LCD Information Sharing (201608 Updates)

This is a simple report consolidating the market information obtained in regards to LCD display for smartphones. It mainly discusses the display technology a-Si and LTPS.

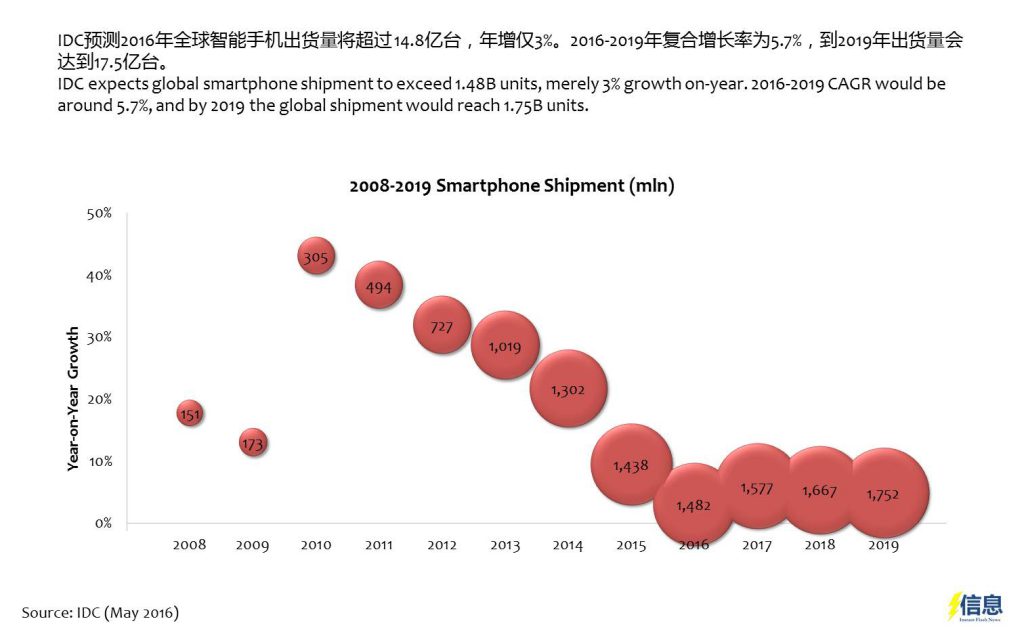

- IDC expects global smartphone shipment to exceed 1.48B units, merely 3% growth on-year. 2016-2019 CAGR would be around 5.7%, and by 2019 the global shipment would reach 1.75B units.

