12-20: MediaTek has allegedly lowered its 10nm production orders to TSMC for 2017; GOME launching their first smartphone soon, and will be released in 1Q17; etc.

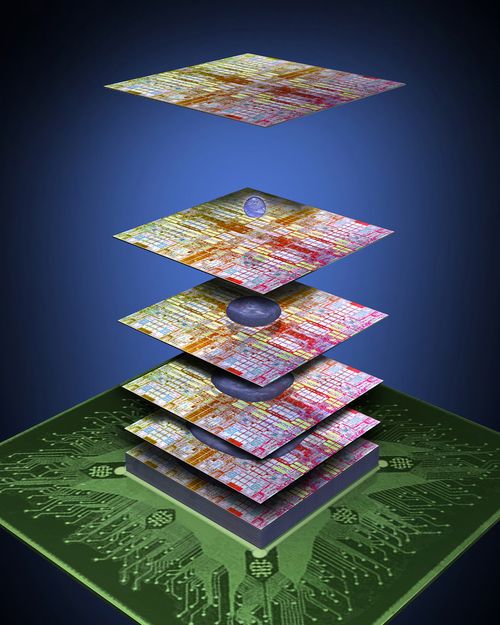

Chipset

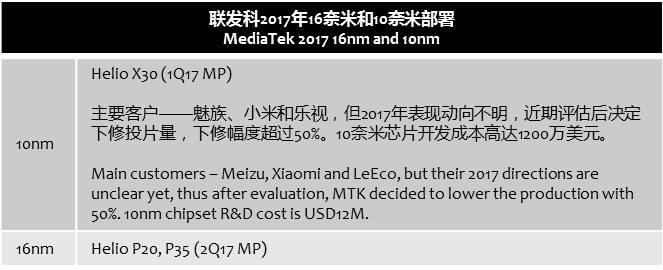

Rumor says that because high-end smartphone market is changing in China, MediaTek recently has lowered its 10nm production orders to TSMC for 2017, and it is 50% lower than originally planned. MediaTek denies such rumor saying 10nm is dedicated to customers with flagships or sub-flagships, thus they are high-end products. Market demand is not high, and the lower rate cannot be that high. (Laoyaoba, CEB2B, EXP Review)

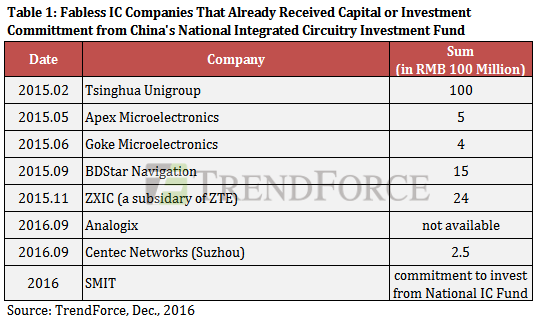

TrendForce estimates that China’s capital expenditures on wafer fabs from the start 2015 to the present has reached around CNY480B, of which 86.5% or about CNY435B came from state-backed funds (including the National IC Fund and local funds for IC ventures). (TrendForce[cn], press, TrendForce, press)

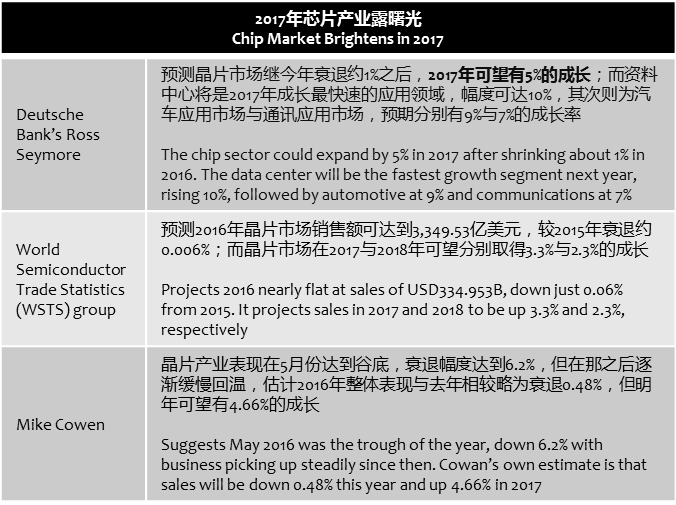

A veteran Wall Street analyst projects the semiconductor industry will snap back to typical growth levels in 2017 after a slight contraction this year. (EE Times, article, Laoyaoba)

