3-16 #ImmersiveWorking : Samsung is planning to transfer the Exynos chip unit to MX division; Meta is allegedly testing its first in-house chip for training AI systems; Apple is reportedly preparing a significant software overhaul; etc.

Samsung is reportedly reviewing a plan to transfer the Exynos chip unit from the LSI division to the mobile experience (MX) division. This is the unit responsible for Samsung Galaxy phones, tablets, watches, and more. However, there is “significant internal disagreement” regarding this proposal. Samsung’s LSI unit, currently responsible for Exynos chip designs, is effectively run like a standalone unit. Bringing the Exynos business into Samsung’s smartphone division could make for closer ties and chips that are more customized for the specific needs of Galaxy devices. Samsung LSI also previously supplied Exynos chips to vivo and Meizu over the years. More recently, it’s assisted Google in developing the Tensor series of chips for Pixel phones. Samsung’s MX division absorbing the Exynos unit could mean that it is “virtually impossible” to supply chips to other smartphone makers. (Business Post, Android Authority)

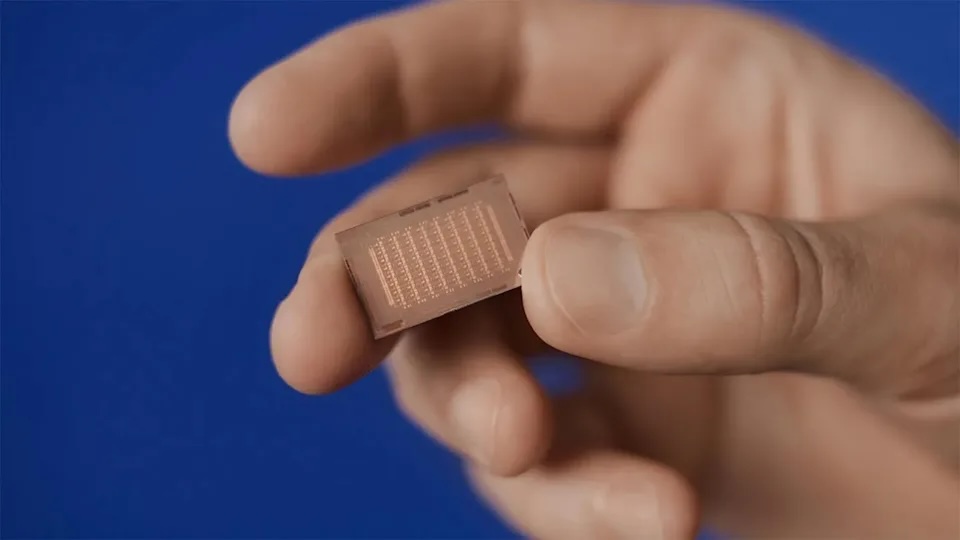

Samsung Foundry, the world’s second-biggest contract chip manufacturer, has started the mass production of fourth-generation 4nm chips. It is said to feature Back End Of Line (BEOL) wiring technology that improves the overall performance of the chip and makes the manufacturing process cost-effective. The mass production of first-generation 4nm chips was started in 2021, and since then, Samsung has introduced improvements to that node almost every year. The new version of its 4nm process node also features high-speed transistors and supports next-generation packaging technologies like 2.5D and 3D. This new process will be used to make AI chips for Elon Musk’s AI firm Grok and South Korean fabless AI semiconductor chip firm HyperExcel. (ZDNet, Android Central, SamMobile)

Facebook owner Meta is allegedly testing its first in-house chip for training artificial intelligence systems, a key milestone as it moves to design more of its own custom silicon and reduce reliance on external suppliers like Nvidia. Meta’s new training chip is a dedicated accelerator, meaning it is designed to handle only AI-specific tasks. This can make it more power-efficient than the integrated graphics processing units (GPUs) generally used for AI workloads. Meta is working with Taiwan-based chip manufacturer TSMC to produce the chip. The chip is the latest in the company’s Meta Training and Inference Accelerator (MTIA) series. Meta has said they want to start using their own chips by 2026 for training, or the compute-intensive process of feeding the AI system reams of data to “teach” it how to perform. (Android Headlines, Engadget, Reuters)