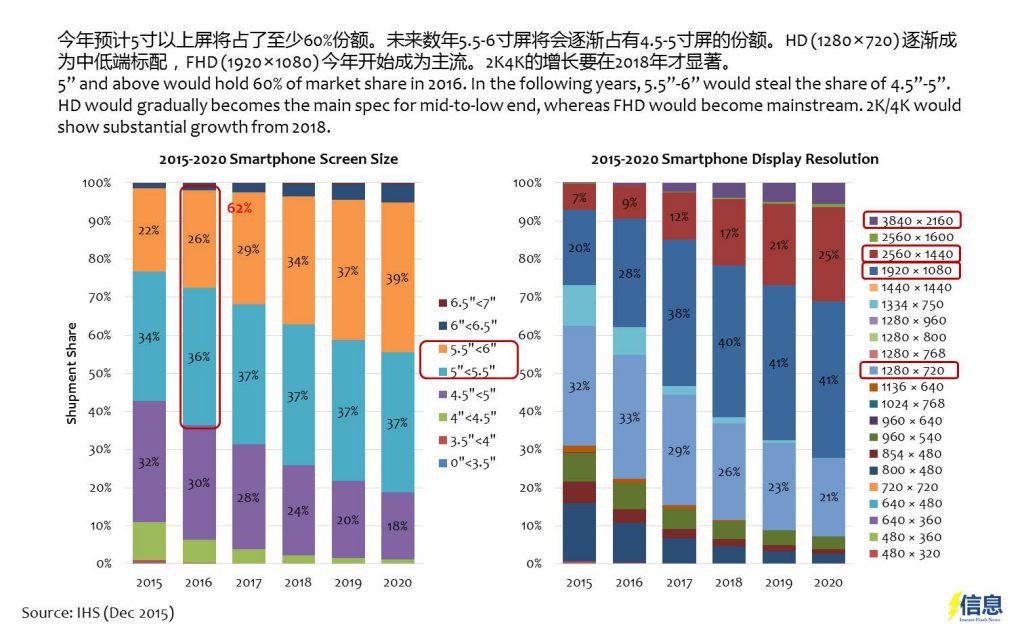

- 5” and above would hold 60% of market share in 2016. In the following years, 5.5”-6” would steal the share of 4.5”-5”. HD would gradually becomes the main spec for mid-to-low end, whereas FHD would become mainstream. 2K/4K would show substantial growth from 2018.

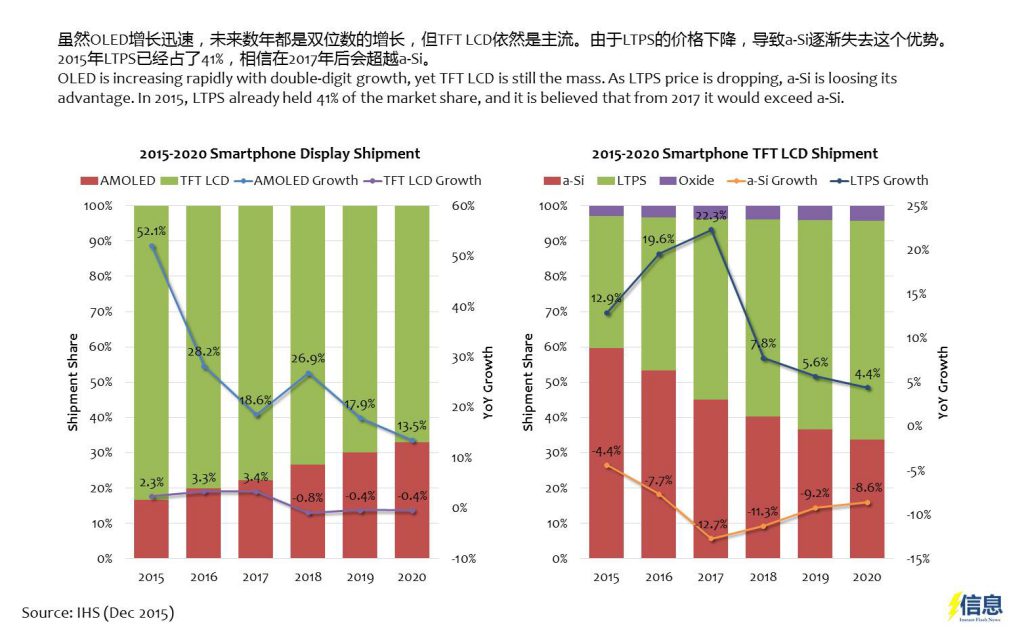

- OLED is increasing rapidly with double-digit growth, yet TFT LCD is still the mass. As LTPS price is dropping, a-Si is loosing its advantage. In 2015, LTPS already held 41% of the market share, and it is believed that from 2017 it would exceed a-Si.

