03-10 Week: Almost a quarter of a new year has passed. Let’s quickly review last week

Almost a quarter of a new year has passed. Let’s quickly review last week—

Headlines:

- TSMC will enter risk production for a MediaTek chip on the newer 7nm process in 2Q17, the SoC incorporates 12 CPU cores

- Softbank will move 25% of ARM, which it bought in 2016 for USD32.4B, to its Vision Fund

- Sharp is reportedly investing JPY1T into OLED screen production

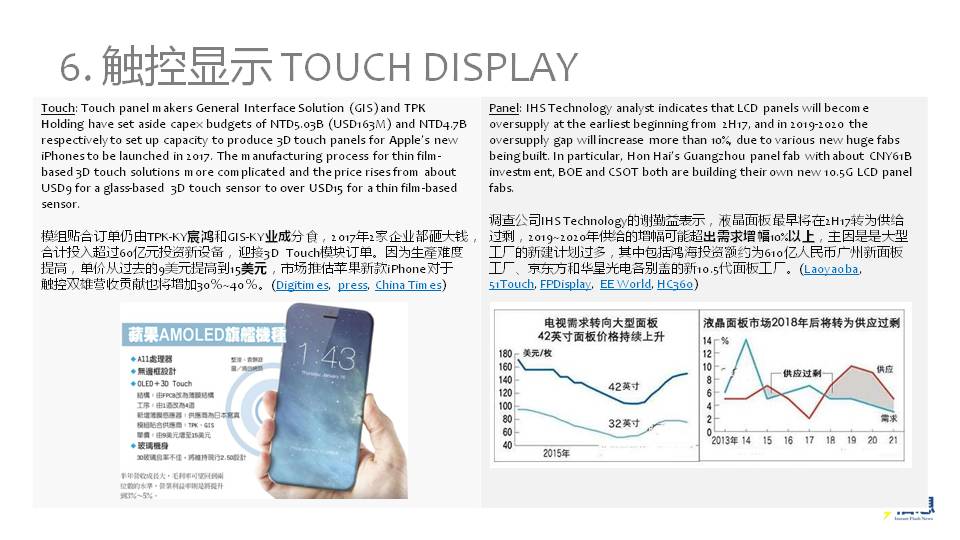

- General Interface Solution (GIS) and TPK Holding have set aside capex budgets of NTD5.03B (USD163M) and NTD4.7B respectively to set up capacity to produce 3D touch panels

- Xiaomi’s CEO, Lei Jun has announced that AI will play a major role in Xiaomi products in 2017

- Xiaomi and LeEco smartphone sales have been affected by recent price hikes

- According to Xiaomi CEO Lei Jun, Xiaomi plans to open up 250 new offline stores in China in 2017

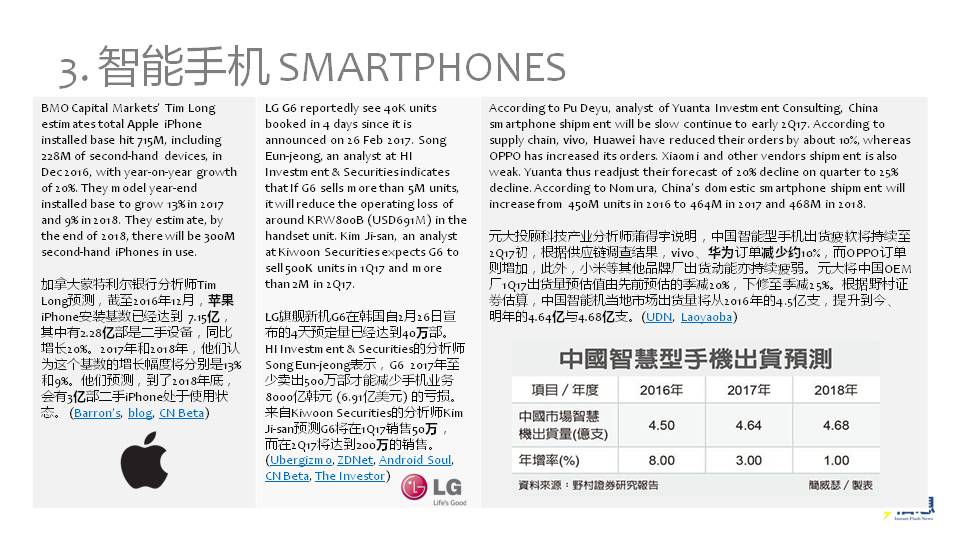

- Pu Deyu, analyst of Yuanta Investment Consulting, says China smartphone shipment will be slow continue to early 2Q17