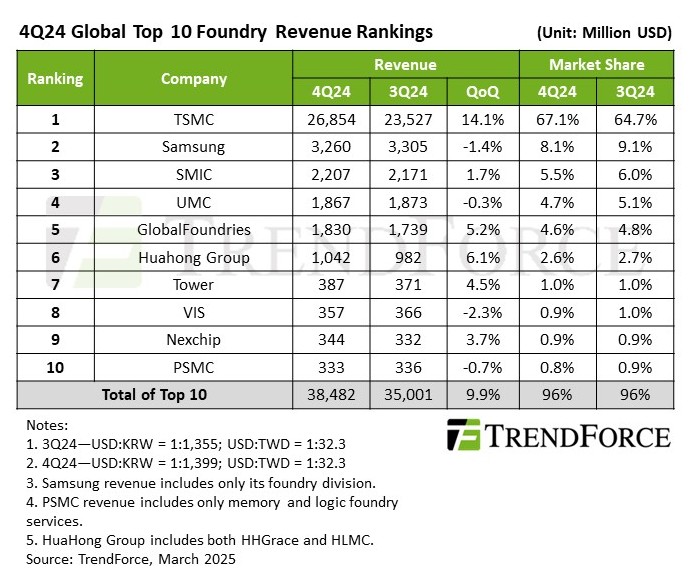

TrendForce’s latest research reveals that the global foundry industry exhibited a polarized trend in 4Q24. Advanced process nodes benefited from strong demand in AI servers, flagship smartphone application processors (APs), and new PC platforms, driving high-value wafer shipments. This growth helped offset the slowdown in mature process demand, allowing the top 10 foundries to achieve nearly 10% QoQ revenue growth, reaching USD38.48B, and marking another industry record. TSMC saw QoQ growth in wafer shipments, which boosted revenue to USD26.85B. The company secured a 67% market share to maintain its leading position. Samsung Foundry ranked second, with revenue declining 1.4% QoQ to USD3.26B, representing an 8.1% market share. SMIC faced customer inventory adjustments, resulting in a decline in wafer shipments. However, the ramp-up of new 12-inch capacity and an optimized product mix, which boosted blended ASPs, helped offset the losses. As a result, SMIC’s revenue increased 1.7% QoQ to SD2.2B, securing a 5.5% market share and the third position. (CN Beta, TrendForce, TrendForce)

Samsung Electronics’ Device Solutions (DS) division has embarked on the development of a next-generation packaging material, the “glass interposer”. This initiative aims not only to replace the expensive silicon interposer but also to enhance performance. Samsung Electronics has recently received a joint proposal from material company Chemtronics and equipment company Philoptics for the development of the glass interposer. It is reported that Samsung Electronics is considering entrusting these companies with the production of the glass interposer using Corning’s glass. In a parallel effort, Samsung Electro-Mechanics, an affiliate of Samsung Electronics, is working on a “glass substrate” with plans for mass production by 2027. This simultaneous development sets the stage for internal competition, which Samsung hopes will boost semiconductor productivity and innovation.(CN Beta, TrendForce, Business Korea, SEDaily)