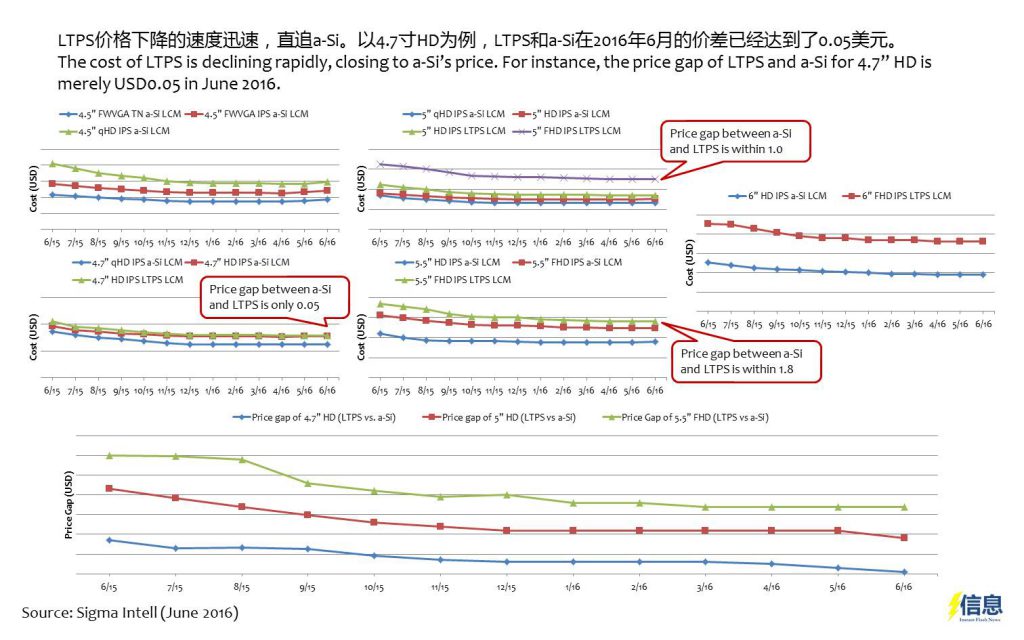

- The cost of LTPS is declining rapidly, closing to a-Si’s price. For instance, the price gap of LTPS and a-Si for 4.7” HD is merely USD0.05 in June 2016.

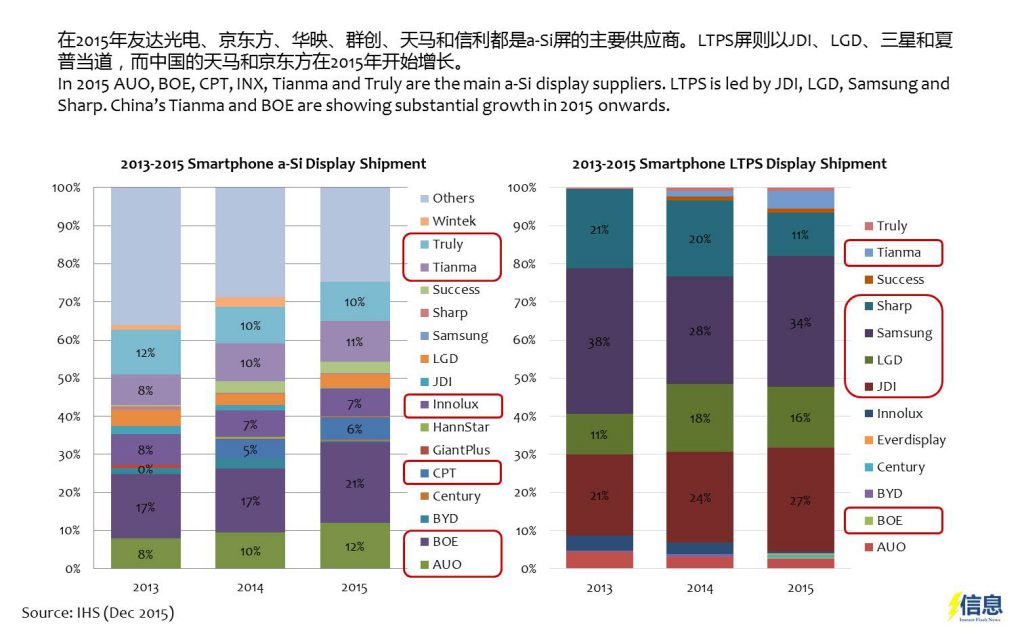

- In 2015 AUO, BOE, CPT, INX, Tianma and Truly are the main a-Si display suppliers. LTPS is led by JDI, LGD, Samsung and Sharp. China’s Tianma and BOE are showing substantial growth in 2015 onwards.