Globalfoundries has announced the addition of 8 new partners to its growing FDXcelerator program—ASE, Amkor, Infosys, Mentor Graphics, Rambus, Sasken, Sonics and QuickLogic. They join Synopsys, Cadence, Invecas, VeriSilicon, CEA Leti, Dreamchip and Encore Semi to provide a suite of services that will enable Globalfoundries customers to implement 22FDX SoC designs. (Digitimes, press)

Touch / Display

Japan Display Inc. (JDI) is reportedly speeding up its OLED display production lay-out, and expects to enter mass production in 2018. JDI currently has plan to introduce Full Active technology in its now running LTPS LCD production, and will produce flexible LCD display in 2018-2019. (CN Beta, Sohu, 163, Reuters, Barron’s, TechNave)

Samsung will reportedly provide OLED display panels for at least one of Apple’s next iPhones, as well as NAND flash memory chips again. Adding DRAM chips into the mix will make Samsung the main supplier out of hundreds of companies. (Forbes, Laoyaoba, Bloomberg, ET News, ET News)

South Korea’s LED maker Seoul Semiconductor has warned 29 foreign lighting companies and TV makers of legal actions if they continue to infringe on its proprietary technologies. The accused include Feit Electric and six others from the United States, Redvan and two others from Europe, Skyworth and 14 others from China, and Advanced Optoelectronic Technology (AOT) and 3 others from Taiwan. (TechNews, Pulse)

Glassmaker Corning Inc. knows automakers are conservative about change when it comes to car windows. But Corning is beginning to make headway in marketing its lighter-weight Gorilla Glass to manufacturers. Corning claims the new-technology glass is stronger and lighter than more commonly used automotive glass. (CN Beta, Auto News)

Memory

Taiwan-based Phison Electronics has announced it will start shipping solutions for Universal Flash Storage (UFS) 2.1 NAND flash storage devices in 1Q17. Phison has rolled out its first UFS 2.1 controller chip, the PS8311, to support 3D TLC NAND flash memory. (ZOL, Digitimes, press)

Fujitsu announced that it has licensed Nantero’s carbon nanotube-based NRAM (Non-volatile RAM) and will participate in a joint development effort to bring a 256Mb 55nm product to market in 2018. (Laoyaoba, Tom’s Hardware, EE Times, The Register)

Biometrics

Voice recognition has come a long way in the past few years. But it is still not good enough to popularize the technology for everyday use and usher in a new era of human-machine interaction. Google, Amazon, Apple, Microsoft and Baidu hunt for terabytes of human speech. (Bloomberg, Laoyaoba, Gulf News)

Battery

Lucid Motors has signed a strategic supply agreement with LG Chem for lithium-ion battery cells. The agreement establishes LG Chem as one of the key suppliers of cells for Lucid’s products. The cylindrical cells that LG Chem will be producing for Lucid will feature a proprietary chemistry that has been developed together in partnership. (CN Beta, Green Car Congress, Lucid Motors)

Connectivity

pureLiFi, a developer of Li-Fi a wireless communication technology based on visible light communication, has improved data transfer rates from 5Mbps originally to 10Mbps and further to 40Mbps, making Li-Fi a technological complement to Wi-Fi, according to Digitimes Research. (Digitimes, press, C114, 163)

Smartphones

GOME, a private electrical appliance retailer founded back in 1987, has announced that they will be launching their first smartphone soon, and will be released in 1Q17. It will have a dedicated security chip and iris / fingerprint recognition. (Gizmo China, CN Beta)

Harish Kohli, managing director, Acer India indicates that the company has put its smartphone business on hold in India. Acer, which had already invested in setting up two manufacturing lines for the personal computer business and smartphones, is finding it difficult to offer quality in a ‘price-sensitive market’ such as India. (TechNews, Mashable, Business Standard)

Following layoffs in its field sales force and the resulting change to HTC’s U.S. business, the company likely won’t launch a new flagship smartphone in 2017 in the United States, according to Cliff Maldonado at handset research firm BayStreet Research. Maldonado said the company will likely move back into an ODM business model, where it will design devices for specific customers like Google and Sprint. (TechNews, Android Headlines, Fierce Wireless)