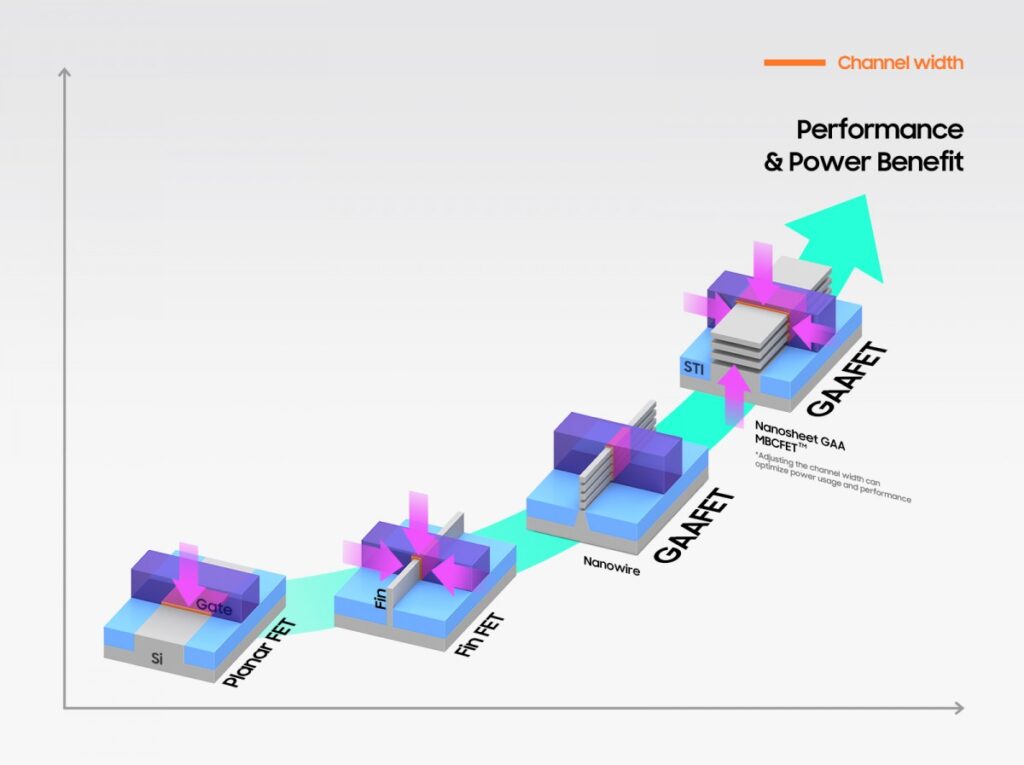

Samsung is said to be focusing on is its 2nm GAA process and, by extension, the next-generation Exynos 2600. Samsung has diverted its focus to its upcoming silicon, with a prototype version said to enter mass production in May 2025. A trial production run of the Exynos 2600 on Samsung’s 2nm GAA technology was previously said to have obtained a 30% yield for the company, which is decent progress, but there is significant ground to cover. To help bring these yields to an acceptable threshold, Samsung has formed a “task force” to oversee all efforts to improve the firm’s manufacturing processes at 2nm and below. (CN Beta, WCCFTech, SamMobile, FNNews)

Although Intel would like to reduce its use of TSMC’s manufacturing services , the company will keep ordering chips from the Taiwan-based foundry for the foreseeable future, according to John Pitzer, vice president of corporate planning and investor relations at Intel. Intel’s grand plan is to produce as many products as possible internally at Intel Foundry, but as this may not be the most optimal strategy, it is currently assessing what percentage of its products should be produced at TSMC. Intel has now embraced a permanent multi-foundry approach, outsourcing approximately 30% of its wafer production to TSMC. Intel currently produces silicon for its flagship Core 200-series ‘Arrow Lake’ and ‘Lunar Lake’ processors for desktops and laptops at TSMC and then assembles them using its Foveros 3D advanced packaging technology at its packaging facilities in the U.S. As a result, the company has to pay TSMC a premium, which significantly hurts its gross margins. (CN Beta, Tom’s Hardware, Intel, Techspot, Investing)

Microchip Technology has announced plans to reduce its workforce by approximately 2,000 roles, equating to about nine per cent of its global staff, as part of a strategic restructuring initiative. The move comes in response to weakening demand from the automotive sector, which has been struggling to clear existing semiconductor inventory. The workforce reductions will primarily affect the company’s semiconductor fabrication plants—commonly referred to as ‘fabs’—located in Gresham, Oregon, and Colorado Springs, Colorado. Additionally, layoffs will be implemented at Microchip’s backend manufacturing facility in the Philippines. (CN Beta, Reuters, Mint)

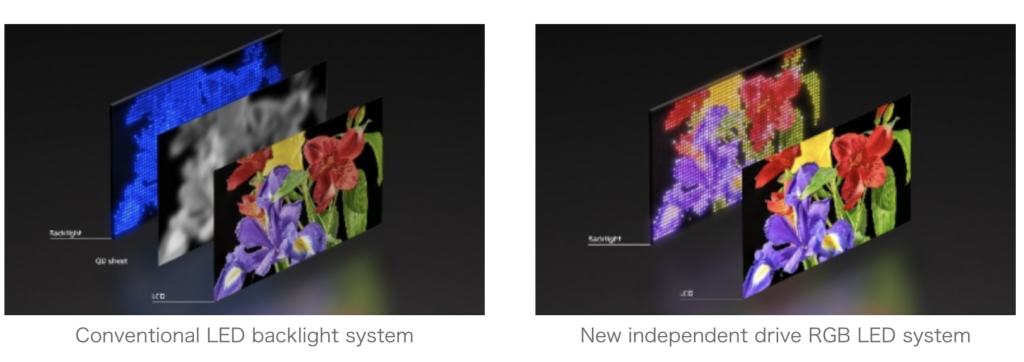

Sony has announced its new display technology that combines proprietary signal processing, individual RGB LED control, and high-density backlight. Sony’s setup allows the red, green and blue LEDs to operate separately, which in turn ensures punchy and accurate colors and coverage of wide color gamuts even on large panels. The precise backlight control also helps the display produce delicate hues and light gradations. Sony says movies with deep blacks, precise light gradients and subtle colors look amazing. The new independent RGB LED design covers 99% of the DCI-P3 color space and about 90% of the ITU-R BT.2020 gamut. Zonal peak brightness exceeds 4,000 cd/m2, so HDR content will look great. Sony partnered with MediaTek for the control processors, ROHM for the LED drive ICs and Sanan Optoelectronics for the LEDs. Sony plans to bring the new tech to consumer TVs and professional displays for content creation, which should enter mass production sometime in 2025.(GSM Arena, Sony)

