1-21 #TechonEyes : TSMC has begun producing advanced 4nm chips in Arizona; ARM [lans to hike prices by as much as 300%; George Zhao is resigning from his position as Honor CEO; etc.

Taiwan Semiconductor Manufacturing Company (TSMC) has begun producing advanced 4nm chips for U.S. customers in Arizona, according to Commerce Secretary Gina Raimondo. In Nov 2024, Commerce finalized a USD6.6B grant to TSMC’s U.S. unit for semiconductor production in Phoenix, Arizona. Apple is nearing the final stages of verifying its first “made in America” advanced processor chips from TSMC’s Arizona plant. Apple’s A16 Bionic iPhone processor is believed to be the first batch of chips manufactured with TSMC’s 4nm node at Arizona. The chips could be ready as early as 1Q25. NVIDIA and AMD are also conducting wafer test production at TSMC’s Arizona facility. However, even chips made in the U.S. will still be sent to Taiwan for advanced packaging until TSMC’s partner, Amkor, finishes building its packaging plant in the U.S. With an initial capacity of 20K wafers per month by year-end, the facility’s early production will primarily serve U.S.-based customers, including AMD and Apple. Additionally, there are rumors that a portion of AWS’s ASIC chips will also be produced at the AZ fab. TSMC’s second fab at the Arizona site, set to launch in 2028, will feature 3nm-class process technologies. By the end of the decade, TSMC plans to develop the third fab, which will manufacture chips using 2nm-class and 1.6nm-class nodes. (GSM Arena, Gizmo China, TrendForce, Tom’s Hardware, Reuters, Nikkei)

Arm Holdings, a technology supplier to chip firms, is reportedly developing a long-term strategy to hike prices by as much as 300% and has discussed designing its own chips in a move to compete with its biggest customers. Arm It licenses the intellectual property that Apple, Qualcomm, Microsoft and others use to design their chips, charging a small royalty for each chip produced with Arm technology. Despite its key role in the rise of smartphones and energy-efficient data center chips, Arm has remained small compared with its customers, with USD3.23B in revenue for fiscal-year 2024. Known in its early stages as the “Picasso” project, Arm’s plans, which date back to at least 2019, aim for a roughly USD1B increase in annual smartphone revenue over about 10 years. For comparison, Apple’s revenue from Arm-powered hardware is over 90 times larger. To bridge this gap, Arm is also considering a dramatic shift in its business model by designing and manufacturing its own chips. Arm’s proposed chip products include chiplets, smaller components that can be integrated into larger processors. (Reuters, Investing, Gizmo China)

Samsung Electronics has reportedly set its production plan for its ‘Tri-Fold’, a foldable phone that folds twice, to be released for the first time in 2025, at around 200,000 units. Tri-Fold components will go into mass production in 2Q25. Samsung Electronics’ foldable phone production plan in 2025 is said to be around 7M units. This figure is the sum of new products and legacy models, such as the Galaxy Z Flip 7 (3M units), Z Flip FE (900K units), Z Fold 7 (2M units), and Tri Fold (200K units). (GSM Arena, The Elec)

