04-21: Hon Hai is considering including the Japanese unit Sharp in its bidding team attempting to buy Toshiba’s spun-off chip-making unit; Xiaolajiao phone founder Wang Xiaoyan announced that the company has received Droi’s CNY45M investment; etc.

Chipsets

Intel and Spreadtrum Communications have extended their foundry ties under which Intel will start making another 14nm chip for the China-based mobile SoC supplier, according to Digitimes. Intel will fabricate Spreadtrum’s SC9853 series chips slated for launch in 3Q17. (Sohu, Laoyaoba, OfWeek, SEMI, Digitimes, press)

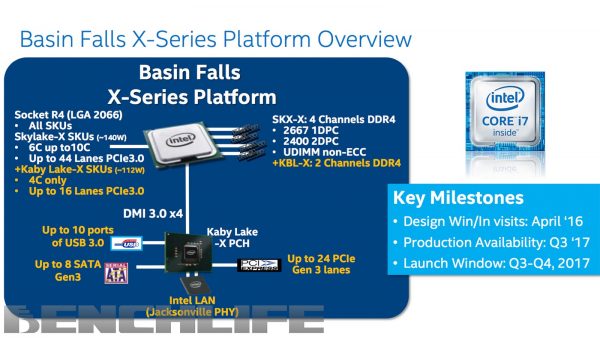

Intel will unveil its Basin Falls platform, i.e. Skylake-X, Kaby Lake-X processors and X299 chipset, 2 months earlier than originally scheduled, and will bring forward the launch of Coffee Lake microarchitecture based on a 14nm process node from January 2018 originally to August 2017, to cope with increasing competition from AMD’s Ryzen 7 and Ryzen 5 processors, according to Digitimes. (Digitimes, press, Extreme Tech, Digital Trends, 163)

HARMAN International, a wholly-owned subsidiary of Samsung focused on connected technologies for the automotive, consumer and enterprise markets, is pleased to announce it has expanded its relationship with Baidu to jointly develop new cloud-based AI solutions aimed at Chinese automakers. (Business Wire, Laoyaoba)

Rosenblatt Securities analyst Jun Zhang indicates that Qualcomm’s market share of baseband modems in the next iPhone “will be down to 35% from 60%,” and that “gains in Chinese OEMs will not be enough to offset the 2H17 revenue decline from Apple”. Apple accounts for roughly 18%-20% of Qualcomm’s revenue, and he believes the share loss will reduce Qualcomm’s revenue by USD200M per quarter in 2H17. (Laoyaoba, Barron’s, blog)

Touch Display

IHS display analyst David Hsieh believes that in 2017 panel is still in tight supply, and demand growth is 5% greater than the production growth, especially for 65” big TV panel demand. It expects that AUO and Innolux are going to perform well in 2017. (51Touch, Laoyaoba)

IHS display analyst David Hsieh indicates that the price of TV panel has been increasing for 15 months sequentially. OEMs cannot handle the rising cost, in addition to increase their inventory, the price will not go further up in 2Q17. Beginning 2019 Gen-10.6 fabs in China will put into production, causing supply is higher than demand, which would cause the cost to go down. However, 2017 will still be a tight-supply year. (Laoyaoba, 51Touch, OfWeek)

Memory

Hon Hai Precision Industry, now the parent of Japanese electronics giant Sharp, is considering including the Japanese unit in its bidding team attempting to buy Toshiba’s spun-off chip-making unit. Hon Hai, also known as Foxconn, is believed to have already asked SoftBank Group of Japan and American tech giant Apple to join it in the bidding. (Laoyaoba, Asia Nikkei, Mobile World Live)

Toshiba is collaborating with TDK and Showa Denko KK to mass produce next generation HDD in 2019. The 3 companies have already started next-generation HDD research and development, and already finished samples. After that, the 3 companies are thinking of to form a JV. (Laoyaoba, EEPW, Sohu)

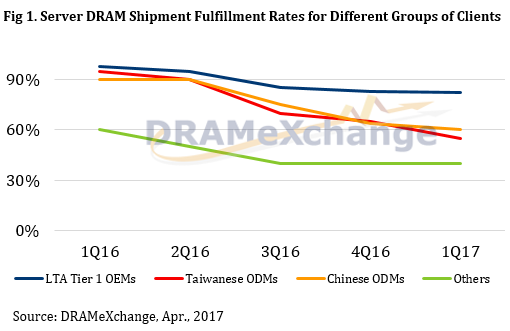

TrendForce reports that demand continues to outpace supply in the server DRAM market. In 1Q17, memory suppliers saw their shipment fulfillment rates dropped for different groups of clients. The fulfillment rate for long-term agreement (LTA) orders was 80% on average, while fulfillment rates for orders from ODMs fell to the 60% level. Due to the persistent undersupply, TrendForce further projects that the global ASP of server DRAM will increase by more than 10% between 1Q17 and 2Q17. (TrendForce, press, TrendForce[cn], press, Digitimes)