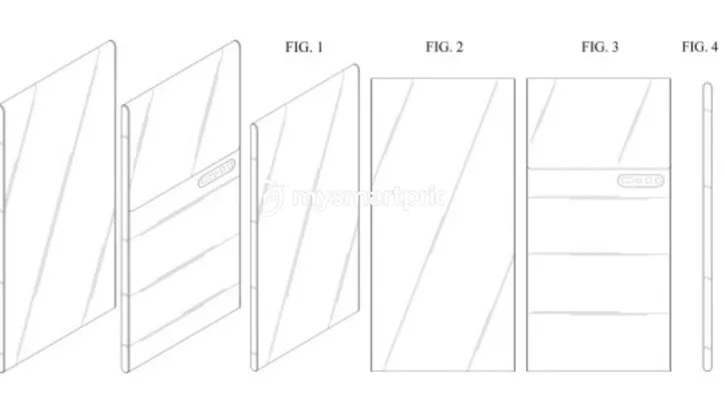

Samsung Display has been granted a new design patent for a display device. It details a unique display featuring a repositionable camera system, allowing cameras to be moved between the front and back depending on the mode of use. This innovative approach offers a new way to integrate cameras within the screen. The concept appears to focus on improving camera placement within a display, potentially for smartphones, tablets, or other advanced display devices.(Android Headlines, MySmartPrice)

Fitbit is working on a non-invasive way to track people’s blood pressure with a future wearable. The latest patent (patent no. 12,239,424 B2) submitted by the company revealed plans for a wearable being loaded with biometric sensors that could track changes in blood flow and artery stiffness. The patent states that the device will have a mix of pressure sensors and optical sensors embedded within the wearable which could either be a smartwatch or a smart ring. The patent describes a system where sensors press against the skin and detect small mechanical changes caused by blood moving through the arteries.(Android Central, Gadgets & Wearables)