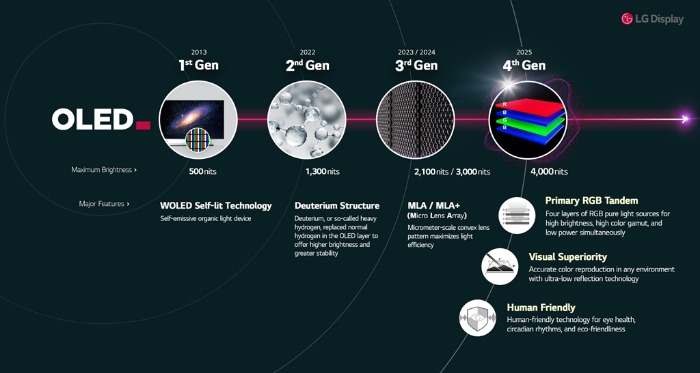

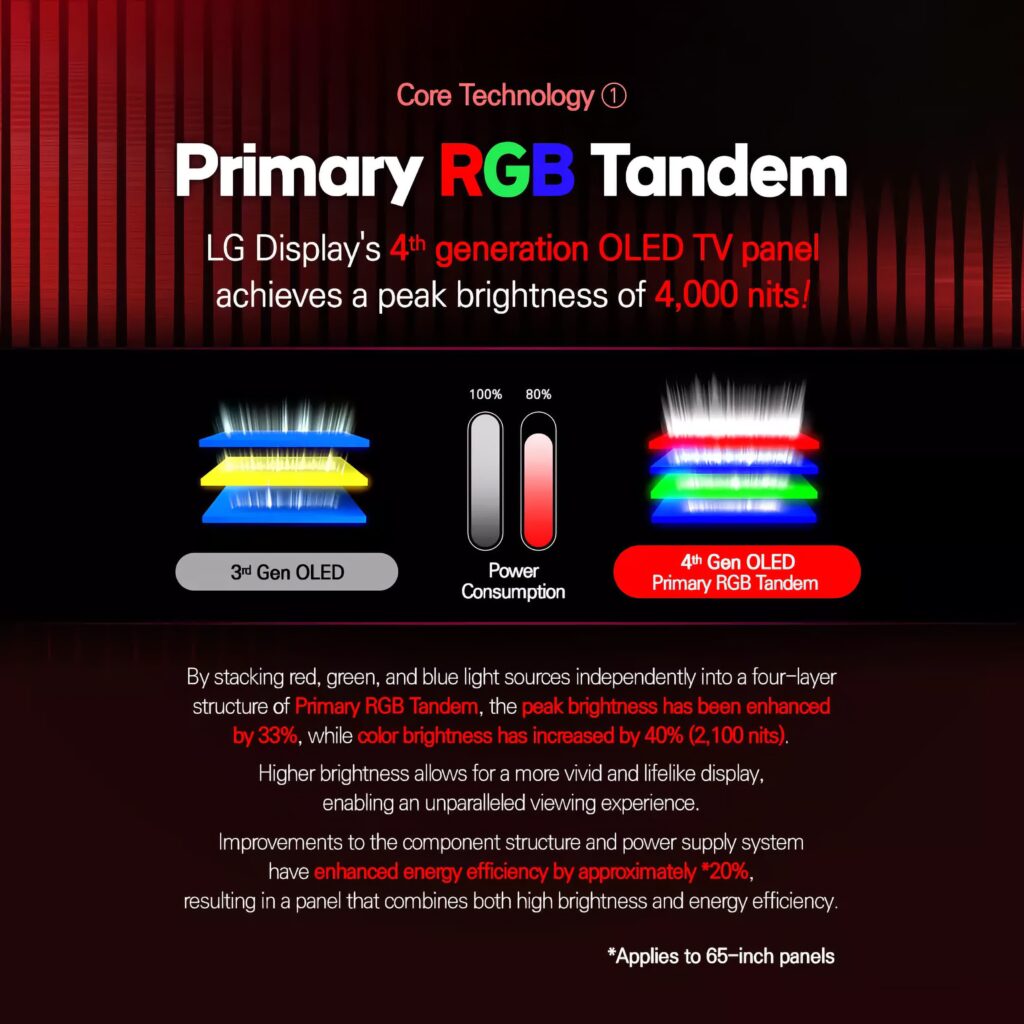

LG plans to launch its brightest OLED screen ever in late 2025. A new internal structure allows the fourth-generation panel to reach a maximum brightness of 4,000 nits, about 30% higher than the previous generation. The new display also improves color brightness by 40%, from 1,500 nits to 2,100 nits. The new panel’s innovation centers on a Primary RGB Tandem structure, which is LG Display’s proprietary technology that uses independent stacks of RGB elements to produce light. The Primary RGB Tandem structure applied to the fourth-generation OLED TV panel organizes the light source into four stacks by adding two layers of blue elements and independent layers of red and green elements. It improves maximum brightness by increasing the amount of light produced by each layer compared to the previous structure.(CN Beta, The Verge, KED Global, MSN)

Samsung LSI has announced a new power management integrated chip (PMIC). It is called the S2MIW06, and it manages wireless charging. This chip allows for much faster charging at up to 50W in receiver mode. It supports all Qi extensions, including Baseline Power Profile (BPP), Extended Power Profile (EPP), and Magnetic Power Profile (MPP). BPP supports up to 5W of wireless charging, while EPP increases wireless charging up to 15W. EPP is used in most high-end Galaxy phones released over the past few years. MPP is required for the Qi2 badge, which is separate from Qi2 Ready and supports up to 25W wireless charging. MPP brings with it a magnetic alignment mechanism, allowing the phone to align perfectly with the wireless charger using strong magnets. This technology was developed by Apple, which then donated it to the WPC. (Android Authority, Samsung, SamMobile)

