, India Times, Mitsubishi)

LG Electronics (LG) has launched LG Radio+, the company’s ad-supported audio streaming service, now available on LG smart TVs running webOS 6.0 and above. This new service allows users to effortlessly access a diverse selection of podcasts and radio programs. For a streamlined user experience, LG Radio+ will work with the LG ThinQ app, providing users with a convenient way to access and enjoy their favourite audio content no matter where they are in the room. To offer a curated list of audio streaming content, LG has partnered with global radio and audio provider Radioline, giving users an all-in-one audio platform allowing effortless access to news, sports, music and more.(GSM Arena, LG)

Bloomberg’s Mark Gurman reports that Apple is working on another new smart home device, which is a doorbell with Face ID that can wirelessly unlock a deadbolt lock. Gurman notes that the upcoming Apple doorbell could connect to existing smart locks that support Apple’s HomeKit protocol. However, it is also possible that Apple will partner with a vendor to offer a complete solution from day one. Gurman expects the device to make good use of Apple’s upcoming “Proxima” chip, a homegrown Bluetooth and Wi-Fi solution slated to go into products starting in 2025. The doorbell is still at the early stages of development, the report claims, with 2026 being the earliest likely introduction for the product. (Apple Insider, Bloomberg, GSM Arena, Android Authority)

Apple is reportedly in talks with Tencent and TikTok owner ByteDance about integrating their artificial intelligence models into iPhones sold in China. ChatGPT is not available in China and the country’s regulatory requirements mandate that generative AI services obtain government approval before public release, forcing Apple to seek local partners for its AI features at a time when its market share in the country is declining. Apple’s discussions with Tencent and ByteDance on using their AI models are at a very early stage. (Apple Insider, Reuters)