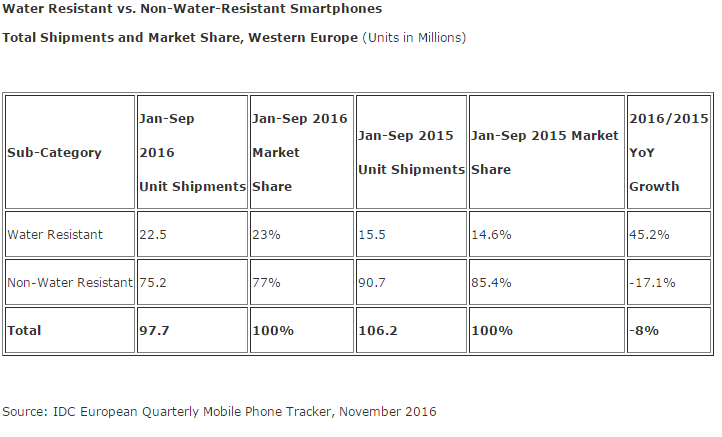

Smartphones offering resistance against water damage (and other liquids) grew 45.2% YoY in the first 9 months of 2016 in Western Europe, while shipments of non-water–resistant smartphones declined 17% in the same period. Water resistant smartphones reached 22.5M units in the period to represent 23% of the total number of smartphones shipped in 2016 to date, according to IDC. (IDC, press)

Lenovo has reorganized its operations in Brazil as part of a plan to reduce spending. It has swapped a manufacturing facility of 52,000m2 in the São Paulo state city of Itu for a facility that is half the size in Indaiatuba, also in the São Paulo countryside. The workforce has also been reduced from 5,000 staff in Brazil to 800 employees (CN Beta, ZDNet)

Huawei Enjoy 6s is announced – 5” HD in-cell touch display, Qualcomm Snapdragon 435 processor, 13MP + 5MP cameras, 3GB RAM, 32GB storage, Android 6.0 (EMUI 4.1), LTE, dual-SIM, fingerprint sensor, 3030mAh battery. (CN Beta, TechWeb, iMobile)

Tablets / PCs

Pegatron and Quanta Computer will be the largest and second largest OEMs for high-end and mid-range notebooks launched by Asustek Computer in 2017, together accounting for 80% of all Asustek notebooks, according to Digitimes. Taiwan-based Wistron and China-based BYD will undertake OEM production of the remaining 20% of Asustek notebooks. (Laoyaoba, Digitimes, press)

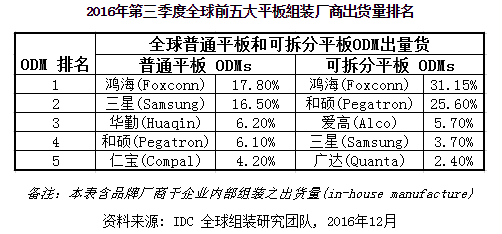

According to IDC, global tablets assembly industry is entering peak season in 3Q16, yet the shipment is still impact by phablets, shortages of main components, causing the quarter reaches record-low for its peak season–only 9.5% growth on quarter. In particular, slate tablet assembler shipment grows 8.7%, and detachable tablet grows 15.1%. (IDC, press)

Wearables

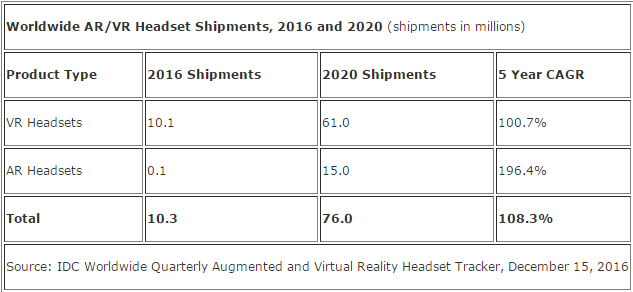

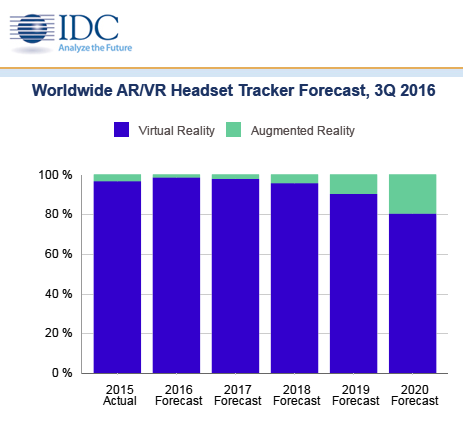

According to IDC, worldwide AR and VR headset shipments are expected to see a CAGR of 108.3% over 2015-2020 forecast period, reaching 76M units by 2020. The more affordable VR devices will continue to lead the market in terms of volume. However, IDC expects AR headsets to pick up momentum over the forecast as more affordable technologies and more OEMs enter the market. (IDC, press, Digitimes)