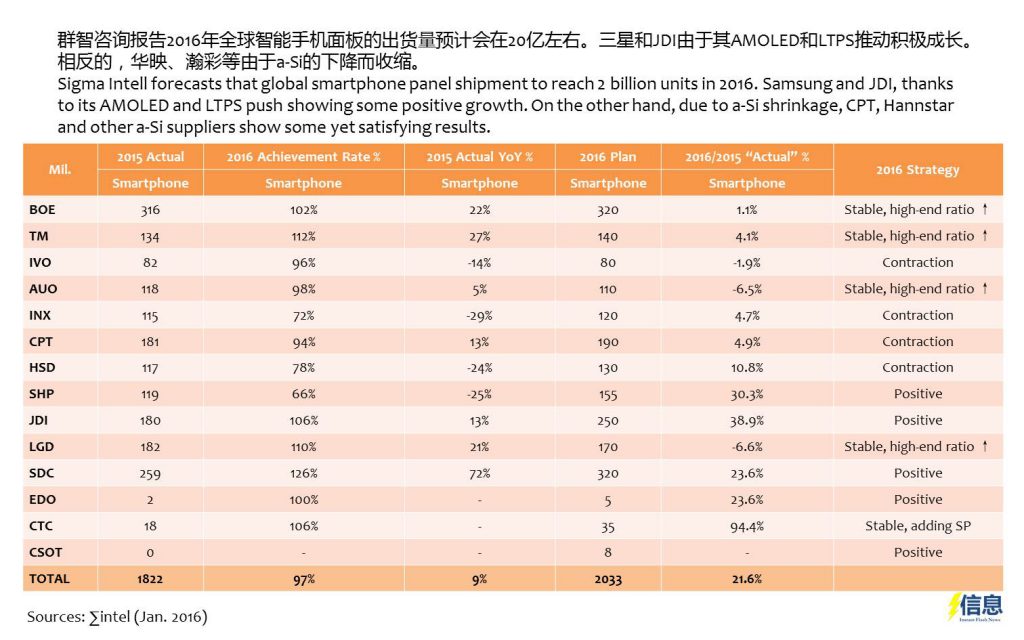

- Sigma Intell forecasts that global smartphone panel shipment to reach 2 billion units in 2016. Samsung and JDI, thanks to its AMOLED and LTPS push showing some positive growth. On the other hand, due to a-Si shrinkage, CPT, Hannstar and other a-Si suppliers show some yet satisfying results.