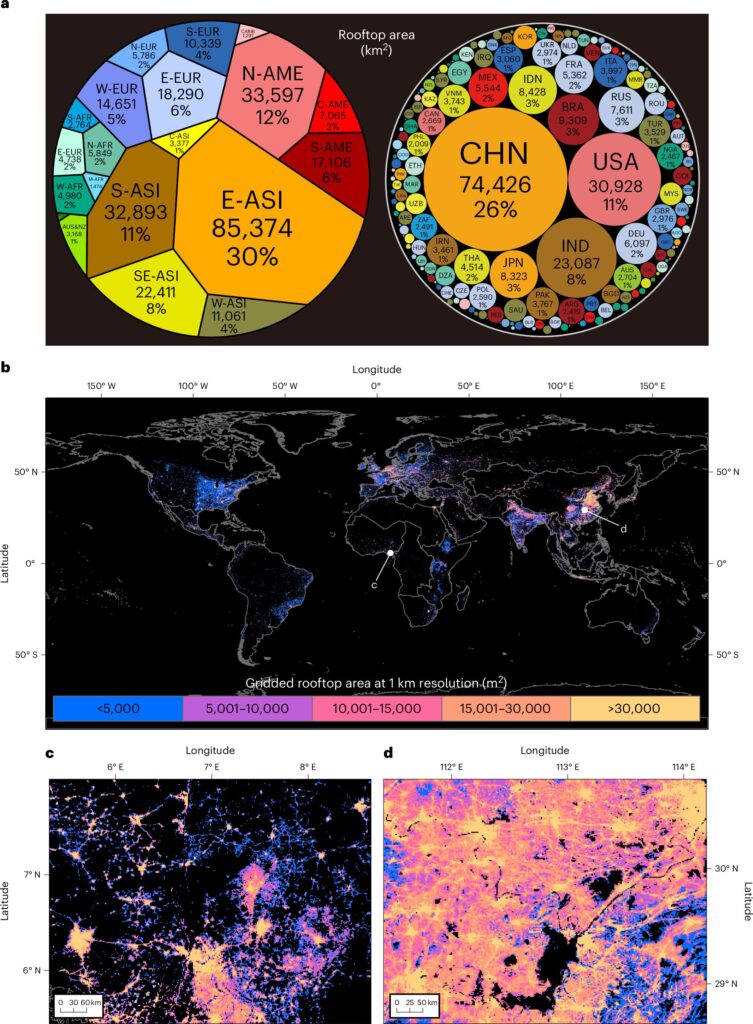

An interdisciplinary team affiliated with a host of institutions across China, working with one colleague from Singapore and another from MIT, has found evidence suggesting that if solar panels could be installed on every rooftop in the world, replacing traditional power sources, the result could be a reduction in global surface temperatures by as much as 0.13° C. The group describes how they used a variety of tools to calculate global rooftop space and how much electricity could be produced if all that area was covered and the possible impact of doing so. (CN Beta, Phys.org, Nature)

Samsung Electronics owned battery and electronic materials manufacturer Samsung SDI has explored building another manufacturing plant in the U.S. as it chased mid-to-long-term growth. Samsung SDI’s move coincides with President Donald Trump’s plans to scrap USD7,500 electric vehicle credit. The General Motors and Stellantis supplier is weighing building a plant independently in North America, according to the company CEO Joo Sun Choi. The company already plans to build plants in collaboration with General Motors and Stellantis in Indiana and has already completed another facility with Stellantis. Choi has said that the company will commercialize its new 46-series cylindrical batteries for EVs for carmakers looking to power their high-performance EVs. (CN Beta, Bloomberg, Yahoo, Korea Herald)

Samsung SDI has announced that the company will commence a rights offering to raise an estimated capital of KRW2T (USD1.38B) for its future competitiveness and mid- to long-term growth. Samsung SDI plans to use the funds secured via the rights offering to invest in the joint venture with General Motors in the United States, expand the capacity of its battery plant in Hungary and build lines for all solid-state batteries in Korea. The company has decided on the latest rights offering by taking into account it takes two to three years from new facility investments to mass production amid growing prospects for mid- and long-term growth of the battery market. (Chosun, KEDGlobal, Business Korea)

Apple is reportedly preparing a significant software overhaul, aiming to unify its ecosystem and refresh the user experience across iPhones, iPads, and Macs. This project slated for release later in 2025, will introduce a revamped interface with redesigned icons, menus, apps, windows, and system buttons, drawing inspiration from the Vision Pro’s innovative visionOS. This redesign code-named “Luck” for iOS 19 and iPadOS 19, and “Cheer” for macOS 16, will be Apple’s most substantial interface update in years. It seeks to create a more consistent visual language across all platforms, addressing the current discrepancies that can make transitioning between devices jarring. (Bloomberg, Apple Insider, Gizmo China)

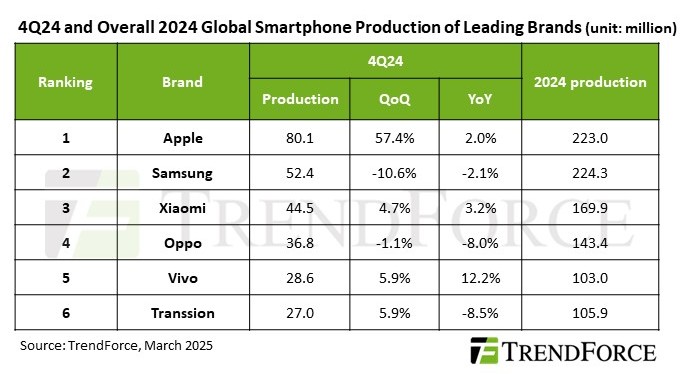

TrendForce reports that global smartphone production in 4Q24 reached 334.5M units, reflecting a 9.2% QoQ increase, driven by Apple’s peak production season and consumer subsidies from local Chinese governments. While Apple expanded production with the launch of new models, Samsung faced production declines due to intensified competition in emerging markets. In 1H24, the smartphone market was no longer impacted by high channel inventory compared to the same period in 2024. With seasonal demand and government subsidies driving growth in the second half, total annual production reached 1.224B units—a 4.9% YoY increase. However, 2025 production growth is expected to slow to just 1.5%, as global economic recovery remains sluggish and geopolitical risks, including tariff hikes, weigh on consumer spending. (TrendForce, TrendForce)