Sensory

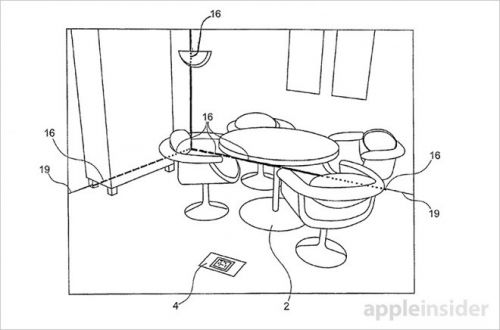

The U.S. Patent and Trademark Office published an Apple patent application “Method and device for illustrating a virtual object in a real environment” detailing a method of inserting virtual objects into a real environment, and relocating or removing real objects from the same, using advanced hardware and complex algorithms. (USPTO, Apple Insider, TechWeb)

A 3D sensing solution requires an RGB camera module an infrared (IR) sensor module that uses VCSEL (vertical-cavity surface-emitting laser) as a light source. With more high-end smartphones adopt 3D sensing, TrendForce estimates that the worldwide market scale of IR sensor modules for mobile devices will reach USD145M in 2017. (TrendForce, press, TrendForce[cn], press)

Biometrics

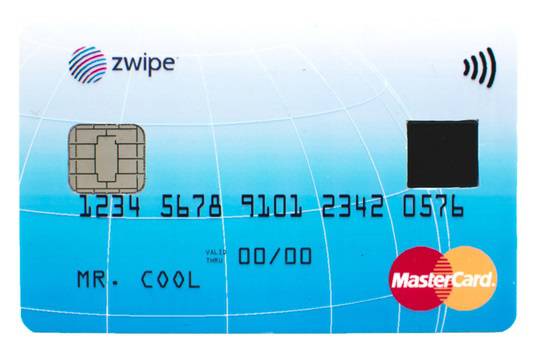

Mastercard has rolled out a credit card that has an integrated fingerprint scanner, making it easier to authenticate purchases at retail stores. The card stores 2 fingerprints, and features an embedded sensor that lets you authorize payments instead of having to sign or use a PIN. (Android Central, Mastercard, RFID World, Tech2IPO, 36Kr)

Battery

Huawei manufactured Google Nexus 6P, unveiled in Sept 2015 for pre-order, is being accused in a class-action lawsuit of having a “Bootloop Defect.” According to the suit, the Nexus 6P devices ”are defective because they are prone to enter an endless bootloop cycle which renders them unresponsive and unusable”. The suit also alleges a “Battery Drain Defect”, which has also been the subject of repeated online criticism by unhappy Nexus 6P consumers. (Ars Technica, Phone Arena, 52RD, 163)

Smartphones

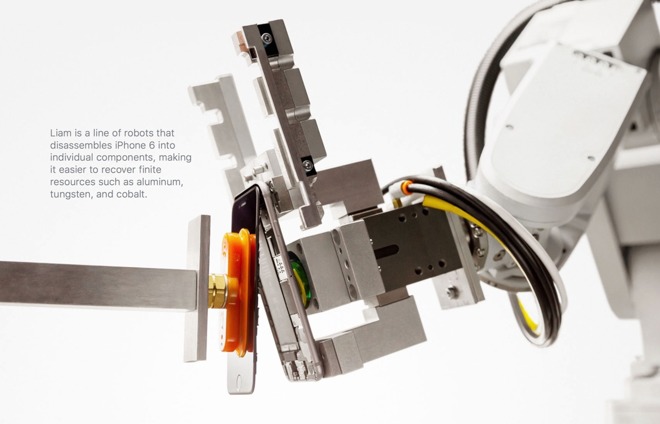

Apple in its 2017 Environmental Responsibility Report said it aims to have a ‘closed-loop supply chain’, where products are built using only renewable resources or recycled material. Apple, which already powers 96% of its facilities with renewable energy, has a new environmental goal: to one day build all its gadgets using only recycled materials. (Apple Insider, report, Vice, Kejixun, PC Mag, Slate)