Apple will reportedly implement vapor chambers in all models of the iPhone 17 family (Pro and non-Pro). Vapor chambers are sealed metal components with a small amount of liquid (usually de-ionized water) that evaporates when exposed to heat from the chipset. The vapor is then transferred across the surface of the chamber to help spread the heat and effectively cool down the device. The new report contradicts a previous rumour from noted Apple analyst Ming-Chi Kuo which suggests that only the iPhone 17 Pro Max would gain a VC cooling system. (GSM Arena, My Drivers, Twitter)

Korean DGIST Division of Energy & Environmental Technology has developed a lithium metal battery using a triple-layer solid polymer electrolyte, claiming greatly enhanced fire safety and an extended lifespan. The developed a lithium-metal battery for electric vehicles and other applications has a ‘three-layer solid polymer electrolyte’ that is designed to offer significantly improved fire protection and a longer service life. Following an extensive testing phase covering 1,000 charging and discharging cycles, the battery was found to retain about 87.9% of its performance capacity. Typical lithium batteries only retain between 70 and 80% of their capacity over such a period, marking a significant improvement. (CN Beta, Batteries News, Electrive, DGIST)

LG Energy Solution has agreed to supply cylindrical products to Aptera Motors, a US solar electric vehicle startup, in an estimated USD440M deal to diversify its customer bases amid prolonged weakness in the global EV industry. LG Energy has signed a memorandum of understanding with Aptera and CTNS, a South Korean battery module and pack manufacturer, to provide 4.4 gigawatt-hours (GWh) of 2170-type cylindrical batteries from this year to 2031. The battery, 21mm in diameter and 70mm in length, is expected to help the US startup ramp up production of its Aptera solar EV, which the company aims to launch in the country in 2025. The Aptera reported more than 50,000 pre-orders as the solar EV can travel up to 643km (400 miles) on a single charge, far longer than 300-500 km of existing EVs, according to the US startup. Its integrated solar panels can power the vehicle for up to 64 km a day and over 16,093km per year. (CN Beta, Aptera, LG, KED Global)

The U.S. Commerce Department and FBI are both investigating a little-known telecoms hardware firm founded by senior Huawei veterans in China over possible security risks. Founded in 2014, Baicells Technologies opened a North American business in 2026 in Wisconsin and has since provided telecoms equipment for 700 commercial mobile networks across every U.S. state. The Commerce Department is investigating Baicells on national security grounds and has sent subpoenas to the company. The U.S. telecoms regulator, the Federal Communications Commission (FCC), is advising it on its review. The investigations illustrate that years after sanctions decimated the U.S. businesses of fellow Chinese tech companies Huawei and ZTE, Washington’s fears that Beijing is using telecoms equipment to spy remain strong. (Android Headlines, Reuters)

George Zhao is resigning from his position as Honor CEO, effective immediately. The new Chief Executive Officer will be Li Jian, a former Huawei executive with over 20 years of experience in the mobile communications sector. Li Jian previously served as Vice Chairman, Director, and President of the Human Resources Department prior to his promotion to CEO. He will need to navigate the challenging landscape of joint-stock management as the company is poised to launch its IPO in the near future. (GSM Arena, Honor, Guancha)