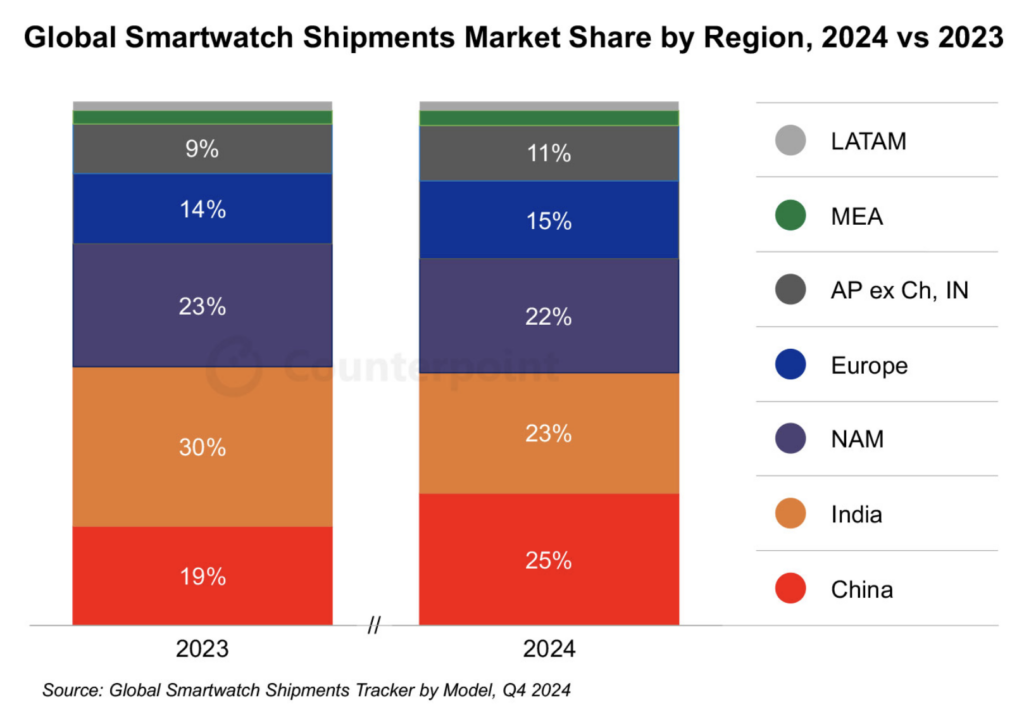

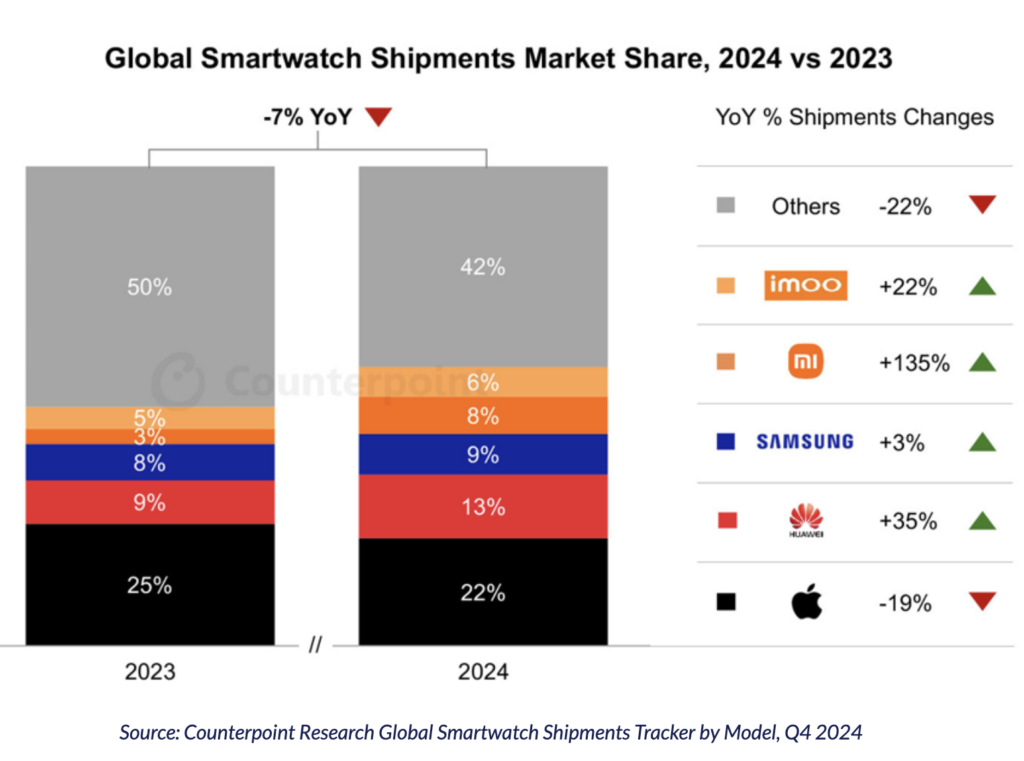

Global smartwatch shipments fell 7% YoY in 2024, the market’s first ever decline, according to Counterpoint. The downturn was primarily due to a decline in Apple’s shipments as the basic smartwatch segment saw lower upgrades amid a slowdown. Weakness in the basic smartwatch market originated in India, where consumer demand waned due to a slow replacement cycle, lack of innovation and unsatisfactory user experiences among first-time buyers. Only the kid’s smartwatch segment witnessed growth with Imoo remaining the market leader driven by its affordable, feature-rich offerings. The kids’ smartwatch segment is gaining traction as parents are concerned for their children’s safety, and they desire to track and stay constantly connected with their children. (GSM Arena, Counterpoint Research)

A new update is in the works for the Apple AirPods, which is rumored to bring an in-person live translation feature to the earphones. This means that the AirPods will allow users to instantly translate conversations when two people speak different languages. The live translation feature for AirPods will be part of a software update coming later in 2025. The update could be linked to iOS 19, which is Apple’s next significant update for iPhones. Notably, the live translation feature on AirPods will rely on the Translate app on the iPhone.(Neowin, Bloomberg)

The White House has mentioned Samsung and LG as it spelled out progress in U.S. President Donald Trump’s push to bring manufacturing back to America through tariffs. This possibility arises from the “50 Wins for the American People in President Trump’s First 50 Days” report shared by the White House. It is noteworthy that the list does not mention which products the plants that Samsung and LG could move to the United States manufacture. The factories primarily produce refrigerators and washing machines. These plants currently operate in Mexico. The potential relocation of LG and Samsung’s North American appliance factories to the United States is believed to be a measure seeking to evade the tariffs imposed by the local government on imported goods. (Android Headlines, Yonhap)