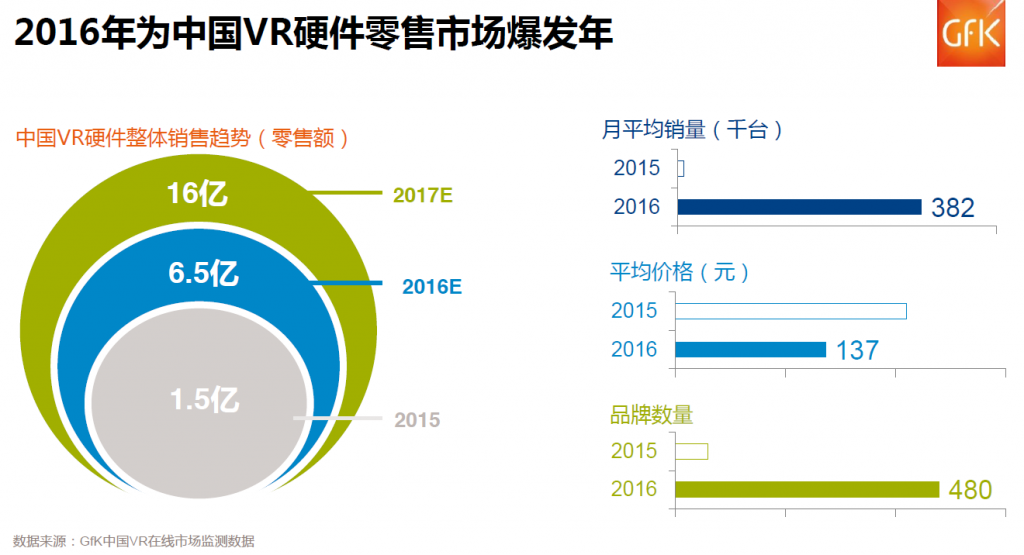

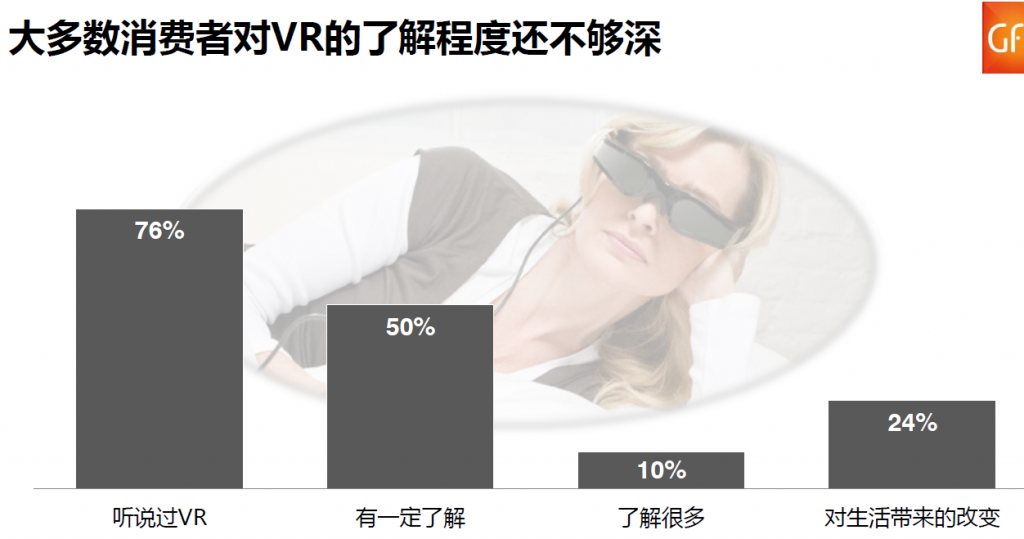

According to GfK, in 2016, China VR devices sales would reach CNY650M, 3 times more than CNY150M in 2015. Monthly sales would be 382 units, and there are 480 brands. However, generally consumers do not know much about VR, 76% of people still only hear about VR. (199IT, GfK report)