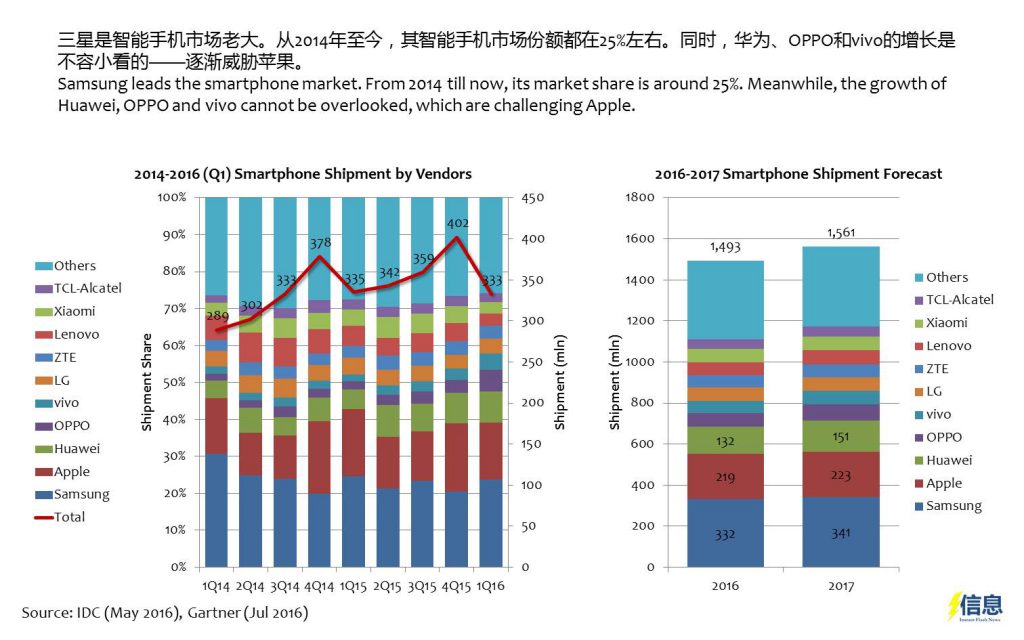

- Samsung leads the smartphone market. From 2014 till now, its market share is around 25%. Meanwhile, the growth of Huawei, OPPO and vivo cannot be overlooked, which are challenging Apple.

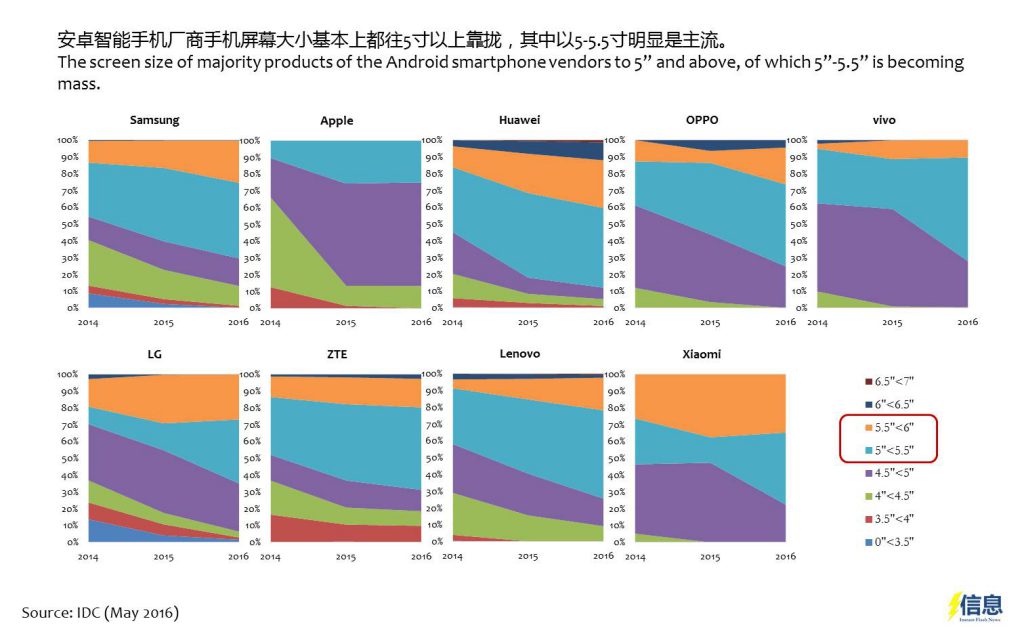

- The screen size of majority products of the Android smartphone vendors to 5” and above, of which 5”-5.5” is becoming mass.

- In 2015, JDI basically supplies panels to all vendors (perhaps except vivo), and Tianma has already entered all Chinese vendors (except TCL).

- 2015 LTPS panel shows some growth among the smartphone vendors, especially Huawei, Xiaomi, OPPO and vivo with the penetration rate exceeding 30%.

