07-15: MediaTek has ramped up shipments of its chips for voice assistant devices; TCL Corp. plans to acquire 10.04% stake in Shenzhen China Star Optoelectronics Technology (CSOT); etc.

Chipsets

Qualcomm has argued over a USD910M antitrust fine that the company was hit with in South Korea in late 2016, asking the country’s Fair Trade Commission (FTC) to postpone the enforcement of its sanction until the company’s lawsuit against the order is processed. (Android Headlines, Business Korea)

With Qualcomm’s full-fledged product portfolio, for MediaTek to exceed Qualcomm is very unlikely. On the other hand, HiSilicon has been aggressively increased their market share, which is challenging MediaTek. (Lanjing TMT, My Drivers)

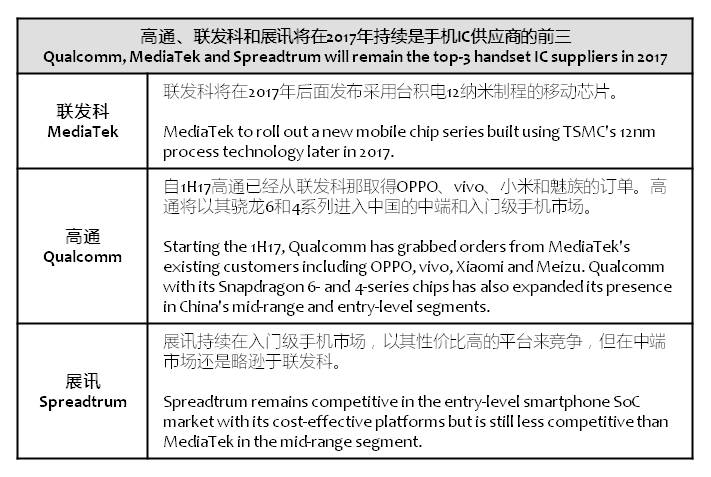

Qualcomm, MediaTek and Spreadtrum will remain the top-3 handset IC suppliers in 2017, with Qualcomm dominating the high-end market, and MediaTek and Spreadtrum sharing the mid-range and low-end segments, according to Digitimes. (Digitimes, press)

Intel has been dominating PC and server SoC for a longtime. Even though there were other competitors, but they failed eventually. In 2017, Qualcomm and AMD have announced entering PC and server market. (Digitimes, Laoyaoba)

MediaTek has ramped up shipments of its chips for voice assistant devices which will further buoy the company’s revenues for 3Q17, according to Digitimes. Alibaba, Tencent and Xiaomi will also roll out voice assistant devices powered by MediaTek’s chip solutions later in 2017, the sources indicated. Shipments of MediaTek’s solutions for voice assistants are expected to jump by 10 times in 2017, and grow another 100% in 2018. (Digitimes, press, Laoyaoba, Tencent)

MediaTek has been aggressively developing its highly-integrated SoC offerings for wearable and IoT applications. MediaTek has gradually expanded its presence in China’s bicycle-sharing market. China-based bike-sharing companies including Mobike, Ofo and Bluegogo have all used MediaTek’s chip solutions in their IoT tracking devices for bicycles. (Digitimes, press, KK News, JRJ)

China’s ambitious plans to build a world-class semiconductor manufacturing supply chain domestically certainly has the industry’s attention. With over 12 new 300mm fab announcements lately from Foundries, DRAM, 3D NAND, and as well as CMOS image sensor companies , China has launched a huge investment in wafer fab capacity that is expected to ramp in the next 5 years. (LTN, Laoyaoba, SEMI)

Touch Display

Japan Display Inc (JDI) has been looking into plans to use their Apple iPhone supplied panels fabs in Mobara and Hakusan as guarantee to raise JPY200B~250B funds, the company also looks into contacting Hon Hai, BOE, Tianma, LGD for possibility of collaboration or investment. (Digitimes, Laoyaoba)

TCL Corp. plans to acquire 10.04% stake in Shenzhen China Star Optoelectronics Technology (CSOT) for CNY4.03B (USD593.87M) via share issue. TCL it will own 85.71% stake in CSOT after transaction. (EEPW, Reuters, Reuters CN, Laoyaoba)