- Google is reportedly working on a budget smartphone that is expected to launch without Pixel branding

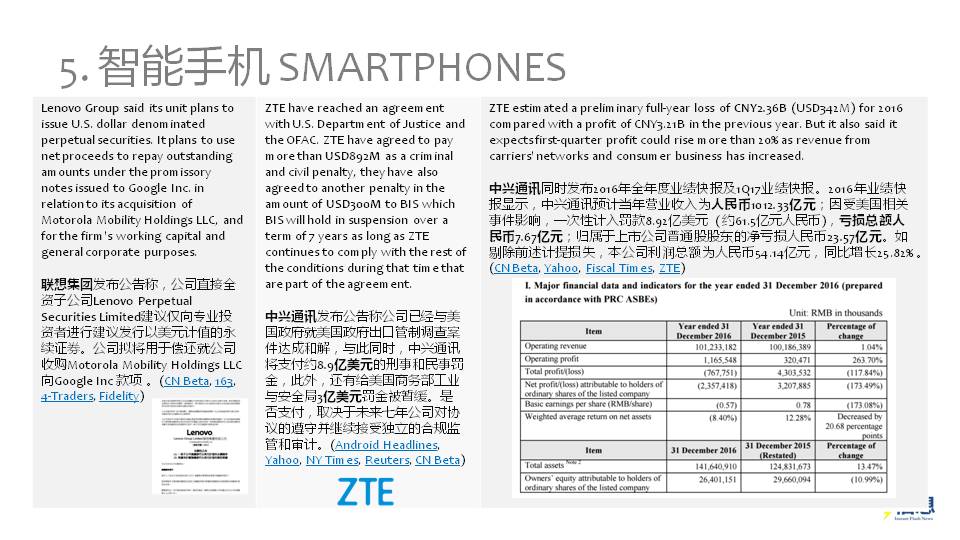

- ZTE have agreed to pay more than USD892M as a criminal and civil penalty, they have also agreed to another penalty in the amount of USD300M to BIS

- For 2017 target, in China alone Gionee aims for at least 30M units, and challenging 38M units.

Numbers:

- According to CMR India, the Indian market recorded a 22% rise in revenues at INR1,359,975M in 2016 as against INR1,117,571M in 2015

- Apple captured 79.2% of global smartphone profits in 2016, according to the Strategy Analytics

- According to IDC, wearables market in China still grow fast in 2016, with shipment YoY growth reaching 68.1%.

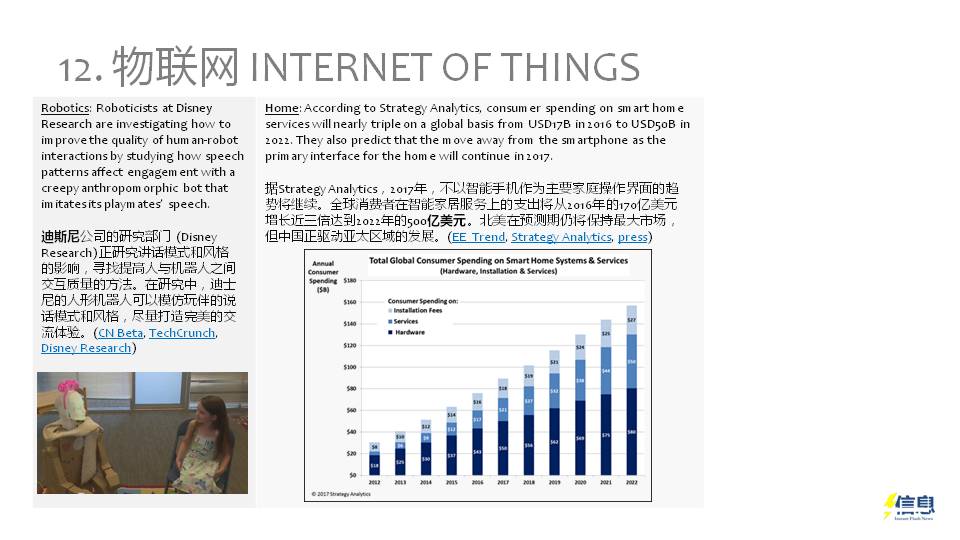

- According to Strategy Analytics, consumer spending on smart home services will nearly triple on a global basis from USD17B in 2016 to USD50B in 2022