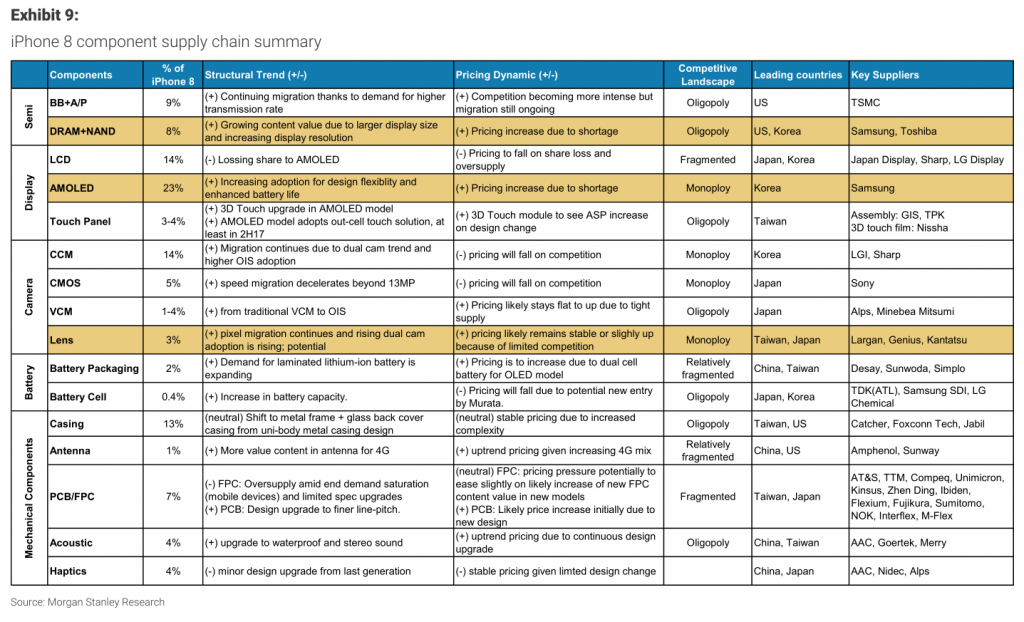

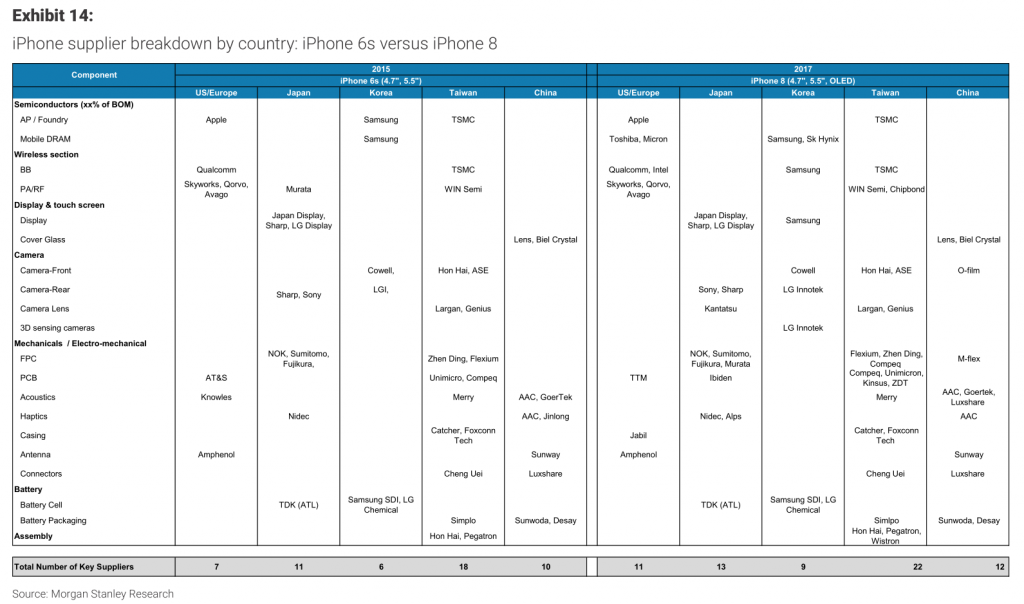

Morgan Stanley indicates that Apple iPhone 8 “super cycle” will bring the upstream and downstream suppliers USD77B demand, which is 62% increased compared to iPhone 7. The rise of retail price, and growing of USD, iPhone 8 shipment is facing pressure. Apple continuously introduces new suppliers to keep it a balance, and to keep the suppliers to compete with each other. This includes 11 Chinese suppliers, 8 of which are public in Shenzhen. (CN Beta, Business Insider, IB Times, NBD, Wall Street, press)

Xiaolajiao phone founder Wang Xiaoyan announced that the company has received Droi’s CNY45M investment. The latter will own 4.5% stake of the company. Now, Xiaolajiao market value is about CNY1B. (Laoyaoba, Tencent, Kejixun)

Wearables

Mozilla has announced Daydream VR support for Servo, which is a new browser rendering engine created by Mozilla Research. This includes support for the Daydream View headset as well as the Daydream controller. (Android Headlines, Android Police, Mozilla VR)

HTC plans to team up with NVIDIA, CyberPower PC and Micro-Star International (MSI) to promote its HTC Vive VR devices in the US market, according to the company. (Digitimes, Tom’s Hardware, Digital Trends, 3DMGame)

Internet of Things

Apple’s CEO Tim Cook is lauding Didi Chuxing‘s ability to harness burgeoning technology for the good of its customers. Gathering, analyzing and applying “big-data algorithms” to its backend services is apparently of particular interest to Cook. (Apple Insider, Time, CN Beta)

Bicycle sharing service ofo has announced collaboration with traditional bicycle manufacturer Tianjing Battle-FSD. Both companies will jointly establish product R&D center and quality center. Ofo founder and CEO Dai Wei reveals that ofo has obtained more than USD650M funding, and daily income is near CNY10M. (163, Laoyaoba)

Foxconn Electronics (Hon Hai Precision Industry) has increased its investment in its robot-development subsidiary in Shenzhen, China by CNY10.39B (USD1.51B). Meanwhile, in order to have more of its subsidiaries to involve in the development of robot products, Foxconn has also initiated a stock swap program among its subsidiaries in Hong Kong and China. (Digitimes, CNA, Digitimes, press)