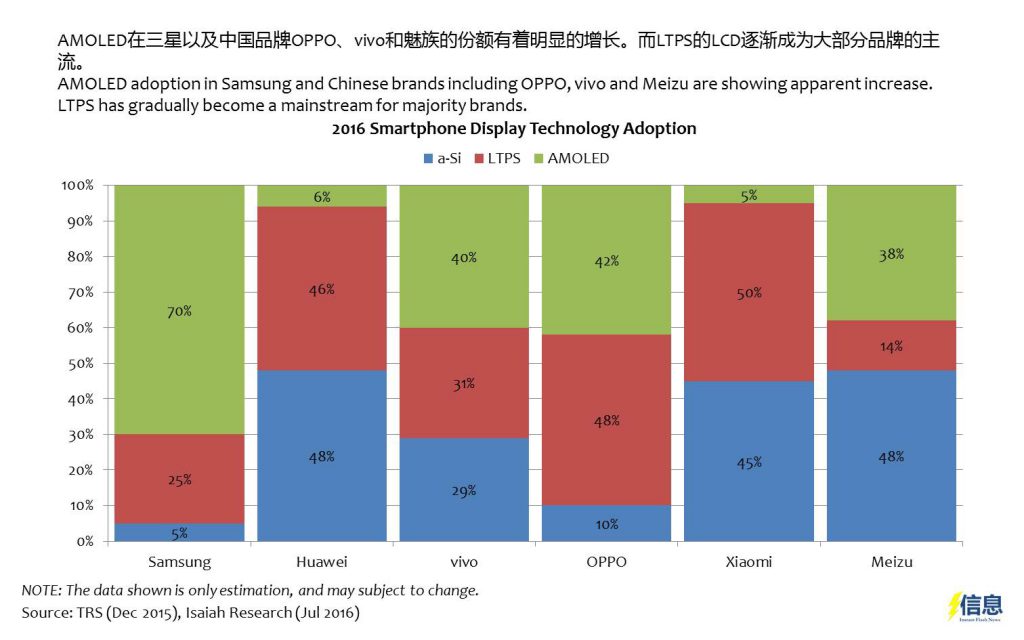

- AMOLED adoption in Samsung and Chinese brands including OPPO, vivo and Meizu are showing apparent increase. LTPS has gradually become a mainstream for majority brands.

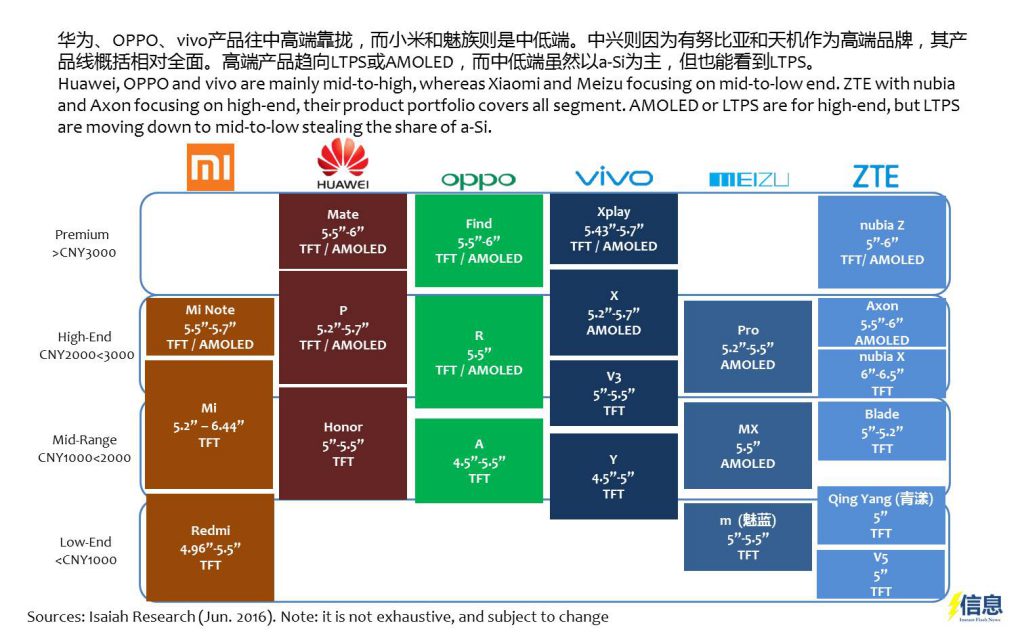

- Huawei, OPPO and vivo are mainly mid-to-high, whereas Xiaomi and Meizu focusing on mid-to-low end. ZTE with nubia and Axon focusing on high-end, their product portfolio covers all segment. AMOLED or LTPS are for high-end, but LTPS are moving down to mid-to-low stealing the share of a-Si.