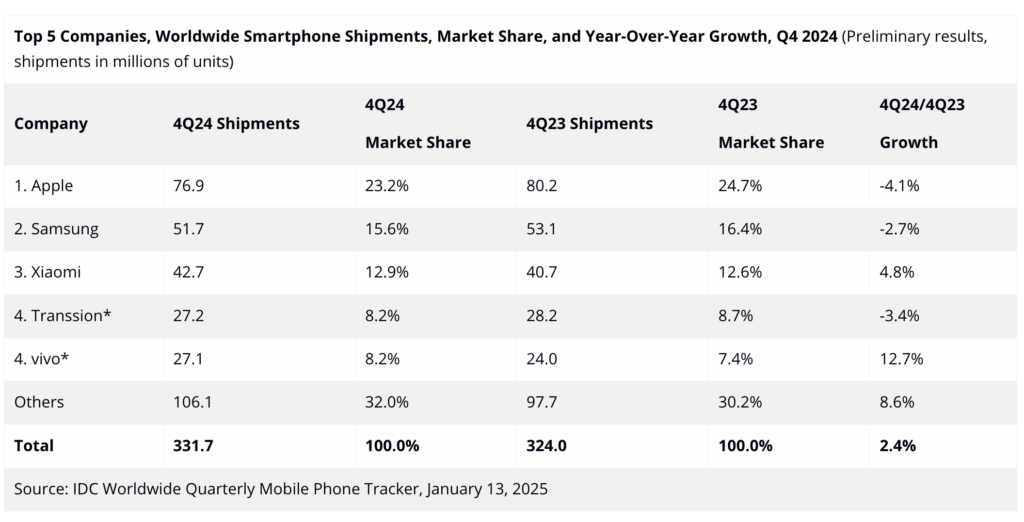

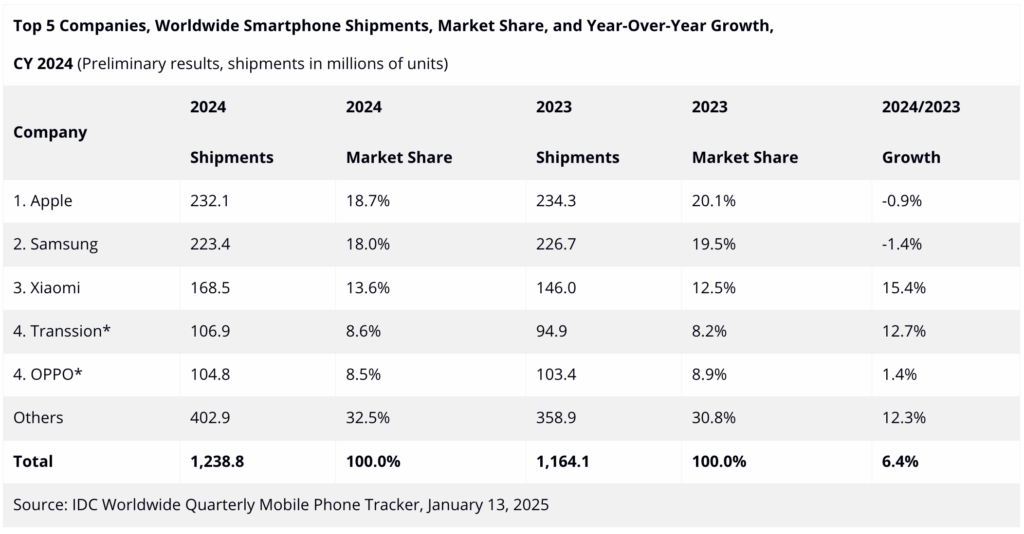

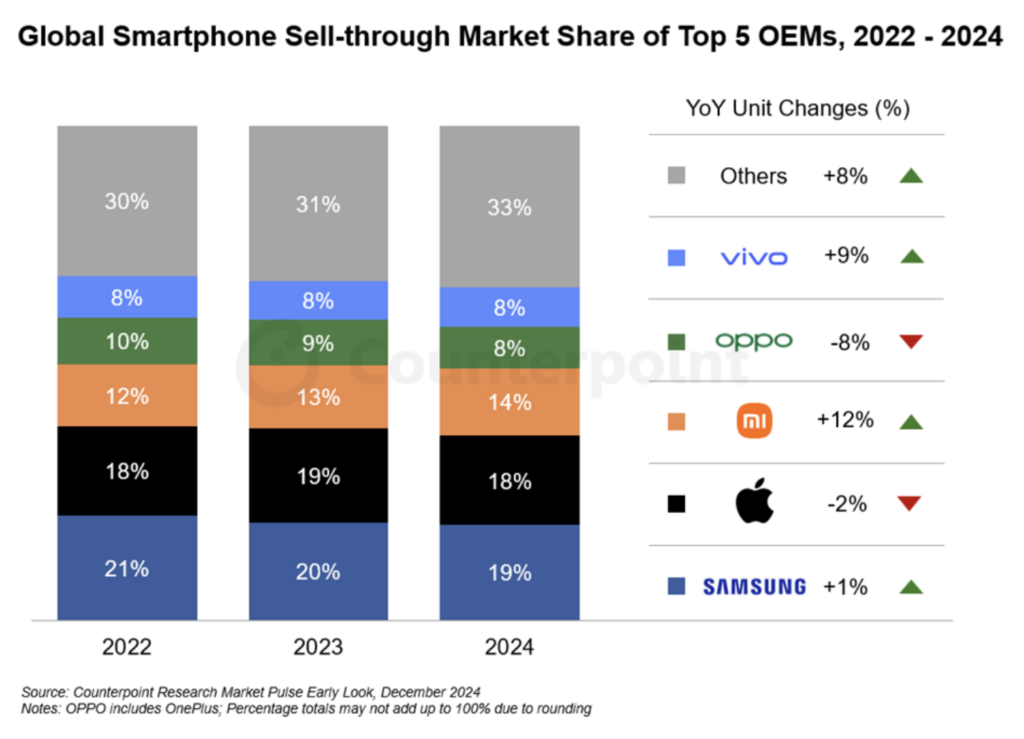

According to IDC, global smartphone shipments increased 2.4% YoY to 331.7M units in 4Q24. This marks the sixth consecutive quarter of shipment growth, closing the whole year with 6.4% growth and 1.24B shipments, marking a strong recovery after two challenging years of decline. We expect the market to continue growing in 2025, albeit at a slower pace, as refresh cycles continue growing and pent-up demand is fulfilled. While Apple and Samsung maintained the top two positions in Q4 and for the year, both companies witnessed YoY declines, and their shares shrunk thanks to the super aggressive growth of Chinese vendors this year—who drove the overall market by focusing on low-end devices, rapid expansion and development in China. Outside of Apple and Samsung, Xiaomi came in third for the quarter and the year, with the highest YoY growth rate among the Top 5 players. Transsion placed fourth but tied with vivo for the quarter and with OPPO for the year as competition intensified between the three. (GSM Arena, IDC)

The global smartphone market returned to growth in 2024 after two consecutive years of annual declines, according to Counterpoint Research. Global smartphone sales grew 4% YoY in 2024, as consumer sentiment fared better than in previous years following macroeconomic improvements. Smartphone sales in 2023 were the lowest in a decade. Samsung continued to lead the market in 2024, led by strong demand for its S24 series and A-series product lines. The S24 series, the first phone positioned