Camera

Largan Precision’s profit is dropping unexpectedly. That is because of the China vendors’ changing their market strategy in 1H17, and the changes are too rapid for Largan to adjust their production smoothly. Additionally, the new specs from the top 3 Chinese vendors Huawei, OPPO and vivo are getting “weirder” – thin with huge aperture – which increases the production challenge, impacting the yield rate of Largan. (Laoyaoba, UDN)

Memory

Semiconductor Manufacturing International (SMIC) has landed more orders for NOR flash chips from GigaDevice Semiconductor and increased output, according to Digitimes. On the other hand, Wuhan Xinxin Semiconductor Manufacturing (XMC) has to cut its production of NOR chips due to fewer wafers supplied by Sumco. The NOR flash market is forecast to rise at a CAGR of 15%-16% 2017~2020, when the market will reach USD4.7B. (Digitimes, press, EE World, Digitimes)

Sensory

Martyn Humphries, VP of Consumer and Industrial i.MX Applications Processors at NXP said by 2018, there will be about 80% of signal used for IP video conferencing. Specs like 4K and HDR will be driving upgrades in the consumer market. Voice control is becoming mainstream. ARM SoC will become a mainstream, replacing DSP. (Laoyaoba, CTimes, Digitimes, press)

Biometrics

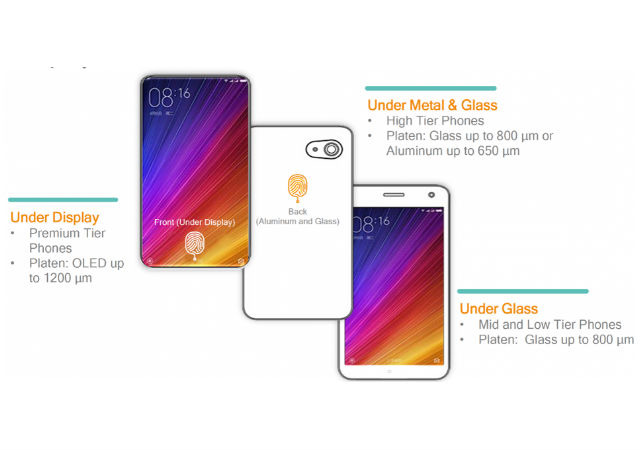

Qualcomm has introduced 3 new forms of fingerprint sensors that work underneath glass, metal and even OLED displays. vivo has showcased the technology, and now there is report saying OPPO is also testing Qualcomm’s new fingerprint sensor. (Laoyaoba, OfWeek, 16RD, Mobilesyrup, Digit)

Smartphones

TCL Group announced in 1H17 sold 21.17M units of mobile phone products, 36.16% decreased on year, in which 2Q17 the sales was 10.62M units, a 33.4% decreased on year. China mobile phone alliance secretary Wang Yanhui indicates that TCL has a lot of products covering foreign countries, but there is no real investment in any technology, and hoping to win the market with cost and sales. This is the biggest factor of failure. (Sina, CB.com, article, Laoyaoba)

ZTE Blade Spark is announced at AT&T – 5.5” HD display, Qualcomm Snapdragon 425 processor, 13MP + 5MP cameras, 2GB RAM, 16GB storage, Android 7.1, fingerprint scanner, USD99. (GSM Arena, AT&T, CN Beta)

HTC Desire 555 is available in US Cricket Wireless – 5” HD IPS LCD display, Qualcomm Snapdragon 210 processor, 8MP + 5MP cameras, 2GB RAM, 16GB storage, Android 7.0, 2200mAh battery. (Phone Arena, Cricket)

Wearables

Facebook is reportedly planning to launch a new wireless Oculus Rift VR headset in 2018, codenamed “Pacific”, priced at around USD200. (My Drivers, Variety, Bloomberg)

The establishment of VR arcades will enable VR content and hardware developers to provide facilities for consumers to try out immersive VR experiences and thereby to accelerate development of the VR industry, according to Jack Tong, founder and CEO of JPW International Technology. (Digitimes, Digitimes, UDN)

Internet of Things

Microsoft’s BMW partnership now includes Skype for Business, allowing those with a vehicle that’s part of the most recent BMW 5 Series lineup the ability to engage in Skype for Business voice calls right from the comfort of the driver’s seat. (CN Beta, Android Headlines, The Verge, Investopedia, TechCrunch)

Xiaomi’s VP Liu De indicates that till 30 Jun 2017 the company has invested in 89 companies for its eco-system investment, which is close to its target of 100 companies. (Laoyaoba, Tencent)