05-14: Intel and Samsung backing FTC filing a complaint against Qualcomm; Apple said Corning will receive USD200M from the USD1B Advanced Manufacturing Fund; etc.

Chipsets

Samsung is reportedly developing a 64-bit system-on-chip (SoC) called the Exynos 7872 using the 14nm FinFET LPP process, the same one that was utilized in the creation of the Exynos 8890. (Android Headlines, PC Online, My Drivers, Gizmo China)

Back in Jan 2017, the US Federal Trade Commission (FTC) filed a complaint against Qualcomm, accusing the company of forcing Apple into an exclusive chip deal. Qualcomm later denied the claims and asked the court to dismiss the suit in Apr 2017. A number of companies are backing the suit, including Apple, Samsung and Intel. (Android Headlines, Bloomberg, Market Watch, Softpedia, CNET, Tencent, iFeng)

ARM and HOPU Investments have launched the HOPU-ARM Innovation Fund with investments from a leading Chinese sovereign wealth fund and international and domestic Chinese investment institutions and companies. Now HOPU-ARM is planning to initiate a JV in China, handling IP development and service platform. (Laoyaoba, Huanqiu, STCN, FINET, ARM)

Touch Display

Samsung Display and LG Display are reportedly ramping up investments to make more OLED displays even before their first stage investments are complete. Both companies have however denied rumors that they plan to open up new OLED production plants in China. (ET News, The Investor, Global Times, Android Authority)

Apple said Corning will receive USD200M from the USD1B Advanced Manufacturing Fund. Oppenheimer analyst Andrew Uerkwitz believes Apple is developing wireless charging technology for the next generation of iPhone. Patrick Moorhead of Moor Insights believes that they are working on glass that properly magnifies the 180º experience of AR. (CN Beta, Apple, NY Times, CNN, CNBC)

Macroblock stated that the small pitch LED display market is continuously maturing, and currently P2.5 LED displays have already become a basic product for small pitch LED display manufacturers. However, in order to achieve smaller spacing in displays, it is imperative that industry supply chain manufacturers have corresponding solutions. To date, while manufacturing small pitch LED displays, which are P1 (1mm dot spacing) or below, they have bumped into technological and cost bottlenecks. This is the true opportunity for micro-LED. (Laoyaoba, Digitimes, EE World, Macroblock, CTimes)

Samsung Display, due to booming orders for smartphone-use OLED panels, is reportedly constructing a factory to produce flexible OLED panels in South Korea, with production to kick off possibly in 2H18. The plant, dubbed A4, will have annual production capacity of up to 800M smartphone-use flexible OLED panels. (Laoyaoba, Digitimes, press)

Memory

Sumco has reportedly cut its wafer shipments to Wuhan Xinxin Semiconductor Manufacturing (XMC), and given priority to Taiwan Semiconductor Manufacturing Company (TSMC), Intel and Micron Technology, according to Digitimes. A cutback in wafer shipments from Sumco has led to a more severe shortage of NOR flash memory. (CN Stock, Laoyaoba, Beijing Time, Digitimes, press)

Macquarie Research’s Daniel Kim indicates that all data points and anecdotes point to a stronger-than-expected memory market in 2H17. He thinks “contract” prices that Micron and others charge customers for DRAM for the PC market will be “flat to slightly up in 3Q17,” and that DRAM for mobile phones and the like will “take over the baton of price hike” from PCs and servers that same quarter. He also thinks that limited NAND supply to spot market leads to a spot price premium of 30%-100%. (Laoyaoba, Barron’s, blog)

Battery

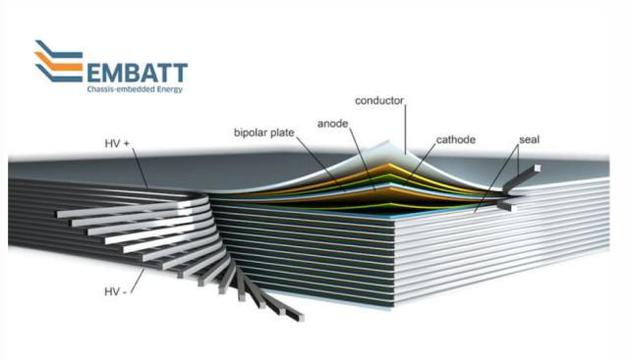

Fraunhofer-Gesellschaft in Dresden, Germany, is working a new battery that would give electric cars a range of about 620 miles (1,000 km) on a single charge. The researchers stacked several of these so-called bipolar electrodes one on top of the other, like sheets of paper in a ream, separating the electrodes by thin layers of electrolyte and a material that prevents electrical charges from shorting out the whole system. (CN Beta, Live Science)

Connectivity

China Unicom chairman and CEO Wang Xiaochu has admitted that in 3G era the company has made “some mistakes”, but the company is hoping to patch the mistakes in 4G era. (CN Beta, Laoyaoba, 163)