as an AI device, outperformed its predecessors and was received especially well in Western Europe and the USA. Apple, with an 18% share took the #2 spot. Apple’s iPhone 16 series was met with a mixed response, partly due to a lack of availability of Apple Intelligence at launch. However, Apple continued to grow strongly in its non-core markets like Latin America, Africa and Asia-Pacific-Others. (GSM Arena, Counterpoint Research)

Nothing, the London-based smartphone startup known, is looking to raise at least USD100M in a new funding round. Currently, India is Nothing’s largest smartphone market, followed by Germany and the UK. Interestingly, the trend is reversed for their audio products, with the US being their top market, followed by the UK, Germany, and Japan. In 2024, the company reportedly doubled its annual revenue to over USD500M and surpassed USD1B in lifetime sales. They also informed investors of improved profit margins and over 7M units sold across all product categories. (Gizmo China, Bloomberg, Yahoo, Android Police)

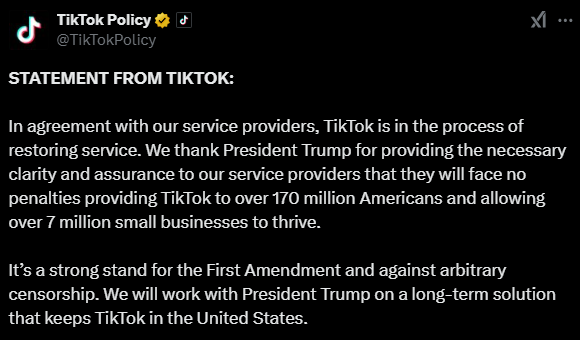

TikTok shut down services in the US merely hours before a federal ban on the ByteDance-owned app was due to take effect on 18 Jan 2025. Users who logged into the platform received a notification highlighting the ban, and the app became available on the Google and Apple app stores. TikTok began restoring its services on 19 Jan 2025 after President-elect Donald Trump said he would revive the app’s access in the U.S. when he returns to power on 20 Jan 2025. (Android Authority, Reuters, Android Central, Android Headlines, TikTok, Twitter)