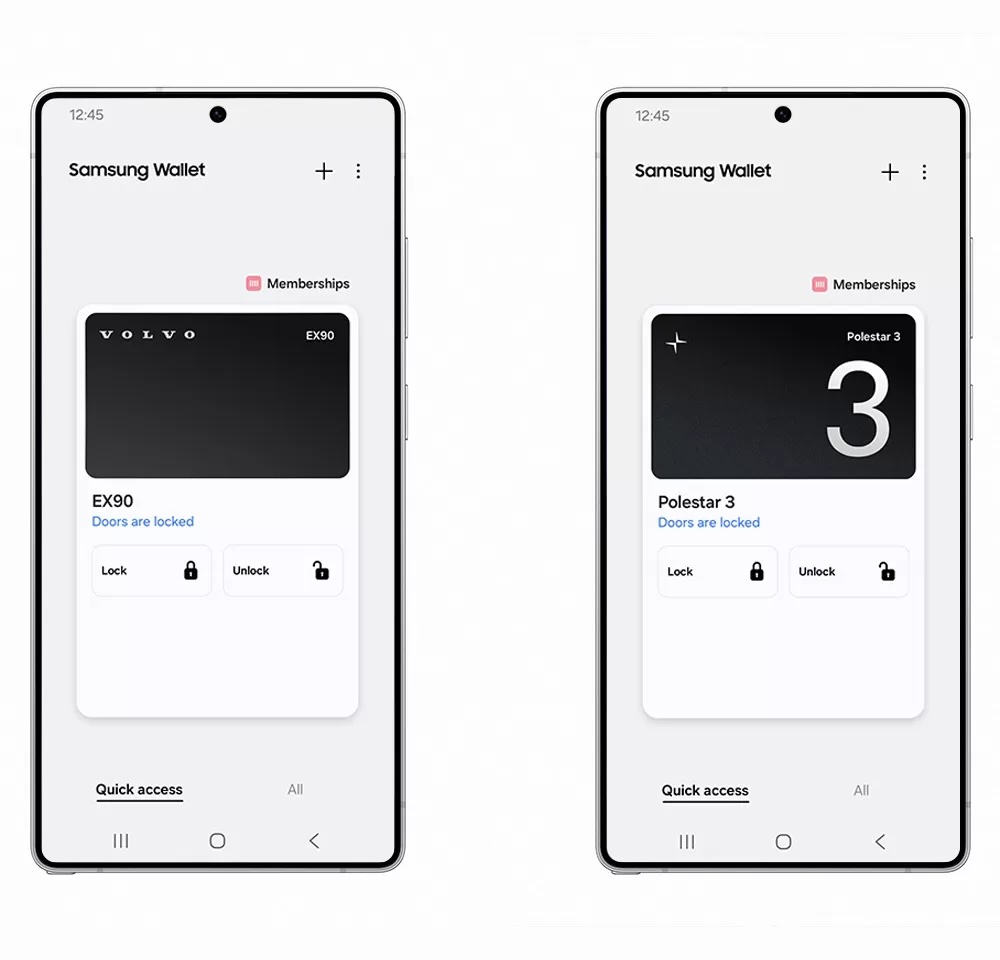

Samsung is expanding its Digital Key compatibility found under Samsung Wallet to more cars. Starting Feb 2025, owners of a compatible Samsung Galaxy phone and a Volvo or a Polestar car will be able to unlock, lock and even start their vehicles. The vehicle compatibility is currently limited to Volvo EX90 and Polestar 3 but Samsung has confirmed to extend the Digital Key to more models in the future. Digital Key emulates the functionality of a physical key and is supported by car manufacturers like BMW, Audi and Hyundai. The key offers hands-free access via integrated technologies like ultra-wideband (UWB), tap-to-unlock and start via NFC, and Bluetooth via Samsung Wallet. (Sammy Hub, Samsung)

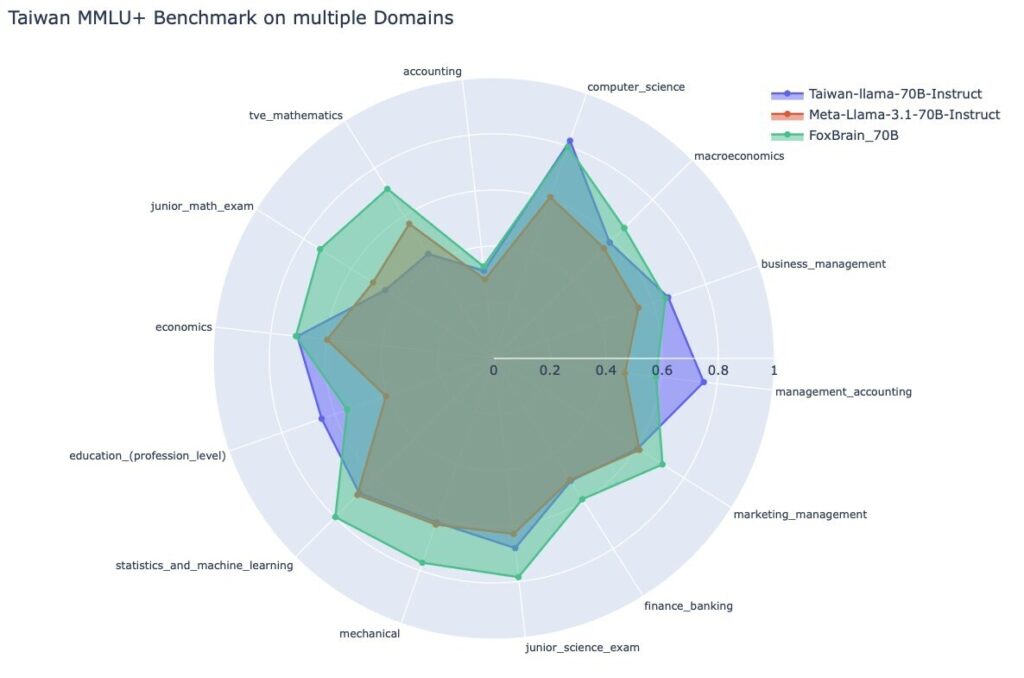

Hon Hai Research Institute, backed by Foxconn, has unveiled FoxBrain, a new Traditional Chinese Large Language Model (LLM). Developed by the institute’s Artificial Intelligence Research Center, FoxBrain is built on Meta’s Llama 3.1 architecture with 70B parameters and tailored for Traditional Chinese applications, making it particularly relevant for Taiwanese industries. The model was initially designed to support internal Foxconn operations, including data analysis, decision-making, document collaboration, and code generation. It has demonstrated notable strengths in reasoning, outperforming similar-scale models like Taiwan Llama in regional benchmarks, though it remains slightly behind some global leaders. (CN Beta, WSJ, Reuters, Digitimes, Neowin)