Smartphones

Apple has reportedly acquired Lattice Data, a company that applies an AI enabled inference engine to take unstructured, “dark” data and turn it into structured (and more usable) information. (Laoyaoba, TechCrunch, Engadget)

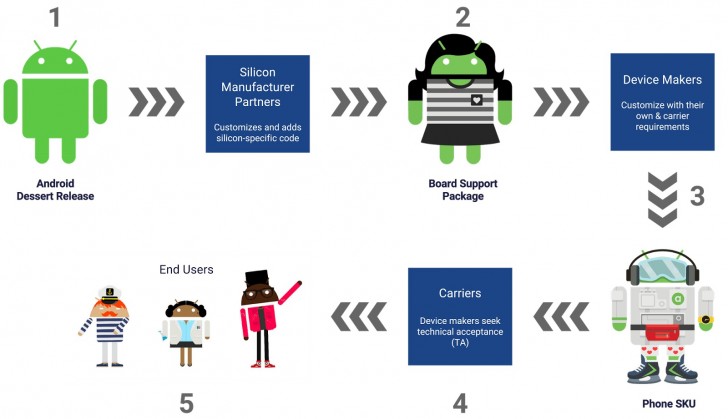

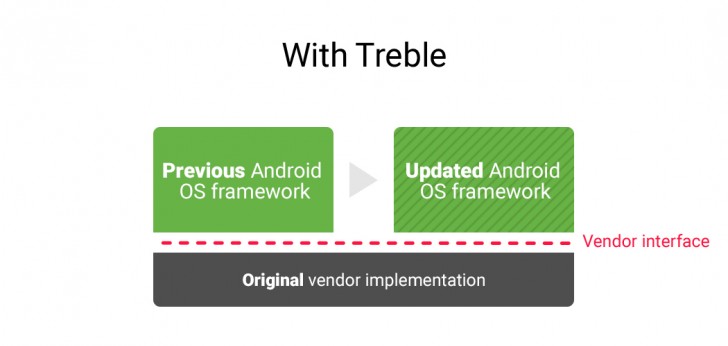

Google announces Project Treble, a modular base for Android aiming to make updates faster. With Project Treble, Android will gain a “Vendor Interface” (VI), of which aim is to separate Vendor Implementation (the device-specific, lower-level software written in large part by the silicon manufacturers), from the Android OS framework. (GSM Arena, Google, CN Beta, JRJ)

Samsung launches Tizen smartphone Z4 – 4.5” WVGA 2.5D curved display, 1.5GHz quad-core processor, 5MP + 5MP cameras, 1GB RAM, 8GB storage, Tizen 3.0 OS, 2050mAh battery. (CN Beta, NDTV, Ars Technica)

Wearables

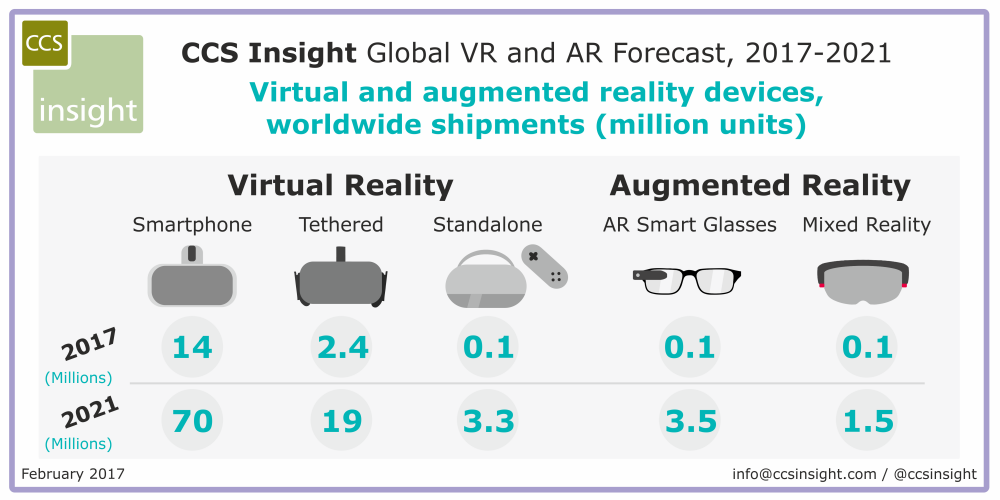

CCS Insight estimates that a mere 100K AR glasses were sold in 2016 — and even this could be an optimistic number. The market will take time to develop. CCS Insight forecast indicates the first significant unit sales will not occur until 2019, when 1.5M units are predicted to be sold. They forecast this will rise to 5M units in 2021, with a total market value of USD2.5B. (CCS Insight, press, Laoyaoba)