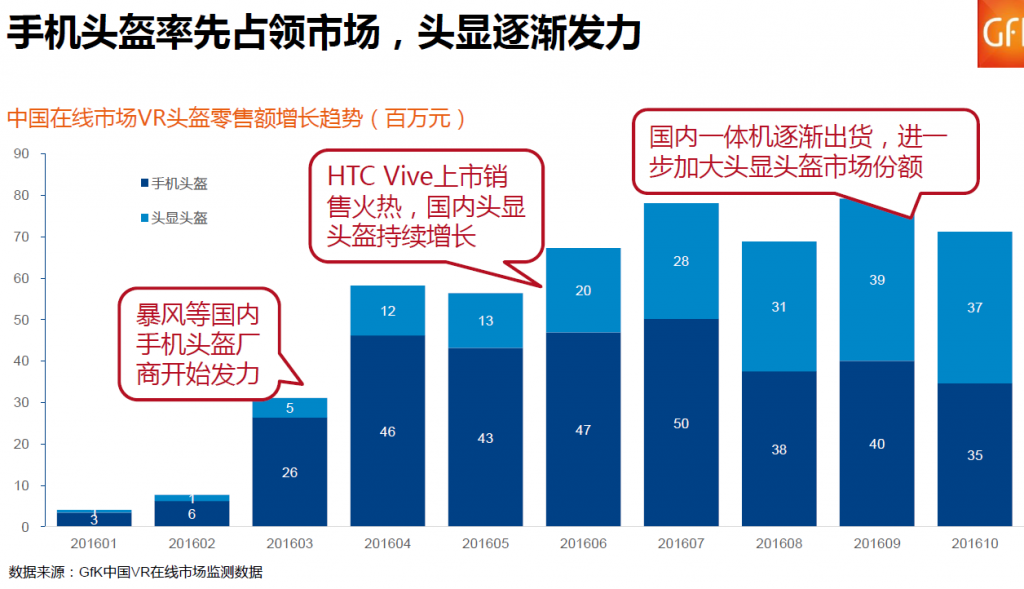

Mobile VR headset is portable, and prices are affordable, thus driving the VR device sales. In the past 6 months, monthly sales could reach millions, in particular Baofeng and other local brands are the drivers. However, following the launch of HTC Vive, all-in-one VR market is becoming more apparent, and in Oct. 2016, all-in-one sales exceed mobile VR. (199IT, GfK report)

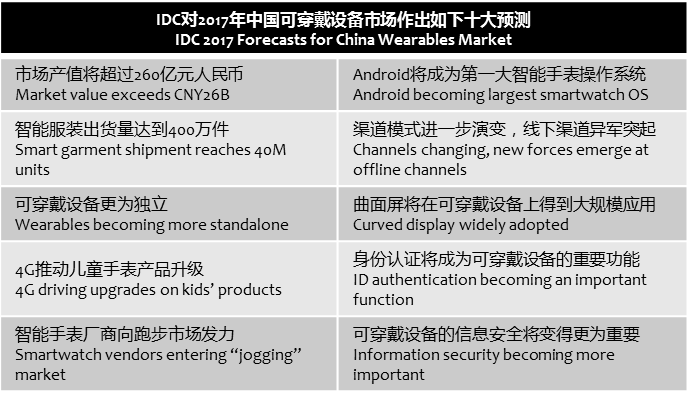

According to IDC, China wearables shipment would reach 38.76M units in 2016, 57.1% increase on year. Wearables is the 2nd largest mobile consumer electronic devices after smartphones in China. (IDC, press, 199IT, EE Trend)

Internet of Things

After more than a year of negotiation, ZTE has bought stake in Zhuhai bus manufacturer Guangtong Bus with millions of yuan. (CN Beta, iFeng, 10JQKA)

Hyundai Motor’s top priority of its self-driving tech is keeping costs low enough for the technology to be attainable by mass-market buyers; ensuring people wary of advanced driving-assist systems are comfortable with fully automated cars; and solutions for legal, regulatory and security issues that will dictate how soon robotic vehicles can be deployed. (Engadget, CNET, Forbes)