Perplexity AI has submitted a bid to TikTok parent ByteDance, proposing that Perplexity merge with TikTok U.S. The new structure would allow for most of ByteDance’s existing investors to retain their equity stakes and would bring more video to Perplexity. Perplexity AI, the artificial intelligence search engine startup competing with OpenAI and Google, started 2024 with a roughly USD500M valuation and ended the year with a valuation of about USD9B, after attracting increasing investor interest amid the generative AI boom — as well as controversy over plagiarism accusations.(CN Beta, Reuters, CNBC, TechCrunch)

vivo is reportedly working on its next sub-brand following iQOO. The brand will be called Jovi. The information comes from records found in the GSMA database. These show three upcoming vivo devices that will be using the Jovi brand, namely Jovi V50 (model number V2427), Jovi V50 Lite 5G (model number V2440), and Jovi Y39 5G (model number V2444). (Sohu, GSM Arena, Smartprix)

HMD has discontinued all of Nokia’s smartphones and tablets on its website. The site had 16 Nokia phones and 3 tablets. They have all been listed as unavailable on the HMD website and moved to a separate section from HMD’s smartphones. HMD has rearranged the site to place more focus on its own devices. Nokia’s feature phones are still available for purchase, at least for now. Back in 2017, HMD (formerly HMD Global) obtained the rights to make phones with the Nokia branding. (CN Beta, Nokiamob, Android Headlines)

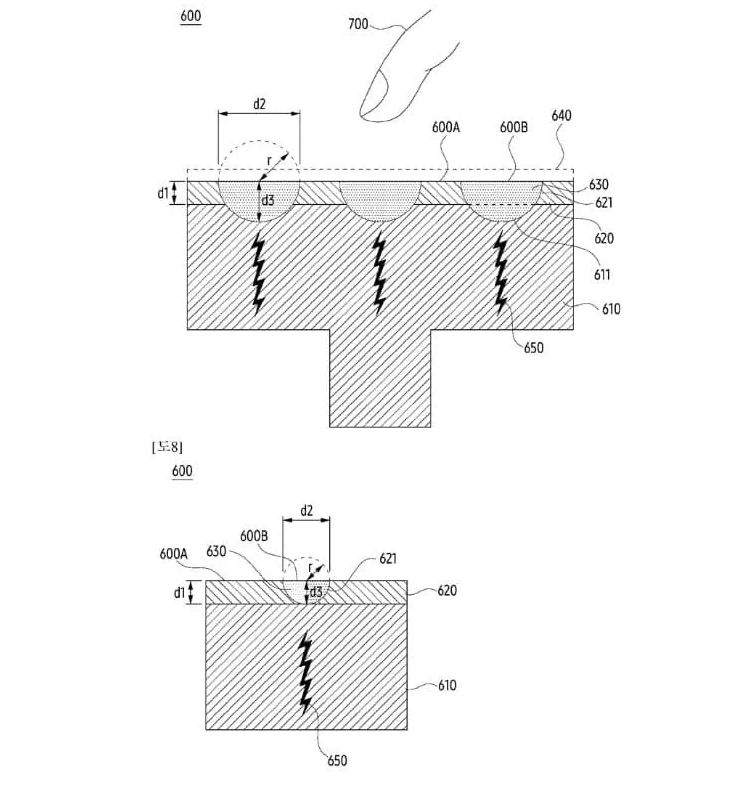

Samsung has filed a patent for a device with a conductive key button. This could be a more secure and responsive tactile input mechanism for Samsung’s future smartphones or wearable gadgets. As per Samsung’s WIPO filing, these buttons are made of conductive material that can transfer micro currents generated by external objects (user’s fingers) to electronic components inside the device. The filing suggests these devices can be smartphones and smartwatches. Its key components include: Metal layer made of stainless steel, aluminium, titanium, etc. It could act as the base of the key button and an electrode for internal sensors. Deposition layer could be on top of the metal layer, as a plating with materials like titanium or chromium. It could offer a matching colour with the device housing and protect the metal surface.(Android Headlines, 91Mobiles, WIPO)

Apple is allegedly in talks with Barclays to replace Goldman Sachs as the tech giant’s credit card partner, as the Wall Street giant steps back from its consumer finance ambitions. Credit card issuer Synchrony Financial is also in discussions with Apple about the card partnership. JPMorgan Chase has also been in talks with Apple about the business since 2024. (GSM Arena, Reuters)