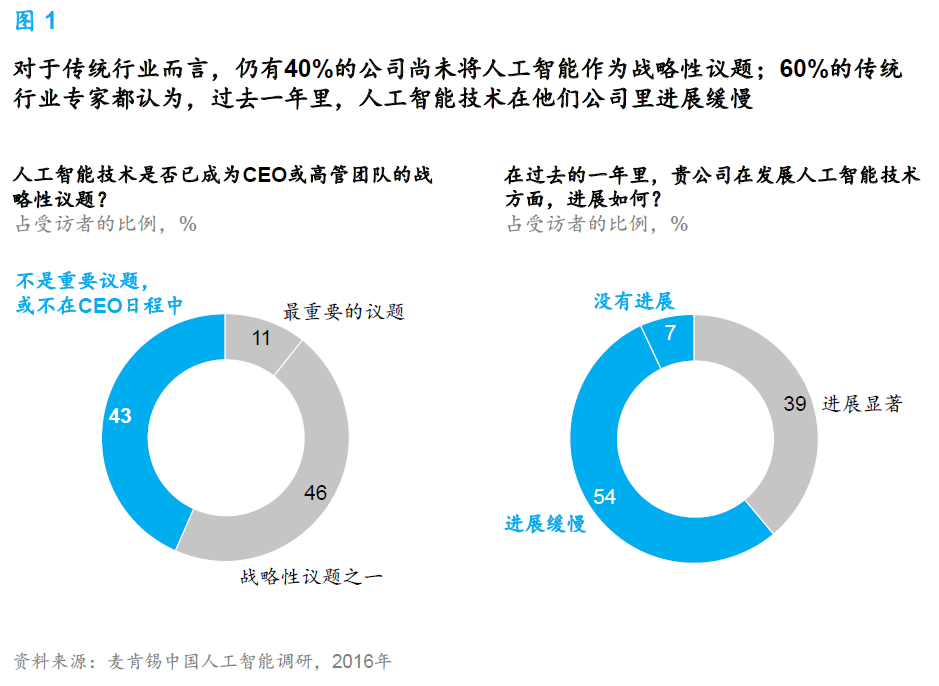

According to a survey conducted by McKinsey & Company with 80 corporates involved in traditional and Internet business, 90% of the respondents think that AI would change its industry from its core. However, traditional corps still struggle on how to invest in this technology. More than 40% of the respondents indicate their CEO has not put AI as one of the strategic focuses, more than 60% think in past 1 year, their company has not gained satisfactory development from their AI strategy. (Laoyaoba, McKinsey, report)

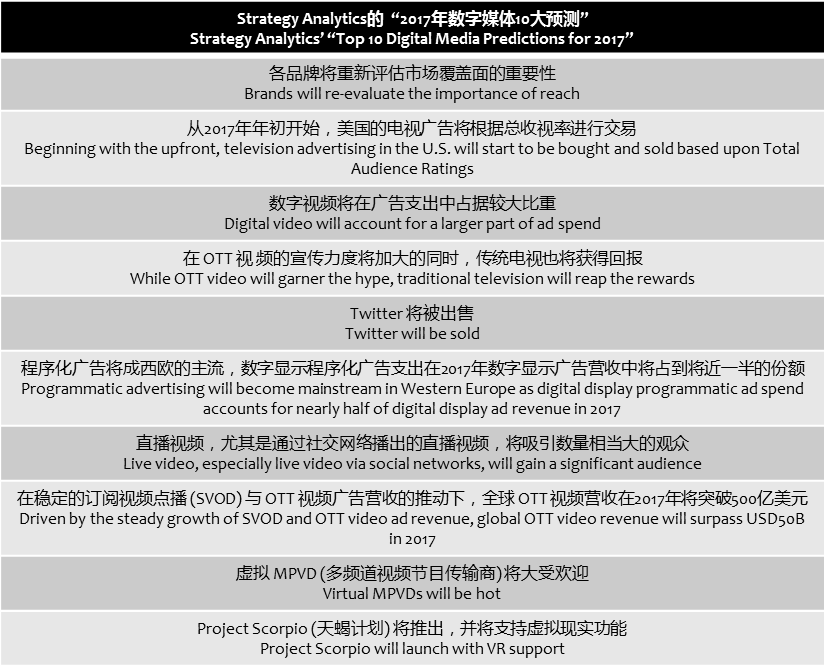

Strategy Analytics’ “Top 10 Digital Media Predictions for 2017” highlights the trends and events that will shape OTT video, digital advertising and VR in 2017. (EE Trend, Strategy Analytics, press)